7th CPC Children Education Allowance and Rates

7th CPC Children Education Allowance Orders: The Children Education Allowance (CEA) was introduced by the 6th Pay Commission in 2008 to alleviate government employees’ school fees and expenses for their children. The CEA allowance is available to all Central Government servants, including deputation employees from State Government, and eligible civilian and industrial employees, without any pay limit. The allowance is applicable to two children who are studying up to standard XII, with a maximum cap of Rs. 2250 per month, while the Hostel Subsidy rate is Rs. 6750 per month, effective from 1st July 2017. Both CEA and Hostel Subsidy can be availed of concurrently. However, the process of providing receipts for every expense is cumbersome and should be substituted with an affidavit. Furthermore, the scheme should be extended to cover higher education courses, and the allowance should be increased.

After the 6th CPC, the educational benefit program named “Reimbursement of Tuition Fee” was renamed to “Educational Assistance.” Central Government employees are entitled to the Children Education Allowance (CEA) and Hostel Subsidy (HS) to support their children’s education and hostel fees. The “Reimbursement of Tuition Fee” program was first proposed by the 2nd Central Pay Commission and initiated in March 1962. This scheme has been modified and expanded by subsequent pay commissions, with the 6th Pay Commission prioritizing it. The Central Government accepted the proposals and began implementing them in September 2008, which was greatly appreciated by employees.

Central Government employees with school-going children can benefit from an increase in the rate of Child Education Allowance as per the 7th CPC report. The allowance has been raised by 50%, allowing Central staff to enroll their children in high-quality educational institutions.

The reimbursement of Child Education Allowance will be processed annually, subsequent to the conclusion of the financial year. The maximum permitted amount for CEA is Rs. 27000, while the Hostel Subsidy is Rs. 81000. It is noteworthy that these limits will be increased by 25% automatically each time the Dearness Allowance rises above 50%.

Highlights of Child Education Allowance

| Topic | Children Education Allowance |

| Beneficiaries | Central Govt Employees |

| Recommended | 7th Pay Commission |

| Motive | Quality Education to Children |

| CEA Rate | Rs. 2250 per month |

| Hostel Subsidy Rate | Rs. 6750 per month |

| Both Availed | Yes |

| Revision of CEA | Whenever DA Increases by 50% |

| Day Boarding School | Eligible |

| Husband & Wife Employed | One of Them Allowed |

| Home Page | Click Here |

What is meant by Child in CEA?

The term “Child” within the context of CEA reimbursement pertains to an employee’s biological child, stepchild, or adopted child who is entirely dependent on the Central government employee.

What is the educational criterion for CEA eligibility?

Children enrolled in Nursery to Twelfth grades are eligible for CEA, which covers classes one through twelve, as well as two classes before the first grade, regardless of their name. The most important factor is that the child is studying at a recognized school or institution. After completing the 10th grade, Diploma and ITI students are also eligible for CEA.

Child Education Allowance Eligibility Age Limit

To be eligible for the Child Education Allowance (CEA), children must meet certain age requirements. Specifically, they must be under 20 years of age or have completed 12 classes, whichever occurs earlier. It is important to note that this condition regarding the age limit applies to all applicants seeking to receive CEA benefits.

The eligibility age limit for Child Education Allowance reimbursement does not have a minimum age requirement for children enrolled in nursery classes. However, there used to be a minimum age limit of 5 years for physically challenged children undergoing non-formal/vocational education. This rule was removed on February 21st, 2012. Therefore, there is no minimum age limit for reimbursement, regardless of whether the child is physically challenged or not. The maximum age limit for a normal child is 20 years and 22 years for physically challenged children. Reference can be found in O.M. No.12011/07(ii)/2011-Estt.(AL) dated 21.02.2012. [View more]

Child Education Allowance Exemption

The Children Education Allowance (CEA) and Hostel Subsidy (HS) exemption limit is Rs. 100 per month per child up to a maximum of two children. The current rate of CEA is Rs. 1000 per child. Tuition fees paid to any educational institution in India for the full-time education of any two children can also be claimed for deduction under Section 80C up to a limit of Rs. 1,00,000. The total exemption limit for CEA and HS is Rs. 1200 per year, and relief can be claimed under Section 89(1) for previous year’s allowance. Click to know more…

Child Education Allowance Rates

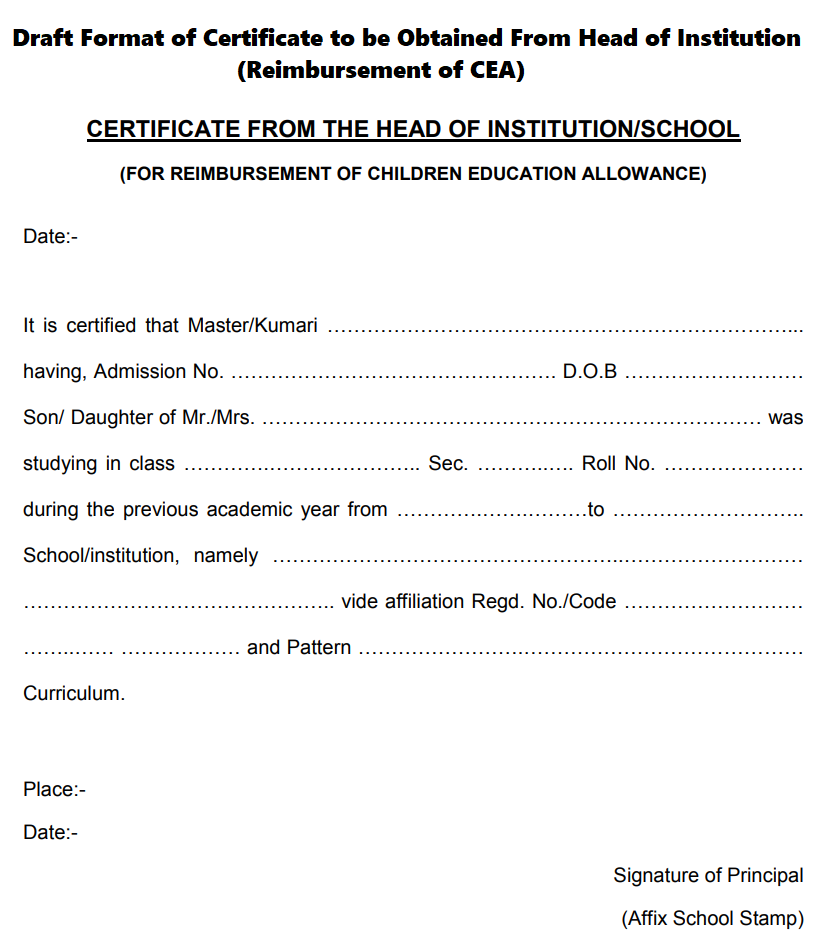

The Child Education Allowance (CEA) and Hostel Subsidy (HS) have been updated with effect from 1st July 2017, following the approval of the 7th CPC recommendations by the Government. The CEA has now increased to Rs. 2250 per month, while the HS has been revised to Rs. 6750 per month. Parents can claim reimbursement for only one of their children and must provide a bona fide certificate from the previous academic year’s school for CEA, and a bonafide certificate detailing boarding and lodging expenses for HS. The rates are raised by 25% every time the DA reaches 50%, and CEA and HS are doubled for differently-abled children. The CEA scheme applies to children from nursery to Class XII, with the exception that it can only be claimed for the two eldest surviving children (twins/multiple births excluded). The CEA and HS application forms can be downloaded in word or pdf format, and there is no time limit for reimbursement claims.

Child Education Allowance Form PDF Download

- Application for Children Education Allowance (CEA) and Hostel Subsidy (HS) PDF Download

- Reimbursement claim form download with details

- Children Education Allowance: Format of Certificate from School

- Proforma for Reimbursement – Click to Download

- Certificate from the Head of Institution / School – Format

- 7th CPC Children Education Allowance: Self Declaration – Click to read

Bonafide Certificate for Child Education Allowance

To claim reimbursement of Child Education Allowance (CEA), government employees must provide a Bonafide Certificate issued by the Head of the institution for the period in question. This certificate should serve as confirmation that the child was enrolled in the school during the previous academic year. If such documentation cannot be obtained, a self-attested copy of the report card or fee receipts for the entire academic year may be submitted as supporting evidence to claim CEA.

Children’s Education Allowance Rules

- REIMBURSEMENT CEA & HS – CLARIFICATION ON LEAVE OR SUSPENSION

The Children Education Allowance or hostel subsidy shall be admissible to a Govt. servant while he/she is on duty… - UPPER AGE LIMIT FOR CEA & HS

The upper age limit for Divyaang children has been set at 22 years… - REIMBURSEMENT OF CEA & HS – IN CASE OF RETIREMENT…

In case of retirement, discharge, dismissal, or removal from service, clarification was given… - CEA CLARIFICATION – IF A GOVERNMENT SERVANT DIES…

If a Government servant dies while in service, the Children Education Allowance or hostel subsidy… - CLARIFICATION ON CEA – CHILD FAILS IN A PARTICULAR CLASS

The reimbursement of Children Education Allowance and Hostel Subsidy shall have no nexus… - CEA & HS – DISTANCE OF RESIDENTIAL EDUCATIONAL INSTITUTION

Clarification on distance for Residential Educational Institution studied children’s reimbursement… - REIMBURSEMENT OF CEA & HS – BOTH ARE GOVERNMENT SERVANTS

Clarification on Husband and wife both are Government Servants, reimbursement… - CEA & HS – PERIOD FOR REIMBURSEMENT

Quarterly, Half-Yearly, or Annual reimbursement of Children Education Allowance… - REIMBURSEMENT OF CEA & HS – DA IMPACT

Increasing DA over 25%, the amount of Children Education Allowance… - CEA & HS PAYABLE FOR CITIZENS OF NEPAL AND BHUTAN – CLARIFICATION

- CEA is payable to the children of all Central Government employees including citizens of Nepal and Bhutan…

CHECK ALSO: CEA FORMS DOWNLOAD

Latest Developments on Child Education Allowance

- Children Education Allowance – Frequently asked questions (13.05.2014) August 9, 2024

- Children Education Allowance – Format of Certificate from School May 2, 2024

- Increased Children Education Allowance Rate | From 1.1.2024 | ₹2812.5/month April 30, 2024

- One Time Relaxation for Reimbursement of Children Education Allowance March 15, 2024

- Submission of Child Education Allowance and Hostel Subsidy claims for Reimbursement August 30, 2023

- Reimbursement of Children Education Allowance to Railway Servants having Divyang Children June 28, 2023

- FAQ on Children Education Allowance, OTA / NDA, Honorarium/Fee, Leave June 17, 2023

- Husband and Wife Govt Servants – What about CEA and HS? June 14, 2023

- 7th CPC Children Education Allowance (CEA) and Hostel Subsidy – Consolidated instructions issued by DoPT June 8, 2023

- Double CEA for CG Employees who have Divyang Children June 1, 2023

- Any proposal to raise the Children Education Allowance from 27000 to 60000 for Central Government employees? June 1, 2023

- CEA Clarification on a Govt Servant Dies While in Service May 17, 2023

- Income Tax Exemption on Children Education Allowance April 3, 2023

- Rules for Schools Seeking CwSN Affiliation | Board for Children with Special Needs March 13, 2023

- Clarifications on Children Education Allowance – DoPT on 1 July 2021 July 3, 2021

- Children Education Allowance – Hostel Subsidy for the year 2019-2020 May 26, 2020

- Children Education Allowance – Rates, Reimbursement and Forms September 23, 2019

- Children Education Facilitation Allowance to GDS September 20, 2019

- 7th Pay Commission Children Education Allowance – Eligibility, Reimbursement, Rates and Download Forms September 18, 2019

- Children Education Allowance for CG Employees – An Overview August 26, 2019

- 7th CPC Children Education Allowance – Procedures 2019 August 21, 2019

- 7th Pay Commission Children Education Allowance – Consolidated instructions to Railway Employees August 17, 2019

- Top 20 Updates on 7th CPC Children Education Allowance July 29, 2019

- 7th CPC Children Education Allowance – Central Govt Orders and clarifications July 9, 2019

- Children Education Allowance Admissible for Suspension Employees? June 17, 2019

- CEA is eligible for the Citizens of Nepal and Bhutan June 17, 2019

- Studying through Correspondence is eligible for CEA and Hostel Subsidy? June 17, 2019

- CEA and Hostel Subsidy for Retiring Employees June 17, 2019

- Is CEA Connected with the Performance of Child? June 17, 2019

- Reimbursement of Children Education Allowance and Hostel Subsidy – CG Employees Should Know the Key Points June 17, 2019

- What is the Ceiling of CEA for Divyaang children? June 17, 2019

- What type of Certificate or Self- Attestation to Produce for Claiming Hostel Subsidy? June 17, 2019

- What type of Certificate or Self- Attestation to Produce for Claiming CEA? June 17, 2019

- What is maximum reimbursement amount of CEA and HS? June 17, 2019

- How many children eligible for CEA & HS? June 17, 2019

- 7th Pay Commission Children Education Allowance – Orders, Circulars and Clarifications June 12, 2019

- 7th Pay Commission Children Education Allowance June 11, 2019

- 7th CPC Children Education Allowance Comparative Analysis with 6th CPC June 11, 2019

- Children Education Allowance Income Tax Online Tools for CG Employees June 8, 2019

- Reimbursement of Tuition Fee to Children of Martyrs February 15, 2019

- Children Education Allowance to Railway Employees – Orders issued August 19, 2018

- 7th CPC Children Education Allowance: PCDA Clarification issued on 1.8.2018 August 8, 2018

- 7th CPC Children Education Allowance – DoPT Orders Dated 17.7.2018 July 18, 2018

- Need Uniform Format to Claim Children Education Allowance – NFIR June 6, 2018

- Amount Fixed for Reimbursement of CEA 2250 pm May 11, 2018

- Clarification on Children Education Allowances – DOP May 3, 2018

- 7th CPC CEA: Total Claim for Academic Year 2017-18 April 20, 2018

- 7th CPC Children Education Allowance: Self Declaration April 18, 2018

- 7th CPC CEA: Certificate from the Head of Institution / School – Format April 18, 2018

- 7th CPC CEA – Proforma for Re-Imbursement April 18, 2018

- Guidelines for Submission of Children Education Allowance Claim April 18, 2018

- Educational Assistance to College-going children of Non-Gazetted Railway Board Staff April 2, 2018

- Clarification on Reimbursement of Tuition Fee and Hostel Charges March 31, 2018

- Educational concessions to the children of Armed Forces Officers and PBORs March 22, 2018

- New Methodology of Application and Schedule of Payment towards Children Education Allowance March 12, 2018

- Guidelines for Payment of Children Education Allowance as per 7th CPC March 12, 2018

- Children Education Allowance Reimbursement Form Download March 12, 2018

- Implementation of CEA for differently abled children of government employees – Railway Board Orders February 6, 2018

- Grant of CEA to Two Children in case of a Child being totally mentally disabled – NFIR December 19, 2017

- Claiming of Children Education Allowance & Hostel Subsidy November 20, 2017

- Clarification orders on Children Education Allowance – DOPT issued on 31.10.2017 November 1, 2017

- Grant of Children Education Allowance and Hostel Subsidy to Railway Employees October 15, 2017

- Educational Concession to Children of Armed Forces Officers/PBORs – DESW Order September 16, 2017

- 7th CPC Children Education Allowance – Orders issued by DoPT on 16.8.2017 August 17, 2017

- Cabinet Decision on 7th CPC Children Education Allowance June 29, 2017

- Need relaxation for third child for Children Education Allowance – NFIR April 10, 2017

- E-Receipts as a proof of payment of fee may be treated as original for Children Education Allowance October 7, 2016

- Clarification on Children Education Allowance (CEA) – Dopt orders on 22.8.2016 August 23, 2016

- Claiming Children education Allowance is made simple in 7th Pay Commission January 12, 2016

- Eligibility criteria of a school for Reimbursement of Children Education Allowance – Clarification issued by CGDA December 22, 2015

- Simplified procedure for claiming Children Education Allowance: Revised Procedure: JCOS/ OR – PCDA(CC) Instruction December 17, 2015

- Children Education Allowance: Submission of original bills with details for reimbursement November 5, 2015

- Children of Government servants should study only in Government schools – Allahabad High Court August 25, 2015

- Children Education Allowance -Frequently asked questions – Railway Board Orders on 1.6.2015 July 6, 2015

- Clarification on Children Education Allowance as FAQ issued by Railway Board on 1.6.2015 June 9, 2015

- Railway Board orders – Grant of Children Education allowance/Hostel subsidy to third child October 2, 2014

- Grant of Children Education Allowance – Hostel Subsidy to third child October 2, 2014

- Recommendation of JCM Staff Side on Children Education Allowance June 25, 2014

- Will 7th CPC Add Lustre to the Children Education Allowance Scheme..? May 6, 2014

- DA Over 100% – Clarification on increase in certain allowances by further 25% w.e.f. 1.1.2014 April 28, 2014

- 100% D.A from January 2014 – Some Allowances and Advances Rise by 25% April 14, 2014

- FAQ on Children Education Allowance Scheme – Dopt Orders on 1.4.2014 April 1, 2014

Similarities and Differences Between CEA and Hostel Subsidy

CEA and Hostel Subsidy share some similarities and differences. The CEA is intended for children who are studying in recognized schools from nursery to 12th class, while the Hostel Subsidy is designed for children who are residing in a hostel. Unlike the Hostel Subsidy, the CEA’s reimbursement amount is fixed at Rs. 2,250 per month, and distance from the institution and age limit do not apply. In order to claim CEA, one must provide a certificate from the head of the institution, a self-attested report card, and fee receipts. CEA can be claimed once a year, after the completion of the financial year.

Children Education Allowance (CEA) for Divyaang

The Children Education Allowance (CEA) is available for Divyaang children in nursery to 12th class, as well as for diploma, polytechnic, ITI, and engineering courses for the first two years after 10th grade. Only the two eldest surviving children are eligible, except in cases of twins or a failed sterilization operation. The reimbursement amount is fixed at Rs. 4500 per month or Rs. 54,000 per year, and can be claimed once a year in April. The age limit is 22 years and required documents include a certificate from the school, self-attested report card and fee receipts. The allowance is also applicable during suspension or leave, and even after retirement or removal from service until the end of the academic year.

7th Pay Commission Hostel Subsidy

The Hostel Subsidy is available for government employees’ 2 eldest children in classes Nursery to 12th, as well as for those pursuing initial diplomas, polytechnics, ITIs, or engineering courses. The reimbursement is available for boarding or lodging expenses of up to Rs. 6,750 per month, with a maximum limit of Rs. 81,000 per year. The child must be under 20 years of age or until they pass 12th class, whichever comes first. The institution must be at least 50 kilometers from the government servant’s residence. Both CEA and Hostel Subsidy can be claimed concurrently.

Source: Click to view the PDF

What is CEA?

CEA is the short form of Children’s Education Allowance. This is Educational Financial Assistance for the children of Central Government employees.

Who is eligible to get CEA?

All Central Government employees with school-going children are eligible to avail of Children’s Education Allowance.

Can a third child be enrolled in the Child Education Assistance system?

The program permits enrollment of only the two oldest surviving children, except in cases where the second child’s birth results in multiple births and the number of children exceeds two.

What are the age requirements for claiming CEA?

The scheme does not specify a minimum age for either normal or disabled children. However, the maximum age for normal children is 20 years or until the completion of 12th class.

May I know whether distance education or correspondence is permissible for availing CEA?

Yes, the children enrolled in recognized institutions for distance education or correspondence are eligible to claim CEA.

Is Child Education Allowance taxable?

Yes, the amount getting on the chapter of Child Education Allowance is taxable. However, you can claim a tax exemption under Section 80C (maximum amount of Rs. 1200 per year for two children).

Could you please clarify the upper limit for CEA scheme reimbursements applicable to Divyaang children?

As of July 1, 2017, the maximum amount allowed for Divyaang children reimbursement is fixed at Rs. 54,000.

What is the upper age limit for Divyaang children who can receive benefits under the CEA scheme?

The CEA scheme provides reimbursements for education-related expenses to physically or mentally challenged children enrolled in any institution that is aided or approved by the central or state government. The reimbursement is applicable regardless of whether the institution is recognized or not, and can be availed until the child reaches 22 years of age, without any minimum age requirement.

Is it possible to claim CEA twice for the same class?

CEA may be claimed twice for the same class only in the event that a child fails in a particular class. However, if a child is admitted to the same class for other reasons, CEA cannot be claimed twice for the same class.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Sir, will the payment for 2015-2016 Children Education Allowance be received today? I need this urgent answer please.

Sir,

I got retired on 31 December 2022 from defence services , and my son is doing MBBS , sir can I have children allowance or hostel subside

Greetings..

Any order containing, ” no time limit to avail child education allowance” as given in 7th pay commission government of India decisions pdf

I am retired from service on June 2021. I am elligible for CEA for the F.Y 2021_2022 for my child in class IX.

My one child is disable and 2nd one is ok what will be the total cea amount per year.

Respected sir,

One employee has been claiming child education allowance after 12 years from 2008 in the month of April 2022. can he reimbursement? please advice.

DAS

No.

sir,

under which rule ? and OM details or rule copy

You can buy the SWAMY”s publication rule book of CEA and study it.

If an employee has been claiming Child Education Allowance since 2008 in the month of April, 2022, can he pay?

My son has taken up with B. Engg after completing his Diploma (after SSLC). I had claimed CEA from my department for a period of 10+3 (upto SSLC & DIPLOMA. Can I claim CEA for engineering purpose (lateral entry for 3yrs).

What is the time period for claim of CEA, as per Government Guidelines, whether an Govt Employee can claim his old bills of last more than 3 years, is he eligible. kindly post the Govt Orders if any please.

Sir, my date of initial appointment was 20.04.2020. Weather I am eligible for CEA 2019-20 academic year claim? If yes, wheather full amount per child or partial amount?

My child fee is 14400 per year …Can I claim 27000 please clear this fact with evidences…urgent

My child is studying in Sainik school which is a govt boarding school. The fees of Sainik school is 95000 per annum. Can I apply for CEA?

Yes, but claim restricted to government rates.

Thanks for sharing such information I really like it

My father is serving in air force now…35years of service finished..I am pursuing my b.ed (46k/year).so can my father get any amount refunded.pls reply

If he is having GPF amount he can take loan. If more amount require he can give VRS, so that he will be given Gratuity, balance of GPF, Insurance amount, encashment of leave amount, & commutation amount.

Is retired as junior warrant officer eligible for CEA if his ward studying in class 7th -12 th

After retirement not eligible to claim CEA.

Latest cghs impanneled hospital in Kolkata please

I am central govt employee my children studying in Central School

Kya I apply CEA

I am working in a central government mental hospital and my daughter is studying in nursary in a Montessori school which is unrecognised and not affiliated to a board. May I entitle to claim CEA reimbursement as per 7th CPC? My office refused to reimburse CEA claim as the school is unrecognised, please kindly suggest.

If child failed in class, can CEA be claimed again

Can pensioner reimburse the children education allowance.

Nursery to first tak kitni bar children education allowances le skte h railways

I am deaf and also My wife. My son is studying in NURSERY in a Eurokids pre-school as India study centre. May I entitled to claim CEA reimbursement as per 7th CPC? My office refused to reimburse CEA claim as the school is unrecognised. So I do not understanding what they refused. Please suggesting me.

My daughter is studying in UPPER NURSERY in a Montessori school which is unrecognised . May I entitled to claim CEA reimbursement as per 7th CPC? My office refused to reimburse CEA claim as the school is unrecognised. Please suggest.

Now What amount paid for children education allowance to employee if he already take advance of rs. 9000- for quater march-may? ❓ ❓ ❓

In our office, certificate from school is being applied as mandatory to all classes right from nursery till class XII this year(2018) since the recently issued order clarified that this certificate will be sufficient for claiming CEA. In this matter,I just wanted to be clear whether the same is required to be submitted yearly or not for claiming reimbursement in future?Kindly clarify clearly please……..

My daughter is in 9th class. She is learning bhartnatyam from recognised institute. Her school tution fee is 100 rs per month. Her dance fee is 3800 per month. Can I claim her dance fees under extra activity from railway department. If I can then tell how.

Sub.: Request for reimbursement / payment of education bill of my child – reg.

Sir,

With reference to the above-mentioned subject I would like to bring to your kind notice that my first wife met with unnatural death in the year 2003, she gone birth of a child who is legally living with his maternal grandfather (Nana jee), (as per order of Patna High court dated 04.02.2010 is enclosed) and I never claimed any expenditure incurred towards his study or other claims.

In the meanwhile I got second marriage in the year 2010 and blessed with the birth of two children (Daughter & Son). I am entitle for getting reimbursement of expenditure incurred towards study of my two children.

Since I have not claimed any amount for the child from my first wife. I am entitled for reimbursement of CEA of two children.

So, please inform me :- Can I claim for CEA of my 2nd child of my second wife & oblige.

The certificate from the school is sufficient for reimbursement of total amount of CEA , but fee receipts are needed for the month of April, May and June 2017 as CEA Order w.e.f 1.07.2017. There is no need to take receipts for July 2017 to March 2018. So pay Rs 1500 per month for April to June 2017 and Rs 2250 from July 2017 to March 2018.

Kindly clarify wether Rs 2250/- will be fixed for per month CEA without submitting school fee and other fee.

Kindly clarify how to check the total AMT of fees, uniform, books etc paid by the employee, if no receipts are needed to be produced. As it has not being mentioned in the bonafide certificate from school. Employees are forcing to pay them 27000/- for last year even if they have paid lesser AMT. As fees urgently guide.

Can I claim for ITI Student, who is completed 21 yrs age in 29 April 2018

Kindly clarify how to check the total AMT of fees, uniform, books etc paid by the employee, if no receipts are needed to be produced. As it has not being mentioned in the bonafide certificate from school. Employees are forcing to pay them 27000/- for last year even if they have paid lesser AMT. As fees urgently guide.

kindly clarify whether CEA has to be paid without verfying fee receipts/other vouchers or lumpsum amount of Rs. 27000/- is to be paid. As the tution fees of some employees are quite less.

Is receipt of school fees required for getting the reimbursement of CEA or only certificate from School is sufficient? Kindly clarify it.

Whether the certificate from the school is sufficient for reimbursement of total amount of CEA or we have to submit the relevant bills against expenses of school fees, uniform, text books etc. ?

Kindly check the O.M.s for CEA from this site-Ministry of personnel, public grievances and Pension (Deptt of personnel and training)from Allowance.Here you can get all the previous orders relating to this case,o.k.

I have SOS from Army wef 30 Apr 2008 (AN) being LMC and attributable to Military Service. My elder daughter is studying in BCA at Barasat Brainware Institute wef Jul 2017. Please clarify whether she is entitled to reimburse CEA and hostel subsidy ?.

Your comment is awaiting moderation.

My children is studying in ukg in a recognized school I had claimed nursery and lkg class fees in the same after completion of ukg can I claim ukg fees or not because some news I had heard that from nursery to ukg we should claim only two years is it correct or not plz let me know

we want to clarify whether CEA reCeipt is mandatory for claiming the same.

Please clear raimbersmentof college going studenrwho are studing in professionals course

academic sedsion in w.b.b.s.e from january to december.so when l appeal for CEA.

I was retired in oct 2016 and since then I am getting the normal pension all the 7 CPC benifits has not been adjusted till date and released till date . Kindly intimate as when the outstanding amount shall be given .

Please clarify whether the Children’s education allowance received as 2250/- per month is taxable?

If I’m working in the same district as of hostel .Will I get the reversement ?

I have 3 child.I never claim education allowance for my first and second child.May I claim education allowance for my third child????? Yes or no..please reply.

I am a railway service holder. My son is studing in class KG( one class below than class 1 ) in KIDZEE which has not any board permission.am l elegeble for CEA?

I am divorced got remarriage 1son for 1wife but he is not my dependant 2wife two child are the two child eligible for child education allowance

I am reemployed as PPS with Krishna Water Disputes Tribunal under Ministry of Water Resources, Govt. of India and getting all the benefits of regular employee such as HRA, LTC,, EL and CL, Newspaper reimbursement and telephone reimbursement. I have been given the 7th CPC benefits also. My pay has been fixed as per the new pay commission. I would like to know whether I am entitled to get children’s education allowance or not. When I was reemployed with National Security Council during 2014-2016 I was getting tuition fee reimbursement. Kindly guide.

Sir, i have payed 10 k as special fee and 4500 as Registration fee is that can included in TDS

Clk not found any supporting documents from records regarding cea still demanding receipts has annoyed for dsc records Kannur

So require proof any letter along with do pt ii

Sir, my wife is a teacher in a private school and my children study in same school. We do not pay any fee to school for children. But School reflects tuition fees in the form of perks to her salary. Can we get a receipt of tuition fees from school for claiming children education allowance.

I have three children. two of them have passed out XIIth class. They are not entitled for Education Allowance. Now o ne Child is differently abled and studying in 10th class.. Can I take Education Allowance for nextTwo Children

Sir,

Can children education allowance reimburse without submitting any memos, receipts etc.? Is only certificate from educational institute in prescribed pro forma as prescribed by the Govt. In 7th CPC sufficient for reimbursement of CEA?

Yours faithfully,

I have three children. one of them has passed out XIIth class. She is not entitled for Education Allowance. Now o ne Child is in Third Class and one is in First class. Can I take Education Allowance for nextTwo Children

Sir mera beta hostel me dalna hai our vah mere ghar se 10 km duri par hai kya mai hostel subcidy le satka hau

Sir, my two daughters are studying in medical colleges and I am a retired JCO . Shall I get any CEA in this situation.

My two children studying in private school,not affiliated by any board,can I claim for CEA reimersment?please guide us.

Sriman g main janna chahta huin k 7th pay co.mission k anusar kya hmko shool fees dress fees ka bill vgara v dena pdega ya only form fill up kr ka office main jma krna padega please reply dein sir.

My child get admission in Govt. Engineering college and his age is 18 year. Can I avail CEA for him for his hostel expense, Tution Fees and Mess Fees.

Sir’ My son is studying in class 2 , English medium, it’s a private school. But school authority stating that they have applied for NOC. Please tell me that whether I can apply for re- imburshment claim for CEA.

Sir,

MERI BETI KA ADMISSION KV ME HO GYA HAI WAHA KI FEE TO 500 HAI LAKIN TRANSPORT FEE 2000 JATA HAI KYOKI DUR KA SCHOOL MILA IS IT POSSIBLE TO CLAIM THE TRANSPORT BILL ALSO TO PRESENT THE BILL.

presently CEA is applicable for two children up to Class-XII. To promote the education for girl student, my suggestion/request is to increase the scheme for girl student up to Graduation level. it may help to strengthen the slogan “Beti bachao, beti parow.”

Hope you will look into the matter positively.

I have four children. I am availing tuition fee for second and fourth childre.First is married and third is disable.Both have been the students of govt school and never been claimed.Is it justified?

no as allowance is effective from 1.7.17 onwards, hence u can claim for A.Y. 17-18

What will be the child education allowance from april 2017 to june 2017.

Sir, please clear about CEA/tution fees and hostel subsidy for children after 12th , as my children are studying in higher class (degree course) in private college.

Is CEA is restricted to only first two children, is it not applicable to the other children for example if a employee is having four children and first two or above 20years and passed XII class and the other two children are studying in lower classes of IV and V below 20 years, can the employee claim CEA or not.?

Sir, My CEA claim is pending for the Edu. Yr. 2016-17, can i claim it at new rates ? kindly suggest me what can i do ?

Sir Kv school don’t have buses my child going to school by auto we are paying 800pm we are paying 8000 per year the govt provide buses to Kv schools plz

if admission is done in september and and claim is upto march only ,how much will be reimburse? whether the whole 18,000 or 7 x1500=10500 will be reimburse?

I am CISF serving at IGI airport New Delhi. My question is , why different rules in different CISF unit about CEA, TPT,

Gov’t served one memorandum, CISF is one department under MHA.. But out supervisory officer why not make uniform rule in all CISF Unit. It is so much lake of responsibility of our Sr. Supervisory officers.

Sir my two children who was studies in 12th and ९th class and expired in 2006 and2008 respectively. Now I hv a girl born in October 2009 please clarify whether I get C E A for herself as I hv only one Live children as per rule

Pl. Clarify

kindly close the k. v. school seats opening to central government employees. when central government employees children studied in k. v. school it is waste others are claiming full amount but here can;t possible atleast if they give full amount to the employees they can offer other activities. kv is not located near by house at least 3 to 6 k.m will be there transport expenses everything is loss

what is currently reimburse amount of CEA?? how much max can claim…it is still 18000 or 27000 Per year…plz reply with logic…Thanxxx

Sir

Are followings Items covered in education allowance ?

1 Stationary

2 Calculator

3School bags

Will we get some allowance or not. It is a worst injustice towards CG employee . No good pay commission no good allowance. I think we are going backward.

Sir,

No class required for handicapped children e.i special children for publication of part II order due to child already didabled, as such this conditions class not required.

Because not value of class for handicapped children.

Reimburse be paid only with out any class and observations.

Sir

Please as a suggestion add transport expenses in CEA . All students come in school by local,personal or institute prvided transport facility by paying money.

Sir,

If a central govt employee have three children, then only two elder children are authorized for CEA. In case the wife of an employee is expired leaving two children (both are authorised for CEA) and employee again remarried and have one more child from his new wife then in this case is also the third child is not being authorised for CEA. This is not good. Please look into the matter to authorised the third child for in this type of case.

This is a very fair request. Serving the nation and protecting the nation from hostile neighbors and terrorists is a supreme function and they deserve this concession,

Well if corporates as exporters operating from the SEZ can be given 100% tax exemption, where there is no philanthropy involved and is purely a commercial transaction for the purpose of making profits, the service of the defence personnel deserve a better concession who sacrifice their life and comforts for the sake of our nation. I cannot agree better that they need to be given 100% tax exemption and this needs a very serious consideration by the government.

Sir,

All the military and para military forces of our country are being performing their duties with fully dedication & determination during their services. But they are paying lowest salary package system in the world.

Sir, if they may be exempted from the paying of yearly Income Tax , they will help to maintain their children/family please.

I, request to Honorable FM Shri Arun Jaitely to look into our request please.

Sir,,

1. Refer to Janvani karyakaram of 1984. You may seen even rectified that requirement of food in respect of a man either poor or rich is one scale but rank structures are different. Accordingly pay scales and allowances are required to be fixed as per the humanity. i.g Minimum/maximum stages pay Rs 18000/- and 2,50,000/- will get increased rate of DA @ Rs 3% in which 18000/- will get increased DA Rs 540/- whereas 2,50,000/- scale will get DA Rs 7500/-. per month but the eating mouth of richer and poor never increased. Accordingly other allowances are also there which are based on pay scale/stages. Taking into consideration of the fact of poor and riches there should be a rule in between poor and rich men so as to maintain co-status as family members without making/bridging the gap of richer/poor.

2. In order to prevent the partial discrimination between people of lower and higher categories (poor and richer) there may e system to gather impartial modification which may be apprised to the coming generations unless you may arrange/open two type of markets in various places in the countries namely one for richer/officers another one for poor/lower rank to cater/serve their routine needs according to their income.

3. Keeping in vies of the gap of the ridging the richer and poor, I am mentioning the fact for future/welfare of the people of the country and not for mine.

defence pay anmalies are expected to be resolved as to what date

Hi sir CEA (1 st children ko 18000) aur 2 nd ko 18000 to abhi 7pay me kitna he

under the Scheme Children Education Allowance reimbursement can be availed by Government Servants up to to a maximum of 2 children but last issue twin. Why he claimed of 3 children of 7cpc?

CEA actualy direct pay to account as per children. No should be need of bill for cliam

under the Scheme Children Education Allowance reimbursement can be availed by Government Servants up to to a maximum of 2 children but last issue twin. Why he claimed of 3 children of 7cpc?

What is the new CEA. And those who have already taken their cea of last academic year that conditions they will get arrier? ?

Mohan

Minimum basic Pay for group D posts should be Rs atleast 25000/ and maximum should be 3 lakhs ,since it has to cover the entire cost escalation of the next 10 years {excluding HRA} which will be a

very longPeriod. Modiji will accept the above proposal and announce 30%HRA to four cosmopolitan cities instead of 24,% to the new basic Pay ji – by loving ly yours chandrmohan

Mohan

Minimum basic Pay for group D posts should be Rs atleast 25000/ and maximum should be 3 lakhs ,since it has to cover the entire cost escalation of the next 10 years {excluding HRA} very longPeriod. Modiji will accept the above proposal and 30%HRA hike to the new basic Pay ji chandrmohan

Wheather CEA is admissible for PSU’s employees who are transferred to North East Region & leave their family at the last station of posting

CEA procedure should be easier than present procedure of submission of fee receipt, bills of books/ note books etc . It should be based on publication of Part-II orders only. CEA amount should be credited in monthly salary like other allowances.

CEA procedure should be easier than present procedure of submission of fee receipt, bills of books/ note books etc . It should be based on publication of Part-II orders only. CEA amount should be credited in monthly salary like other allowances.

CEA should be incl in monthly salary on the basis of school continuation cert. Not need to publish pt II order.

CEA SHOULD DIRECTLY BE CREDITED IN MONTHLY PAYMENT LIKE OTHER ALLOWANCES. ALL DEPARTMENTS ARE HAVING THE RECORD OF CHILDREN OF THEIR EMPLOYEES (NIL/ONE/TWO OR NORMAL/HANDICAPPED). SO WHAT IS THE USE OF CLAIMING CEA BY INDIVIDUAL BY SIMPLY WASTING TIME AND PAPER.

The cea claiming procedure should be easy. Should not be required any certificate by school, only part 2 order publications for two children to be sufficient.

present procedure for claiming of CEA is better. ceiling limit should reqd to be increased.

Children alliance ko fix kar do quarter ly ya har maheene school ke sine kabhi koi number kabhi koi number paresan ho jate h phir lagta na

CEA should be easier procedure rather than present and credited with salary per month. It will be easier if it is based on part-ii order of children. No need to produce any school certificate because no one spoil their child at home without sending them school. Thanks

I have a physically disabled son whom I cannot send to school due to his severe physical and medical problems. But he is being given tuition for 10th and 12th stds at home. Tuitions for 10th and 12th stds is very expensive. I am paying Rs.10,000/- for home tuition. Childrens Educational Allowance does not take into account such expenses made to employees’ children. I cannot reimburse this expense. Childrens educational allowance should take into account such severe disabled childrens also and shoud provide the allowance with the undertaking from the employee and Administration who disperse the amount. Such disabled childrens who cannot go to schools are deprived of educational allowance and the parents are put to such a big burden. I request the govt should consider giving allowance to PH dependents to encourage them for home studies.

CEA should be easier procedure rather than present and credited with salary per month. It will be easier if it is based on part-ii order of children. No need to produce any school certificate because no one spoil their child at home without sending them school. Thanks

1. Procedure for claiming CEA should be simplified as present system is cumbersome.

2. It should be granted on the basis of an affidavit / self certification from individual concerned at the beginning of the academic year. Thereafter it should be realsed every month automatically with salary.

sir, for CEA for the children to join residential colleges in irrespective of the distance may kindly be allowed

SIR, IRRESPECTIVE OF THE DISTANCE TO RESIDENTIAL COLLEGE THE HOSTLE SUBSIDY MAY KINDLY BE ALLOWED

CEA should be admissible at least up to graduate level.

CEA may pl be paid with salary not to embers after produce of bills. Duplicate incurred.

CEA must be credited based on school certificate. It is very difficult to consolidate all receipt for a army personal who doesn’t live with his family. So that the payment may be credited directly.

Sir cea Grduation tak hona chahiye

Sir,payment of CEA should be pay with monthly salary

Sir,It means 2250×12=30000 rupees per annum.Sir then tell me how much has cea 1200 increased now?

payment of CEA should be pay with salary

sir we are getting children education allowance,but it is very complicated process, i think it will be simplify as every employ submit his children’s bonefide certificate and payment made by billing section.

Sir , In seventh pay commission ,the children education allowances is same or any changes . Is the allowances continuous. What is the amount given for one child for the academic year in seventh pay commission.

Sir, When effected 2250/-per month CEA

Sir children education allowance monthly salary ke saath milna chaye q ke is ko apply karne ke lea bohut se documents ke zarurat hoti he jo ke jwan ko chuti sehi time par na milne ke karn puri nhi hoti

It should be minimu 4000.

Per month and be started every month

No do-II be required due to non doc issue

I WANT TO GET THE UPDATED NEWS IN THIS REGARD

Children education allowance and hostel subsidy should be given to higher class.

sir, govt yeh sub kuch auth karti par har jawan tak iska labh nahi milta karan bahut sare document issue hote hai .meri yeh vinti hai ki sr school se cert. issue hona chahiya each year aur uske bad autmactic salery me Rs anachayea .thnx.

Children education allowance should also be given in higher education.after class XII

Yes sir CEA should creadited with monthly payment on production of certificate from school authorities once oin starting of academic year . And its muts be per month of one child 4000/-. No other docoments like DO part-2 orderrsfor all military and paramilitary personal.

CEA should credited with monthly payment on production of certificate from school authorities once in starting of academic year. No other documents like DO part -2 Orders for Defence personal

15 Dec 15

CEA should credited with monthly payment on production of certificate from school authorities once in starting of academic year. No other documents like DO part -2 Orders for Defence personal

I request to Finance Minister to increase pay scale all 4th class employee because all food materials was go to very high then it is very difficult for lower employees and child education fees and tuition fee goes to very high. sir I am very thank full to you.

If uniform multiplication factor 2.57 is taken kindly clarify a person in pay band pay 15600-39100 with grade pay 6600 having band pay of 19510 will get only entry level pay of level 11 that is 67700 which is same with a person having band pay of 18750 which is the entry level, that means a person with one year more service and who was drawing more in 6th cpc than the entry level 18750 person will be getting same along with one year junior. This is same with all persons at different level who are having one year more experience than the entry level persons. This is an anomaly to be rectified

Cea har mahina salary me hi hona chahiye kyo ke bill payment ke samay koi problem nahi hota iske alalwa samay barbad nahi hota employee saaci lagan say apni duty thik dhang kar sakta hai is ke alawa post gradutation tak ka CEA milna chaiye

Sir jo bhi cea dena usko bacche ka sal main ek bar school certificate dekhkar dena chahiye bill system nahi hona chahiye bill system se koi bhi jawan nahin kar pata hai.

The cost of education from Nursery onwards per month has crossed to around Rs.4000 minimum. Then imagine the cost of higher education which has escalated to almost 1.5 lakhs p.a. How do we manage?

CEA should credited with monthly payment on production of certificate from school authorities once in starting of academic year. No other documents like DO part -2 Orders for Defence personal

CEA should be credited into the individual’s IRLA directly based on production of annual certificate ie once in a year by the individual to avoid the unnecessary paper work at all level

CEA should issue to govt employ in monthly salary after receaving the school certificate. The amount of CEA is not sufficient pl increase it.

CEA should pay with salary after taking a certificate whether children is studying or not served by school to avoid other paper working or corruption.

Since only tuition fees is about 4000 the amount 18000/-is quite low amount

The cost of education from Nursery onwards per month has crossed to around Rs.4000 minimum. Then imagine the cost of higher education which has escalated to almost 1.5 lakhs p.a. How do we manage?

the ceiling of CEA will be increased to 6000/- monthly, this is because now every parent are aspiring their children to be an IIT ian or MEDICO. Since to become an IIT ian or MEDICO one (PARENT) HAS PAY LAKHS OF RUPEES AT THE 10+2 LEVEL.. In the wake of fee expenditure payment to education institution, it is just and fair on the part of the Government to consider the maximum hike in CEA.

Cea monthly salary ke sath hi fixed hona chaye billing system hona nhi ahaye kyonki jawan cilame nhi ker pate hai isliye annual school certificate honi chaya

Whole allowances should be credited to the salary account at the begining of academic year on producing of school bonafied certificate obtained from school authority.

Annual CEA may be fixed and given to the employee on monthly basis with salary only after producing a certificate to be provided by school once in a year before effecting the CEA this is better than govt emploies.

asper DOP&T directive only two eldest children are authorised for CEA. But clearly not mention in any PDF file of DOP&T, regarding disabled children, either two eldest disabled children or any two disabled children are eligible for reimbursement of tuition fee

Annual CEA may be fixed and given to the employee on monthly basis with salary only after producing a certificate to be provided by school once in a year before effecting the CEA

Sir whats CEA increase

The amount of children Educational Allowances may be fixed in slabs i.e. Primary, Middle & Secondary instead of common Ceinling.

Thanks

amount fix up needs as per hick of market price and need high level disscussion

CEA must be given up to graduation level for girl child only, be-cause we are telling for the girl child to pay more attention and giving lot of benifit for education

Dear Sir

As u know every govt employee children is going to school regularly,then stop the process of depositing bill.Instead of that u can ask for bill at the time of admission and in the month of Apr each year.secondly I request u to fix the amount because there is a large difference in adjustment by the CDA. Someone is getting 800 rs per Mon n someone is getting 1500 per month for the same.so I request u to fix the amount which will be same for each n everyone

Thnx

I hope 7th pay commission also sanctioned to suggest of children Education allowance will be paid up to post Graduate level .

CISF

Sir in indian army for PBOR also get physical promotion as MACP service as per enrolment dt

Respected Sir,

Many of the army pers suffering from this CEA fobia. Sir, the govt had started this scheme for the welfare of troops and to give them a financial support so that their wards can be able to go for higher studies. however, since last three years (since initial stage) most of the Pay Account Office, are not adjusting any amount on account of CEA and is manually rejecting the CEA Pt-II Orders by giving various reasons each and every time they had submitted fee bills as they had prepared their own law of adjustment. As per Army HQs letters fees includes every general things like tuition fee, science fee, sports fees etc but even if someone had submitted a bill of 3,000/- they adjusted sometime 300/- sometime 1,000/- and etc. On asking the reasons for not adjusting that 3,000/-, they replied nothing.

Sir, plz stop this procedure and i am requesting you to give a suitable amount and publication of part II order is not required every time and without submitting fee bills or abolish this scheme. You can also take survey amongst the troops for this and take action accordingly.

Sir, that already government has been announced as each child will get 18000/- per year as children education allowance but concerned department demand for submit bill to refund so what necessary to submit bil so this system should be stopped.

Respected Sir,

I hope that 7th pay commitee will take decision in favour of Central employee in reference of CEA.

Today give to better education to children very difficult task for all. In this situation ,all central employee have seen towards you.

Thanking you….. .

SIR, All Governments promotting for ONE GIRL CHILD NORMS. .Then CPC .may give attention to those Govt; employees having only girl child . ..

i am DEO’B’ since jan,2006. but there is no further promotion till now. it should be merged in admin grade. as i have completed 30 years service. what will be in the 7th pay scale. in this grade the grade pay is lower than my juniors.

Sir, I am requesting to introduce :-

1. Every pers who have children will provide CEA.

2. No bill will be forwarded to PAO office.

3. Pay account office will ask about living of children every year.

4. Certificate from Principal, stating that this child is studying with this school will be forwarded to PAO.

5. Ask certificate from indl every year, stating that this is my child and studying in such and such class.

6. On completion of academic session CEA will be published on or after 01 Apr of preceding year providing previous year documents.

4. Adjust amount aromatically as per scale..

Yours’ Kishor Hadekar

Respected Sir, I am working as Sr. Accountant in the Office of the Principal Accountant General, Arunachal Pradesh, Itanagar. There is a ban on implementation of Unilateral transfer in this IA & AD (Indian Audit & Accounts Department). This is very weird to know that there is no transfer in such an important Department of Central Govt. This Department is considered for checking the prevalent corruption in various Central Govt and State Govt Departments. Here it is note worthy to mention that how this IA & AD is able to check CORRUPTION when it doesn’t allow Unilateral Transfer to its employees.?? Every Department under Central Govt exhibit the Policy of Unilateral Department. I am posted in the O/o the Principal Accountant General, Itanagar, Arunachal Pradesh. In this state, the rate of Corruption is very high. Various employees working in this state are being offered huge sum of bribery in Lakhs of Rupees. I seek attention from the Department of CAG and Central Govt to see into the matter and implement the policy of Unilateral Transfer in IA & AD, Department of CAG, so that the integrity of the employees of this Department is maintained along with observing the transparency in rendering our services to the Central Govt and the Nation. Jai Hind Jai Bharat.

One rank one pension for para military personnel ( for PB0R). CEA claim should be introduced for pensioners also (for PBOR). Ex Servicemam facility for PBOR of paramilitary personnel. Calculation should be equally for service and pensioners personnal for same grade pay. There should not be different because there are no scope of income burden also increased like higher studies, marries of childrens and self illness due to age factor.

Sir, plz stop this procedure and i am requesting you to give a suitable amount by publication of Pt-II Order and without submitting fee bills or abolish this scheme. Sir mostly troops are suffering the same poblem. You can also take survey amongst the troops for this and take action accordingly.

Hai sir good evening I am Hav Manjunath my twin children’s I was forwarded to cea bills both but my PAO OR has adjustable only child please instruct my records claim to both children cea thank you

Sir please change the procedure of CEA. Because all soldier busy in duty and he can not submitt the all types of bill.some time pao reject the part II order.and CEA has not claims at time.soldier has mantely upset.

Respected sir, Education is beneficial to not only individual but also is necessary for nation building , The government should provide maximum effort for wards of employee to become Engineer, Doctor etc. after the 10+2 fee for them may be reviewed

as of this days every one wish to send their children for better education at a best institution. So the proceedures may simplify as early 2006. Amount may be fixed variously for Nursery, Primary, Upper Primary, High School etc. All clerks are bothered about their GRADE PAY only, not for work or staffs welfare. This can be gave a little relax to LDC/UDC

.

Respected Sir/Madam., Govt has been entitled CEA for 2 child . Those who are in service they are getting the facilities but those servicemen who’s child is very minor and issue after retirement they are not getting CEA even they are doing same service in the force/department My question is that if govt has given CEA for 2 child. some individual not got any child or they have minor child while in service after retirement they get child. In that time their income source also decrease in this time how he can give education for minor child. So it should be good if govt has give CEA for 2 child whither in service or after retirement. that would be justice because both type of children parents had done same service.

Respected Sir , I and my whole PBOR requested regarding CEA procedure amended please Child Edn Allces atomically adjusted by PAO (OR) only initial certificate obtained from respective school and fwd to PAO (OR) thereafter no part II order publication for the same so that all CEA adjustment adjusted in timely without any problems

School fees have increased very much. It must be at least Rs. 2000/- to Rs. 2500/- minimum, then only the purpose will be solved.

1) None of the government has planed about the educational facilities for Handicapped, Blind and Deaf and dump children. some NGO’s are providing the higher educational tutors for those children Government shall provide special Education allowance to such parents for welfare of handicapped child .in 7th Pay commission.

2) To motivate the girl child birth rate , the special education allowance for parents having one or two girl child shall be provided in 7th pay commission

Sar

retirement ke bad ek x man ki pension kitni hogi.

camission ke bad army retirement ki age limit kya hogi

I think that slab of d.a. is required because every person either group- A or group- D all are marketing from Indian market but some group drawing DA 5-10 time then other . Whereas according to rank, basic lay and grade pay already prescribed according to rank and responsibility . The commission may take care to this matter of DA slab as like before 6th CPC.

Whether the Government think that the children of Central Government Employees should study upto 10+2 level as the Children Education Allowance is being paid upto 10+2 level. The education beyond that level i.e. Graduation(B.Tech/BAMS./MBBS/B.Arch.) Post Graduation is more expensive. Hence, the Govt. should seriously think about that so that the children of Central Government Employees can study as per their ability to study and they can be compensated by way of paying children education allowance. Jai Hind Jai Bharat.

One rank one pension for para military personnel ( for PB0R). CEA claim should be introduced for pensioners also (for PBOR). Ex Servicemam facility for PBOR of paramilitary personnel. Calculation should be equally for service and pensioners personnal for same grade pay. There should not be different because there are no scope of income burden also increased like higher studies, marries of childrens and self illness due to age factor.

Sir,

Army, Airforce, and Navy Avition tach will be going with aircraft every shorty but pilot’s has get risk alounce but Avition tech not get risk alounce

This alounce get Avition tech

Respected Sir,

I am suffering from this CEA fobia. Sir, the govt had started this scheme for the welfare of troops and to give them a financial support so that their wards can be able to go for higher studies. however, since last three years (since initial stage) my Pay Account Office, Ahmednagar is not adjusting any amount on account of CEA and is manually rejecting the CEA Pt-II Orders by giving various reasons each and every time i had submitted fee bills as they had prepared their own law of adjustment. As per Army HQs letters fees includes every general things like tuition fee, science fee, sports fees etc but even if someone had submitted a bill of 3,000/- they adjusted sometime 300/- sometime 1,000/- and etc. On asking the reasons for not adjusting that 3,000/-, they replied nothing.

Sir, i had approached my child’s school to provide bills as per my PAO (OR)’s requirement, the school said they cannot change their bill format for just few persons request. Now, what should i do?

Sir, plz stop this procedure and i am requesting you to give a suitable amount by publication of Pt-II Order and without submitting fee bills or abolish this scheme. You can also take survey amongst the troops for this and take action accordingly.