7th CPC DA Calculation – Do you know how DA is calculated? – Easy online calculator for you!

7th CPC DA Calculation – Do you know how DA is calculated in 2024? Calculating Dearness Allowance (DA) and Dearness Relief (DR) on salary and pension is a very simple! The first step is to determine the existing rate of DA percentage, which is common for all employees. For example, if your basic salary is 29200 (pay matrix level 5), your DA calculation will be as follows (50 x 29200) / 100 = 14600. Hence, the DA amount you’ll receive Rs.14600 from 1st January 2024 (Expected)!

Similarly, to calculate DR on your pension, follow the same method. Multiply your basic pension by the current DR rate and divide the result by 100. For example, if basic pension is 24500 (not bank pension), your DR calculation will be as follows (50 x 24500) / 100 = 12250. Hence, the DR amount you’ll receive Rs.12250 from 1st January 2024 (Tentative)!

Central DA Calculation Effective from 1.7.2023

| Current Rate of DA | 42% of the Basic Salary |

| Minimum Basic Salary | Rs. 18000 |

| Minimum Dearness Allowance | Rs. 7560 |

| Minimum Basic Pension | Rs. 9000 |

| Minimum Dearness Relief | Rs. 3780 |

DA Online Calculator

| Tool Name | DA Online Calculator |

| Beneficiaries | Central Govt Employees |

| Published on | 25.7.2020 |

| Updated on | 11.4.2022 |

| Input Details | Pay Matrix Level and Basic Pay |

| Output Details | Amount of Dearness Allowance (Current Rate) |

| Tool Feature | Previous rate and Expected rate of DA % |

| Developed by | TEUT Digital Concepts |

7th Pay Commission DA Calculation

On September 28th, 2022, the Cabinet Committee gave their approval for a 4% increase in Dearness Allowance for both Central Government employees and Pensioners. The new rate will be effective starting July 1st, 2022, replacing the current rate.

The status of the expected DA from July 2022 appears to be nearly confirmed. The Dearness Allowance for central government employees and pensioners may be raised by 4% from July 1, 2022, changing the total percentage from 34% to 38%. As for the current DA, it stands at 38%. The suspension on increasing the DA for CG employees and pensioners has been revoked by the Union Cabinet Committee. The increased rate, which includes three installments from January 2020, July 2020, and January 2021, will now be at 31% starting July 1, 2021. However, the additional installment of DA due from July 2021 is yet to be granted – View More

[It is important to note that the Variable Dearness Allowance (VDA) is not applicable to employees of the Central Government. It should be noted that the Variable Dearness Allowance and the Dearness Allowance are two separate entities.]

How can one calculate their Dearness Allowance (DA) in their salary?

The process is uncomplicated. All that’s needed is to multiply the current rate of Dearness Allowance with the basic salary to attain the DA figure. As an example, suppose an individual has a basic salary of Rs. 49000 and the prevailing rate is 12%. In that case, their DA would be (49000 x 12) /100.

How do fix the DA and DR Percentage for CG Employees and Pensioners?

One way to address the inflation of essential goods is for the Indian government to set a specific percentage of DA and DR for its employees and pensioners every six months. The calculation of these percentages involves using the AICPIN data from the previous 12 or 18 months depending on the specific month for which the percentage needs to be determined. For example, to determine the DA percentage for September 2019, data from October 2018 to September 2019 would be needed, and the percentage would take effect from October 2019. Therefore, having access to the relevant AICPIN data is crucial in accurately calculating these percentages.

Also check: DA Loss Calculator (January 2020 to June 2021) for Central Govt Employees

All India Consumer Price Index (AICPIN)

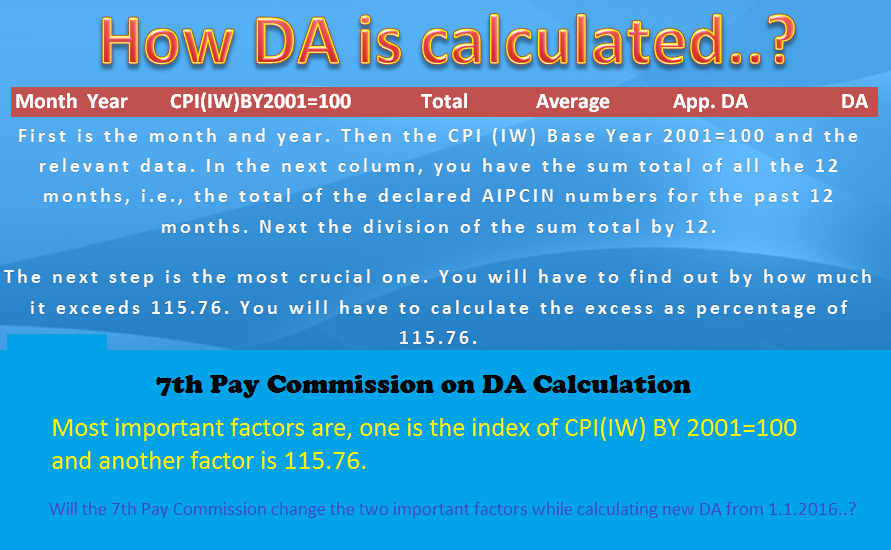

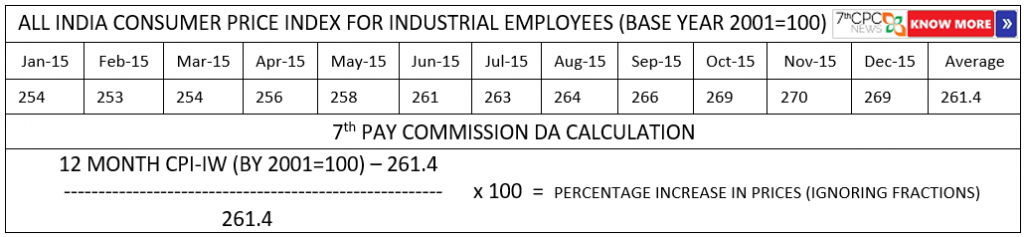

The Dearness Allowance computation depends on the All India Consumer Price Index for Industrial Workers Base Year 2001=100, which the Labour Bureau releases monthly. The 6th CPC DA Percentage calculation is (12 Monthly Average – 115.76) / 115.76 x 100 (decimals excluded), while the 7th CPC DA Percentage calculation is (12 Monthly Average – 261.42) / 261.42 x 100 (decimals excluded).

6th CPC DA Percentage = (12 Monthly Average – 115.76) / 115.76 x 100 (ignore decimals)

7th CPC DA Percentage = (12 Monthly Average) – 261.42) / 261.42 x 100(ignore decimals)

Check also: 7th Pay Commission DA Chart

For instance, in order to calculate DA for January 2018, it is required to gather AICPIN data of the entire previous year, from January 2017 until December 2017. Next, let’s analyze the chart that presents the process of DA computation.

| Month / Year | AICPIN |

| January 2017 | 274 |

| February 2017 | 274 |

| March 2017 | 275 |

| April 2017 | 277 |

| May 2017 | 278 |

| June 2017 | 280 |

| July 2017 | 285 |

| August 2017 | 285 |

| September 2017 | 285 |

| October 2017 | 287 |

| November 2017 | 288 |

| December 2017 | 286 |

| Total of 12 Months of AICPIN | 3374 |

| Average of 12 Months of AICPIN | 281.17 |

| DA Fitment (Linking) Factor (261.42) | 7.55 |

| DA for the month of January 2018 | 7% |

How to Calculate DA for Defence Personnel

Calculating DA for Defence personnel follows the same process as for Central Government employees. However, the relevant ministry issues the directive for this calculation. To illustrate, we can examine an instance of DA calculation.

| DA Calculation for July 2022 | |

| AICPIN 314 Points | |

| 12 Month Total | 3648 (291 + 301 + 301 + 301 + 302 + 302 + 301 + 307 + 307 + 309 + 312 + 314) |

| 12 Month Average | 304.00 (3648/12) |

| Increased Over 261.42 | 16.29 (304.00-261.42) / 261.42) * 100 |

| Approximate DA% | 16 |

Also check: DA Rates from 1986 to 2015

What is the difference between DA and DR? and What is the meaning of ‘DA Freeze’?

The distinction between DA and DR lies in their recipients – DA is given to active Central Government employees, while DR is given to retired government personnel or CG pensioners. “DA Freeze” refers to the temporary suspension of an increase in Dearness Allowance that is given to both groups every six months. This has been put on hold for 18 months, from January 1st, 2020 to June 30th, 2021. [Click to know more]

7th Pay Commission Salary Calculator Updated Oct 2019 Basic + DA Calculation Sheet

Basic plus DA (Dearness Allowance) Calculation Sheet:

| Pay Matrix Level | Basic Salary | DA 28% |

| Pay Level – 1 | 18000 | Rs. 5040 |

| Pay Level – 2 | 19900 | Rs. 5572 |

| Pay Level – 3 | 21700 | Rs. 6076 |

| Pay Level – 4 | 25500 | Rs. 7140 |

| Pay Level – 5 | 29200 | Rs. 8176 |

| Pay Level – 6 | 35400 | Rs. 9912 |

| Pay Level – 7 | 44900 | Rs. 12572 |

| Pay Level – 8 | 47600 | Rs. 13328 |

| Pay Level – 9 | 53100 | Rs. 14868 |

| Pay Level – 10 | 56100 | Rs. 15708 |

| Pay Level – 11 | 67700 | Rs. 18956 |

| Pay Level – 12 | 78800 | Rs. 22064 |

Top Related Updates on 7th CPC DA

- Bank DA Feb 2024 – Latest Updates!

- Expected DA Jan 2024: Almost Confirmed by Oct-23 AICPIN

- AICPIN plays like seesaw! – What happens next?

- DA 50% from Jan 2024 – Looks Promising!

- अक्टूबर 2023 AICPIN – जनवरी 2024 DA गणना

- AICPIN for October 2023 | Expected DA for Jan 2024

- Expected DA in 2024 Latest News Today

- AICPIN September 2023 | Crucial Stage for Jan 2024 DA!

- 46% DR from July 2023 – DoPPW Order

- Dearness Relief Arrears Calculator After Revised to 46%

- Dearness Allowance Arrears Calculator After Revised to 46%

- Check The Monthly Salary of Your Pay Level and Basic Pay | DA Revised to 46%

- Revision of Rates of Dearness Allowance effect from 1.7.2023 | FinMin Orders On 20.10.2023

What is the meaning of Freezing of Dearness allowance

What is Dearness Allowance (DA)?

Dearness Allowance (DA) is an allowance given to employees by the government and certain private sectors to help them cope with inflation and the rising cost of living.

How is DA calculated?

The calculation of DA involves taking into consideration several factors such as the current inflation rate, cost of living index, and consumer price index.

How can I calculate my DA?

You can calculate your DA by using a 7th Pay Commission DA calculator. It’s an easy-to-use tool that considers your salary and current inflation rate to determine your DA. You can also speak with your HR department or refer to your employment contract for more information.

Who is eligible for DA?

All Central and State government employees, pensioners, and family pensioners are eligible for DA.

What is the current DA rate?

The current DA rate is 46% as of July 2023 and the expected DA from Jan 2024 is 50%!

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

I was on TD from April 2017 to September 2017. I have been paid ta/da as per old rule/rate for whole period of TD and I had to bear loss of rs 50000 approx. Whether I am entitled for new rate we 01/07/2017 or not. Pl advice. I am a paramilitary staff.

According to DA is worked out as 10% of basic pay from July 2018 but the order says it is 9%. I am not quite convinced how reduction of 1% resulted?

Sir this month onwards how much DA give it to anyone

[26/10, 2:05 pm] Dilbagh Rai: Dear Sirs, I would like to bring it to your kind notice that recently the government have increased D.A. of employees by 1%. for those who get revised pay. And 3% for those who do not get revised pay. I calculated that my unrevised pension was 18215 , and that way I would have got Rs.547/-as d.a. but now my revised pension is 46813 and at the rate of 1% of d.a. I shall get 468 only I.e.a loss of Rs.79/- app. Hence that a revised pay or pension receiver gets less instalment every time inspite of the

fact that he got raise in basic pay and pension. It has been happening right from the first instalment of d.a. after revision. Isn’t it a fraud on all employees and retirees?

Similarly from 1.7.16 till today we have got 5%d.a. that on 46813 I get 2340 whereas on18215 I would have got 14% that is 2550. Now please calculate the exact loss . That is 210 till1.7.17 0nly.

It is requested that the issue may be raised at proper forum of Central gov’t. The injustice done must be got undone by getting the fitment formula revised and also getting the D.A. calculation formula rectified accordingly.

[26/10, 2:05 pm] Dilbagh Rai: Dear Sirs, I would like to bring it to your kind notice that recently the government have increased D.A. of employees by 1%. for those who get revised pay. And 3% for those who do not get revised pay. I calculated that my unrevised pension was 18215 , and that way I would have got Rs.547/-as d.a. but now my revised pension is 46813 and at the rate of 1% of d.a. I shall get 468 only I.e.a loss of Rs.79/- app. Hence that a revised pay or pension receiver gets less instalment every time inspite of the famil

[26/10, 2:08 pm] Dilbagh Rai: fact that he got raise in basic pay and pension. It has been happening right from the first instalment of d.a. after revision. Isn’t it a fraud on all employees and retirees?

[26/10, 2:21 pm] Dilbagh Rai: Similarly from 1.7.16 till today we have got 5%d.a. that on 46813 I get 2340 whereas on18215 I would have got 14% that is 2550. Now please calculate the exact loss . That is 210 till1.7.17 0nly.

The grade pay system abolished by the govt .then there should be two increament in the place of one increament for promotion otherwise there are great loss for jco in the armed forces and sub inspector in capf.

GOVT DA WAS 2% ON JULY 1, 2016. IT WILL BE MINIMUM 5% ON JANUARY 1, 2017

What will be DA after fixation of 7th pay commissio. How much

DA Government sanctioned. Weather Govt. issued orders for release of pension plus DA for the month of August?

What will be the DA after fixation of 7th pay commission pension. Weather August month pension calculated as per new

Pension including DA?

One employee pay on 1.1.2016 is 12530+4200(basic + GP). Got promoted on 1.3.2016 to GP 4600 and 2 increment on 1.1.2017 (BP is 13640 on 1.7.2016. What would be Basic Pay now and how (option 1or 2 )

What will be the DA after fixation of 7th Pay ? Everybody wants to know , publish immediately and get everybody out of doubts and gossips

One employee working in my office drawing pay Rs.6330+GP1800 on 01.01.2016 got promotion to Pay band 5200-20200+ GP 1900 on 6.6.2016 how will be his fixation and date of ?

what is situation in Dearness allowance in 7 th pay?

how we get Dearness allowance i our salary?

how it is calculated ?

I think, New DA from 01.07.2016 will be 2% as the calculation worked out it as 2.90% as detailed below:

Step 1- Average of 12 months (Jul 15 to June 16) to index is 269

Step 2-Average of 12 months (Jan 15 to Dec 15) is 269.42 which will be base index as on 01.01.2016 as per approval by Govt.

Step 3- formula has been used only by changing base index (earlier it was 115.75 and now it may be treated as 261.42) as under

(269-261.42) X 100/261.42 and it will come as 2.90

It means that New DA as per 7th CPC would be 2%,if my presumption is correct.

If any other opinion, please write us

Vijay Kumar Gupta

Bokaro

iaadvijay@gmail.com

M 9431464174

for the D.A from 01-07-2016, the factor 261.4 is not correct. I think it is arrived as 115.76* 2.25 = 260.46. So it should be 260.46 only. The 12 months average in CPI-IW is 269. Now the D.A = (269-260.46) *100 / 260.46 = 854/260.46 = 3.2788144. So, the D.A from july 2016 should be 3%

Whatever base pt/ reference is fixed for DA as on 1/1/2016, DA increased be considered up to first decimal place, otherwise loss will occure to cg employees. Suppose there is 7.3% increase on pre revised salary, corresponding inc in revised salary would be around 2.8% . Leaving fraction 0.8% in revised salary will be large amount compare to 0.3% of 7.3 in old salary. Should it not be considered up to first decimal place.

Example

DA on pre rev salary say Rs 10000/ will be Rs700/ if 7% DA increases

Corresponding revised salary Rs 25700/will have DA of Rs 514/ if corresponding ins is 2%

125% D.R. is not taken into account while fixing the revised pension as on 1.1.2016. if the present basic pension is multiplied by 2.57 without adding the D.R of 125% is nothing but an increase of 1.32 % only. ie. after 10 years of revision only meager increase will come to the effect. As recommended by earlier pay commission 100% DR should have been merged with the basic pension and then to be multiplied by 2.57%. Otherwise it is nothing.

i retired on 31-12-2008 the pension fixed incorrect the case was before cat chandigarh now the decission given by cat chd is pending before the HONOURABLE theMinistery of Finance New Delhi G.O.I i am from M E S Deptt No 357717 kuldip singh MCM Refrigerator Mech G E. AIR FORCE AMBALA CANT Your kind honour is requseted for early settlement of case favourabily i will be highily grateful to the honourable Ministery thanks My Address ;Vill URNA P O KHERA-GAJJU Teh RAJPURA Distt PATIALA PUNJAB Pin- Cod -140602

The D,A. applicable upto June 2016 i.e. 125% has been merged with the new basic so as to make new applicable basic.. So the D.A. for Jan. to June 2016 will be zero. . For other allowances there is no clarification till now,

pay commission implement from 01-01-2016 then the DA up to 31-12-2015 will be merge in new pay in place of the DA up to June 2016 meagre , as stated by all unions and ministry .etc. need clarification from ministry.

Will the notional increment earned at promotion /Financial up gradation count towards no of increments under the second option in 7th pc

Let me know sir

How the dearness allowance be calculated after 125% or in very new 7th CPC . There is matrix pe system . Suppose it increase 7% after 01.01.16 ,what will be the figure ,will it run in decimal or rounded off .

There is no clarity on da calculation ahead

Kindly help me .

Thanks

S.k. sharma

There is no clear details of D.A. in 7th Pay Commission of Central Govt. employees after merging 50% of D.A. out of 135% with effect from 01-07-2016. Further no details for what will be the D.A. after new pay hike. According to present cost of living over all monetary benefit should be 50% to 60%. Is the Central Government will be consider this fact? If somebody known about the D.A. details, please inform me. Thanking you.

The New DA formula is( 12 months average CPI IW – 261.33)x100/261.33. The average CPI IW on 01/01/2016 is 261.33. Thus expected DA is only 2% from July 2016

D.A. due w.e.f. July 2016 will no .doubt be applicable with new salary but it will be paid later on as arrears after approval by the cabinet ministry.

pay fixation is to be done by adding one increment in the old pay scale 6 cpc and fixed in 7 cpc at appropriate at apppropriate Pay Matrix Level pay scales this is not mentioned no where clearly kindly clarify it

I think, DA due from July 2016, would be applicable with new salary

Does DA will added in pay band matrix of minimum level of 59,000 for captain in MNS or it is excluded Please confirm and say

Any DA after processing of 7th CPC

Namskar… now my self is serving in BSF and enrolled on 14/07/1990. After 12 years completed service, 1st ACP not granted in annual increment. There was condition by department that…. you were completed promotional course i.e. Section Leader Course (SLC) before twelve yrs. According to large numbers of soldiers who enrolled in year 1990 were done SLC after 14 years of service instead of before 12 years as per course plan of BSF.. I got 1st ACP in year 2004 after completed SLC/DPC and service 13 yrs 7 months instead of 12 yrs.

Now I want to clarify that … I am able to get ACP from 12 years of service or not… please inform me.

Most govt servants opt for 40% cut of Basic pension towards lump sum viz., Commutation Value of Pension (CVP).

Your table can be updated as: 1.Pay Band6PC fixed/ Refixed at Retirement.2.Basic pension drawn 6PC. 3. Pension drawn after Commutation in 6PC.(60%) 4. Pension fixed as per 7PC. 5..Reduced Pension after Commutation fixed 7PC. DA 7PC1.1.2016. Total.

A table as per above will be helpful as most GS have opted for CVP.

Thanks

Ruchen S.Barua.

Respect ed sir any calculations for how to calculate the number of increments to retirement scale

Retired aao dad Band pay 22200 grade pay 5400

At the time of 5th pay commission all clks was in Gp B and after 6th pay commission one gp Y is fixed for all i.e GD,DVR, Trademens, it was not justified for clks trade because they are continued office work after attend the PT and game parade. So please dont ignore. Also request for justified pay and pension with all JCOs of the Army. MSP should be equal for Offrs,JCOs and ORs.

MSP not justified for JCOs.It should be at least. In the ratio of 1:2:3 for ORs:JCOs: Offrs.Pl don’t degrade JCOs. ( ie Rs 5200 for ORs Rs 10400/ pm for JCOs& Rs 15600/ pm for Offrs as per VIIth PC.Even Hon Offrs ( JCOs) are proposed for Rs 15600/ pm Who is performing duties& responsibilities of JCOs.Pl relook. thanks

MSP giving only for defence combat persons. Then why a greater MSP more than Other Rank given to Military Nurses and they have no any hardship duty also.

No calculator for doctors serving under central government.

ARVIND KUMAR GOEL retired PS, DoP

I retired in April 2014. My basic pay at the time of retirement was 13170 and grade pay Rs.5400. Kindly let me know what will be my pension after implementation of 7th CPC and how much arrear I will get.

I RETIRED IN 2003 IN THE SCALE 5500=9000 AND MY LAST BASIC PAY IS 7250. MY PRESENT BASIC PAY IS 8035. KINDLY LET ME KNOW WHAT WILL BE MY NEW PENSION IN THE 7TH CPC

i retired in march 1996, as per sixth pay commission my pention is (9226).What will be my pention as per 7th pay commission?

I am a pre 2006 family pensionar . My basic pension is now 4887 and total pension is 11203 . Please calculate my new pension after 7th cpc.

kindly tell me what will be my new pay from 1.1.16 . Now my pay is bp.12350, gp is 2800. Living and working in chennai. 3rd macp also received. Thanks.

My pension as per 6th pay commission is 10800. I received 4 increment on my last pay. What will be my pension as per 7th pay commission

Why zigzag ways are being used for explaining DA/DR w.e.f. 1-1-2016? Why at all calculate DA w.e.f. 1-1-2016 when it is being said / inferred that DA would be ZERO wef 1-1-2016 & now DA would be due only wef 1-7-2016?

Please Don’t confuse people.

The NDA govt. has took action on 7th pay commission at appropriate time, we should have some patience, I presume at or after budget it will be announced. You compare when 6th cpc was announced with 7th cpc. IT SHOULD HAVE BEEN ANNOUNCED ON 31-12-2015, but it is India, previous govts. have done KARAN GAY, DEKHAY GAY, KAR RAHAY HAIN etc. etc, and I think this govt. is trying to come near perfection. IT IS MATTER OF TIME IF ALL GOES LIKE THIS .

Heard regarding upgradation from 4200, 4600 and 4800 Grade Pay. What steps are being taken regarding upgradation of Payment of Private Secretary in field area as per 6th cpc in Field area Steno-II is having GP 2400,Steno-I is having 4200 and PS is having Rs. 4600 where as in Ministry Steno-D Rs. 2400, Steno-C Rs. 4600 and PS Rs. 4800 and after four years 5400. No SPS cadre so PPS gets Rs. 6600 GP. Heard that in 7.1 it is there. but not clear.

At present my basic pension is Rs.5156 and DA is Rs.6136 now as per 7th pay commission what will be my basic pension and DA

I am ex CPL from Indian Air Force retired 01.05.1981 and at present basic pention as on01.02..2016 is 5156 kindly let me know my basic pention and D A as per 7th pay commission

DEAR VIEWER, THE PAY COMMISSION NOTIFICATION WILL BE ISSUED SOON AND WILL BOOST UP THE ALL CG EMPLOYEES …….JAI BHARAT , JAI HIND ………..

Govt. Efforts at implementation of 7th Pay Commission Report are delayed as Jan.2016 is coming to end today. Probably FM is waiting for the Budget speech to make some declaration. The Secretary level committee of various ministries is supposed to see the implementation but

When?

राजनीति ओर चाणक्य नीति में थोडा ही फर्क है, बात बङी करते हैं ये लोग काम कम.

Have they restored old ACP to the Promotional Hierarchy or MACP to just next level/GP continues as in Sixth CPC.

Where pay commission report gone? Today 8th january 2016.No order for implementation yet declared. No cabinet approval yet announced. CG employee, Defence personel, CG pensioners are worried about delay.

The largest stagnation population of Lt Cols and equivalents in the other two wings of defence forces have suffered at the hands of 6th CPC and now 7th CPC. All defence officers further suffered because the Pay scales were not revised after deduction of rank pay was annulled by SC. If it was done they would have fitted in Pay Band 4 nice and proper. Special pay band PB 4A was created to their disadvantage. They are entitled to Grade Pay of Rs 8700 but have been reduced to 8000. Now they will have column 12 A for them whereas they should be in Column 13. Veterans of this group will be put to illegal disadvantage. DEGRADATION CONTINUES.

Iam drawing basic pension@Rs9507/p.m.&addl pension at the rateof20% beingcrossed 80yrs I retiredon superanuation on30 April1993 kindly let me know my revised basic pension &ADDLPENSIM &what isthe best option for me IMy last paydrawn was 2825/ inthe scale 2000_3500

Really the Pay commission partiality with CAPF personal….. The duties of CAPF is equivalent to Defense force and front line duty….so 7thc cpc or Government of India should reconsider about pay of CAPF Personnel..

Now a days a vegetable seller are earn more money than a government employees. Almost one lakh salary should be paid to capf personal. Our duty is very resky.

Jai hind. ….

Here is to much differance between the salery of officers and jawan. Please do justice with jawan.

THIS IS NOT SUFFICIENT SALARY FOR CENTRAL GOVT. EMPLOYEE IN 7TH CPC.

KINDLY ATTENTION TO P.M NARENDRA MODI FOR RE- REVIEW FOR SALARY

—- ARVIND KUMAR VEWRMA,

VICE -CHAIRMAN

NATIONAL UNION OF POSTAL EMPLOYEE

BEGUSARAI DIVISION , BEGUSARAI, BIHAR

Sir my basic pay is 13500 now. How much will I get when 7th pay commission is implemented.

No one clarify as to what would be D A in new matrix scale fixation of pay? ie after fixing oay in matrix table of pay. And 2.57 is baised on DA of 125% as on 01/01/2016 whether DA , after pay/pension fixed on 01-01-2016 would be NIL of 6%.?

नो like

Sir, because of uncontrollable Dearness in the market payment of DA to Retirees should continue xI retired in year 1990 and my pension is Rs. 5416-00 plus DA 119 percent x I would like to know how much I will get on recommendations of 7th CPC?

the pay commission should get effect from 1-1-2014 since the DA cross 100%

request to enhance the medical allowance to the retired employees getting presently Rs.500/- and which is not been enhanced in 7th cpc it is very disgraceful to the retired employees.

Reading the comments, I find there is no end to greediness.

Sir, my present basic pay (pension) is Rs 6785/-. How much increased in 7th pay commission ?

my present pension is 23555 approx and here si 119% DA is included in. Now I would like to know that how much pension i will have after implementation of the 7th pay commission.

The recommendations of the 7th CPC is not so encouraging. No effort has been made to maintain parity with the private sector. The objective of the 6th CPC to attract better talents to the Govt. sector will definitely suffer with the present recommendations. Moreover, the HRA rate has been reduced, which, for class X type cities is by 6%.

I strongly appeal to the concerned authorities to restore the HRA rates back to 10%, 20% and 30% respectively instead of the proposed 8%, 16% and 24%.

pay must be on the work output. Every month output should monitored and next month should be increased if one is performed well and curtailed who not performed bad. the – & + should be equal. at the same time there is no loss to state. for implement this revise the all olden methods for calculating work forces for any particular work. like in past clerk will type all letter with type writer now with computer. This had increased efficiency of individual 50%. till date calculation is following the same for strength.

we are very much disapointed with the paycommission recomendations after doing service of 32 years

Government should pay Incometax free pay to all its employee.All services should be on contractual basis only.

It is a great drama. What benefit gave by 7th pay commission?

if the DA of 100% WAS MERGED INTO THE PAY , THEN THE PAY WORKS OUT TO RS.200/- AND THE REST OF 25% DA WORKS OUT TO RS.50/- AND THUS THE TOTAL PAY COMES TO 250/-.

IN THE PRESENT 7TH PAY COMMISSION FORMULA IS PAY + GP x 2.57 IE PAY 80+GP 20 = 100 x 2.57 = 257/-

SO THE DIFFERENCE HIKE IN PAY COMMISSION IS ONLY RS.7/- ( 257 – 250)

HOW FAR IT IS TRUE TO BE VERIFIED FROM THE ACTUALS

PAY-RS.20200 + GP 4800 = RS.25000/- x DA 100% -RS25000/- = RS.50000/-

THE BALANCE DA 25% AS ON 1ST JAN 2016 25% WORKS OUT TO RS.12,500/-. SO THE TOTAL WORKS OUT TO RS.62,500/-

AS PER THE 7TH CPC- RS.25000 x 2.62 = RS.65,500/-

SO THE DIFFERENCE PAY HIKE IS ONLY RS.3,000/- IN PAY HIKE.

WITH Regard to hike in HRA is benefits to only employees who residing in own houses subject to payment of incometax on such hike in HRA as per the falls on slab rate ie ,may be 20% or 30%. With respect to employees residing in government quarters no benefit. with respect to living in rented houses, this small hike will not give benefit since the owners will rise the rental fee on observing this.

for this no pay commission is required. simply merge the DA into Pay whenever it croses 100% which benefit is enough since atlest can avoid vide publicity and because of this publicity, the market inflation starts increase in that inflation in the means of hike in rates etc.

final is 6th pay commission is best becuase, at least first 4 years employees felt happy and got loans from banks and able to pay emis.

but due to huge hike inflation, now those 6th cpc salary is not enough to live, every employee has got expectation some benefit may get. but this 7th pay commission recommendation is created tears in the eye of employees .

i have joined govt.service on 1.1.2013 as manager grade-ii in the grade pay of Rs.2400 for the Departmental canteen of Department of environment and forest and supervising in total 25 staffs is this justified one…please update me..

Govt should take good steps for employees because NDA govt looses its confidence on employees.If so then it will go soon as shining India .our popular PM attention towards it.

Respected Sir,

1. I would like to invite your kind attention towards upgrading of pay band from Rs 4200 to Rs 6600 in PB 3 to General Manager, Departmental canteen working in ministry of Defence under the Administrative Instructions of DOP&T the same is requested on the basis of same rank same pay because the General Manager of Deptt. of space Banglore is getting band pay Rs 6600 in pay band- 3 wef 3rd CPC. It is therefore requested to save the goodwill of the apex post of canteen i.e. General Manager, hence he is controlling and managing the 22 to 57 staff of canteen , performing a job of Reporting Officer during the completion of ACRs of staff and their responsibility as Incharge of Canteen. The apex post of the General Manager in the hierachy of the Non Statutory canteen employees cadre will be filled now by promotion on the basis of 10 years experience and from the feeder grades of D. G. M., Manager Grade II, and Manager cum Accountant etc. after the commerce graduation as per the ammended model rules od DOP&T. Due to merger of pay scales by 6thCPC General Manager carrying the same grade pay as per their juniors- Manager Grade II , DGM and Accountant cum Manager of feeder grade i.e. Rs 4200 which is the cause of functional disturbance. Befor 6thCPC GM was in the scale of 5500-9000 and Manager Grade II & others were in 5000-8000 pay scales. This can be seen from the hierachical chart of canteen cadre post at para 3 of the Vth CPC, and as per SIU report of Dec 2004 when the feeder grades of D.G.M etc were upgraded to Rs 5000-8000 from Rs 4000-6000, then also consequently SIU D.O.P&T upgraded the pay scale of General Manager from Rs 5000-8000 to Rs 5500-9000, A similar situation has now taken place whereby the apex post of General Manager has been brought at par with the feeder grades i.e Manager gd II, D.G.M etc. This anomaly warrants reconsideration on lines of post Vth CPC upgradation order of D.O.P&T OM No. 13/10/2001-Dir(c) dated 22 Dec. 2004.

2.. Designation of Manager gd II should be replaced as Manager only because there is no post of Manager gd I in Departmental Canteen cadre of Ministry of Defence , Therefore the designation of Manager gd II in the absence of Manager gd I does not arise.

3. Please take on priority and include in the agenda of next meeting of conceren Committee and Cadre Review committee for Non Statutory Departmental Canteen Employees as deemed fit.

4. It is humbly requested to the Honourable Authority of 7th CPC, Authority ,the Honourable Authority of DOP&T and our Executive Members of National Council JCM to solve the issues as mentioned above and also mentioned in forwarded 10 copies to the 7thCPC for all AFHQ canteen cadre in a positive manner please.

Your favourable action in this matter will be highly obliged .

A K GARG

General Secretary

AFHQ Canteen Employees Association (Recognized by Defence Ministry)

Ministry of Defence, New Delhi.

Mobile No. 9868127027.

DA caculation is very importent in 7th CPC

it is only for higher class

I am working Chennai. ALL INDIA CIVIL ACCOUNTS EMPLOYS ( PAY AND ACCOUNTS OFFICE ) our department staff all India level every pay commission time very very lowest pay fix it is our staff very bad time what will do many more time asking it government.

7th pay commissions how to there take our office

v.n.kishorkumar (LDC)

25/06/215

Considering the present daily increasing rates commodities Pay Commission should ask the Govt. to declare immediate Interium releaf to the Pensioners.

I retired from Railway on 29.02.2012. My basic pension is Rs. 14280 & portion commuted is Rs. 5712. What will be my basic pension after 7th. pay commission ?

Good decision let’s hope better

sir meri basic pay 9300 hai 7th pay commission mai meri total pay kitni hogi

I was retired on July 2016 or march 2016 because presently fro Nov 2014 under sick due to masude accident what is my pojisition presently working at secumdersbad div. Scrailway as controllerTPC what is my pension fixation

Good news

Department of post gds edda is payable for 7th pay commission

I would like to see the details

Good

good

DA caculation is very importent in 7th CPC