7th Pay Commission House Building Advance

The esteemed Central Government goes above and beyond in ensuring the well-being of its employees by offering numerous perks beyond just monetary compensation (such as CGHS, LTC, educational assistance, and leave). Adding to this impressive list of benefits is the HBA Home Loan (House Building Advance).

A Home for Everyone – HBA is one of the initiatives by the Central Government

The House Building Advance (HBA) is a highly sought-after benefit that Central Government employees can take advantage of. This program provides a generous amount of funds to assist with the purchase of a new flat or the construction of a home. Furthermore, the Central Government offers a low interest rate on the loan, which makes it even more attractive. In addition, if certain conditions are met, the borrower may also be eligible for a rebate.

Check also: CG Offices Holiday List 2023 PDF Download

House Building Advance New Rules Effect from November 2017 after implementation of the 7th pay commission

Purposes of House Building Advance Rules

Central Government employees are eligible for BHA if they meet any of the following criteria:

- New house construction on an owned plot

- Purchase of a plot

- Purchasing a plot from Co-Operative Group Housing Societies

- Purchasing a house from Self Financing Schemes

- Purchase of flat or new ready-built house

- Extension of already owned building

- Repayment of loan taken from Govt or Hudco or Private sources

- Migration of housing loans taken from banks and other financial institutions

- Construction only residential portion of the building on a plot earmarked for a shop-cum-residential plot

Also see: Latest Dopt Orders 2023

Eligibility Rules for House Building Advance

- All Central Government permanent employees

- All other employees with a minimum of 5 years of continuous service

- Member of All India Services deputed for service under the Central Government

- Employees of Union Territoires and North East Frontier Agency

- Staff and Artistes of the AIR

- CG Employees are governed by the payment of wages act 1936

- CG Employees on deputation to another Department or on Foreign Service

- Ex-Servicemen and suspended employees with extant rules for eligibility conditions

Also see: Swamy News and Rules Books for Central Government Employees

Rate of Interest for House Building Advance

The Interest on Housing Building Advance for the financial year 2017-18 onwards shall be 8.50%. This shall be reviewed every three years to be notified in consultation with the Ministry of Finance.

HBA Interest Rate 2019-20

The interest rate on House Building Advance (HBA) for Central Government Employees will be 7.9% from October 1, 2019 [Click to read more]

In cases where both spouses are CG employees, both of them are admissible for the grant of HBA.

Cost of Ceiling of House Building Advance

The cost of the house or plot should not exceed 139 times the basic pay and subject to a maximum of Rs. 1,00,00,000. In individual cases, if the Administrative Ministry is satisfied with the merits of the case, the cost ceiling may be relaxed up to a maximum of 25% by the HoD.

Advance Amount of House Building Advance

The maximum amount of HBA is 25 Lakhs. 34 months basic pay or Rs. 25 lakhs whichever is least for purchasing of new flat or house. For the expansion of the existing house, the HBA will be admissible is limited to 34 months of basic pay or a maximum of Rs. 10 lakh.

Also see: 7th Pay Commission Salary Calculator Updated Oct 2019

HBA Repaying Rules and Conditions

The repaying capacity of Central Government employees will be calculated as given below:

- In the case of an employee retiring after 20 years, the repaying amount will be taken as 40% of his basic pay

- In case of an employee retiring after 10 years but not less than 20 years, the repaying amount will be taken up to 40% of his basic pay and 65% of DCR Gratuity may also be adjusted.

- In case of an employee retires within 10 years, the repaying amount will be taken up to 50% of his basic pay, and DCR Gratuity up to 75% can be adjusted.

Also see: 7th Pay Commission Pay Scale Calculator

The Methodology of Recovery of House Building Advance

The methodology of recovery of HBA shall continue as per the existing pattern of recovery of principal first in the first fifteen years in not more than 180 monthly installments and interest thereafter in the next five years in not more than 60 monthly installments. The advance carries simple interest from the date of payment of the first installment.

All cases of subsequent tranches/installments of HBA being taken by the employee in different financial years shall be governed by the applicable rate of interest in the year in which the HBA was sanctioned, in the event of a change in the rate of interest.

Note: The clause of adding a higher rate of interest at 2.5% above the prescribed rate during sanction of House Building Advance, as reproduced below, stands withdrawn.

Also see: Expected DA from January 2020 Calculator

“Sanction should stipulate the interest 2.5% over and above the Scheduled Rates With the stipulation that if conditions attached to the sanction including those relating to the recovery of amount are fulfilled Completely to the Satisfaction of Competent authority, a rebate of interest of the extent of 2.5% Will be allowed”.

Disbursement of House Building Advance (HBA)

Advance for purchase of a ready-built house can be paid in One Lump Sum as Soon as the applicant executes an agreement in the prescribed form. The employee should ensure that the house is purchased and mortgaged to the Government Within 3 months of the draw of the advances.

Advance for purchases/construction of new flats may be paid either in one lump sum or in convenient installments at the discretion of the Head of Department. The employee should execute the agreement in the prescribed form before the advances / first installment of advance is paid to him/her. The amount drawn by the employee should be utilized for the purchase/ construction of the flat within one month.

Advance for construction/expansion of living accommodation, etc., shall be payable in two installments of 50% each. The first installment will be paid after the plot and proposed houses / existing houses are mortgaged and the balance on the Construction-reaching plinth level.

Advance for expansion to be carried out on the upper story of the house will be disbursed in two installments, the first installment on executing the mortgage deed and the second installment on the construction reaching roof level. In the case of advance for purchase of plot and construction of the house, the advance will be disbursed as below:

a) Single Storeyed House: After agreement in prescribed form is executed on the production of the surety bond, 40% of the advance or actual cost will be disbursed for the purchase of the plot. The balance amount will be disbursed in two equal installments, first after the mortgage is executed and second, on the construction reaches the plinth level.

b) Double Storeyed House: 30% of advance for the cost of the plot will be disbursed on executing the agreement. The balance amount will be disbursed in two equal installments, the first on executing the mortgage deed and the second On construction reaching plinth level.

Mortgage and Creation of Second Charge

a) House shall be mortgaged on the behalf of the President of India. However, if the employee, if he wishes to take a second charge to meet the balance Cost of the house’s plot or flat from recognized financial institutions, then he/ she may declare the same and apply for NOC at the time of applying for HBA. NOC for the second charge will be given along with the sanction order of HBA. The total loan from HBA and from all other Sources Cannot be beyond the ceiling cost of the house as defined under para 4 above.

b) In case HBA is availed by both husband/ wife jointly,

i. HBA Mortgage paper, insurance paper and other papers regarding property shall be submitted to one of the loan sanctioning authorities Of their choice.

ii. A No Objection Certificate may be obtained from the 2nd loan sanctioning authority.

iii. The property mortgaged on behalf of the President of India, shall be reconvened on the prescribed form to the central government employee concerned (or their successors in interest, as the case may be), after the advance together with interest thereon, has been repaid to Government in full and after obtaining No Demand Certificate in respect of HBA loan sanctioned by the 2nd loan sanctioning authority.

Insurance for House Building Advance

Immediately on completion of construction/purchase of house/flat, the employee shall insure the house with the recognized institutions as approved by Insurance Regulatory and Development Authority (IRDA), for not less than the amount of advance and shall keep it so insured against damage by fire, flood and lightning till the advance together with interest thereon is repaid in full and deposit the policy documents with the Head of the Department (HoD). Renewal of insurance will be done every year and premium receipts produced for the inspection of the HoD regularly.

Penal interest of 2% over and above the existing rate of interest will be recovered from the employee for those periods which are not covered by the insurance of the house.

Migration of House Building Advance

For existing House Building Advance beneficiaries who wish to migrate, a separate Order for migration to the revised House Building Advance rules will be issued shortly.

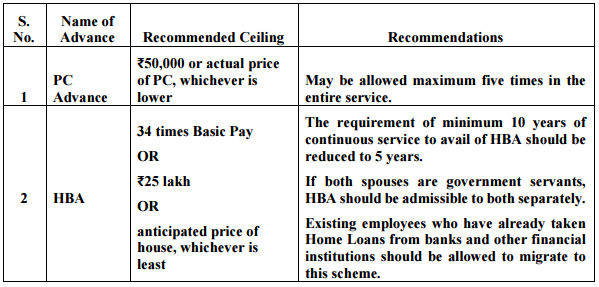

| Suggestions on HBA in 7th CPC Report | |

| Ceiling | Recommendations |

|

|

House Building Advance (HBA) rules for Central Government Employees after the 7th Pay Commission

House Building Advance Rules (HBA) 2017

The Government has revised the House Building Advance (HBA) rules for Central Government Employees with effect from November 2017. An Office Memorandum was issued on 9th November 2017 by the Ministry of Housing and Urban Affairs.

As per the OM, the following points are new features of the HBA rules:-

- The total amount of advance that a central government employee can borrow from the government has been revised upwards. The employee can up to borrow 34 months of the basic pay subject to a maximum of Rs. 25 lakhs (Rs. Twenty Five Lakhs only), or the cost of the house/flat, or the amount according to repaying capacity, whichever is the least for new construction/purchase of new house/flat. Earlier this limit was only Rs.7.50 lakhs.

- Similarly, the HBA amount for expansion of the house has been revised to a maximum of Rs.10 lakhs or 34 months of basic pay or cost of the expansion of the house or amount according to repaying capacity, whichever is least. This amount was earlier Rs.1.80 lakhs.

- The cost ceiling limit of the house that an employee can construct/ purchase has been revised to Rs.1.00 crore with a proviso of upward revision of 25% in deserving cases. The earlier cost ceiling limit was Rs.30 lakhs.

- Both spouses, if they are central government employees, are now eligible to take HBA either jointly, or separately. Earlier only one spouse was eligible for House Building Advance.

- There is a provision for individuals migrating from home loans taken from Financial Institutions/ Banks to HBA if they so desire.

- The provision for availing a second charge on the house for taking loans to fund balance amounts from Banks/ Financial Institutions has been simplified considerably. ‘No Objection Certificate will be issued along with the sanction order of HBA, on the employee’s declaration.

- Henceforth, the rate of Interest on Housing Building Advance shall be at only one rate of 8.50% at simple interest (in place of the earlier four slabs of bearing interest rates ranging from 6% to 9.50% for different slabs of HBA which ranged from Rs.50,000/- to Rs.7,50,000/-) .

- This rate of interest shall be reviewed every three years. All cases of subsequent tranches/ installments of HBA being taken by the employee in different financial years shall be governed by the applicable rate of interest in the year in which the HBA was sanctioned, in the event of a change in the rate of interest. HBA is admissible to an employee only once in a lifetime.

- The clause of adding a higher rate of interest at 2.5% (two point five percent) above the prescribed rate during sanction of House Building Advance stands withdrawn. Earlier the employee has sanctioned an advance at an interest rate of 2.5% above the scheduled rates with the stipulation that if conditions attached to the sanction including those relating to the recovery of amount are fulfilled completely, to the satisfaction of the competent authority, a rebate of interest to the extent of 2.5% was allowed.

- The methodology of recovery of HBA shall continue as per the existing pattern recovery of principal first in the first fifteen years in 180 monthly installments and interest thereafter in the next five years in 60 monthly installments.

- The house/flat constructed/purchased with the help of House Building advance can be insured with the private insurance companies which are approved by Insurance Regulatory Development Authority (IRDA).

- This attractive package is expected to incentivize the government employee to buy houses/flats by taking the revised HBA along with other bank loans if required. This will give a fillip to the Housing infrastructure sector. [click to read more…]

How to Calculate Interest for HBA?

A simple interest calculation is followed for HBA. The amount of interest is determined depending on the outstanding balance on the last day of the month. The interest rates are applicable from 6% to 9.5% according to the loan amount. [Click to view detailed interest calculation with example]

HBA Interest Rates Declined from 8.5% to 7.9%

The Central Government has decided to reduce the interest rates on House Building Advance from 8.5% to 7.9% with effect from 1.10.2019.

To boost the Real Estate Sector, the Centre has taken new measures in various steps like reduction of GST and allocation of more funds. And now another measure on target of Central Government employees, the rates of interest on HBA reduced to 7.9%. The move will help the Government employees to build new houses or buy a new flat of their own. [Click to read more]

7th CPC HBA – Expectation on House Building Advance for CG Employees

Changes are expected in the 7th CPC on House Building Advance…

- Eligibility Service should be revised

- The amount of Advance should be increased

- HBA calculation should be on Basic pay (pay in the band + Grade Pay)

- 34 times and 80% are not sufficient

- Conditions of repaying capacity should be revised.

- The rate of Interest should be decreased

- Second Mortgage rules to be relaxed

7TH CPC PAY SCALE WITH MATRIX TABLE

Top Developments on 7th CPC HBA

- Home Loan Interest Subsidy – Interest Rate and Eligibility February 12, 2020

- Central Government Employees News Latest Update – Top 5 Recent Developments October 7, 2019

- HBA Interest Rate Declined from 8.5% to 7.9% October 4, 2019

- Interest Rate on House Building Advance (HBA) from October 1, 2019

- HBA for CG employees at affordable rate of interest September 16, 2019

- 7th CPC House Building Advance – Loan Migration – CGDA November 20, 2018

- 7th CPC House Building Advance Rules (HBA) – Partial Modification August 8, 2018

- 7th CPC HBA – Amendment to Rules on House Building Advance May 14, 2018

- Migration of Home Loan to Revised HBA – Ministry of Housing & Urban Affairs February 12, 2018

- HBA Interest Rebate as per the recommendations of 7th CPC February 12, 2018

- House Building Advance Rules 2017 November 13, 2017

Who is eligible for House Building Advance?

All Central Government permanent employees, all other employees with a minimum of 5 years of continuous service, members of All India Services deputed for service under the Central Government, employees of Union Territories and North East Frontier Agency, staff and artistes of the AIR, CG Employees on deputation to another Department or on Foreign Service, Ex-Servicemen, and suspended employees with extant rules for eligibility conditions are eligible for House Building Advance.

Are Central Government employees the only ones eligible for House Building Advance?

No, other employees with a minimum of 5 years of continuous service and members of All India Services deputed for service under the Central Government are also eligible for House Building Advance.

Are employees of Union Territories and North East Frontier Agency eligible for House Building Advance?

Yes, employees of Union Territories and North East Frontier Agency are eligible for House Building Advance.

What about staff and artistes of the AIR?

They are also eligible for House Building Advance.

Are there any specific rules for CG employees?

Yes, CG Employees are governed by the payment of wages act 1936.

What about CG employees on deputation to another Department or on Foreign Service?

They are eligible for House Building Advance.

Are Ex-Servicemen and suspended employees eligible for House Building Advance?

Yes, they are eligible with extant rules for eligibility conditions.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Pls provide HBA migration form

same question how can I apply for HBA

can central university employees apply for HBA?

Kumaran – 27/3

If you are permanent or 10 years of completed service you are eligible for HBA.

My basic pay pay is3300 can i purches plot in the help of hba

when the order of migration of existing loan to be introduced.

Where and how l can apply for this advance as a central gov employee? And what documents should be furnished for that?

I want to know about is HBA is also granted to purchasing a plot and construct a house or only granted for construction of house.

i am central government employee under level – 5 category. Pay is 31,000rs.how much eligible of HBA for me.Please let me know.

Iam central govt employee apply for HBA to meet the requirement please reply

where and how I can apply for this advance as a central govt employee? and what documents should be furnished for that?

WE HUSBAND AND WIFE BOTH ARE CENTRAL GOVT. EMPLOYEE.

IF I APPLY FOR HBA JOINTLY TO MEET THE REQUIREMENT OF FUND, IN FUTURE WILL MY WIFE BE ELIGIBLE FOR HBA ??

PLEASE REPLY.

I want to take home, so please tell me way to take home loan or hba

I am a central government employee

10 years complet service

Sir

I am serving Indian railway department. Since July 12 2016. Can I get HBA and what is the process and where should I go to get this loan? Please send me all details about this scheme.

Kindly publish details regarding how to apply for HBA, its form and the documents required

Respected sir

I am rank constable Arun koushal employed in Indo Tibet Border Police Force under MHA from February 2009 . sir i am purchased land and then construction home. so please give me guide line for HBA loan how to apply.

I am a postal employee and I want to get house builting advance so what document are required for this

I am serving Indian railway department. Since July 12 2016. Can I get HBA and what is the process and where should I go to get this loan? Please send me all details about this scheme

I am Bhuneshwar serving in Indian railway,group d since July,2013 .Can I get hba and what is the process and where should I go to get this loan? Please send me all detail about this scheme. Thanks sir

I am serving in parameletry force since 2013. My rank is constable. Can i get house building allowance. I want to purchase 2bhk flat which price is 20 lakh. Can i get so price. Please tell me in detail. Where can i get it.

Hello I am rakesh kumar serving in Indian army since 1997 what are documents requirements for home loan in hba

I am rakesh kumar serving in Indian army since 1997 what are documents requires for home loan I will be very thankful to you for this

I am serving in railway Department since December2010. Can I get HBA and what is the process and where should I go to get this loan?

Please send me all details about this scheme. I have So much requirement for this.my email ID is shijinmt26@gmail.com

I am serving in cisf ASG MUMBAI (AIRPORT)since March 2009. Can I get HBA and what is the process and where should I go to get this loan?

Please send me all details about this scheme. I have So much requirement for this.

I will be highly grateful if you do the needful. Thanking you

I am Prakash Dhale serving in Indian Navy as a CMD.Am I eligible for HBA and what is the process and where should I go to get this loan? Please send me all details about this scheme. I have so much in requirement for this. My E-mail id is prakashdhale12@gmail.com

I will be highly grateful if you do the needful. Thanking you

I am serving in India Post Department since March 2014. Can I get HBA and what is the process and where should I go to get this loan?

Please send me all details about this scheme. I have So much requirement for this.

I am serving in border security force since 04 March 2013. Can I get HBA and what is the process and where should I go to get this loan? Please send me all details about this scheme. I have so much requirement for this.

I am serving in indian navy since 2015. Can I get HBA and what is the process and where should I go to get this loan?

Please send me all details about this scheme. I have So much requirement for this

I am serving in ssb (MHA) since 30 oct. 2006.how can get HBA for purchase a plot and construct a house own ……pls contact me as soon as possible.

How to get house building advance in service CISF CT/GD pls tell rules and what paper are need Sumit my no 9817675999

how can i apply hba loan please send details

What’s is basic requirement for taking hba loan. Plz provide details . I want take 2500000 loan.

How can i apply

I would like to avail hba.how can i apply.

How I can apply

I have taken a loan of Rs.275000 from my office but i want sell him and i want 2nd home loan in my city can i take the second hba

I am serving in indian army since 16 sep 2010. Can I get HBA and what is the process and where should I go to get this loan?

Please send me all details about this scheme. I have So much requirement for this.

I want to avail HBA

How can I apply

HOW CAN I APPLY HBA ANY CONTACT NUMBER OR ANYTHING ELSE BY WHICH I CAN MAKE CONTACT TO GET MORE INFORMATION IN THIS REGARD. PLS INTIMATE ME………THANX AND REGARD

I am working in Indian Air force .How can I apply for HBA ? Please tell me.

how to apply

i would like to avail hba

How i can apply

Employee how join after 2004 is eligible for HBA.

I GOT HBA LOAN FROM MY OFFICE CENTRAL GOVT .NOW I NEED TO GET SECOND MORTAGAGE FROM BANK. FOR EDUCATIONAL LOAN . CAN I GET IT. ANY RULES FOR THAT

I couldn’t apply for House Building Advance from my Department (Income Tax) for want of fresh notification in this regard after 7th Central CPC. Please convey me, how long time it’ll take to publish the notification so that I can apply for the same as early as possible.

I am availing HBA and also from home loan form bank and as per recommendation of 7th cpc bank loan can be shifted to HBA. Can i Shift my bank loan to HBA.

I applied for departmental house building advance in February 2016. I work in department of post . but till now I don’t get so. Tell me how much time it take to sanction and disbursement. When I am calling to know my status of loan the pmg office replied that central govt does not sanction disbursement fund. When I will get so. Please know me.

Is there any change in HBA after 7th CPC? I want all details of revised HBA. Please let me know as soon as possible

Suppose I am getting 25,00,000 as hba loan what is the interest amount I have to pay in addition to 25,00,000

Hba = 34 times of (basic + dp) is OK when basic was merged with 50 % da as dearness pay during 5th pay commission. It was continued like that with a reduced basic ( – grade pay) during 6th pay commission. now since there is no pay in pay band. it is changed back to basic again. but now even dearness pay is not there, so When there is no dearness pay, hba should be restored back to 50 times of basic pay as in earlier pay commissions except during dearness pay and grade pay period.

Thank you somuch

which month will be better for me to take increament as my D.O.B-15.06.1966.AND APPOINTMENT-03.06.1991

Where i apply for house building advance and how ? ??

Thanks

Thank sir for your given kind information. ….

Praise worthy but Must be accepted and implemented in time

thanks u

Those Govt. employee, who have posted out of home station and not alloted govt. accommodation through employer (office) should pay HRA as market rate or provide a accommodation by lease.

Respected sir, AGI Kay dwara soldiers ko kam interest par loan milna chhahia jissay wo makan aur plot Kay sath sath awasyakta Ki saman kharid sakay. AGI nay loan procedure itna critical bana rakha hai jiski wajah say jawan banko may Dhaka khata hai par AGI Ki taraf nahi dekhta hai

suggestions made to 7th CPC are good but must be accepted by Govt. Reducing the age of Central Govt Employees will have a very negative impact on the working of Central Govt. People will question the appointment of Sh Nirpeder Mishra with PM Modhi ji.

thank u hope the best

Thanking you