7th Pay Commission Fitment Factor 2.57

The fitment factor is a crucial aspect of the pay commission for central government employees. It refers to a numerical value that holds significant importance in the process of revising the old pay salary to a new basic salary for both employees and pensioners. The determination of the fitment factor is a critical element in fixing the basic salary after the pay commission. The 6th CPC had proposed a fitment ratio of 1.86, while the 7th Pay Commission has recommended a standard fitment benefit of 2.57 for all groups of Central Government employees.

7th Fitment Factor Table Overview:

Anticipated Table of 7th Fitment Factor:

The prospect for change is endless. Even though 7 years have passed, it is speculated that the fitment factor for all central government employees will be altered from 2.57 to 3.86. The linking factor and recommended fitment factor were suggested by the Pay Commission and were 1.86 and 3.86 respectively. Currently, the 7th CPC Fitment Factor is set at 2.57.

| Fitment Factor | Linking Factor |

| Recommended By | Pay Commission |

| 6th CPC Fitment Factor | 1.86 |

| Expected Fitment Factor | 3.86 |

| 7th CPC Fitment Factor | 2.57 |

7th Pay Fixation Table PDF Download

Calculating the fitment factor in the 7th Central Pay Commission (CPC) does not follow a specific formula. However, there is a logical calculation process that can be utilized to determine the new fitment factor in the future. The 7th pay committee employed a methodology to arrive at the current figure of 2.57 for the fitment factor as shown below:

| Assuming that the Basic Pay as of 31.12.2015 (100%) | 1.00 |

| Dearness Allowance as of 31.12.2015 (125%) | 1.25 |

| Total (Basic Pay + DA) | 2.25 |

| 7th CPC recommended increasing 14.29 percent on the above Total (Basic Pay + DA) | 0.32 |

| Fitment Factor | 2.57 |

What is the Fitment Factor?

The Fitment Factor pertains to a specific numerical value suggested by the pay commission to compute the revised pay from pre-revised pay. It is indicative of the revision in Basic Salary through a distinct element. The Fitment Factor is applicable to all employee groups serving in Central Government Services. As per the recommendations of the 6th Pay Commission, the Fitment Factor was advised to be 1.86, whereas the 7th Pay Commission suggested a Fitment Factor of 2.57.

How to calculate the fitment factor with basic pay?

To calculate the fitment factor based on an employee’s basic pay, you can use the following method. Suppose an employee is receiving a basic pay of Rs. 15,500 with a 4200 Grade Pay. According to the recommendations of the 7th pay commission, his/her pay will be determined as follows: Multiplying the basic pay by 2.57, you get Rs. 39,835. Since the Grade Pay is 4200, the corresponding 7th CPC level is Level 6. Therefore, the employee’s pay will be fixed at a minimum of Rs. 39,900, which is equal to or higher than the value of the cell in the pay matrix for Level 6. The Fitment Formula and Multiplication Factor for this calculation is 2.57.

Check also: Pay Matrix Table for Central Government Employees and Pensioners

How fitment factor is working?

To compute the revised pay, the fitment factor is multiplied by the current basic pay. For instance, if an employee has a basic pay of Rs. 20,500 (Grade Pay 4600), their pay will be determined using the pay matrix table provided below: 20,500 x 2.57 = 52,685 (next higher cell in the proportionate pay level of 7). The value of 52,685 corresponds to an equal or higher cell in the proportionate pay matrix table Level 7, which is 53,600. For reference, the Fitment Table PDF can be downloaded to convert pre-revised basic salary to revised basic salary for Pay Matrix Level 5 (GP 2800 PB 5200-20200) in accordance with the methodology recommended by the 7th Pay Commission.

| Fitment Table for 7th CPC Level 5 (GP 2800) | ||

| Existing Basic Salary | Revised Basic Salary | |

| From | To | 7th CPC Basic Pay |

| 8000 | 11380 | 29200 |

| 11390 | 11730 | 30100 |

| 11740 | 12080 | 31000 |

| 12090 | 12430 | 31900 |

| 12440 | 12810 | 32900 |

| 12820 | 13200 | 33900 |

| 13210 | 13590 | 34900 |

| 13600 | 13980 | 35900 |

| 13990 | 14400 | 37000 |

| 14410 | 14840 | 38100 |

| 14850 | 15270 | 39200 |

| 15280 | 15730 | 40400 |

| 15740 | 16200 | 41600 |

| 16210 | 16670 | 42800 |

| 16680 | 17170 | 44100 |

| 17180 | 17680 | 45400 |

| 17690 | 18210 | 46800 |

| 18220 | 18760 | 48200 |

| 18770 | 19310 | 49600 |

| 19320 | 19890 | 51100 |

| 19900 | 20480 | 52600 |

| 20490 | 21100 | 54200 |

| 21110 | 21730 | 55800 |

| 21740 | 22390 | 57500 |

| 22400 | 23010 | 59200 |

7th Pay Commission Fixation Table

The following is the Fixation Table for the 7th Pay Commission, pertaining to employment levels six through nine, with grade pay ranging from 4200 to 5400 and PB-2 (9300-34800) designation. The table is organized according to grade pay, with corresponding Pay Matrix levels for levels six through nine being Level 6, Level 7, Level 8, and Level 9 respectively. The index ranges from one to four, with the corresponding Pay Matrix values being 35400, 44900, 47600, and 53100.

| Grade Pay 4200 | Grade Pay 4600 | Grade Pay 4800 | Grade Pay 5400 | |

| Index | Pay Matrix Level 6 | Pay Matrix Level 7 | Pay Matrix Level 8 | Pay Matrix Level 9 |

| 1 | 35400 | 44900 | 47600 | 53100 |

| 2 | 36500 | 46200 | 49000 | 54700 |

| 3 | 37600 | 47600 | 50500 | 56300 |

| 4 | 38700 | 49000 | 52000 | 58000 |

| 5 | 39900 | 50500 | 53600 | 59700 |

| 6 | 41100 | 52000 | 55200 | 61500 |

| 7 | 42300 | 53600 | 56900 | 63300 |

| 8 | 43600 | 55200 | 58600 | 65200 |

| 9 | 44900 | 56900 | 60400 | 67200 |

| 10 | 46200 | 58600 | 62200 | 69200 |

7th CPC Fitment Factor Table

The 7th CPC Fitment Factor Table is a set of recommendations concerning the fitment factor outlined in the 7th CPC Report. The starting point for the first level of the matrix is established at 18,000, which corresponds to the present starting pay of 7,000. This starting point is the beginning of PB-1 viz., 5200 + GP 1800, on the date of implementation of the VI CPC recommendations. Therefore, the proposed starting point is 2.57 times that of what was prevailing on 01.01.2006, and this fitment factor of 2.57 is proposed to be applied uniformly to all employees.

The starting point for a Sepoy (and equivalent), which is the entry-level personnel in the defence forces, has been fixed in the Defence Pay Matrix at 21,700, whereas it is currently at 8,460. The fitment in the new matrix involves multiple factors of 2.57, which is the ratio of the new minimum pay (18,000) and the existing minimum pay (7,000), and this fitment factor is being applied uniformly to all employees.

It also includes a factor of 2.25 to counterbalance DA neutralization, assuming that the rate of Dearness Allowance would be 125 percent at the time of implementation of the new pay as of 01.01.2016. The recommended raise/fitment by the Commission is 14.29 percent, and an identical fitment of 2.57 has also been applied to the existing rates of Military Service Pay (MSP), which applies to defence forces personnel only. Therefore, the proposed starting point is 2.57 times that of what was prevailing on 01.01.2006, and this fitment factor of 2.57 is proposed to be applied uniformly to all employees.

- 7th CPC New Pension Scheme Fitment Table

- Latest News for Defence Pensioners

- 7th CPC Ready Reckoner Pension Tables from 4th CPC to 7th CPC

- 7th CPC Pension Calculator as per Concordance Tables

Fitment Table for Defence Personnel

The Fitment Table for Defence Personnel outlines the entry pay for various ranks of defence forces personnel, with the exception of MNS Officers. The entry pay has been determined based on the same premise used for civilians. For instance, the entry pay for a Captain is calculated by adding the entry pay in the existing pay band to the residency period for promotion to Captain from Lieutenant multiplied by the annual increment and grade pay of the rank of Captain. As a result, the entry pay for a Captain is Rs. 22,960, which is calculated as Rs. 15,600 plus (2 x Rs. 630) plus Rs. 6,100. However, in the case of Brigadiers or equivalents, their pay has been established based on the fitment table as notified by the Ministry of Defence through its Special Army Instructions of October 2008.

History of Fitment Factor

7th Pay Commission Fitment Table: National Council JCM Staff Side suggested in their memorandum regarding the fitment formula as follows…

The National Council JCM Staff Side has proposed a fitment formula for the 7th Pay Commission. According to their memorandum, previous Pay Commissions’ fitment formulas did not accurately reflect wage revisions. Employees who were on the payroll at the time of implementation received fewer benefits compared to new employees. Even among existing employees, those with less service received more benefits due to the rejection of the Staff Side’s demand for point-to-point fixation. However, this issue was addressed during discussions with the Group of Ministers in September 1997. The Staff Side was able to negotiate a fitment formula of 40% instead of the 20% recommended by the 5th CPC, which resulted in near-total satisfaction among all employees. This benefit also brought about a uniform multiplication factor. Therefore, the Staff Side suggests applying the multiplication factor of 3.7 uniformly in all cases to arrive at the revised pay in the new pay scale. Regarding pensioners, there is no separate fitment table in the 7th Pay Commission report. The fitment factor of 2.57 is commonly used for the revision of pay and pension.

7th Pay Commission multiplication factor

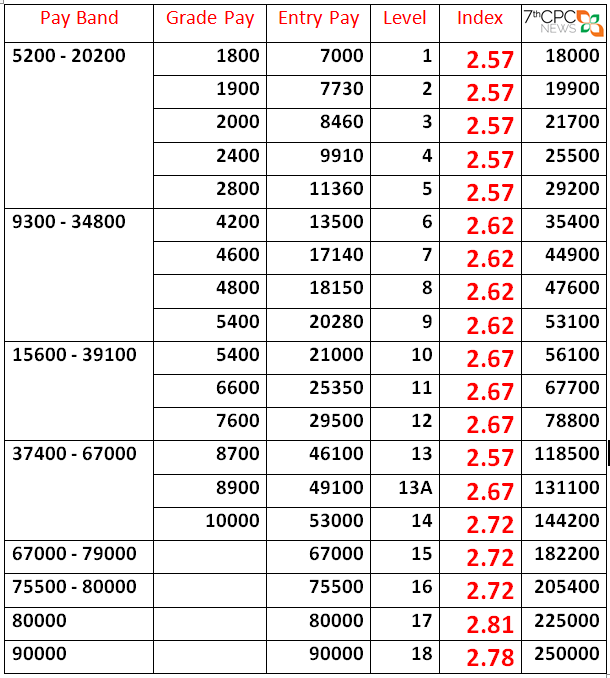

The Index of Rationalization (IoR) is utilized for determining the entry pay in the new pay commission and slightly differs from the Fitment Factor proposed by the 7th Pay Commission. The calculation for rationalized entry pay involves multiplying the current entry pay by 2.57 for personnel in Pay Band 1, by 2.62 for personnel in Pay Band 2, by 2.67 for personnel in Pay Band 3, by 2.72 for Senior Administrative Grade, HAG, and HAG+ levels, and by 2.81 for the apex level. However, for Service Chiefs and Cabinet Secretary, the index is set at 2.78. The matrix of the rationalization index applied at this level has been fixed at 2.57, which is lower than the index of 2.67 applied to existing PB-3 officers. In order to ensure uniformity in the defence pay matrix and considering that Lieutenant Colonels received a marked increase in their pay level post VI CPC recommendations, a similar formulation has been applied to the officers in the rank of Colonel and Brigadier and their equivalent.

7th CPC Index of Rationalization Table

Index of Rationalization for Pay Levels 1 to 5

| 6th CPC PB 1 | Rationalized Entry Pay | 7th CPC Pay Level | RoI |

| 1800 | 7,000 | Pay Level 1 | 2.57 |

| 1900 | 7,730 | Pay Level 2 | 2.57 |

| 2000 | 8,460 | Pay Level 3 | 2.57 |

| 2400 | 9,910 | Pay Level 4 | 2.57 |

| 2800 | 11,360 | Pay Level 5 | 2.57 |

Index of Rationalization for Pay Levels 5 to 9

| 6th CPC PB 2 | Rationalized Entry Pay | 7th CPC Pay Level | RoI |

| 4200 | 13,500 | Pay Level 6 | 2.62 |

| 4600 | 17,140 | Pay Level 7 | 2.62 |

| 4800 | 18,150 | Pay Level 8 | 2.62 |

| 5400 | 20,280 | Pay Level 9 | 2.62 |

Index of Rationalization for Pay Levels 10 to 12

| 6th CPC PB 3 | Rationalized Entry Pay | 7th CPC Pay Level | RoI |

| 5400 | 21,000 | Pay Level 10 | 2.67 |

| 6600 | 25,350 | Pay Level 11 | 2.67 |

| 7600 | 29,500 | Pay Level 12 | 2.67 |

Index of Rationalization for Pay Levels 13 to 14

| 6th CPC PB 4 | Rationalized Entry Pay | 7th CPC Pay Level | RoI |

| 8700 | 46,100 | Pay Level 13 | 2.57 |

| 8900 | 49,100 | Pay Level 13A | 2.67 |

| 10000 | 53,000 | Pay Level 14 | 2.72 |

Index of Rationalization for Pay Levels 15 to 18

| 6th CPC HAG | Rationalized Entry Pay | 7th CPC Pay Level | RoI |

| – | 67,000 | Pay Level 15 | 2.72 |

| – | 75,500 | Pay Level 16 | 2.72 |

| – | 80,000 | Pay Level 17 | 2.81 |

| 90,000 | Pay Level 18 | 2.78 |

Top Developments in the 7th CPC Fitment Factor

- 7th CPC Minimum Pay and Fitment Factor: Again Staff Side of NC JCM insisted to constitute High Level Committee July 18, 2019

- Important Issues Discussed in 47th NC JCM Meeting: Revision of Minimum Wage and Fitment Formula and Withdrawal of NPS June 26, 2019

- 7th Pay Commission: Change in Minimum Pay for CG Employees? June 8, 2019

- Scrap NPS and Hike Minimum Pay and Fitment Factor – Protest from 15 to 30 March 2019 March 27, 2019

- 7th CPC Fitment and HRA – No Change Therein is Envisaged December 20, 2018 Increase of Fitment Factor from 2.57 to 3.68 under 7th CPC? August 13, 2018

- Central Govt should increase Minimum Pay and Fitment formula – Karnataka COC May 28, 2018

- 7th CPC Minimum Pay and Fitment Factor: Confederation writes to NJCA March 17, 2018

- Increase in Minimum Pay and Fitment Factor – Rajya Sabha Q&A March 14, 2018

- Minimum Pay increased to 21000 – No Scope Anymore to Continue this Story November 29, 2017

- Defence Pay Matrix enhanced from 2.57 to 2.67 for level 12A & 13 November 20, 2017

- 7th CPC Minimum Wage – NC JCM Proposed Items and Comments of DoPT November 18, 2017

- Increase in 7th CPC Minimum Pay and Fitment Factor – Confederation November 17, 2017

- 7th CPC for TN Govt Employees – New Pay Matrix, 32 Levels, 2.57 Fitment Factor, Min 15700 and Max 225000 October 12, 2017

- 7th CPC Minimum Pay Fitment Factor – No any substantial evidence or facts… October 10, 2017

- Increase in Minimum Pay and Fitment Formula – NC JCM Staff Side August 28, 2017

- 7th CPC Pay Matrix Anomaly : Anomaly in the Fitment Factor in Index rationalisation July 6, 2017

- Impact on Revision of IOR from 2.57 to 2.67 of Pay Matrix Level 13 May 18, 2017

- 7th CPC Pay Matrix Level-13 enhanced from 2.57 to 2.67 May 17, 2017

- GDS Committee Report – Pay Scale, Fitment Factor and Arrears January 19, 2017

- 7th CPC Minimum Wage and Fitment Formula – Outcome of the meeting published by NC JCM Staff Side October 24, 2016

- Implementation of the recommendations of 7th CPC – Fitment Factor and Pay Fixation for Running Staff September 17, 2016

- We need not jump into the conclusion that multiplication factor will not be increased – Confederation July 22, 2016

- Questions raised in Parliament regarding 7th CPC Notification and Fitment Factor July 21, 2016

- Disappointed over not increasing Minimum wage and Fitment Factor – NFIR June 29, 2016

- Expected DA Calculation – Fitment Factor of 7th CPC January 14, 2016

- Fight for uniform multiplication of 14 times of the Grade pay December 29, 2015

- Demand of Central Govt employees to increase the Fitment Factor recommended by 7th CPC December 27, 2015

- Clarification on Uniform Fitment Factor recommended by 7th Pay Commission November 30, 2015

- Uniform Fitment Factor recommended by 7th Pay Commission November 27, 2015

- Check also: 7TH CPC PAY SCALE CALCULATOR FROM 1.1.2016

7th Pay Commission Fitment Table PDF

Salary Increment Fitment Table for Pay Matrix Level 1 to 5, Pay Matrix Level 6 to 9, and Pay Matrix Level 10 to 12

- Salary Increment Table for Pay Matrix Level 1

- Salary Increment Table for Pay Matrix Level 2

- Salary Increment Table for Pay Matrix Level 3

- Salary Increment Table for Pay Matrix Level 4

- Salary Increment Table for Pay Matrix Level 5

- Salary Increment Table for Pay Matrix Level 6

- Salary Increment Table for Pay Matrix Level 7

- Salary Increment Table for Pay Matrix Level 8

- Salary Increment Table for Pay Matrix Level 9

- Salary Increment Table for Pay Matrix Level 10

Fitment factor 3.68 Latest news

FAQ related to the 7th CPC Fitment Factor

What is Initial Pay Fixation?

When an employee joins Central Government Services, the initial pay fixation has been done for determining the first-month salary. The new pay fixation on initial as per rule 7 of CCS (RP) Rules 2016.

How to fix Pay Fixation on Promotion?

When an employee gets a promotion his pay will be fixed as per the method of calculation prescribed by rule 13 of CCS (Revised Pay) Rules.

How to fix Pay Fixation on Increment?

When an employee is eligible for an annual or promotional increment, his pay will be fixed as per the latest revised pay rules.

How to fix Pay Fixation on Pay Commission?

When an employee is in service, new pay commission recommendations are eligible for him and his pay will be revised as per the recommendations of the new pay commission.

How can I revise my basic salary in 7th pay commission?

Revision of new salary in the 7th pay commission is based on the pay matrix table. Multiply your basic pay with a fitment factor of 2.57. And match the figure (equal or higher) according to your pay level in the pay matrix table.

How calculates the fitment factor in the 7th CPC?

The percentage of Dearness Allowance as of December 2015 was 125%. The 7th CPC recommended raising 14.29% and fixing the fitment factor to 2.57.

How do you calculate salary with fitment factor in 7th CPC?

After the implementation of the 7th pay commission, the old basic pay multiplies with the fitment factor of 2.57 and matches the basic salary in the pay matrix table according to their pay level.

How is the fitment factor calculated after the 7th pay commission?

The 7th pay commission recommended the fitment factor as 2.57. The fitment factor is the important figure to convert the basic salary from 6th CPC to 7th CPC as of 1.1.2016.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

What is entry pay

How to calculation of entry pay

Entry pay is only for new recruitment specific post.

Sir, I am working as sub staff, but when 7th pay commission was released, The training programme was given to the employees who are non matriculate, but the employee who is working matriculation they were not given any training else the benefits of the pay scale. The grade pay of 1800/was the same but actual the employees who are matriculated for them grade pay Rs 1900/ is to be released. So the actual benefit of the eligible qualification for the next post having also the promotion was not given.

I was released from Indian Air Force on 30/11/2011 as a Corporal with basic pay of Rs. 17270/- (including Grade Pay of Rs. 2400/-). My new basic pension as per Seventh Pay Commission is Rs. 22385/- +DA-Rs.4355/-. I had joined as LDC in Patent Office coming in Department of Industrial Policy and Promotion under Ministry of Commerce and Industry. My basic pay was fixed at Rs.19900/- (Grade Pay of Rs. 1900/-) plus all other allowances admissible to Central Government Servants. Please educate whether my basic pay fixed is correct or not and also how it can be rectified?

When will get the pay commission

Pension 20746 basic pay 22070 as on 3042017 retired 30.04.2017

Pensioners pay my pension Rs .20746 as on retired on30.4.2017 basic 22070 when will get 7th pay

On 31.12.2005 my basic pay was Rs.11850/-. 6th CPC was implemented from 1.1.2006, was placed in the scale of Rs.8000/- to Rs 13500/-.(Gr.A). on 2.1.2006 I was promoted to the next scale of Rs.10000-/- to Rs.. 15600 and subsequently retired on 31.1.2006 . My basic basic pay was fixed at rs 29480/- including Rs.6600/- being grade pay.at the time of retirement . My date of increment falls in April. Hence i was deprived the benefit of one extra increment although DNI falls between February and June. I am not convinced on my fixation and find there is annomally in my case right from the implementation of 6th CPC. Requests redressal

Basudeo prasad myBasic 1400-2300 salary anomaly junior staff MACP dated 06- 03-2016 GP Rs5400 my macp dated as 26 -06-2010 GP Rs 4600 insted of Rs 5400

my date of joinning 15 july 1991 yearr

The basic pay of mts/group D 5200+grade pay 1800=7000 fitment 2.57=17990 new 7th pay commission salary fixed 18000/ basic but other category 5200+gp 1900/ fit ment 2.57 ? And 5200+2000gp =? 2.57 fitment =? 5200+2400gp =and 2 .57 fitment ,the fitment calculate 2.57 only low class employs , that see new pay scale .now group D post up grade group C category but no benefit to them. Expet group D employees fitment 2.57 and others is 3 and above .can see the two salery scales 6th and 7th chart.

Mujhe hasi aa rhi h aapke is betuka question pe…2000 gp wala ka entry pay 6460 tha 6cpc me to 2.57 se multiply 6460+2000 se hoga..usi trah 2400 ka 7510 tha 6cpc me…

Sir, One thing I want know about the fitment factor of 7th Pay Commission. As per government policy, government wants to decrease parity gap between upper class employee and lower class employee but 7th pay commission recommended and sanctioned by government that upper class employee upgraded by 3.81 fitment factor of their basic salary whereas lower class employee upgraded by 2.57 fitment factor which is increase the gap of salary between the above mentioned employees.

In view of the above explanation as per my view the Government do not want to decrease the gap between upper class employee and lower class employee otherwise Government should take action for the same.

sir , at the time of implementation of 7 th cpc the DA was 125% it is converted in to 100 +125 =225. the increase in pay was 14.29%. 225*14.29%= 32..15.

225+32.15=257.15

that is became 2.57

why the allowances were deprived for the people who retired between Jany 2016 to June 2017. However the perks and allowances payable out of public money to politicians were doubled/tthre times, the multiplication factor was not uniform for all cadres. Replace the factor by 2.75 as mentioned in the recommendations.

My basic on 1/1/16was 25610+6600(grade pay) then on 6/1/16i got an increment of family planning TT operation.

Now if new basic is calculated on basic on 1/1/16 then where will my increment go.

Should I add it after fixation in the new matrix.

Please respond as I am not getting any guidelines regarding this matter from anywhere.

Thanks

Pay in pay band Rs. 23410 / Grade pay Rs. 5400 / scale of pay band 9300–34800. What will be my basic pay as on 01-01-2016.

I was promoted as TGT in June 2006, now I have completed 10years in this grade. My present basic pay is 56900. What will be my new pay after implementing MACP. In July 2017.

My date of retirement is 31.8.2003 with last Pay Drawn Rs.7900/- in the Scale of Pay Rs.6500-200-10,500 [Gazetted Gr.B] ( 5th CPC) .My Basic Pension as on 01.01.2006 was fixed as Rs.8724/- & on 01.01.2016 on 7 CPC my Basic Pension was fixed on multification factor (2..57) as Rs.22,421/-. Kindly confirm my Basic Pension as per Min. of Personnel, PG & P, DoP&PW Order dt. 12.5.2017. As per g..servants.com, the result on the basis of my aforesaid data, my revised pension payable has been reckoned as Rs.24,500/-.Kindly confirm whether the amount is correct. If not, the correct position with mode of fixation may kindly be intimated.

My basic pay on 31/12/2015 is 31150(25750+5400) on level 10

Then 1/1/16 – 31150*2.57=80055.5..Then what will be my basic on 01/01/2016—80000 or 82400 ?

Mr.Laman, Revised Pay Rules said below…

”

5.1.29 The pay in the new pay matrix is to be fixed in the following manner:

Step 1: Identify Basic Pay (Pay in the pay band plus Grade Pay) drawn by an employee as on

the date of implementation. This figure is ‘A’.

Step 2: Multiply ‘A’ with 2.57, round-off to the nearest rupee, and obtain result ‘B’.

Step 3: The figure so arrived at, i.e., ‘B’ or the next higher figure closest to it in the Level

assigned to his/her grade pay, will be the new pay in the new pay matrix. In case the value of

‘B’ is less than the starting pay of the Level, then the pay will be equal to the starting pay of

that level.”

C.G. government employee hu. Mera Date 1.1.16 ko 8330+1900tha. Mera pramotion Grede 2 5200-2400, Date 4.07.17 ko hua hai. July 2017 ko Basic Kita hoga please batai.

It is not fair. Government is not thinking for its employees.

Congress government is far more better than modi government. He is just taking tax per minute by d people but not giving the actual increment. All d bjp politician are going rich. Every one who is in d government are thief’s.they are increasing their power,property and wealth.but they are not thinking about employees who is giving 24×7 duties.

Shame on you modi government.

It is not fair. Government is not thinking for its employees.

Congress government is far more better than modi government. He is just taking tax per minute by d people but not giving the actual increment. All d bjp politician are going rich. Every one who is in d government are thief’s.they are increasing their power,property and wealth.but they are not thinking about employees who is giving 24×7 duties.

Shame on you modi government.

The lowest pay in 6 CPC was 7000 and by multiplying a factor of 2.57 it comes to 17990 and his pay has been fixed at 18000(he got just Rs.10/- to reach the level). The highest pay in the Govt. was 90000 and by multiplying a factor of 2.57 it comes to 231300 and his pay has been fixed at 250000(he got Rs.18700 to reach the level). See the difference of Raja Bhoj and that of Gangu Theli. Our Union leaders should not allow to occur such huge differences.

I agree to your views (Ram Singh). In the notification and news they said 2.57 is for all posts but it isn’t like that. Higher posts personnels are drawing higher basic grade and allowances so what’s the need for higher multiplication factor of upto 2.81

Fitment factor is increasing as per the grade pay increasing. It has implemented just as Britishers had done to our Indians. This is the wrong policy of the govt,it shows partiality between low rank and high rank.fitment factor should be equal. By this richer is going more richer than how it will be possible that everyone would be equal.

JCM has failed to put forth the greviences of retired persons. The fitment formula suggests by the govt. Is very lower. I hope the secretaries in the govt may look into the matter for sanction of good fitment formula of 3.7 at the earlier.

The 7cpc only proves that rich are growing richer. The plight of the lower category staff is still that of the British era.

why not settled fitment by empowered comitee. I have retired on 31.1.16 till date i have not awarded any 7cpc benefit nor enhenced pension what type of drama is going on. Pl clarify

The revision of pension for pensioners drawing 1/3rd pension after getting 100% benifits joining PSUs etc. have not been restored like any other pensioners.The banks gives an excuse that no orders have been received in such cases. Some banks have applied 2.57 matrix on the full basic pension and credited the revised pension and also arrears from l.l.2016. I would like to get a copy of the orders on this matter so that I can demand my revised pension and arrears.

At the time of releasing 7 th cpc ,It was stated by the commission that the serving CG employees will get 14.25% in pay and 64% in allowances ovrall 24% increase in their salleries and retired employees will get 24% increase in their pention.But both serving and retired employees got 14.24% hike and serving employees likely to get 63% hike in allowances.But what about retired employees.Are the retirees not entitled to hike on par with serving employees.

m

In 5th pay commission, there was a provision of merging of 50 % DA with basic once the DA crossed 100 %. In 6th PC no such merger allowed. Had the merger of 50 % DA allowed, the factor would have been 2.625 even if Govt. not given a single rupee as pay commission benefit. Unfortunately this angle has not been found projected any where.

Further, in the present pay fixation, it is seen that some of the people getting amount almost equal to one increment in addition to the pay commission benefit of 14.222…% (ie 2.57/2.25) as they have just crossed a particular stage for few rupees (when multiplied with factor 2.57) and fixed at the next stage where as some people lost that benefit as they fall short by few Rs. in a stage and fixed in that stage with the benefit of 14.222..%. A wide disparity almost equal to one increment can be seen in such cases.

My basic is 6310+1900 = 8210 on 1.1.16 but I was on holiday in July I joined the on 1 Aug. Therefore my basic is on 6560+1900=8460 on 1.8.16

In option 1

1.1.16= 8210*2.57=21000

1.7.16= 21700

In option 2

If my option is taken on 1.8.16 then

8460 * 2.57 = 21742 = 22400 in pay matrix

My question is that whether I m able to obtain 2 option or not ?

Sir, I am getting promotion in Oct-2016 from 5200-20200 in Gp-2800 to 9300-34800 in GP 4200, is there any option for getting 7thCP effect from Jan – 2017. If it is possible they I am ready to take 6th pay upto Jan-2017 with out any arrears. since im loosing 4000Rs every month. please reply

Respected Sir,

Please provide Chief Librarian pay scale 7th pay scale College librarian and University Librarian

Thanking you

my pay on 01.01.2016 19490+gp 5400, revised pay fixed *2.57 i.e. 63968 will be fixed at 65000. Recently i was on excadre higher post in the GP 6600 on 20.06.2016. In that case my pay will be next cell 67000, next level 11(6600) fixed on 67700 , whereas my pre-revised pay is 19490+750+770+6600 i.e 27610. As such I am in loss. ie. on 01.01.2016 the difference of revised pay and pre revised pay is 9000 whereas in 20.06.2016 the difference is 4473 . the question is can i get any bunching benefit , which i am facing loss today.

In the example basic is multiplied by 2.57 referred to matrix to arrive at new pay is the same is applied in pension fixing after multiplying basic by 2.57 referred to matrix and 50%of this amount is new pension is it. Correct

I am gujarat govt pensioner , retired before 01-01-2006

State is implementing GOI scale for emplyee and AICTE

Pay scale for university teachers

State had yet not paid me 50 % (of pay band +grade pay) as

pension as per GOI order from 1-1-2006

State had declared the implementation of 7th PC from

01-01-2016

I was techer in aicte approved uni affiliated govt college

Please guide me how state will pay the revised pension

with out first implementing or paying 50% of pay as

Pension w e f from 01-01-2006

Now a circular regarding submit option in 7th pay commission which is option best for option choose. 1 January 2016 or 1 July 2016

Pl give guide me in the matter

Sir

What is small family sp. Allowance in 7 the pay commission

I am applying for VRS w.e.f 31.01.2017. My date of appointment is 30.12.1988.

Now I am working as assistant, got Assistant promotion in may 2006. Date of increment is on July till now.

a) What will be my date of increment if I resign in Jan 2017?

b) what will be my pension amount per amount and DCRG amount plz.

Pay is fixed at Rs.68000/- on 01.01.2016 in level 7. Third MACP is due on 18th July 2016.

Tell me, whether pay will be fixed simply at Rs.72100/- in level 7 OR at Rs.76500/- of level 8 w.e.f 18th July 2016 after earning an inremnt of 1st July 2016 with the basic pay of Rs.70000/- in level 7?

– Sunil C. Parikh.

The 7th Pay Commission notification issued on 25/26th July 2016 would not apply to PSU pensioners. If at all, this decision is to be applied to PSUs. a separate notification would be issued at a later date.

I am a pre-2006 PSU absorbee with full commutation calculated @ 21/33 factor amounting to Rs.2184/-.This was upgraded to Rs.4936/- by applying 2.29 fitment factor in 6th.CPC with notional pension @ Rs.6682/- in the payband of Rs.15000-39100+5400. On the said notional pension of Rs.6682/- was drawing old age pension @30% & DA@125%.My D.O.B. is 15-07-1930.

Now please tell me what will be my revised pension under 7th.CPC ?

My notional pension in 6th. CPC was fixed @ Rs.6682/- and my restored 1/3rd pension @ Rs.4936/-plus old age pension & DA relief @125%. What will be my total revised pension now under 7th. CPC?

Pay Band of Rs. 15000-39000 with grade pay of Rs.5400/- was applicable to me. pension was calculated @ 21/33 with fitment factor of 2.29.

It is noticed that PAY METRIX given by the commission, in a few cases, Pay Band + Grade Pay when multiplied with the figure of 2.57 does not tie up with the revised pay arrived under 7th pay. There must be some error while rounding up the annual incremnts. As per 6th pay the pay band and the existing grade will be computed and rounded off to the NEXT multiple of 10.

the 50% of DA was merged with basic pay in case of 5th and 6th cpc was called DP. this time DA is not merged and therefore multiple factor can not correlated with 5th or 6th cpc. The multiple factor 3.7 appeares to be appropriate.

Arrears should be only paid after all types of deduct-able arrears like Income tax; Difference of C.G.E.I.S; C.G.H.S. Difference of Professional Tax etc.

OK

I am retired & re employed in same department on the basis of last pay drawn i.e. 23150 including Basic Pay & Grade Pay.

Am i entitled to get revised pay on the basis of 7th Pay Commission?

Regards

I rahimthulla Mohammed retired railway senior goods driver beg to submit 5 th&6 thcpc reports:- my DOB 18-10-1948, DOA 1-12-1975 ,date of retirement 9-9-2003( Valentry)( vr). In 5 th CPC my basic pay: RS/6375 _ scale( RS (5500-9000) level- s -10. In6th CPC my basic shows RS 10888/- scale (9300-34800), level- PB-2. Hence now what am I dra in 7 th cpc, what level in 7 th CPC. Thank you very much

.

Rahimthulla Mohammed

No such pay calculation method yet been noticed for pay fixation of running staff of Indian rly

My grandmother PENSION basic pay is 3500 in 6th pay but what is the new pension basic pay after 7th cpc

Please me gmail. Thanks

My basic pension is12521 my payband is 15600-39100 and gp is 5400. What would be my pension in 7th pc.

sir

my pension carrent take home 11787.Afther orop .and 7th cpc .how much given.me pension.

please give mee reply sir

your sincerly

Rana pratap singh

no.13692288L

My basic pension is 11165 and at the time of retirement my grade pay was 4600.00. Could you please intimate what will be my pension n 7th CPC

I have been granted 2nd acp scale of 10000-325-15200 w.e.f.9-8-1999 and eqivalanent scale as per 6th pay commission recoimmenation is 15600-39100 with grade pay 6600 and retired 0n 31-1-2008 please clarify whether total no of increments earned in 10000-325-15200 and increments earned in 6 pay commission scale of 15600-39100 with grade pay of 6600 after pay is fixed in 6th pay commission scale to be concidered for pension revision or actual increments earned after 1-1-06 as same is not so far discussaed in c g employees news channels

My basic pension is Rs 9060. What is the revised pension in 7th pay commission

I am central government employee and my basic pension is 5605. Please let me know what will my total pension after declaration of 7th pay commission.

With regards

K.M. Balodi

SIR,MY BASIC PAY-19200 AND GP-4800.PLS TELL ME WHAT WILL BE THE BASIC PAY AS PER 7TH PAY COMMISSION.THANK YOU.

Sir .my basice pay 10100 .& gread pay 2400 ..

SIR. Mera 7th pay commition me kithni pay bhai saha hai ..

Sir,

My basic pay is 9820 and grade pay is 2000 now what will be the basic pay in VII pay commission I am working in kendriya Vidyalaya.

VINOD

Sir my basic Rs7210/ and grade pay is Rs1800/ in 7th pay commission how much I will get all total

Sir my pay band is 19190 and grade pay 4800 what will be my scale in 7 th pay?

Dear Sir

My father retaried from army from the post of of subedar (sub) grade y in feb 28 2006 what will my father pension under one rank one pension and 7th pay commission.

is there any separate fixation of scales for kendiya vidyalaya t eachers

Sir! I appointed on clerk post dated 19.02.2007 gread pay 5200-20200 pay band 2000.What is my eastemeted salary according to 7th pay scale.

The central govt attitude towards us is very very bad

Sir,I Appointed in 8/11/2002 as fireman my salery scale 2750 to 4400 ,basic pay on 31/12/2005 is 2960 but my pay fixation do 5700+ 1900 are correct please tell me

In 6th pay commission salary increased by almost 3 time double but now only 9-14% as per formulated fitments whereas the rate of every commodities in market escalated like anything. Every body seems not happy with 7th pay commission.

I am holding the post o Private Secretary with Rs.22,160(Pay Band) +Rs.4,800 and going to retire on superannuation on 31.01.2016. According to fitment formula my basic pay stands at Rs.70,000/- and pension Rs.35,000/- but according to fitment formula of pension in Option-II, pension stands at Rs.44,275/- Please calculate my pension in Option-I and Option-II and suggest me to opt for pension.. .

An employee appointed recently with a grade pay of 1800 at PB 5200 and residing in a quarter is getting 7000 as basic pay and would get DA at 125% thereupon which would be 9163 means a total pay plus DA of Rs. 16493 and he would get Rs. 18000 as basic pay with 0% D. This will result in net increase of Rs. 1508 which is only 9% against the subtotal of 16493. Where is the so called increase of over 14% is a question mark?.

If one is on leave on 1.1.2016, one’s pay will be fixed from 1.1.2016 or from the date of joining after availing of leave

Honorary commission JCOs should not treated as officer for giving pay, allowances and pension. They should be treated as JCOs for all purposes and hononorary allowance to some extent in pay & pension should be given to them as is being given to Honorary Naib Subedar.

Honorary rank of Subedar & Subedar Major being granted after retirement may be given some financial benefits as being given to Honorary Naib Subedar.

pl clarify that after 7 th pay commission, previous DA ie 119% can be retain or abolish. New pay structure can be calculated along with 119% DA or new DA will be applicable.

Pension fixation of pre 2006 pensioners:

Let us take the case of two pensioners Mr.ABC and Mr. DEF. Both has been

promoted to level 11 in the year 1980. Now Mr. ABC got promoted to Level 12

in 1987 after getting 7 increments in level 11 and Mr. DEF did not get any promotion. Both retired in 1989.

Now Mr ABC who got promoted to level B will be fixed at notional pay 83600 after granting him two increments in level 12, and his pension will be fixed at Rs.41800

Where Mr. DEF who did not get any promotion, his notional pay will be fixed at Rs.88400 after granting him 9 increments and pension will be fixed at Rs.44200

i.e that is the man who had been promoted will get lessor pension.

Same thing will happen to people belonging to other pay levels.

This anomaly may only be overcome by fixing the notional pay at lower level the fixing the pay in the level from where the pensioner retired.

Solicit attention ao all concerned.

I was drawing bp Rs 7425 in the 5th cpc pay scale of 5500-9000. What will be my pension under 7th cpc.

Too many circulars, tables orders and revisions make the pay and pension calculation a tedious job. For the OROP I think there is no base level made available for starting the calculations. Te pension increase made in 2014 september onwards but calculation purpose I could not find the rank wise pension of defence PBOR anywhere across the internet. Please provide relevant data required to calculate the arrears. Otherwise one has to satisfy with the amount adjusted in his account without knowing his entitlement.

Finally i come to know ,makaan aur suv kya ek cycle bhi nai arahihai, yaha pe patha chala ki hamare desh mein ache din kyun nahin aa rahe hai Actually , we have poor Economists, a sensational and irresponsiblle MEDIA, INNOCENT PEOPLE AND 10YRS KE BAAD 4.25% NET INCREASE PAAKAR ITNI ALOCHANA SUNANE BALAH, BECHARA CENTRAL GOVERNMENT KARMACHARI,

PLEASE ONCE U THINK MEDIA KAISE PUBLISH KARTHI HAI ,,,,,,,,LIKE BONANZA , 23%HIKE FULL BENFIT , ETC……

2.57 is not excepted

Fitment table

i do not clearly understand what is the principle of One Rank One Pension.Let me give an example in this connection.An officer retired on 31 August,2004 and got basic pension of Rs.1800.00. The same rank of officer retired on 31st.August 2007 and got pension of Rs8000.00..According to the principle of OROP would the officer retired on 31st. August,2004 would be entitled to get pension of Rs. 8000.00 from the month September,2007? Kindly clarify this point and state the details of the principle of OROP.

the 7th cpc report is complete.the chairman has said so.then why to hold it ?perhaps at the instance of govt which is not fair.it sows anti-employees stance of the govt .this is the impression carried by the employees. which will not serve the govt well.

Do you have any authentic news about 7th cpc?

Is fitment formula multiplied with 6th pay basic or basic and grade pay both? Plz reply

Everybody waiting for 7th CPC report, but 7th cpc hanging the report in front of employees. It is not good practice if you have complete your task you should submitted it in time. My prediction for 7th cpc is 2.45% multiplication factor will be given.

C.R.Panda

RLTRI,Aska, Odisha

Present pension is rs.16001what will be new pensiom after 7 th cpc

will 7th pay commission be benefit for temporary or outsource staff?

I think it is a good service provider for news of VII th pay commission

why delay in implememting orop. Defence minister thinks himself as a king of india.

I am solder in one of the armed forces. The pay structure is not separate for armed forces and pays are fixed on the basis of non-skill, semi-skill and skilled, etc. but a solder after tough training how he can be a non-skill or semi-skill. therefore the pays to be fixed as per the norms killed to master skill emplyee otherwise a separate pay fixation to armed forces personal.

sir being serivce in one force we the group-d civilans have not given any benefit as compare to other ranks of civilan empolyees in this force . in this force at present total group-d civilan empolyees are 1000 . but we have not been given any benefit ration money and grade pay as compare to combatised group-d employee in this force he was given grade pay Rs 2800/- after completing 20years of service but non-combatised group-d employees was given grade pay Rs 2000/- after completing 20years of service we have not given ration money

i am an group-d civilan employee in sashastra seema bal i have compelted 20years of service and i was given 2nd MACP with grade pay Rs 2000/= before 2000 this was totally civilan dept and was under cabniet secretrate but after 2000 this dept was given to MHA without any intimation to their civilan empolyees at present their are two wings in the fore one is combatised and another is non combatised as combastised group-d employees received grade pay after 20years of service Rs 2800 but non- combatised employees recevied grade pay after 20years of service Rs 2000/ and no ration money being in one force