Salary Increment for Government Employees in India

The 7th Pay Commission Recommendations concerning Salary Increment for Central Government Employees in India have brought about a significant deviation from the previous system. The Commission has done away with the traditional practice of computing annual increments, and instead, progression to the next pay level in the ‘Pay Matrix Table’ is now treated as a single increment. As per the Commission’s report, it is important to note that the increment now equates to 3% of one’s basic salary.

What is the annual salary increment for CG employees?

What is the percentage for the annual increment recommended in the 7th pay commission?

What is the annual salary increment for Central Government (CG) employees? Also, what percentage of the annual increment has been recommended by the 7th pay commission? As per the recommendations of the 7th Central Pay Commission, the rate of percentage of annual increment for CG employees is 3%. However, it is important to note that the actual amount of increment is not uniformly equal to 3% of the basic salary. This is due to variations in the stages of calculation, whereby some stages may show increments higher than 3%, while others may show lower increments. As a rough approximation, an annual increment of about 3% of the basic salary is granted to Central Government employees every year.

How to calculate an increment in basic pay?

How to calculate the annual increment after the 7th pay commission?

Calculating an increment in basic pay and annual increment after the 7th pay commission can be a complex process. While it is true that the amount of 3% of basic pay equates to the annual increment, it is not necessary to calculate this percentage every year. This is because the pay matrix table already includes an increment table for all pay levels. As per the pay level hierarchy, the basic pay for the next cell value is determined with an annual increment. Therefore, referring to the pay matrix table is the best way to calculate the annual increment.

7th CPC Increment Chart PDF

| Title of the Table | Annual Increment Table |

| Beneficiaries | Central Govt Employees |

| Minimum Annual Increment | Rs. 500 |

| Maximum Annual Increment | Rs. 6500 |

| Pay Commission | 7th CPC (2016-2025) |

Date of Next Increment Rule

The date of the next increment rule is regulated by 10 of CCS (RP) Rules 2016 for all existing employees working in Central Government services. Very recently in November 2019, the Department of Expenditure issued a clarification order regarding the date of the next increment will be 1st January or 1st July after promotion on 1st July.

Increment Table for Pay Matrix Level -1

| Index | Level 1 | Increment |

| 1 | 18000 | |

| 2 | 18500 | 500 |

| 3 | 19100 | 600 |

| 4 | 19700 | 600 |

| 5 | 20300 | 600 |

| 6 | 20900 | 600 |

| 7 | 21500 | 600 |

| 8 | 22100 | 600 |

| 9 | 22800 | 700 |

| 10 | 23500 | 700 |

| 11 | 24200 | 700 |

| 12 | 24900 | 700 |

| 13 | 25600 | 700 |

| 14 | 26400 | 800 |

| 15 | 27200 | 800 |

| 16 | 28000 | 800 |

| 17 | 28800 | 800 |

| 18 | 29700 | 900 |

| 19 | 30600 | 900 |

| 20 | 31500 | 900 |

| 21 | 32400 | 900 |

| 22 | 33400 | 1000 |

| 23 | 34400 | 1000 |

| 24 | 35400 | 1000 |

| 25 | 36500 | 1100 |

| 26 | 37600 | 1100 |

| 27 | 38700 | 1100 |

| 28 | 39900 | 1200 |

| 29 | 41100 | 1200 |

| 30 | 42300 | 1200 |

| 31 | 43600 | 1300 |

| 32 | 44900 | 1300 |

| 33 | 46200 | 1300 |

| 34 | 47600 | 1400 |

| 35 | 49000 | 1400 |

| 36 | 50500 | 1500 |

| 37 | 52000 | 1500 |

| 38 | 53600 | 1600 |

| 39 | 55200 | 1600 |

| 40 | 56900 | 1700 |

Withholding of Increment

The act of withholding an increment may have a cumulative or non-cumulative effect on an employee’s salary. In the event of disciplinary action, an increment may be withheld in two ways as outlined in Rule 11(iv). It is worth noting that increments are granted on either the 1st of January or July based on eligibility. Thus, if an increment is withheld as a penalty, subsequent increments following the date of the penalty will also be withheld.

Also check: 7th Central Pay Commission Report – Download pdf

Increment in Salary Every Year

The annual increment for government employees in India usually denotes a part of the salary hike in a year.

“Pay Hike (Pay Increment) is the most attractive word among employees working in Government Services”. Needless to say that is the most powerful keyword among the Central government employees because a pay hike once a year consolidated according to their basic pay. It is also a consolation even if they are not getting promotions for years.

Government employees are getting two types of increments, one annual increment and another one is promotional increment.

ANNUAL INCREMENT: Annual increment is grating to all group of Central Government employees on 1st January or 1st July of every year (previously in 6th CPC, there was one date for annual increment, 1st July of every year)

PROMOTIONAL INCREMENT: While fixation of pay on promotion or MACP, there will be an increment. That is called promotional increment.

INCREMENT DAY: 1st January or 1st July

NOTIONAL INCREMENT: The direct meaning of ‘Notional’ is hypothetical. An employee deserves to be admissible for an annual increment after completion of one year, but he should have to present his presence on duty to the next day or further. [Know more details]

Also check: 7th Pay Commission Pay Scale Calculator

Leave on Increment Day – What will happen?

It is stated in the FR and SR Rules that if a Government employee is on leave on Increment Day, the increased pay will only be received from the date of resuming duty. It is mandatory for Central Government employees to attend work on the implementation day (01.01.2016) of the 7th CPC recommendations. Therefore, if a government servant’s increment date falls during a period when they are on Earned Leave/Commuted Leave/Half Pay Leave/Leave not due, the benefit of such increment will only be paid from the date of rejoining duty after leave has expired, despite the actual date of the next increment. – Click to read detailed story

Check also: Date of Next Increment Calculator after 7th CPC

Rate of Annual Increment and Increment Date

The 7th Pay Commission has recommended on the rate of annual increment is being retained at 3%

RATE OF INCREMENT: The annual increment granted 3% of basic pay in the 6th CPC. The 7th Pay Commission also retained the rate of 3% as an annual increment. However, there is no calculation for 3% of basic pay. Value of next cell in the same pay level in the Pay Matrix Table. Date of next increment in revised pay structure: There shall be two dates for grant of increment namely, 1st January and 1st July of every year, instead of the existing date of 1st July. Date of next increment clarification as per rule 10 of CCS (RP) Rules 2016

INCREMENT DATE: 7th CPC recommended two dates (1st January and 1st July of every year) for granting increment to all CG Employees with effect from 1.1.2016. Provided that an employee shall be entitled to only one annual increment either on 1st January or 1st July depending on the date of his appointment, promotion, or grant of financial upgradation.

Annual Increment Rules: The increment in respect of an employee appointed or promoted or granted financial upgradation including upgradation under Modified Assured Career Progression Scheme (MACPS) during the period between the 2nd day of January and 1st day of July (both inclusive) shall be granted on 1st day of January and the increment in respect of an employee appointed or promoted or granted financial upgradation including upgradation under MACPS during the period between the 2nd day of July and 1st day of January (both inclusive) shall be granted on 1st day of July.

Annual Increment Calculation Method in 7th CPC

Increments in Pay Matrix: Annual Increment Calculation Method Prescribed by 7th Central Pay Commission in Salary Slab as follows…

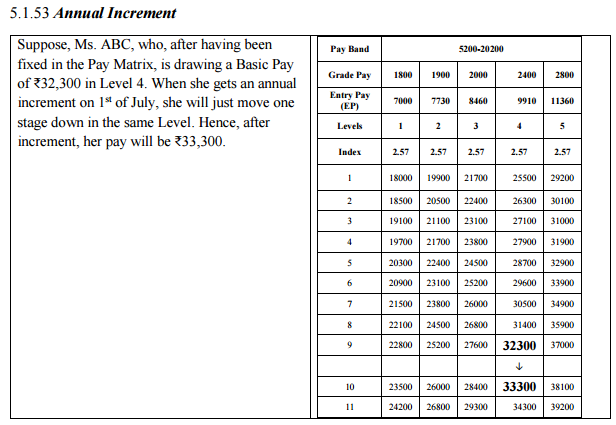

Illustration: An employee in the Basic Pay of 32300 in Level 4 will move vertically down the same Level in the cells and on grant of increment, his basic pay will be 33300.

| GP | 1800 | 1900 | 2000 | 2400 | 2800 |

| L | 1 | 2 | 3 | 4 | 5 |

| 1 | 18000 | 19900 | 21700 | 25500 | 29200 |

| 2 | 18500 | 20500 | 22400 | 26300 | 30100 |

| 3 | 19100 | 21100 | 23100 | 27100 | 31000 |

| 4 | 19700 | 21700 | 23800 | 27900 | 31900 |

| 5 | 20300 | 22400 | 24500 | 28700 | 32900 |

| 6 | 20900 | 23100 | 25200 | 29600 | 33900 |

| 7 | 21500 | 23800 | 26000 | 30500 | 34900 |

| 8 | 22100 | 24500 | 26800 | 31400 | 35900 |

| 9 | 22800 | 25200 | 27600 | 32300 | 37000 |

| 10 | 23500 | 26000 | 28400 | 33300 | 38100 |

| 11 | 24200 | 26800 | 29300 | 34300 | 39200 |

Salary Increment Procedure India

7th Pay Commission Annual Increment (January and July) Anomaly Calculator

Annual increment is granted to all Central Govt employees including Railways equal to 3 percent of basic pay every year on 1st January or 1st July. 7th CPC has calculated annual increment for pay level as in the hierarchy pay matrix table. Click to view the pay increment chart as per the 7th CPC for pay levels 1 to level 18. Click to calculate your increment

Advance Increment in 7th Pay Commission

The Advance Increment in the 7th Pay Commission is a system where an employee is granted one or two annual increments in advance based on their performance of duty. One example of this is the Stenographers of Subordinate Offices who are given one or two advance increments for passing speed tests in shorthand at 100/120 wpm. To calculate the advance increment after the 7th CPC, one step or one stage of the pay hierarchy is granted in the same pay level of the pay matrix of eligible staff. This is equal to an annual increment and should be treated as a separate element in addition to the basic pay, and should be counted as pay for all purposes. The salary increment for State Government Employees follows a similar methodology, where most state governments have created their own ‘Pay Matrix Table’ for their workforce. The system of annual increment calculation has been abolished under the 7th Pay Commission.

What are FR 22(I)(a)1 Rules?

The rule provided options to an employee to fix his pay on promotion or MACP up-gradation in two ways. One is the date of promotion and another is the date of the increment (either 1st January or 1st July). [Click to read full story]

Dopt Orders on Notional Increment issue

- One Notional Increment to those retired on 30 June after completion of 365 days

- Notional Increment for Pensionary Benefits – Court Judgement on Annual Increment

- Anomaly in Determining Notional Pay – Revision of Pension of pre-2016 pensioners

- Grant of Notional Increment on completion of 12 Months of Service

- 7th CPC Pension (Notional Pay) Calculator for Pre-2016 Pensioners

Withholding Annual Increments Of Non-Performers After 20 Years

The perception among employees that increments and promotions are granted automatically has become widespread. Even the grant of MACP, while conditioned on performance, is often taken for granted. The current commission believes that employees who do not meet the prescribed performance criteria should not receive future annual increments. To deter complacency and inefficiency, the commission proposes withholding annual increments for employees who fail to reach the benchmark for MACP or regular promotion within the first 20 years of their service. This withholding of increments should be viewed as an “efficiency bar” rather than a penalty, meaning that disciplinary action norms will not apply. Employees failing to meet the criterion could also have the option to leave service with terms and conditions similar to voluntary retirement.

The Services have requested the removal of the existing stipulation that the next increment be granted from the date of attestation or mustering, as this creates an inequity between low-skilled jobs and those with higher entry-level qualifications. The latter group may not be attested or mustered until later, resulting in a delay in receiving their next increment. The commission agrees that this should not disadvantage those with higher entry-level qualifications and recommends that the date of enrollment be used instead of attestation or mustering for the purpose of granting the first increment to all successful recruits.

Check also: Click To View More News 7th CPC Increment

NC JCM Staff Side Suggested to 7th Pay Commission on Increment

The NC JCM Staff Side has submitted a proposal to the 7th Pay Commission regarding the current system of annual increments. They have raised concerns over whether the present system of annual increments, which takes place on 1st July of every year for all employees, serves its purpose effectively. The single-date increment system has caused several anomalies, which were discussed at length at the National Anomaly Committee, but no agreement was reached. In order to address this issue, the commission should recommend two specific dates as increment dates for administrative expediency: 1st January and 1st July. This would mean that those recruited, appointed, or promoted between 1st January and 30th June would have their increment date on 1st January, while those recruited, appointed, or promoted between 1st July and 31st December would have it on 1st July. Additionally, the commission should recommend granting one increment on the last day of service for employees who retire on 30th June or 31st December.

What should be the reasonable quantum of annual increments?

In the banking industry, the reasonable quantum of annual increments should be at least 5% of the basic pay or the rate of increment agreed upon through bilateral discussion, whichever is higher. As for the provision of variable increments for high achievers, it is important to define the term “high achiever” and establish transparent and objective parameters for assessing high achievement. Without such parameters, the system of variable increments may be subjectively misused. Given these reasons and the response to question 2.3, the scheme of variable increment is not recommended. The annual rate of increment should be set at 5% of the pay. Additionally, pay on promotion should be fixed at two increments and a minimum difference of Rs. 3000 between present and promotional posts.

Date of Next Increment in Six Months on Promotion or MACP

The Finance Ministry issued an important order regarding the DNI on Promotion on 1st July [O.M. No.4-21/2017-IC/E.IIIA dated 29.10.2019].

The Finance Ministry has issued a significant order on the Date of Next Increment (DNI) that pertains to promotion or financial up-gradation, which was released on the 1st of July 2019 [O.M. No.4-21/2017-IC/E.IIIA dated 29.10.2019]. The order has provided clarity on the accrual of subsequent increments for employees who receive a promotion or financial up-gradation on the 1st of July, and benefit from two increments, i.e., the first annual increment due on 1st July and the second notional increment on account of promotion. As per the order, if an employee receives a promotion or MACP on the increment date of 1st July 2019, their pay will be fixed on 1st July 2019, and the subsequent increment will accrue on 1st January 2020, after completion of six months of service. Thereafter, the next increment will be eligible only after completion of one year on 1st January 2021. For further information on the Annual and Promotional Increment rules for Central Govt Employees, please refer to the downloadable pdf version of the order.

Salary Increment Letter Format

The format for a salary increment letter is not required for Central Government Services employees after one year of service. This is due to the fact that an annual salary increment is automatically processed for all groups of Central Government employees each year, based on their basic salary. In addition, promotional increments are also taken into account during pay fixation.

7TH CPC PAY SCALE CALCULATOR FROM 1.1.2016

| Date of Next Increment on Promotion or MACP – Rule 10 of CCS (RP) 2016 – 31.10.2019 |

| Date of Next Increment on Promotion or MACP Clarification Orders pdf Download – 31.10.2019 |

7th Pay Increment Fixation Table for Pay Level 1 to 5

- Salary Increment Table for Pay Matrix Level 1

- Salary Increment Table for Pay Matrix Level 2

- Salary Increment Table for Pay Matrix Level 3

- Salary Increment Table for Pay Matrix Level 4

- Salary Increment Table for Pay Matrix Level 5

7th Pay Increment Fixation Table for Pay Levels 6 to 9

- Salary Increment Table for Pay Matrix Level 6

- Salary Increment Table for Pay Matrix Level 7

- Salary Increment Table for Pay Matrix Level 8

- Salary Increment Table for Pay Matrix Level 9

7th Pay Increment Fixation Table for Pay Levels 10 to 12

- Salary Increment Table for Pay Matrix Level 10

- Salary Increment Table for Pay Matrix Level 11

- Salary Increment Table for Pay Matrix Level 12

7th Pay Increment Fixation Table for Pay Levels 13 to 16

- Salary Increment Table for Pay Matrix Level 13

- Salary Increment Table for Pay Matrix Level 13A

- Salary Increment Table for Pay Matrix Level 14

- Salary Increment Table for Pay Matrix Level 15

- Salary Increment Table for Pay Matrix Level 16

Dopt Orders on Annual Increment

- TN 7th Pay Commission : Pay Matrix Annual Increment Calculation September 26, 2024

- Date of Next Increment on Promotion or MACP – Rule 10 of CCS (RP) 2016 September 21, 2024

- Notional Increment for Pensionary Benefits – Court Judgement on Annual Increment August 9, 2024

- One Notional Increment to Those Retired on 30 June After Completion of 365 days August 9, 2024

- July and January Notional Annual Increment for Pensionary Benefits – IRTSA February 5, 2024

- Increment Day 1.1.2024 for Central Government Employees December 28, 2023

- Check Your Next Annual or Promotional Increment in Our Online Calculator! October 24, 2023

- CAT Jabalpur and Delhi Court Orders for Benefit of One Notional Increment August 4, 2023

- Grant of Notional Increment for Pensionary Benefits – Railway Board July 14, 2023

- Grant of Notional Increment (as due on 1st July) for the Pensionary Benefits June 28, 2023

- Grant of Notional Increment to Employees retiring on 30th June and 31st December June 28, 2023

- Latest News Who Retired 30 June Add One Increment May 28, 2023

- 7th CPC Recommendations Implementation Day: Is Attendance Compulsory? April 10, 2023

- Grant Special Increment as Personal Pay to AIS Officers: DoPT Order 3.8.2021 August 4, 2021

- Grant of Annual Increment Due on 1st July to the Employees retiring on 30th June of the Year – Dopt on 24 June 2021 June 25, 2021

- Date of next increment under Rule 10: One More Opportunity to Exercise the Option May 28, 2021

- Date of Next Increment clarification order issued by Finance Ministry on 15.4.2021 April 19, 2021

- Grant of Notional Increment and Re Fixation of Pensionary Benefits – BPS December 3, 2020

- 7th Pay Commission Advance Increment in 7th Pay Commission to Stenographers – DoPT Order 24.7.2020 July 25, 2020

- Today is the Day for Annual Increment for Central Govt employees – 1.7.2020 July 1, 2020

- Compilation of Government Orders on Annual Increment for CG Staff and Officers June 28, 2020

- 7th Pay Commission Pay Matrix Annual Increment Table for CG Employees June 28, 2020

- 7th Pay Commission Annual Increment – Some Questions and Answers June 26, 2020

- Annual Increment on 1.7.2020 for Central Govt Employees June 25, 2020

- Annual Increment for Central Govt Employees – Claim and FactCheck June 20, 2020

- Rounding off the amount of Annual Increment Rules June 20, 2020

- Grant of annual increment due on 1st July to the employees retiring on 30th June of the year June 4, 2020

- Notional Increment on the day of retirement (increment due on next day) for the purpose of fixation of pension May 16, 2020

- Circulation of OM issued by MoF – DoE regarding 7th CPC April 17, 2020

- Clarification on Date of Next Increment under CCS Rule 10 December 27, 2019

- Determination of Date of Next Increment – Rajya Sabha Questions and Answers December 18, 2019

- Clarification on the Date of Next Increment in 6 Months on Promotion December 2, 2019

- New Annual Increment Rules applicable to Railway employees November 7, 2019

- Avoid Financial Loss to Employees on their Pay Fixation in 7th CPC Pay Matrix – NFIR October 4, 2019

- Increment issue to those retiring on 30th June – SLP dismissed by Supreme Court August 20, 2019

- 7th CPC Increment: Increment Day for CG Employees July 1, 2019

- 7th CPC Increment Calculator for Central Govt Employees June 27, 2019

- 7th Pay Commission Annual Increment Rates and Calculation June 25, 2019

- 7th Pay Commission Increment – Recommendations on Increment Calculation June 14, 2019

- 7th Pay Commission News: Increment Anomaly Calculator June 11, 2019

- 2 Additional Increments to Nursing Staff under 7th Pay Commission – Railway Board Orders June 5, 2019

- Rule 10 of Army Officers and Air Force Officers Pay Rules – MoD Orders May 3, 2019

- 2 Additional Increments to Nursing Personnel – NFIR December 15, 2018

- Finmin Clarification on Increment Date in Rule 10 of CCS (RP) Rules August 2, 2018

- 7th CPC Bunching Anomaly : Denial of Bunching Increment July 6, 2017

- 7th CPC Increment Anomaly – Annual Increment Rate Less than 3% in Pay Matrix July 6, 2017

- Annual increment – Benchmark for MACP or Regular Promotion November 23, 2016

- Date of Birth on 1st January 1956 forced him to retire a month advance affects his 7th CPC benefits June 12, 2016

- Dorai focus on two crucial issues of 50% DA Merger and 3% Increment April 25, 2016

- OROP Table 72 – Disability / Liberalized Disability Element for 100% Disability for Commissioned Officers of Territorial Army February 5, 2016

- 2 Increment days proposal ignored by 7th Pay Commission December 23, 2015

- Performance is the main constraint on Annual Increment in 7th CPC December 15, 2015

- Assessment of INDWF on 7th CPC Recommendations – Fitment, Annual Increment MACP and Cadre Review December 9, 2015

- Opposition to notification of OROP – Rajya Sabha Q&A on 1.12.2015 December 8, 2015

- 7th CPC Increment : Recommendations on Annual and Promotional Increment December 6, 2015

- OROP Notification issued by Central Government for Defence Forces personnel November 7, 2015

- One Rank One Pension – Expected Pension hike and Arrears for ex-servicemen September 7, 2015

- Spotlight of One Rank One Pension September 5, 2015

- One Rank One Pension : A new wave of expectation rises; Announcements expected in 48 hours September 4, 2015

- Arun Jaitley on OROP – Annual pension revision do not happen anywhere in the world September 1, 2015

- Grant of Increment for those who have completed one year on the day of superannuation – NC JCM Staff Side writes to Secretary of DoPT July 11, 2015

- Yearly Increment Calculation – Will the 7th CPC continue the same formula or it brings any changes in to it…! July 9, 2015

- 7th Pay Commission likely to recommend Jan 1, July 1 as Annual Increment days June 30, 2015

- Calculation of Annual Increment for Central Government employees as per 6th CPC May 16, 2015

- Rounding off the amount of Increment to next multiple of 10 May 15, 2015

- 6th CPC INTRODUCES NEW METHOD OF CALCULATION FOR INCREMENTS May 15, 2015

- Increment benefit comparison between 5th & 6th Pay Commission May 15, 2015

- Increment issues – Why is Annual Increment denied to employees retiring in June? May 15, 2015

- Injustice to newly recruited Accountant in respect of 1st increment of service life – NFCAA January 21, 2015

- Why is Annual Increment denied to employees retiring in June? May 23, 2014

- Annual Increment for Central Govt Employees – Comparison table between 5th & 6th CPC April 25, 2014

- 6th CPC INTRODUCED NEW METHOD OF CALCULATION FOR INCREMENTS March 25, 2014

- Rounding off the amount of Increment to next multiple of 10 February 27, 2014

7th Pay Commission Increment FAQs:

What is the minimum increment amount for cg employees?

After the 7th pay commission, the minimum amount of an annual increment for Central Government employees is Rs. 500.

What is the highest increment amount for cg employees?

After the 7th pay commission, the maximum amount of an annual increment for Central Government officers is Rs. 6500.

How to calculate annual increment for cg employees?

After the implementation of the 7th pay commission, there is no need to calculate annual increments for all groups of CG employees and officers. The next cell value in the same pay matrix level is the basic pay with an annual increment.

What is the difference between annual increment and promotional increment?

‘Annual increment’ is being calculated based on a period of one year. But ‘Promotional Increment’ is given only at the time of promotion.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

a) What is the grade pay increment rule for central government employees in autonomous institutes?

b) What is the maximum basic salary can an employee attain in autonomous institutes without any post increment, details are given below:-

1. Current Grade pay-4200 level -6

2. Basic 44900

3. Years of service left 24

4. Joinig date-feb-2017

Now grade pay rules changed. As per the 7th Pay Commission rules it’s fixed as MATRIX TABLE stages cell in levels. Since you are in level 6 of 44900 after 46200.. Increment is 3% of basic pay stage or fixed in that table rounded off. Total service weary from the promotion and as per the APAR records.

I was on EOL without MC (Ex India leave) from 06.04.2015 to 13.03.2017. Am I eligible for getting next annual increment on 01.01.2018? I was given next increment only on 01.07.2018 by my office.

One person in Pay Level – 14 reached his maximum pay in the pay matrix i.e., Rs.2,18,200/- he is due for July Increment in this year. what would be his next annual increment whether we have to given one increment in Pay level-15 or stagnation will be there for him. kindly clarify if anybody knows.

At this stage they get increments they have to pay income tax so they are not getting increment amount.

Sir I have taken EOLs in different periods for the concerned year. My total days of EOL are 181(not continuous but in different spells) My service days are 184. Am I eligible for the increment

If any employee reaches at the bottom of any level of 7th CPC Pay Matrix, how his/her next increment would be regularized. if stagnated, how stagnation increment would be granted on or after 01/01/2016 ? is there any Govt. instruction/order ?

There are forty stages in 7th CPC MATRIX LEVELS, so that question does not arise. One employee cannot cross the stage of basic pay in his service, because the there are only 3 upgradations of fixation as every 10 years or in between those who are not got promotion they will be considered as MACP at the end of 10/20/30 years if their APAR is very GOOD BENCH MARK only.

The date of promotion is June. The fixation took place in June and hence next increment is in January. But this took away the July increment of 6th pay and hence no change in basic salary in 7th pay. Is there any other rule?

No such rules. But you will be getting all the years increments in nest January onwards (i.e.before six months) and also if you may retire in June, you will not get last pay of retirement benefits,. Otherwise you may not get last pay benefits for your future.

If an employee reaches the last cell of the level in which his pay is fixed, how is the increment calculated?

The official who was on EOL for study leave, whether is entitled for annual increment for the period of EOL.

Please clarify.

No.

My basic pay as on 31.12.2019 was 53600 in level 7. I was promoted to level 8 on 01.01.2020. What will be the basic on 01.01.2020 and what will be the date of next increment.

Sir, my son is working in central Government since July 2016. He has been promoted on 1st July 19. But he was on leave from 20th June to 3rd July 19. When his next increment should be given. Whether 1st january 2020 or 1st July 2020.

He should give option increment from January. Then he will be given old MATRIX LEVEL pay on 1-1-20 & next promotional increment in higher MATRIX LEVEL stage of located basic pay From 1-1-21..

I have reached the maximum pay cell of level-6, I.e 1,12,400/-

What will be the next increment for me.

Shall I place in the next level i.e level-7.

No employee will reach after 40years in service, if you reached after retirement.

I have 82 days of lwp in my service between 01-01-2o and 23-07-20. Should i get increment on 24-07-20.

If you have joined duty on 24-7-20 increment is eligible from that day.

Sir,

I had retired on 30th June 2016 on completion of the 12 months on the same day without getting one increment. I heard that the DOE of Finance Ministry of India has issued a circular on 18.10.2019 in reference of granting of one additional increment for same cases. Is this letter been really issued by DOE?.

I Joined Last Year on 02/Feb/2019 In the Department Of Education.

After the 7th Pay Commission, My Increment Should be on the 1st of January But My Clerk says that your Increment will be on the 1st of July 2020.

Now please tell me about, Which is the Perfect date for my Increment, Is It 1st January 2020 Or 1st July 2020?

Please Answer.

1-7-2020 first increment will be given on completion one year service from 1-7-2919 to 30-6-2020.

Sir , I join in woman and child development department in haryana as a supervisor on 28 January 2019 . my first increment date and year please tell me sir. And increment in every department in haryana same rule or different.

Sir before 6th pay commission my increment date is 10 -05 -2017 after 7th pay commission when I my increment date and how much get my grade pay before 1900 and after how much?

Sir My basic pay is 32300 In pay band 4 as per 7 cpc . Now I have been promoted to next rank in PB 5 as on 7 cpc, with effect from 01 Jun 2019 . As On 01 july 2019 what will be my basic pay as per 7 cpc.

No pay benefits in promotions from 7th CPC. Only next designation changes higher.

Hi,

I had joined Govt service on April,2013 and therefore, my 1st increment was given on 1st July,2014, that is after about 15 months from my joining. Now, as per 7 cpc amendment I am actually getting my increment at a delay of 6 months every year. Has there been any provision for revision of increment dates for such employees who have been facing such anomalies for having joined prior to 2016 between Jan to July? Kindly guide.

I got MACP in 2017 and fixed my pay in Level-3, My pay on 30.06.2019 is 29300, I got promotion to higher post i.e. in Level-4 on 01.07.2019 & this is the date of my Annual Increment too. Please clarify whether I’m eligible for Annual Increment along with Promotional Increment? Then what will be my basic pay & date of next increment? Please suggest….

There’s no basic pay in promotions from 7th CPC, only your Designation changes higher. Next MACP for you on completion of 10 year on 2027 at that time your basic pay fixation in level 4. You will get as usual normal increment in level 3. on 1-7-2019.

Sir my joining date is 01 01 2018 kya mujhe July 2019 ka increment milega

Milega.

Dear sir,

My date of Ist appointment is 21/12/2010..My increment date is Ist July every year.What about date of next increment jan. or july.? also i am disable employ (orth.) so what will my travelling allowance double and how much i.e 1350+ D.A. or 2250 + D.A.. I am level 1 in pay.Kindly help in this regard.

Increment from 1/7/2012. Transport allowance Rs.1350/- + D.A. If (DOUBLE) due to percentage of disability.

Sir,

I was enrolled on 13 jan 2015 and muster on 20 Jan 2016 and attested on 30 Jan 2016, what will be mine increment date and at which level my pay will be fixed.

Sir I completeted my 10yeras service in 17.02.19 as chargeman but there is no fixtation given for me my Joining date is 17.02.2009

If you have got any promotion from 17.02.2009 to 17.02.20019 or your condition of not very good bench mark.

I was on Without pay leave from 182 days from 1/7/2018 to 30/06/2018 .pl. let me know my increment date

1/7/1920 , 15 days will not be given & also 1/10th leave will be deducted as minus 18 days leave.

Sir i joined on 28/06/2018.

When i will get increment

1st july 2019 or 1st jan 2019??

If 1 st jan 2019 means could you please provide supporting documents

Thanking you sir

1st JULY, 2019.

file:///C:/Users/kumardas/Downloads/Rule-10-Clarification_CCSRP-Rules-2016_Eng(1).pdf#page=1

If it not opened refer Min,of Finance O.M. No.F.No.4-21/2017-IC-E.III(A) DT.31.7.2018.

In para 4 : Last sentence Thereafter, the next increment used to be given after a period of 12 months” (Not 6 months)

In para 5 : Last sentence : ” The next increment thereafter however accrue of one year”. (Not 6 months)

Sir people got increment on 1 Jan 2019 who joined till 30th June 2018 in ministries. New appointees were in loss in 6 th pay that’s why there is provision of 2 increments please clarify.

And the rule you are quoting also states the provision for increment.please clear doubt sir

Sir please read carefully in para 4 of the clarification notification they are talking about old rule used in 6th pay that increment was admissible on 1july.

In para 5 it is clarified that 1 St increment would be given on 1 Jan or 1 July depending upon date of appointment but after 1 St increment next increment will be after 12 months.

Nobody has given increment on JANUARY. They should complete same pay six months (GP/MATRIX LEVEL) then they will be given (annual) increment only in JULY.

Dear Sir

As per the notification of AICTE/UGC I was not able to complete my PhD within 7 years of incumbent associate professor service and my annual increments were stopped..

Now I have completed my PhD, when will my annual increment will be restored/started.

(1)On the date of competition of my Phd

(2)or the 1st July 2019.

Kindly provide me some notification references for the same.

Please see the UGC., NEW DELHI Gazette No.F.3-1/2009 dated 28.06.2010 & as per your required information from this of 121 page and also for the 7th CPC rules suitable to you.

Those who retired after 15 years from Navy on 31.7.1984, as Petty Officer, are they granted any enmass Honorary Promotion to Chief Petty Officer? If so pls quoted reference.

Do Pension of 1984 granted on the Last Salary Drawn which was with 5 increments in my case, will the 5 Increments will count for fixing pension under 7 CPC????

I promote on 15 june 2015 but financial upgrade optionally on 1st july 2015. when I will get increment 1st jan 2016 or 1st july 2016.

Increment 1/7/2016.

hi

I was promoted on 27 Jun. What is better option in view of increment on 1st july-

1. Pay fixation on Date of promotion

2. Pay fixation after increment on 1 july.

And why

Please advise

If you are upgraded as MACP on completion of 10 year without any promotion, from 27 Jun that day you are pay fixation with as advance increment in same matrix leve, so you are not given increment on that year, next year July your matrix level may be higher to next level. Otherwise the promotion is normal due to retirement/vacant post no monitory benefits only your next designation changes from that date i.e. 27 JUNE.

Sir i joined on 02/01/2019 beacuse 01/01/2019 was government holliday

When i will get increment

1st july 2019 or 1st jan 2020??

Thanking you sir

Annual increment allway given on completion of one year in the month of July only, so you will get increment on 1/7/2020..

Sir i joined on 24/04/2015.

When i will get increment

1st july 2016 or 1st jan 2016??

If 1 st jan 2016 means could you please provide supporting documents

Thanking you sir

1/7/2016. Read Min. of Finance F.No.4-21/2017-IC/E.III(A) dt.31.7.2018.

I was reported on training on 15/10/2015, my 06 months initial training was completed on 17/05/2016. Do I eligible for July’2016 increment? I got my 1st increment on July’2017. Is it correct or not?

No. Increment is given only on annual basis and also it will be given only in the month of July on completion of one year after June, July 2017 is correct.

Hello Sir,

My date of joining and MACP falls on 19th January. Will I get the increment in January or July?

Also please tell that which leaves do not deter/postpone the increment?

July only. Any kind of leave countinueous 180 days increment will be postponed next year. If it except casual leave on 1stJuly & when he/she joins duty from that increment stars.

Now normal date of increment is July Ist. An amployee going to Superannuation Next May or June after serving 11 or 12 months. Any provision to grant next increment in May or June next year in connection with retirement.

Sir, i was appointed on 08 May 2017. I was get first increment on 1st July 2018, But i am thinking as per 7th Pay commission , my first increment date 1st Jan 2018. I want know which one is correct? Please give me clarification.

Increment is given only in the annual (12 months completion in July only) basis July 2018 is correct. Go through Ministry of Finance O,M, NO.4-21/2017-IC/E.III(A) dt.31-07-2018.

sir, i was appointed in state govt on 1/5/2015 and From May 2016-June 2016 increment arrearse given ..later on i didnt get increments so far , not only for me but also some of my collegues who were appointed on same year (2015) what should i do and what might the reason? please clarify..

Check up your orders it may be casual labour appointment for term basis on voucher payment. Otherwise write to letter to your Head of the department/Controlling Officer.

Sir,

For direct recruitment at aided college what will be the payment for the post of assistant professor in Commerce?

As I have done PhD so I’m eligible for five non compounding increment at the time of direct recruitment so what will the amount for the same ?

I have joined as trainee in railway on 9/2/2017.

When will be my first increment

1/7/2018.

Sir I am joined on Oct 2018 when will be my first increments.

From July, 2020.

Sorry increment from 1/7/2019.

I had joined in March 2017 as TGT Hindi in Delhi Government school & in August 2017 I was on maternity leave after that I had joined in 19 February 2018. After 3 days i.e. 24 th February 2018 I availed 21 days Child Care Leave and then joined school in March 2018. TELL me when I got my First increment?

As per your appointed month your increment in 7/18, but you are availed more than 6th months, since you are eligible first increment only on 7/2020 if you are not availing further any CCL. more than 765 days after that your salary may deduct 20%. & increment may proponed later years.

In reference to two dates of increment i.e. 1 st Jan & 1 st July my query is

Whether this rule is only applicable to the employee who joined / promoted / grant of financial upgradation after Jan 2016 or it is also applicable to the employees who joined / promoted / grant of financial upgradation before 2016.

Actually completed 6 months counted for promotion/appointment/upgradrations in 6th CPC but increment is only annual basis as on JULY only. Not in January.

I was on maternity leave from April18 to October 18 and joined in October 18. My increment month was July. After joining when was increment implemented?

Since you are in leave for more than 180 days (,i.e.182 days your increment will be given on 1/7/19. If you are joined before 3 days, your increment given to you from 15/10/18.

Now when was increment implemented sir,,,in November or in January??

Increment will be from 1/7/2019, since you are aviled 182days leave so it was given next year increment, (no increment on 1/7/18, November or January), on 1/7/2019 only.

I have been upgraded to SS from sk……from 17 Jan 18 under direct recruitment.sir what about my increment.

Increment from 1/7/19,

Sir i was promoted on 1/2/2017 sir i am eligible for promotion increment and annual increment both . my last annual increment was on 1/7/2016…kindly text your suggestion for which i am grateful to you…

If it is MACP upgradrations of completion of 10th year pay level changes, other any promotions no pay benefits.

Can a person eligible for two annual increments by way of promotion/MACP? Rule 10 provides only one annual increment. As per your replies. An official promoted on his date of increment, ie 1 Jan 2018, his pay is fixed on that date after giving annual increment & promotion increment and his DNI will be on 1 july 2018. Is it contradicts the provisions to rule 10 of CCS(Revised pay) rules 2016

For that only in MACP upgradrations one additional increment is given.

My date of (MACP promotion and date of joining is Feb of every year I am retiring on 1st

of March 2019 , so whether I am eligible for One increment my Basic pay i s 60400 and

completing 27 years service as on 18.2.19 I am in level 7 as per 7th pay commn. pl. reply.

24.1.19 6.00 p.m

Can railway employee get annual increment in long sick perind…circular please

No after joining duty with medical fitness certificate.

My joining date is 28 March 2015 when will I get my first increament please tell

1/7/2016.

Please inform when 7cpc says two dates of increament Jan & July then why increament is not applied on jan16 instead of July 16 even after completion of 9 months service and 7 cpc came in to force from 1.1.16

Normally first increment will be given on completion of full year after in July only. If upgradrations of MACP it will change on request.

Date of joining 15 june 2015 what will be his date of next increnent 1st jan 2016 or 1st jul 2016

Iam joining in railway service on dt. 08.01.2015 what will be the my increment date july 2015 or jan2016

From 1/1/2019

Sir,

I joined my organization on 08th May 2018, so according to swamy book i am eligible for my first increment on 01st January, 2019. But my organization is saying that it is not clear whether the increment can be granted to fresh recruits. Sir, how can I tell them that the rule is valid for fresh recruits also as I have completed 6 months of service as on 01.01.2019. Can, you provide my any order of this kind?

Min.of Finance, New Delhi O.M. F.No.4-21/2017-IC/E.III(A) Dt. 31-7-2018

I got 80 days if HPL and 104 days of EOL for ExIndia leave from 1.8.2009 to 30.1.2010. I was not given increament for that year based on fact that my leave period was more than 180 days in one year. However I got information that only EOL more than 180 days comes in this rule and in my case it was 104 days. Am I eligible to get annual increament for that year. kindly suggest so that I may reopen my case.

Since you are having balance HPL 84 days, but you have availed that leave so it was included as 184 days. Normally increment you may be on E.L. after joining duty only increment counts. More over your credited E.L for 15 days on 7/11 due to 104 days E.O.L it will after deducting 10 days balance 5 days only credited.

I was on casual leave on 01/01/2019 but on same day my Increment was due. However I have joined my duty on 02/01/2019 So what will be the my effective date of increment.

Do i need to write to my DDO, is there any rule?

I am a direct entry Hav and completed 15 yrs of service. I got 1st MACP on 19.09.2011 as ACP NB SUB. If I will be promoted to NB SUB on 07 Jan 2019, whether I will get 2nd MACP on completion of 16 years ie 19.09.2019. Now I am getting annual increment on 1st July? After promotion on 07Jan 2019 without any increment in pay, whether my date of increment will be 01 July or 01 January?

Your promotion will be given on 7/9/19 but you will not get monitory benefits. Monitory benefits given only on 2nd MACP with one additional increment in same matrix level and basic pay fixed in next matrix level equalant or same pay from 19/9/19 with the condition of VERY GOOD BENCH MARK.

After MACP increment on JULY, 2020 in next matrix level.

I’m in 45 days abortion leave up to January 20.I will get annual increment or not. My increment month is January 1

Increment will be given only on reporting duty from that day.

My date of Ist appointment is 22/6/2009.My increment date is Ist July every year.My time bound promotion is due from Ist July 2018.Should I fix my pay on 1/1/2016 or 1/7/2016.What about date of next increment?Kindly help in this regard.

I need Higher education cerclour for 7th cpc in central govt employees…

What is the minimum benchmark in ACR needed for annual increament for railway employee group c

Very good bench mark required for every increment/MACP upgradrations.

if i get promotion on 02/01/2019 what will be the next increment date?

july- 2019 or jan-2020

If it is MACP UPGRADED only increment changes. Normal promotion due to retirement/vacant post Promotions no monitory benefits only designation changes higher post only.

Increment not given to me as I retired on 30th Juñe 2012. Kindĺy clarify whether I am eĺigible as per 7th cpc. If eligible kindly show relevant OM of Dopt of 18th Sept 2018. Thank you very much in anticipation of quick reply.

So for orders were not issued, only court judgement released. On the basis of Finance Ministry/DOPT orders it can be implemented.

I got promotion w.e.f. 1/07/2018, what will be my date of next increment- 1st january 2019 or 1st july 2019. Please advice.

If it is upgraded as MACP Scheme on 1/7/18 as monitory benefits as given one additional increment in same matrix level and basic pay fixed at next level matrix & increment again on 1/1/2019 or if it is normal promotion as designated changes no monitory benefits (in view of the vacant post) and increment as usual next year as 1/7/2019..

If I got promotion on 31/12/18, and my assumption report send on 02/01/19, or shall I send my assumption report on 31/12/18, which benefit its for me for promotion.

Increment is not given to me without any prior information. I m very confused. please advice.

If you are in leave from 1st July, EOL or your increment may be postponed from 1/1/19 may be due to MACP UPGRADATION on completion of six months higher next level of matrix table.

If I am on leave preparatory to retirement upto 31 July will I be eligible for increment if so from which date . Or to get increment can I join on 30 July ??

Answer to KIRAN : Any how you have to join before retirement from any leave. If you joined on 30th July from the joining duty increment counts. for only 2 days increment only not for full month from returning duty. Pension will also count for average 10 months of last pay.

Please give me your expert opinion on the above mentioned post…need it urgently as I am planning for LPR soon

Thanks in advance for your kind information.

Answer to KIRAN : Expand post of LPR

Answer to : To grant LPR to extent of E.L.due not exceeding 300 days together with HPL due subject to the condition that such leave granted as Leave Preparatory to Retirement shall not includes Extraordinary Leave (loss of pay). Moreover LPR shall be admissible only when QUITS DUTY (WITHOUT PENSION) under the foreign employee. The Govt. servant continues in service under such foreign employer the Govt. servant shall not be eligible for grant of cash payment in lieu of CCS LEAVE Rule (39).

Sir, please inform me if 300 days LPR can be sanctioned before voluntary retirement. If so the can you please share the rule or OM for the same. My office is denying stating cannot accept vrs application before 3 months or latest 6 months.

How should I approach for 300 days LPR. I have completed 27 years service.

Regards

Answer to KIRAN : If you are quite the Service LPR will be sanctioned for settlement in abroad and paid for 300days encashment before leaving India. afterwards Pension cannot be given. If you taken voluntary retirement you are eligible for Pension for your life time & 300days Encashment leave salary will be given afterwards.

Answer to : Otherwise pay one month salary and get VRS don’t take LPR. So that you will get all government facilities.

I joined education department on 13 april 18 after technical resignation from central excise .. in central excise my annual increment was on 1 july…

Now when will b my next increment… In this 1 july or 1 jan ?

Answer to VIMAL KUMAR – 21/8 : If your services of central excise office counts as usual annual increment on July 18, otherwise only on 1/7/19. This is to inform you that if you have upgraded through MACP scheme from 2/1 to 31/12 increment will be in next January due to upgraded on completion from 1/7 to 31/12 of 6 months promotion.

Dear sir,

If a person joined in his service date on 30.01.2012 and he got annual increment date on 01.07.2013, so he got increment for 1 year 5 month, is their benefits in 7th cpc for this kind of reasons. Kindly reply me.

Thanking you sir

Answer to PKR – on 20/8 : No. If you are upgraded through MACP scheme then only increment changes that to on completion of 6 months from July to December than it will change on next January.

I ,pwd ,level 1, staff of ERLY/HWH .lg my first increment may double?

Hello sir

I m presently on maternity leave. On which day my increment will be started

After joining duty from that day increment counts.

Is central government employees getting annual increment on two date i. e 1st of jan and 1st of july?

No. Only in the case of MACP upgraded of completion of 10th year additional one increment and on completion of six months upgradations increment may change January or July. From this period on completion of every year increment counts.

I was iod between 12 apr to 16 july. Then what is my increment date ?

I am a railway employee and I was iod leave during 12/04/18 to 16/07/18. Then what is my increment date.plz reply

Increnent on Joining duty from 17/7/18.

My ACP date is april 2017 and annual increment is given to me on dated

01-01-2018 than what is my next increment date.

Please reply as soon as possible

Thanking you

Next increment on January,2019.

An employee is on leave E/L from 2nd to 6th July, 2018. Since 1st July, 2018 is Sunday when will be his increment date ? (Office working days Monday to Friday. Saturday and Sunday off).

Increment counts from joining duty if it on 9th July from that day onwards.

An employee on leave w.e f 26/6/18 to 7/7/18 , in which day of increment will be made. And which financial effect will be made ?

Other than C.L. increment is from joining duty only.

Since 1July 2018 is Sunday(Holiday) , I was present on 29th June (Fri) 2018 and 30th June2018 (Sat) . I was absent on 2nd July 2018. Whether I am eligible for increment. from 1st July 2018 or not.

If you applied 2nd July as casual leave, increment is allowed from 1/7/2018 or it is E.L./E.O.L whenever you joins duty from that day will count increment.

I applied 2july to 5 July c/l & joining 6 July finencial benifit in ncriment count in leave day

If it is C.L no change, as usual you will get increment from 1/7/18.

In our office some contract employees regulated from 1.6.2018 so clarify, their pay fixed 7th CPC from 1.6.2018 is eligible annual increment from 1.7.2018 or 1.1.2019?

This is most urgent to us for fixation of pay from 1.6.2018 so kindly clarify earliest please.

Increment periods should complete from one year. 1/6/18 to 31/5/19 those from 1/7/19 next increment stage.

i retired on 30.04.2016 . oi shall be getting grauity 20, lac rupee

No. Order date is 28/3/2018.

Soumyadipta – 9/4 : 1/7/2018 is SUNDAY if your office is working on that day after completion of joining duty from that day your increment counts.

If I am on Earned leave on 01/07/2018, as per 7th CPC, shall I be eligible for increment for the year 2017.

Hello ! One ifs got his promotion as additional pccf during Nov. 2015. and as usual sanctioned increments on1..7.2016 and retired on 28.2 17 He has opted for sanction of increment on 1.1.2016.. and not on 1.7.2016..kindly enlighten.

I have joined income tax department in 19, june2013. As per increment rule i shall get increment in first January 2014. But i got first increment in july 2014. But now i wants to change increment criteria to get increment in January. Can i request to change?

Hai sir, I joined as postman on 28.12.2017 .

Can I get incriment on July 2018?

Mean if appointed between 1 jan to 30 june increment on 1 jan and 1 july to 30 dec.on 1 july and it will b 5% of basic…kindly clarify

Does it 2 increments for the year has been implemented for Seventh Pay Commission.

Whether a person appointed in grade pay of 4800. in sept 2016 submitted technical resignation and get appointed in grade pay of 4600 in april 2017 without any break in service will be entitled for next increment in july 2017

Hello sir my colleague promoted from 1st July 2017 accidentally the day is Saturday so he could not assume charge then what will be his date of promotion and increment and pay benefit date will be 1st July or 3rd july

Annual increment is less than 3% in my July salary my pay 41100after fixation 42300 rupees 33 is less please tell is my fixation is right I am railway servant

I am a primary teacher in m.c.d. I goted my First MACP on 03/10/2016. That’s mean i am getting the scale of tgt now. If i, now take promotion as tgt, will i get any increment on promotion.

Increment given in July 2017 is less then 3% what should be done.

Given 28rs less then the calculated amount.

Please answer.

Sir,

What is the solution to the damage done in regard to the date of increment to the people promoted before implementation of the order for two dates of increment i.e. 1st Jan and 1st July. ( a 7th CPC recommendations, if not wrong)

For e.g. I was promoted on 15 Jan 2014 and my next increment was granted in July 2015 after almost 1.5 years just because of 15 days gap for 6 months condition (from 1st Jan. 2014) causing me a perpetual loss of one increment @3% for six months every year.

Please suggest the course.

regards,

I am working in a Government Hospital. Account’s department of the hospital has set the basic pay of Rs. 65443 for employees joined before 01.01.2016 but working on ad-hoc basis . On the other hand employees who also joined before 01.01.2016 but are regular getting 10,000 more than employees on ad-hoc basis. Is the hospital paying the right amount to employees working on ad-hoc? Ad-hoc system is not only taking away annual increments but such large differences in pay structure will also be seen in 7th CPC recommendations?

joined central govt. Service on 02 Jan 2017 after one holiday I.e. 01 Jan 2017. When shall I be given increment.

Pls reply

I was on Child Care Leave since MAY 2016 TO MARCH 2017. When shall i be given increment?

in some cases annual increament 3% when calculated comes out to be more than the amount in the next level. so what should be done in such cases?

why not enhenced fitment 2.57 to 2.86 not understood pl reply

I am a doctor who joined the Indian railways on 28 the Marc 2016 after writing exam in 2014 combined medical services exam. My friends who cleared the exam opted cghs services are getting 61300 as basic pay. But we who joined Indian railways are getting only 56100. How can there be such a difference in our basic pay. Both from same exam but from different departments. Have lost faith. Whom to approach

What is the rule of increment for Senior scale of assistant professor. ? Nowhere found the answer. Pls clarify it bcoz lot of institutions are waiting for the rule of increment for Senior scale of assistant professor after 5 year of experience.(As per seventh pay).

I joined central govt. Service on 02 Jan 2017 after one holiday I.e. 01 Jan 2017. When shall I be given increment.

Pls help me to understand

Sir on joining to the promoted post on 02/01/2017(Sunday on 01/01/2017), what is the next date of increment in July or in Jan

I opted for 7th CPC pay from the date of my joining duty i.e. w.e.f 11/01/2016 But my promotion date is 22/12/15 what is date of my next increment…..whether from July 2016 or January 2017?if January 2017. what is settle my regular increment due from July 2015 & July 2016. If opted for 7th CPC pay date of my subsequent increment i.e. 01/07/2016. what is date of my next increment. whether from January 2017 or July 2017……kindly brief details .

I opted for 7th CPC pay from the date of my subsequent increment i.e. w.e.f.01/07/2016. What is date of my next increment, whether from January 2017 or July 2017? Kindly clarify.

I got promotion in Ist July 2016 and promoted to Level 13

I opt for new pay from Ist January2016

Whether I am eligible for an increment after portion to Level 13 on January 2017 after forgo of increment in Ist July 2016

What about the annual increment for employees get promotion between 2 January to 30 June. I have got promotion on 1/4/2016 and give option to fix my pay on DNI in the old patterns. But our office fix my pay on 1/4/2016 by giving one increment in the old level and change the level as per promotion r equired. They are silent about my Annual increment. The are as follows:-

Pay on 1/1/2016 Rs.19720+5,400=25,120 Fixed 25120X2.57=64,558 i.e. 65,200/=

Promotion on 1/4/2016 from Level 9 to 10. They fixed by giving next stage in Level 9 i.e. Rs.67,200/= and change the Level 9 to 10 and fixed as Rs.69,000/=.

They are silent about my annual increment, for which I am entitle in July, 2016 as per 6 CPC. Hence I have lost my ANNUAL INCREMENT.

WHAT IS THE SOLUTION.

My joining date was 21 January 1992 and recent promotion date was 12 Nov 2011

When Do I suppose to get my increment day in seventh pay commission? is it January or July.

Please reply me as I am planning to take VRS in November 2016.

I was superannuated on 30.06.2015. Whether benefit of complete one qualifying service required for next increment will count for fixation of my pension under 7th CPC? Kindly guide on this grieviance.

my app date 22 dec 1980. i retd. superannuation on 31 march 2016 last increment july 2015

pay scale 9300 -34800 .last basic pay 15390 + 4600 grade pay

will i get an increment in jan 2016 under 7cpc or it will go under anomally . pl guide me

Sir,

I got my macp on 1.05.14 under 6cpc with just benefit of next gp whereas as per 7cpc I m entitled for gp of promotional grade, then what will my pay in new cpc ,is it to be fixed by giving notional fixation with retrospect and replaced accordingly my promotional hierarchy on 1.01.16.

Accordingly what should be my date of increment weather it is to be considered as 01.01.16 instead of 1July 16

ROOP SINGH says

August 5, 2016 at 7:40 pm

If the employee was benefited by MACP on 24.04.2016 and his pay in old pay was fixed on 24.04.2016 then when will his annual be allowed. What will be procedure of fixation of pay. Now date of increment is 31.7.2016.

Reply…

Above official may calculate his pay in 7 cpc and elect the option whichever is beneficial either wef 1 jan or wef date of promotion.. DNI will be january 2017

Sir, I am working in a aided college at Madurai. Tamilnadu. Now I am getting pay18560+Gp4200 after increment on 01.07.2016. My HRA Rs1800 CCA Rs360 andMedical allowance Rs100. My Scale is 9300- 34800 PB2. What will be my Gross pay on 01.08.2016. I am going to retire on 31.05.2017. Thank you Sir.

Sir i have got macp in oct 2009 in gp 4600 and now i am promoted pn 29 jan 2016 pl tell me

2016 what option for increment 01 jan 2016 or 01 jul 2016

In kendriya vidayalyasangathan macp benifit was not given to teachers only. In 7th paycom. Macp will be given or not.pls tellme.

Sir, I have joined service on dated 02/03/2009 & awarded Ist increment on 01/07/2010. Now increment has been awarded in July 2016. Am I eligible to get increment on January 2016 or its July 2016

My pay on 1.1.2016 was 17540+GP 4600=22140 & on 1.7.2016 is 17540+3%(670)+4600=22810 please you calculate my fixation on 1.1.2016& 1.7.2016 which option is benefits me

I have joined on 28th June 1994 and got ACP on 28th June 2006.As per 7th CPC .In which date I will get my increment as per 7th CPC?

1 Sir, My pay as on 1 Jan 16 is 11380 + 4200= 15580 . on fixation as per 7 CPC on 1 Jan 16 it will be 15580×2.57= 40040 so basic sets on 41100 (Matrix level 6, cell 6)

Now on 1 Jul 16 , I have 3% increment on basic pay 41100= 1233, so my basic should 41100+1233=42333 and is crossing the next cell of level 6 (Rs. 42300) in matrix, And next cell in level is 46300. so what should be my pay on 1 Jul 16,,, after increment ttt

2 I HAVE TAKEN OVER MY PROMOTION,AS ON 10.03.2016, FROM GP 4200 TO GP 4800 (9300-34800) . IN THIS 7TH CPC WHICH OPTION IS BENIFICIAL FOR ME. KINDLY HELP ME. I shall be ever grateful to you.

3 service in Ordnance factory, On 01/jan/16 I am Hs-2My basic has 8790 & Gp is 2400,

But, 01/02/16 I am promoted to Hs-1 & I choose option for increment is at the time of increment date i.e. 01/july/16

then on 01/02/16 My basic was 8790 & Gp 2800,

plz send me how fixation in this case. Plz help.

4 If an employee opts for Voluntary Retirement Scheme (VRS), his increment falls due on 1st July and he got relieved from service on 30th June, i.e. the previous day of increment date, whether retirement benefits viz. Gratuity, Leave Salary, etc. will be computed after granting increment which will be due on the next date (1st July). In support of this, please inform any Rules or Supreme Court verdict available, if so, give its details.

Sir, on 01.01.2016 my basic pay is Rs. 19550+4600GP. on 2nd May 2016 i promoted in the GP of Rs. 4800/-. And may pay was fixed at Rs. 19550+4800 GP on 02.05.2016 i.e on Promotion and further on 01.07.2016 my pay was fixed at Rs. 21030+4800GP. So please advise what option should be given by me as per 7th pay commission and how my pay will be fixed and what will be my next date of Increment Thanks

Sir, My pay as on 1 Jan 16 is 11380 + 4200= 15580 . on fixation as per 7 CPC on 1 Jan 16 it will be 15580×2.57= 40040 so basic sets on 41100 (Matrix level 6, cell 6)

Now on 1 Jul 16 , I have 3% increment on basic pay 41100= 1233, so my basic should 41100+1233=42333 and is crossing the next cell of level 6 (Rs. 42300) in matrix, And next cell in level is 46300. so what should be my pay on 1 Jul 16,,, after increment ttt

If the employee was benefited by MACP on 24.04.2016 and his pay in old pay was fixed on 24.04.2016 then when will his annual be allowed. What will be procedure of fixation of pay. Now date of increment is 31.7.2016.

SIR,

I HAVE TAKEN OVER MY PROMOTION,AS ON 10.03.2016, FROM GP 4200 TO GP 4800 (9300-34800) . IN THIS 7TH CPC WHICH OPTION IS BENIFICIAL FOR ME. KINDLY HELP ME. I shall be ever grateful to you.

As per 6th Pay Commission my basic pay was Rs. 12620+2800 in the month of Jan, 2016 But I was promoted as T -4 in the pay scale of 9300-34800 GP 4200 and I was awarded Grade Pay Rs. 4200/- in the month of Feb, 2016 (i.e. Basic pay 12620+4200) and I got increment in the month of July, 2016 and basic pay fixed twice i.e. first I got increment of my promotion and second routine increment i.e July,2016. which was 13090+4200 & 13570+4200. Now my question is that what is my basic pay on 1-1-2016 and on 1-7-2016

Sir, with the implementation of 7th pay commission report, increment will be given either on January or July depending upon date of recruitment/promotion/financial upgradation. Here there is a doubt that is this applicable to those recruited/promoted in January 2016 onwards only ? If Mr.X got promoted in February 2015 and as per 6th PC drawing increment in July, whether Mr.X would continue to draw increment in July since thing being a post-2016 promotion ? Kindly clarify.

Sir,

my date of birth is 1st July 1959 and date of retirement is 30th June 2019. Also, 3rd MACP was granted to me on 1st Apr 2010 instead of 1st Apr 2004. Which date of increment will be allotted to me on the basis of the 7th pay commission?

Please also equip me about my pay fixation.

Thank You

Regards

Smt Madhu Bala

Sir,I service in Ordnance factory, On 01/jan/16 I am Hs-2My basic has 8790 & Gp is 2400,

But, 01/02/16 I am promoted to Hs-1 & I choose option for increment is at the time of increment date i.e. 01/july/16

then on 01/02/16 My basic was 8790 & Gp 2800,

plz send me how fixation in this case. Plz help.

One who wants to fix his pay on his time bound promotion date 01 08 2016 instead of 01 01 2016

My 2nd macp fall on 16th january/2016. Please advise me either i take from this date or take an option from 1st july/2016. With regard.

NO as per Govt of India order if employee is on duty on ist day on date of increment then heor She is eligible for increment.

E.R.YADAV

A.O.

ELE( BSNL)

DBL

If an employee opts for Voluntary Retirement Scheme (VRS), his increment falls due on 1st July and he got relieved from service on 30th June, i.e. the previous day of increment date, whether retirement benefits viz. Gratuity, Leave Salary, etc. will be computed after granting increment which will be due on the next date (1st July). In support of this, please inform any Rules or Supreme Court verdict available, if so, give its details.

Thanks and Regards

V Vijay Shanker

Sir,

I will be obliged if you give knowledge about 6th PC annul increment, if person remain absent for 13 days in between period from 01.07.2005 to 30.06.2006 whether he is eligible for annual increment or not. Any other rule came regarding employee has to attend qualifying service of 6 months from 01.01.2006 to 30.06.2006.

So kindly clearify my doubts with rule I shall be ever grateful to you

Really I am proud very thanks to defence. Iget arrears’. thank u. gopal

What will be the minimum years of se vice one has to put in the railway to earn minimum pension.

At 60 years I will be completing only 17 years of railway service

The main proplem for the employees is Health. If the reimbursement of medical is there, some of the employees will missuse and false bills will be submitted with the help of doctors as well as medical shop owners. Hence fix the amount for the month or issue cards and specify the hospital so that employee along with family members will go to the hospital for treatment. I request the govt. should give lot of preferrence to the retired employees who are suffering from many ailments at retirement age.

Clerk’s should be included in x group

New Basic Pay must be 4 times of old basic pay ( i.e. Pay in payband +GP) .

If I draw Rs.18180 as old basic pay (Pay in pay band +GP) , then NEW BASIC PAY must be 18180 multiply by 4 equal to Rs.72720/-.

Additinally weightage for every 5 years of completion of service must be given of Rs. 5000/ per each five years of service rendered. If I have completed 20 years upto date 1/1/2016 , then additional of Rs.5000/ multiply with 4 equal to Rs.20000/- must be added to the NEW basic pay of Rs 72720+20000= Rs.92720 shall be given or fixed as my NEW basic pay of Rs. 92720/- wef 1/1/2016

There are employees whose parents being pension holder, not dependents. But due to the megre amount they are receiving, are actually dependants on the employee. Taking into consideration, at least the medical facilities should be provided to the parents as dependant. Kindly think about it.

Employees residing at govt. Qtrs. Loosing a huge salary being not entitled for HRA, where as who have their own house, both the couple are working, are double benefited. Govt. Should think about it. Either govt should ensure house after retirement to the qtr holders or they should be supported to have their house.

Mr Sanjay thorat

12 dec 2015

Respected sir,

Basic pay is minimum multiply 4 in basic pay and annual increment 5% should be in 7th pay commission. Requested early action please.

Respected sir,

Basic pay is minimum multiply 4 in basic pay and annual increment 5% should be in 7th pay commission. Requested early action please.

my basic pay is 12320 with 2800 g.pay .what is the actual b.pay after 7th pay recommendation &also intend to know other alowences with the basic & D.A?

Thanks for 5% increment, request one point to Govt, marged the high skilled grade-I to grade-II (for same grade pay). from O. F. BADMAL., ODISHA

yearly increment should be 5%

Sir,

3% yearly increment on what basis recommended in 6th pay i dont know. But this is very less when we compare with the outside salary hike. at least minimum hike should be 5% in the 7th pay. so friends we used to wait for DA hike rather than increment in 6th pay. We hope Government may take good decisions on Increment.

YEARLY INCREMENT SHOULD BE 5%

YEARLY INCREMENT BE INCREASED BY 5% IS REASONABLE

Respected sir,

The most important issue on allowance of CEA. Its fixed on Rs.2000 monthly basis started when children’s age is 3 years completed as per the proof produced in army recods. Now presently its very difficult procedure for PBOR to claim their CEA.

you are requested to revise this as early possible. Thanks.

DA on TA compulsory

So bad…comparing TG&AP state govt eemployees salaries

YEARLY INCREMENT SHOULD BE 4% INSTEAD OF 3%.

MSP, all allowances irrespective of area/place of duty, transport allowance should be equel to all ranks because all serve in the same place/climate In same conditions. Rather officers get all kind of facilities in every place of duty readily available with the jawans. For transport allowance price of petrol are not cheaper in other town areas. Yearly increment should be 6% in view of inflation. HRA should be fixed as per rates of rent of house prevalent in a particular city not 10, 20 & 30%. In my views lower rank persons should get allowance more than offrs because they face more hardships every where in the sphere of their duty/living

All types of allowance may be equal to all ranks in defence ( Army , navy & Air force )

Increment increased 3% to 5% every year

If there’s any possibility then withdrawn NPS

GREETING SIR,

YEARLY INCREMENT SHOULD BE 5% INSTEAD OF 3%.

Sir ADSO trade must be kept in X group because of nature of duty

Sir education also given due respect for promotion

Sir

Msp must be equal all ranks like pbor and officers.

Dear Sir,

Post of clerk trade in indian army are downgraded from last two pay commissions (From Gp B) as they equaled with gp D and Gp E Emp as notified in 4th pay commission. You are kindly requested to upgrade to the post of clerk in Group X as it is very responsible post and very hard work faced by Clerk.

Sir,

As per 6th CPC the military pay made only two group ie for PBOR up to JCO Rs.2000/- & for commissioned officer Rs.6000/- In field PBOR suffer more hardship, fight face to face and more life risk & more casualties happens to them. Hence PBOR to be given Military pay more than Officer or at least equal to them.

Increment should be increase @ 5% of basic pay instead of 3% of basic pay.’

Thanks with Best Regards

Sir military service pay should be equal to all in service and increment 5% instead of 3% so PBORs can manage their family life.PBORs are neither getting promotion nor financial benefits and working harder than anyone.

Sir the allowances of all rank in the army should be same specially MSP and CI Ops.

Sir,

in military service all allowances are made in 3 categories ie i) sep. to Havelder, ii) JCO and iii) Commissioned officer, However in 6th CPC the military pay made only two group ie for PBOR up to JCO Rs.2000/- & for commissioned officer Rs.6000/- In field PBOR suffer more hardship, fight face to face and more life risk & more casualties happens to them. Hence PBOR to be given Military pay more than Officer or at least equal to them. The rank pay is given to only Commissioned officers where as in PBOR also given rank and length of service, allowances pay structure provide base on rank so kindly introduce rank pay for PBOR and provide equal allowances to all categories .in 7th CPC.

Thanks with Best Regards

B.P.Roy

Arrears of pension and gratuity should also be calculated as per their respective years of service

Retirement gratuty limit shall be increased to 25- 30 lakhs in the 7th pay commission.

please do fast .

Sir

Pilot project of 6cpc for traveling to pbor by train is not completed. Means online train ticket to serving personal.

In case of temp duty of army men always required confirmed ticket just like tatkal cotta in train.

Sir

All types of low medical category will be discharge from defence services and resettle them in civil service as per candidate illegibility (education, service experience). Many problems of defence personal and defence will be short out. In case of vrs this facilities will bee optional.

Second all types of allowance may be equal to all ranks in army.

YEARLY INCREMENT SHOULD BE 5% INSTEAD OF 3%.

YEARLY INCREMENT MAY BE 5% INSTEADE OF 3%.