Ridiculous recommendation of 7th CPC regarding CGEGIS

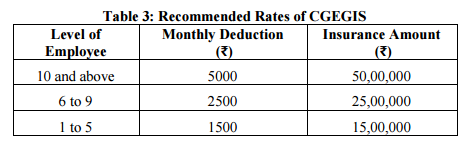

As per the recommendation of seventh CPC, subscription and insurance amount have been increased manifold. Let’s discuss the same as per available data.

Recommended Rates of CGEGIS

| Level of Employee | Monthly Deduction | Insurance Amount |

| 10 and above | 5000 | 50,00,000 |

| 6 to 9 | 2500 | 25,00,000 |

| 1 to 5 | 1500 | 15,00,000 |

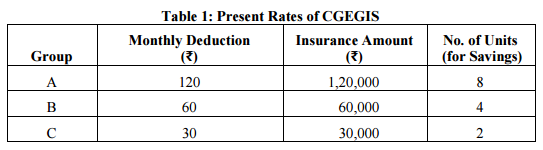

The present rate of monthly deduction is Rs 120, Rs 60 and Rs 30 for Gr A, B and C employees with Insurance cover of Rs 1,20,000, Rs 60,000 and Rs 30,000 respectively.

The suggestion of increased insurance cover is a very good one which nobody will oppose. But the question is whether the amount of monthly deduction prescribed is at all justified ? Let’s have a quick look on fact and figures.

Out of the monthly deduction under this scheme, 70% goes to a savings part which is refundable and 30% goes to insurance fund for providing life cover.

In the proposed structure, take for example the second category where monthly deduction is Rs 2500 for insurance cover of Rs 25 Lac. in this case yearly go out to non refundable insurance fund is Rs 9000 (30% of 30,000).

If a 25 year new entrant purchase a Term Policy of Rs 25 Lac for 35 year term period, his yearly premium will be only Rs 5095 (including service tax). Then why should he shell out Rs 9000 ?

It may be beneficial for older ones, like for example a 50 year old person will have to pay Rs 15,057 for Rs 25 Lac insurance cover for 10 years. Click here to view LICI website.

So the rates of monthly deductions should be fixed in more rationalized manner taking account of variable age groups and depending upon the incumbents age the premium (monthly deduction in this case) should be calculated as done in the premium calculation of any insurance company.

Hope, Govt. will seriously look into this suggestion before implementing the same.

Click here to know more about Term Insurance.

7th Pay Commission Salary Calculator 2024 India

7th Pay Commission Salary Calculator 2024 India

CGEGIS contribution is beneficiary, but the monthly rate is too high.