7th CPC Allowances for Central Govt Employees, Railway Employees and Armed Forces Personnel

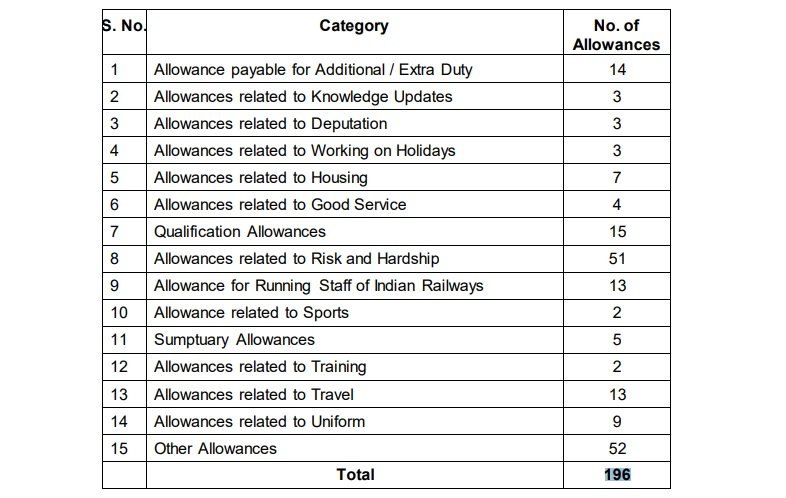

The remuneration of Central Government employees largely comprises of the term ‘Allowance’. This term encompasses three major types of allowances that are applicable to all groups of Central government employees, namely: Dearness Allowance, Transport Allowance and House Rent Allowance. However, there are other types of allowances that are only applicable to specific employees and officers. Interestingly, the 7th Pay Commission suggested 196 new allowances on their report.

7th CPC Allowances Gazette Notification Order PDF Download

The Dearness Allowance has recently been raised to 28% for Central Government employees and pensioners as of July 2021. This increase is expected to have a significant impact on the various allowances that are available, according to the recommendations of the 7th pay commission. In July 2016, the Central Government established a review committee on allowances, which submitted its report in April 2017 and was subsequently implemented in July of the same year. The 7th CPC made recommendations that specific allowances should be increased once the DA exceeds 25% and 50%. We have compiled a list of all allowances that will be increased from 1st July 2021.

- House Rent Allowance New Rates 27%, 18% & 9% [Click to view more]

- Briefcase Allowance – The allowance will be hiked by 25% after DA crosses 50% [Click to view more]

- Conveyance Allowance – The allowance will increase by 25% each time DA rises by 50% [Click to view more]

- Detachment Allowance – The amount of allowance will increase by 25% each time DA rises by 50% [Click to view more]

The 7th Pay Commission has recommended a total of 196 allowances to be granted to government employees as per the Gazette Notification. These allowances cover a range of categories, from housing to travel to health, and are intended to provide additional financial support to employees in various aspects of their work and personal lives. The full list of these allowances can be found in the Gazette Notification released by the Commission.

7th CPC Dearness Allowance

Dearness Allowance (DA) and Dearness Relief (DR) both are the same. Dearness allowance and Dearness relief are being granted to existing employees and retired employees respectively. Dearness allowance is calculated on the basis of current basic pay of Government employees and the dearness relief is calculated on the basis of basic pension of Government pensioners. [Click to read more]

7th CPC House Rent Allowance

The Indian government has announced a revision in the rate of House Rent Allowance (HRA) for employees, with different rates for X Class, Y Class, and Z Class cities. Effective from 1st July 2021, the revised rate of HRA is 27% for X Class Cities, 18% for Y Class Cities, and 9% for Z Class Cities, as per the official orders issued on 18th August 2021. This change is expected to impact the lives of many employees across the country, especially those living in cities with higher living costs. [Click to read more]

7th CPC Transport Allowance

All workers employed in the Central Government sector receive a transport stipend to cover their travel expenses from home to the office and vice versa. Diverse modes of transportation are utilized by employees to commute to and from their workplace. [Click to read more]

7th CPC Briefcase Allowance

In order to receive reimbursement, it is important to note that the amount will be limited to the ceiling limits mentioned above. To ensure proper processing, it is essential to submit the required documentation, including an invoice or bill containing the trader’s GST number, Book number, and invoice number. Failure to provide these details may result in delays or denial of the reimbursement. [Click to read more]

7th CPC Conveyance Allowance

Conveyance Allowance is paid to Doctors for visits to hospitals and dispensaries outside normal duty hours as well as for making domiciliary visits. It is also paid to those employees who maintain their own Motor Car, Scooters, Motor Cycle, Moped and have to undertake frequent journeys on official business in their conveyance. [Click to read more]

7th CPC Library Allowance

Library Allowance is a financial benefit that is granted to teachers who are assigned to library duties, and who work in various ministries such as education, culture, and social affairs. This allowance is meant to compensate them for their additional responsibilities and the skills required to manage a library effectively. These teachers are responsible for selecting new books, organizing the library collection, and assisting students and other library users with research and reference services. The Library Allowance is an important tool for promoting literacy and access to knowledge in communities around the world. [Click to read more]

List of 7th CPC Allowances PDF

If you’re interested in the allowances included in the 7th Pay Commission report, you can download a comprehensive list of 196 allowances that have been compiled for your convenience. This list includes detailed information, and is available in PDF format so you can easily access it from your computer or mobile device. With this information, you can better understand what allowances are available and how they might apply to your situation. Click to download the 7th Allowances PDF.

Committee on Allowances Report 2017

The Government of India, vide OM No.1/2016-IC dated 23rd July 2016 constituted a committee under the Chairmanship of Finance Secretary & Secretary (Expenditure) as Chairman, Secretaries of Home Affairs, Defence, Health & Family Welfare, Personnel & Training, Posts and Chairman, Railway Board as Members to examine the recommendations of the 7th CPC on Allowances. [Click to view the detailed report in pdf format]

7th CPC Accident Allowance

The Accident Allowance in the 7th CPC report did not make the cut. However, according to the Allowance Committee Report, rates for this allowance will be determined through discussions between the Railway Board and Federations, and will only be approved with the agreement of the Ministry of Finance.

7th CPC Acting Allowance

The report on the 7th Central Pay Commission has recently been released, and it has been decided that the separate allowance will no longer exist. However, employees who are eligible for this allowance will now be under the governance of the newly proposed “Additional Post Allowance.” On another note, the report on Committee Allowance has been accepted. To Know New Rates: Click Here

7th CPC Aeronautical Allowance

The aeronautical allowance, as per the recommendations of the 7th Central Pay Commission, has been retained and increased by 50%. The committee allowance report on the matter has been accepted as well. To Know New Rates: Click Here

7th Pay Allowances List (Starting with ‘A’)

- Air Despatch Pay

- Air Steward Allowance

- Air Worthiness Certificate Allowance

- Allowance in Lieu of Kilometer age (ALK)

- Allowance in Lieu of Running Room Facilities

- Annual Allowance

- Antarctica Allowance

- Assisting Cashier Allowance

- Accounts Stock Verifiers (ASV) Allowance

7th Pay Allowances List (Starting with ‘B’)

- Bad Climate Allowance

- Bhutan Compensatory Allowance

- Boiler Watch Keeping Allowance

- Book Allowance

- Breach of Rest Allowance

- Breakdown Allowance

- Briefcase Allowance

7th Pay Allowances List (Starting with ‘C’)

- Camp Allowance

- Canteen Allowance

- Care taking Allowance

- Cash Handling Allowance

- Handling and Treasury Allowance

- Children Education Allowance (CEA)

- CI Ops Allowance

- Classification Allowance

- Clothing Allowance

- Coal Pilot Allowance

- Command Battalion for Resolute Action (COBRA) Allowance

- Command Allowance

- Commando Allowance

- Commercial Allowance

- Compensation in Lieu of Quarters (CILQ)

- Compensatory (Construction or Survey) Allowance

- Composite Personal Maintenance Allowance (CPMA)

- Condiment Allowance

- Constant Attendance Allowance

- Conveyance Allowance

- Cooking Allowance

- Cost of Living Allowance

- Court Allowance

- Cycle Allowance

7th Pay Allowances List (Starting with ‘D’)

- Daily Allowance

- Daily Allowance on Foreign Travel

- Dearness Allowance (DA)

- Deputation (Duty) Allowance for Civilians

- Deputation (Duty) Allowance for Defence Personnel

- Desk Allowance

- Detachment Allowance

- Diet Allowance

- Dual Charge Allowance

7th Pay Allowances List (Starting with ‘E’)

- Educational Concession

- Electricity Allowance

- Entertainment Allowance for Cabinet Secretary

- Entertainment Allowance in Indian Railways

- Extra Duty Allowance

7th Pay Allowances List (Starting with ‘E’)

- Family Accommodation Allowance (FAA)

- Family HRA Allowance

- Family Planning Allowance

- Field Area Allowance

- Fixed Medical Allowance (FMA)

- Fixed Monetary Compensation

- Flag Station Allowance

- Flight Charge Certificate Allowance

- Flying Allowance

- Flying Squad Allowance

- Free Fall Jump Instructor Allowance

- Funeral Allowance

7th Pay Allowances List (Starting with ‘G’)

- Ghat Allowance

- Good Service/Good Conduct/Badge Pay

Also Check: Allowances List with PDF Calculator

7th Pay Allowances List (Starting with ‘H’)

- Hair cutting Allowance

- Handicapped Allowance

- Hard Area Allowance

- Hair dying Money

- Headquarters Allowance

- Health and Malaria Allowance

- High Altitude Allowance

- Higher Proficiency Allowance

- Higher Qualification Incentive for Civilians

- Holiday Compensatory Allowance

- Holiday Monetary Compensation

- Hospital Patient Care Allowance (HPCA)/Patient

- HPCA and PCA

- House Rent Allowance (HRA)

- Hutting Allowance

- Hydrographic Survey Allowance

7th Pay Allowances List (Starting with ‘I&J’)

- Initial Equipment Allowance

- Instructional Allowance

- Internet Allowance

- Investigation Allowance

- Island Special Duty Allowance

- Judge Advocate General Department Examination Award

7th Pay Allowances List (Starting with ‘K’)

- Kilometraage Allowance (KMA)

- Kit Maintenance Allowance

7th Pay Allowances List (Starting with ‘L’)

- Language Allowance

- Language Award

- Language Reward and Allowance

- Launch Campaign Allowance

- Leave Travel Concession (LTC)

- Library Allowance

7th Pay Allowances List (Starting with ‘M’)

- MARCOS and Chariot Allowance

- Medal Allowance

- Messing National Holiday Allowance

- Metropolitan Allowance

- Mileage Allowance for journeys by road

- Mobile Phone Allowance

- Monetary Allowance attached to Gallantry Awards

7th Pay Allowances List (Starting with ‘N’)

- National Holiday Allowance

- Newspaper Allowance

- Night Duty Allowance

- Night Patrolling Allowance

- Non-Practicing Allowance (NPA)

- Nuclear Research Plant Support Allowance

- Nursing Allowance

7th Pay Allowances List (Starting with ‘O’)

- Official Hospitality Grant in Defence forces

- Officiating Allowance

- Operation Theatre Allowance

- Orderly Allowance

- Organization Special Pay

- Out of Pocket Allowance

- Outfit Allowance

- Outstation (Detention) Allowance

- Outstation (Relieving) Allowance

- Out-turn Allowance

- Overtime Allowance (OTA) [Click to know more]

7th Pay Allowances List (Starting with ‘P’)

- Para Allowances

- Para Jump Instructor Allowance

- Parliament Assistant Allowance

- PCO Allowance

- Post Graduate Allowance

- Professional Update Allowance

- Project Allowance

7th Pay Allowances List (Starting with ‘Q’)

- Qualification Allowance

- Qualification Allowance

- Qualification Pay

7th Pay Allowances List (Starting with ‘R’)

- Rajbhasha Allowance

- Rajdhani Allowance

- Ration Money Allowance

- Refreshment Allowance

- Rent Free Accommodation

- Reward for Meritorious Service

- Risk Allowance

- Robe Allowance

- Robe Maintenance Allowance

7th Pay Allowances List (Starting with ‘S’)

- Savings Bank Allowance

- Sea Going Allowance

- Secret Allowance

- Shoe Allowance

- Shorthand Allowance

- Shunting Allowance

- Siachen Allowance

- Single in Lieu of Quarters (SNLQ)

- Soap Toilet Allowance

- Space Technology Allowance

- Special Allowance for Child Care for Women with Disabilities

- Special Allowance to Chief Safety Officers / Safety Officers

- Special Appointment Allowance

- Special Compensatory (Hill Area) Allowance

- Special Compensatory (Remote Locality) Allowance (SCRLA)

- Special Department of Telecom (DOT) Pay

- Special Duty Allowance

- Special Forces Allowance

- Special Incident/Investigation/Security Allowance

- Special Security Allowance (SSA)

- Special Level Crossing (LC) Gate Allowance

- Special National Crime Records Bureau (NCRB) Pay

- Special Running Staff Allowance

- Special Scientists’ Pay

- Specialist Allowance

- Spectacle Allowance

- Split Duty Allowance

- Study Allowance

- Submarine Allowance

- Submarine Duty Allowance

- Submarine Technical Allowance

- Subsistence Allowance

- Sumptuary Allowance in Training Establishments

- Sumptuary Allowance to Judicial Officers in

- Sunderban Allowance

7th Pay Allowances List (Starting with ‘T’)

- TA Bounty

- Territorial Army Allowance.

- TA for Retiring Employees

- TA on Transfer

- Technical Allowance

- Technical Allowance (Tier – II) to continue beyond 31.03.2018 only after review of courses.

- Tenure Allowance

- Test Pilot and Flight Test Engineer Allowance

- Training Allowance

- Training Stipend

- Transport Allowance (TPTA)

- Travelling Allowance

- Treasury Allowance

- Tribal Area Allowance

- Trip Allowance

7th Pay Allowances List (Starting with ‘U & V’)

- Uniform Allowance

- Vigilance Allowance

7th Pay Allowances List (Starting with ‘W’)

- Waiting Duty Allowance

- Washing Allowance

New Allowances for Railways

Railway staff members will receive two new allowances. The first is the Special Train Controller’s Allowance, which will pay Rs. 5,000 per month to Section Controllers and Dy. Chief Controllers. The second is the Risk and Hardship Allowance, which will apply to Track Maintainers I, II, III, and IV of Indian Railways. This allowance will be granted under cell R3H2 of the Risk and Hardship Matrix and will amount to Rs. 2700 for Level 8 and below and Rs. 3400 for Level 9 and above. Additionally, firefighting staff of Central Government & UTs will also be granted Risk and Hardship Allowance.

New Allowance for Fire-fighting Staff

Effective immediately, fire-fighting personnel will receive an added bonus in recognition of their courageous efforts. This new allowance will be calculated based on cell R2H3 of the Risk and Hardship Matrix, with those in Level 8 and below receiving Rs. 2700 and those in Level 9 and above receiving Rs. 3400. Our brave fire-fighters deserve nothing less than the utmost respect and compensation for their dedication to keeping our communities safe.

7th CPC Night Duty Allowance Order PDF

The Order PDF for the 7th CPC Night Duty Allowance can be found easily. It’s noteworthy that the Central Government employees receive a range of allowances, some of which are based on a percentage of their Basic Pay, while others are based on a specific amount. The Night Duty Allowance is a benefit that is limited to Industrial employees, and there are additional allowances that are only available to certain employee categories.

The 7th Pay Commission allowances are additional monetary benefits given to government employees in India, in addition to their basic salary, as per the recommendations of the 7th Central Pay Commission.

The 7th Pay Commission covers various types of allowances such as house rent allowance (HRA), dearness allowance (DA), travel allowance (TA), medical allowance, and more.

The allowances under the 7th Pay Commission are determined based on factors like the employee’s city of residence, basic pay, and grade pay.

The recommendations of the 7th Pay Commission were implemented by the Government of India on July 1, 2017.

Yes, all central government employees, including those working in ministries, departments, and public sector undertakings, are eligible for the 7th Pay Commission allowances.

Yes, the 7th Pay Commission allowances are considered part of the employee’s income and are subject to taxation as per the applicable income tax laws.

No, once the recommendations of the 7th Pay Commission are implemented, previous allowances and benefits may be rationalized or subsumed into the new allowances structure.

Yes, the 7th Pay Commission allowances are subject to periodic revisions and revisions may be made based on government regulations and economic conditions. Employees will be informed in advance about any such revisions.

The purpose of the 7th Pay Commission allowances is to provide additional financial support to government employees to meet various expenses related to housing, travel, medical needs, and other necessary expenditures.

I agree with the decisions made by CPC

Deputation allowance with spl security allowance to a deputationiist in DG security is admissible or not?

SPECIAL PAY FOR SAS PASSED CANDIDATE

Sir

What have considered govt about dress allowance and anomalies of msp. Sainik was happier in 6th pay commission than 7th pay commission.

RISK AND HARD DUTY ALLOWANCE ENHANCED TO GOVT DUE TO VARIOUS CALAMITY OF ALL OVER IN INDIA PARAMILITARY FORCE HAS DEPLOYED IN ALL OVER IN INDIA ON BORDER INDIA PAK, INDIA BENGLADESH, CHINA BHUTTAN NEPAL.

special appointment allowance renamed now extra work allowance applicable to whom. previous related details required.

acting allowance – what is this ? now renamed. applicable to whom

What about Rum and Cigrate allowance given to JCO/OR. Is any clerification here?

please inform correct rupees for special pay to the typist.

Sir

With due respect to state that the defence forces are still not in the position to give benefits of 7th pay commission to it’s veterans. Really ashamed on this. I don’t know how much time they need to settle it down. Already one and half years passed.

I am working as CLI.I am getting₹ 400 personal pay allowance from jan 2014. This allowance continue or not ?

if an kvs empioyee drawing family pianning allowance since april 2004. its continew in 7th cpc. reply please.

Special pay or special increment for national and international sport for securing medal.

All para medical allowances patients care allowance which not mention

govt has assured medical assistance to central govt employees from rs 500 to rs 100, whether it is payable from 01/01/2017 or from july2017? if it is from 01/01/2016, whether arrear will paid ?

i am a retired central govt employee.

If an employee drawing family planning allowance since March 1987,whether fpa will be discontinued in 7th pay commission?

Reply please.

I agree with the decisions made by CPC.

Why family planning allowance be abolished. This is injustice to those ladies who were encouraged by the earlier incentive related sterilization procedure.. Can our PM revert the irreversible procedure of tubectomy?

No benefit to GE

Family planning allowances may restored with conditions applicable for one child.

What will be the SDA rate in percentage as per 7 CPC?

Hard duty allowance for railway track maintener approve?

They should have included medical allowance for all staff. Now only those who claim medical reimbursement are benefitted. Lot of paper work and running around hospitals which is not possible by many. Hence medical allowance would have solved the problem. Reimbursement in inpatient cases only.

Over time allowance (ota) is abolished as shown in the table . That means from July ,2017 there will be no overtime duty. Now my question is that will there be any other allowance replacing ota or no?

I THINK NDA GOVERNMENT AGAINST FAMILY PLANNING THAT’S WHY THEY ABOLISHED FPA.PRIME MINISTER SHOULD LOOK INTO THE MATTER AND RETAINED THE FPA.

So No. 185 Training allowance should be abolished. Because in the battalion formation the security duty is more harder than Instructor duty. Everyone like to perform Instructor duty. Instructor duty are full save lives with their families. Instructor course are conducting every year and they may be obtained opportunity to perform instructor duty for getting at least 3-4 years save and peaceful life from Border /Security duty. Right to equality of Indian constitution. JAI HIND

How much Traveling Allowance is fixed in 7th Pay instead of existing 800/-

How can the government reduces HRA from 30% instead increasing in 7th cpc, all years putting service and waiting for 7cpc results deceiving the dreams of central govt. servents.

ramesh babu

The govt. has totally neglected the paramilitary forces of the country. .Even, a very meagre amount of allowance being paid to gallantry awardees for facing grave risks of life against the enemy,has not been revised. Will the HM, FM & the PM relook in to the pay & allowances of CPO’S

Not only against family planning. They are against all types of planning. Note that they abolished planning commission.

I think family planning should be well motivated and much attractive so that biggest problem which we are facing is population blast can be stopped some where.

I think NDA Government is totally in against of Family Planning in India, so they abolished Family Planning Allowance. Very good decision.