“7th Pay Commission Latest News: Cash & Treasury Allowance”

As of today, the latest news regarding the 7th Pay Commission in 2019 concerns the Cash Handling and Treasury Allowance. This allowance is provided to employees who handle and manage cash on a regular basis, such as cashiers and treasurers. The aim of this allowance is to compensate for the risks and responsibilities associated with the job, and to motivate employees to perform their duties to the best of their abilities. The amount of the allowance varies depending on the grade and level of the employee, and is subject to change according to government regulations and policies.

7th Pay Commission Latest News Today 2019

The 7th Pay Commission Latest News Today 2019 has brought about a clarification regarding Cash Handling and Treasury Allowance. This allowance is given to employees who handle cash and other valuable documents as a part of their job. The clarification states that the allowance will only be given to those employees who handle cash and other valuables at least once a week. The amount of the allowance will be determined based on the level of responsibility and the amount of cash and valuables handled by the employee. This latest update is expected to benefit a large number of government employees who handle cash and other valuable documents as a part of their daily work routine.

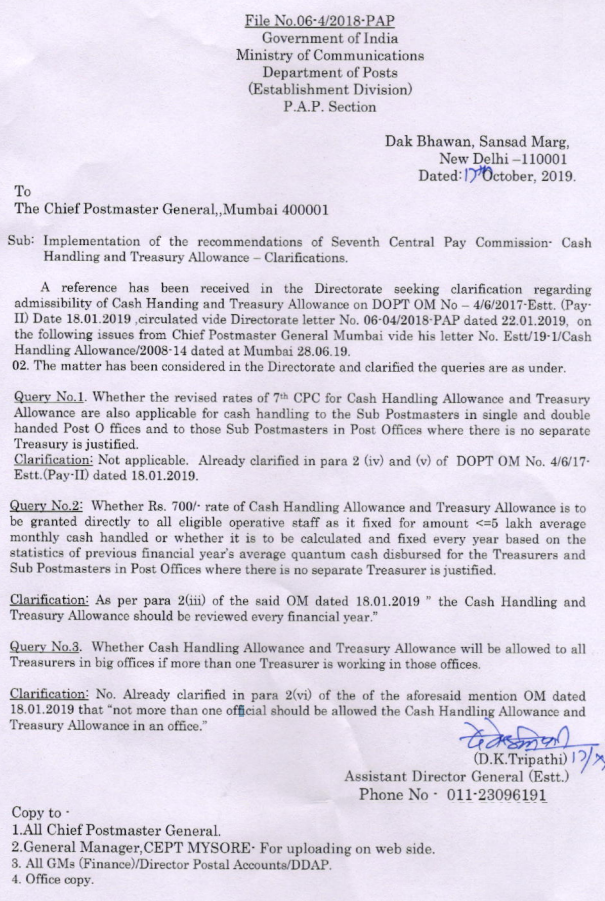

As per the DoPT order issued on 18.1.2019, the revised rates of Cash Handling and Treasury Allowance as follows…

- Cash Handling of Below 5 lakh – Rs. 700

- Cash Handling of Above 5 lakh – Rs. 1,000

Now, the Department of Posts has clarified on the admissibility of Cash Handling and Treasury Allowance to the Sub Postmaster working in Post Office and Establishments Offices as follows…

Query No.1: Whether the revised rates of 7th CPC for Cash Handling Allowance and Treasury Allowance are also applicable for cash handling to the Sub Postmasters in single and double handed Post offices and to those Sub Postmasters in Post Offices where there is no separate Treasury is justified.

Clarification: Not applicable. Already clarified in para 2 (iv) and (v) of DOPT OM No. 4/6/17- Estt.(Pay-II) dated 18.01.2019.

Query No.2: Whether Rs. 700/- rate of Cash Handling Allowance and Treasury Allowance is to be granted directly to all eligible operative staff as it fixed for amount <=5 lakh average monthly cash handled or whether it is to be calculated and fixed every year based on the statistics of previous financial year’s average quantum cash disbursed for the Treasurers and Sub Postmasters in Post Offices where there is no separate Treasurer is justified.

Clarification: As per para 2(iii) of the said OM dated 18.01.2019 ” the Cash Handling and Treasury Allowance should be reviewed every financial year.”

Query No.3: Whether Cash Handling Allowance and Treasury Allowance will be allowed to all Treasurers in big offices if more than one Treasurer is working in those offices.

Clarification: No. Already clarified in para 2(vi) of the of the aforesaid mention OM dated 18.01.2019 that “not more than one official should be allowed the Cash Handling Allowance and Treasury Allowance in an office.”

7th CPC Cash Handling and Treasury Allowance – DoPT Orders dated on 18.1.2019

7th Pay Commission Other Topics

- 7th Pay Commission Pay Scale Calculator

- 7th Pay Commission Salary Calculator 2019

- 7th Pay Commission Pay Fixation Calculator

- 7th Pay Commission DA Rates Table

- 7th Pay Commission Pay Fixation

- 7th Pay Commission MACP Scheme

- 7th Pay Commission Children Education Allowance

- 7th Pay Commission Transport Allowance

- 7th Pay Commission Increment

- 7th Pay Commission House Rent Allowance

- 7th Pay Commission Classification of Posts

- 7th Pay Commission LTC Rules

- 7th Pay Commission Leave Rules

- 7th Pay Commission Travelling Allowance

- 7th Pay Commission House Building Advance

- 7th Pay Commission Allowances

- 7th Pay Commission Fitment Table

- 7th Pay Commission Advances

- 7th Pay Commission CGEGIS

- 7th Pay Commission Risk & Hardship Allowances

7th Pay Commission Latest News Today is a program which provides Cash Handling and Treasury Allowance for government employees.

The eligibility requirements for the 7th Pay Commission Night Duty Allowance (NDA) vary depending on the individual’s job title and responsibilities.

The formula for calculating the 7th Pay Commission Night Duty Allowance (NDA) is based on the individual’s job duties and responsibilities.

The Cash Handling rate for amounts below 5 lakh is Rs. 700.

The Cash Handling rate for amounts above 5 lakh is Rs. 1,000.

Yes, you must provide a certificate of eligibility in order to receive the 7th Pay Commission Night Duty Allowance (NDA).

Leave a Reply