GPF Interest Rate Calc. Format Sheet

The Department of Accountant General of Uttar Pradesh, a government organization responsible for financial management, recently released a notification containing a sample calculation of the General Provident Fund (GPF). This fund is a retirement benefit provided to government employees in India and the sample calculation, which includes variables such as interest rates and contributions, aims to provide clarity and transparency about how the GPF is calculated.

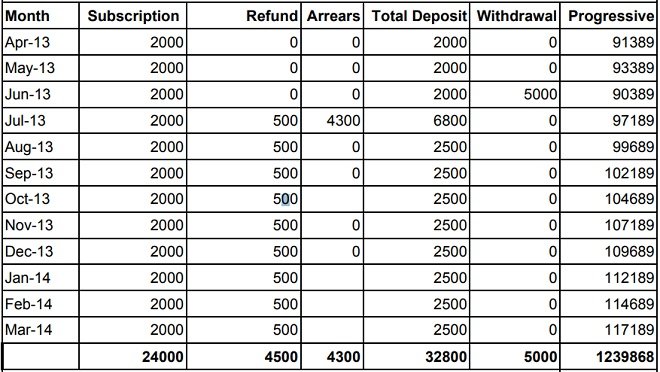

Format of GPF Calculation

In regards to Y.C M.O, the interest for the fiscal year 2013-14 needs to be calculated. The following information is available: an opening balance of Rs. 89,389 as of April 1st, 2013, monthly subscriptions of Rs. 2,000, a refundable advance of Rs. 5,000 drawn on June 25th (refundable at a rate of Rs. 500 per 10), DA arrears of Rs. 4,300 for July 2013, and an interest rate of 8.70%.

The balance at the beginning of April in 2013 was a whopping Rs. 89,389, which was then added upon with a deposit of Rs. 32,800. Interest was then calculated using a formula of (Progressive x Rate of Interest) / (100 x Months), where the result of 1239868 multiplied by 8.7 was divided by the product of 100 and 12. This calculation resulted in an additional Rs. 8,989 being added to the account. The grand total in the account then became Rs. 1,31,178. Unfortunately, a withdrawal of Rs. 5,000 was made, leaving a closing balance of Rs. 1,26,178 by March 31st, 2014.

GPF Interest Calculator for CG Employees

- GPF Certificate Verification – Checklist for GPF Subscription and Withdrawal Rules February 8, 2024

- GPF Interest Rate Jan to Mar 2024 PDF February 5, 2024

- Clarity on Interest Above Rs. 5 Lakhs for GPF: DoPPW July 14, 2023

- Rate of Interest on GPF and Other Similar Funds for Q2 of FY 2023-2024 July 6, 2023

- Transferring NPS Subscription into GPF Account June 19, 2023

- Online processing of GPF Final withdrawal/advance-DAD June 19, 2023

- GPF Guidelines for Submission of Final Withdrawal June 19, 2023

- General Provident Fund drawal of Advance to Armed Forces Personnel June 19, 2023

- GPF Interest Rate Fixed 7.9% for Further Three Months June 19, 2023

- GPF Interest Rate in Tamil Nadu: Between 1.4.2019 and 30.6.2019 June 19, 2023

- GPF for those who have been Recruited on or after 1-1-2004 June 19, 2023

- Centralized Online GPF Module: Interest Calculation June 19, 2023

- GPF to be introduced to willing NPS Employees June 19, 2023

- NPS Vs GPF – General Provident Fund Facility to National Pension Scheme Governed Employees June 19, 2023

- GPF Interest Rate 2019-20: 7.9% from Oct to Dec 2019 June 19, 2023

- Amendment in General Provident Fund Rules: Advance, Recovery, and Withdrawal June 19, 2023

- PF Accumulation Interest Rate History 1952-2023 June 19, 2023

- Ceiling of Rs. 5 Lakh on Subscription to General Provident Fund (GPF) June 19, 2023

- GPF Interest Rate 2022 PDF Download June 19, 2023

- Issuance of Annual Statement of GPF Account June 19, 2023

- GPF Interest Rate from July to December 2020 is 7.1% June 19, 2023

- GPF Interest Rate Calculation Format Sheet June 19, 2023

- Freezing of DA and DR: IRTSA appeal to credit the Additional DA to Provident Fund June 19, 2023

- GPF Interest Rate from January to March 2020 June 19, 2023

- GPF Interest Rate January to March 2023 June 19, 2023

- Post Office Savings Scheme Interest Rates on PPF, FD, RD, NSC, KVP January 2, 2020

- GPF Interest @ 8% from 1st April 2019 to 30th June 2019 – Finmin Orders April 16, 2019

- EPF Rate of Interest 8.65% February 22, 2019

- GPF Interest 8% from 1.1.2019 to 31.3.2019 January 26, 2019

- GPF Interest Rate 8% from October 2018 October 9, 2018

- Speedy Clearance of GPF Final Settlement – DAD Estt. October 3, 2018

- General Provident Fund Interest Rate from April to June 2018 April 16, 2018

- Aadhaar linking and interoperability of GPF, PPF and EPF September 25, 2017

- General Provident Fund Interest Rate for 1st April to 30th June 2017 – Finmin Orders April 20, 2017

- GPF interest rate is presently fixed at par with that of PPF interest rate April 12, 2017

- Central Government expects its employees to work with full dedication, sincerity and diligence – Dr Jitendra Singh March 20, 2017

- GPF Advance Limit Enhanced upto 12 Months of Pay – DoPPW Order March 8, 2017

- Clarification regarding timely payment of GPF final payment to the retiring Government Servant – DoPT January 25, 2017

- Govt puts on hold new Provident Fund withdrawal norms till July 31 April 20, 2016

- Tax on Provident Fund withdrawn March 9, 2016

- NFIR writes to PM to withdraw of Budget proposal to levy Income Tax on Provident Fund March 6, 2016

- Centre decides to withdraw tax on Provident Fund March 6, 2016

- Deduction of Income Tax on withdrawal of Provident Fund 60% March 5, 2016

- Casual Labourers with temporary status-clarification regarding contribution to GPF and Pension under the old pension scheme February 26, 2016

- GPF Resolution 2015-16 – Finmin published today April 23, 2015

- General Provident Fund Interest Rate 8.7% for 2015-16 April 21, 2015

- GPF – General Provident Fund Interest Rate during the year 2014-15 – Finmin Orders March 5, 2014

The GPF Interest Rate Calculation Format Sheet helps calculate the interest earned on GPF (General Provident Fund) investments.

To calculate the GPF interest rate, you will need the opening balance of the GPF account, monthly subscriptions, any refundable advances taken, any arrears received, and the applicable interest rate.

GPF interest is calculated using the formula: (Progressive x Rate of Interest) / (100 x Months). The result is then added to the account balance.

Sure! Let’s consider the fiscal year 2013-14 with an opening balance of Rs. 89,389. Monthly subscriptions of Rs. 2,000 and a refundable advance of Rs. 5,000 were made. DA arrears of Rs. 4,300 were received, and the interest rate was 8.70%. After calculating the interest and deducting a withdrawal of Rs. 5,000, the closing balance was Rs. 1,26,178.

Leave a Reply