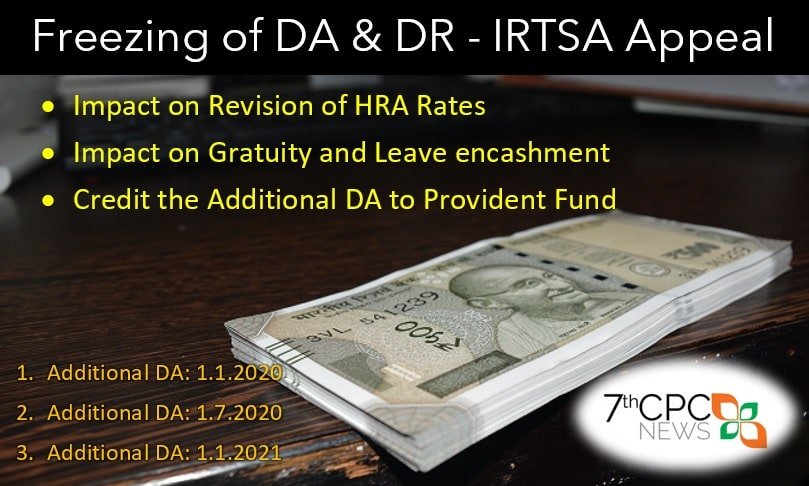

Freezing of DA & DR: IRTSA Appeals to Credit Additional DA to Provident Fund

The Indian Railways Technical Supervisors Association (IRTSA) is taking a strong stance against the government’s decision to freeze Dearness Allowance (DA) and Dearness Relief (DR) for its employees. In a recent memo sent to the Ministry of Finance, the IRTSA has demanded the immediate withdrawal of the DA and DR freeze and the granting of an option to credit the additional DA amount to Provident Fund (PF) accounts. The memo has been sent with the intention of following up with the Prime Minister’s office to ensure that the voices of railway employees are heard and their concerns addressed.

Highlights of the letter:

- DA is a part of Pay, compensating for the erosion in the real value of the salary

- Total loss would be over 1.5 months of Pay & Pension and possibly even more

- Freezing of DA will also delay the revision of HRA rates, whenever DA crosses 25%

- Heavy loss to the employees who retire between 1-1-2020 to 30-6-2021 in terms of Gratuity and Leave encashment

- Order for freezing of Dearness Allowance and Dearness Relief may please be withdrawn.

- Instead option may please be given to Employees for crediting of the amount of Additional DA to their Provident Fund in case of pre-1-4-2004 employees and to the Pension Fund (Tier 2) in case of those covered under the NPS.

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 1965, Regd. No.1329) Website http://irtsa.net

CHq. 32, Phase 6, Mohali, Chandigarh-160055.

No: IRTSA/CHQ/Memo. 2020-3

Date: 30.4.2020

Smt. Nirmala Sitharaman,

Hon’ble Minister for Finance,

Government of India,

North Block, New Delhi-110001.

Respected Madam,

Subject: Freezing of Dearness Allowance to Central Government employees and Dearness Relief to Central Government pensioners at the current rates till July 2021 – Appeal for review of decision; And Grant of option to credit the Additional DA to Provident Fund

Ref: Ministry of Finance, Department of Expenditure OM No.1/1/2020-E-II (B), dated 23-04- 2020

1) Indian Railways Technical Supervisors Association (IRTSA) extends its fullest support and cooperation to the Government of India in its all-out effort to control COVID-19 pandemic. Railway men are working on the forefront risking their lives to keep freight & parcel services operational for ensuring uninterrupted supply of essential commodities across the country. Indian Railways have taken up many special tasks to fight against COVID-19 pandemic.

2) Railways’ and other government employees and pensioners have contributed generously to PM CARES for the fight against COVID-19.

3) It is, however, very disheartening that the Government has decided, as per the order cited above, that the DA/DR is frozen and would not be revised up to July 2021; and that no arrears will be paid. This has adversely affected the morale of the employees.

4) DA is a part of Pay, compensating for the erosion in the real value of the salary. DA can only be deducted either as a punitive measure or with the consent of the employees.

5) Assuming 4% additional DA & DR for each of 3 spans of six months, the total loss of employees and pensioners would be over 1.5 months of Pay & Pension and possibly even more than that, if the inflation is higher than 4 % in the next 2 spans.

6) Freezing of DA will also delay the revision of HRA rates since as per decision of the Government on 7th CPC, whenever DA crosses 25%, rates of HRA will be revised.

7) It will also cause additional heavy loss to the employees who retire between 1-1-2020 to 30-6-2021 in terms of Gratuity and Leave encashment as the DA is counted for the same.

8) We fully realize that a lot of funds are required to combat the social & economic impact of COVID. But freezing the DA & DR would be counter-productive, as freezing this huge amount would give a further blow to the market as well as to the employees and the pensioners since the amount paid as DA and DR will actually flow out to the market. This will help boost the sagging economy in post-COVID times.

9) Government had advised all private sectors to pay their employees for the lockdown period. Government, as a model employer should set an example by not making any cut in the pay & allowances of its own employees.

10) Lower and middle class employees and pensioners are hard pressed to meet their liabilities due to heavy inflation which is bound to increase in the post-COVID-19 scenario especially in respect of cost of Medicines and household requirements.

11) In the past, when funds were required for a National calamity like War, Floods or Cyclones etc., DA installments were deposited in the Provident Fund with the consent of the employees. It was never frozen as of now.

12) It is, therefore, requested that, keeping in consideration all the above aspects, the following proposals may please be considered sympathetically to avoid heart burning amongst employees and pensioners:

a) Order for freezing of Dearness Allowance and Dearness Relief may please be withdrawn.

b) Instead option may please be given to Employees for crediting of the amount of Additional DA to their Provident Fund in case of pre-1-4-2004 employees and to the Pension Fund (Tier 2) in case of those covered under the NPS.

c) Employees and pensioners may be encouraged to invest in Infrastructure Bonds etc. by increasing the ceiling limit thereof. This would provide the government with the requisite funds and the employees will not be at a loss in the long run.

Thanking you

Yours faithfully,

sd/-

(HARCHANDAN SINGH)

General Secretary

Copy for Information with a request to please consider and recommend our submissions:

i) Hon’ble Minister for Railways, Rail Bhawan, New Delhi – 110001

ii) Dr. Jitendra Singh, MOS PP&PG, North Block, New Delhi – 110001

iii) Cabinet Secretary, Rastrapati Bhawan, New Delhi – 110004

iv) Secretary Finance (Expenditure), North Block, New Delhi – 110001

v) Secretary Personnel, North Block, New Delhi – 110001

Source: https://www.irtsa.net/

Also Check:

- DA Loss Calculator (January 2020 to June 2021) for Central Govt Employees

- DR (Dearness Relief) Loss in Pension Calculator for Govt Pensioners

What is the current status of Dearness Allowance (DA) and Dearness Relief (DR) for Central Government employees and pensioners?

The DA and DR have been frozen at the current rates till July 2021.

Why have the DA and DR been frozen?

The freezing of DA and DR is a decision made by the Central Government.

Who is appealing for a review of this decision?

The Indian Railways Technical Supervisors Association (IRTSA) is appealing for a review of the decision to freeze the DA and DR.

What is the appeal by IRTSA?

IRTSA is appealing for the review of the decision to freeze the DA and DR and also requesting the option to credit the Additional DA to the Provident Fund.

Cabinet Approves 50% DA Hike from 1.1.2024

Cabinet Approves 50% DA Hike from 1.1.2024

It is good to employees. But what about the pensioners. It is beneficial to salaried people to avoid tax ( in addition their contribution ) The pensioners do not have any other manner to credit the same in any account and have to pay for the money once paid in the FY. The infra structure is also having a minimum amount to save. Not all pensioners can afford to. It will be a meager amount to consider by the Govt. for investment.. It would have been ideal if the arrears to pensioners on payment should have been claimed to exempt for pensioners. This suggestion or any other have not been looked in by IRTSAs appeal