केंद्र सरकार के कर्मचारियों के लिए 7वें वेतन आयोग के तहत परिवहन भत्ता

7th CPC Transport Allowance PDF: The 7th Pay Commission recognizes the Transport Allowance as a crucial element of the salary package for government personnel. This allowance is designed to reimburse staff for expenses incurred during their commute to and from work. The rate of Travel Allowance (TA) is based on the employee’s rank or position in the public service, with the location of their workplace being a significant factor in determining their Transport Allowance (T.A.). Our organization has collated essential details concerning the Transport Allowance for government workers.

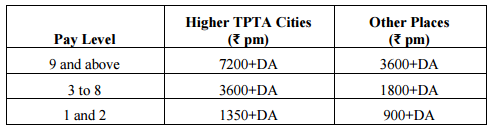

Transport Allowance Chart from Jan 2025

Please find below the updated Transport Allowance Chart effective from Jan 2025. The rates of Transport Allowance for Higher TPTA Cities and Other Places are as follows:

| Rate of Transport Allowance from 1st January 2025 | ||

| Pay Matrix Level | Higher TPTA Cities | Other Places |

| Pay Matrix Level 9 and above | 7200 + (50% of 7200) | 3600 + (50% of 3600) |

| Pay Matrix Level 3 to Level 8 | 3600 + (50% of 3600) | 1800 + (50% of 1800) |

| Pay Matrix Level 1 and Level 2 | 1350 + (50% of 1350) | 900 + (50% of 900) |

Transport Allowance Rates 7th Pay Commission

According to the accepted recommendations of the 7th pay commission, the percentage of Dearness Allowance is also calculated on the Transport Allowance and provides both the elements as Transport Allowance so, the Transport Allowance enhanced from July 2021 as given below:

Pay Matrix Level 1 and 2

- Other Cities: 900 + DA

- TPTA Cities: 1350 + DA

Pay Matrix Level 3 and 8

- Other Cities: 1800 + DA

- TPTA Cities: 3600 + DA

Pay Matrix Level 9 & above

- Other Cities: 3600 + DA

- TPTA Cities: 7200 + DA

- Click to view more details

Higher TPTA Cities List In India

TPTA Cities Allowance Calculation: A group of cities known as Higher TPTA Cities has been identified. These cities, numbering 19 in total, are: Ahmedabad, Bengaluru, Chennai, Coimbatore, Delhi, Ghaziabad, Greater Mumbai, Hyderabad, Indore, Jaipur, Kanpur, Kochi, Kolkata, Kozhikode, Lucknow, Nagpur, Patna, Pune, and Surat.

Transport Allowance Calculation For Central Government Employees

In response to the COVID-19 pandemic crisis, the Central Government has announced that Dearness Allowance for all CG employees will be held for 18 months. As a result, the Transport Allowance will remain at the same amount for the duration of the freezing period from January 1st, 2020 to June 30th, 2021. From July 1st, 2020 to June 30th, 2021, employees will receive their Transport Allowance plus an additional 17% of TA. It is important to note that Transport Allowance remains crucial for employees working from home during the lockdown period. One of the requirements for granting Transport Allowance is that employees must have a minimum of one-day attendance in a whole month.

1st July 2020 to 30th June 2021 = Transport Allowance + 17% of TA

Is ‘Work from Home’ a physical attendance for duty?

“Does ‘Work from Home’ constitute physical attendance for duty? The Indian government has recently announced that all government employees will be permitted to work from home. However, the guidelines surrounding this new policy remain unclear. To access the official order, please click on the following link. [Click to read the order]

7th CPC Transport Allowance Order PDF

You may download the PDF file containing the Transport Allowance Orders for the year 2022. As per the directive from the Ministry of Finance on February 21, 2022, eligible Divyang employees are entitled to receive double the standard transport allowance, up to a maximum of 50 percent or 35 percent ceiling. Please click on the link provided to access the PDF file. [Click to Download PDF]

50 Percent of DA from Jan 2025

After the Cabinet Committee approval the Finance Ministry issued orders to increase the Dearness Allowance by 4% from the existing rate of 42% for Central Government employees and pensioners, effective from Jan 1st, 2025. This increase will bring the overall Dearness Allowance percentage to 50%. Accordingly, the Transport Allowance also revised from 1.1.2025. [Click to know more]

Click To View TA with DA Chart as per 7th CPC

*Pay matrix level 14 and above = Rs. 15750 + DA or Availing Official car

Double Transport Allowance To Physically Handicapped Dopt Order PDF

What is the procedure to avail of the benefit of Double TA?: To avail of the benefit of Double TA, employees who are physically disabled as per the DoE Order dated 31st August 1978 – including those who are visually impaired, orthopedically handicapped, deaf and dumb/hearing impaired spinal deformity – will continue to receive Transport Allowance at double the normal rates. These employees must obtain a recommendation certificate from the Head of the Orthopedics Department, Head of the Ophthalmologist Department, and Head of the ENT Department of a Government Civil Hospital.

6th CPC Transport Allowance Order PDF

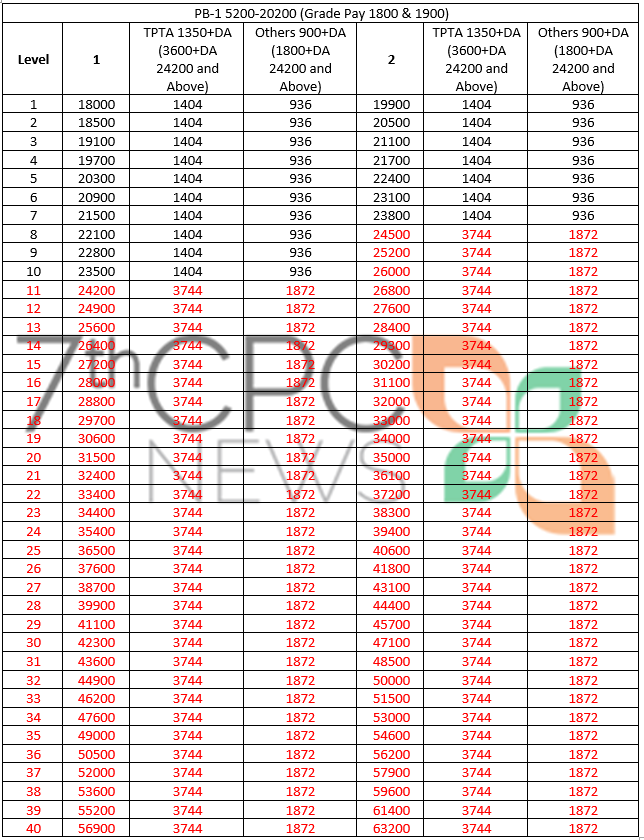

What is the 6th CPC 7440 issue and when settled?: During the 6th Central Pay Commission (CPC), employees who earned a pay of Rs. 7440 or more in Grade Pay below 4200 were entitled to a higher transport allowance of Rs. 1600 for A1/A cities and Rs. 800 for other places, instead of Rs. 600 and Rs. 400, respectively. The 7th pay commission did not address this aspect in its report, but after considerable discussion, the government accepted the demand and issued orders on August 2, 2017. According to the order, central government employees with a pay of Rs. 24200 or more in Pay Level 1 and 2 of the Pay Matrix will receive a transport allowance of Rs. 3600 plus DA for cities listed in the annexure to the OM, and Rs. 1800 plus DA for all other places.

TA Chart for Level 3 and Above

The below table has described the changes in TA rates for pay matrix level 1 and level 2

| 7th CPC Level | TPTA Cities | Other Cities |

| Level-1 (GP 1800) and Level-2 (GP 1900) | ||

| Level – 1 | 1350 + DA | 900 + DA |

| 3600 + DA (24200 and Above) | 1800 + DA (24200 and Above) | |

| Level – 2 | 1350 + DA | 900 + DA |

| 3600 + DA (24200 and Above) | 1800 + DA (24200 and Above) | |

| Level-3 (GP 2000) to Level-8 (GP 4200) | ||

| Level – 3 | 3600 + DA | 1800 + DA |

| Level – 4 | 3600 + DA | 1800 + DA |

| Level – 5 | 3600 + DA | 1800 + DA |

| Level – 6 | 3600 + DA | 1800 + DA |

| Level – 7 | 3600 + DA | 1800 + DA |

| Level – 8 | 3600 + DA | 1800 + DA |

| Level-9 and Above (GP 5400 PB-2 and Above) | ||

| Level – 9 | 7200 + DA | 3600 + DA |

| Level – 10 | 7200 + DA | 3600 + DA |

| Level – 11 | 7200 + DA | 3600 + DA |

| Level – 12 | 7200 + DA | 3600 + DA |

| Level – 13 | 7200 + DA | 3600 + DA |

TA Table for Levels 1 and 2

The TA Table for Levels 1 and 2 outlines the Transport Allowance for Matrix Pay Level 1 and Pay Level 2, which is a significant component of the salary package for Central Government employees, including Railway employees. The Matrix Pay in Levels 1 and 2 is a crucial factor in determining the magic number of Rs. 24,200. The amount of Transport Allowance varies based on the employee’s grade and position, ranging from a minimum of Rs. 12,000 to more than one lakh per annum. – Click to read and continue

TA on During Leave

The allowance will not be admissible for the calendar month(s) wholly covered by leaves.

TA on During deputation abroad

The allowance will not be admissible during the period of deputation abroad.

TA on During Tour

If an employee is absent from the Headquarters /Place of Posting for full calendar months due to a tour, he/she will not be entitled to Transport Allowance. During that/those calendar months. However, if the absence does not cover any calendar month(s) in full, Transport Allowance will be admissible for a full month.

TA on During Duty

During training treated as duty. The allowance may be granted during such training, if no Transport Facility, Traveling Allowance, or Daily Allowance is provided for attending the training institute. During the Official tour of his training course, the allowance will not be admissible when the period of the tour covers the whole calendar month. Also, during training abroad, no Transport will be admissible when the period of such training covers the whole calendar month.

TA on During Inspection

During inspection/survey duty by Members of Special Parties within the city but exceeding 8 km. From the Headquarters or during continuous field duty either in or outside the Headquarters: Transport Allowance is given to compensate for the expenditure incurred for commuting both to and from between the place of duty and residence. In case when one gets Road Mileage/Daily Allowance or free transportation for field/inspection/survey duty or tour for a period covering the whole calendar month, he/she will not be entitled to Transport Allowance during that calendar month.

TA on Vacation Leave

To vacation staff: Vacation staff is entitled to Transport Allowance provided no free transport facility is given to such staff. However, the allowance shall not be admissible when such a vacation spell, including all kinds of Leave, covers the whole calendar month.

TA on Suspension Period

During Suspension: As a Government employee under suspension is not required to attend office, he/she is not entitled to Transport Allowance during suspension where suspension covers the full calendar month(s). This position will hold well even if the suspension period is finally treated as duty. Where the suspension period covers a calendar month partially, Transport Allowance payable for that month shall be reduced proportionately.

Admissible Travelling allowance

To Whom and When Travelling allowance is not admissible?

1. Central government employees who have been provided the Government facility of Staff Car Transport.

2. Absence from duty during a full calendar month, will not be admissible Transport allowance.

Central Government constituted a Committee under the Chairmanship of the Finance Secretary to examine the recommendations of the 7th CPC on Allowances. The Allowance Committee submitted its report on 27 April 2017 to Government.

Finmin Issued Detailed Orders about Transport Allowance on 7.7.2017 – Click to read the full story

Amendment order regarding Transport Allowance on 2.8.2017 – Click to View the Order

DoPT & Finmin Orders on TA

More Finance Ministry and DoPT issued orders regarding the Transport Allowance and are compiled here for your ready reference…

| Transport Allowance to deaf and dumb employees – Click to read Finmin Order |

| Transport Allowance on Leave, Training, Tour, and Suspension – Click to Read Full Story |

| Transport Allowance with Dearness Allowance Chart from 1.1.2018 – Click to Download |

| Comparison of Transport Allowance between 6th and 7th CPC – Click to Download |

| Finmin Issued Detailed Orders about Transport Allowance on 7.7.2017 – Click to read full story |

| Allowance Committee Report on Transport Allowance – Click to read full story |

| JCM Staff Side suggestion on Transport Allowance – Click to read full story |

| 7th CPC Transport Allowance Rate Chart – Click to view the chart |

| Check Your Transport Allowance using Our Exclusive Calculator – Try it now… |

| Amendment order regarding Transport Allowance on 2.8.2017 (7440 issue settled) – Click to View the Order |

The below table describes the Transport Allowance for Pay Matrix Level 1 and Level 2 after the release of the Finance Ministry Clarification…(Calculation for DA taken as 4%)

- 7th CPC Transport Allowance with DA(5%) Chart w.e.f. 1.7.2017

- 7th CPC Transport Allowance with DA(7%) Chart w.e.f. 1.1.2018

- 7th CPC Transport Allowance with DA(9%) Chart w.e.f. 1.7.2018

- 7th CPC Transport Allowance – Finmin and DoPT Orders

TA Eligibility Rules

Transport Allowance Eligibility Rules for the Month of April 2020 to CG Employees

Transport Allowance Admissibility Rules for the month of April 2020 to Central Government Employees. Admissibility of Transport Allowance to Central Government Employees in the lockdown period of April 2020. [Click to read more]

List of Other Cities for TA

Other than TPTA Cities, all cities and towns are classified as ‘Other Cities’. Faridabad, Gurgaon, Ghaziabad, and Noida are entitled to Transport Allowance at the rates applicable to ‘Other Cities’. [Click to read more]

TPT Allowance Rules For Central Government Employees Latest News

- Double Transport Allowance for CPSE Employees (2026) February 2, 2026Read more...

- 7th Pay Commission Rates of Transport Allowance (Updated 2025) January 26, 2025Read more...

- Double Transport Allowance to Physically Handicapped in Railway January 20, 2025Read more...

- Double, Additional Transport Allowance out of the 50%/35% ceiling relating to Divyangjan – Date of effect of Implementation January 20, 2025Read more...

- Double Transport Allowance to Persons with Disabilities Employed in Central Government January 20, 2025Read more...

- Double Transport Allowance out of the 50 per cent 35 per cent ceiling relating to Divyangjan January 20, 2025Read more...

- Transport Allowance for Pay Matrix Level 14 – Recovery of Excess Payment Issue January 20, 2025Read more...

- Clarification on Transport Allowance during Nation-wide Lockdown to Railway Employees January 20, 2025Read more...

- Clarification on Transport Allowance During Lockdown – BPMS Demands to Withdraw January 20, 2025Read more...

- Transport Allowance during lockdown for Central Government Employees January 20, 2025Read more...

- Payment of Transport Allowance to the Employees of National Library Kolkata January 20, 2025Read more...

- Payment of Transport Allowance for the month of April 2020 January 20, 2025Read more...

- 7th Pay Commission Transport Allowance Latest News – 17% DA Table from July 2019 January 20, 2025Read more...

- Inclusion of HRA and Transport Allowance for the purpose of calculating Overtime Allowance January 20, 2025Read more...

- Eligibility of Staff Car/ Higher Rate of Transport Allowance to SAG Rank IOFS Officers June 14, 2023Read more...

- Travel by Premium Trains on LTC, Official Duty, Tour, Training, Transfer – Clarification orders issued by PCAFYS April 3, 2023Read more...

- 7th CPC Transport Allowance – Finmin Implementation Order March 29, 2023Read more...

- Check List for Temporary Duty Claim July 15, 2020Read more...

- Check List for Permanent Duty Claim July 15, 2020Read more...

- Clarification on Transport Allowance to Railway Employees February 27, 2019Read more...

- Transport Allowance to persons with disabilities employed in Central Government August 31, 2018Read more...

- Grant of Transport Allowance to Service Officers and PBOR August 31, 2018Read more...

- TA double to persons with disabilities – Finmin Clarification on 12.7.2018 July 12, 2018Read more...

- DA on Transport Allowance at Pre-revised Rates – Noting of DoE June 19, 2018Read more...

- 7th CPC Transport Allowance to Railway employees – NFIR June 16, 2018Read more...

- Transport Allowance to the Railway employees – Deprival of higher rate to those working in pay Level 1 & 2 April 6, 2018Read more...

- Transport Allowance (TPTA) : Report of the Committee on Allowances October 24, 2017Read more...

- 7th CPC Transport Allowance 7440 issue settled August 14, 2017Read more...

- 7th CPC TA/DA, LTC and PT Claims – Clarification Orders July 22, 2017Read more...

- Analysis of comparison of the transport allowances of 6th CPC and 7th CPC July 15, 2017Read more...

- 7th CPC Allowances Gazette Notification : Transport Allowance (TPTA) and Travelling Allowance July 7, 2017Read more...

- Date of implementation of the allowances has created lot of anguish and serious discontentment in the CG Employees – NC JCM Secretary writes to Cabinet Secretary July 3, 2017Read more...

- Transport Allowance Ready Reckoner for both Sixth CPC and 7th CPC July 1, 2017Read more...

- Transport Allowance will be lower in 7th CPC June 30, 2017Read more...

- Cabinet Decision on 7th CPC Transport Allowance June 29, 2017Read more...

- Grant of Transport Allowance at double the normal rates to deaf and dumb employees of Railways March 10, 2017Read more...

- Grant of Transport Allowance at double the normal to deaf and dumb employees of Central Government January 18, 2017Read more...

- Clarification on admissibility of Transport Allowance in the cases where the officers are drawing Grade Pay of 10,000 August 22, 2016Read more...

- Grant of Transport Allowance to Railway employees on the basis of revised classification of cities/towns/localities – AIRF August 13, 2015Read more...

- Finmin orders on granting Transport Allowance to Central Government employees as per census 2011 August 7, 2015Read more...

- Based on the Census of 2011 HRA and TA increased for Central Government employees June 5, 2015Read more...

- Revision of classification cities for the purpose of House Rent Allowance and Transport Allowance to Central Government employees May 31, 2015Read more...

- Foreign travel of Government officers – Clarification issued by Finance Ministry November 10, 2014Read more...

- Transport Allowance and Travelling Allowance Rules at a glance October 24, 2014Read more...

- Confederation writes to Finance Ministry regarding Transport Allowance to regulate to Faridabad Gurgaon, Ghaziabad and Nodia cities at par with Delhi rates August 28, 2014Read more...

- JCM Staff Side suggestion on Transport Allowance June 25, 2014Read more...

- Transport Allowance to Central Government Employees at Faridabad, Ghaziabad Gurgaon, and Noida rates applicable to ‘Other Places’ March 10, 2014Read more...

- Granting of Transport Allowance to Deaf and Dumb Employees at double the normal Rates February 19, 2014Read more...

Transport Allowance for Levels 1 and 2 (24200)

- 7th CPC Transport Allowance 7 July 2017 PDF Download

- 7th CPC Transport Allowance 13 July 2017 PDF

- 7th CPC Transport Allowance 19 July 2017 PDF

- 7th CPC Transport Allowance 2 August 2017 PDF

- 7th CPC Transport Allowance 1 December 2020 PDF

Categories of Disabilities for Double TA

The Central Government employees with the following categories of disabilities as mentioned in Rights of Persons with Disabilities (RPwD) Act 2016 of D/o Empowerment of Persons with Disabilities (EPwD), shall be paid Transport Allowance at double the normal rates subject to fulfillment of the stipulated conditions. [Click to read more]

7th Pay Commission Transport Allowance In Railway

Transport Allowance Order J&k PDF

Transport allowance is given to all employees working in Central Govt services for the expenditure on travel from residence to office and back. Employees are using various modes of travel to come to the workplace and return.

Transport allowance is divided into three segments according to their pay matrix level. The cities and towns are classified into two categories on the basis of population for the purpose of Transport Allowance. One is ‘Higher TPTA Cities’ and another one is ‘Other Places’. Note: List of Cities/Towns eligible for Higher Rates of Transport Allowance on Re-Classification of Cities/Towns as per Census 2011 (w.e.f. 1.4.2015)

The Transport Allowance is common to all categories of Central Government Employees with effect from 1.7.2017. (Recommendations on Revised Pay Structure of 7th pay commission was implemented w.e.f. 1.1.2016).

19 Cities are classified under Higher TPTA Cities. 1. Ahmedabad (UA), 2. Bengaluru (UA), 3. Chennai (UA), 4. Coimbatore (UA), 5. Delhi (UA), 6. Ghaziabad (UA), 7. Greater Mumbai (UA), 8. Hyderabad (UA), 9. Indore (UA), 10. Jaipur (UA), 11. Kanpur (UA), 12. Kochi (UA), 13. Kolkata (UA), 14. Kozhikode (UA), 15. Lucknow (UA), 16. Nagpur (UA), 17. Patna (UA), 18. Pune (UA), 19. Surat (UA).

Blind and Orthopaedically handicapped (Deaf and Dumb) employees will continue to be paid at a double rate, subject to a minimum of Rs.2,250 plus DA.

Who has a minimum of 40 percent permanent partial disability of either one or both upper limbs or 50 percent permanent partial disability of one or both upper limbs or one or both lower limbs?

‘Other Places’ means, all cities, and towns other than TPTA Cities. Central Government Employees posted at all ‘Other Places’ including Faridabad, Gurgaon, Ghaziabad & Noida.

Officers in Pay Level 14 and higher, who are entitled to the use of an official car, will have the option to avail themselves of the existing facility or to draw the TPTA at the rate of Rs.15,750 plus Dearness Allowance (DA) per month.

Respected, Sir / Madam,

Physically handicapped employee can claim “Travelling Allowance” for office duty book exceeding 08 kilometer, leave Headquarters. Please replay as soon as possible, and any Government circular / Order found please attached here with.

As directed by the competent authority’s office directive, certain employees reported to work in the month of April 2020. A committee was established to confirm attendance, and they verified it. These employees do not receive the TA allowance for a year. Please help me with recovering the TA allowance.

Sir I was on Course from 04 Jan 22 to 06 Apr 22 at training centre

Can I claim daily allowances and what documents are required for the same

I want to claim Transportation and messing only

Rs 113 per day for Transportation

Rs 380 per day for Messing excluding Rs 120 per day For NRA

sir I prmoted from lebal 8 to 9 and my TAis increase from 1800 to 3600 I got arear of pay,DA.HRA but I could not get TA arrears please clear this matter

Seventh Pay commission recommendations are effective from 01/01/2016.

What is the case of an employ who got his promotion in the first half of 2015? For example, if some one gets a promotion to a higher level in February 2015, he is not eligible for his annual increment in July 1, 2015.

On the other hand, some one who gets promotion after July 1, (assume this person is also in the same post as the fellow who got promotion in Feb 2015) get his annual increment and also promotion benefit on the date of promotion.

Is the person who got promotion in Feb 2015 is eligible for his next increment i(the one missed in July1, 2015) n Jan 2016, before converting his pay to Seventh pay scale?

Thanks for now the rules and others of promotions in 2015 employees. This is inform that both of their promotion are given on that day the OLD Grade Pay plus basic pay with 3% increment fixation i.e..on that day of February 2015 and also their basic pay plus NEW GP basic pay with 3% increment on 7/2015 they are not eligible for January 2016 increment option as per the th CPC RULES. New rule are from 1-1-2016 only. For them option given upto 24-7-2016 of their willingness opinion 6th CPC or 7th CPC pay fixations. Since 7th CPC report submitted on 25-7-2016.

Any further clarification required to know please write your questions.

Dear Sir/Madam,

I was appointed as SCIENTIST in CSIR laboratory on 10/02/20217 on the pay scale 15600-39100 with GP-6600 with additional three increments.

Now I want to know what is the initial payment should start at the 7th pay commission.

Kindly guide me in this regard

As on 1-7-21 as 74000..

Wheather base amount of ta will increase by 25%when da cross the slab of 25 %

Can Transport allowance be granted to a Govt employee who has been granted Work Related Illness and Injury Leave(WRIIL)? if the employee is absent for more than 2 Full calendar month

No.

If govt. employee attended the office only one day in a month, will he be entitled for getting full transport allowance?

No.

How many days is it required to be present in a month to be able to claim sda and tpt allowance?

Suppose, if i go on leave on the 20th of mar and i rejoin on 20th of april. Will i be eligible for both allowances for both march and april?

Sir,

When a vocational employee attends the office for one day, can be admissible for transportation allowances for a full month.

Plz reply

No.

Transport allowance will not be paid if the employee is on leave for a calendar month..how is the same granted if the starting of the leave and ending of the leave comes in mid of the calendar month…pro rata basis or full?

It will be counts leave period more than 15 day on the month.

is there any rule which define the max permissible distance between residence & office? More clearly, anyone can travel (as per rule position) daily 50 or 100 or whatever Km to attend office? It has been observed that so many people are travelling 150 KM even daily and requesting undue relaxation of timing etc in view of long distance travel everyday. During my initial days of govt service I was taught that there is some 20 or 30km restriction. However never seen in black & white

Is Transport allowance admissible for the month of April, 2020 when the GOI and State Govts have declared lockdown for the whole month.

As per the Transport Allowance not attending duty it is not eligible.

Respected Sir/Madam,

I want to know that If an employee goes in training for PA Induction training where the officials lives in PTC compound and they don’t get any transport facility/traveling allowance/daily allowance . Whether the officials are entitle to Transporting allowance or not. Thanking you

if employee is RMC (SICK)they will get TA allowance

More than 30 days, Transport Allowance will not given.

I joined in IIT 3 months ago and I have applied for transportation charges for shifting my household items but administration said that i am not eligible. because my earlier job was contractual in state govt institute. They have asked 5 years of experience in govt/contract in the notification. Please tell me whether I am eligible to get these benefits are not.

Thanking you

It should be clearly mentioned in appointment letter, Please to that letter.

when Defence person posted to new location, what will be the date of grant of TPTL at new location, i.e. Date of Posting in (TOS) or date of actual reporting to new unit (TORS)? Please clarify at the earliest.

Date of reporting duty (new) station only.

When an official is transferred to a place drawing higher rate of transport allowance in the middle of a month whether he is eligible for the higher rate for the whole month.

I am a handicapped person i have taken extra ordinary leave , when i will join my duty what will my transport allowance. on whole month or counting of present day.

Is srinagar station authorised transportation allce…?

My basic pay on 31/12/2015 is RS. 18890 plus grade pay Rs. 4600 = 23490. My higher scale date is 16/04/2016 and my retirement date is 30/09/2019. My higher scale level is 5400 grade pay. Please give advise to get maximum benefits with calculation. When i take higher scale and 7th pay commission? Whether I take first higher scale first or 7 th pay commission first ? Give me details calculation.

In my opinion as on your pay of 23490 x 2.57=60369 fixed at matrix level 7 at stage 13 of RS.60400 next higher scale (if it is next MACP only of completion of 10 year not promotion) with 66000 with one increment next stage of 68000 from 1/7/16, give increment on January from 1/1/17 next level 8 as 70000 & 1/1/18 as 72100.

Grade Pay 4600×(factor) 2.57 or 2.62 pl.conform factor

Answer to SURYAKANT : Only the entry pay was calculated by 2.62 for GP 4600, not for all other stages of calculations. Above the entry pay in the matrix tables it should be calculated to all grade pays by 2.57 only.

Travelling to Bastar District ,how much Hotel charges and Good bill is allowed ?

What’s the Jagdalpur city grade ?

How to know the level of any Central goverment employee ?

How can calculate the the time period for per day for Hotel accommodation during tour?

I am person with desibility my basic is including grade pay 7730 may I know double TA caliculation

If the employee is posted within 1 km from his duty place. Is he or she is entitle for draw transport allowance. Please mention the rule.

Thank you.

What is the conveyance allowance rate per km. of two wheeler and four wheeler on transfer?

I am CG employees. According to 6th cpc, my GP is 1900. According to 7th cpc, I am going to travel Hyderabad (out of state). My journey time start from 11.11.17 to 21.11.17. Can i travel to 3rd AC in train and what is my TA and DA calculation.

Again unjustis on Tpta In level 1&2

Level 1

basic pay 24200/- then TPTA 3600/-

Level 2

Basic pay 24500/- then TPTA 3600/-

Level 3

*Basic pay 21700/- then TPTA 3600/-*

😡😡😡😡😡😡😡

Thanks for amendment in TPT Allowances

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

From which date of year Transport Allowance will be admissible

Huge loss for employees, no need for this type of pay commission.

I was drawing TPT Allowance Rs.1600+DA after crossing the minimum basic pay Rs.7440/- in 6th CPC. Now it is misfortune for us that we are drawing 1350+DA after implementation of TPT Allowance wef. 01 July 2017 according to 7th CPC in Level 1 & 2.which is not fare.Limit should be fixed for Level 1 & 2 whenever it is said that there will Not be any changes in TPT Allowance in 7th CPC.then how Order has been made & issued .It should be modified & reissued, otherwise we are in great loss. Pl take the matter seriously in favour of us.

N. SAMPANGI SAYS A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

pl. look in to this matter and do favorable action .

Person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

The rates of TA Rs 1350+DA is applicable to all employees who are in grade pay of Rs 1800 & 1900 or it is for initial appointment

N. SAMPANGI SAYS A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

pl. look in to this matter and do favorable action .

What the hell of this recommendation on TPA. I am in level 02 and worked as LDC since 2009 in New Delhi. Now I was drawing the TPA 3600/- but after recommendation of it . It is reduced to Rs.1350/-+ DA.. after implication of all this bad recommendation I have a loss of 2500/- less salary than present. Union should raise the voice of the low income salary persons..otherwise they should lead to suicide or live in depression. It happens never before that any staff get lower salary after recommendation any pay commission. Frnds pls raise voice against it..

Very large loss in TA, 7cpc in level 1 and 2 employees, a person 6 cpc basic pay increase, in TA but 7cpc level 1 and 2 increase basic pay not increase in TA, so level 1 and 2 some people are promoted but large people are not promote in next lebel but 10 year service 1st MACP and 2MACP 20 year so that TA increase but level 1, 3 MACP so that increase TA .

very small sealary level 1 and 2 and very large losses in 7cpc level 1 and 2 , plz so revised in TA

It’s a great 7cpc gives a most painful thinks on my life due to after recommendation accepted by C.G. I have received 2376 rs lower pay due to my TPTA reduce can PM revised this rate.

person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

pl. look in to this matter and do favorable action .

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

It a big mistake of 7CPC relating to transport allowance of 1 and 2 level employees

जिस देश की सरकार कमजोर होती है वह सम्पूर्ण देश कमजोर माना जाता है/ सरकार को चलाने के लिए सरकारी कार्मिको की आवश्कता होती है/ लेवल 1 से 5 तक के कार्मिक सरकारी विभाग / सरकार की रीड की हड्डी एवं नीव के पत्थर होते है/ रीड की हड्डी कमजोर हो जाने पर व्यक्ति झुक जाता है तथा नीव कमजोर होने पर इमारत डह जाती है/ 7वे वेतन आयोग में लेवल 1 से 5 तक के कार्मिको को बहुत ही कम लाभ दिया है उस पर भी जो कार्मिको 7-8 साल की सेवा उपरांत परिवहन भता 1600+डी.ए. के हक़दार होते है उन्हें 7वे वेतन आयोग में वापस 600+डी.ए. के समकक्ष 1350 कि श्रेणी में रखा गया है/ यह इन अल्प वेतनभोगी कार्मिको के साथ अन्याय व अत्याचार की सीमा है/

My basic pay was as on 01..01.2016 Rs..8810 and Grade Pay. 1800/- according to 6th cpc and drawing transport allowance Rs.1600+DA. Now according to 7th cpc allowance transport allowance is reduced. to Rs. 1350+DA . It is the financial loss to me. Kindly considered the revised the rate of TPT allowance.

I m getting tpt 3600 in six pay commision and now government decided 1350 for new pay commision es ka matlab hua ek hath se diya dusre hath se bapis. Chin liya esa jurm hamare sath hi ku kiya government ne

The actual pre-revised rates of Transport Allowances are BP < 7440/- in PB-1 are: Rs. 800/- (for A/A1 class cities) and Rs. 400/- (for other places) hence there is a big mistake for calculating new TA rates. So the Minimum should be (800×125%) = 1800/- and (400×125%) = 900/- for the BP < 19100/- (7440×2.57 = 19120.8) in the Pay level 1 only. Others are eligible to get 3600/- (1600×125%) and 1800/- (800×125%) in the Level 1 and 2. This should be implemented to save them from the huge loss in salary.

As recommended in case of Travelling allowance that entitlement of the government servant will not decrease due to the implementation of 7th cpc and it will remain the same as in 6th cpc same should be followed in case of Transport allowance also other wise there will huge loss of pay for the employees of Level-1 and Level-2

I am presently Draw TPT 800+DA= 1888/- pm but 7th cpc 900+Da=936/- big loss

As per 7th CPC Recommendations on Transport Allowance, Pay Level 1 and 2 will draw Rs.1350/- but pay Level 3 to 8 will draw Rs.3600/- which is 62.5% more than Rs.1350/-. More over promotion from level 2 to 3 will take at least 10 years. This is gross injustice. Cost of Monthly bus pass in bangalore is Rs.2250/-. Kindly review the Transport Allowance for Pay Level 1 and 2.

sir TPT allowance increase nahi kar sakte to decrease kyo kar rahe ho. me 3600 tpt leta tha or ab 7th cpc ne 1350 kar diya. loss 2250 ka ho raha h.please revised TPT rate for level 1 and 2 employees.

I am drawing tpta Rs.1600+2000 pm,at 18 years of servise running.Now 7cpc tpta is decreases to 1350+da, newly appointed candidet is equal to me it is sheme to me and who is recomend it. If you dont whant to increase tpta do not do it but decreasing tpta,it is not good desition .

What is this…? Thanyou

Sir, as per 6th cpc I am getting TA 3600 but as per7th cpc iam getting TA 1350 this is financial lose for me in every month.which type of pay commission. I HATE THIS PAY COMMISSION.

Sir Lebal 1 & 2. Kiya Gunha kiya that Jo aap log 3600 ke niche Rakh deye hai 1350 par 1800/ & 1900 /wale Jo koe. Gunha kiya hai to bateye. Sir Lakho karmchari hai Jisé T P T. All. Rs 3600 per month milta tha next month she 1350 TPT milnelgega -2400 per month los please Railway bord. & Railway Union . Revised to TPT Rate lebal 1 & 2. And Not Happy Lakho Kendreya Employees.

what is this 7th cpc tpt allows level 1and2 not happy this employees very bad discuss 7th cpc camity very bad.

A person whose Basic Pay was below Rs 7440 draws initially TA Rs 600+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his was enhanced to TA 1600+DA. Now upto level 2 it is 1600+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2. I am in level 2 in 7th CPC and drawn TA Rs. 1600+DA in 6th CPC now I am drawing 1350+ DA according to 7th CPC. it is big financial loss to me.

Sir agar tpt allowance increase nahi kar sakte to decrease ku kar rahe ho 10 sal ke bad cpc aata hai me 3600 tpt leta tha aur 7th cpc ne 1350 kar diya. Please revised tpt rate for level 1 and 2 employees

An LDC who has joined in 2010 his pay will be 5830 + 1900 which falls in level 2. draws lower Transport allowance i.e 1350 + DA.

But After 7 years his pay becomes 7640+ 1900.in the pre revised scale and becomes eligible for higher Transport allowance i.e 3600 + DA

As per the notification issued and LDC working in CGHS and who has completed 7 years of service, who is drawing transport allowance of Rs.3600 will be getting Rs.1350.

A very big anomaly. Very strange a lower grade employee will bear a loss of Rs.2340 due to lack of study by the committee in finalizing the allowances.

There are many clerical cadre and MTS who will be facing this losses.

Immediate action by the authorities in this regard required.

Immediate action

Before 7cpc transport allowance I am getting 1600+125% DA.

Now it becomes 1350+4% DA, after 7cpc, can it is possible to get less money in any type of allowance ?

My basic before 7cpc 8960+1800 GP

Pl read Rs 70000/- in place of 7000/-

I have been transfer from Nagpur to Mumbai in public interest . My old basic as per 6 th pay commission is 23575/- + grade pay 4600/- where as; as per 7 th pay commission it is 7000/-.What will be my transfer grant?

It is not understood tpt of 7th.cpc as per 6th. cpc i am getting Rs. 1600 on gp. 1900/-

But showing new table i will get 1350/-

Pl.. clarified the matter.

A person whose Basic Pay was below Rs 7440 draws tpt initially Rs 400+DA and after some times when his Basic Pay reaches Rs 7440 in old scale his tpt was enhanced to 800+DA. Now upto level 2 it is 800+DA then what will be tpt rate for person who already reached Rs 7440 in old scale and what rate will be applicable to newly employees in level 1 or 2

I have been relieved from my earlier office at Hyderabad on 30.06.2017 afternoon and will join the new office at Delhi on 03.07.2017 i.e the next working day.

What will be the applicable transfer grant in this case:-

Will it be 100% of the basic pay based on 6th CPC, or

Will it be 80% of the basic pay based on 7th CPC

What is the rate of CILQ & FAA as per 7 cpc

Transfer benefit is an allowance, till the date of implementation of new allowances in accordance to 7 CPC, allowence will be paid with old rate and basic, ie @ basic drawn before implementation of 7CPC

Bigger question is when will the new rates be implemented? Problem witj DA linked allowances is that if the revised allowances are applicable from date of notification then till then, from Jan 16 all these allowances, which have already been paid, will get reduced as DA is 2 to 4%. Is anyone looking towards this aspect? All DA linked allowances should rightly be applicable from 01 Jan 2016.

as per 7th pay commission my new basic is 78800 in the month nov 2016 i transfered udaipur to alwar as per norms one basic ka 80 percent TA to be calculated but office give my old basic 28290 pl clarify the rules

DA should be allowed on existing TA w.e.f. July 2016 as both existing and 7th CPC recommended TA happens to be indexed to DA

The transport allowance of GP 1900 is 1350 very low .transport allowance must be increase or previous pay commission slab apply.Presently expenditure of general employee pm. is 4500 approx.

The transport allowance should be thought rationally for employees in GP 10000 who are entitled for office car to commute from residence to office. If he take office car, expenditure to govt is 50000/-. If he opts tpa, he gets rs 15750/- only out of which 5000/- goes for income tax @30%. In hand only 10750. Then petrol expenditure 10000/- who will pay for car Emi and driver pay. If he is given tax free tpa of 35000/-( with fitment factorof 2.57), he will prefer to purchase vehicle by his own paying Emi 15000, driver pay 10000/- and petrol expense 10000/- saving to govt 15000/-. Can we think this rationality while considering TPA to cg employees. It will exchequer to govt only.

9-8-1999 1st ACP will be given and after that 2nd ACP will be during 2009. ACP is after 12 years only. The first promotion will be counted against 1st ACP. The question is not clear. If it is ACP the next promotional scale you are eligible, if in the MACP then only hierarchy of the grade pay only.

I was appointed as Assistant in 1985 and I was promoted as Asstt. Finance and Acct. Officer in the scale of the than 7450-11500 equivalent to G.P. Rs. 4600 IN vI PAY COMMISSION. Now, the scale of Asstt is upgraded to Rs. 4600 w.e.f 01.01.2006.

In the above circumstance I hope due to ACP. ( since there would be no promotion count) I amy get nex higher scale i.e. 5400 w.e.f. 1.1.2006 and G.P 6600 w.e.f. 01.09.2008 ( II promotion on the implementation of vi p.c. ) and next benefit after completing 30 years . Pl. confirm the same

Your promotion date in MACP is 07-10-2015 i.e. stay or completion of 10 years service in present pay scale.

I appointed as LDC in the pay scale of Rs.950-1500 on dated 15.3.1993 and promoted as UDC in the pay scale of Rs.1200-2040 (4000-6000) on dated 9.8.1996 and promoted as Assistant in the pay. scale of Rs.9300-34400 with Grade pay Rs.4200/- on dated 7.10.2005 continuing. I want to know that what is the date of MACP will be effective in my favour……. 10 year after getting my last pay scale which is 7.10.2005 or complete 30 year of my service…

The position of claiming the relevant portion of food bills when on duty from one country to headquarters in India is totally not clear like the previous 6th CPC. Now this needs to be clarified as to whether a)there will be a lumpsum TA grant which will include the food bills ? b) whether the receipt for the food bills needs to be produced which is difficult when eating in mini dhabas and restaurants in around Delhi, getting a bill is not possible to be submitted along with the TA claim. HOW TO GET THE FOOD BILLS ADJUSTED AND HOW TO SETTLE THAT PART IN THE TA CLAIM? PLEASE EXPLAIN?

Now the Centrel govt employee who are getting Pay 7440 and above getting tpt 1600+ Da = 3600 now. But it is regrettably inform that as per 7th pay they were pull down into levels 2 and tpt 1350+Da. As they were now getting 3600. Govt May consider to this point.

Dharampal Singh

27/07/2016

I am appointeed as LDC dt 26.03.1990 (Pay scale 3050-4590) and I got 1st MACP after 12 years 26.03.2002 (Pay scale 4000-6000) and I am promoted as UDC 21.08.2002 (Pay scale 4000-6000) and 2nd MACP give me after my 20 years service 26.03.2000(5200-20200 GP 2800). I am promoted as Assistant 29.04.2012 (PB 2-9300-34400 GP Rs. 4200) Please explain me ..which date is admissible my 3rd MACP

Transport Allowances for commuting from home to work place should be same to all the employees, because if we travel from home to work place by metro train or public transport they are not asking our grade pay or designation. they are issuing ticket depending on the distance and flat rate. considering this method it should be equal to all employees.

I am state government employee.. And I posted in one of the urban areas.. Hence my office is 12 km from my rented house… Shell I get traveling allowances…. More over the rent in this area are very high.. Almost compare to city area not less then 3500/-, so how much we get the HRA…

1800, 1900 grade pay person’s already reached in 1600+(1600DA), total 3200, but 7th CPC gives 1350. 1850 less in over salary. Please justify

Regarding transport allowence, Its highly regretted to inform the govt that, some people are happy who use to get 600 now they will get 1350, who use to get 1600+1600 they are getting 3600 from level 3 onwards as per 7cpc, but what about people in level 2. Pay in pay band 7440 and above in level 2 Who use to get 1600+1600. now they are getting 1350 totally pulled down by 7cpc. Please justify..

Rates of ta should be same for all employees at same station except for SAG grade and above. Higher grade cities have metres and locals. Rickshaw and three wheeler charges are horrible at small places. You are at their me cry. Why buses cannot be provided by office S at other places at these places.

Now the centrel govt employee who are getting Pay 7440 and above getting tpt 1600+ Da = 3600 now. But it is regrettably inform that as per 7th pay they were pull down into levels 2 and tpt 1350+Da. As they were now getting 3600. Govt May consider to this point.

This is unjustified for those employee because transport charges in. Public sector is some

T.A.. for Physically Challenged CG employees may please be increased by 4th times of normal rate.. Plus DA on TA. for their smooth and convenience service to the Public. It (TA+DA) needs total exemptions from I.T .( For SPECIALLY ABLE GOVT. EMPLOYEE) . The 7th CPC recommendation is outstanding for all category of employees

T.A already 1600+DA but is Gr. Pay 1900

my residence is premises in the office. Can I entitled for Transport allowance

I m a railway employee (Group C) in PB-2 with Grade pay of 4600/_ .My basic pay is Rs. 18010(pay in PB-14010+ Gp-4600).

1.What shall be my current entitlement of road mileage allowance in respect of rate per kilometer when journey by road is undertaken on official duty —-a) within & near my Headquarter , b) when outside Headquarter.

2.Shall I not been entitled for performing local journey near HQ by non-AC taxi as per my basic.

I have been denied for entitlement of Non-AC taxi while travelling locally near HQ referring RB’s circular no. RBE-49/2013 & also of 2010 , as has been advised to undertake journey by Auto as my pay in PB is not 18050/- excluding Grade pay.

Please offer your valuable remarks along with clarification circular or guideline if any in this regard.

I got R’s 3504 in old pay commission.but now they announced only R’s 1350. As travelling allowance..we don’t know how it is possible. We have loss of R’s 2250 per month.

Sir ji officer aur worker ek hi bus ,train ma safar kartay hai fir etna baed bhab kyu .sab ka sath sab ka vikas kaise sambabh hai.

Worker,s ta -1350 ,officer ta 7200/_ Etna difference kyu

Sir jee all works civil defence service 25-40years not liqer card and not msp pay & not toll tax very down grade civilian services

Sir

I have been serving since 2003, I promoted from group ‘D’ to LDC in 2013, my grade pay is now 1900, now I am drawing 1600 Transport Allowance, now this 7th pay commission shows 1900 grade pay is level 2 , in level 2 transport Allowance is 1350. It is increase or decrease?

I ex Sub Maj Hony Capt Gharu Ram fromJammu retired from Indian Army on 30.09.2009 after completing 26 yr 03 months and 28 days of service. there is no pension mentioned for below 28 yrs of service for Hony Capt. what will be my pension. kindly reply

Sir I m an employ of indian Coast Guard in Yantrik cader. I would like to know that is the x group pay which is recomended for the yantriks of Coast Guard will be considered for calculating HRA and DA on it is admissible or not as x group pay is part of pay being paid due to disparity in pay of Direct entry diploma holders

Respected Sir,

I am a physically handicapped employee in CAG in Bangalore. I want to know about my transport allowance how much I will get after 7CPC. Plz send in my mail I’d.

Thanking you.

Respected Sir, I really would not believe that this much parity of Allowances will be carried with the past. Peoples think that now we are heading towards the new Era/Generation where everybody tells that we all are equal but why this so much gape within the employee at least. forget about the Officers that will remain forever because they are policy and rule makers so they will always make benefit for them only.

1. Transport Allowance – level 1/2 – old 600 and new 1350/- and 3 and above will get new rates of 3600/- (This only u Count – How crushes you)

This is only one simple example I am giving with my Years of Experience that whoever is analyzing or making this type of parity with the Allowances is really making himself injustice and joke of the democratic things we India’s poor grade of people will remain poorest because of there grace or bless and this all being done purposely and they dont want to pass on the benefits to poor people.

It is simple that they dont want you should be a proud people because they are the only great tagma or you can say damad of the Indian Government.We are the Slave people still as per their recommendations. Even Top leaders and bureaucrats knows that who works how much and new generation of 4th grade employee how smart in working, At the last I only say that believe in yourself and carry your life better by praying the only God who gave you the Birth.. Jai HInd……

Respected sir,

sub:- Enhancement of MSP of PBORs

(a) The MSP in respect of PBORS was not analysed correctly in VI CPC thus it was initially recommended as 1000/-pm and later it was considered as 2000/-pm (lumpsome).Now in VII CPC the rate of MSP should have been re-analysed and refixed,instead it has re-fixed with a multiple factor.

(b) Non combatant members has got a fair enhancement from Rs.1000/- to 3600/-pm(i.e.almost 70% of PBOR rate),PBOR also should have been considered for 70% of officers rate.

t.a. double allowance deaf dumb have rule

CPF ko gpf me change kre sir kyoki 01/01/2004 Keep bad wale employer to lever ki Torah hair or pension ki bhi facility did jaye sir

please request sir please

7cpc recommendations are offrs. He is give more fasailty for offers.

Who are govt vehicle use but tpta is more. I not know oil is less rates for PBORs. He is veh are not used. Pl check.

Re-check MSP of PBORs. I now govt and 7cpc commette are happy for PBORs MSP. A meeting with PBORs in any places. When jastify.

Requesting for 7th cpc- cpmf’s maximum jawans said to 7th cpc are reqst per year issue only rupees buy uniform , shoes ,pt shoes and other some items from a out market pls ensure and reccommended my cpmf member yr faithfully all jawans. Jai hind

No special benefit is given to the Physically Handicapped Employees who are really expecting some more financial support from the Govt.side.

Please don’t difference to pbor &offcers

Officer & jawan me fark nahi hona chahiye quonki jawan bhi apni duty karte hai our officer bhi apni duty karte hai

Our jawano ko bhi wahi faccilitise honi chahiye or officerocho bhi

Officer apni man Mani nahi karni chahiye

Kindlh dont differentiate as fare is same

kindly dont differenicite between officers and lower gra de employees in paying transport allowence as every body pays same charge

transport allowance should be same for all the CG employees or just little difference between classes. . VII CPC is only for the higher class. Even for entry level different fitment factors are recommended. lower for lower post and higher for higher post.. As usual this pay commission is for upper class .

Transport allowance granted by 7 th CPC is just doublng the earlier one without taking much trouble, It is known that 2/4 wheelers are used by all CG employees for trekking the distance between office and residence..An uniform rate of allowance may be considered s

The reimbursement angle put forth by the commission under Travel charges required production of journey tickets/ indicating auto numbers for journey at camp. This requires compounding the allowances per day with out reimbursement angle. A Single allowances including, Food charges &travel charges at out station may be considered as incidentals to tour with out hassels .

The lodigng charges should be further rationalised, so that a person on tour should stay comfortably without searching for lodges since the earlier holders of grade pay of 4200,4600,4800, can have a safe stay

Government should also consider introduction of allowances on tour on percentage basisi with reference to Lodging rates.

The scrapping of small family norms increment is not justified with the reasons putforth by Commission. This requires re-consideration under social security angle since the population control has taken a beating in the implementation stage. The revival of SFN/FPA should be continued at a lumpsum amount for all the cadres

There is a loss for the employee of Grade Pay 1900 having Basic Pay above 7440 in 6th CPC, he was getting TA @ 1600 which comes at present (including DA) Rs 3504/- but now he/she will have just Rs. 1350/- there is loss of Rs. 2154/-

Worst Pay Commission it is. Commission only favor to Class-I officers. Generally, Group-D & Lower C class employees.take GPF advances for fulfill their need i.e. Bhaat Ceremony etc but now they will have to Pay interest for this on taking advances from their own GPF.

Rate of TPT should be equal to all as every one pays the same price for fuel.

WHY THERE SHOULD BE DIFFERENCE IN TRANSPORT ALLOWANCE TO BE PAID TO CG EMPLOYEES, WHEN EVERYBODY IS PAYING THE SAME PRICE FOR PETROL/ DIESEL IN UTILISING 2 WHEELER / 4 WHEELER TRANSPORT MODE FOR COMMUTING BETWEEN OFFICE AND HOME.

TA SHOULD BE PAID EQUALLY TO ALL EMPLOYEES IRRESPECTIVE OF CLASS/ CATEGORY OF CITY.

Rate of this allowances must be equal all over India & whole amount including DA must be exempted from Income Tax.

Recommendation of 7th cpc for TA is well described and practical than earlier pay commission.

Thanks

WHY THERE SHOULD BE DIFFERENCE IN TRANSPORT ALLOWANCE TO BE PAID TO CG EMPLOYEES, WHEN EVERYBODY IS PAYING THE SAME PRICE FOR PETROL/ DIESEL IN UTILISING 2 WHEELER / 4 WHEELER TRANSPORT MODE FOR COMMUTING BETWEEN OFFICE AND HOME.

TA SHOULD BE PAID EQUALLY TO ALL EMPLOYEES IRRESPECTIVE OF CLASS/ CATEGORY OF CITY.

I was retired from doordarshn and I was PB -3 Total including of GP my salary was 40130/- ( GP WAS RS 5400/-) I was retired on 31-12-2014 . request pl. calculate my pension as per 7th cpc.

I was retired as Sub Maj Hony Capt on 30.09.2009 after completing 04 yrs service as Sub Maj but could not complete 28 yrs of service due to rules & regs applicable to a Sub Maj. My pension was fixed ad Rs 15412.00 . Now in rev orop Hony Capt is not reflected below 28 yrs of service and hence what will be my revised pension.

Travelling Allowance should be equal for everyone as everybody has to travel to the office either by bus/train/two wheeler / four wheeler and expdr is same for everyone whether he is getting higher or low paid wages indl. There should not be any difference as everybody is paying same price for petrol/deisel

Travelling Allowance should be equal for everyone as everybody has to travel either by two wheeler/four wheeler and rates of petrol are similar for who are taking higher pay or low paid wages

transport allows. union budget 2015 mai 800 se 1600 nahi kiya gaya hai balki income tax mai ab 800 ki jagah 1600 tak tax free hai

Transport allawnce increase from800 to 1600 in 2015 union buzzet .but from which date effect? Have any deceleration given by FM.

Sir, sabhi logo ka ta duguna ho jata hai Y city se X city me jane par. Lekin 400 wale ka 600 hi kyon? Kya 400 wale kuchh bol nahi sakte ya nichale post par hote hain isiliye… Aisa bhedbhaw kyon kiya jata hai? Plz reply sir.

Transport allawnce increase from800 to 1600 in 2015 union buzzet .but from which date effect? Have any deceleration given by FM.

Respected sir, Car is the major transport to reach to office according to seniority/class/rank allowances must be kept.

we are all happy because the central govt. taken good decision about the retirement