7th CPC Transport Allowance Rate Chart [Conveyance Allowance] TPT Allowance Calculation, Deduction, Taxable Rules 2025

7th CPC Transport Allowance Rate Chart: Transport Allowance (TA) is a type of allowance given to employees to cover their transportation expenses while commuting to and from work. It is a fixed amount paid by the employer to the employee as a part of their salary package. The purpose of this allowance is to provide some relief to employees from the ever-increasing fuel prices and transportation costs.

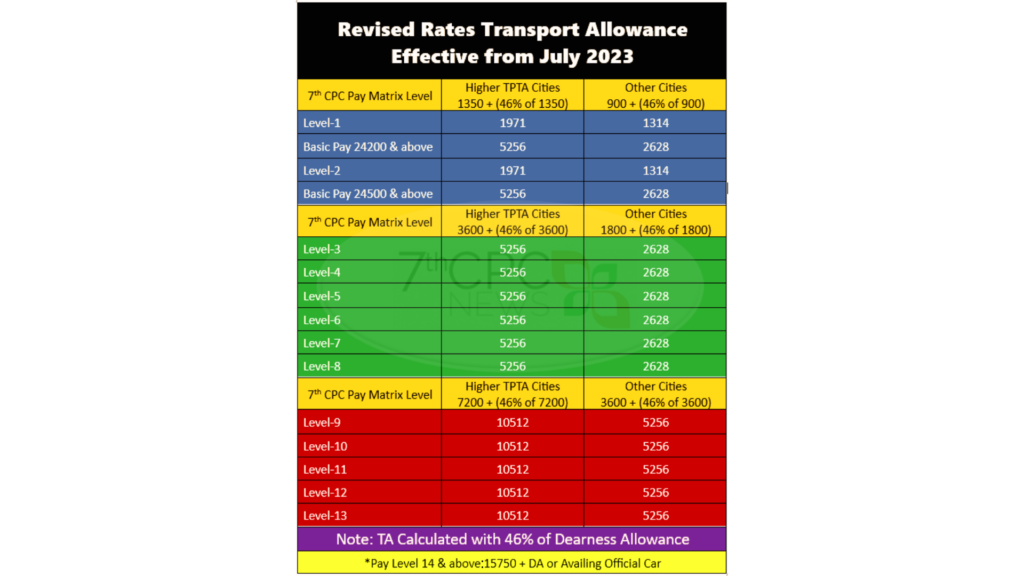

7th CPC Transport Allowance Rate Chart 2025

Many people often confuse Transport Allowance with Travelling Allowance (TA). However, the two are different from each other. Travelling Allowance is paid to employees when they are required to travel for official work, such as attending a conference or a meeting in a different city. On the other hand, Transport Allowance is paid to employees as a part of their regular salary package to cover their daily commute to the workplace. While Travelling Allowance is reimbursed based on actual expenses incurred, Transport Allowance is a fixed amount paid monthly or annually.

DA 53% from January 2025

Latest Update on DA Hike in January 2025: The Union Cabinet Committee decided to provide the Dearness Allowance at the rate of 53 percent from January 2025 to all Central Government employees and pensioners. [Click to know more] The revised rates of transport allowance for all groups of Central Government employees as per the 7th pay commission.

Revision of Transport Allowance from January 2025

Pay Matrix Level 1 and 2

- Other Cities: 900 + 50% of DA

- TPTA Cities: 1350 + 50% of DA

Pay Matrix Level 3 and 8

- Other Cities: 1800 + 50% of DA

- TPTA Cities: 3600 + 50% of DA

Pay Matrix Level 9 & above

- Other Cities: 3600 + 50% of DA

- TPTA Cities: 7200 + 50% of DA

How to calculate Transport Allowance in basic salary?

The computation method for the Transport Allowance on Basic Salary, in accordance with the 7th pay commission’s proposals, has been implemented from the 1st of July, 2017. The monthly calculation formula for determining the Transport Allowance is as follows: A is the rate of Transport Allowance and D represents the percentage of the current Dearness Allowance.

Transport Allowance = A + [(A x D)/100]

To calculate the Transport Allowance, you can use this formula: [(Dearness Allowance x Rate of Transport Allowance)/100] + Rate of Transport Allowance. As an illustration, if a worker is in pay level 6 and earns a basic salary of Rs. 49,000 while working in Metro, their monthly Transport Allowance would be Rs. 4212. This is derived by adding 3600 to the product of 3600 and 17 divided by 100.

Transport Allowance Enhanced to Pay Matrix Level 1 and Level 2

According to the order issued by the Department of Expenditure on 2nd August 2017, employees who are drawing of Rs. 24,200 and above in Pay Matrix Level 1 and Level 2 shall be eligible for grant of Transport Allowance at the rate of Rs. 3600 plus Dearness allowance per month for metro cities and Rs. 1800 plus Dearness allowance per month for all other cities.

Amendment order regarding Transport Allowance on 2.8.2017 (7440 issue settled) – Click to View the Order

Transport Allowance Calculation Formula

DA on Transport allowance calculation: The existing percentage of Dearness allowance is applicable for Transport allowance also. Apart from the amount of Transport allowance, the specific percentage of Dearness allowance will be calculated from the rate of TA and added to the Transport Allowance. A simple formula is given below for better understanding the calculation:

Amount of Transport Allowance = TA + [(DA% x TA)/100]

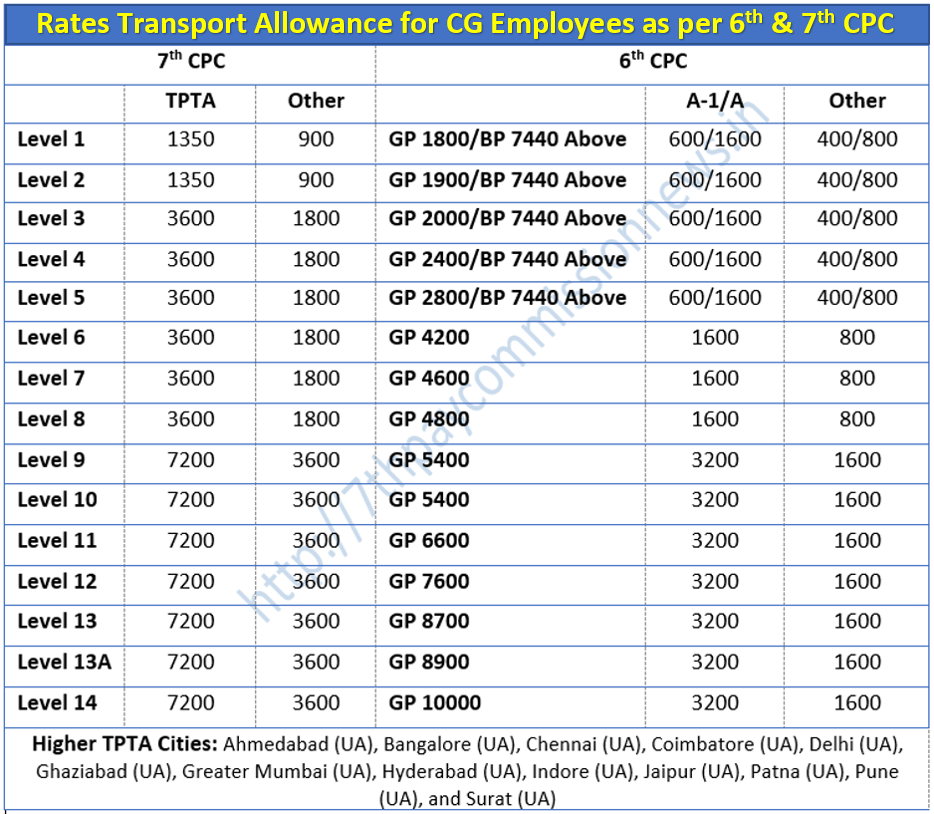

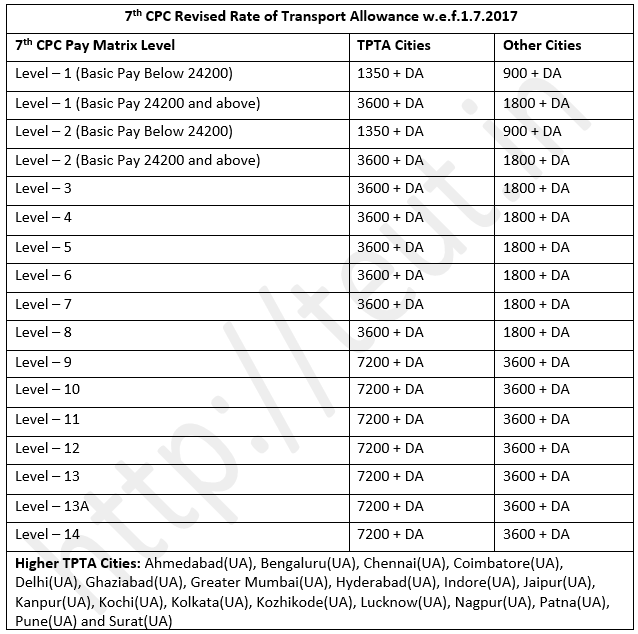

| Rates Transport Allowance as per 7th CPC | ||

| 7TH CPC PAY MATRIX LEVEL | TPTA CITIES | OTHER CITIES |

| Level-1 (Basic Pay Below 24200) | 1350 + DA | 900 + DA |

| Level-1 (Basic Pay 24200 and above) | 3600 + DA | 1800 + DA |

| Level-2 (Basic Pay Below 24200) | 1350 + DA | 900 + DA |

| Level-2 (Basic Pay 24200 and above) | 3600 + DA | 1800 + DA |

| Level-3 | 3600 + DA | 1800 + DA |

| Level-4 | 3600 + DA | 1800 + DA |

| Level-5 | 3600 + DA | 1800 + DA |

| Level-6 | 3600 + DA | 1800 + DA |

| Level-7 | 3600 + DA | 1800 + DA |

| Level-8 | 3600 + DA | 1800 + DA |

| Level-9 | 7200 + DA | 3600 + DA |

| Level-10 | 7200 + DA | 3600 + DA |

| Level-11 | 7200 + DA | 3600 + DA |

| Level-12 | 7200 + DA | 3600 + DA |

| Level-13 | 7200 + DA | 3600 + DA |

| Level-13A | 7200 + DA | 3600 + DA |

| Level-14 | 7200 + DA | 3600 + DA |

TPTA Cities: *Ahmedabad (UA), Bengaluru (UA), Chennai (UA), Coimbatore (UA), Delhi (UA), Ghaziabad (UA), Greater Mumbai (UA), Hyderabad (UA), Indore (UA), Jaipur (UA), Kanpur (UA), Kochi (UA), Kolkata (UA), Kozhikode (UA), Lucknow (UA), Nagpur (UA), Patna (UA), Pune (UA), Surat (UA).

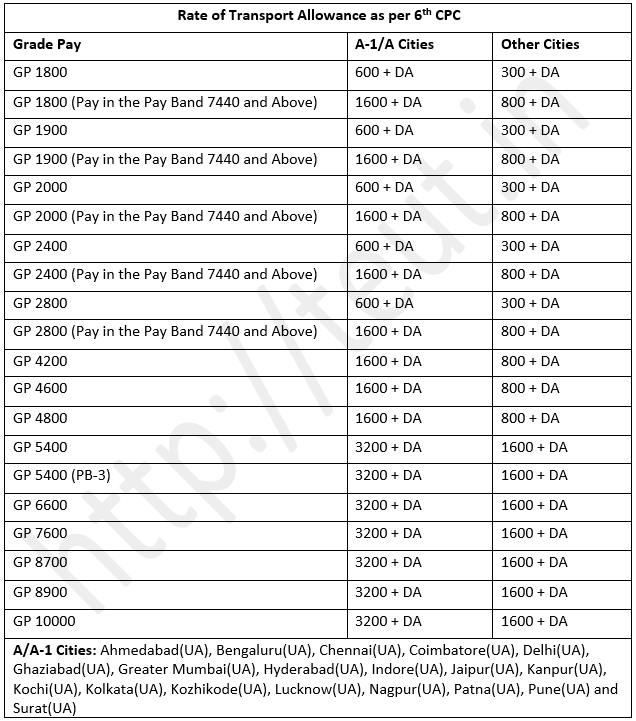

| Rates Transport Allowance as per 6th CPC | ||

| 6TH CPC GRADE PAY | A1/A CITIES | Other Cities |

| GP 1800 | 600 + DA | 300 + DA |

| GP 1800 (Band Pay 7440 and above) | 1600 + DA | 800 + DA |

| GP 1900 | 600 + DA | 300 + DA |

| GP 1900 (Band Pay 7440 and above) | 1600 + DA | 800 + DA |

| GP 2000 | 600 + DA | 300 + DA |

| GP 2000 (Band Pay 7440 and above) | 1600 + DA | 800 + DA |

| GP 2400 | 600 + DA | 300 + DA |

| GP 2400 (Band Pay 7440 and above) | 1600 + DA | 800 + DA |

| GP 2800 | 600 + DA | 300 + DA |

| GP 2800 (Band Pay 7440 and above) | 1600 + DA | 800 + DA |

| GP 4200 | 1600 + DA | 800 + DA |

| GP 4600 | 1600 + DA | 800 + DA |

| GP 4800 | 1600 + DA | 800 + DA |

| GP 5400 | 3200 + DA | 1600 + DA |

| GP 5400 | 3200 + DA | 1600 + DA |

| GP 6600 | 3200 + DA | 1600 + DA |

| GP 7600 | 3200 + DA | 1600 + DA |

| GP 8700 | 3200 + DA | 1600 + DA |

| GP 8900 | 3200 + DA | 1600 + DA |

| GP 10000 | 3200 + DA | 1600 + DA |

7th Pay Commission Travelling Allowance Chart

Which cities fall under the higher TPTA classification?

According to the 7th pay commission’s recommendations on Transport allowance, there are 19 cities grouped into the A1 category including Ahmedabad (UA), Bengaluru (UA), Chennai (UA), Coimbatore (UA), Delhi (UA), Ghaziabad (UA), Greater Mumbai (UA), Hyderabad (UA), Indore (UA), Jaipur (UA), Kanpur (UA), Kochi (UA), Kolkata (UA), Kozhikode (UA), Lucknow (UA), Nagpur (UA), Patna (UA), Pune (UA), Surat (UA).

Which cities are classified as A1 category?

These cities, namely Ahmedabad, Bengaluru, Chennai, Delhi, Greater Mumbai, Hyderabad, Kolkata, and Pune, have been categorized as ‘X Class’ Cities for the HRA.

How to calculate the Transport allowance?

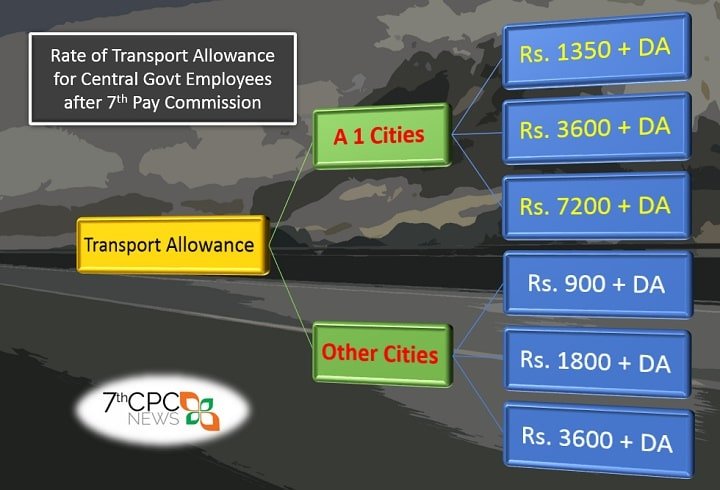

The Transport allowance is determined based on the rates set by the Government, which are subject to change over time. Currently, it is divided into two categories – A1 Cities and Other cities – and then further subdivided into three categories within each pay level.

What is the current rate of Transport Allowance?

The range for the Transport Allowance is between Rs. 900 and Rs. 7200. These rates are determined based on the pay matrix level, which includes Rs. 900, 1350, 1800, 3600, and 7200 for the Transport Allowance.

Is DA included in Transport Allowance?

The Dearness Allowance percentage is determined based on the Transport Allowance amount and includes the combined value of both.

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

Leave a Reply