6th Pay to 7th Pay Calculator for Central Government Employees

First Basic Salary Calculator in India!

Disclaimer: Please note that this 7th CPC Pay calculator provides approximate figures based upon the 7th Central Pay Commission Gazette Notification and the data submitted by the reader. For exact information, please refer to the CCS Revised Pay Rules 2016. Calculate your new salary with our 7th Pay Commission Pay Matrix Table for Central Govt Employees today!

First Basic Salary Conversion Calculator in India!

7th Pay Commission Pay Scale Calculator: Introducing the 7th Pay Commission Pay Matrix Table for Central Govt Employees: Discover the first-ever Basic Salary Calculator in India designed for Central Government employees. Our online tool helps you calculate your revised or new salary and allowances in line with the 7th Pay Commission recommendations. Over one crore users have already benefited from this accurate and convenient calculator. We offer a free 7th Pay Commission Salary Calculator download for Central Government employees as well as a 7th Pay Commission Calculator online. You can also access the 7th Pay Commission pay scales with our pay matrix table.

The 7th Central Pay Commission (7th CPC) submitted its report to the Finance Minister on 19th November 2015. Since then, the Pay Matrix Table has become a hot topic among all Central Government employees and Pensioners. According to the 7th CPC Report, there were 33,01,536 CG employees in service as of 1.1.2014, including 91,501 Group ‘A’ Officers, 2,80,892 Group ‘B’ Officers, and 29,29,143 Group ‘C’ employees.

The 7th CPC recommended a new pay fixation method that differs greatly from the 6th CPC and proposed a 2.57 fitment factor applicable to all CG employees. Instead of a salary slab system, the commission suggested a new Pay Matrix System. Pay and arrears-related revisions have been effective since 1.1.2016.

Basic Pay Converter (6th CPC to 7th CPC)

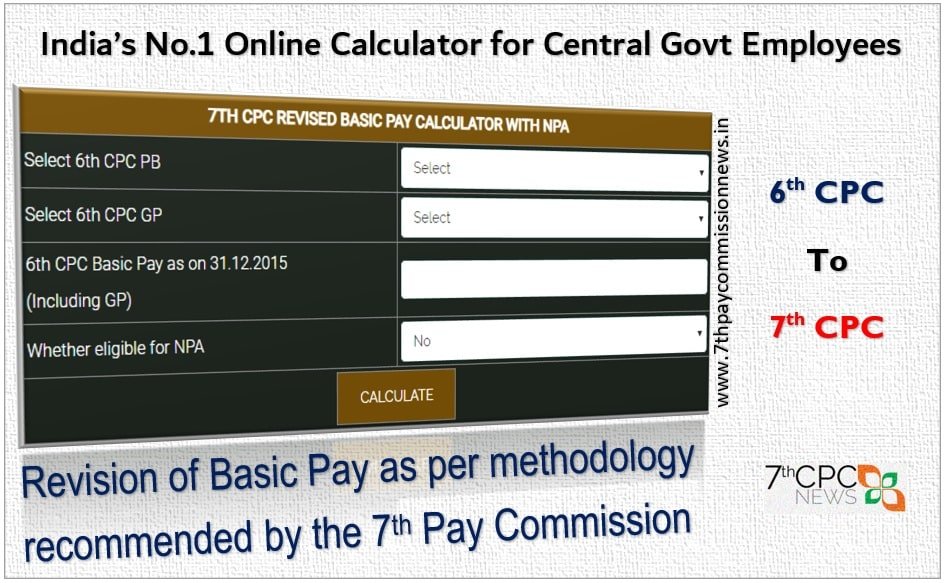

Our online tool, the Basic Pay Revision Calculator, is specifically designed to assist Central Government employees in determining their revised and new basic pay following the implementation of the 7th Pay Commission recommendations. This free tool requires the input of an individual’s pay details and effectively calculates their next basic pay, providing them with an excellent opportunity to convert their current basic pay to a revised basic salary from 1.1.2016. However, calculating the new basic pay of an individual can be somewhat challenging given the abolishment of the grade pay system and the introduction of a new pay structure known as the ‘Pay Matrix Table’, which is entirely new for Central Government employees. To simplify this process, we have thoroughly reviewed the 7th pay commission report and developed a user-friendly tool that is tailored to meet the needs of CG employees.

How to calculate the 7th CPC revised pay scale?

To calculate the 7th CPC revised pay scale, follow these instructions as recommended by the 7th Pay Commission. Determine your basic pay (including grade pay) as of 31.12.2015. Multiply your basic pay by a fitment factor of 2.57 and round it off to the nearest rupee. Then, refer to our Matrix Pay Table and select the Level corresponding to your Grade Pay. Lastly, select either the same pay or the next higher pay in the corresponding Matrix Level. To use our calculator, select your Pay Band and Grade Pay, enter your Basic Pay (as of 31.12.2015, including Grade Pay), and if eligible, select NPA. Click the ‘Calculate’ button, and the calculator will display your revised basic pay calculation detail as of 1.1.2016 with the pay matrix table.

7th Pay Commission Salary (Pay Scale) Calculator Download

| Pay Scale Calculator Type | Conversion from 6th CPC to 7th CPC |

| Pay Scale Calculator Beneficiaries | Central Government Employees |

| Pay Scale Calculator Introduced | August 2016 |

| Pay Scale Calculator Updated | December 2017 |

| Pay Scale Calculator Inputs | Pay band, Basic pay, Grade Pay, and NPA |

| Pay Scale Calculator Results | Basic pay conversion as per 7th CPC |

| Pay Scale Calculator Method | Prescribed in the 7th Pay Commission Report |

| Pay Scale Calculator Feature | Basic pay indication in 7th CPC Pay Matrix Table |

| Software Language | HTML, Java, and PHP |

| Developed by | TEUT Digital Concepts |

How to Fix Basic Salary as per 7th CPC in Calculator?

To determine your revised basic pay under the 7th Central Pay Commission (CPC) structure, you can utilize a calculator that allows you to input your pay band, grade pay, and basic pay as of January 1, 2016, under the 6th CPC regime. Upon clicking the Calculate button, the tool will display your updated basic salary with the pay matrix table. This calculator also has the additional feature of showcasing the complete pay matrix table, which is a useful resource for Central Government employees. It is worth noting that many prominent websites in India have provided a direct link to this calculator on their platforms.

New Salary Calculator July 2023 with 46% DA

Check Your Latest Expected Salary Package after the announcement of the Dearness Allowance with 38% of DA + Revised HRA and TA Rates.

What is the Basic Pay Revision Calculator?

The Basic Pay Revision Calculator is an online tool designed to help Central Government employees determine their revised and new basic pay following the implementation of the 7th Pay Commission recommendations.

How does the Basic Pay Revision Calculator work?

The tool requires the input of an individual’s pay details and effectively calculates their next basic pay, providing them with an excellent opportunity to convert their current basic pay to a revised basic salary from 1.1.2016.

How can I fix my salary in the 7th Pay Commission?

Your salary should be fixed on the methodology approved by the Central Govt as per the recommendations of the 7th Pay Commission. 2.57 is the common fitment factor for all groups of Central Govt employees. Your basic salary as of 31.12.2015 with multiply 2.57 and the figure will match the pay matrix of your entitled pay level.

Is the 7th Pay Commission Pay Scale Calculator the first Basic Salary Calculator in India?

Yes, the 7th Pay Commission Pay Scale Calculator is the first-ever Basic Salary Calculator in India designed for Central Government employees News [www.7thpaycommissionnews.in].

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

How to fix pay of an Assistant Professor of a college in Maharashtra State who was promoted from stage I (Rs 6000) to Stage II (Rs 7000) on 15.04..2024.

Please enlighten the subject:-

If an Senior Resident doctor has been appointed on 01.10.2020( on contract basis for three years). As per rules the Earned leave should be credited as 2.5 for every completed month i.e. 3 months X 2.5=7.5 (rounded off to 8 Earned leaves). After completion of three years contract period his services are terminated and he has been credited the Earned Leave as:-

01.10.2020 to 31.12.2020 = 8 Earned Leaves

01.01.2021 to 30.06.2021 = 15 Earned Leaves

01.07.2021 to 31.12.2021 = 15 Earned Leaves

01.01.2022 to 30.06.2022 = 15 Earned Leaves

01.07.2022 to 31.12.2022 = 15 Earned Leaves

01.01.2023 to 30.06.2023 = 15 Earned Leaves

01.07.2023 to 30.09.2023 = total completed months 3 X 2.5 = 7.5 (rounded off to 8)

As such his total Earned Leave becomes 91 days (however he has rendered 3 years service only and normally 90 days Earned leave can be earned during the 3 years of service). Please cast some light on this issue with rule position. Thanking you in anticipation.

My mother is receiving Civil Defense family pension. How do I know which Pay level she is in? I have the PPO order.

As per her basic family pension multiply by two and see in MATRIX LEVEL Table it is yours father’s pay as per the 7th Pay Commission. But minimum family pension is Rs.9000/- fixed.

My basic was 9690/- as ACC on 01/07/2010 (5200-20200/2000)

Self promoted as Goods Guard on 07/05/2011

Self promoted as Sr.Goods Guard on 01/11/2013

What will be my basic today….

Please help with reference RBE.

I will be grateful to you

good evening all,

i am working as assistant professor in Telangana state in state job but with UGC scale, kindly give reference pdf for transport allowance in UGC PRC 2016 for disabled persons.

thank you

Sir

I am a Maharashtra government employee working as Professor. My date of appointment is 02/01/2002. My date of increment in 6th pay is 1St July. My basic pay (including grade pay) as of 31.12.2015 is 36030 so my 7th pay on 1/1/2016 is 95300. On 02/01/2016 I become an associate professor with AGP 9000. Kindly tell me the date of the next increment.

1st July 2016.

sir as on 31.12.2015 my pay was 7430rs please what pay will fix in 01.01.2016 please clarify my problem sir

Is it grade pay included 1800 Level 1 it will be 19100, if 1900 included level 2 1900 it will be 19900, if 2000 in level 3 it will be 21700, if 2400 in level 4 it will be 25500 & it will be 2800 in level 4 it will be 29,200.

My date of joining is 19.1.2009 and my increment date is 1/7/2010 and I have lost one increment. My due date for macp is 19/1/2019 . Current pay as on date is 19/1/2019 is 42300. Please suggest me for next date of increment month is Jan or July to make option and please post my pay as on date on 1/7/2021 includes macp and in increments and along c choice of increment.

My date of birth is 28/2/1984 for information.

January increment option is good so as on 1-7-19 as 43600 in MATRIX LEVEL 6 & from January, 2020 as 44,900 in MATRIX LEVEL 7.

Thanks for the reply sir, I have a macp due date on 19/1/2019 and increment due date is also on 1/7/2019. How my pay is fixed with according to macp and increment due date. So my pay will be fixed under macp from that date or not. Why would be from jan 2020 on level 7.

As per the rule CSS 10 six months pay should completed so your normal increment on 1-7-19 and promotional increment of option from January 20 in higher MATRIX LEVEL basic pay fixation. Pay changed from MACP date. If you give July increment option benefits be given from 1-7-20 it is loss of six months pay.

Ok Sir thanks for your valuable information and comment

Suppose if any female Govt. Employee takes CCL but later she qualifies the test and get selected in other department then is it possible for that individual to avail CCL in other department ? It must also be cleared that is it possible anyway for any Govt. Employee to take more than 750 CCL in both various services.

No, Because all your leave entries have been recorded in the service book…if you are continuously service, then this will be NO……if service does not count, in this case, you can avail again…

Hi, I joined service on 20january 2015. As per 6th cpc, my increment was due on 1.7.2016. My 7th cpc pay fixation was done as on 1.1.2016. Will i be granted one increment on 1.1.2016? Previously my department had granted one increment at the time of fixation i.e. on 1.1.2016 and another increment was applied on 1.7.2016. Since then, my pay fixation has been revised and recovery has been made from me on account of excess payment due to early increment grant. I am unable to get clarification on this. What should i do? My increment date is 1st july as of now.

It is correct. That was administration mistakes.

I had opted for pay fixation under Fr(22)1a in the lower grade in July 2016 (DNI) as I had been promoted in Feb 2016. Can I re-excersise to fix my pay in Jan 2017 as per the office memorandum

No you’re benefited in higher next Grade pay of 6th CPC from 7/2016 already given & also 2.57 multiply by basic pay of 31-12-2015. If you’re giving January increment you will be eligible from January 2018 of 7th CPC next MATRIX LEVEL stage of located basic pay.

Entry level pay benefits for chargeman not granted for me i am retired on 31-08-2007 ordnance factory service 33 years and 4 months plz reply

Sir mai itna janana chahata hu ki jo log retired ho rahe hai, aur DA increase nahi ho raha hai to jo lumsum amount basic amount ke saath DA calculate kiya jata hai retired pe milta hai uski calculation kis percentage pe di jayegi , koi next year July 2021 me retired hoga to kya 17 percent DA ko jodkar calculation ki jayegi ya ya jo ab Tak da increase hua hai uske adhaar pe di jayegi, aur sir leave encashment me group X pay add kiya jata hai ya nahi.please sir clarify this.

I join as group d (Field worker) on 16.12.1999, deployed as lasker on 23/08/2005 with basic pay 5200-20200+1800 and promotion as Supervisor by departmental examination on 09/01/2009 in grade pay of Rs.1800/-, after 10 years as supervisor given acp on 09/01/2019 in grade pay of Rs.1900/- please I would like to know the pay fixation of my salary as per the 7th pay cpc and arrears

please give in details

You have mentioned. Pay scale of you since you have joined in 5 th CPC so inform your basic pay as on 31-12-2015.

SIR MY FAMILY PENSION WAS FIXED RS.2122 ON 1999 I AM DRAWING MY FAMILY PENSION FROM 2005 JUNE. WHAT IS THE BASIC PAY AS PER THE 6TH PAY COMMISSION. KINDLY HELP ME SIR. IN 2005 DEC MY FAMILY PENSION WAS 3183(BASIC) + 21% DA

Mention the pensioner last basic pay with scale of pay.

Revision of basic pay wef01-01-2004 -2005after50%DAmergerd in basic pay is not clear. Basic pension fixed after50%DA merger hasnot been revised in the parent deptt. PAO office wef01/04/2004,6thcpc&7thcpc scale grade is under process , information is yet to receive fromCSMRS ,MOWR palme marg new delhi. DIR.CSMRS hasbeen informed but not replied yet.Iam receiving pension in old scale and grade with out 50%DAmerger inbasicpay wef01-01-2004.So kindly revise pension and arrearasper7thcpc pre206latest amendment before August 2020.Hoping for justice to revise pension./arrear payment.

As per your basic pay pension will be credited. 50% Dearness pay was merged in 6th CPC and give as GRADE PAY. So arrears question does not arise.

Hello Sir,

I am a Central Govt Employee in Survey of India, Approximately one year before, in 7th CPC, I was holding the post of UDC in Pay Level 5 (got 2nd MACP on 3rd May, 2014 i.e. in 6th CPC Scenario), and was drawing Basic Pay of Rs.40,400/- as on 1st July, 2018 in Pay Level-5 with the date of next increment w.e.f. 1st July, 2019.

Subsequently, I was promoted to the post of Assistant on regular basis w.e.f. 22-05-2019 in the Pay Level-6. I gave my option to my deptt. for my pay to be fixed from date of next increment i.e. 1st July, 2019 under provisions contained in FR 22(I)(a)(1). My deptt fixed my pay as follows:-

(1) As on 22-05-2019 = Rs. 41,100/- p.m.

(2) As on 01-07-2019 = Rs. 42,300/-p.m.; and next accrual increment would be w.e.f. 1st July, 2020.

Sir, in my purview which appears and seems to be totally incorrect.

Therefore, it is requested to kindly enlighten and clarify the correct fixation of my pay i.e. on the following dates:-

1. W.e.f. 22-05-2019 to 30-06-2019,

2. As on 01-07-2019,

3. As on 01-01-2020,

4. As on 01-07-2020; &

5. As on 01-01-2021

I shall be very grateful and obliged to you forever.

Thanking you in anticipation.

You have to give option increment for January so that you may get normal increment same matrix level 6 of Rs.42,300/- on 1-7-2019 & from January 2020 onwards Rs.44,900/- in level 7, if you’re basic pay as on 25-6-19 of Rs.41,100/- in level 6. DNI on 1-1-2021 as Rs.46,200.

Good Morning Sir,

In my purview, according to the option already given in my deptt., at my present situation, the correct fixation of my Basic Pay will be as follows:-

(1) As on 22-05-2019 must be Rs.41,100/- (which my deptt. already fixed very correctly).

(2) As on 01-07-2019 must be Rs.43,600/- (i.e fixation from the date of next increment, as per my option already given in my Deptt.).

(3) As on 01-01-2020 must be Rs.44,900/-.

(4) As on 01-01-2021 must be Rs.46,200/-.

Sir, it is once again requested that kindly let me know, is it correct or not?

Thanks.

If you are been fixation on 22-5-2019 increment will not been given on 1-7-19 since you have not completed six months same basic pay & increment on 1-7-20 only. It is also as per 6th CPC Rule.

Good Morning Sir,

Please clarify the following in the light of CCS pay rules 2016 (i.e. in 7th CPC Chronology). As every OM issued by Govt. of India after implementation of 7th CPC, which nothing mentioned clearly regarding benefit of rule FR22(I)(a)(1) i.e. on the methodology of pay fixation “on direct promotion” or “on regular promotion which comes after MACP” of a Govt. Servant. Rather, every OM only indicates/shows words “promotion/upgradation” which is confusing. Therefore, it is once again requested you to kindly clarify –

(1) Is there any different method of pay fixation on –

(i) direct promotion from one pay level to another, at present, in 7th CPC Chronology?; and

(ii) regular promotion after MACP from one pay level to another, at present in 7th CPC Chronology?

and if so, is there any kind of pay fixation rule presently exist, related to above, in 7th CPC Chronology? Then please quote Govt. of India’s OM or Pay fixation Rule in detail, specifically for those –

(i) who had already got MACP in 6th CPC and now getting regular promotion in 7th CPC (i.e. on change of pay level); and

(ii) for those who got MACP after 01-01-2016 (i.e. in 7th CPC) and then now getting regular promotion (i.e. on change of pay level).

Or

(2) In 7th CPC Chronology, when there will be change in pay level (i.e. from one pay level to other) i.e. on direct promotion or upgradation or regular promotion after MACP-

Could we get benefit of rule FR22(I)(a)(1) every time, i.e. on fixation of pay? or it will be applicable on getting direct promotion only (i.e. not on regular promotion after MACP), in 7th CPC Chronology.

You can see the subsequent revised pay fixation F.R.22(I)(a)(1) under G.S.R.370 subsequently revised dated 19-11-2018.

you are absolutely right

In revised pay fixation for pre 1.1.2016, NPA and special pay are included or not for notional fixation? I reired on 1.4.2014 , scale was 37.400-6700 Pay band 10.000. Basic salary was 60940 +NPA 15235 +_ Spl pay 2000 . Now revised notional fixation is 157900 and pension remains the same as it cannot be reduced. Had NPA and Spl. pay added to basic and then notional fixation would have been done, pension would have been higher. Youe opinion????

For pension purposes any other allowances should not be added. Only 50% of basic pay.

My basic pay is (13410 + 4200-gp) = 17610=00 as on 01.01.2016

I got promoted to next higher level with GP 4600=00 on 08.07.2016

I would like to know the pay fixation of my salary as per the 7th pay cpc and arrears

please give in details

Your period of promotion comes under option 6th CPC, but you are asking for the 7th CPC Pay so it was not benefited to you because 6th CPC pay more. As per 7th CPC you may be got Rs.47,600/- from 1-1-2017. only. If you have got the amount should refund the old already got in GP 4600 from 8-7-16.

1-50%DA hasnot been merged with basic payRs5664/ retiredondate31/03/2004asper latest amendment of centralgovt.w.e.f.01/04/2004

2-50%DA merged withbasicpay of centralgovt.employees andpensioners w.e.f01/04/2004.

3-Iam getting pension asperoldscale of Research OfficerRs8000-13500 but 6thcpc&7thcpc pay &grade pay hasnot been received as per latest amendment of Central Govt.

This is to inform you that from 1-1-2004 your basic pay was merged with 50% D.A. was Dearness Pay. That was merged in 6th CPC from 1-1-2006. So you have to less 50% D.A (as D.P). from your basic pay that is your basic pay. From 1-1-2006 as per your Grade pay rs.5400 (as per scale) plus last basic pay 50% as your pension. If you are not received revised pension (minimum Rs.26,550/-) from 1-1-2016 and arrears you have to contact your Ex-Employer.

Sir,

I have joined as Protocol Officer on 01.01.2016 in the scale of Rs. 9300-34800 G.P. 4200/-. Prior to that I am drawing my salary in the scale of pay Rs. 5200-20200/- G.P. 2800/-. After joining as Protocol Officer on 1.1.2016 my pay was fixed Rs. 13,380/- G.P. 4200/-. . Kindly fix my pay as on 1.1.2016 after the implementation of 7th pay commission.

Rs.35,400/- from 1-1-2016.

I WAS SUPERANNUATED AS ON 30TH JUNE 2018, AS PROFESSOR.

MY LAST BASIC WAS 70000 INCL GP.

WHAT SHOULD BE MY NEW BASIC IN THE 7TH PAY FOR CALCULATIONS AND ARREARS.

I HAVE TO GET ARREARS FROM JAN 2016 TO JUNE 2018, EQUAL TO 30 MONTHS.

Pension from 1-1-2016 as rs. 35,550/-. Arrears calculate you already got basic pension amount minus from the amount for 30 months.

I have been selected as Jr.staff Nurse under sro 202 of 2015, under pay scale of level 4 (25500-81100) what will be my starting salary

I join as group d on 12.01.1994 in cbi, promotion as ldc by departmental examination on 18.04.2000 in grade pay of Rs.1900/-, after 10 years as ldc given acp on 18.04.2010 in grade pay of Rs.2000/- and promotion on 27.01.2020 as udc. presently my pay Rs.35000/- what pay after fixation of pay as udc on 27.01.2020.

Since you got two promotions in 20 years of service now there is no pay benefits only your designation changes higher. You will get 3rd MACP on completion of 30 years service from January, 2025 as Matrix Level 4 ( GP 2400).

Dear sir . Pensioners when get msp 5200 pre 2016 pensioners

I retired SUB & Hony LT on 31.1.2005. What is my pension as on date

Hello Sir,

I am at highest pay level in my gp 10000 since July 2011. with basic pay 77000.Please provide information about stagnation increment. And how much advance increment i will get in 2016 due to stagnation .

Dear sir/madam,

my mother family pension 9000 per month,

as per new DA-wef july-2019, how much it will increase and when it will credit to account

.

D.R.From July 5% of increased as rs.450/- p.m. total D.R.12% i.e. Rs.1080/- (9000+1080 = 10080) Arrears for 4 months from July to October,as rs.1,800 or as per order to be released if in October 450/- will be included & arrears get 3 months as 1350/-.

Kindly calculation my Basic pay the detail are as under:

1- basic pay on 31-12-15 =9680/- Gp=1800

2- MACP due on = 01-5-2016

3- my promotion as a clerk on 13-4-2017

4- my promotion as a Sr.. Clerk on 09-10-2019

, please send me the fixation from 1-1-2016

Your basic pay as on 31-12-2015 Rs.9860×2.57=25340.20 rounded to MATRIX LEVEL 1 as Rs.25600 and. From MACP as on 1-5-2016 as Rs.26400/-. No increment on 1-7-16 since you have already got advance increment and next increment as on 1-7-17 as rs.26800 in MATRIX LEVEL 2, increment as on 1-7-18 as rs.27600 & I’rom 1-7-2019 as rs.28400/-. This is to inform you that since the 7th CPC no promotional pay benefits, so only you’re designation changes higher. Now your designation from 13-4-17 as Clerk and from 9-10-2019 as Sr.Clerk no pay fixation for these promotions. Your next MATRIX LEVEL 3 from 1-5-2026/36on completion of 20/30 years of servicer respectively.

Sir,In Dec 15 basic of all of my batch mates was 8060/ and grade pay 2000/.

I got promotion on 03 jan 16 and now my basic is 30500/ and my batch mates got promoted later to me 06 months on 01 Jul 16,now their basic is 32300/.

I talk to my organization to fix my basic at par with my batch mates they denied.

Sir kindly suggest me what should I do for the same.

1)Have you got any promotions between your joining duty any promotions other upgradrations of MACP on completion of 10th year on 10-5-2017 ?

2) Mentions your basic pay including GP as on 31-12-2015 also your bench mark position.

My joining date is 10-05-2007 so grade pay 1900 my increment or when start my increment date and how much get total basic pay

1)Have you got any promotions between your joining duty any promotions other upgradrations of MACP on completion of 10th year on 10-5-2017 ?

2) Mentions your basic pay including GP as on 31-12-2015 also your bench mark position.

HI SIR / MAM,

I NEED SPONSORED POST WITH YOUR SITE:

I AM WAITING YOUR POSITIVE RESPONSE

THANKS

Sir,

I am working in IIM Shillong as a Librarian.

My scale of pay was 15600-39100 GP 8000 basic 23730 (March 2016)

As per 7th CPC what will be my pay level. ?

Kindly Inform me, Pls.

As you mentioned in the pay scale of 15600-39100 of basic pay GP 7600 (not 800) of ₹ 23730 X 2.57 = ₹ 78,800 (if increment was 7/15 so you will fix your basic pay in 7th CPC MATRIX LEVEL 12 starting stage as ₹ 78,800,,0 7/17 as 81,200, 7/18 as 83,600 & 7/19 as Rs.88,100/-

I enrolled in the Army on 30 Jul 1968 and retired on 31 Jul 1996 as Sub Gp B and drawing pay ₹ 12268 as on 31 Dec 2015. Please let me know my pay as on today.

Sir

My basic pay in 6th cpc was 28470 as on 31./12/2015. The pay band was

9300–34800. The grade pay was 4600.

I retired from central government on

29/02/2008. What will be my basic pay

In 7th cpc.

I think you retired on 28/2/18 of your last basic pay of 7th CPC. at ₹ 78,800/- 50% of basic Pension as ₹ 39,400/- if you are not got any MACP upgradrations of basic pay from 1/1/2016 to 28/2/2018. You have fixed basic pay as on 1/1/2016 as ₹ 74,300/- increment on 1/7/16 as ₹ 76,500/- & increment on 1/7/17 as ₹ 78,800/-. If you want any other details ?

6th CPC basic pay is 28470.

Date of retirement is 29/02/2008.

7th CPC basic pay……..?

What is your last basic pay (including grade pay) retired as 28/2/2008 ? If you are retired on 28/2/08 how will you get basic pay as on 31/12/15 as ₹ 28,470/-.

Sir,

My basic pay is Rs. 9260 i.e. Rs. 7360(Pay) + Rs. 1900(GP) as on 01-01-2016.

Your calculator clearly shows basic pay is Rs. 24500 (7cpc) as on 01-01-2016.

Please clarify whether your calculator is correct or wrong.

Whether existing HRA slabs as per their location, as on 31-12-2015 would continue to apply from 1-1-2016 to 30-6-2017 ? (till the New HRA slabs replace from 1-7-2017). Some say there shall not be any HRA on new UGC 7th Pay, till 1-7-2017, if it so, is it not against natural justice ? ..Pl Clarify

Check up no D.A. from 1/1/2016 to 30/6/16. O!d H.R.A. is given from to 1/1/2016 to 30/6/17. Since all allowances were given from 1/7/2017 only.

Sir,

REVISED PAY CALCULATION AS PER 7TH CPC GAZETTE NOTIFICATION

(7thpaycommissionnews.in/7th-pay-commission-pay-scale-calculator)

Pre-Revised PB PB-1

Pre-Revised GP 1900

Pre-Revised Pay in PB 7360

Pre-Revised Basic Pay 9260

Pre-Revised BP x 2.57 23798

Level corresponding to GP 1900 Level 2

Revised Basic Pay as on 1.1.2016 24500

Your 7cpc calculator shows Rs. 24500(Revised basic pay) with bunching benefit.. Whether it is correct or not?

Please clarify for our future reference.

23798 rounded off to 24800/- not 24500/-

You have put 1900 & 7360. Instead of this you put 1900 + 9260 it is wrong. 7360+1900 = 7360.

Sir,

P.B. = Rs. 7360

G.P. = Rs. 1900

B.P = (PB + GP) = Rs. 7360 +Rs. 1900 = Rs. 9260

This calculator shows basic pay(7cpc) Rs. 24500

Sir,

The same Calculator format of your website follows as under:

7th Pay Commission Pay Scale Calculator as per 7th CPC Notification

(Revised Basic Pay Calculator as per 7th CPC Gazette Notification)

Enter your 6th CPC Pay details and get your revised pay as per Revised Pay Rules 2016.

7TH CPC REVISED BASIC PAY CALCULATOR WITH NPA

Select 6th CPC PB PB-1 (5200 – 20200)

Select 6th CPC GP GP -1900

6th CPC basic Pay As on 31.12.2015 9260

(Includig GP)

Whether eligible for NPA No

Calculate

The same output calculation follows as under

REVISED PAY CALCULATION AS PER 7TH CPC GAZETTE NOTIFICATION

Pre-Revised PB PB-1

Pre-Revised GP 1900

Pre-Revised Pay in PB 7360

Pre-Revised Basic Pay 9260

Pre-Revised BP x 2.57 23798

Level corresponding to GP 1900 Level 2

Revised Basic Pay as on 1.1.2016 24500

Sir, the revised Basic Pay as on 01-01-2016 shows Rs. 24500 not Rs. 23800.

I hope your 7cpc calculator shows the correct figure.

Please advise me.

9260 x 2.57 = 23798 fixed as 23800 not in next stage 24500. You have added again 1900..

Respected Sir,

My basic pay is Rs. 9260 as on 01-01-2016.

( Pay Rs. 7360 + GP 1900).

Please put my above pay practically in your website 7th CPC revised basic pay calculator. Sir you will see whether my 7cpc basic pay is Rs. 24500 or Rs. 23800.

Thank you very much Sir.

Duration of blood donation schedule time

Sir my basic pay as on 01 January 2016 is Rs. 9260 (7360 + 1900) .

The same had fixed in 7th CPC for Rs. 24500 by giving bunching of stages benefits wef 01 January 2016.

My branch office already submitted the application with the DOE, GOI bunching orders.

But my head office still not granting one bunching benefits and fixed my pay as on 01 January 2016 as Rs. 23800.

Please tell me whether bunching benefits of one increment is applicable in my case or not.

No, you fix basic pay as 1/1/2016 as ₹ 23800/- and from 1/7/16 as ₹ 24500/-.

Basic Pay Consolidation based Pay fixed as Pay after bunching

(G.P. 1900) on 2.57 multiple (Rs.) on 01-01-2016 as on 01-01-2016 (Rs.)

8,990 Rs. 23,104 Rs. 23,800 Rs. 23,800

9,260

(8,990+3%) Rs. 23,798 Rs. 23,800 Rs. 24,500

Please tell me whether bunching benefits of one increment is applicable (Basic Pay 9260) in my case or not as per Office Memorandum of Ministry of Finance, Department of Expenditure, Government of India (vide No. 1-6/2016-IC/E-IIIA, dated 7th February, 2019)

No.

Basic Pay 6th CPC (as on 01-01-2016) = Rs. 8990

ROP 2016 = Rs. 23800

Basic Pay 6th CPC (as on 01-01-2016) = Rs. 8990+3% = Rs. 9260

ROP 2016 = Rs. 24500 (Pay raised because of bunching)

Bunching benefit is applicable vide DOE, GOI bunching OM dated 7th February, 2019

Your is not bunching. Why 3% should be added. That fixation was abolished from 6th CPC.

Sir,

My junior Basic Pay (as 01-01-2016) = Rs. 8990 (6CPC)

CSS ROP 2016 Rs. 8990 x 2.57 = Rs. 23,104 = Rs. 23800 (7CPC)

My Basic pay (as on 01-01-2016) = Rs. 8990 +3% = Rs. 9260 (6CPC)

CSS ROP 2016 Rs. 9260 x 2.57 = Rs. 23798 = Rs. 23800 = 24500 (pay raised because of bunching)

Basic pay Rs. 9260 i.e. 3 % is more than previous Basic pay (Rs. 8990)

As per Page No. 3, Para 9 (i) DOE, GOI O.M. No. 1-6/2016-IC/E-IIIA, dated 7th February, 2019 clearly illustrated one example..

Please suggest me whether bunching is applicable or not for the above case.

This is to inform you that the bunching order shown by you is for the GP 8700 in PB-4 of Rs.46100 + 3% = 47490 it was not in pay of Rs.48,920/- this may noted. Your pay is only Rs.8990/-.

Sir,

My basic pay is Rs. 9260 as on 01-01-2016. My previous basic pay is Rs. 8990. My 7cpc basic pay is fixed at Rs. 23800 on 01-01-2016.

On the other hand, My junior staff basic pay is Rs. 8990 as on 01-01-2016. His 7cpc basic pay is fixed at Rs. 23800.

I am senior from him i.e. 3% increment advance from my junior staff who is working in the same grade pay 1900 and same designation.

As per Page No. 3, Para 9 (i) DOE, GOI O.M. No. 1-6/2016-IC/E-IIIA, dated 7th February, 2019

Where consequent upon fixation of pay in terms of Rule 7 (1) (A)(i) of the CCS (RP) Rules, 2016, two different pay drawn in the pay structure obtaining immediately before 1.1.2016, which were separated by one another by 3% of the previous stage, are fixed at the same cell of the applicable Level of the Pay Matrix effective from 1.1.2016, then the benefit of bunching by way of one additional increment as on 1.1.2016 shall be admissible in respect of the pay which is more than 3% of the previous pay,

My questions : May I applicable to get bunching benefit Rs. 24500 instead of Rs. 23800?

With kind regards

Same my problem

Sir,

I was promoted from the post of Assistant in the grade pay Rs. 4,200/- as Office Superintendent in the same grade pay of Rs. 4,200/-w.e.f 20.4..2019.What is my pay fixation and from which date I have to give Option

If it is upgradation of MACP it will be benefited from the completion of service, 10 years without any promotion. Otherwise no pay fixation only your designation changes from 10.4.2019 no monitory benefits.

My PPO No.239038903696, Basic Pension as on 31.12.2015 Rs.6750. Now as per CPC 7th Basic Pension fixed to Rs.17,348 which now reduced to Rs.15050/-. Please confirm correct Basic Pension.

Your basic pension from 1/1/2016 is Rs.17,450/- (without D.R.). Check up with your bank any Income tax has been recovered in the month of February, 2019 or if any reduced as family pension due to any change. . Contact your pension paying bank.

Sir, Kindly confirm as to whether bunching benefit can be claimed in respect of below mentioned pay fixation as on 1.1.2016. (Ref;OM No.1-6/ 2016-IC/E-IIIA dated the 07th February, 2019)

6th CPC: PB-2 (9,300-34,800) + GP Rs.5,400/- 7th CPC : Level-9(53,100-1,6(53,100-1,67,800)

Pay Consolidation based on 2.57 multiple Pay fixed as on 1.1.2016 Pay after bunching

34,400 Rs.88,400 Rs.90,300/- Rs.90,300/-

35,020 Rs.90001.4 Rs.90,300/- Rs.95,800/-

(34,400+3%)

You may see the reply of D.C.DONGRE on 11/4/2019. It contents so many rules applicable which applies to you may refer.

My basic pension as on 1/2006 is 9170 and as on 31-12-2015 with grade pay 15004-level -6 in paymatrix-entry pay 13500-what is my basic pension as on 1-1-2019-?

01/01/2005. Rs2550(basic) per month+1275(DP)+650.25D.A @ 17%ON BP+DP NEW PAY IN 2019?

Have you not promoted in between 2005 to 2019, if promoted mention that period or your basic pay as on 31/12/2015.

what is the meaning of PAY SCALE (pre-revised) = 9000-16400?

and what will be my CTC & in hand, if company is a government organization?

I retired in rly as guard on. 2-2-1998: now. My. Basic. Pension rs.34058/-is this correct. .in new. Pop in the column written as n/a

PaYOn 31.12.05 rs 6500 in5500-175-9000 scaie. From 1.1 .0 6 scale was upgraded from 4200 to 4600. by mof Order in oct 18 PayWorld not be fixed less than entre Pay rs 12540+ 4600=17140.now Pay of all officials in pre revised sale On basic Pay On 31.12.05

AT stage

from 5500/5675/5850/6025/6200/6375/6550 r fixed rs 17140(12540+4600= 17147). Now officials of stage1 to upto 7th Stage B. P of all officials r fixed rs 17140. How the benefit of bunching would be regulated under 6th Pay commission. In above cases.

Pay Scale in 5th CPC 5500-175-9000 not upgraded as GP 4600 (it is GP 4200 only). Pay Scale of 6500-10500 upgraded as GP 4600 from 1/1/2006. Yours is 6550+4200 = 10750 x 2.57 = 27627.5 fixed at matrix level 6 as Rs.35,400 stage 1 & Notional Pension 50% as basic pension of Rs.17,700/- from 1/1/2016 plus D.R. as applicable rates from time to time.

I got CAS in 01 Jan 2017 with grade pay 7000,in Pay Band III, in UGC scale, how to caluclute my basic in new PAy revision

It depends upon your basic pay plus Grade Pay, as per your grade entry pay is Rs.25790 begins it contains 40 stages.

I had retired from Min. of Defence as Junior Works Manager on 30.04..2016 (Defence Civilian Staff Gr.B Gazetted) My Pay as on 31.12.2015 (16790 + 4600GP) Rs. 21390.. The Pay was fixed on 01.01.2016 Rs. 55,200/-. But your table shows Rs. 62200/-. Which one is correct. Please verify and tell me.

Check up to basic pay may be as on 31/12/15 is 12190+4600 (16790+4600 not) total 16790×2.57=43150 fixed on matrix level 7 as rs.44,900/- as 1/1/2016,not as mentioned above by you.

Apki basic pay and grade pay ko add karke 2.57 se multiply karo. Unhone 55200 sahi pay fix ki hai apki

Ok. sorry, I thought 16790 as (12190+4600). If 16790+4600+21390×2.57=54972 fixed as 55200. It is not 62,200 it is 12th stage you might have calculating wrong numbers, please check up.

Sir, I have been granted 3rd MACP w.e.f 16/02/2012 with grade pay Rs.5400/- on 13/09/2018 by the appropriate authority. On Feb 2012 my pay band was Rs.9300 – Rs.34900 and was drawing Pay of Rs.18080 and grade pay Rs.4800. I retired from service on 31/10/2016.

In this circumstance I like to know the procedures to be followed for fixation of my Pay.

i joined Delhi university, hindu collegein may 2018 on permanent post of 1800 grade pay . whether i will be eligible for one increment on 01.01.2019. as 7th cpc increment rules

Increment given on completion of one year after in the month July annual only in the 7th CPC. For you 1/7/19.

Jab nhi Pata ho to kyo kisi ko mis Guide Kar raho ho. Increment or joining ke bich me minimum 6 month ka gap Hona chahiye bas agar isne 1 July 2018 tak join kiya honga to 1 Jan 2019 ko increment milega.

Ahab HINDI MEY 7TH CPC ANUUAL INCREMENT RULE padiya.

Check up Min.of Finance O.M. F-21/2017-IC/E.III(A) DT. 31/7/2018 – regarding JULY INCREMENT ONLY IN ANNUAL.

What is the

Up lekhpal salary in hand when newly join service

I AM DRAWING FAMILY PENSION FROM HARYANA UNDE PPO NO.4134/HR THE PENSION DRAWN BY ME

FROM STATE BANK OF INDIA, GURDEV NAGAR, BRANCH HAVING BASIC PENSION OF RS.3729/- NOW I WANT TO CLARIFY WHAT WILL BE MY BASIC PENSION AS PER 7TH PAY COMMISSION

As per the 7th CPC from 1/1/2016 minimum Pension/Family Pension is Rs.9000/- P.M. plus applicable D.R.

I m retired as subedar in 2001, want to know what would be net pay pension for me in 2019.

You have not mentioned basic pay as on 19/6/2008 or basics Pension on retirement. May be you level 10 pay & level 11 or same amount or given with your salary.

I retired from service on 31.05.2017 in level 10 and I got macp to level 11 wef 19.06.2016 after retirement in 2017. IAAD. I have not got my salary arrears and revision of pension inspite of repeated requests. What could be the possible reason?

You have not mentioned basic pay as on 19/6/2008 or basics Pension on retirement. May be you level 10 pay & level 11 or same amount or given with your salary.

I retired from air force on 31 jan17. . I’m level7 index 14 . What will be my basic pension and gratuity.. as per matrix my fixation is 66000/-

Basic Pension of Rs.33,000/- plus applicable D.R. Gratuity will be as per your total service.

When get 7th PRC I pension Nowgetting.pension Rs.21585 per month retirement on 31.04.2017 arrears effect what date sir

7th CPC from 1/1/2016.

I want to know the period about the restoration of 2nd commutation of pension .

I was allowed 2nd comutation in 2007.

I got voluntary retirement in 1992 after completion of 21 & half years of service.

I also got my pension commuted at that time .

2nd computation was also allowed to me in 2007 ie after completion of 15 years of retirement.

I want to know in which year this commutation will be restored ?

Thanks

Sukhija S C .

8882727888

It seems you have re-employed in other institution after volunteer retirement hence second commutation will also restored after completion of 15 years from the amount received if it is in 2007 it will recovered in 2022.

Mene NK PROMOSON NAHI LIYA LEKIN 17 THREE MONTH ME DISCHARGE JA RAHA HU MERI KALAR SERVICE 20 YEARS HAI KYA MUJE ACP HAV MELEGA

I retired as TGT(Hindi) from kendriya vidyalaya on 30/7/2016,when will I be getting my 7cpc pension

in 6th prc 9000 agp is also there. why it is not shown here/

Please intimate eppo no for ex Sgt Purshotam Das 607474 DOJ 7/7/1970 and DO D 31/7 1985.Please intimate earliest.

Sir, What is my 100%disability pension asper revised 7th cpc pl requested to kindly letus know. (DSC 10 Yrs service low med categories)

Thanking you sir yours sincerely

how to arrear calculate 1/1/16 to 31/3/2018j&k jammu

whats the pay fixation for Telephone operator under 7th pay

My fixed medical allowance Rs.1000pm required with arrear since 2002

Pp0 s/028256/2000,army, my fixed medical allowance rs.1000 pm with arrear since 2002 required.

Answer to DURAIBABU : If it’s upgraded as MACP it will be RS.35,300/-

According to 7th CPC, Am sitting in band 3, level 16, 34000 basic. Currently am going to promote in 2800 GP. Having 30 years of service. What will be my basic after promotion ?

30/6/2006 sahayak bhandaar pal se sevanirvirt pansion me 1/1/2016 se Purv matrix k dwara passion me antar kya h

DR.GOUTAM ADHIKARI(DR.GOUTAM SCHWARZENAGER-DR.BALARAMDEB GANGAPADHAYA”S) ADMINISTRATION HAS BEEN STRONGEST ADMINISTRATION IN THE WHOLE UNIVERSE.I WANTED EVERY CITIZENS MUST BE GOVERNED TO AT ALL. ALL THE CITIZENS MUST BE CO-EFFICIENT AS SOON AS POSSIBLE. .HE HAS BEEN DECLARE WORLD WAR-VII THROUGH THE UNITED NATION ORGANISATION SINCE 2018-2029.

I retired on the post of Vice chancellor, The basic pay (Fixed ) for retired VC in 6th pay commission was Rs 75000. So my basic pension was Rs 37500 as per 6th Pay commission on 1-1-2006. Now what shall be my pension on 1-1-2016 as per 7th pay commission. Pl;ease give repl;y only on my email. Thank you.

B.A.Parikh

Answer to PARKH BHUNUPRASAD AMRATLAL : Pension seems to including grade pay. Revised NOTIONAL matrix Pension from 1/1/2016 may be ₹ 49,900/- plus applicable dearness relief.

Answer to PARKH BHUNUPRASAD AMRATLAL : Sorry for above. Pension seems to including grade pay. Revised NOTIONAL matrix Pension from 1/1/2016 will be ₹ 1,99,600/-plus applicable dearness relief.

My net pension 24544, I don,t know my actual pension after 7th cpc, with 50% disable

Pl reply

My disable 75% as per 7th cpc

My disabled 75% as per 7thcpc revised

Sir,

My basic salary was Rs. 19650 as on 31.12.2015 i.e. 15050+4600(GP).As per 7th cpc fixation as on 01.01.2016, my basic salary is multiplied with 2.57 i.e 19650×2.57= 50500.5. Then in Level 7, where my pay should be fixed either 50500 or 52000?

Is there any guideline issued by Ministry of Railway regarding rounding off to the nearest rupee ( fraction of 50 paise and above to be rounded off to the next higher rupee and fraction of less than 50 paise to be ignored) while fixation of pay as per 7th cpc?

Sir,

My basic salary was Rs. 19650 as on 31.12.2015 i.e. 15050+4600(GP).As per 7th cpc fixation as on 01.01.2016, my basic salary is multiplied with 2.57 i.e 19650×2.57= 50500.5. Then in Level 7, where my pay should be fixed either 50500 or 52000?

Is there any guideline issued by Ministry of Railway regarding rounding off to the nearest rupee ( fraction of 50 paise and above to be rounded off to the next higher rupee and fraction of less than 50 paise to be ignored) while fixation of pay as per 7th cpc?

Answer to KANHAIYA SHARAN – 16/27-8 : In this site…….. See the examples in 6th CPC introduced new method of calculation for increments. Previous Pay Rules 2008 of 6th CPC Rs.100.90 is to be taken as Rs.100/- and 101 is to be rounded off as 110/-. Even the 7th CPC is fast approaching about the pay fixation/increment calculations on the basis of 6th CPC persists, especially about the rounded off to the next multiple RUPEES TEN method. Paise is to be ignored. It is obvious that doubts persist.

How much in hand salary I will get that directly come into account as Group C level 3 ? please tell me asap…

Answer to SAMI : Minimum first stage of ₹ 21,700/-& it depends upon your service periods with other allowances of your living city.

I was drawing basic pay of 67000/- and grade pay of 10000. My NPA was limited to Rs 7500/- as the limit was 85000/though 25% of my NPA comes to 19375/-.. Please let me know whether the 125% DA on NPA for pay fixation as per 7th CPC will be based on 7500/- NPA or 125% of Rs 19375?-which is actual 25% of my basic pay .

Dear Dr. Ashok

Similar is the case with me and many others I have written to Department of expenditure, GoI. No reply so far. I request you to write to Deptt of expenditure. When they will have more representations we can expect clarification. You can communicatie with me on shrikanttyagi07@gmail.com

Answer to Dr.ASHOK & Dr. SRIKANTH THAGI – Min. of Finance, Department of expenditure, New Delhi O.M. F.No.12-2/2016-A dt. 7-7-2017 will solve both of your problems. As per the 7th CPC pay 20% NPA.

Sir, I am waiting my new PPO as per Martix table 7. I retired from Ordnance Factory Kanpur in July 2008.I want to know about new PPO. How much I get arrears.for your kind information 9300 ‘-34800.&Grade pay was 4600.

Contact your ex-employer.

Sir,

My PPO No.018720401247.

My last pay drawn (Average emoluments for pension )Rs.9750.

Date of retirement 30/6/2004.

Pay scale 4500-125-7000 ( As per 5Th cpc)

Total service 23 Yrs 11 Month.

Received pension as per pro rata basis Rs3546. Revised pension to Rs.5344 As per 6 Cpc.Again revised to Rs.5585.As per full pension order w e f 1/1/2006.

My full pension should be Rs.4875 As per my average emoluments Rs.9750.( Last drawn pay as per 5Th cpc and pension was drawing accordingly) So as per full pension order my pension should be Rs7345 As per 6 Cpc w e f 1/1/2006. But received Rs.5585 Only.

Now, as per 7th cpc pension revised to Rs.14354. w e f 1/1/2016. And now again revised to Rs.19600.As per notional basis w e f 1/1/2016. By CPAO letter dated 21 Nov 2017. ,Here my last drawn pay shows Rs.6500 Instead of Rs.,9750. Why ? I was drawing pension as per the last drawn pay Rs.9750 Since My retirement.Then how it is eliminated to Rs.6500?

As per last drawn pay Rs.9750. I should get revised pension as per notional basis Rs.27100.w e f 1/1/2016.

I earnestly requst you to take necessary action as early as possible.

Thanking you in anticipation.

Yours faithfully,

K M Ibrahim.Phone 9847311786.

Sir,

My pay bay band as per 6 CPC 5200-20200 GP 2800.

This is to inform you that your last basic pay is ₹ 6500 only, in the scale 6500-125-7000 (that ₹ 3250/- it was your DEARNESS PAY it was merged in the 6th CPC.)

I am a retired employee of a PSU. , In my ex-organisation 7th pay scale has just implemented, Since I superannuated on 31st July 2016 I should also get a lumpsum amount as arrears. It will be pleasure if let me know please the accumulated arrears will accrue together with Basic Pays based on my following information :

Basic Pay as on 1,1,2016 : 23540 (9300-34800), Grade Pay : 4600

Got promotion wef. 30.05.2016 when effecting concerned grade pay of Rs.5400(15600-39100 i.e. 10th label) my basic pay was fixed at 24340.

On 01.01.2016 I got two increment, one as regular & other for promotion and

my Basic pay was fixed at 25810.

My basic on 31/12/15 approx 23000/- than i pramoted as smo on 20/12/16 on gp 6600 i avil non practice alllwne also please tell me what is my new salary i work in central university sagar mp

fitment factor ko badhao 3 guns 3.00 minimum pay ki jaye varna sit khali kare ye janta ka wada hai

As per the 6th Pay Commission after including two advance increments the Basic Pay is as follows: (The two advance increments has to be shown separately as per the GI OM No 1/1/2010-Estt.(Pay I) dtd 6.12.2012. The two increments should be shown separately as per the order. In that order they have mentioned the two increments should be taken for all purposes. (like pay, DA TA etc).

Sl. Date Basic Grade Pay 2 advance Increments Total Basic

1 1.1.2016 11160 2400 760 14320

2 1.7.2016 11590 2400 760 14750

3 1.7.2017 12040 2400 760 15200

As per the 7th Pay Commission the Basic pay is as follows

Sl

No Pay fixed in revised pay matrix as on 1/1/2016 (in Rs.)

Pay as on 1/7/2016 (in Rs.) 37500

Pay as on 1/7/2017 (in Rs.) 38600

Pay as on 1/7/2018 (in Rs.) 39800

Please suggest at the earliest

See individual your office O.M. for 2 increments in which periods you have passed. If it in the 6th CPC period what your office done is correct. O..M date may be after 2016 but exam results date is main.

Answer to PUSPA : Further to inform you from 2016 Grade Pay was abolished and only matrix table used for basic pay. That was multiple (as on 31/12/2015) × 2.57 and fixed in stage of table. Not previous 6th CPC conducted exam in new increments in 7th CPC stages of increments. Next increments will be given in this table.

Sir, I am a Jr.stenographer and I got two advance increments for passing the test. as per the 6th pay commission since 2013. As per the order the two advance increments should take for all allowances etc.

My question is, as per 7th pay commission two advance increments have to take for pay fixation.

Ex.: Basic Pay 11160

Grade pay 2400

2 adv.incremnt 760

Total Basic 14320

as per this my basic pay in 7th pay commission is Rs. 37500/- but my office has fixed my pay in 35300/- please send the answer immediately.

Since you have passed the exam in 6th CPC so your old increment should be given is correct. You added increment as RS 2400 is not correct for that amount plus basic pay is only 3% of increment. i.e basis pay 11160 + 2400 = 13560 ÷ 3% first increment 407, 11160 +407 = 11567, 2 nd increment 11567 + 2400 =13967 ÷3%=2nd increment 419 total 11567+419 = 11986 × 2.57 = 30804+ one increment on 1/7/15 with fixed in 7th CPC matrix level 4 for from 1/1/2016 as 32300, 1/7/16 as increments of 33,300, 1/7/17 as 34,300 on 1/7/18 as 35,300.

.mp me ra employe no 100000309he.ariyr 7th pay menu wale 100442/-aur saftveyra se 95034samthing fist istal ment 15800/-lag Bhagat jabki mp sar kar ne 50pratishati Gpf me Jma and 50 pratishta nagda.

Nic nd worth informatiom..i luk frwrd fr retiremnt on superannuation settle ments calculatiin in details sr pl feed back.

Sir Mera sawal hai asha rakhta hu uska muje answer milega. Sir level 3 ka banda office work se out of station jata hai to as per 7cpc usko hotel accommodation 450 rs hai sir Aap bataiye 450 rs me muje hotel me Kaha room mil sakta hai. Muje jyadater x or y cities me Jana padta hai. Sir plz hotel accommodation 1500 rs tak badhya jaye taki sahi room mil paye

sir 7 pay kb say lagu hoga koi repot aaya hai ki nhe or kis wabsid par chak kar saktay hai ki 7 pay kb say lagu hoga ya 7 pay ki sari new chak karsay koi websaid batayiya sir

7th pay commition bhul jao bjp sarkar mei intjar karo next sarkar ka yadi sarkar badal diya to yadi sarkar nahi badla to 6th pay commition lete raho

I am a govt teacer my joining is 20.11.99 my basic on 01.01 .16 19000 and my acpdone on 20. 11 .17 and i not found benofit of 7th pay commisionplease told me that 1 when fixation will be useful 2 01.01 16 eithe july 2018

Sir I appointed as a Havaldar radio operator in 19/01/1998 in itbpolice and boarded out on 22/09/2011 on the account of disability percentage 80% aggravated to military service my basic was at the time of boarded out 9490+2800 gp total 12290 .i am getting disability pension before 7th cpc basic pension 9832 (in which service element 50%+disability element 30% of last emoluments) .sir what will my pension after revision by 7th cpc notional pay fixation

I am inspector of income tax, earning basic salary of Rs.55200/- , in pay band : pay level-7 ( 44900 – 142400) . As on today I have completed 23 years, 11 months & 7days of qualifying service. I want to avail VRS from the department. Kindly, let me know whether I can opt the scheme and what will be the gratuity amount and other benefits receivable by me.

I have been promoted from grade pay -2800 level 5/15 i.e basic 46762 to grade pay 4200 I. e level 6 in the month of August 2018.what will be my new basic and total salaries from the month of September 2018

I hope bjp govt will hike fitment factor. Because someone tell that there will be no hike in da, fitment factor when bjp is in ruling. When congress is there will be definitely increase in salaries and we are the low paid employees bcoz pay commission will be for 10 years

7 pay commission report says that fitment factor will be uniform for all. But level 1-5 fitment factor is 2.57, level 6-9 is 2.62, level 19-12 is 2

67 …..are these uniform factor. Lower grade employess are supresses….this is awkward

I have been promoted from grade pay -4800- level-8/17 i,e. basic 76500.00 to grade pay 6600 i.e. level-11 in the month of March, 2018. What will be my new basic and total salaries from the month of April, 2018.

sir i am medical office and my joining date is 26/12/2016 at chc shahgarh amethi. and my PB-3, ( 15600 -39100 ) and grade pay 5400….

so please sir tell me how much my salary?

March 13, 2018 at 10:09 pm

sir i am medical office and my joining date is 26/12/2016 at chc shahgarh amethi. and my PB-3, ( 15600 -39100 ) and grade pay 5400….

so please sir tell me how much my salary in january2017

Reply

मेरी नियुक्ति 15/01/2016 को 4750+1300 ग्रेड पे पर हुई तो.मुझे जनवरी2016,की स्थिति मे कितना सॉतवा बेतनमान मिलेगा 15500 या16000

मुझे 21/02 /2016 से समयमान वेतनमान का लाभ प्राप्त हुआ। 1/1/2016 को मेरा वेतन(6thpay ) 8030+1900=9930 था।21/02 /2016 को समय मान वेतन के लाभ से मेरा वेतन 8030 +2400=10430 हो गया।

कृपया मुझे बताइए की सातवां वेतनमान निर्धारण में मेरा वेतन 1/7/2016 की स्थिति में क्या होगा?

मेरा अप्रेल 2005 में उच्च वेतन मान स्वीकृत हुआ था। सातवें वेतन आयोग की अनुशंसा के अनुसार वेतन निर्धारण के उपरांत मुझे दिनांक 1-1-2016 से वेतन वृद्धि प्राप्त होगी अथवा नहीं ?

मेरा अप्रेल 2005 में उच्च वेतन मान स्वीकृत हुआ था ।सातवें वेतन आयोग की अनुशंसा के अनुसार वेतन निर्धारण के उपरांत मुझे दिनांक 1-1-2016 से वेतन वृद्धि प्राप्त होगी अथवा नहीं ?

मेरा नियोजन बिहार सरकार ,शिक्षा विभाग के आलोक में 07/04/2015 को प्रशिक्षित माध्यमिक के पद पर हुआ। ग्रेड पे पाने की तिथि 07/04/2017 हैं।7th pay में कब-कब increment होगा ?

सर मेरा नियोजन दिनांक 10 मार्च 2003 को शिक्षामित्र के रूप मे बिहार सरकार मे प्राथमिक विद्यालय मे हुआ था। 7th पे कमीशन फिक्सेसन मे मेरा वेतन कितना होगा।

Sharmila,

Sir I got my macp on 7th Aug. 2016. Now I want my salary to be

get fixed from Aug. 2016 instead of Jan.or July 2016under 7th CPC. Whether is it possible or not.as per rule.

Sir Indian army jcos ki salary se Hav ki salary jyada hai uske bad jcos ko class pay aur good service pay bhi nhi milti sabhi allces OR aur JCOs ke barabar hain to phir jCOs rank kyon isliye mahoday se request hai ki JCO rank Army se abolished kar Diya jaye sarkar jab jcos ko salary nhi de Sakti to rank upgradation kyon kar rahi hai. Jcos ke bachchon aur OR ke bachchon ko barabar scholarship Sainik aur Army school men Hona chahiye jab ek jCO Hav se kam vetan le rha hai to bachchon ki fee kyon jyada pay kare.

sir my basic pay as on 1.01.2016 is Rs. 9260.(7360+1900).the same had fixed in 7th CPC for Rs.24500 by giving bunching of stages benefits wef 01.01 2016.But my up Basic office still not granting one bunching benefitsand fixed my pay as on 01.01 2016 as. Rs. 23800 .Plese tell me whether bunching benefits of one incriment is applicable in my case or not.Hence railway revised his employes salary .

My basic pay was 22600 as on 31/12/2015 how much in salary I will get what would be my new basic pay as per the 7th pay commission

Sir I m doctor by profession and I read in gazette notification that railway running staff and doctor must get minimum hike 14.29 of total emollient. And after calculating I found one level more than ur calculation.. plz be clarify thnks

My current basic according to 7 th pay is 42300 (4200), after my 1st higher pay what would be my new basic

Joined SSB in 1989 in the pay scale 2000-60-2300-EB-75-3200. Promoted on 24.08.1993 in the pay scale 2000-3500. Remained in this post till 15.04.2013. Awarded pay fixation on 01.01.2006 in the pay scale 15600-39100 with GP-5400. 2nd MACP was allowed on 01.09.2008 in pay scale 15600-39100 with GP- 6600. Whether I am entitled for 3rd MACP from 01.09.2013 as I was in the same post from 24.08.1993 to 15.04.2013 as 2nd MACP with GP 6600 is deemed for remaining 1993 t0 2003 & 2003 to 2013 in the same post. As also, receiving the same GP i.e. Rs.6600 for last 15 years calculated fro 01.09.2008.

Sir my basic pay as on 01 jan 2016 is Rs. 9260 (7360 + 1900) .

The same had fixed in 7th CPC for Rs. 24500 by giving bunching of stages benefits wef 01 jan 2016.

But, my PAO office still not granting one bunching benefits and fixed my pay as on 01 jan 2016 as Rs. 23800.

Please tell me whether bunching benefits of one increment is applicable in my case or not.

What will happen if an employee reaches at the highest level of his matrix table? Will the employee be switched over to the next higher matrix table to avoid stagnation.

My grandmother gets benefit of family pension of 11000 so now after applying seventh pay commission how much she will get?

My first appointment 1995 after 2009 permanent as LdC but macp no benefit me

Please guide me macp require me

Sir my baic +GP on31.12.15 is

8450+1900=10350

But my first A.C.P is on 1st jan.16 than my

Basic +gp

8750+2400 what will be my salary after 7th pay commission on jan.2016

And July 2017

We have payroll software for central govt organizations earlier it works as per 6th pay rules.Now it is updated as per 7th pay rules.This is java based application.we have pension software also.Any one interested to take software contact 9848868739.

BP+ GP(31/12/15)=₹10560

BP- ₹27600(1/1/16)

Increment in July – ₹28400

Then I got promotion on 16/2/17 with GP -₹ 2400/- ( no pay fixation).

How to calculate my pay on 16/2/17 and which option I have selected for increment (1st January or 1st July?)

If fitment facter multiply by3 then what will be the basicsalary from1.1.2016 if my basic is 25770 including 4800gp in PB2

My basic.is 16140 including go 3600 what is my new pay in 7th pay

I am teacher in govt service. Basic pay on 1-1-2016, 26590 and grade pay 5400.what is my basic pay 1-8-2017.

My fix pay 14430 in probesnary traini rajsthan gov in 7 pay how many salary in probesnary trani

वर्तमान में राजस्थान सरकार ने ४२०० पे ग्रेड को ४८०० पे ग्रेड में बदला है। यह २०१३ से लागू किया है। सर जुलाई २०१४ में राजस्थान सरकार ने मेरे को ४८०० पे ग्रेड देकर बेसिक पे २२०७० पर नियत किया था । मुझे बताते कि १जनवरी २०१६ को मेरी बेसिक पे क्या होगी जुलाई २०१४ में राजस्थान सरकार ने मेरे को एसीपी देकर पदोन्नति दी थी

Harish chandra pathak

BP+GP (31-12-2015) = 7650+1800=9450 BP(1-01-2016)=24900 INCRI IN JULY BUT ACP DUE DATE 22-4-2016 hone par BP (22-4-2016 )=25600 (LOHAR GREAT VETAN BIRDHI) LEVEL 2 RS 1900 MAI BP 26000 SIR MY NEXT VETAN BIRDHI DATE KYA HOGI

grade pay 4200 .now in probation on post nurse grade 2. now fix pay 14430. what will fix pay in 7 pay commission.

what will be the new pay for class D or class 4th employee,like peon …

earlier was 4440-7440+gp= 1300

I was appointed as assistant professor in govt aided college in 2017 May what is my basic pay according to 7 th revise

How many percent allowed to incentive

i am gujarat government employee fix of 38090 from february my scale is 9300-34800 older and grade pay 4400 now i am permanent and complete 5 years of fixation so how much salary as per 7th pay

BP +GP (31-12-2015) =19310+4600

=23910

BP (1-1-2016) = 62200

INCRI IN JULY _2016=. 64100

Then I got senior-scale in

1 -3-2017 (GP =4800)

What would be my basic in March-2017.

It is earnest to govt of odisha to provide 7 th pay to all non govt colleges of odisha.because the discrimination should not do for college employees

I was central government employee as accounts officer in 1973 and absorbee in psu on 31.3.1977 and my basic pay was 1056.00 as accounts officer after 22 years of service. Please let me know what is my corrent pension. My dob 21.10.1933.

I joined on 22 July – 1998 as a LDC Basic pay Rs.3,050/- and present time fix my basic after increment is Rs.33,000/- this is for your kind information that I have getting one MACP.

SIR MY BASIC PAY 37780 AND GRADE PAY 6600 PL CALCULATE MY PENSION

Dear Sir i joined as LDC grade 2 in January 2017 fix payment is 8910 Rs. what effect occurred if 7 pay wiil be for me in probation.

Sir,

I am contractual employee . draw only pay+GP . 5200+1900=7100

Regular after 6years.

I am eligible or not in 7 pay commission .

My basic pay 9300-34800 and pay band is 4200, and my basic 19530/- so please calculate my 7th pay fixatation.

sir,

I had got promotion to the post of AO/EO on adhoc basis on 13.05.2011 and subsequently got regular promotion to this post on 31.07.2017. Now if I opt for fixation under F R 22(1)(a)(1) how my pay will be fixed?

Retired 2003 at the pay scale 6500-200-10500, basic pay reached 8300, 6th CPC fixed 9289, at 7th CPC fixed 23873 on 1/1/16 now what will be my pension after modified reviwasid pension kindly tell me thanks with Regards, Damodar Kandpal contact no 8169536141.)

Sir my pay as on 31.12.2015 was Rs. 13460, after implementation of 7th CPC my pay is fixed on Rs. 35300 then I again promoted to Sr. Steno (GP -4200) from 01.12.2016.

Sir, my question is that I had already promoted to Sr. Steno in 6CPC then I transferred and my pay was fixed is Rs. 13460/- and again promoted after implementation of 7 cpc. when i transferred from GP 4200 to Rs. 2400 only GP difference was reduced from my basic pay. so kindly intimate me what is my pay fixation at this stage. My present basic Pay is Rs. 37500

Sir. My details are give below, What will be my manual calculation in 7 CPC.

Basic = 17699

DA = 4389

Allowance = 500

Disability = 3094

Net Pension = 25652

Regards

M Sampath

9032736547

SIR MY PAY40088 PAY+GP MY RETIERMENT ON DT NOV 1 2017 PL CALCULATE MY PENSION AS ON NOV 1 2017

Sir, My Basic Pay is Rs. 7360/- + Grade Pay is Rs. 1900/- as on 01.01.2016. manual calculation of 7th pay commission – my Basic pay is Rs. 23800/- as on 01.01.2016 but in the Pay calculator is shown my Basic pay is Rs. 24500/- as on 01.01.2017. What is the correct Basic pay to me.

there is anomaly in the Level 7 (4600) and Level 8 (4800). Employee on getting MACP between 2nd january 2016 and before 1 july 2016 do not get benefit in the next level because in both the level slabs are same and dont get changed

Dear sir, As HPCA/PCA given to Hospital staff…but till it was not given to Defence hospital staff working in uniform as paramedical staff but given to civil staff working in same hospitals…in 7cpc is there any provision to extend it

Good news

nice information

Sir my basic pay on 1.1.2016 is 5430 and grade pay is 1800 what is my actual pay fixed in 1.7.2016.

Mr.Aman,

Use the simple calculator with your pay details…

Your revised pay as on 1.1.2016: 19100

Your revised pay as on 1.7.2016: 19700

Your revised pay as on 1.7.2017: 20300

I did not benefited in 6th CPC was given widows saliery was 3050/- what to do not getting any help.

29 YERAS IN CENTRAL GOVRMENT SERVICES. 12 YEARS ACP GP 2400, 20 YEARS MACP GP 2800 AND PROMOTION IN 21 YEARS NO ICRIMENT AND NO BENIFIT. SIR PLS MY NEST PROMOTION WHEN WICH GP WHAT PLS.

There are different multiply factor for level 1 to 5 I.e 2.57& 2.62 for level 6 to 9 & 2.67 to 2.72 in original pay matrix table

Sir, If bunching updated then payment should also be given to the employee but as of now not happaned. That’s why one or more year Junior employee in the same rank fixed in the same sale/payment. I am advising to the gov letter who released from his side again needs to be circulated to each and every department wings regarding bunching updated letter.

Sir, The OROP pay matrix has not yet finalised to Hony Fg Offr as the pay roll made in different of 32.5 yrs Rs.16090/= and 33 above Rs.16160/=. It is very funny things, pensioners , who have served 38 yrs of service, paymatrix is Rs.16090/= and under the provision of 32.5 yrs category. The central Govt is proud of fixation of pay matrix in OROP. The OROP is different pay in different services as well as rank.

Please tell me about the minimum salary after Lavasa report of tracmaintainers in the Railways

Sir why computer technical staff is not included in 7 th paycomm since 3 decades mhrd files are kept pending . Action initiated in 30 yrs we are in same post with no promotion .i.e jntuhyd.

Sir,

A clerk get rs 500 up after 12 yr in gp what kind of gradation & some post change scale after 5 to 6 yr. So please consider it they are people 500 growth only after 12 yr its not good.

Sir,

7 cpc give Different scale higher post & lower post. So allowance give equal & fixed means rent 2000, traveling 2000, house 4000 because train bus petrol & kirana etc rate equal every where please consider it.

Hlo i am retired crpf Person. Please sugest me .after implement of 7th pay commisin. What is My Pension

I retired on august 01 1982 with my basic salary of Rs 2500 in the grade 2000-50-2500.

My bitthdate is july 29 1922.

My present pension is Rs32410 plus DR of 125 percent which totals to Rs72920.

What would my pension be now ?

I am a state government emplyee in kerala police department. Now my basic pay is 37500 and I have completed 19 years of service. Now I am Head Constable. I wish to apply to the deputation post of Head Constable at National Police Academy,Hyderabad. If I choose deputation,what will be my total monthly salary?

I am working as Associate Professor with basic pay of Rs 22320/- with a Grade Pay of Rs. 8000/- in a Private university in Technical Education. How much I will as per 7th Pay commission

i am primary teacher in Maharastra zp school and my besic pay on 01/01/2016 is 18180 (included 4200 grade pay) my inceiment date is 01st july what wil new date in 7 th pay and what is NPA is it for me pls help

Myself In 3rd CPC Rs330/,nowG/pay 2800/and complete 40y 9y, myself retaired on 31.12.15 ,my besic pay 26260/ g/pay 4800/ at the time of my retairment pension fixed 15530/ comutetion 6212/,

7y(330_560), 21y(455_700),4y(4600 g/ pay)&11y(4800 g/pay) total service without any Panisment , Pl let me know my pension in 7th CPC?

Date of promotion 10.06.2016

Asper 7cpc basic salary Rs 49000 on 01.01.2016

Asper 6cpc Rs 18560 (14360+4200)

Please advise me

1)my date of promotion Asper 7cpc and basic salary on that date

2)my increment date Asper 7cpc and basic salary on that date of 2016 and next increment date .

I am JAS. My basic pay on 01.01.16 was 20280 (grade pay 5400). While on 05.02.16 I got my increment after passing departmental exam and my basic became 21520. How can my basic pay will fix in 7th pay.

Bunching circular issued on 7-9-2016. Please publish latest position on how to calculate additional increments in grade pay 4800. Where people were promoted from 4600 and there pay was fixed way below the pay for direct recruits. My case is I have earned 4 additional increments in grade pay 4800 but under 7cpc my pay is fixed at index 1 of level 8. And there is also a junior whose pay is fixed at index 1 level 8. And difference of pay is 24%.

I am a primary teacher in Jharkhand; joined in Feb.2004. I got a time bond promotion after twelve yrs. of job in February 2016 and thus my grade pay upgraded from 4200/- to 4600/- and as per 7th. CPC upgraded level 6- to level 7. My existing pay on Jan.2016 is 18560(14360+4200) pay band 2 . Increment drawn in July 2016. Now Kindly help me in fixation as per 7 th CPC -what will be my pay on 1st Jan.16 and what will be the date of my increment.

My basic on 1.1.2016 is 18560 and we get MSCP on 06.01.2016 what will be my pay on 1.1.2016 and next incriment

I appointed as assistant teacher in 1992 I am running on 14410+pb 3200

Whre I stand in 7th pay commission report in mp govt. What will be my scale in 7th pay commission by mp govt.

In the above case my MACP is due exactly on 01.07.2016. Which will be the best option for me? Please guide.

I was appointed as Assistant Teacher in Dec 1982. Part B of 4CPC implemented from April 1998 with my basic of Rs 5500. In july 2007 i was promoted to Junior Teacher and at present i drawing t basic of Rs 23770 with gp 4800. Please give me my exact basic to be drawn in 7cpc and shall i get double increment in july 2017 after completion of 10 years in JT.

i have joined 8 sept. 2015, my basic pay 7000(5200+1800) now i want of my 7 th pay

As per pay matrix my pay on 1.1.2016 was 21710+gp 4800 =26510 which was in 7 cpc 70000/- and as on 1.7.2016 was 72100/- my 3rd MACP wef 8.12.2016 what would be the Basic pay as on 8.12.2016 in 5400 gp (Third upgradiation in level-9 gp 5400)wef 8.12.2016

My 6cpc basic pay as on 1.1.16 is 20040 + 4600 GP. On 14th May, MACP granted and pay hiked to Rs.21550/- + GP 4800. My date of retirement is 31.05.2020. What would be my pay as on 1.7.16 ? Which option is beneficial for me whether 1st January or 1st July?

My 6cpc basic pay on 1.1.16 is 23790 in pay band 9300-34800 grade pay 4800.my increment date is 20-6-16 and20 yearly MACP date is 1-7-17 which option will be profitable for me and howmuch will be my pay on 1-7-17

Helpful tool to easily understand the calculation but I am not clear about increment calculation and factor indicated below level from 1 to 18.

I do agree with the multiplication by the fitment factor to the basic pay(band pay+grade pay). But below the Level there is 2.57 factor in Level 1 to 5, 2.62 factor in level 6 to 9, 2.67 factor in level 10 to 12, Where is the application of these factors in level 1 to 12. Again this factor is 2.57 for level13, 2.67 in level 13A, 2.72 in level 14.

the change is consider for increment then why 3% is taken as increment on band pay +grade pay.

very much easy to calculate the revised pay in 7 pay commission rules.thanks and helpful tool in esteblishment office

In the first column

Do i need to include basic pay + grade pay

Sir,what about the TA Calculatipn ( %DA on TA is Not included ) in 7 pay .

Is it only TA ( 1600/month ) ?

Dear sir/madam

Thank you so much for making easy to calculate. I would like to know basic cuttings explaination

Mai Vivek Kumar Sharma, LCOM in Indian Navy me karyarat hu.

Mera Jun 2015 me basic pay 8770 tha aur Jul me as usual 3 present ke bad basic pay 9110 ho gaya. Arthat as of Jan 2016 me basic pay 9110 aur 2400 gp tha.

Par jab 7th CPC ke anusar calculate karte hai to harani Hoti hai ki Dono stithi me new basic pay 29600 hi Aya hai. Sir ye kaise ho sakta hai ki mere se aik increment Kam wale ka payment 7th pay commission me Barbara ho jaye.

At the time of retirement .the pay of Director was 37400-67000 with pay band of 8700but in year 2014,the pay band was increased to 10000. How the pension after 1.1.2016 will be fixed.

What will be the salary for Senior Research Associate under CSIR Scientists Pool scheme when it was mentioned as on 01.01.2016 and maintaining same till date that the basic pay may be fixed between 21000 to 28000 plus usual allowances as per CSIR employees excluding transport allowances. Suppose basic pay is fixed at 21000 in offer letter dated 16.10.2016, then how will the salary be calculated.

Tell me what’s about interium relief to haeyana gorv.employess? Will this amount addec to basic pay of employees of haryana government or not ……

Tell me what’s about interim relief to haryana govt. Employees? Will this amount added to basic pay pay of employees of haryana government or not……

I am working for a grant-in aid hospital under Dept of Atomic Energy. I am eagerly waiting for the notification from the Ministry of Finance Government India. All other Central Government staff have already got the new payment along with arrears. I want you to look into the problem and do the needful.

There is no much difference between the Clerical staff and the class D employees now. Once more 7th Pay recommendations have failed to give due cognisance to the fact that , they are worthy of the work they do.

It is ridiculous !

government is declared the central government employees bonus is 3500 to 7000 but instead of that why bonus is giving 6908 rupees. I want to know that.

Sir, if the next level in the pay matrix for Rs. 23798 exists as Rs 23800, then how are you calculating it as Rs 24500 as on 01.01.2016.

Please define it as my department has fixed it as Rs 23800 as on 01.01.2016.

My basic pay was Rs (7360 +1900) = 9260 as on 01.01.2016.

Ur given power to state government to revised pay any different in pay scale if they have power to modify lower post high higher post low

need not get the any order from central government

Like sanitary inspector and pharmacist are identical pay in 6th pay commission revised decrease pay band pharmacist 2800GP sanitary inspector 4200GP (more different in pay band)

6th pay commission 5900-200 revised to 9300-4600Gp this may is decrease trend for junior entomologist post(Administator office post is identical in 6th pay commission )

7th pay comm what will be happen decrease or increase pay scale

Sir 6th pay commissions pay band is 5900 increment is 200 (junior entomologist & administrative officer pay are identical )post and revised 6th pay commission pay band is 9300-39900 grade par 4600 but administrative officer is grade pay 5100

In 7th pay commission pay scale junior entomologist scale will increase trend or like revised 6th pay decrease the grade pay. Which will be happen I need ur valuable suggestion thank you

In 7cpc pay matrix,The pay of Major rank is calculating with multiplication factor of 2.67 (in PB -3),but in pension resolution,for calculation of pension factor is 2.57. Why it is so?Aray bhai kahin to justice karo.

HRA and other Allowances will not be declared before November 2016 as per latest govt order

When will be declare HRA and other allowances

When will be declare HRA android other allownces

Sir i join in SSB IN 1982 AND TAKE VOLUNITER RETAIRMENT AT 2005 AS A MATTER OF FAMILY PROBLE,actually sir,in month of August i recive Rs.18000 but now what only 9487 RS.only in september,i dont understan about OROP..sir tell us about detail information of revise pay..till now i think no revise is there or either any change of payment.is made

Sir, my basic pay on 1.1.2016 was 15860 with grade pay of 4200. I got my 3rd MACP Scheme on 22.1.2016 with grade pay of 4600, but i opt to have my increment of MACP in the month of July with annual increment. Now, my pay has been fixed at 55,200/- as per 7th Pay Commission. But surprisingly I got the arrears of 45,096/- upto July, which is very less then others. Kindly clarify and give me in details that how much arrears i am entitled, so that you can claim my balance amount.

In comparision sixth pay commission seventh pay commission is not satisfactory for the employees

kindly increase some allowances for the employees

Sir I appointed in Mar 1997 and my old pay was 18120 and grade pay 4600 total pay was 22720 and new pay fixed in Rs 58600. My junior (One year appointed in Mar 1998) old basic pay was 17740 and gde pay 4600 total pay was 22340 they also fixed in Rs 58600. than where is my one year seniority.

in our office they fixed my pay 7th cpc as 52000/- and my basic pension as 26000/- and nowthey are preparing due drawn statement for previous 6th & 7th cpc. is it correct. I have already given my pay details to you. you have replied – “awaiting for moderation”. pl. clarify.

As on 1..1.2016, my basic pay is Rs 30670 [as per 6th CPC, PB2: 9300-34800 + GP: Rs 5400].

On 1.9.2016, I got promotion and elevated to PB3: 15100-39100 + GP: 5400.

Please tell me what will my basic pay on 1.7.2016 and 1.9.2016 as per 7th pay commission.

As on 1..1.2016, my basic pay is Rs 30670 [as per 6th CPC, PB2: 9300-34800 + GP: Rs 5400].

On 1.9.2016, I got promotion and moved to PB3: 15100-39100 + GP: 5400.

Please tell me what will my basic pay on 1.7.2016 and 1.10.2016 (due to my promotion) as per 7th pay commission.

Vivekanandan Says

As on 1..1.2016, my basic pay is Rs 30670 [as per 6th CPC, PB2: 9300-34800 + GP: Rs 5400]. On 1.9.2016, I got promotion and moved to PB3: 15100-39100 + GP: 5400. Please tell me what will my basic pay on 1.7.2016 and 1.9.2016 (due to my promotion) as per 7th pay commission.

I have been granted NFSG in the pay band of Rs.15600_39100+5400 (grade pay). In 1..11.14. At that time i draw Rs.19870 +4800 in the pay band 9300_36900.. what will my pay in 7th pay commission.

I am retired on 30/06/2016 from the service of LIC of India recently central government enhanced the gratuity to twenty lakhs whether I am eligible for this revision since Life insurance corporation of India is the central government under taking organization please clarify

My basic pay as on 1..1.2016 is 22050/- + grade pay Rs. 5400/- in the scale of Rs. 9300-34800

My question is that I am going to Retire on 18.5.18

I will opt my increment from January 16 or July 16 which is profitable

What’s the current rate of NPA as per 7th CPC? Will be the rate of NPA depend on increment?

My Scale of pay is Rs.37400-67000 with GP of Rs.8700. My pay as per 7th pay commission should be Rs 118500 and my pay being pensioner shall be Rs 59250

+ 20% extra being over 80 yrs age and works out to Rs 71100 where as the SBI has drawn only 71087 without following Matrix table.

What would be my pay from July 2016 on wards .

sir,

I am giving my VRS on 31.03.2017. My appointment date is 30.12.1988. I am now working as assistant since May 2006 till date. what would be my pension emoluments and gratutity. 6th pay commission basic pay 1s 13450 + 4200 grade pay before fixation of vii pay commission pay.