7th Pay Commission Pay Fixation in the New Pay Structure

Within the context of Indian government employment, the term “pay fixation” is frequently used. It refers to the process of determining an employee’s salary upon joining, being promoted, or receiving an annual increment. In order to have their salary fixed after the implementation of a new pay commission or after receiving a financial benefit under any scheme (such as the ACP or MACP Scheme), all central government employees and staff must submit a physical application form. This form is crucial as it asks employees to indicate whether they wish to fix their pay on their promotion date, annual increment date, or some other optional date. It is important for employees to be aware of the rules related to pay fixation.

It is worth noting that the option to fix one’s pay in the updated pay structure is only available once. If an employee chooses to modify their basic salary from the 6th CPC to the 7th CPC, their basic salary will be adjusted according to the recommended pay fixation procedure.

Pay Fixation Rules in 7th Pay Commission

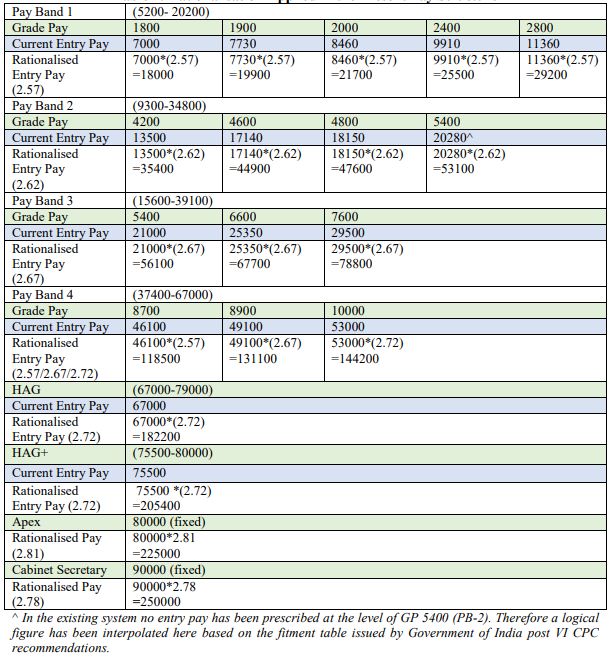

In the context of revising basic salaries from one pay commission to the next, the ‘Fitment Factor’ holds great importance. The recommendation of the ‘Fitment Benefit’ by each pay commission varies and under the 6th pay commission, a single-window format for Central Government employees was recommended in relation to the ratio of Fitment Benefit. To revise the basic salary from the 5th to the 6th Pay Commission, a common Fitment Factor of 1.86 was suggested. The 7th Pay Commission followed a similar approach and revised the ratio to 2.57. Hence, it is essential to calculate the Fitment Benefit (1.86) carefully in the context of the 6th CPC. Click to read a detailed report

7th Pay Commission Pay Fixation Formula

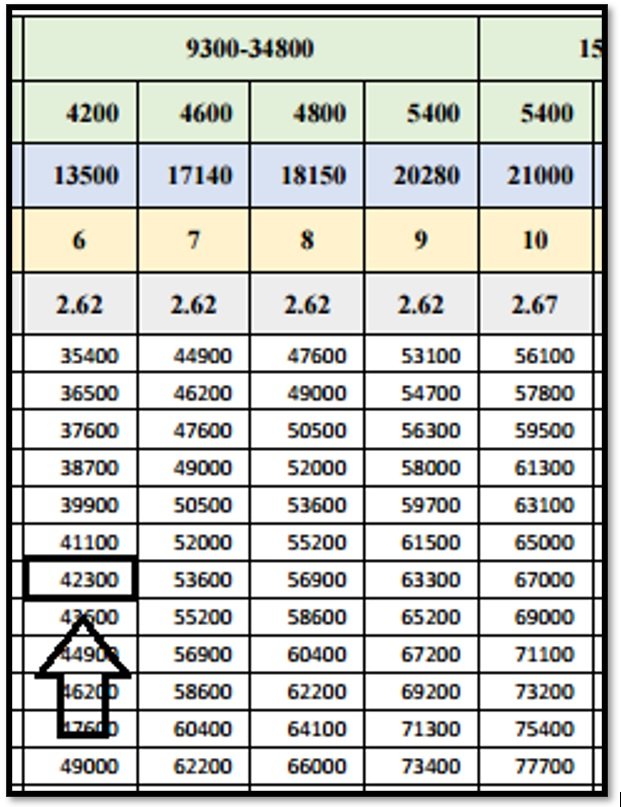

The 7th Pay Commission has recently introduced a new method for pay fixation, consisting of four steps. Firstly, the basic pay as of 31st December 2015 should be multiplied by a fitment factor of 2.57 and rounded off to the nearest rupee. Secondly, the Pay Matrix Level based on the Grade Pay must be determined. Thirdly, the value obtained in step one should be compared with the corresponding Pay Matrix Level pay hierarchy that has an equal or higher value. Lastly, the chosen value will become the revised pay as of 1st January 2016. These revised rules are applicable to all categories of Central Government employees under the Central Civil Services (Revised Pay) Rules 2016.

Pay Fixation Example in 7th CPC

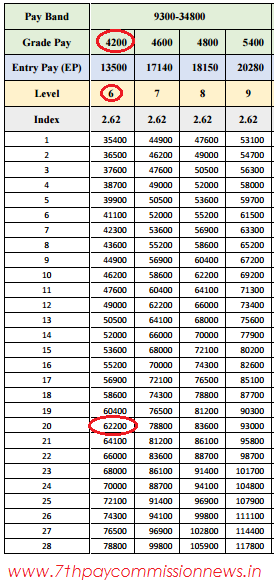

As per the 7th CPC, here is an illustration of pay fixation. Suppose an employee, designated as ‘T,’ currently holds a GP 4200 position and receives a salary of Rs. 20,000 under PB-2. Based on these details, the individual’s Basic Pay would be Rs. 24,200 (20,000+4200). After applying the multiplication factor of 2.57, the total pay for ‘T’ would be Rs. 62,194, which would place them in Level 6 of the salary structure. Therefore, ‘T’s salary would be revised to Rs. 62,200 in Level 6.

Fitment Factor for CG Employees

A proposal has been put forth to introduce a standardized Fitment Factor of 2.57 for all Central Government (CG) employees. This factor takes into account a neutralization factor of 2.25 for Dearness Allowance (DA). The assumption is that the rate of DA will be at 125 percent during the implementation of the new pay, which is mentioned in paragraph 5.1.27 of the 7th CPC Report.

Dopt Orders on Pay Fixation

The Department of Personnel and Training has been consistently releasing orders and circulars pertaining to the fixation of pay for Central Government employees during promotions or Modified Assured Career Progression (MACP). To access all of these Dopt orders and circulars, please click on the provided link. – Click to view all Dopt orders circulars

Fitment Factor for Defence Personnel

The starting point for entry-level personnel in the defence forces, including Sepoys, has been established at Rs.21,700 by the Defence Pay Matrix. The new matrix’s implementation is significantly influenced by a multiple of 2.57, which is the product of the current minimum pay of Rs.7,000 and the Commission’s proposed minimum pay of Rs.18,000. This fitment factor applies to all employees without discrimination. Military Service Pay (MSP) will also receive an identical fitment of 2.57, as detailed in Paragraph 5.2.7 of the 7th CPC Report, but only for Defence forces personnel.

Staff Side Suggestion on Pay Fixation

In accordance with the Staff Side Suggestion on Pay Fixation, when an employee is elevated to a higher grade within the revised pay structure, a specific method is used to determine their new pay. The process involves calculating an increment equivalent to 3% of the sum of the employee’s Pay in Pay Band and Grade Pay, which is then rounded off to the nearest multiple of 10. This amount is subsequently added to the employee’s existing pay in the Pay Band. Furthermore, it is essential to ensure that the newly fixed Pay is not below the minimum amount established for the Pay Band into which the employee has been promoted. Staff Side suggestion in detail – Click to read full story

Rationalization Applied in the Present Pay Structure

7th CPC Pay Fixation Table

The following is a compilation of VII Pay Fixation Tables aimed at providing a ready reckoner table for pay fixation on promotion, taking into account the pay fixed on the date of promotion or the date of the next increment. These tables are specifically designed for employees who have been promoted from Level 1 to 2, Level 2 to 3, Level 2 to 4, Level 4 to 5, and Level 5 to 6.

- VII Pay Fixation Tables: Promoted from Level 1 to 2

- VII Pay Fixation Tables: Promoted from Level 2 to 3

- VII Pay Fixation Tables: Promoted from Level 2 to 4

- VII Pay Fixation Tables: Promoted from Level 4 to 5

- VII Pay Fixation Tables: Promoted from Level 5 to 6

Pay Fixation on Promotion Format Rules

The guidelines for the Pay Fixation on Promotion format have been established. In addition, a calculator for computing the salary revision under the 7th Pay Commission has been introduced, known as the 7th CPC Pay Fixation on Promotion or MACP Calculator. The Pay Matrix has simplified the process of calculating the revised pay. To provide an example, if an individual’s current position has a Grade Pay of Rs. 4200 and Band Pay-2 of Rs. 12110 as of 01.01.2016, their updated Basic Pay and Allowance can be determined by following the instructions provided below.

7th CPC Pay Fixation Step 1

- Your 6th CPC Basic Pay ( Grade Pay + Band Pay) is = 4200+12110= Rs. 16310

7th CPC Pay Fixation Step 2

- Multiply your 6th CPC Basic Pay with 7th CPC’s Fitment Formula i.e. 2.57:- 16310 x 2.57 = Rs.41916.70 ( Paisa to be rounded off to the nearest Rupee) = Rs.41917

7th CPC Pay Fixation Step 3

Please match the figure displayed above (41917) with the corresponding figures assigned in the Matrix Table provided below, specifically in the Grade Pay column of Rs.4200. Unfortunately, no direct match was found. However, the closest higher figure in the Grade Pay column is Rs. 42300, which can be chosen instead. Therefore, your New 7th CPC Basic Pay will be Rs. 42300.

7th CPC Pay Fixation Step 4 (HRA)

The HRA percentage has been updated to 24%, 16%, and 8% for the existing 30%, 20%, and 10%, respectively. Individuals who were previously in the 30% HRA Bracket will now have an HRA of 24% under the 7th CPC. This means that the HRA under the 7th CPC is calculated as Rs.10152, which is 24% of Rs.42300.

7th CPC Pay Fixation Step 5 (TPTA)

The 7th Central Pay Commission has proposed Transport allowance for employees belonging to three distinct categories and two types of locations. Those residing in cities categorized as A1 and A (a list of 19 such cities is available) are eligible for higher TPTA rates. Based on your Grade Pay, which falls in the range of 2000 to 4800, your TPTA is Rs. 3600+DA.

7th CPC Pay Fixation Step 6 (DA)

From January 1st, 2016, DA will be null. Hence, it won’t be necessary to consider DA while calculating gross pay as of that date. In order to arrive at your revised 7th CPC Gross pay as on January 1st, 2016, simply add up the numbers: Basic Pay + HRA + TPTA + DA = 42300+10152+3600 = Rs.56052.

- 7th Pay Commission MACP Calculator as per Rule FR 22(I)(a)(1)

- 7th CPC Pay Fixation on Promotion or MACP Calculator

Top Developments on Pay Fixation

FAQ Related to 7th CPC Pay Fixation

How is the fitment factor calculated after the 7th pay commission?

As of January 1st, 2016, the essential number for converting the basic salary from 6th CPC to 7th CPC as recommended by the 7th pay commission is the fitment factor which has been set at 2.57.

How can I revise my basic salary in 7th pay commission?

The process for adjusting the salary under the 7th pay commission involves reference to the pay matrix table. By multiplying the basic pay with a fitment factor of 2.57, one can then locate the corresponding figure (either equal to or greater than) within the pay matrix table, corresponding to their specific pay level.

How do you calculate salary with fitment factor in 7th CPC?

Following the 7th pay commission’s implementation, the basic salary is determined by multiplying the previous basic pay by the fitment factor of 2.57, thereby aligning it with the corresponding pay level in the pay matrix table.

How calculated the fitment factor in the 7th CPC?

As of December 2015, the Dearness Allowance percentage was at 125%. The 7th CPC recommended an increase of 14.29% along with a fixed fitment factor of 2.57.

Please post the rule by which one get pay upgrade to the same pay with the staff junior to him.

If my promotion on 1/2/2016 and pay 13690 with pay band we 2800 and on date my pay fix on this date 13690 with pay band 4200 and on date 1/7/2016 my pay fix on 14700+4200=18900 on 7pay commission my payment fix 49000 please tell me is correct or wrong

As per the rule CCS 10 your basic pay as on 13690 x 2.57 = 35183 was fixed from 1-1-2016 as 35,900 than due to promotion you will be fixed 2 increments on 1-7-2016 one normal & promotional increment as 37000 in MATRIX LEVEL 5 & DNI on 1-7-2017 as 37600 in MATRIX LEVEL 6 onwards.

I was in level 7 with basic salary 50500 as on 30.06.2022 and got promotion from level 7 to level 10 w.e.f. 01.07.2022.

In this case what should be my basic w.e.f. 01.07.202022.

I selected next date of increment w.e.f. 01.01.2023.

Kindly guide me.

Good give January increment option then from 1-1-23 as 52000 in MATRIX LEVEL 7 & DNI on 1-1-24 also fixed equal stage of 52000 in MATRIX LEVEL 8 as per the latest rules but your destination will be higher since there’s no pay scales for the post/designation from the 6th CPC rules.

1) Promoted official has two option for switching over to 7cpc.

A) on 1.1.2016, or

B) on date of promotion (between 1.1.16 and ccs (RP)rules-2026 notification)

2) Promoted official has two option for fixation of pay under FR22(i)(a)(1)

A) on DOP or

B) on date of next increment

–————————————-

Revised pay on 1.1.16………..

PPB 10890+2800= 13690

Revised pay= 13690×2.57=35190=35900L5

Pay under FR22 ((B) OPTION) on 1.2.16 on 36500 L6…

pay on DNI 1.7.16 two increments in level5 37000, 38100 then shifted to Level 6 38700

DNI 1.1.17

–———————–

REVISED PAY ON DOP 1.2.16

1.2.16- 10890+4200= 15090×2.57=39200L5 then till DNI 39900L6

Pay under FR22 ((B) OPTION) on 1.7.16

Two increments in L5 40400,41600

then shifted to Level 6 42300…

DNI 1.1.17

IF TWO (ONE MEDICAL (GETTING NPA) AND ONE NON-MEDICAL) OFFICER HAS TO JOIN THE SAME ORGANIZATION AND WORKING IN THE SAME CADRE WITH A GRADE PAY OF 7600. BUT THE CELL ID=S DIFFERENT. NON-MEDICAL FELLOW GETS BP 96800 AND MEDICAL FOLLOW GETTING 112100 IN GRADE PAY OF 7600. ON PROMOTION TO GRADE PAY 8700. WHAT WILL BE THE BASIC SALARY OF MEDICAL AND NON-MEDICAL OFFICERS IN THE CENTRAL GOVT?

I join the service in 1984 got 1st promotion 1993 then 2nd in 1998 then i got macp in 2008 now am i eligible for macp in 2018 and also i got promotion in 2019 am i elegible for pay fixation either in 2018 or 2019

Since you got three upgradations of basic pay fixation in service, so you are not eligible for any other fixation.

Sir,

It is regarding my officer’s pay fixation issue. He was in PB II with GP Rs.4600/- on 31.08.2008. He got 1st macp w.e.f 01.09.2008 as per the OM dated 16.09.2014. Further, on 21.08.2009 he has promoted to Group A post in PB III with Grade Pay Rs.5400/-.

On 31.08.2008 his BP + GP was 16960+4600= 21560

01.09.2008 his BP + GP was fixed as 17610 + 4800= 22410 (1st MACP)

01.07.2009 his BP + GP was fixed as 18290+4800 = 23090 (Annual increment)

21.08.2009 his BP + GP was fixed as 18990 + 5400= 24390 (Promotional increment 3 % & difference in GP 600)

Now the Accounts office raised an objection that the pay fixation is wrong.

Please give a reply quoting rule and OMs if any

This is to inform that in the 6th CPC increment only in JULY onwards.For promotion/MACP will be given on that day old basic pay plus old GP multiple by 3% increment as fixation rounded of to ten as per the rules.

On 31.08.2008 his BP + GP was 17610+4600(old) = 22210

01.09.2008 his BP + GP was fixed as 17610+ for 3% as 528=18138+4600=22750 (1st MACP)

01.07.2009 his BP + GP was fixed as 18140 for 3% as 540+4800 = 23480 (Annual increment)

21.08.2009 his BP + GP was fixed as for18680 for 3% as 560 + 4800= 23940

01.07.2010 his BP + GP was fixed as 19140 for 3% as 570+5400= 25110

Some correction last total as 24040. Method is same you can calculate.

Sir, I m ex hav army gp y retired on 31 Jan 2004 after completing 18 years service in Vth CPC. My last basic pay was 4700 per month. Sir what is my basic pension as on date. Sir how my basic pension fix from 5th to 6th and 6th to 7th CPC. Pl advise. thx

Pay fixation in State government

sir,

I have retired from Army on 2013 in 6th cpc scale then I have joined in AP state government job.

I would like to know how my pay fixation has been done. is there taken my DA in pay fixation or provide suitable illustrations in this regards

As the that State Government recruitment scale of pay plus their allowance at that stage. You’re previous pay and D.A. wouldn’t courts for fixation. Only your are treated as Ex-service man in appointing stage for age relations.

I have been promoted and my pay has been fixed at 91100 in pay matrix 11 in the month of July 2021 . Now our pay scale has been revised and as per revised pay scales we will be placed in level 12 in the pay scale of 15600 GP 7600 . in the month of August 2021. what will be my basic pay fixation as per level 12

Rs.911400 fixed at MATRIX LEVEL 12.

Sir, my increment date was 1.1.2016 at Rs.64100 in pay level 7. Further, I got MACP on 16.02.2016 from pay level 7 to 8 and pay fixed as 66000 and next increment date is 1.1.2017. Please specify fixation is correct or I would have opt for fixation of pay on 1.7.2016. Please guide me, sir.

Correct.

Please re exercise option for pay fixation from DNI i.e 01.07.16 vide DOE OM dtd 15.04.21 before 15.7.21.

Your pay will be….

Pay on promotion/mapc 66000, L8

Pay fixation onDNI 1.7.16 – 68000, L7 to L8

DNI 1.1.17. -. 70000 onwards L8

My pay as LDC as per VI CPC as on 01.01.2016 was 7360+1900 = 9260

I was appointed to the post of UDC on direct recruitment in same organization on 30.06.2020. I opted to get my pay fixed w.e.f 01.07.2016 (DNI) and my pay was fixed as 7930+2400 as per VI CPC by granting two increments (one regular increment and other increment for promotion).

For VII CPC also i opted to get my pay fixed w.e.f 01.07.2016. But now they have fixed my pay w.e.f 01.01.2016 to Rs. 23800/- as LDC and Rs. 25500/- as UDC as on 30.06.2016 with DNI on 01.01.2017.

Please check if the pay is fixed correctly as they are saying i being direct recruit i cannot exercise option for getting my pay fixed.

There’s no pay scales from 1-1-2006 post of promotion. In the 6th CPC as Grade pay & in the 7th CPC as MATRIX LEVEL changes.

4. It is submitted for your kind info that I graded to MACP Nb Sub as on 01 Oct 2018, at the time my basic pay has been calculated Rs 39,900/- as per the 7th CPC table.

5. Now, if I switch over the 7th CPC up to 01 Oct 2018 i.e graded to the MACP Nb Sub, since I have agreed to surrender the arrears already drawn.

Sir I am promoted to the rank of Private Secretary on 24 Jan 2020 in pay label 6 to 7 my present BP is 52000 in pay label 6 and my date of retirement is Aug 2024 which is more profitable for my pay fixation please help me.

If it MACP on compensation of 10 years you are eligible from 1-1-21 as Rs.53,600 in level 6 and DNI 1-1-2022 as Rs.55,200 in level 7. Otherwise no monetary benefits only destination changes from 24-1-2020.

nothing to worry. wait till 2024.

Retirement date does not matter .

Bp on 23.1.20. –. 52000 L6

Bp on promotion 24.1.20. – 53600 level 7

Pay fixation from DNI 1.7.20. 55200 (2 incre. L6) L7

DNI 1.1.21 – 56900 onwards

You can calculate with above calculator pleae.

If one opt for 7th pay commission revised pay with effect from 01.07.2016(with increment) instead of 01.01.2016 Whether he can get next increment from 1st Jan 2017 and further increments every year Janaury.

No. Annual increment July only.. If promotion/upgradation of MACP option for increment arises the option is applicable.

No change in your increment date even if switch over revised pay from Jan-2016 or July-16.

It only happens on pay fixation on promotion/MACP from DOP or DNI.

I was promoted from Level 8 (4800/-) to Level-10 (5400/-) on 25.10.2019. My existing basic pay is Rs.86100/-.DNI is on 1st July. Please comment on my fixation of pay i.e. which would be beneficial as per the latest order.

With Regards.

If the promotion is next designation changes no pay fixation. Only if MACP pay will be upgraded in level 8 to 9.

I retired from Govt service on 30.9.2009. My last pay drawn in PB-4 was Rs 60340 with Grade Pay of Rs 8900.

My pension was fixed at Rs 30170. Subsequently, in terms of Note 10 Below Rule 7(1) of CCS (Revised Pay) Rules 2006 my pay was revised to Rs 44,700 plus Grade Pay Rs 8900 wef 01.6.2006. It was stepped up as on 1.1.2006 with DNI 1.7.2006 and it became Rs 48,230 plus rade Pay Rs 8900. Thus my Last Pay Drawn as on 30.9.2009 was fixed at Rs 62,440 and accordingly my Basic Pension was revised to Rs 31,220.

Now consequent to a Supreme Court judgement in my favour I have been placed in PB-4 with Grade Pay Rs 10,000 wef 3.1.2006.

Please tell me what will be my Basic Pay as on 3.1.2006, my last pay drawn as on 30.9 2009, and my revised Basic Pension after 1.1.2016 ie after implementation of the 7th CPC.

As per your basic pay of Rs.44700 3% 10000 as 3-1-2006 as 56340 (since you’re pay was not same from 1-1-2006 you will not get on 1-7-200) so you are eligible only increment as on 1-7-2007 as Rs.563400+3% plus 10000=68030 as on 1-7-2008 total 78030 + 3% + 10000 total increment as on 1-7-2009 as total of Rs.90370/-up till 30-9-2009 retirement date. From 1-10-2009 as pension as Rs.90370/2 as 45190 up to 31-12-2015. From 1-1-2016 45190 × 2.57 = 116138 fixed at matrix level 144200/2 pension as 72,100/- plus D.R. as applicable from time to time.

Thank you so much, Sh Kumar, for a very prompt reply. Appreciate.

Dear Sh Kumar Sir,

I had a doubt in the calculations made by you. Therefore, I have tried to work out a solution as under. Kindly see if the calculations done by me are correct.

Basic pay to be fixed wef 03-1-2006 i.e. the date of grant of SAG to me = Rs 44,700 + 3% + 10,000 = Rs 56,340 (one increment is equal to 3% (three per cent) of the sum of the pay in the pay band and the grade pay to be computed and rounded off to the next multiple of ten). Since my pay was not same from 01.1.2006 I will not get an increment on 01-7-2006. Thus, I will be eligible for next increment on 01.7.2007. As on 01-7-2007 the basic pay will be = Rs 56,340 + 3% + 10,000 = Rs 68,030. As on 01-7-008 it will be = Rs 68,030 + 3% + 10,000 = Rs 80480/-. As on 01-7-2009 it will be = Rs 80,480 + 3% + 10,000 = Rs 92,900. Thus basic pay on the date of retirement i.e. on 30.9.2009 = Rs 92,900. From 01.10.2009 the pension will be 50% of Rs 92,900 = Rs 46,450 up to 31.12.2015. From 01.1.2016 basic pension will be 46450 × 2.57 = Rs 1,19,380. However, since the minimum pay at Level 14 in the new pay matrix is Rs 1,44,200 my pension will be fixed at min of matrix level = Rs 1,44,200. Thus basic pension as on 01.1.2016 will be = 1,19,380 plus Dearness Relief as applicable from time to time.

As on 01-7-2019 the total pension will be = Rs 1,19,380 – Rs 12,488 (commuted pension) = Rs 1,06,892. With dearness relief(DR) @ 17% wef 01-7-19 I should get a total of Rs 1,06,892 + Rs 12,257(DR) = Rs 1,19,149.

Request check and confirm.

Request confirm.

Both of us calculation up to Rs.63038 correct after that 3% as 2,041 plus 10000 = 80071 + 3% = 2402 for increment as on 82473 + 10000 total 92,473 last rounded off 92,470 50% of pension up to 31-12-2015 In the 7th CPC from your basic pay for in matrix level 13 it was fixed in pay of rs.92,470 multiple by 2.57 = 2,37,650/- actually it was 50% as rs.1,28,825/- but pension limited to rs.99,800/- from 1-1-2016. (3% 7/07 as 1640, 8/08 as 2,041/- & 7/09 as 2402/-.) In last it will be rounded off to ten only.

Dear Sh Kumar,

Thank you very much for correcting me. I was not aware that the pension is to be limited to Rs 99,800/-. Is there a clause or provision in the CCS Rules or a recommendation by the 7th CPC which limits the pension? If so, please share the reference with me. I shall be obliged.

With best wishes.

J S Bhalla

One more corrections in it. Your last basic pay was rs.2,18,200 pension may 1,09,100 but it was restricted as maximum MATRIX LEVEL 14 as basic pay up to stage 15 as last, so 50% of that is Rs.99,800. Sorry previously in service period I use to refers with ready reconer. After retirement from 2011 I use so many electronic devices, more over from 3 days I am having fever.. I like this calculateds to my time pass. I got retired in GP 4600. MY I’D is kmrds64@gmail.com. You may know it from the age of 80 onwards percentage vice increased basic pension. All the best also given me a good chance. Thanks all.

You might help got promotions earlier in service, so it reaches in this stage. It will cross those who are not got 3rd MACP in next higher scales on compliance 30 year as on 1-8-2008.

If you are saved (20%) under income-tax rules for this year of rs.5,00,000/- your profit of that amount without any other income in current FY.. Still there is time to investment up to 31- 3-2020

.Arrears will of that F.Y. credited under 10(E) rule.

I am having one dough whether you basic pay might have been included 50% of. Dearness pay from 1-1-2004 since the 6th CPC report was passed, it was from 7/2007 from the date 1-1-2006.

I find out that your 6th CPC pay scale was 37400-67000, so you will not 92470/- so it should be work out 100% basic pay not 150%, that 50% was merged and treated as GP 9000.

If you’ve basis pay of rs. 39,800/- as on 1-1-2006 your pension as 1-1-2016 as Rs.72,100/- .

Correct LEVEL 14.

Sir I retired in May 2016 from KV.. I was in senior scale till 09-02-2016 with Basic+Grade pay ( 24400+5400). I got my selection scale from 10-02-2016 with Basic+Grade pay (24400+6600).. How will I be fixed in 7th CPC. I am a CPF holder. . please let me know which will be the most beneficial fixation for me and how it is done..

Your pay will be fixed as on 31-12-2015 multiple by 2.57 amount of total fixed nearest in Matrix Level 9 upto 9-2-16 from 10-2-16 onwards next nearest amount in Matrix Level 10. In that amount 50% as Pension from 6/16 onwards.

Sir thanks for your reply. I still have certain doubts to be clarified. I got my selection scale due to MACP. Will I get 3 percent increament. You mentioned matrix level 9 and next matrix level as 10. But my organisation KVS has taken matrix level 10 and 11 and fixed me from 77700 to 78 500. Whereas as per your reply it comes to 77900 to 80000..I come in pay band 15600-39100 . Please clarify.

Your figures are not tallying so you give your basic pay as on 31-12-2015. More over since you have to give the option you required 6th CPc grade pay change from the promotion date or you require 7th CPC pay ? Best option is GRADE PAY change, because you retired on 31-5-2016. Since as per the 7th CPC Matrix change got no promotion benefit because your increment will not given on 1-7-2016.

Sir thanks for your prompt reply. My basic pay as on 31-12-2015 was 24400 in pay band 15600-39100 with Grade pay 5400. Promotion date Basic pay remains the same 24400 but Grade pay changed to 6600 in the same pay band 15600-39100. As per your advice if I opt for 6th CPC Grade Pay change from the promotion date , in which matrix level will I be fixed and what will be the amount. Kindly clarify.

Sir why there is no response from you. Please clarify.

It may be your 4th promotion in service on my 3 promotions from 7th CPC. As I already informed no promotional benefits from 7th CPC. No, the option time is also barred to give pay in 6th CPC. At the time retirement you are in GP 5600 only and no increment for promotion, but I designation changes higher.

Sir at the time of retirement I am in Grade pay 6600 and not 5400. As per the rules they should have given one increament in 6th CPC due to my MACP and then fixed me one step higher in 7thCPC in the changed Grade.

Ok, if it is MACP the GO 6600, but your MACP was 10-2-2016 it was in 7th CPC (started from 1-1-2016) so as per rules one increment in matrix table 9 (GP 5400) only. You are suppose to be given on 1-7-2018 as matrix level 10, since you have retired on 5/16 so it will not possible as per 7th CPC RULES. Likely you got in GP 6600 chance given for the period of employees up to 25/7/17 as per the report released. If you might have been given 7 th CPC you are not eligible matrix table 10 it may be given in level 9 (GO 5600) i.e. as I said. From this your difference of amount .basic pay plus rs. 1000 plus D.A.125% multiple by 2.57 gained and fixed as per 7th CPC level 9. (not level 10). It is correct procedure.

Sir, I am stated that after completion of my 30 years of my service IIIrd MACP was granted to me wef 01.04.2016 and I was given Level-6. In the MACP Order option for fixation of pay to the higher scale was called and I was submitted in the time limit that first give me my annual increment and then my pay be fixed. in higher grade. My next increment date was 01.07.2016. Dispite my option my pay was fixed from date of MACP ie from 01.04.206 and my option was not considered.. Whereas in some other offices option was accepted and pay was fixed from DNI. My pay was fixed as per below:-

01.01.2016-Rs. 12820+2800=15620.

01.04.2016-Grant IIIrd MACP.

01.04.2016- 13290+4200=17490(pay fixation on MACP after giving one increment in the pre revised pay scale)

01.04.2016- 17490*2.57= 44949=46200(pay fixed in the revised pay level-6 of pay matrix-2016)

01.01.2017- Date of next increment.

Now it may be advised whether my option for fixation of pay from DNI which was as per rules or otherwise.

whether I am entitle to fix my pay from DNI. What I can do pl suggest me.

This is to inform you that you have got increased GP 2800 to 4200 from 1-4-2016, so you are not eligible for increment on 1-7-16, on completion of 6 months from 1-7-2016 to 31-12-16 accident but as per the 7th CPC CSS RULE 10 annual increment will be on 1-7-2017 in Matrix Level 6. Since your pay was fixed from 1-4-2016, if you are asked option it will be given from 1-7-16 this is only option, but you got earlier 3 months higher pay i.e. GP 4200 not GP 2800. You have already in Matrix Level 6 from 1-4-2016. If you require in 7th CPC option you have to refund your higher pay in GP 4200 & you will be given in Matrix Level 6 from 1-7-2017 only, normal increment will be eligible on 1-7-16 in Matrix Level 5.

If promotion policy is 4600 (pb2) to 5600(pb3)

And my basic is 52000 in 7th level (4600 grade pay) what is the my new basic when i will get promotion to level 10 (pb3 5400 grade pay )

No promotional benefits from 7th CPC. Moreover from level 7 to 8 (GP 4800)) only in case of completion of 10/20/30 years as MACP upgradrations pay benefits from after next year of completion those who have without any Promotions, in next matrix level.

Dear Sir,

I am working on a 2400 go job and after one increment my basic pay is 26300.

I have completed 14 months on this job my queries are :-

1. I am going to be selected on 1900 gp job so if I leave this job(2400 gp job) & join the new one (1900 gp job) then what will be my new basic sailary ?

2. For getting pay fixation will I need to complete my probation in my present job ?

3. I have intimated my present office about the new vacancy before taking exam and now the recruitment process is ongoing and may be it will take 6 months for final result at that what should I do for getting technical resignation and after that for pay fixation in new job ?

4. Will there be any problem in getting technical resignation for a lower grade pay job ?

Plz reply for my queries

Nd if possible then mail me about this as I am new to this site

If you have applied through proper channel your pay will not less, you will be 26,800/- & increment in July only.

Sir,

I am working on a 2400 go job and after one increment my basic pay is 26300.

I have completed 14 months on this job my queries are :-

1. I am going to be selected on 1900 gp job so if I leave this job(2400 gp job) & join the new one (1900 gp job) then what will be my new basic sailary ?

2. For getting pay fixation will I need to complete my probation in my present job ?

3. I have intimated my present office about the new vacancy before taking exam and now the recruitment process is ongoing and may be it will take 6 months for final result at that what should I do for getting technical resignation and after that for pay fixation in new job ?

4. Will there be any problem in getting technical resignation for a lower grade pay job ?

Plz reply for my queries

Nd if possible then mail me about this as I am new to this site

My DOB is 01-07-1959.when I will retire. Can I get increment on July 2019?

No. So far orders were not released, only judgement issued.

You will get increment of July.

You will retire on Jun 30 and no increment on July 1;be given to you as you will not be in service in July

I am retired in Sept 2016. My initial appointment as on 18/09/1981 in Northern Railway after 5 years took transfer to Eastern Railway and completed total 33 years continuous service. Only 2 MACP given to me. Am I eligible to get 3 MACP? Please advice.

This is to inform you that the first ACP (completed 12 years of service given additional one increment) was started from 9/1999 & you got it from 1/9/2008 the MACP Scheme started at that time 2nd MACP on completion of 20 years. As per the scheme started date next on completion of 30 years it was 1/9/2018 (not your completion of 30 years service from 1981). Since you are retired in 9/2016 so you are not eligible for 3rd MACP.

Iam working in department of Post and got MACP-2 on 17.05.2017 . In 6th CPC the grade pay will be 2800 to 4200 and which most benefit to me . But the 7th CPC is implemented with effect from 01.01.16 .Shall I take the 7th CPC from the date of my MACP-2 ie 17.05.2017 by re-excersing option. Our accountant says that there is such provision. Please clarify shall I eligible to take the 7th CPC from the date of my MACP-2 by refunding the pay of 7th CPC till my MACP-2 ie 17.05.2017.

If it is normal designated promotion you will get lower benefit, but it is MACP-2 it will be benefited in matrix level 6.

I had opted fixation of pay in 7th cpc w.e.f. 01.01.2016 in pay level 5. I have got promotion in level 6 w.e.f. 01.04.2017. If my pay is fixed in sixth cpc on promotion i.e. gp 2800 to 4200 Then it is more beneficial to me compare to fixation in 7th cpc. Whether i can revise my option to switch over to 7th cpc w.e.f. from date of my promotion against om dated 12.12.2018 of finance ministry

Yes, now you can give option. Before giving option, check up old pay fixation (basic pay with GP & d.a.) in new matrix level 6 with D.A. Also your coming MACP in near future, because it will be added one increment while pay fixation if it so long it will be better.

Dear Sir

I was PSU absorbee in 1984 3cpc. worked as Extra Asst. Diir in cea/min.of power. ppo#136 170 300 104.I was in 650- 1200 scale with Rs 880/- as my 10 months average basic pay. I am engineering graduate.

please clarify my following doubts.

1.what is my grade pay 4200/4600/4800?

what is my basic pension in 4th,5th,6th,7th cpc

tell me proceedure to arrive at 7 cpc pension basic from 3 cpc using notional pay method too

V. JAGANNATHA REDDY

PPO# 136 170 300 104/ MOB :770 220 3231

In the 6th CPC GRADE PAY is ₹ 4200/-. Your last basic pay of ₹ 880 × 1.86 = 1636.8 + 4200 = 5836.8 × 2.57 = 15000.58 basic pay fixed at minimum of ₹ 18,000/- 50% of notional Pension as ₹ 9,000/- plus D.R. applicable as per the time to time from 1/1/2016.

Continues to my comments : Additional Pension is eligible as per attaining the age of. 80 as 20%,85 as 30%,90 as 40%, 95 as 50% & 100 as 100%.

My BP was 13690 GP 2800 as on 31 Dec 2015. I got my first MACp on 01 sep 2008. I was promoted on 03 mar 2016 with GP 4200. How much my pay fix as per 7th pay commission as on 01 jul 2016.

As per your basic pay as on 31/12/2015 of ₹ 13690+2800=16,490 × 2.57 = 42379.30 fixed at 42800 in matrix level 4 GP& from 1/3/16 due to Promotions it will be fixed as 43600 then due to increment postponed on January, 17 as ₹ 44,900/- in Matrix level 5. But you have to give option for promotion & increment.

My PPO/028256/2000. Fixed medical allowance with arrer since 2004.

My ppo no s/028256/2000,new ppo not received.

I am working at basic pay 50500 in gp 4600. I want to give technical resignation and to join in 4800 gp. I get increment in July. At what amount my pay will be fixed. Please reply

Rs.52000/-.

I was working in the office of central govt, at GRADE PAY 2800 with basic pay of 31000/- . I technically resigned from the office and joined the job in lower grade pay 2400 at what amount my pay will be protected.

At ₹ 31,400/- if it’s proper channel.

Please give any order or rule in respect of same.

If you are applied proper channel and technical resignation your pay was product-ed with your service & basic pay as per the Pay Matrix Table in level 5 (GP 2800) to 4 (GP 2400) in stage after your old basic in table 4 of Rs.31,000/- next stage as Rs.31,400/-. If not technical resignation it Rs.25,500/- only.

I was getting 53600 in level 8 of GP 4800 upto December 2016 after getting annual increment on 01.07.2016. From January 2017 I promoted to higher post of Group A – 5400 GP in Level 10. As per new rule will my basic revise ?

Answer to A N MISHRA : No. As per the 7th CPC rules no promotional monitory benefits, only designation changes. By way of MACP of every 10 years pay will be upgraded as next matrix level changes.

I worked in level 6 index 3 and I technical resigned and joined in a new post in level 10 recruited by UPSC what is the my index number in level 10 please clarify

Are upgraded grade pay in the seventh CPC, eligible for bunching?

Answer to A K SINHA : Yes with additional one increment in same level and fixed to nereast amount of stage in next level for upgradration in MACP.

I am asking only for upgraded grade pay by seventh cpc not macp.

Eg. 4200 gp is upgraded with 4600 go. Due to upgradation can Senior officers claim bunching from juniors officers if differences more than 3% in the basic. However both officers have joined in sixth CPC. Therefore no one r having basics below the entry pay.

Explain how is it determined?

There is no grade pay in 7th Central Pay Commission only MATRIX LEVELS.

Good analysis . I think u have not seen bunching order of dated 3 Aug 2017. Before giving any comments read carefully. Then suggest oj

Read 7th para of O.M. From last ……..As a result …………..7th CPC. Para 8 (iv) reproduced .. “All pay stages lower than the entry pay in 6th CPC pay structure as indicated in PAY MATRIX contained in 7th CPC REPORT are not to be taken into account for determining the extent of benching.” Moreover this O.M. & O.M. dt.7/9/16 is for HAG Scale, HAG+scale, Apex Scale & the scale of CABINET SECRETARY. Not .for others like GP 4200 & 4600. Read the O.M. fully. Thanks for your comments

I am working 18 years in PB-1 and now i will join with the new post of PB-2. What will be my monthly pay of my new post.

Answer to RICHARD – PB-2 of 6th CPC starts from Rs.9300-34800 with GP 4200, in 7th CPC MATRIX LEVEL 6 of Rs.35,400/- it depends upon your starting basic pay and scale of pay (promotions/MACP if any) of Grade Pay it will be fixed at new post of matrix levels.

Your next MACP on completion of 10th year on 16/2/2022 from that day upgraded your pay in level 8 and getting one additional increment in matrix level 7 and pay fixed in level. 8. In the 7th CPC no monitory benefits for any promotions.

I am working in Income Tax Department

I got MACP on 16/02/2012 Grade pay Rs. 4200/- to Rs, 4600/- with one increment (post hold as Sr. T.A.),

25/01/2016 promoted as “Office Superintendent” same grade pay Rs. 4600/- not received any monetary benefit and on dated 30/07/2018 promoted as “Administrative Officer” is same grade pay,Rs. 4600/-, can I get any monetary benefit?

Pl give reply early as possible because I want to give option form to the department.

thanking you

Your next MACP on completion of 10th year on 16/2/2022 from that day upgraded your pay in level 8 and getting one additional increment in matrix level 7 and pay fixed in level. 8. In the 7th CPC no monitory benefits for any promotions.

My Band Pay as on 01.01.2016 is Rs.15520+Grade pay Rs.4600 = 20120

Accordingly my new pay as per 7th CPC = Rs.52000 ( Cell 6 in level 7 of pay matrix ) based on the option exercise with effect from 01.01.2016.

i retired on superannuation = 29.02.2016 A/N.My last date of increment is 01.07.2015.

I have served 8 months after my last increment and before my retirement. Whether i am eligible to get an additional increment. Because as per the 7th CPC recommendation the minimum service required is 6 months to get an increment.

No, Actually increment counts service of one year, in the middle if any upgradations of pay as MACP in the 6th CPC grade pay changes & in the 7th CPC as next matrix level of pay.

My Band Pay as on 01.01.2016 is Rs.15520 + GP Rs.4600= Rs.20120. Accordingly my 7th pay = 20120×2.57=51708 or Rs.52000 as per cell 6 in level 7 of Pay Matrix of 7th CPC.based on the option exercised w.e.f.01.01.2016 My date of last increment is 01.07.2015. I have retired on superannuation on the a/n of 29.02.2016. Based on the New pay of Rs.52000 I am receiving my Pension.

As I have served 8 months after my last increment and before my retirement,whether there is any rule to get an additional increment. Because as per 7th Pay Commission recommendation the minimum service to get an increment is six months.

1. Before ACP my basic pay was Rs. 55200 as on 01.01.2017 in the pay scale 9300-34800 (GP-4600) Level-7.

2. I got 2nd MACP on 28.01.17 in the pay scale 9300-34800 (GP-4800) Lavel-8.

.4. My last date of increment was 01.07.2017 and next increment date is ????????????

As you asked your next increment will get benefited on 1/7/2018 only. Regarding pay benefited due to 2nd MACP your basic pay as given with one increment in that level 7 of Rs.56900 and fixed pay as Rs,58600 in level 8, stage 8 as on 1/7/2017, next increment in that level 8 at stage 9 as Rs.58,600 on 1/7/2018.

Sorry you will be benefited increment from 1/1/2018 on completion of 6 months from 1/7/17 to 31/12/17. You have to given option of increment From 1/1/18. your basic pay as 1/1/2018 as RS..58,600/- not from 1/7/18.

Correction : New pay on MACP (28/1/2017) ₹ 56900/-

DATE OF NEXT INCREMENT if new pay on the date of MACP 1/1/2018

NEW PAY ON THE DATE OF NEXT INCREMENT ON 1/7/2017 ₹ 58600

DATE OF NEXT INCREMENT IF NEW PAY ON 1/7/2018

June 25, 2018 at 4:30 pm

Revised

1. Before ACP my basic pay was Rs. 56900 as on 01.02.2017 in the pay scale 9300-34800 (GP-4800) Level-8.

2. I got 2nd MACP on 19.02.17 in the pay scale 9300-34800 (GP-5400) Lavel-9. In this regard I opted benefit of FR 22 B.

3. In meantime I have been promoted as AEC in the pay scale of 15600-39100 (GP-5400) Lavel-10 on 20.06.2017.

4. My last date of increment was 01.07.2016 and next increment date is 01.07.2017

5. What should be my fixation of pay as on 01.07.2017 i.e. the date of next increment.

6. Are it is beneficial for me to fix my pay on date of increment or not. If not, then what I can choose.

As pay as on 1/2/17 i.e. Rs.56,900/- in matrix level 8 (4800) on upgraded pay due to 2nd MACP from 19/2/17 will be fixed with one increment in that level 58,600 and next stage in that level as 59700 fixed from 1/7/2017 in next level 9 (GP 5400) stage 5 as 60400 and next increment will be on 1/7/2018 as 61500 at stage 6. Your fixation of pay as on 1/7/17 is 60400 surely you are benefited and your matrix level changes so you will be getting next increments in that level 9. This is inform you that your designation changes from your promotion as on 20/06/2017 but at that time your pay may not change, from the 6th CPC on wards there will not be monitory benefits, only MACP of every 10th year getting benefits by changing the matrix levels. Further there will not be pay scales for promotions (if the pay changes only the pay is less than pay and not to over pay in that level).

1. I have been promoted as EE in the pay scale of 15600-39100 (GP-6600) and Level -11 on 08.12.2017.

2. Promotion my basic pay was Rs. 77900 as on 01.07.2017 in the pay scale 9300-34800 (GP-5400) Level-9.

3. Before promotion i got 3rd MACP on 01.06.2016 (GP-5400).

4. My last date of increment was 01.07.2017.

5. What should be my fixation of pay as on 08.12.2017 i.e. the date of promotion.

After 6th CPC there will be no promotional benefits of monitoy,only designated changes. Only MACP will get monitory benefits upto 3rd MACP, Since you got 3rd MACP only increment in 1/7/18 as RS.80,200 in matrix level 9 at next stage.

I am a posted as Jr. Clerk in Indian Railway. I have already taken MACP in GP Rs2000/- under 6th CPC. My Basic Pay Rs. 32000/- fixed on 01.07.2016 under 7th Pay Commission. I got Promotion as Sr. Clerk in GP Rs.2800/- in Level 5 under 7th pay Commission on 30 August 2016., Now Office give me Grade Pay Difference only Rs. 800/- Previous rate accordingly 6th Pay Commission. So I get loss Approximately Rs.1200/- .Kindly advise and solution to me for this.

There is no pay scales for promotional designated benefits from 6th CPC. Only monitory benefits by way of MACP of every 10 years from 1/9/2008 by way of GRADE PAY changes and in the 7th CPC as next matrix level changes.

I retrired on 30 04 2016 my basic pay 18450 (9300-34800) gpay4200.pl.tellme my fixation ofpay (7thcpc) new formula

There is no pay scales for promotional designated benefits from 6th CPC. Only monitory benefits by way of MACP of every 10 years from 1/9/2008 by way of GRADE PAY changes and in the 7th CPC as next matrix level changes.

This answer is to Tvsubburaju – 8/4 : As per your last pay of ₹18450 your NOTIONAL PENSION FROM 1/5/2016 is ₹ 23,800/- plus D.R. as applicable rates.

MERA NIYOJIT 10.03.2003 MEN HUA HAI JANUARY 2018 MEN SALARY KITNA MILEGA

my pay as on 01.01.2016 is Rs.6050/- in the PB of Rs. 5200-20200/- & GP of Rs. 1900/-. After multiplying with 2.57 my pay arrived at Rs. 21742/- now tell me in level 2 where my pay need to be fixed whether it will be Rs. 21700 or Rs.22400/-

Ans.: 22,400/-

my pay as on 01.01.2016 is Rs.6050/- in the PB of Rs. 5200-20200/- & GP of Rs. 1900/-. After multiplying with 2.57 my pay arrived at Rs. 21742/- now tell me in level 2 where my pay need to be fixed whether it will be Rs. 21700 or Rs.22400/-

I am retired on 31-08-2015 my basic pay 21250(9300-34800)g pay4200.pl.tell me my fixation ofpay(7th cpc)New formula

my date of joining 17/05/91, pre-revised scale drawn basic pay of Rs. 111610/-

(i. e. PB+GP) as 0n 31/12/15 and

my most junior colleague date of joining 25/06/91, he getting more basic pay than me i. e. of Rs. 11920/- as on 31/12/15. So, now pay fixation as per 7th CPC

given below :-

I am Matriculate & my junior is non-matriculate, I have get scale 3050-4950 upgraded by ACP w.e.f. 17/05/03 and MACP w.e.f. 17/05/11 also my junior get scale 2650-3200 upgraded by ACP w.e.f. 25/06/03 but his ACP super-session as per MACP scheme and he get two MACP on 01/09/08 & 25/06/11

7th CPC revised scale pay fixation, my basic of Rs. 32000/- as on 01.01.16 and my junior basic pay 33000/- as on 01.01.16.

Under the circumstances I want to know that would be what provision as

per pay rules for that situation ?

thanking you in anticipation.

banibrata ray.

Sports Authority of India,

Kolkata.

my junior

Onwards1.1.2016

10190+2400=12590

1.11.2016

10570+2400=12970

Now 1.11.2016 I have got my first higher scale and grade pay 4200

So 10960+4200=15160

So how much pay in 7th pay scale plz rply

sir my pay band is 4440-7440 and GP 1300 as on 01-01-2016. so sir tell me what will be my pay according to 7th pay commission. last 1/10/2017 my pay 15700 +DA+786+HRA+610MA+300 TA+150 = 7 pay gujarat gov.

Sir, I have opted fixation of 7th pay from date of next increment i.e from 01/07/2016 as per rules 22(1)(a)(1) and get benifit on one increment. My department paid salary for the month from jan-16 to june -16 as per six pay as i have opted from 01/07/2016. But as per government notification dated 27/07/2017 the basic would be paid as per seventh pay structure matrix and given with illustration. I have been promoted from 01/07/2015, but the interview and promotion order was issued in the month of march 2016. after implementation of seventh pay during fixation option i have opted 7th pay from 01/07/2016 to get benefit of one increment.

pl advice me that the payment from jan-16 to june -16 would be paid as per sixth pay or seventh pay.

My current basic pay is 12420/- grade pay 4400/- what will be my current salary as per 7th pay in mumbai

Sir I am retieard 1sep2016 from army acp nb sub .mysrvice inarmy24years four month 2day.my basik pay 9382 is correct? Hwo many penson grant me.

sir my pay band is 4440-7440 and GP 1300 as on 01-01-2016. so sir tell me what will be my pay according to 7th pay commission.

An employee under medical category appointed on 01/12/2016 in the 7CPC matrix level 10. He is Medical Doctor and eligible for Non Practicing Allowance (NPA). What will be his pay fixation as per 7CPC on the date of his joining i.e. 01/12/2016.?

1-1-2016 my basic 8900/-and GP 1900/- to Promotion dt.11/03/2016 GP 2400 my next basic as per 7thpay commission if my basic was fixed…….?

Promooted from level 6to level 7 on11/08/2017,what is my next basic as per 7thpay commission if my basic was in level6 43600.

Respected Sirs,

Fixation of Pay for the employees who got the MACP between the period 01.01.2016 to 30.06.2016 may kindly be illustrated clearly as illustrated in RBE No. 79/2017 Dated 31.07.2017 with example.

I PROMOTED ON 26/05/2010 and before promotion my basic pay is Rs.10310 and grade pay Rs.2800/- and after promotion I go to grade pay is Rs.4600/- . Kindly let me tell what is my basic on 01/07/2017 as per 7th pay commission

Retired on 31 May 2006 in the scale of 67000 –79000 at basic pay 75 500 plus NPA @ rate of 25% restricted to Rs 85000 basic pay and pension 50% of it was fixed at 42,500 plus DA.

Option 1 is 42500×2.57

Option to 2, notional pay fixation in corresponding grade+NPA limiting to not more than 237000 and 50% of it

2nd option will be beneficial

Where my basic pay will be Fixed?

Pay fictetion enclosed please

As on 1 jan 16 my basic pay+grade pay=10440 after macp on 2 jan 16 my basic pay+grade pay= 10840 two increment due on 1 july 16 what will be my new basic pay in 7th cpc

Sir,

Most Respectly, I want to submit few lines about 7cpc pay matrix table. In the Matrix table fixation according to Service years has been ignored. Sir, after 15 yrs of service, the pay fixation has not been carried out as per indls service yrs.

For example, in the Level-3, i.e. in Grade Pay Rs. 2000/-, after 28 yrs of service my pay in 6cpc was Rs. 9980 + 2000 = 11980/- on 01 Jan 2016 and it has been fixed in 7cpc on Rs. 31,100/- only whereas in the minimum level-1, i.e. in G.P. 1800/-, after 28 yrs of service, fixation carried out on Rs. 39,900/-, hence I am loosing 39,900 – 31,100 = 8,800/- p.m. in Basic Pay which is a great loss to me.

Further, no bunching benefit has been given to me. Please advise me

Sir, what can I do for this great loss.

Thanks for your advice. Yours faithfully

Sir I promoted in the next pay matrix from 5th to 6th on 25/02/2017 and I opt to fix my pay on acqural of my next increment in the lower pay matrix I. E. 01/07/2017 My pay at the time of my promotion is Rs.37000/-. Sir please help me and intimate the formula of fixation my pay in the next pay matrix.

I retired on 31.5.2003 as PS ‘B’ in DRDO in the pay scale of 7500-250-1200 (after 6th CPC 15600-39100 GP 5400) drawing pay Rs. 9250 at the time of my retirement. What should be my basic pension as per the OM dated 12.5.2017.

The basic salary of a person Rs.14060/-,but other person on the same cader of IIT.,INCOME TAX,join in one year as basic pay 17140(including 4600/-),but bunching is fixed by deptt.pay as on 01.01.2016 Rs.55,200/-.,@ 7 increament added of his scale in during one half year from date of joining.but it just seems it exceeded the pay scale of higher authority those who are working more than 20 year service.It can possible the higher authority can counted on bunching system..

I was running on 17470 including GP 4200 on 31/12/2015 with 8 years service. I promoted on 1/1/16 in 4600 GP and fixed on 18400.In seventh pay commission I fixed at 49000 in 8th level .I have not been given benifit bunching.Can I get benifit of bunching with employee of my earlier cadre i.e.4200

I was granted MACPS in June, 2013 with Grade Pay 2800/-. I want to know which Option, I should exercise to avail the benefit of 7th Pay commission.

I am a lecturer in medical college eligible for npa. I have joined my job on 1/6/ 2016. My starting pay values were as follows

basic pay:18750+ 6600( grade pay)= 25350

npa: 6338

kindly tell me what my new basic pay would be. I am having an argument with my employer regarding the same.

if as on 01.01.2016 pay is 17820 + 4200 GP it comes to 22020 then fixation will be 22020X2.57 =56591 hen it is fixed to level 6 index 17 at Rs 56900/-

thereafter after adding 3% yearly increment as on 01.01.2016 or 01.07.2016 as per recommendation it comes to @3% of 56900 is Rs 1707 then BP 56900+1707 (increment 3%) it comes to Rs 58607. then in level 6 index 18 is 58600 next index 19 in level 6 is Rs.60400 then fixation should be 60400 not the less than 58607. As with increment comes to 58607 . then next higher to be fixed not lower than the fig comes. pl suggest and take remedial action to avoid loss to employee.

Please suggest is the below mentioned fixation is right under 7th CPC:-

1. Current Pay Scale/Pay Band BP=58600, Level= 7 at S.No. 10

2. Promotion to the post of Bacteriologist

w.e.f. 05.08.2016 in the pay Band-II

(9300-34800) + GP Rs.4800/-

3. Existing Pay as on 06.08.2016 BP= 58600

4. Adding 3% Increment of promotion in 58600×3%= 1758, the lower grade as on 06.08.2016 BP= 58600+1758= 60358/- i.e.

60400

5. Pay to be fixed as on 06.08.2016 BP=60400, Level= 8 at S.No. 9

6. DNI 01.07.17

I worked as auditor with 9630 basic and 2800 gp till 10.02.2016.

on 11.02.2016 after taking technical resignation i joined as tax assistant in gp of 2400. but as per 7th CPC pay will be fixed on 01.01.02016 and that time I was on 9630+2800.you are requested to help me in how my pay will fix.

Working as LDC with Ist MACP of Rs. 2000,The grade pay was Rs.10200+2000 as on 01.01.2016

Further on 04.08.2016 promoted under Limited Departmental Exam as UDC in the grade pay of Rs.2400/-

Please tell me-

1) whether I shall be entitled for one increment(on promotion) as my office is saying that you have already given an increment at the time of fixation is MACP (Grade pay Rs.2000) that’s why you are not eligible for one increment on promotion

please guide me..

@ Shri A.K. Ghosal Ji, it will be benefited if you opt 01.07.2016. Your basic pay will be 71300 in Level 9 after getting MACP. If you opt 01.07.2016, your pay will be fixed in 6th CPC upto 30.06.2016. i.e. Rs. 27220/- (25080+760+780+600 difference of GP). Till the time of Retirement i.e. 31.07.2016 your basic will be Rs. 75600/- However. you will not get arrears and your immediate loss is Rs.57420/-. Your increment date will 1st July

If you opt 01.01.2016. your basic will be Rs. 66000/- as on 01.01.2016 after getting MACP on 23.06.2016 your basic will be Rs. 69200/- in Level 9 and your increment date will be 1st of January. Till the time of retirement i.e. 31.07.2016 your basic will be Rs. 73400/-. You will get arrears of Rs.56000/- approx.

I think option date 01.07.2016 is better, however, you will not get arrears but basic will increase from Rs. 73400/- to Rs. 75600.

The above calculation is as per my understanding.

My pay in pay band + grade pay as on 31.12.2015 was Rs. 20280+4800

MACP is due on 23rd June, 2016 (not yet received, file is still in process) (also still not got annual increament in July, 2016)

My retirement date is on 31st July 2018

What option date will be ultimate beneficial for me. please give comparison of option date 1.1.2016 and 1.7.2016

i have obtain 44100 in 2800 grade pay. my promotion due in April 2017 in grade pay 4200. my increment date july in every year. what is new pay in 4200 grade pay. what is the best option for choosing the increment date or date of permotion.

Sir,

When I was promoted from 2400Grade Pay to 4600 Grade pay in year 2009. My salary was fixed as 9300+One Increment+4600 Grade pay as per 6th CPC.

Now as on 01.01.2016 my salary is 12020+4600 Grade pay. what will be my new pay scale as per 7th CPC. if minimum will be fixed as per fitment table i.e. 44900 then my Juniors will also fixed at the same scale there will be no difference and my seniority become zero. Kindly suggest what is the provision in these cases as per 7th pay commission.

Sir,

My salary 11380+2400 = 13780 Ist January 16

and promotion 1St May 11380+4200 = 15580

July Increment

1477=4200 = 18970 kindly fixation my 7th pay commission

As on 1.1.2016 I worked in the scale of 15600-39100 + 5400 (G.P) at basic pay of Rs. 25090 (including grade pay of 5400), I got promoted in the month of February 2016 in pay scale 15600-39100 + 6600 (G.P) and my basic fixed as Rs. 25840 (including grade pay of 6600) in February 2016. In July I got Increment of promotion and annual increment and my basic fixed as 27830 (including 6600 GP). Please guide me how I can calculate my salary as per 7th Pay commission and arrears as well as on January 2016, on promotion in February 2016 and as on July 2016. Please guide me.

Sir,

When I was promoted from 2400Grade Pay to 4600 Grade pay in year 2010. My salary was fixed as 9300+One Increment+4600 Grade pay as per 6th CPC.

Now as on 01.01.2016 my salary is 12020+4600 Grade pay. what will be my new pay scale as per 7th CPC. if minimum will be fixed as per fitment table i.e. 44900 then my Juniors will also fixed at the same scale there will be no difference and my seniority become zero. Kindly suggest what is the provision in these cases as per 7th pay commission.

my basic pay including GP as on 01.01..16 is Rs.28010, kindly inform what will be my new basic pay:

a)if i exercise 01.01.16 option for fixation as my new date of increment.

b) if i exercise 01.07.16 option for fixation as my new date of increment.

which is beneficial for me?

I have proMoted to 4600 from 4200 on 01.04.2016, my basic pay including GP at the time of proMotion is 15200 and I opted increment on July 2016. In that case how can I fix my salary and salary arrears according to 7th CPC.

Medical officers, In GOVT college hospitals are losing private practice and serving the poor downtrodden BPL freely asper govt polycyclic. thus they are entitle to get heir on right of NPA 40% basically. NPA BE COUNT IN THE PENSON as basic

i have been prom0ted and placed in pay band of 6600 in April 2016.

From 1./1./2016 to 1./4/.2016 my GP was 5400.

I opted for pay fixation in july 2016

My basic pay on 1/.1./2016 is 25510 +GP 5400

what is the option i should choose?

I hv been passed sas exam in 2015 and ihv been received 3rd macp in 2008, at present I am getting 160 as special pay. I hv been fixed rs. 64100 as on 1. 1. 16 consequently my basic is rs. 66000 as on July 2016. My promotion is due on promotion I was to avail rs. 4800 as my grade pay. Now when my promotion took place then I shall get a notional increments or on what amount this will fixed. Let me know, please. Thanx

i am working in ordnance factory. i am my holding the post of MCM from 2010 at the grade pay 4200 and i am promoted Chargeman from 1 April 2016. Govt decided to give one increment on same grade pay. Sir please give your suggestion from when i take my fixation. and fix my pay

I have been in receipt of 2nd MACP with GP of Rs. 5400 in PB2 from 8th July 2014 and subsequently granted NFS with GP of Rs. 5400 in PB3 from 1st July 2016. How will my pay be fixed as on 1st January 2016 and what will be my pay on 1st July 2016?

My basic pay on 01 jan 2016 bp 23430 and gp 4800 fix by new pay commission Rs. 74300 and next pay fix on 01/07/2016 with one increment 3% (76529) where is fix of my basic pay on 01/07/2016

Promoted on 01.01.2016 from basic pay 10400 grade pay 2800 to basic pay 10800 grade pay 4200. Request confirm my new basic pay with example. Confirm basic set on old or new grade pay. What is my increment date

It has been asked to fix the pay on date of promotion in respect of employees who have been promoted between 02.01.06 to 30.06.16 as per below but what about the General Principle of giving option under FR 22 from Date of Next Increment is that not available or banned

13. Fixation of pay on promotion on or after 1st day of January, 2016.—The fixation of pay in case of

promotion from one Level to another in the revised pay structure shall be made in the following manner, namely:-

(i) One increment shall be given in the Level from which the employee is promoted and he shall be

placed at a Cell equal to the figure so arrived at in the Level of the post to which promoted and if no

such Cell is available in the Level to which promoted, he shall be placed at the next higher Cell in

that Level.

My grade pay is 4800 after macps in Gp 4600 & my increment on 1st July ;now I will give option for pay fixation from 1st Jan 16 or from 1st July; kindly suggest

Please check the following fixation Exmp:- A’s basic pay in 6th pc on 01/01/2016 in scale 5200-20200 GP 2800/- PB 1 Rs 14420/- pay fix in 7th pc on 01/01/2016 Rs 38100/- in level 5 on 01/07/2016 Rs 39200/-

However B’s basic pay in 6th pc on 01/01/2016 in scale 9300-34800 GP 4200/- PB 2 Rs 14620/- pay fix in 7th pc on 01/01/2016 Rs 37600/- in level 6 on 01/07/2016 Rs 38700/- both are appointed in same capacity and same year. is it possible?

Dear Sir,

Please tell me what is the round off formula under 7th Pay Commission Rs. 100 OR Rs. 10

how to relate pay marix if grade pay is not matching…..

i am giving here an example

my basic as on 1-1-16 as per 6th pay — 15210.

my pay scale is 9300-34800 and Grade Pay is 4400

it is neither 4200 nor 4600. so what to do in this case.

My Basic + GP = 9460 +2400 =11860, with multiple factor 2.57 × 11860 = 30,480.2, my new Pay in 7th CPC is 30500 in Jan 2016. I have been given option to select Pay on 1st July 2016 as 32,300 with surrendering arrers of 7th CPC. Alternatively I have been given option 31400 7th CPC with arrears. Please suggest which option to select.

What has happened to fixation / revision of pension of pre & post 2016 retirees ? No comment is available from the Finance Ministry / Govt of India / Staff unions.

i have doing at national law university, jodhpur. my current basic band is 4440-7440 with GP 1400. My current basic pay is 8680 with 20% HRA and 70 Rs. CCA. and 125% DA. please how much salary increase after implimention of 7th CPC.

Suppose Mr. A’s basic as on 01..01.2016 is 7000. So new basic is 18000. After increment in 01.07.2016 the new basic must be 3% of revised pay. So 18000*3/100=540.So new basic as on 01.07.2016 must be 18540. But in 7th pay commission pay fixation method it is said that after increment the pay goes to next level that is

18500. Here Rs.40/- is less compared to the original increment. So is this means that this amount is avoided……Please reply.

Hello

I have been promoted to the grade pay of rs 4200 in higher pay band wef 15 Mar 2016. Previously I was getting grade pay of rs 2800 I. e on 1.1.2016. How will my pay be fixed as per 7 cpc.

Further can I exercise option to get my pay fixed from 15.3.2016.

Sir,

I am working in the pay band 5200+2400 from the year 2009 .

At present my basic pay is 9100

According 7th pay commission, multiply factor 2.57 is given. If my basic pay multiple with 2.57 than new pay basic pay will be 25500 as pay matrix which is given by 7CPC

Now if a person getting the appointed for same post, His drawing basic is also equal to my basic pay that is 25,500

My service is almost over by 8 years

I feel that there is no different in pay for working employee.

Kindly give me clarification for this issue..

Advice to remove the disparity in pay existing from the date of appointment in the same organization at the same post even after the judgement of High Court but unimplemented by the organization

can ant one clarify the following please

1. what is the pay band and grade pay for extra assistant directoe in ministry of power cea?

2. what is the pension in case of fully commuted and restarted after 15 years after commutation.

Release 7cpc immediately as per federation directions it is good for govt

Politician s earned crores of money within 5 years, but employees doing 40 years service but they are not earned at least 40 thousands in their accounts . What’s the secret behind politicians earning capacity.

Old pension scheme should be implemented sympathatically as well as for social security point of view please.

Sir,

If you could help me out in calculating my pay fixation as per 7th CPC. My present grade pay in the rank of Inspector is Rs.4600/- . I was granted MCP w.e.f. Nov.2009 and my grade pay is fixed at Rs.4800/- even though my hierarchy grade pay is Rs.5400/-.. Now, as per the 7th CPC , the grade pay of Inspectors have been upgraded to Rs.4800/- from Rs.4600/ w.e.f. 1.1.2016. How my pay will be fixed in the 7th CPC ? Am I eligible for the next grade pay of Rs.5400/- as I am drawing the enhanced grade pay under MACP since Nov.2009 ?

Sir,

It is correct and genuine but the merger of two grade pay is not correct. Separate fitment for 4600 GP and 4800 GP must be followed. The seniority will be affected.

As on 31/12/2015 i was in pay band 9300-34800 with pay 20410 and grade pay 4600. On 02/01/2016 i got MACP , i was given option whether i want promotion increment on 02/01/2016 or on 1st of JUly 2016. if i agreed for 2nd Jan 2016 then i will not get yearly increment onJUly 2016 as per rule. But if i opted for JUly 2016 then i will get two increment on 1st July. So can i know what will be my basic as per seventh pay commission on 1st Jan 2016 and on 1st July 2016. what i came to know from office that before MACP and after MACP as per seventh pay my basic will be on 66000. Then what is the use of MACP if with grade pay of 4600 or with 4800 my basic will remain 66000

THE LOWER LEVEL PAY SCALE OF SELECTION GRADE AND SPECIAL GRADE MUST BE EQUALISED TO THE HIGHER LEVEL PROPOSNATE PAY SCALE

PROPOSNATE SELECTION GRADE SPECIAL GRADE

9300 – 34800 15600 – 39100 39200-67000

+4600 +5400 +11000

15600-39100 39200-67000 ———

+GP 5400 GP 11000

WHAT AMOUNT OF GRATUITY TO BE AFTER 7 YEARS OF SERVICE

Thanks

those who have got increment within 14,December,in which process they will include that increment with their basic pay that already has been done.

How much will be the initial dearness relief rate to be fixed on the new basic pension ?

Beside the pay revision efficiency of an employee should be tested to encourage to get higher pay than the inefficients.

Employee always want more pay. The more the better. They never look at fellow citizen. They only work if somebody pay them.The secretariat is the hot bed of corruption. The empolyment should be on contract basis for five year only.

Appointed as PWM on 12.04.1989 in the scale 1400–2300.(Engineering dept)Now performing duty as SSE in the grade pay 4600.Is the grade pay correct. If not then what will be.

There is a heavy difference in the pay of Govt. employee and public sector employees. The PSU employees are getting fixed 50% more salary in the form of perks. This difference need to removed. Moreover, the PRP is additionally paid to them which is nothing but a source of bungling done at higher levels and also corruption tool. This also need to be eliminated in the coming revision for them which is due from 1-1-2017. Moreover, the experience of creating posts of Functional Directors in CPSUs is very bad as they do not have any work and are simply signing machine on proposals put up by juniors. They are white elephants in most of the cases and are burden on the finances of Govt. The posts need to be abolished urgently. In case govt. takes some action on these issues, Govt. and the PSUs will be benefitted immensely. FM and PM are requested to look into this.

My pasic pay is 9150 also grade pay is 2400 but neu grade pay how much sir

Pay difference in between two employee working as same grade pay 4200,because if one employees got promotion before 1.1.2016 and another get promotion after 1.1.2016….huge difference of pay,but they working as same post…Difference near about 4000 rs…..it is unjustified….. Mathur has no basic idea,how to remove grade pay and introduce pay matrix…. After 7 the pay commission any employee can not take responsibility, because the promotional hike is only one increment…….pay matrix system is same to old pay scale….. needs to teach from Sri Krishna(6th ppay commission chairman)..

my basic pay 9110 and grade pay is 2400 my new pay how much sir

Why salary of gp4200&gp4600 has large difference whereas difference in gp4600&4800 is small?

My basic pay is 11450 and grade pay 2800.I will be promoted to grade pay 4200 on 01Apr 2016 .What will be my pay matrix position after 7th pay commission?

Will the 7th pay commission affect the centrally sponsored schemes,such as RMSA,SSA?

In every CPC recommendation i don’t think why panel are made a huge difference between Gp A, B, C and D. In the today’s scenario more talented and able persons are joining in Job irrespective Gp due to non availability of much Job. So why that much of differences. I am requesting to the penal through this message to kindly review the same again.

Why didn’t upgrad Pharmacist grade pay 2800 to 4200

The 7th CPC recommendations are ‘WORST” projected, the NJCM recommendations may be implemented for the benefits of all the

Group C & D employees. The Group A & B cadres in 7th CPC are benefitted there is no exception to that cadres..

The NJCM recommendations may be recommended.

Sunil Kumar

Hyderabad

On promotion grade pay 2800 to 4200 in 7th pay commotion how much benefits.

7th central pay commission must settle the issue of kendriya vidyalaya’s primary teacher’s entry scale 44900 i,e level-7 as per the order passed on dated 13 November 2009 by GOI for the grade pay 4200 to 4600 for per- revised scale 6500-200-10500

Otherwise it will become the matter of great grief for humanity in Independent India in KVS PRT’s life……….

I ve retired from Indian navy in June-1992 as a chief petty officer after 15 years service and getting basic pension 6080/- n total around 13500/- as now, what will be my new pension in B grade ???

Rs.5400 grade pay (NFG) given to some of the departments under entry grade of class one and some other departments to group ‘B’ those who are completed 4 years of service. Because of this some of the employees loosing benefit in VII CPC as well as VI CPC.

Due to sanction my selection grade grade pay will change in 01-01-2016 from 4800 to 5400 and pay band will also change from 2 to 3 and date of increment date is jan 2016. The pay in payband 2 is 18950 and grade pay is 4800 at present so please tell my revised pay in present 7th cpc recommendation. Thanks

Mygp is 4200 in the matrix table shown multiple figure given 2.62 but here calculation shown 2.57 which is correct pl.reply

The employees in the old pay structure are getting no benefits from the beginning of the pay commission. As you are continuing old employees in the same pay structure as it was from the different pay commissions. Sir, it is requested that the old employees may please be given new pay scales, instead of continuing in old pay structures.

My grade pay upgraded from 4200 to 4600 and by multiplying present basic pay by 2.57 it is coming out to be 37856 including 400/- hike in GP, where as entry pay for new entrants 44900. If one is brought to 44900, then what will be the basic pay for others in 7 cpc whose basic is coming to be around 39000, 40500 etc in the same grade pay i.e one or two years senior to me.

How to fix after fixation under the 7th CPC, if promoted for the grade pay of Rs. 4200 when increment not allowed in 6th CPC

mohan lal meena says

November 22, 2015 at 8:24 am

how the pay will merge of s-10 and s-11 as per v CPC and grade pay 4200 as per VI CPC to place in VII CPC

how the pay will merge of s-10 and s-11 as per v CPC and grade pay 4200 as per VI CPC to place in VII CPC

Two Gd pay of 8700 and 10000 are existing in one level of SE CPWD. As per 7 CPC the Gd pay has been abolished. Instead of Gd pay, level 12 and 14 have been created for these two Gd pay respectively. I want to know what is the difference between Gd pay scales and levels and how the pay will be fixed for SEs drawing different Gd pay.

Sir ring pay fixcion of from 3-4-5-6cpc to heavy vehicles drivers of govt three recruitment rules from 3cpc only one pay scale sir all CPC down pay setp to govt drivers scales 2cpc drivers scale equal to group b recruitment to 4-5-6 CPC group d scales 7cpc from 6cpc up pay grade all India govt drivers group b sir 30% ration & km payment per month equal air-sea 20000rs road drivers thanks

Sir,

Before any fixation of pay scale NC(E)’s of INDIAN AIR FORCE Should be categories with ranks and grade. This time they are been treated as personnel slavers of higher ranks. Supreme court should give the decision as soon as posible. Either, untill the time bhagvaan bharose

hai i am pay scales was deaf dumb how exisitance

Pay fixation start from Jan 2014 on words previous government will be done late, be cause of that government gone employees are happy your government also happy.

i am going to get macp-2 on 01..01..2017 . my present pay is 13280+gp 2800. what will be my pay+gp on 01.07.2017

Military service pay should be equal to all the ranks from sepoy to General. Because all the soldiers and officer’s are serving for the nation there should not be any variance in MSP.

Shall tech2 and tech 1 be in railway workshop be merged

Pay fixation on promotion should not be less than Direct Recruit Pay before giving effect additional 02 increments on promotion.

As per the revise structure of 7th pay commission the pay bands in 6th C P C S1 to S4, S5 to S8, S9 to S12, S13 to S15, S16 to S18 these grades are integrated. The integration policy may effects on the employee of technical grade in such cases a special attendance must be taken. employees working with machinery training, critical atmospheric conditions shall provide special attention in fixation

sir my basic pay now 14320or grade pay 4200 and house rent is 15% and DA 107%. than what is salarey after 7 pay scale.

Grade pay introduse in 6th CPC but this is not good for govt employees I request to 7th. CPC chairman and.it’s members pl cancel this system and introduce pay scale for promotons and MACP

Pay fix + ((6cpc pay+gp)*222)-GP

sir my basic pay now 9170 or grade pay 2400 and house rent is 15% and DA 107%. than what is salarey after 7 pay scale.

Ofcorse it is very good but is it possible.

Partha Acharya

29.01.2015

please reply for pay scale sturcture for 7 the commission

very good

good

Good

PAY FIXATION ON PROMOTION MUST BE ABOVE GRADE PAY + 2 INCREMENTS