7th Pay Commission Pay Scale Calculator for Central Govt Employees Latest Updated July 2021

Freezing of Dearness Allowance is withdrawn!

The suspension of Dearness Allowance for 18 months due to pandemic is now withdrawn! Suspended installemnts from January 2020 to June 2021 has been added and approved to hike by 11% from the existing rate by the Cabinet Committee on 14th July 2021. Now the revised rate of DA and DR is 28% with effect from 1st July 2021. You can check your Expected Salary Package from July 2021 with cummulative DA and revision HRA. [Click to calcualte]

Arrears for Freezing DA Period

As per the Finance Ministry order on Freezing of Dearness Allowance, there has been clealry indicated that no arrears for the period between 1.1.2020 and 30.6.2021.

Enhancement of HRA Rates from July 2021

According to the recommendations of the 7th pay commission accepted by the Central Govt, the House Rent Allowance (HRA) rates will be revised automatically to 27%, 18%, 9% when DA crosses 25%. Now the DA is 28%. So, the hike in HRA is applicable and implemented soon!

Hand Salary including Basic Pay, DA, HRA, TA and NPA (if eligible) pay level calculator updated for existing CG employees after the announcement of 28% DA from July 2021. [Waiting for HRA Revision order!]

Read also: DA Loss Calculator from Jan 2020 to June 2021

How to Calculate Monthly Salary in India?

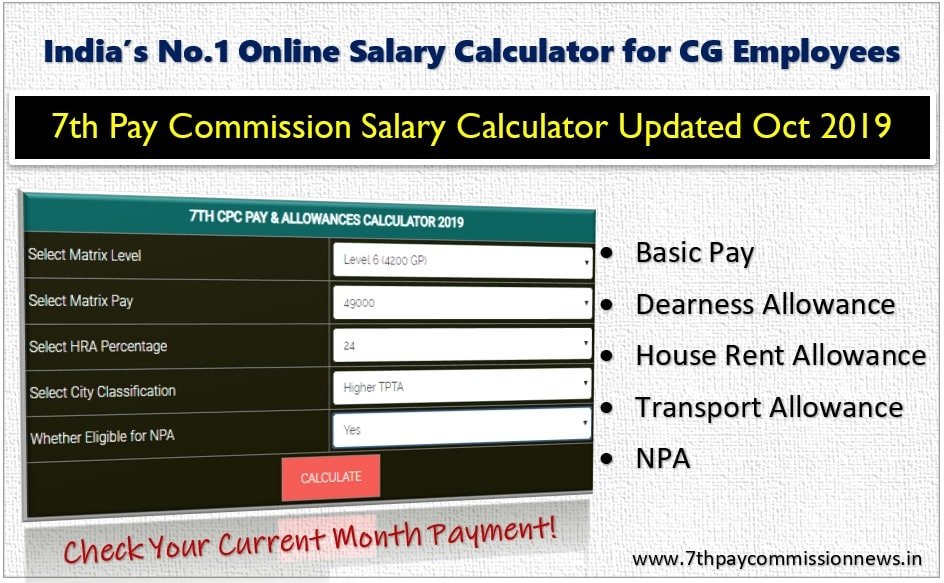

We are providing a simple online tool to find the monthly salary with admissible allowances as per the existing formula.

- 1st Step: Select your designation pay level

- 2nd Step: Select your basic salary

- 3rd Step: Select rate of House Rent Allowance

- 4th Step: Select classification of city (for Transport Allowance)

- 5th Step: If Doctor, Select NPA (Non-Practicing Allowance)

The simple calculator will give you a gross salary of the current month. The following allowances including Dearness allowance (17% of basic salary): Basic Salary, Dearness Allowance, House Rent Allowance and Transport Allowance.

DA Freeze for 18 Months

The Central Government has declared to freeze the Dearness allowance for three segments of January to June 2020, July to December 2020 and January 2021 to June 2021 for Central Government employees and pensioners due to COVID 19 pandemic crisis. [Click to view the detailed order issued by the Finance Ministry]

Expected DA from July 2020 Calculator with AICPIN

Expected Dearness Allowance (DA) for the month of July 2020 Calculator to Central Government Employees and Pensioners. We provide here a simple online tool (not excel sheet format) to predict the percentage of additional DA and DR with the input of imaginary AICPIN. [Click to calculate]

DA Loss in Salary Calculator 2020

DA Loss Calculator (January 2020 to June 2021) for Central Govt Employees: We have created a simple online estimation tool to predict the approximate loss in salary for 18 months due to freezing the DA for Central Govt employees. The calculator will show the loss amount of individuals on the basis of input their basic salary and Transport allowance details. [Click to calcualte]

DR (Dearness Relief) Loss in Pension Calculator

After implemented an important order issued by the Finance Ministry under the title of “Freezing of Dearness Allowance and Dearness Relief” on 23rd April 2020, all Central Government pensioners including Railways are wishing to know their total contribution to the Govt. [Click to calculate]

Government pay scale calculator | Central government salary calculator | 7th pay commission salary calculator download 2020

Check other Government pay scale salary calculator

7th Pay Commission Salary Calculator Updated Oct 2019

Hand Salary including Basic Pay, DA, HRA, TA and NPA (if eligible) pay level calculator updated for existing CG employees after the announcement of 17% DA from July 2019. [Click to calculate]

7th CPC Pay Fixation on Promotion and MACP Calculator

7th Pay Commission Pay Fixation on Promotion and MACP Calculator

If designation or grade of the post changed due to promotion, salary computation is more important as per the existing rules for Government employees. We provide here a simple tool to determine your new salary! [Click to calculate]

Expected DA from January 2020 Calculator

The calculation of Dearness Allowance from January 2020 is already over! And the next installment from July 2020 is almost over! Calculation of Additional DA from January and July 2021. [Click to calculate]

Expected DA from July 2020 Calculator with AICPIN

The calculation of Dearness allowance with effect from 1st July 2020 begins with the AICPIN (January 2020) of this year. We provide here a simple online tool (not excel sheet format) to predict the percentage of additional DA and DR with the input of imaginary AICPIN. [Click to calculate]

DA Loss Calculation for CG Employees

DA Loss in Salary Calculator for the period of January 2020 to June 2021

Additional DA Freeze (Temporarily Suspended) for Central Govt employees for eighteen months between January 2020 and June 2021. [Click to calculate]

DR (Dearness Relief) Loss in Pension Calculator for Govt Pensioners

After implemented an important order issued by the Finance Ministry under the title of “Freezing of Dearness Allowance and Dearness Relief” on 23rd April 2020, all Central Government pensioners including Railways are wishing to know their total contribution to the Govt. [Click to calculate]

How to Calculate Basic Salary in India?

What is the basic salary or basic pay?

Basic salary or basic pay is the fixed amount which pre-determined according to the post or grade. Basic salary is the base amount for the salary structure to be paid to an employee. All other allowances and increments also will be calculated on the base salary element. [Click to calculate]

Expected DA Calculator from January 2021

Everyone is expecting that the DA will touch 25% in the month of July 2020. In case of this not happening, certainly, the DA will cross 25% in the month of January 2021. [Click to calculate]

Expected DA Calculator from July 2021

As per the Finance Ministry order (No.1/1/2020-E.II(B) Dated 23.4.2020), the rates of Dearness Allowance and Dearness Relief as effective from 1st January 2020, 1st July 2020 and 1st January 2021 will be restored prospectively and will be subsumed in the cumulative revised rate effective from 1st July 2021. [Click to calculate]

Leave encashment for Central Government Employees

As per the Finance Ministry order (No.1/1/2020-E.II(B) Dated 23.4.2020), the rates of Dearness Allowance and Dearness Relief as effective from 1st January 2020, 1st July 2020 and 1st January 2021 will be restored prospectively and will be subsumed in the cumulative revised rate effective from 1st July 2021. [Click to calculate]

Salary Slab for CG Employees after the 7th Pay Commission

After the implementation of the 7th Pay Commission, the salary slab for Central Government employees has been totally changed as a new pay matrix system. The pay matrix system is explained below in detail:

Pay Level Salary Slab 1

Grade Pay: 1800

Pay Band: PB I

Salary Slab: Pay Level 1

Pay Index: 40 Stages

Minimum Basic Salary: Rs. 18000

Maximum Basic Salary: Rs. 56900

The minimum monthly salary in Central Government is Rs. 23913 including 17% Dearness Allowance, 8% House Rent Allowance and Transport Allowance. The minimum basic salary is Rs. 18000.

Rs. 5400, Rs. 3600, Rs. 1800 are the minimum House Rent Allowance (HRA) fixed for the employees working in X, Y, Z classified cities respectively.

Rs. 900 and Rs. 1350 is the minimum Transport Allowance for Central Government employees residing in Metro and Other classified cities respectively.

The current rates of House Rent Allowance (HRA) are 27% for X Class Cities, 18% for Y Class Cities and 9% for Z Class Cities as per the classification of cities and towns published in the notification. These rates are applicable from July 2021 (DA 28% from July 2021).

Good evening sir, my father was retired in the year 2010.27/02/2010 my father basic was 12140.and worked 33 years service. What would be the 7th pay pension. Please kindly give the answer. Thank you

If the basic pay was included grade pay or what is his grade pay of last pay.

I have retired on 31st May 2000 as an IB(P)S officer of the grade Station Director(JAG) AIR, Govt of India. Pay pension was fixed at Rs.14960/- on lst june 2006.my original pay scale was 12000 to 16500/ and my original pension was Rs.9845/ at time of my retirement on 31.05.2000. I was kept. in pay matrix level 12 item 3.. Please let me know what is the expected pension I would be getting as per the 7th Pay commission . My grate pay was 7600/-. Please let me know. Thanks.

Since you are in 5th CPC pay scale so at that time your basic pay plus 50% of additional pay was merged in 6th CPC. Please mention your basic pay only. 50% additional pay was merged and given as GRADE. Pensions it is 50% only.

Please fix my salary w.e.f. 01-01-2016 I have option to get increment w.e.f. 01-07-2016 and my time bound is due w.e.f 01-05-2016 let me know next date of increment as per rationalization and clarification by Director General finance

Without knowing your basic pay with Grade pay as on 31-12-2015, how it wil fix it?

No. It is allowed level 8 & 9 Group A & B non-ministerial employees allied healthcare professionals excluding Nurses.

I am laboratory technologist in lhmc new Delhi in central government and pay level 5

Am i eligible for hpca /pca

Above answer is for you.