7वें वेतन आयोग के परिवहन भत्ते की दर चार्ट [वाहन भत्ता] टीपीटी भत्ता गणना, कटौती, कर योग्य नियम 2026

7th CPC Transport Allowance Rate Chart 2026: Transport Allowance (TA) refers to a specific allowance provided to all Central Government employees to assist with their transportation costs incurred while traveling to and from their workplace. This allowance is a predetermined sum disbursed by the employer to the employee as an element of their overall salary package. The intention behind this allowance is to provide employees with some financial relief from the continually rising fuel prices and transportation costs.

7th CPC Transport Allowance Calculator 2026

Transport Allowance Finder (Oct 2025)

Important Note: The Dearness Allowance directly impacts the TA calculation. This post presents TA rates with two different DA percentages: 58% (effective from July 1, 2025) and expected to hike by 60% with effect from January 1, 2026!

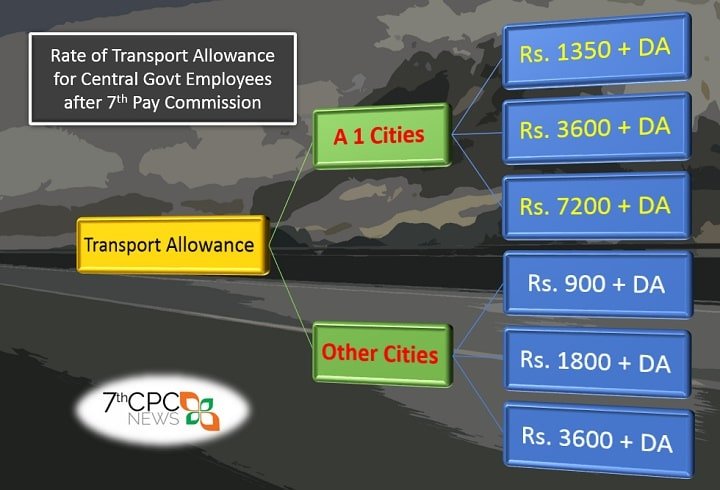

The Transport Allowance (TA) for Central Government employees is provided based on two categories of cities: TPTA Cities and Other Cities. The rates vary according to the pay matrix level (Pay Level 1 to 14) and are affected by the Dearness Allowance (DA) percentage.

7th CPC Transport Allowance Rate Chart 2026

Many people often confuse Transport Allowance with Travelling Allowance (TA). However, the two are different from each other. Travelling Allowance is paid to employees when they are required to travel for official work, such as attending a conference or a meeting in a different city. On the other hand, Transport Allowance is paid to employees as a part of their regular salary package to cover their daily commute to the workplace. While Travelling Allowance is reimbursed based on actual expenses incurred, Transport Allowance is a fixed amount paid monthly or annually.

TA Rates with 58% DA – Effective from July 1, 2025

| 7th CPC Pay Matrix Level | TPTA Cities | Other Cities |

| Level-1 (Basic Pay 18000 to 23500) | 1350 + 58% DA | 900 + 58% DA |

| Level-1 (Basic Pay 24200 to 56900) | 3600 + 58% DA | 1800 + 58% DA |

| Level-2 (Basic Pay 19900 to 23800) | 1350 + 58% DA | 900 + 58% DA |

| Level-2 (Basic Pay 24200 to 63200) | 3600 + 58% DA | 1800 + 58% DA |

| Level-3 (21700 to 69100) | 3600 + 58% DA | 1800 + 58% DA |

| Level-4 (25500 to 81100) | 3600 + 58% DA | 1800 + 58% DA |

| Level-5 (29200 to 92300) | 3600 + 58% DA | 1800 + 58% DA |

| Level-6 (35400 to 112400) | 3600 + 58% DA | 1800 + 58% DA |

| Level-7 (44900 to 142400) | 3600 + 58% DA | 1800 + 58% DA |

| Level-8 (47600 to 151100) | 3600 + 58% DA | 1800 + 58% DA |

| Level-9 (53100 to 167800) | 7200 + 58% DA | 3600 + 58% DA |

| Level-10 (56100 to 177500) | 7200 + 58% DA | 3600 + 58% DA |

| Level-11 (67700 to 208700) | 7200 + 58% DA | 3600 + 58% DA |

| Level-12 (78800 to 209200) | 7200 + 58% DA | 3600 + 58% DA |

| Level-13 (123100 to 215900) | 7200 + 58% DA | 3600 + 58% DA |

| Level-13A (131100 to 216600) | 7200 + 58% DA | 3600 + 58% DA |

| Level-14 (144200 to 218200) | 7200 + 58% DA | 3600 + 58% DA |

TA Rates with 60% DA [Expected] – Effective from January 1, 2026

| 7th CPC Pay Matrix Level | TPTA Cities | Other Cities |

| Level-1 (Basic Pay 18000 to 23500) | 1350 + 60% DA | 900 + 60% DA |

| Level-1 (Basic Pay 24200 to 56900) | 3600 + 60% DA | 1800 + 60% DA |

| Level-2 (Basic Pay 19900 to 23800) | 1350 + 60% DA | 900 + 60% DA |

| Level-2 (Basic Pay 24200 to 63200) | 3600 + 60% DA | 1800 + 60% DA |

| Level-3 (21700 to 69100) | 3600 + 60% DA | 1800 + 60% DA |

| Level-4 (25500 to 81100) | 3600 + 60% DA | 1800 + 60% DA |

| Level-5 (29200 to 92300) | 3600 + 60% DA | 1800 + 60% DA |

| Level-6 (35400 to 112400) | 3600 + 60% DA | 1800 + 60% DA |

| Level-7 (44900 to 142400) | 3600 + 60% DA | 1800 + 60% DA |

| Level-8 (47600 to 151100) | 3600 + 60% DA | 1800 + 60% DA |

| Level-9 (53100 to 167800) | 7200 + 60% DA | 3600 + 60% DA |

| Level-10 (56100 to 177500) | 7200 + 60% DA | 3600 + 60% DA |

| Level-11 (67700 to 208700) | 7200 + 60% DA | 3600 + 60% DA |

| Level-12 (78800 to 209200) | 7200 + 60% DA | 3600 + 60% DA |

| Level-13 (123100 to 215900) | 7200 + 60% DA | 3600 + 60% DA |

| Level-13A (131100 to 216600) | 7200 + 60% DA | 3600 + 60% DA |

| Level-14 (144200 to 218200) | 7200 + 60% DA | 3600 + 60% DA |

Key Points to Remember

- Transport Allowance is categorized based on two types of cities: TPTA Cities and Other Cities

- TA rates vary according to the 7th CPC Pay Matrix Levels (Level 1 to Level 14)

- Dearness Allowance (DA) directly impacts the TA calculation

- DA increased from 55% to 58% effective from July 1, 2025

- Higher pay levels (Level 9 and above) receive higher TA rates

- Employees in TPTA Cities receive approximately double the TA compared to those in Other Cities

How to calculate Transport Allowance in basic salary?

Transport Allowance Calculation Formula; The method for calculating the Transport Allowance based on Basic Salary, as per the recommendations of the 7th Pay Commission, has been implemented starting from July 1, 2017. The formula used for the monthly calculation of the Transport Allowance is as follows: A denotes the rate of Transport Allowance, while D signifies the percentage of the existing Dearness Allowance.

Transport Allowance = A + [(A x D)/100]

To determine the Transport Allowance, the following formula can be applied: [(Dearness Allowance x Rate of Transport Allowance)/100] + Rate of Transport Allowance. For example, if an employee is classified in pay level 6 and receives a basic salary of Rs. 49,000 while employed in a Metro area, their monthly Transport Allowance would amount to Rs. 4212. This figure is calculated by adding 3600 to the result of multiplying 3600 by 17 and then dividing by 100.

Transport Allowance Enhanced to Pay Matrix Level 1 and Level 2

As per the directive released by the Department of Expenditure on August 2, 2017, employees earning Rs. 24,200 or more in Pay Matrix Level 1 and Level 2 are entitled to receive a Transport Allowance of Rs. 3,600 along with Dearness Allowance each month for metropolitan areas, and Rs. 1,800 plus Dearness Allowance per month for all other locations.

Amendment order regarding Transport Allowance on 2.8.2017 (7440 issue settled) – Click to View the Order

Transport Allowance for all pay matrix levels in 2026

| 7th CPC Pay Matrix Level | TPTA Cities (TA + 60% DA) | Other Cities (TA + 60% DA) |

| Level-1 (Basic Pay 18000 to 23500) | ₹ 2160 | ₹ 1440 |

| Level-1 (Basic Pay 24200 to 56900) | ₹ 5760 | ₹ 2880 |

| Level-2 (Basic Pay 19900 to 23800) | ₹ 2160 | ₹ 1440 |

| Level-2 (Basic Pay 24200 to 63200) | ₹ 5760 | ₹ 2880 |

| Level-3 (21700 to 69100) | ₹ 5760 | ₹ 2880 |

| Level-4 (25500 to 81100) | ₹ 5760 | ₹ 2880 |

| Level-5 (29200 to 92300) | ₹ 5760 | ₹ 2880 |

| Level-6 (35400 to 112400) | ₹ 5760 | ₹ 2880 |

| Level-7 (44900 to 142400) | ₹ 5760 | ₹ 2880 |

| Level-8 (47600 to 151100) | ₹ 5760 | ₹ 2880 |

| Level-9 (53100 to 167800) | ₹ 11520 | ₹ 5760 |

| Level-10 (56100 to 177500) | ₹ 11520 | ₹ 5760 |

| Level-11 (67700 to 208700) | ₹ 11520 | ₹ 5760 |

| Level-12 (78800 to 209200) | ₹ 11520 | ₹ 5760 |

| Level-13 (123100 to 215900) | ₹ 11520 | ₹ 5760 |

| Level-13A (131100 to 216600) | ₹ 11520 | ₹ 5760 |

| Level-14 (144200 to 218200) | ₹ 11520 | ₹ 5760 |

TPTA Cities: *Ahmedabad (UA), Bengaluru (UA), Chennai (UA), Coimbatore (UA), Delhi (UA), Ghaziabad (UA), Greater Mumbai (UA), Hyderabad (UA), Indore (UA), Jaipur (UA), Kanpur (UA), Kochi (UA), Kolkata (UA), Kozhikode (UA), Lucknow (UA), Nagpur (UA), Patna (UA), Pune (UA), Surat (UA).

7th Pay Commission Travelling Allowance Chart

Leave a Reply