Defence Pension Calculation Formula

PBOR (Personnel Below Officer Rank)

How to Calculate Commutation?

A PBOR may commute 50% of his basic pension. Amount commuted will be in whole rupee. A commuted value of pension is calculated on the basis of age on next birthday, which falls after the date on which the commutation become absolute.

Commutation Formula

50% of pension x 12 x Purchase Value( on the age next birth day)

Absolute Date

Commutation application submitted After one year

- The date on which medical board signs the medical proceedings.

Commutation application submitted within one year

- The date of commencement of pension when application received prior to retirement.

- The date of receipt of application by PSA where application is received after retirement.

A few examples of calculation of pension/family pension in the manner prescribed above in the orders (MoD Order No.17(01) / 2017 (02) / D (Pen/Policy) dated 5th September 2017) are given in Annexure-I to this letter.

Check also: Latest news for Defence Pensioners (Ex-Servicemen)

Defence Pension and Regulations: Kinds of Pension

- Service Pension: Pension is granted @ 50% of emoluments last drawn or average of reckonable emoluments during the last 10 months, whichever is more beneficial to pensioners subject to minimum of Rs. 9000 /p.m. The minimum qualifying service to earn pension is 20 years in case of Commissioned Officer and 15 years in the case Personnel Below Officer Rank.

- Ordinary Family Pension: The pension is granted @ 30% of reckonable emoluments last drawn subject to a minimum of Rs.9000/- p.m. (in case of natural death of the individual).

- Special Family Pension: The pension is granted at a uniform rate of 60% of reckonable emoluments last drawn by the deceased (in case of death of a individual attributable to military service).

- Liberalized Family: The pension is Pension granted which is equal to the reckonable emoluments last drawn by the deceased (to the families of personnel killed in war or war like operations, counter-insurgency operations, encounter with terrorists etc.)

- Disability Pension: The pension has been referred to Anomaly Committee-Ministry of Finance, Department of Expenditure.

- War Injury Pension: The rates of War Injury Element for 100% disability for various rank shall be equal to the reckonable emoluments last drawn in case of invalided out and 60% of reckonable emoluments last drawn in case of discharge, which would be proportionately reduced where disability is less than 100%.

ANNEXURE-I

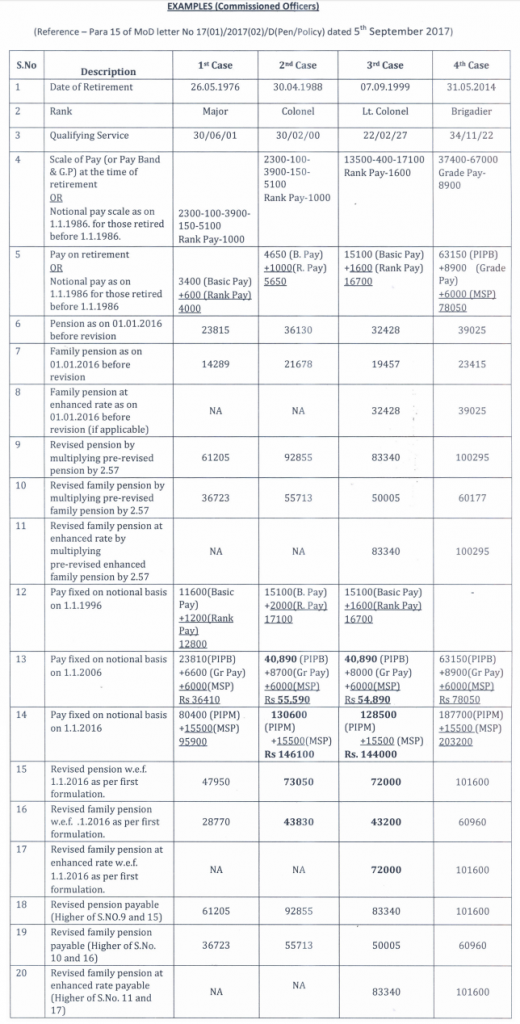

EXAMPLES (JCOs / ORs)

(Reference – Para 15 of MoD letter No 17(01)/2017(02)/D(Pen/Policy) dated 5th September 2017)

Pension Revision Example for Naik, Havildar, Nb Subedar and Subedar

| Sl.No. | Description | 1st Case | 2nd Case | 3rd Case | 4th Case |

| 1 | Rank | Naik | Hav | Nb Sub | Subedar |

| 2 | Group | ‘C’ | ‘D’ | ‘Y’ | ‘Y’ |

| 3 | Date of Retirement | 31.12.1984 (3td CPC scale) | 31.01.1989 (4th CPC scale) | 30.06.1999 (5th CPC scale) | 30.09.2013 (6th CPC scale) |

| 4 | Qualifying Service | 20 | 18.5 | 26 | 30 |

| 5 | Scale of Pay (or Pay Band & G.P) at the time of retirement OR Notional pay scale as on 1.1.1986 for those retired before 1.1.1986. | 980-20-1140- 25-1315 | 1050-25-1300- 30-1450 | 5620-140-8140 | 9300-34800 GP- 4600 MSP- 2000 |

| 6 | Pay on retirement OR Notional pay as on 1.1.1986 for those retired before 1.1.1986 | 1140+40 (CA) | 1175+30 (CA) =1205 | 6320 | 15030 (BP) 4600 (GP) 2000 (MSP) 21630 |

| 7 | Pension as on 01.01.2016 before revision | 7170 | 7693 | 10405 | 12690 |

| 8 | Family pension as on 01.01.2016 before revision | 4302 | 4616 | 6243 | 7614 |

| 9 | Family pension at enhanced rate as on 01.01.2016 before revision (if applicable) | NA | NA | NA | 12690 |

| 10 | Revised pension by multiplying pre-revised pension by 2.57 | 18427 | 19772 | 26741 | 32614 |

| 11 | Revised family pension by multiplying pre-revised family pension by 2.57 | 11057 | 11864 | 16045 | 19568 |

| 12 | Revised family pension at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | NA | NA | NA | 32614 |

| 13 | Pay fixed on notional basis on 1.1.1996 | 3500+80 (CA) (3150-70- 4200 | 3680+80 (CA) (3600-85-4875) | NA | NA |

| 14 | Pay fixed on notional basis on 10.10.1997 | 3510+100(CA) (3425-85- 4700 | 3700+100(CA) (3600-100-5100) | NA | NA |

| 15 | Pay fixed on notional basis on 1.1.2006 | 6840 (BP) 2400 (GP) 2000 (MSP) + 200 (CA) 11440 (PB-I, GP-2400) | 7050 (BP) 2800 (GP) 2000 (MSP) + 200 (CA) 12050 (PB-I, GP-2800) | 11760 (BP) 4200 (GP) + 2000 (MSP) 17960 (PB-II, GP- 4200) | NA |

| 16 | Pay fixed on notional basis on 1.1.2016 | 25500 +5200 30700 (Level- 4) | 29200 +5200 34400 (Level- 5) | 41100 +5200 46300 (Level- 6) | 50500 +5200 55700 (Level- 7) |

| 17 | Revised pension w.e.f. 1.1.2016 as per first formulation. | 15350 | 17200 | 23150 | 27850 |

| 18 | Revised family pension w.e.f.1.1.2016 as per first formulation. | 9200 | 10320 | 13890 | 16710 |

| 19 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation. | NA | NA | NA | 27850 |

| 20 | Revised pension payable (Higher of SI.No. 10 and 17) | 18427 | 19772 | 26741 | 32614 |

| 21 | Revised family pension payable (Higher of SI. No. 11 and 18) | 11057 | 11864 | 16045 | 19568 |

| 22 | Revised family pension at enhanced rate payable (Higher of SI. No. 12 and 19) | NA | NA | NA | 32614 |

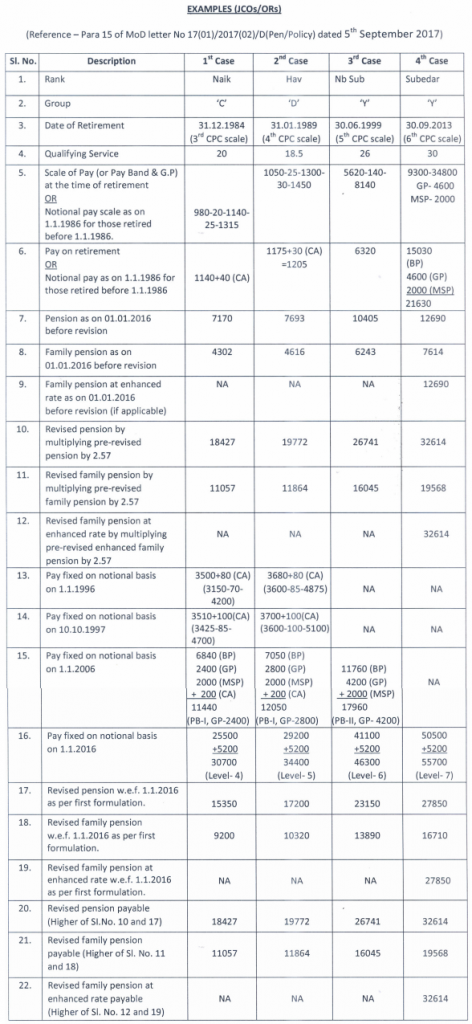

Pension Revision Example for Major, Colonel, Lt. Colonel and Brigadier

| S.No | Description | 1st Case | 2nd Case | 3rd Case | 4th Case |

| 1 | Date of Retirement | 26.05.1976 | 30.04.1988 | 07.09.1999 | 31.05.2014 |

| 2 | Rank | Major | Colonel | Lt. Colonel | Brigadier |

| 3 | Qualifying Service | 30/06/01 | 30/02/00 | 22/02/27 | 34/11/22 |

| 4 | Scale of Pay (or Pay Band & G.P) at the time of retirement OR Notional pay scale as on 1.1.1986. for those retired before 1.1.1986. | 2300-100-3900- 150-5100 Rank Pay-1000 | 2300-100- 3900-150- 5100 Rank Pay-1000 | 13500-400-17100 Rank Pay-1600 | 37400-67000 Grade Pay- 8900 |

| 5 | Pay on retirement OR Notional pay as on 1.1.1986 for those retired before 1.1.1986 | 3400 (Basic Pay) +600 (Rank Pay) 4000 | 4650 (B. Pay) +1000(R. Pay) 5650 | 15100 (Basic Pay) +1612 (Rank Pay) 16700 | 63150 (PIPB) +8900 (Grade Pay) +6000 (MSP) 78050 |

| 6 | Pension as on 01.01.2016 before revision | 23815 | 36130 | 32428 | 39025 |

| 7 | Family pension as on 01.01.2016 before revision | 14289 | 21678 | 19457 | 23415 |

| 8 | Family pension at enhanced rate as on 01.01.2016 before revision (if applicable) | NA | NA | 32428 | 39025 |

| 9 | Revised pension by multiplying pre-revised pension by 2.57 | 61205 | 92855 | 83340 | 100295 |

| 10 | Revised family pension by multiplying pre-revised family pension by 2.57 | 36723 | 55713 | 50005 | 60177 |

| 11 | Revised family pension at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | NA | NA | 83340 | 100295 |

| 12 | Pay fixed on notional basis on 1.1.1996 | 11600 (Basic Pay) +1200(Rank Pay) 12800 | 15100 (B. Pay) +2000(R. Pay”) 17100 | 15100(Basic Pay) +1600(Rank Pay) 16700 | – |

| 13 | Pay fixed on notional basis on 1.1.2006 | 23810 (PIPB) +6600 (Gr Pay) +6000(MSP) Rs 36410 | 40,890 (PIPB) +8700(Gr Pay) +6000(MSP) Rs 55,590 | 40,890 (PIPB) +8000 (Gr Pay) +6000(MSPI Rs 54.890 | 63150(PIPB) |

| 14 | Pay fixed on notional basis on 1.1.2016 | 80400 (PIPM) +15500(MSP) 95900 | 130600 (PIPM) +15500(MSP) Rs 146100 | 128500 (PIPM) +15500 (MSP) Rs. 144000 | 187700(PIPM) +15500 (MSP) 203200 |

| 15 | Revised pension w.e.f. 1.1.2016 as per first formulation. | 47950 | 73050 | 72000 | 101600 |

| 16 | Revised family pension w.e.f. 1.1.2016 as per first formulation. | 28770 | 43830 | 43200 | 60960 |

| 17 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation. | NA | NA | 72000 | 101600 |

| 18 | Revised pension payable (Higher of S.N0.9 and 15) | 61205 | 92855 | 83340 | 101600 |

| 19 | Revised family pension payable (Higher of S.No. 10 and 16) | 36723 | 55713 | 50005 | 60960 |

| 20 | Revised family pension at enhanced rate payable (Higher of S.No. 11 and 17 | NA | NA | 83340 | 101600 |

Example of Pension Revision for Commissioned Officers;

7th Pay Commission Salary Calculator January 2025 (53% DA Updated)

7th Pay Commission Salary Calculator January 2025 (53% DA Updated) January 2025 DA Calculator (56% Confirmed!)

January 2025 DA Calculator (56% Confirmed!)