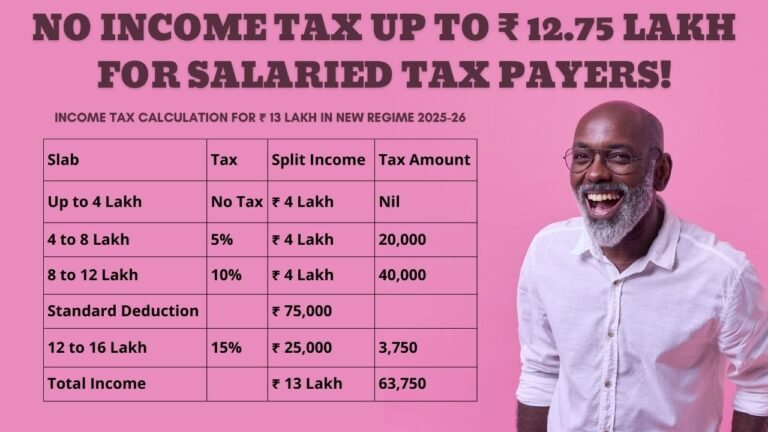

No Income Tax Up to ₹ 12.75 Lakh for Salaried Tax Payers! No Income Tax Up to ₹ 12.75 Lakh for Salaried Tax Payers: Income Tax Exemption for Salaried Individuals Earning Up to ₹ 12.75 Lakh: Is This Accurate? Indeed, it may seem astonishing, but it … [Read more...]

Income Tax Online Calculator for Salaried (Government) Employees

Income Tax AY 2020-21 Calculator for Salaried (Central and State Government) Employees 100% of the Government employees are paying income tax for their monthly salary, arrears, bonus, and every rupee [Note: The above calculation for general … [Read more...]

HRA Income Tax Exemption Calculator for Central Govt Employees

HRA Tax Exemption Calculator for Salaried Employees Income Tax Exemption Calculation on House Rent Allowance for Central and State Government Employees with Rules and Regulations The new rates of 7th Central Pay Commission House Rent Allowance with … [Read more...]

Old Regime Vs New Regime Tax Calculator 2023-24 from Income Tax Department

Income Tax India has provided a Tax Calculator to compare the tax system in the Old Regime with the New Regime, as stated in the Finance Bill of 2023. Old Regime Vs New Regime Tax Online Calculator 2023-24 According to Finance Minister Nirmala … [Read more...]

Pension Need To Be Income Tax-free – BPS Demands

Tax-Free Pension: BPS Calls for Change, PM & FM Addressed In a heartfelt and urgent plea for change, the Bharatiya Pensioners Samaj (BPS) has penned letters to the Prime Minister, the Finance Minister, and the Minister of State in the Prime … [Read more...]

Income Tax Benefits for Senior and Super Senior Citizens 2023 PDF

Benefits for Senior Citizens & Super Senior Citizens Under Income-Tax Act The Income Tax Department has released an informative e-brochure titled "Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act, 1961." This … [Read more...]

Guidelines for Retention of Departmental Laptop – Policy and Application Form

Retention of Laptop After Retirement | Policy & Form The policy and application form for the retention of a departmental laptop after retirement on superannuation or leaving the organization provide guidelines and a formal process for individuals … [Read more...]

Clause 10D Life Insurance Policy: Income Tax Act Guidelines (2023)

10D Life Insurance Policy Guidelines - Circular No. 15 of 2023 According to Circular No. 15 of 2023, there are specific guidelines outlined under clause (10D) for the sum received from a life insurance policy under Section 10 of the Income-tax Act, … [Read more...]

Rate of Exchange for Tax Deduction – Income-tax (17th Amendment) Rules, 2023

Income-tax 17th Amendment Rules 2023 - Foreign Currency Tax Rate According to the Income-tax (Seventeenth Amendment) Rules of 2023, a set of regulations that govern taxation, there is a specific rate of exchange that is used for the purpose of … [Read more...]

Income Tax Rules 2023: Life Insurance Policy Tax Computation

Income Tax Amendment Rules 2023: Life Ins. Policy Income Tax The Income Tax Amendment (Sixteenth Amendment) Rules of 2023 provide guidance on the computation of income tax for sums received under a life insurance policy. These rules outline the … [Read more...]

- 1

- 2

- 3

- …

- 16

- Next Page »

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)