7th Pay Commission Benefits for Pensioners

The 7th Pay Commission Benefits for Pensioners include a range of financial benefits such as Pension, Gratuity, Commutation of Pension, Family Pension, Disability Pension, and Ex-gratia Lump-sum Compensation. These benefits are designed to provide financial security to retired employees and their families, ensuring they have access to the resources they need to live comfortably in their golden years. With the help of these benefits, pensioners can enjoy a worry-free retirement and focus on the things that truly matter.

Calculation of Pension and other Retirement Benefits for Retiring Employees

The calculation of pension and other retirement benefits is a crucial process for employees who are approaching retirement. Retirement benefits include not only pension but also other benefits such as medical coverage, life insurance, and other perks. Proper calculation of these benefits is essential to ensure that retiring employees receive the appropriate amount of compensation they are due. Factors such as years of service, salary, and age play a significant role in the calculation of pension and other retirement benefits. Accurate calculation not only ensures employees receive the benefits they are due, but also helps employers manage their budget and plan for the future.

Service Gratuity

- You are entitled to receive only service gratuity (and not pension) if your total qualifying service is less than 10 years.

- It is calculated @ 1/2 month’s emoluments for each completed six monthly period of qualifying service.

An emolument for this purpose includes DA admissible at the time of retirement. - There is no limit for minimum amount

- This is a one-time lump sum payment in lieu of pension and is distinct from and is paid over and above the retirement gratuity referred to later in this section.

Pension

- If you retire under the rules and have qualifying service of 10 years, your pension is calculated @50% of last pay or average emoluments (i.e. average of the basic pay drawn by you during the last 10 months of your service), whichever is more beneficial to you.

- Guaranteed minimum pension is Rs. 9,000 (Rupees Nine thousand only) per month. In addition, Dearness relief is also payable thereon.

- Maximum limit on pension is Rs. 1, 25,000 (Rupees one lakh twenty five thousand only) per month. In addition, Dearness relief is also payable thereon.

- Pension is payable upto and including the day of death.

Also check: 7th CPC Pension Fixation Examples

Commutation of Pension

- You have an option to commute a portion of pension, not exceeding 40% of it, into a lump sum payment.

- You need not undergo any medical examination if you exercise this option within one year of retirement.

- The lump sum payable to you is calculated with reference to the commutation table as provided in CCS (Commutation of Pension) Rules, 1981.

- Your monthly pension will stand reduced by the portion commuted

But, your dearness relief entitlement will be calculated on the basis of the full pension (i.e. including the commuted portion) - The commuted portion of pension will be restored to you on the expiry of 15 years from the date of commutation.

- In the event of death of pensioner, commuted portion is not deducted from family pension.

Also check: 7th CPC Pension Calculation

Retirement Gratuity

- 5 years of qualifying service and eligibility to receive service gratuity/ pension is essential to get this one-time lump sum benefit.

- Your retirement gratuity is calculated at the rate of ¼ month’s emoluments for each completed six-monthly period of qualifying service subject to a maximum 161/2 times the monthly emoluments.

- Emoluments for this purpose will include DA admissible at the time of retirement.

- There is no guaranteed minimum amount.

- The maximum retirement gratuity payable is 161/2 times the emoluments limited to Rs. 20.00 lakh from 01.01.2016.

Also check: Commutation Factor Value of Pension Calculator 2020

Dearness Relief

- Dearness Relief is sanctioned as compensation against price rise.

The quantum payable will be governed by the orders issued by the Government from time to time. - All pensioners, irrespective of the amount of their pension, are eligible for this benefit (expect these on re-employment).

- There is no ceiling in regard to the total of pension plus dearness relief which a pensioner can receive.

Calculation of Family Pension

Death Gratuity

Widow/Widower or the nominee of an employee, dying while in service is entitled to receive Death Gratuity.

There is no requirement of completing any minimum length of qualifying service by the decreased employee for this purpose.

Entitlement is regulated as under:

| Length of Qualifying Service | Rate of Death Gratuity |

| Less than 1 year | 2 times of emoluments* |

| One year or more but less than 5 years | 6 times of emoluments* |

| 5 years or more but less than 11 years | 12 times of emoluments* |

| 11 years or more but less than 20 years | 20 times of emoluments* |

| 20 years or more | Half of emoluments* for every completed six-monthly period of qualifying service subject to a maximum of 33 times. |

* The total of death gratuity payable cannot exceed rupees twenty lakh in all cases. Emoluments for this purpose include dearness allowance admissible at the time of retirement.

Family Pension

- Family pension becomes payable to the Widow/Widower or an eligible family member from the day following the date of death of the employee either while in service or after retirement.

- The decreased employee should had either one year of continuous service or should have been declared medically fit for government service if death takes place before completion of one year of continuous service.

- It is normally payable only to one member of the family at a time barring cases wherein more than one widow is left behind, twin children, etc.

- The Guaranteed minimum pension is Rs. 9,000 (Rupees Nine thousand only) (Since 01.01.2016). In addition, Dearness relief as per prescribed rate is also payable.

- Entitlement is calculated as shown below:

Basic Pay Amount of Monthly family pension

All levels 30% of basic pay subject to a minimum of Rs. 9000 per month since 01.01.2016 - In case of a Govt. Servant who dies while in service family pension at enhanced rate is admissible for a period of ten years from the date following the date of death. In case of death of a pensioner, family pension at enhanced rate would be payable for a period of seven years or till the pensioner would have attained the age of 67 years, whichever is earlier.

- Like pension, family pension is also payable upto and including for the day of death of the recipient.

- But, family pension is payable for life to a son/ daughter who is suffering from any disorder/ disability of mind or is physically crippled /disabled/ thus rendering him/ her unable to earn a living. Dependent, divorced, widow and unmarried daughter, dependent parents, dependent disabled siblings are eligible for family pension for life subject to fulfilment of certain conditions.

Dearness Relief

Dearness relief to family pensioners is paid at the same rate and on the same conditions as for pensioners.

F. No 38/37/2016-P&PW(A)(ii)

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Pension & Pensioners’ Welfare

Lok Nayak Bhawan, New Delhi-110003

Dated the 4th August, 2016

OFFICE MEMORANDUM

Sub: Implementation of Government’s decision on the recommendation of the Seventh Central Pay Commission – Revision of provisions regulating pension/gratuity/ commutation of pension/family pension/disability pension/ex-gratia lump-sum compensation, etc.

The undersigned is directed to state that in pursuance of Government’s decision on the recommendation of the Seventh Central Pay Commission, the President is pleased to introduce the following modifications in the rules regulating pension, Retirement / Death / Service Gratuity, Family Pension, disability pension, ex-gratia lump-sum compensation, etc. under the CCS (Pension) Rules, 1972 and Commutation of Pension under CCS (Commutation of Pension) Rules, 1981, CCS (Extraordinary Pension) Rules, 1939, etc.

2. These orders apply to Central Government Employees governed by the CCS (Pension) Rules, 1972. Separate orders will be issued by the Ministry of Defence, Ministry of Railways and the AIS Division of the DOPT in respect of Armed Forces personnel, Railway employees and the officers of All India Services respectively on the basis of these orders.

DATE OF EFFECT

3.1 The revised provisions as per these orders shall apply to Government servants who retire/die in harness on or after 1.1.2016. Separate order have been issued in respect of employees who retired/died before 1.1.2016.

3.2 Where pension/family pension/Gratuity/Commutation of pension, etc has already been sanctioned in cases occurring on or after 1.1.2016, the same shall be revised in terms of these orders.

In cases where pension has been finally sanctioned on the pre-revised orders and if it happens to be more beneficial than the pension becoming due under these orders, the pension already sanctioned shall not be revised to the disadvantage of the pensioner in view of Rule 70 of the CCS (Pension) Rules, 1972.

EMOLUMENTS

4.1 The term ‘Emoluments’ for purposes of calculating various pensionary benefits other than various kinds of Gratuity shall have the same meaning as in Rule 33 of the Central Civil Services (Pension) Rules, 1972.

4.2 Basic pay in the revised pay structure means the pay drawn in the prescribed level in the Pay Matrix with effect from 01.01.2016 but does not include any other type of pay like special pay, etc.

4.3 In the case of all kinds of gratuity, dearness allowance admissible on the date of retirement/death shall continue to be treated as emoluments along with the emoluments as defined in Paragraph 4.1 above.

PENSION

5.1. Subject to para 5.2, there shall be no change in the provisions regulating the amount of pension as contained in Rule 49 of the CCS(Pension) Rules.

5.2 The amount of pension shall be subject to a minimum of Rs.9000/- and the maximum pension would be 50% of highest pay in the Government (The highest pay in the Govt. is Rs 2,50,000 with effect from 1.1.2016). The provisions of sub-rule (2) of Rule 49 of the CCS (Pension) Rules, 1972 shall stand modified to this extent.

5.3 The quantum of additional pension/family pension available to the old pensioners / family pensioners shall continue to be as follows:

| Age of Pensioner/family pensioner | Additional quantum of pension |

| From 80 years to less than 85 years | 20% of revised basic pension/ family pension |

| From 85 years to less than 90 years | 30% of revised basic pension / family pension |

| From 90 years to less than 95 years | 40% of revised basic pension / family pension |

| From 95 years to less than 100 years | 50% of revised basic pension / family pension |

| 100 years or more | 100% of revised basic pension / family pension |

The Pension Sanctioning Authorities should ensure that the date of birth and the age of a pensioner is invariably indicated in the pension payment order to facilitate payment of additional pension by the Pension Disbursing Authority as soon as it becomes due.

The amount of additional pension will be shown distinctly in the pension payment order.

For example, in case where a pensioner is more than 80 years of age and his pension is Rs.10,000 pm, the pension will be shown as (i) Basic pension=Rs.10,000 and (ii) Additional pension = Rs.2,000 pm. The pension on his attaining the age of 85 years will be shown as (i).Basic Pension = Rs.10,000 and (ii) additional pension = Rs.3,000 pm.

Retirement Gratuity & Death Gratuity

6.1 The rates for payment of death gratuity shall be revised as under

| Length of Service | Rate of Death Gratuity |

| Less than one year | 2 times of monthly emoluments |

| One year or more but less than 5 years | 6 times of monthly emoluments |

| 5 years or more but less than 11 years | 12 times of monthly emoluments |

| 11 years or more but less than 20 years | 20 times of monthly emoluments |

| 20 years or more | Half month of emoluments for every complete six monthly period of qualifying service subject to a maximum of 33 times of monthly emoluments |

Accordingly, Rule 50(1)(b) 50(1)(b) of CCS (Pension) Rules, 1972 shall stand modified to this extent.

6.2 The maximum limit of Retirement gratuity and death gratuity shall be Rs. 20 lakh. The ceiling on gratuity will increase by 25% whenever the dearness allowance rises by 50% of the basic pay.

Accordingly, first proviso under Rule 50(1)(b) of CCS (Pension) Rules, 1972 shall stand modified to this extent.

FAMILY PENSION 1964

7.1 Family pension shall be calculated at a uniform rate of 30% of basic pay in the revised pay structure and shall be subject to a minimum of Rs,9000/-p.m. and maximum of 30% of the highest pay in the Government.

Rule 54(2) relating to Family Pension, 1964 under CCS (Pension) Rules, 1972 shall stand modified to this extent.

7.2 The amount of enhanced family pension shall be 50% of basic pay in the revised pay structure and shall be subject to a minimum of Rs.9000/-p.m. and maximum of 50% of the highest pay in the Government. (The highest pay in the Govt. is Rs. 2,50,000 with effect from 1.1.2016).

7.3 There will be no other change in the provisions regulating family pension, enhanced family pension and additional family pension to old family pensioners.

COMMUTATION OF PENSION

8.1 There will be no change in the provisions relating to commutation values, the limit upto which the pension can be commuted or the period after which the commuted pension is to be restored.

9.1 The pension/family pension under para 5 and 7 above shall qualify for dearness relief sanctioned from time to time, in accordance with the relevant rules/instructions.

FIXED MEDICAL ALLOWANCE

10.1 Fixed Medical Allowance to the pensioners who are residing in non-CGHS areas and are not availing OPD facility of CGHS shall continue to be paid at the existing rate till a final decision is taken on the basis of recommendations of the Committee constituted for the purpose.

CONSTANT ATTENDANT ALLOWANCE

11.1 The amount of Constant Attendant Allowance to pensioners who retired on disability pension with 100% disability under the CCS (Extraordinary) Pension Rules, 1939, (where the individual is completely dependent on somebody else for day to day functions) shall continue to be paid at the existing rate till a final decision is taken on the basis of recommendations of the Committee constituted for the purpose.

EX GRATIA LUMPSUM COMPENSATION

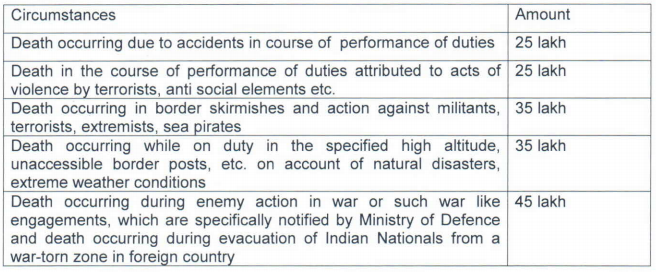

12.1 The amount of ex gratia lump sum compensation available to the families of Central Government Civilian employees, who die in the performance of their bonafide official duties under various circumstances shall be revised as under:

| Circumstances | Amount |

| Death occurring due to accidents in course of performance of duties | 25 lakh |

| Death in the course of performance of duties attributed to acts of violence by terrorists, anti social elements etc. | 25 lakh |

| Death occurring in border skirmishes and action against militants, terrorists, extremists, sea pirates | 35 lakh |

| Death occurring while on duty in the specified high altitude, unaccessible border posts, etc. on account of natural disasters, extreme weather conditions | 35 lakh |

| Death occurring during enemy action in war or such war like engagements, which are specifically notified by Ministry of Defence and death occurring during evacuation of Indian Nationals from a | |

| war-torn zone in foreign country | 45 lakh |

13.1. Formal amendments to CCS (Pension) Rules, 1972 and CCS (Extraordinary) Pension Rules, 1939 in terms of the decisions contained in this order will be issued in due course.

Provisions of the CCS (Pension) Rules 1972, CCS (Extraordinary) Pension Rules, 1939, and CCS(Commutation of Pension) Rules, 1981 which are not specifically modified by these orders, will remain unchanged.

14.1. These orders issue with concurrence of the Ministry of Finance Department of Expenditure vide their U.O. No. 30-1/33(c)/ 2016-IC dated 03.08.2016

15.1. In their application to the employees of the Indian Audit and Accounts Department, these orders issue in consultation with Comptroller and Auditor General of India.

16. Ministry of Agriculture etc. are requested to bring the contents of these orders to the notice of Controller of Accounts/Pay and Accounts Officers and Attached and Subordinate Offices under them on a top priority basis.

(Vandana Sharma)

Joint Secretary to the Government of India

What is the 7th CPC on Pensionary Benefits?

The 7th CPC (Central Pay Commission) on Pensionary Benefits is a report that sets new salary, allowances, and pensions for central government employees.

Who will be affected by the 7th CPC on Pensionary Benefits?

The 7th CPC on Pensionary Benefits will affect all central government employees who are receiving or will receive a pension.

When was the 7th CPC on Pensionary Benefits implemented?

The 7th CPC on Pensionary Benefits was implemented on January 1, 2016.

What are some of the changes implemented by the 7th CPC on Pensionary Benefits?

The 7th CPC on Pensionary Benefits has increased the basic pension by 2.57 times, introduced a system of gratuity for employees with service of less than 5 years, and abolished the Advances for purchase of Personal Computer.

How can I check my pensionary benefits under the 7th CPC?

You can check your pensionary benefits under the 7th CPC by contacting the concerned department or by logging into the official government pension website.

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

Commutation pension is the part of pension which is change in the 7th cpc but yet clarify by the cpc committee to pensioner who retired on 01.01.2016 will get diffrential amount as per 7th cpc

commutation table revised w.e.f 1-1-2016 not yet released. pl clarify whether to adopt the old commutation table

for the present.