The Department of Revenue published a detailed notification about the deduction of Income Tax from salaries during the financial year 2020-21 with latest Income Tax Rates Table. F.No.275/19212020-IT(B) Government of India Ministry of … [Read more...]

Income-Tax Exemption for LTC Cash Voucher Scheme

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees The Central Government has decided to extend the income tax exemption available under leave travel concession (LTC) cash voucher scheme to non-central government … [Read more...]

Payment of salary to employees during the lockdown period can be adjusted against the CSR expenditure?

The Ministry of Corporates Affairs has clarified through a set of FAQs (Frequently Asked Questions) the eligibility of Corporate Social Responsibility (CSR) expenditure related to COVID-19 activities. General Circular No.15 /2020 No. … [Read more...]

Union Budget 2020 – New Personal Income Tax Slab Rates

New tax regime to be optional for the taxpayers New Personal Income Tax Regime heralds significant relief, especially for Middle Class Taxpayers New rates entail estimated revenue forgone of Rs 40,000 Crore per year In order to provide significant … [Read more...]

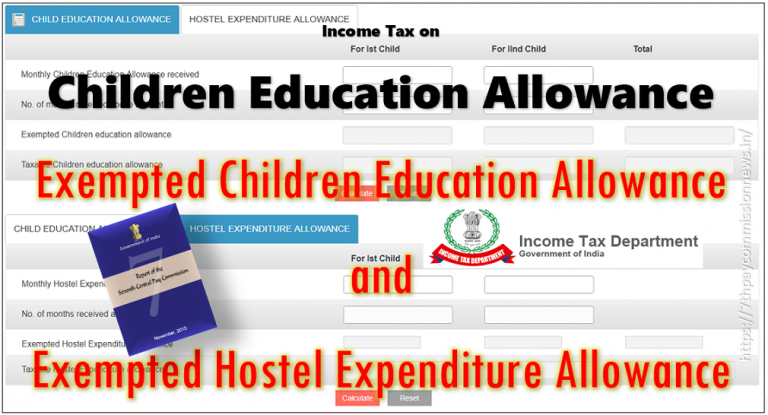

Children Education Allowance Income Tax Online Tools for CG Employees

Children Education Allowance Income Tax Online Tools for CG Employees Exempted from Income Tax for Children Education Allowance and Hostel Expenditure allowance - A simple calculator for CG Employees How to use the tool Step 1: Select the option … [Read more...]

Income upto Rs 5 Lakh to Get Full Tax Rebate

Income upto Rs 5 Lakh to Get Full Tax Rebate "Additional deductions such as interest on home loan up to Rs.2 lakh, interest on education loans, National Pension Scheme contributions, medical insurance, medical expenditure on senior citizens" Income … [Read more...]

Highlights Of Interim Budget 2019-20

Highlights Of Interim Budget 2019-20 Tax exempted on notional rent on a second self-occupied house Tax collections nearly doubled in five years- from Rs. 6.38 Lakh crore in 2013-14 to almost Rs. 12 lakh crore this year Defence budget to cross Rs … [Read more...]

Interim Budget 2019: No Need to Pay Income Tax up to 5 Lakh

Interim Budget 2019: No Need to Pay Income Tax up to 5 Lakh Income Tax Exemption for Individuals up to Rs.5 Lakh per annum Finance Minister Piyush Goyal has announced that no need to pay income tax for individuals with income upto 5 Lakh for the … [Read more...]

No TDS upto 50,000 for Senior Citizen – CBDT Notification Dt. 6.12.2018

No TDS upto 50,000 for Senior Citizen - CBDT Notification Dt. 6.12.2018 TDS DEDUCTION UNDER SECTION 194A OF THE INCOME-TAX ACT, 1961 IN CASE OF SENIOR CITIZENS F. No. Pr. DGIT(S)/CPC(TDS)/Notification/2018-19 Notification No. 06/2018 Government of … [Read more...]

Employees thank Prime Minister for allowing standard deduction of Rs 40,000

Employees thank Prime Minister for allowing standard deduction of Rs 40,000 Ministry of Personnel, Public Grievances & Pensions Delegation of DoPT employees calls on MoS (PP) Dr Jitendra Singh Employees thank Prime Minister for allowing … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)