Payment of Gratuity Act 1972 for NVS Employees under NPS

The Government of India introduced the New Pension Scheme (NPS) to the Navodaya Vidyalaya Samiti on April 1st, 2009, as per the notification of the Ministry of Human Resource Development, Department of School Education & Literacy, in letter F.5-7/98-UT-1 dated August 14th, 2008. All regular employees of NVS joining on or after April 1st, 2009 are members of the NPS. Those employees who had joined NVS on a regular basis prior to this date were given the option of continuing with the existing Central Provident Fund scheme, or joining the New Pension Scheme, within three months of the notification (i.e. August 4th, 2009).

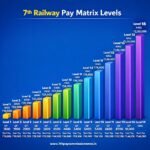

The New Pension Scheme (NPS) comprises two tiers: Tier I and Tier II. Participation in Tier I is mandatory and requires employees to contribute 10% of their basic pay plus Dearness Allowance (DA). This amount is deducted from the salary bill each month by the Pay and Accounts Office (PAO). The Samiti matches this contribution. Withdrawal from Tier I accounts is not permitted. In accordance with the 7th Central Pay Commission (CPC), deductions for NPS must be taken from the revised pay of those who elect to use the revised pay structure, effective from the specified date.

Payment of Gratuity Act, 1972 for the employees of NVS covered under National Pension System (NPS)

The Navodaya Vidyalaya Samiti has adopted the Payment of Gratuity Act, 1972 for the employees joining on or after 01.01.2004 and covered under NPS with the approval of the Ministry of Education, as indicated in letter No. 17-15/2022-UT-3 dated 10.01.2023.

NVS Pension News 2023

Navodaya Vidyalaya Samiti

Ministry of Education

(Dept. of School Education & Literacy)

Government of India

B-15, Institutional Area, Sector-62

Noida – 201307 (Uttar Pradesh)

F.No.1-7/2018-NVS(Admn.)/III

Dated: 19.01.2023

Circular

Subject : Payment of Gratuity Act, 1972 for the employees of NVS covered under National Pension System (NPS) – reg.

The Navodaya Vidyalaya Samiti hereby adopts the Payment of Gratuity Act, 1972 for the employees of NVS, joined on or after 01.01.2004 and covered under NPS.

This has the approval of the Ministry of Education as communicated vide letter No. 17-15/ 2022-UT-3 dated 10.01.2023.

sd/-

[Dr. Sameer Pandey]

Joint Commissioner (Admn.)

Click to view the order in PDF

Also check:

- Navodaya CGHS Hospital List 2023

- Navodaya School Admission Revised Age Criteria Order 2022 PDF Download

- NPS To Old Pension Scheme Latest News, Orders, and Judgements

- Jawahar Navodaya (JNVST) Class 9 Admission Online Application 2023-24

- HRA Revised Order 2021 PDF Download – NVS

- Revised Ceiling for Reimbursement of Medical Claims for NVS Employees

- Notification regarding Old Pension Scheme : NVS

- NVS PGT, TGT Recruitment 2020-21 – Notification Exam Date PDF Download

- NPS Applicable to NVS Employees w.e.f. 1.4.2009

- Special Allowance to Teaching Staff in NVS

The Payment of Gratuity Act, 1972 applies to employees of NVS who have joined on or after 01.01.2004 and are covered under the National Pension System (NPS).

The purpose of the Payment of Gratuity Act, 1972 is to provide employees with a gratuity payment as a form of social security upon retirement, resignation, or death.

No, the act is only applicable to employees of NVS who have joined on or after 01.01.2004 and are covered under the National Pension System (NPS). Employees who joined before this date may be covered under different gratuity rules.

Yes, the Payment of Gratuity Act, 1972 for employees of NVS covered under the National Pension System (NPS) has the approval of the Ministry of Education.

The Payment of Gratuity Act ensures that NVS employees covered under NPS are eligible to receive gratuity payments upon retirement, resignation, or death as per the provisions of the act.

The gratuity payment is calculated based on the employee’s length of service and last drawn salary. You can use a gratuity calculator or consult your employer or HR department for assistance in calculating your gratuity amount.

Yes, to be eligible for gratuity under the act, an employee must have completed a minimum of 5 years of continuous service with the employer. However, there are exceptions such as in cases of death or disablement.

Leave a Reply