Pay Fixation on Promotion or MACP in 7th CPC – Option Calculation with illustrations

7th CPC Promotion Option Calculation

All the central government employees are in busy with calculating which Option is beneficial to them in order to get full benefit from 7th CPC Revised pay.

Actually there is no dilemma for CG employees those who didn’t get any Promotion/MACP from 1st January to 1st July 2016.

There are some cases in this category that choosing Option to revise Pay from Date of Next Increment gives more benefit than opting 1.1.2016 to revise 7th CPC Pay.

The government servants those who got Promotion / MACP in the Period from 2nd January to 1st July are finding it difficult to decide which Option is correct and More beneficial to them.

No body in the administrative Department ready to guide the right way to the Government servants since there is no clarity in 7th CPC in respect of Revising/Fixing pay on Promotion Date.

But It was clearly illustrated in Sixth CPC.

Let us workout the Pay Fixation in different Options to revise pay in 7th CPC to understand which Option is Beneficial in Longer run.

Let us take an example,

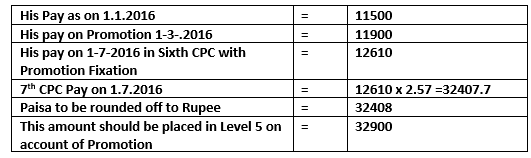

Assume a government servant has been promoted to Next Grade to 2800 on any date between 2nd January 2016 to 1st July 2016. Let us take 1st march 2016 was his date of Promotion.

His existing pay as on 1.1.2016 = Band Pay of 9100 + Grade pay of 2400 = 11500

If He Choose Option -I to revise his Pay from 1.1.201

If He Choose Option -II

a) Pay revision on Increment Date

b) Fixation for Option to revise Pay on Promotion Date need to be Clarified by Government.

Since there is no Grade pay involved in 7th CPC, Adding Grade Pay difference on Promotion date is not applicable in 7th Pay Commission for this category.

Which Option is More beneficial ..?

From the above calculation, it shows that Selecting Option -II to revise Pay with effect from Date of Next Increment i.e 1st July 2016 is more beneficial than Option-I.

It may differ to individual to individual based on Grade Pay and no of increments earned in that Particular Grade.

The Impact of Selecting Option -II in the above case

a. Pay revision come into force with effect from 1st July 2016,

b. You have to travel in Sixth CPC Pay up to 30th June 2016

c. So There will be no arrears for the Period from January 2016 to June 2016

Source: http://www.gservants.com/

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

My basic pay 35300/ hai & my Loco pilots (goods) me pramotion 20.12.2017 ko hai. Please my basic pay after pramotion what ?

With the increment option from January 2018 basic pay as 36,400 in MATRIX LEVEL 4 and “DNI on 1-1-2019 basic pay as 37,000/-, 1-1-20 as 38,100 & 1-1-21 as 39,200/-in MATRIX LEVEL 5.

i was in the grade 9300-34800 gp 4400 on 1..1..2016 got promotion to 15600-39100 gp 6600 from 4.7.2016. how to fix in 7th pay

Got macp on 2015 and now got promotion on 2018 sir l will be fixed with adding another increment or not

No, only next MACP on completion of 10th year i.e. 2025 your next matrix level will change.

Sir, i am a superintendent of central excise/customs, joined the Deptt. of Central Excise(as Inspector) on 19.11.1986. Thereafter, i got promotion as superintendent on 30.09.02. Next, i got 3rd MACP benefit w.e.f. 30.09.16 when my pay was fixed at Rs.87,400/= p.m.(Level 10in new pay matrix), with just the earlier pay being at Rs.82,600/=(Level 9) + other perks and allowances. Against earlier basic pay of Rs.82,600/= p.m; I had recd. HRA of Rs.9,474/=(A-1 city) calculated at old rate under 6th CPC formula. Later on while receiving 3rd MACP arrears against arrear bill drawn in Jun’17,(period: 30.09.16 to 31.05.17) i got HRA again at old sum of Rs.9,474/= p.m. despite my pay being changed/enhanced to Rs.87,400/= from Rs.82,600/= p.m. whereas one of my contemporary colleague drew Rs.9,960/= p.m.(old rate) who also has been having same common basic pay of Rs.87,400/= like me w.e.f. 30.09.16. Am I also not entitled to drawing differential HRA sum of Rs.486/= p.m.(i.e. Rs.9,960/= minus Rs.9,474/=) calculated at old rate formula of 6th CPC? Awaiting for your prompt reply pl. Regards! –

How to fix macp as per 7th CPC wet march

2016 date of increments in July basic pay 32000 & level no 03. Pay fix with examples

Got promotion on 10 Jun 16 in grade pay 2400. Already in receipt of macp with a grade pay 2000. My initial payment as on 01 Jan 16 fixed to rs 30200. My basic as on 31.12.15 was 9450+2000. Am I eligible for 2 increments on date of annual increment which falls on 01.07.2016

Sir,

I got promotion in Sept’2016 from grade pay 4600 to 5400. But I was already adopted 7th CPC on Aug’2016 because I don’t know acceptance of 7th CPC was taking OR postponed. I came to know that existing pay fixation is not beneficial to me as shown below :

As per desired option

01-01-2016 18160+4600

01-07-2016 18850+4600

01-09-2016 19560+5400=24960(After Promotion)

01-09-2016 24960X2.57 = 64147 (Taking 7th CPC) Fixation 65000

As per existing pay fixation as on Jan’ 2016

01-01-2016 58600

01-07-2016 60400

01-09-2016 After Promotion 63100

Fixation on 01-09-2016 63100

LOSS = 65000 – 63100 = 1900

So please help me to sort out this problem. I will be highly obliged.

I have the following two cases :-

1. Mr.Vijayakumar, LDC

His pay as on 1.1.2016 = Rs.10660 + 2400 = 13060

He got Macp-2 wef 2.3.16 and his pay = Rs.10660 + 2800 = 12460-

He opted to fix in 6cpc wef 1.7.16 = Rs.11470 + 2800 = 14270- x 2.57 = 36674 in Level-5- Rs.37000-

His pay on 1.7.17 is = Rs.11900 + 2800 = 14700- x 2.57 = 37779 in Level-5- Rs.38100-

Now my request is

a) what option he should given in Option form 1 or 2 (i) or 2(ii)

b) What would be his 7cpc pay as on 1.1.2016, 2.3.16, 1.7.16, 1.1.17 and 1.7.17

c) what would be his date of fixation of pay and pay amount and Date of next increment is Jan-17 or Jul-17

——–

2. One Primary Teacher joined on 2.5.2016 with pay Rs.9300- + Gp 4200-

a) How to exercise option for her

b) I think I should fix her pay+GP x 2.57 factor and its equivalent level im paymatrix to be fixed as Pay as on 2.5.16 till 31.12.16 and with one increment on 1.1.17. Am I correct Sir.

Pl clarify Sir. I attached vijaykumar and chitra worksheets in same excel file. Pl correct it sir in red color.

Umashankar

Sir

My 3rd MACP is due from 13/04/2017 & I have submitted an Option for pay fixation my next due annual increment.. Kindly provide my pay fixation.

my running basic pay 88700/ GP – 4800/ Level 8

Suraj Pal Maurya

MCF/RBL

I got MACP on 20/01/2016 with 2800/- (GP)

My pay as on 31.12.2015 was Rs. 12970 (10500+2400(GP)

Kindly let my know what option will benefit me I and how my pay will be fixed pl answer at earliest

Thankyou

Biswajit

Sir,

I got MACP on 04/05/2016 with 2800/- (GP)

My pay as on 01/01/2016 was Rs. 13070 (10670+2400(GP)

Kindly let my know what option will I adopt , and how my pay will be fixed pl answer at earliest

Thankyou

R. Nigam

As per 7th CPC, my pay fixation has been done by department as per following manner:- Existing basic pay on 01.01.2016- 19550 + Gp.4600

01.01.2016 – 24150 x 2.57 = 62065.5 (As per matrix, pay fixed to Rs.62,200/-(Level – 7)

01.07.2016 – Rs.64100/- (Annual increment)

I have been granted 3rd financial upgradation under MACP scheme wef 06.01.2017. What will be my pay on the date of MACP wef 06.01.2017.Please clarify.

Sir,My basic was upgraded from 17650(4200) to 18050(4600) on 06.01.2016(after 10 years service), from 18050 to 18600 on 01.07.2016 and from 18600 to 19160 on 25.10.2016. for promotion. What is best option to me?

After implementation of 7th pay commission there is no option to fix the pay on prmotion. the pay has to be fixed on the date of promotion after switching over to the 7th pay. pl go carefully through the Rule 10 of revised pay rules 2016 which clearly states the DNI.

got promotion on 08.02.2016 from 2400 GP to 2800 Basic pay on 1.1.2016 Rs 9490 what is my pay fixation on 08.02.2016 basic pay is 10180 can I get increment or not please clarifie

I got my MACP on 05.02..2016 from 4200 to 4600 G.P. After taking benefit of macp on 05.02.2016, Kindly tell me, after taking macp on 05.02.2016 and entering into 7th pay commission, can I get two increment in the 7th pay commission table?

I joined As Senior Stenographer on 30.09.1988 on direct recruitment. On 30.09.2000 I was granted the scale of Rs.6500-10500 through first Assured Career Progression and on 30.9.2008 after completion of 20 years I was granted the grade pay of Rs.5400 in PB-2 through 2nd MACP. On 7th July, 2011 I was promoted as Private Secretary in the grade pay of Rs.5400 in PB-2 in the same scale. Please clarify what pay scale should I get as Non Functional Scale after completion of 4 years from July 2011.

There is no option to the employees who got promotion between 2.1.2016 to 1.7.2016 to opt the pay fixation after drawing the increment. . the unrevised pay can be extended only upto the date of promotion as per 2nd proviso of rule no. 5. Further there is no clarify on who to fix the pay in respecet of the employees who got promotion after 1st july to 31st december every year.

Sir, I have some confusion, whether the employees got MACP-II between Jan-16 and Date of notification, is eligible to elect date of effect form

Next increment date

Because for employees of such category, GP has been changed between Jan-16 and Date of notification .Proper Clarification from competent authority is highly solicited.

My another confusion is that, supposing an employee having BP 16750 (GP-2800), has already drawn BP 19180/-(GP-4200) on 01.07.2016, as he got MACP-II between the said Period. His HRA has been drawn @10/20/30 % on 19180. If he is not allowed to opt for fixation other than from 01.01.2016, his revised BP on 01.07.2016,will be 47600 which is equivalent to 18530/- in Old Scale. Following the 7th CPC notification he will be paid same HRA as applicable for 19180 in Old Scale. Although it is as per old rate, but BP of Drawn Side and Due Side should be equivalent, that is 50500 . The employees of this post, who did not have MACP during this period do not have such problem

I am a doctor and will be prompted to pay band 4 and gp 8700 w. e. f. February 2016. Which option will be better for me also considering da on npa in new pay fixation

Dear sir,

what about the pay annomoly in the same cadre, The senior taking less pay than the junior, as per (macp). How will be justice with th senior please confirm…