What are allowances? Are all allowances taxable? - INCOME TAX FAQ What is considered as salary income? section 17 of the Income-tax Act defines the term ‘salary’. However, not going into the technical definition, generally whatever is … [Read more...]

CBDT issues Certificates of Appreciation to Tax Payers

CBDT issues Certificates of appreciation to nearly 3.74 lakh tax payers for their contribution towards Nation building Press Information Bureau Government of India Ministry of Finance 07-February-2017 20:26 IST CBDT issues Certificates of … [Read more...]

Tax-exemption to partial withdrawal from National Pension System (NPS)

Tax-exemption to partial withdrawal from National Pension System (NPS) : This benefit will be effective on partial withdrawal made by the subscriber after 1st April 2017. Press Information Bureau Government of India Ministry of … [Read more...]

Simple one- page Income Tax Return form – FM

Simple one- page Income Tax Return form - FM "A simple one- page Income Tax Return form for the category of individuals having taxable income upto Rs 5 lakhs other than business income." "Finance Minister Shri Jaitley said that the present burden of … [Read more...]

Salient Features of Direct Tax Proposals in Union Budget 2017

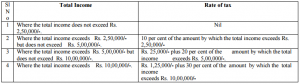

"Personal Income Tax: Personal income tax for people with income in the slab of 2.5 lakh to 5 lakh to be reduced to 5% instead of 10%. This will reduce their tax liability to half while all other tax payers above this slab will also be benefited in … [Read more...]

Budget 2017 : Income tax reduced by 5% for Income upto Rs. 5 lakh

Budget 2017 : Income tax reduced by 5% for Income upto Rs. 5 lakh Finance Minister announced in the budget speech for 2017-18 today in Lok Sabha, there were legitimate expectations of the salary class after demonetization to reduce the tax burden. He … [Read more...]

Income Tax Rates FY 2016-17 (AY 2017-18) – Finmin Orders

Income Tax Rates FY 2016-17 (AY 2017-18) - Finmin Orders INCOME TAX CALCULATOR - PRE & POST BUDGET 2017 CIRCULAR NO : 01/2017 F.No.275/192/2016-IT(B) Government of India Ministry of Finance Department of Revenue Central Board of Direct … [Read more...]

Income Tax Ceiling Raised to 7.5 Lakh – AIBEA

Ceiling on IT for salaried persons should be raised to Rs.7.5 lakh: AIBEA to Jaitley The ceiling on Income Tax for salaried persons should be raised upwardsto Rs 7.5 lakh with exclusion of fringe benefits like housing,medical and educational … [Read more...]

Clarification of Status of Political Parties under Income Tax Act, 1961

Clarification of Status of Political Parties under Income Tax Act, 1961 Press Information Bureau Government of India Ministry of Finance 17-December-2016 18:29 IST Clarification of Status of Political Parties under Income Tax Act, 1961 There have … [Read more...]

Extension of date of filing of Income Tax Return throughout India – CBDT

Extension of date of filing of Income Tax Return throughout India - CBDT Press Information Bureau Government of India Ministry of Finance 29-July-2016 20:47 IST CBDT extends the date for filing income tax return for Assessment Year 2016- 2017 from … [Read more...]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 16

- Next Page »