Arun Jaitley Against High Income Tax Rate to Raise Revenues By PTI NEW DELHI: Ahead of the budget, Finance Minister Arun Jaitley today said the NDA government is not in favour of high taxation, instead it would want to leave more money in the hands … [Read more...]

Instructions regarding observance of Wednesdays as a ‘Public Meeting Day’ for hearing public grievances

Instructions regarding observance of Wednesdays as a 'Public Meeting Day' for hearing public grievances F.No.Dir(Hqrs.)/Cb.(DT)/29/2013 Government of India Ministry of Finance Department of Revenue {Central Board of Direct Taxes) Room … [Read more...]

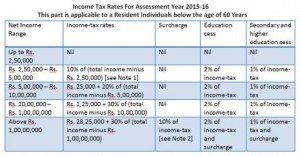

Income Tax Rate Chart For AY 2015-16 / FY 2014-15

Income Tax Rate Chart For AY 2015-16 / FY 2014-15 The rates of income-tax as applicable for Assessment Year 2015-16 for the following category is given below:- 1) in the case of every individual below the Age of Sixty Years 2) For a resident … [Read more...]

IT Exemption Slab Could be Raised Further: Fin. Minister Arun Jaitley Informs

Income Tax Exemption Slab Could be Raised Further: Finance Minister Arun Jaitley Informs “I have no intention of burdening the salaried and middle classes by imposing heavy taxes on them. At the same time, I’m not going to let tax evaders get away. … [Read more...]

Income Tax exemption limit may raise further – Finance Minister

Income Tax exemption may raise further - Finance Minister May raise tax exemption limit further: Arun Jaitley NEW DELHI: Finance minister Arun Jaitley on Saturday said that he does not favour burdening the salaried and middle-class with more taxes … [Read more...]

Amendment in Cadre Restructuring Plan of the Income Tax Department – CBDT Orders

Amendment in Cadre Restructuring Plan of the Income Tax Department - CBDT Orders Amendment in the scheme of distribution of posts under the Cadre Restructuring Plan of the Income-Tax Department - CBDT Orders GOVERNMENT OF INDIA, MINISTRY OF FINANCE … [Read more...]

Income Tax Exemption Limit Raised by Rs.50,000 – Does it meet the Central Government employees’ expectations?

Income Tax Exemption Limit Raised by Rs.50,000 – Does it meet the Central Government employees’ expectations? Finance Minister Arun Jaitley announced that the Income Tax exemption limit for individual taxpayers, below the age of 60 years has been … [Read more...]

Personal Income Tax Exemption Limit and 80C limit also raised by Rs. 50,000

Personal Income Tax Exemption Limit and 80C limit also raised by Rs. 50,000 Personal Tax Exemption Limit Raised by Rs. 50,000/- ; No Change in the Rate of Surcharge; 15% Investment Allowance to Manufacturing Companies, to Incentivize Small … [Read more...]

Budget 2014 – CII suggests raising 80C deductions to Rs. 2.5 Lakhs

Budget 2014 – CII suggests raising 80C deductions to Rs. 2.5 Lakhs In its Pre-Budget wish list regarding Income Tax 80C, the Confederation of Indian Industries (CII) has suggested to the Finance Ministry that the consolidated deduction under 80C be … [Read more...]

Central Government is planning to raise the Income Tax exemption slab to Rs. 5 Lakhs

Central Government is planning to raise the Income Tax exemption slab to Rs. 5 Lakhs According to information from the Finance Ministry, the Government is giving serious thoughts about raising the income tax exemption slab from the current Rs. 2 … [Read more...]