7th Pay Commission Travelling Allowance Rules for Central Government Employees

Travelling Allowance is not a regular allowance for all employees! Travelling Allowance is that the permission to avail reimbursement of the expenses incurred by an employee while on duty in outstation! Travelling Allowance is the package of various allowances. Travelling Allowance and Daily Allowance (TA-DA), Hotel Charges, Travelling Charges, Food Charges, Mileage Allowance, Reservation Charges, Internet and E-Ticketing Charges, Cancellation Charges, Conveyance Charges, TA on Deputation, TA on Transfer and TA on Retirement.

(Compilation of TA/DA Rules for CG Employees)

New Revised Rate and Entitlements of Travelling allowance as per 7th pay commission with effect from 1st July 2017: For Armed Forces Defence Personnel and Railway employees, the concerned department will issue separate orders on this subject respectively. Supersession of all orders issued earlier, particularly DoE Office Memorandum No.19030/3/2008-E.IV dated 23.9.2008, in respect of Travelling Allowance rules.

Travelling Allowance (TA) on Retirement: Time-limit for submission of claims for TA on Retirement is modified from 60 days to 180 days (six months), succeeding the date of completion of the journey – Finance Ministry Orders on 15th June 2021 – Click to read more

Also Check: Transport Allowance Chart

TA/DA Rules for Central Govt Employees

What is TA/DA?

TA/DA stands for Travelling Allowance and Daily Allowance (not Dearness allowance). TA means the travel expenses as per entitlement on official duty. DA means the food and accommodation charges as per the entitlement. Travelling allowance and Daily allowance are fixed amounts as per the pay matrix level after the 7th pay commission.

What is Travelling Allowance?

A reimbursement system for travelling expenses while on duty (official duty or temporary duty). And any kind of travelling expenses is permissible as per entitlements of TA/DA Rules. Other than travel expenses, accommodation, food and other related expenses are also eligible for reimbursement under Daily Allowance. The revised rates of TA and DA allowances after the 7th pay commission are given below in detail.

Also check: Expected DA from January 2020 Calculator

- 7th Pay Commission Travel Entitlement

- 7th Pay Commission Rate of Travelling Allowance

- 7th Pay Commission Orders on Travelling Allowance

This Allowance on tour comprises fares for a journey by rail/road/air/ sea or road mileage for road journeys otherwise than by bus and Daily Allowance for the period of absence from Headquarters [Para 4.2.27 6th CPC Report]

Also read: Pay Matrix Table for Central Government Employees

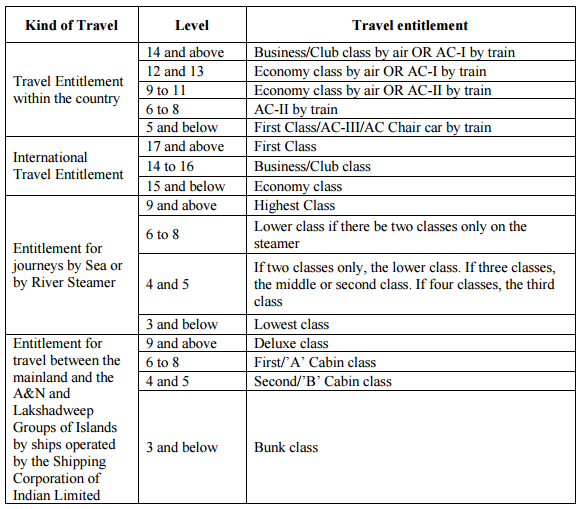

Travelling Allowance Rates 7th Pay Commission – Travel Entitlement as per Pay Level in Pay Matrix

Entitlement of Daily Allowance and Travelling Allowance as per Pay Level in Pay Matrix Table

Travel Entitlement for Tour and Training (within the Country)

| Pay Matrix Level | Travel entitlement |

| 14 and above | Business or Club class by air or AC-I by train |

| 12 and 13 | Economy class by air or AC-I by train |

| 9 to 11 | Economy class by air or AC-II by train |

| 6 to 8 | Economy class by air or AC-II by train |

| 5 and below | First Class or AC-III or AC Chair car by train |

Check also: CG Offices Holiday List 2022 – PDF Download

Entitlement of Premium Trains, Premium Tatkal, Suvidha, Shatabdi, Rajdhani and Duronto Trains

| Pay Matrix Level | Travel Entitlements* |

| 12 And Above | Executive or AC 1st Class (In Case of Premium, Premium Tatkal, Suvidha, Shatabdi, Rajdhani higher class) |

| 6 To 11 | AC 2nd Class or Chair Car (In Shatabdi Trains) |

| 5 & Below | AC 3rd Class or Chair Car |

International Travel Entitlement

| Pay Matrix Level | Travel Entitlement |

| 17 And Above | First Class |

| 14 To 16 | Business or Club Class |

| 13 And Below | Economy Class |

Entitlement for journeys by Sea or by River Steamer

(i) For places other than A&N Group of Islands and Lakshadweep Group of Islands:-

| Pay Level In Pay Matrix | Travel Entitlement |

| 9 And Above | Highest Class |

| 6 To 8 | Lower Class If There Be Two Classes Only On The Steamer |

| 4 And 5 | If Two Classes Only, The Lower Class, If Three Classes, The Middle Or Second Class. If There Be Four Classes, The Third Class |

| 3 And Below | Lowest Class |

For travel between the mainland and the A&N Group of Islands and Lakshadweep Group of Islands by ships operated by the Shipping Corporation of India Limited

| Pay Level In Pay Matrix | Travel Entitlement |

| 9 And Above | Deluxe Class |

| 6 To 8 | First / ’A’ Cabin Class |

| 4 And 5 | Second / ’B’ Cabin Class |

| 3 And Below | Bunk Class |

Mileage Allowance for Journeys by Road

(i) At places where specific rates have been prescribed:-

| Pay Level In Pay Matrix | Entitlements |

| 14 Or Above | Actual Fare By Any Type Of Public Bus Including AC Bus OR At Prescribed Rates Of AC Taxi When The Journey is Actually Performed By AC Taxi OR At Prescribed Rates For Auto Rickshaw For Journeys By Auto Rickshaw, Own Car, Scooter, Motor Cycle, Moped, Etc. |

| 6 To 13 | Same As Above With The Exception That Journeys By AC Taxi Will Not Be Permissible. |

| 4 And 5 | Actual Fare By Any Type Of Public Bus Other Than AC Bus OR At Prescribed Rates For Auto Rickshaw For Journeys By Auto Rickshaw, Own Car, Scooter, Motor Cycle, Moped, Etc. |

| 3 And Below | Actual Fare By Ordinary Public Bus Only OR At Prescribed Rates For Auto Rickshaw For Journeys By Autorickshaw, Own Scooter, Motor Cycle, Moped, Etc. |

Daily Allowance as per Pay Level in Pay Matrix

Rate of Daily Allowance Travelling Allowance as per Pay Level in Pay Matrix Table

| Pay Level | 5 and below |

| Accommodation Charges | Rs. 450 per day |

| TA Charges | Rs. 113 per day |

| Lump-sum | Rs. 500 per day |

| Pay Level | 6 to 8 |

| Accommodation Charges | Rs. 750 per day |

| TA Charges | Rs. 225 per day |

| Lump-sum | Rs. 800 per day |

| Pay Level | 9 to 11 |

| Accommodation Charges | Rs. 2,250 per day |

| TA Charges | Rs. 338 per day |

| Lump-sum | Rs. 900 per day |

| Pay Level | 12 and 13 |

| Accommodation Charges | Rs. 4,500 per day |

| TA Charges | AC taxi charges of up to 50 km per day |

| Lump-sum | Rs. 1000 per day |

| Pay Level | 14 and above |

| Accommodation Charges | Rs. 7,500 per day |

| TA Charges | AC taxi charges as per actual expenditure |

| Lump-sum | Rs. 1,200 per day |

Check also: 7th CPC Transport Allowance Rate Chart

Note: The Rates of Accommodation Charges, Travelling Charges, and Lump sum amount will further increase by 25% whenever DA increases by 50%.

Clarification on accommodation charges for stay in Hotels as per CCS (TA) Rules – Dated: 18.6.2018 – Click to read in detail

Reimbursement of Hotel charges

Claiming of hotel charges procedure for CG Staff and Officers with effect from 1st July 2017 as per the recommendations of 7th pay commission.

For levels 8 and below, the amount of claim (up to the ceiling) may be paid without the production of vouchers against self-certified claims only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. additionally, for a stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be Rs. 1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers.

Also read: Travelling Allowance for Election Duty – Clarification

Reimbursement of Travelling charges

Reimbursement of TA for Central Government Officers and Staff from 1st July 2017.

Similar to Reimbursement of staying accommodation charges, for level 8 and below, the claim (up to the ceiling) may be paid without production of vouchers against self-certified claim only.

The self-certified claim should clearly indicate the period of travel, vehicle number, etc. the ceiling for levels 11 and below will further rise by 25 per cent whenever DA increases by 50 per cent. For journeys on foot, an allowance of Rs.12/- per kilometre travelled on foot shall be payable additionally.

Reimbursement of Food charges Procedure

Reimbursement of food bills procedure for CG Employees after 7th pay commission.

There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table E (i) above and, depending on the length of absence from headquarters, would be regulated as per Table (v) below.

Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates). i.e. Lump sum amount payable.

Timing restrictions – Absence from HeadQuarter

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per-day basis.

If absence from headquarters is less than 6 hours = 30% of Lumpsum amount

If absence from headquarters is between 6 -12 hours = 70% of Lumpsum amount

If absence from headquarters is more than 12 hours = 100% of Lumpsum amount

Travelling Allowance Rules – Implementation of the Seventh Central Pay Commission – Finmin Order No.19030/1/2017-E.IV Dt. 13.7.2017 pdf download

Transportation Rules for Personal Effects

Transportation of personal effects on transfer by road calculation. Transportation entitlement for Central Government employees with effect from 1.7.2017

| Level | By Train/Steamer | By Road |

| 12 And Above | 6000 Kg By Goods Train/4 Wheeler Wagon/1 Double Container |

Rs. 50 Per Km |

| 6 To 11 | 6000 Kg By Goods Train/4 Wheeler Wagon/1 Single Container | Rs. 50 Per Km |

| 5 | 3000 Kg | Rs. 25/- Per Km |

| 4 And Below | 1500 Kg | Rs. 15 Per Km |

Transportation Rules for Conveyance

Reimbursement for transportation of conveyance charges for CG employees effective from 1.7.2017.

| Level | Reimbursement |

| 6 And Above | 1 Motor Car Etc. Or 1 Motor Cycle/Scooter |

| 5 And Below | 1 Motorcycle/Scooter/Moped/Bicycle |

Classification of pay level for Travelling allowance

Rate of transportation of conveyance on transfer

| 7th CPC Travelling Allowance |

| Pay Level in Pay Matrix |

| Level-14 (GP Rs. 10000) and above |

| Level-12 (GP Rs. 7600) and Level-13 (GP Rs. 8700) |

| Level-9 (GP Rs. 5400) to Level-11 (GP Rs. 6600) |

| Level-6 (GP Rs. 4200) to Level-8 (GP Rs. 4800) |

| Level-4 (GP Rs. 2400) and Level-5 (GP Rs. 2800) |

| Level-3 (GP Rs. 2000) and below |

TA-DA Allowance Rules for Central Government Employees

Also read: Travelling Allowance Rates for Railway Employees in 7th cpc

SR 116 of TA Rules PDF

The travelling allowance referred to will be admissible in respect of the journey of the Government servant and members of his family from the last station of his duty to his home town or to the place where he and his family is to settle down permanently even if it is other than his declared home town and in respect of the transportation of his personal effects between the same places.

SR 147 of TA Rules PDF

S.R. 147 the expenditure on transportation of conveyance by government servants on their retirement shall be reimbursed without insisting on the requirement that the possession of the conveyance by them while in service at their last place of duty should have been in the public interest. Finance Ministry issued an important clarification order on Travelling Allowances rules and rates as per 7th Pay Commission on 13.7.2017. [Download pdf click here]

TA/DA Rules for Retiring Employees

TA on Retirement includes 4 components:-

- Travel entitlement for self and family

- Composite Transfer and packing grant (CTG)

- Reimbursement of charges on transportation of personal effects

- Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements

Travel entitlements as prescribed for tour/transfer in Para 2 above, except for International Travel, will be applicable in case of journeys on retirement. The general conditions of admissibility prescribed in S.R. 147 will, however, continue to be applicable.

(ii) Composite Transfer Grant (CTG)

(a) The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of those employees, who on retirement, settled down at places other than the last station(s) of their duty located at a distance of or more than 20 km.

However, in case of settlement to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay.

Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG.

The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc., at the old and new station, are already subsumed in the composite transfer grant and will not be separately admissible.

(b) As in the case of serving employees, Government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 km may be paid one-third of the CTG subject to the condition that a change of residence is actually involved.

(iii) Transportation of Personal Effects:- Same as Para 3(iii) above.

(iv) Transportation of Conveyance:- Same as Para 3(iv) above.

The general conditions of admissibility of TA on Retirement as prescribed in S.R. 147 will, however, continue to be applicable.

Who is eligible for Travelling Allowance?

7th CPC Travel Entitlements

| 7th CPC Travel Entitlements within the Country w.e.f. 1.7.2017 – Click Here |

| 7th CPC Entitlements of Travel by Premium Trains – Premium Tatkal – Suvidha Trains w.e.f. 1.7.2017 – Click Here |

| Entitlement for journeys by Sea or by River Steamer – Click Here |

| Travel between the mainland and the A&N Group of islands and Lakshadweep – Click Here |

| 7th CPC Mileage Allowance for Journeys by Road – Click Here |

| 7th CPC Daily Allowance on Tour – Click Here |

| 7th CPC Transportation of Personal Effects – Click Here |

Travelling Allowance and Related matters | Finmin Orders

| Office Memorandum No. & Title | Download | Date |

| F.No.19030/1/2017-E.IV: Travelling Allowance Rules – Implementation of the Recommendations of the Seventh CPC |

Download | 01/02/2018 |

| Admissibility for reimbursement for travel within the city | Download | 17/02/2017 |

Transfer Travelling Allowance Form for Central Government employee

Travelling Allowance Bill For Transfer

- Part-A (To be filled by the Government Servant)

Particulars of an employee

Part-B (To be filled in the Bills Section)

- Expenditure Details

Note: This bill should be prepared in duplicate-one for payment and the other as an office copy

Click to view or download the TA Application Form on Transfer as PDF format

TA/DA Advance Application Form PDF Download

Time-limit for submission of claims for Travelling Allowance (TA) on retirement regarding

The time limit for submission of TA claim in all other cases i.e. on tour, transfer and training etc. will remain 60 days. [Click to view in order]

Travelling Allowance (TA/DA) Chart

| Title of Subject | Travelling Allowance Rules |

| Beneficiaries | Central Government Employees |

| TA/DA | Travelling Allowance & Daily Allowance |

| Eligibility | Official Duty or Temporary Duty |

| Rules Based on | 7th Central Pay Commission |

| Travel on | Air, Train, Road and Sea |

| Level 5 & below | First Class/AC-III/AC Chair Car in Train |

| Level 6 to 8 | AC-II in Train |

| Level 9 to 11 | Economy Class in Air or AC-II in Train |

| Level 12 & 13 | Economy Class in Air or AC-I in Train |

| Level 14 & above | Business/Club Class in Air or AC-I in Train |

Travelling Allowance on transfer to/from North-Eastern Region, Union Territories of Andaman & Nicobar, Lakshadweep Island and Ladakh

If the family of Railway employee does not accompany him on. transfer to from these areas, the employee’ is entitled to carry personal effects upto 1/3rd of his entitlement and production of receipt/voucher is not mandatory to claim 1/3rd of his entitlement of transportation of personal effects.

If the family of Railway employee accompanies him on transfer to/from these areas, the employee is entitled to the admissible cost of transportation of personal effects and production of receipt/voucher is mandatory to claim admissible amount.as per his entitlement for transportation of personal effects.

- Air Travel is Allowed for JCOs in Defence Forces September 5, 2024

- Frequently Observed Shortcomings in TA/DA Claims June 17, 2023

- 7th Central Pay Commission Conveyance Allowance Revised rates to Railway Medical Officers June 17, 2023

- Conveyance Allowance to Railway Doctors after 7th Pay Commission June 17, 2023

- 7th CPC Conveyance Allowance June 17, 2023

- 7th CPC Travelling Allowance Rules – Finance Ministry Orders April 3, 2023

- Travel by Premium Trains on LTC, Official Duty, Tour, Training, Transfer – Clarification orders issued by PCAFYS April 3, 2023

- Admissibility to Travel by Tejas Express Trains on Official Tour for Central Government Employees April 3, 2023

- Clarification on Traveling Allowance During Disciplinary Proceedings – EPFO October 26, 2022

- Travelling Allowance on Transfer To/From NER Region, A&N Islands, Lakshadweep Island & Ladakh August 3, 2022

- Time limit for submission of Travelling Allowance and other claims by retired employees: Railway Board November 30, 2021

- 7th CPC Travelling Allowance Rules – Production of receipts or vouchers for reimbursement of TA and DA December 30, 2020

- Check List for Temporary Duty Claim July 15, 2020

- Check List for Permanent Duty Claim July 15, 2020

- Guidelines for Air Travel on Official Tours – Latest Railway Board Order July 10, 2020

- Travelling Allowance (TA) Rules – Submission of Boarding Pass along with TA Bill June 24, 2020

- TA Rules to Central Govt employees for participating in National and International sports events May 15, 2020

- Participation in Cultural Events Treated as on Duty with Travel Entitlements February 13, 2020

- Travelling Allowance (TA) for Election Duty 2019 November 20, 2019

- 7th CPC Travelling Allowance – Travel Entitlement as per Pay Level in Pay Matrix June 21, 2019

- 7th CPC Travel Entitlements – Clarification Orders issued by DoPT on 18.10.2018 October 19, 2018

- 7th CPC Travelling Allowance: Finmin Clarification dt. 12.9.2018 September 15, 2018

- 7th CPC TA Rules: Reimbursement of Accommodation Charges for Stay in Hotels June 25, 2018

- Time-limit for submission of claims for Travelling Allowances March 13, 2018

- TA/DA Entitlements to Defence Personnel December 14, 2017

- TA and Sitting Fee Payable to Official and Non-Official Members/Experts – UGC November 10, 2017

- 7th CPC Travelling Allowance : Railway Board Issued Modification Orders on 25.9.2017 October 6, 2017

- TA/DA entitlements of Non-officials of Committees/Boards/Panels – DoE Orders on 14.9.2017 September 14, 2017

- Instruction regarding overpayment in r/o of TA/DA on account of Temporary Duty/Tour September 12, 2017

- 7th CPC Allowances Gazette Notification : Transport Allowance (TPTA) and Travelling Allowance July 7, 2017

- Clarification on admitting Travelling Allowance claim by family of deceased employees – Finmin Orders December 23, 2016

- Admissibility of Travelling Allowance (TA) and other expenditure incurred while on training by the Government Servants on probation January 21, 2016

- Travelling Allowance – Analysis and Recommendations of 7th Pay Commission December 16, 2015

- DA Over 100% – Admissible of supplementary claims for difference on arrears of TA/DA September 23, 2015

- Based on the Census of 2011 HRA and TA increased for Central Government employees June 5, 2015

- Travel by Premium Trains on Official Duty/Tour/Training/Transfer etc.- Clarification from Finmin April 23, 2015

- Travelling Allowance for Election Duty – Clarification April 13, 2015

- Finmin Orders on Travelling Allowance – Granting to the Government servant with Disabilities on travel during tour/training February 18, 2015

- Relaxation for purchase of Air-Tickets on TA (Transfer) from Private Agents: CBDT Order January 12, 2015

- Foreign travel of Government officers – Clarification issued by Finance Ministry November 10, 2014

- Transport Allowance and Travelling Allowance Rules at a glance October 24, 2014

- JCM Staff Side suggestion on Transport Allowance June 25, 2014

- Government’s Travel Allowances for the MPs June 14, 2014

Granting of Travelling Allowance for Central Government employees is based on the travel expenses including boarding and lodging expenses while on official duty.

Transport Allowance is a fixed monthly amount and this is common for all government employees. The Transport Allowance is grating for the expenses travelling between office and residence. Travelling Allowance is entirely different from Transport Allowance. The Travelling Allowance is generally called TA/DA. This allowance is eligible only for the employees who have travelled on official duty.

The accommodation charges for pay levels 1 to 5 are Rs. 450 per day after implementation of the 7th pay commission.

I was posted at siliguri last year and joined Malda( WB) in July 2023. I took permission from HOD to keep family at siliguri as my child was studying in class 10th and accordingly didn’t claimed transfer TA and luggage transportation

of family and permission was also granted to claim Transfer TA beyond 6 months. Now again I am posted to Orissa which is non family station and suppose to move in June 2024. . I intend to shift my family to delhi for better study of my children. What Transfer TA will I get in respect of my family and house hold goods shifting

1. Siliguri to Malda or Malda to Delhi or both or can I shift family and luggage directly to delhi from siliguri

Your 6 months permission was completed in January was over to shift your family. Now your duty point is ORISSA, if Orissa is temporary post you can claim Malta to Orissa only not in Delhi.

payment gate way charges during tour are reimbursable or not please clarify.

No.

Kindly define public transport,. Is travel by any private bus permitted for central government employee .

Sir,

Will the central government official attending preliminary hearing in the departmental proceedings in his case at the same station (from residence to the place of hearing which are in the same city) claim TA Bill. If he allows, please share the rule provision for the same.

Thanks in advance.

Sir, I have proceeded on temp duty for which I have claimed for food & lodging charges @ Rs.1550/- per day (i.e. food charges @ Rs.750/- & lodging charges @ Rs.800/-per day). In addition to the above, I have claimed conveyance charges @ Rs.225/-per day and Foot charges @ Rs.12/-as per rules, but my audit authorities have disallowed conveyance and foot charges in full without any reason or quoting any govt rules/orders. Therefore, I request to kindly confirm I am entitled to conveyance charges @ Rs.225/- and Foot charges @ Rs.12/- per day in addition to food and lodging charges as per rules, please. I aspect for your fruitful reply with quoting rules, so that I can re-submit my claim to audit authorities in support, please.

Any Incidental charges are applicable for VII th pay commission ?

It depends upon the duty.

Please clarify about the rule of TA in case an officer travels in his own car between the places not connected by railways.

He is entitled to get the prescribed rates of the car by the state transport department or he will get the rates of Auto Riksha as given in the above table

Mileage Allowance for Journeys by Road

(i) At places where specific rates have been prescribed:-

14 Or Above Actual Fare By Any Type Of Public Bus Including AC

Bus OR At Prescribed Rates Of AC Taxi When The Journey is Actually Performed By AC Taxi

OR At Prescribed Rates For Auto Rickshaw For Journey

By Auto Rickshaw, Own Car, Scooter, Motor Cycle, Moped, Etc.

If your own car in this table is a topographical mistake (it was not there in 6 CPC) how to get it corrected from Finance Ministry.

If you’ve to surrender your transport allowance for the full Financial Year it will be given to you as per your basic pay rs.24/- or rs.12/- per Km.

The logic is not understood. How Transport Allowance is connected to Road Mileage Allowance while on transfer??

Public Transport and Own/Private vehicles are playing in Road only. If you are availing road mileage in your own/private vehicle, what are purposes to give public transport allowance.?

Kindly clarify the term places connected by rail in view of travelling allowance for central government employees and quote the relevant rule.

Is a Central Govt. employee going to appear in departmental examination for promotion is entitled for T.A and D.A.. Where the examination centre is 200 kms away from the place of posting and the Central Govt. employee has to stay for 4 continuous days to appear in examination.

sir ,

is there any limit of distance from headquarter for claiming the stay.

can someone claim stay charges 10 km away from headquarter.?

please code the authentic circular or O.M also.

If you are taking Transport Allowance, the T.A. will not eligible from Headquarters.

if a person on tour for 40 days.

so that can we claim ta/da for 30 days on full rate and remaining 10 day on half rate

please clarify

Up to 180 days full D.A. If it is a temporary transfer/training period/tour,(if he is not is not given transport allowance for that financial year).

If an official is absent for full calender month than there will not be any TPTA for that mont. If he is present even a single day in a calender month will be eligible for full TPTA.

Whether the newly appointed central govt officer through upsc is entitled for travelling allowance at the time of joining job station.the head of Deptt/appointing authority mentioned that t.a. will be paid as per govt.instructions. please clarify.

Sir,

I am working in IAAD . I need to go to Chennai from Mumbai for taking incentive exam for Sr Auditor.

Can air fare be reimbursed ? I am in level 6 as per 7th CPC. Please reply.

What would be the nett and gross salary of level 1 navy civilian employee @ y category city.

1. Is boarding pass mandatory to submit for TA claim for central government employees ?

2. Is boarding pass mandatory to submit for TA claim for the students of IITs?

sir, i retired from central govt on 30.11.2018 from delhi. my pay level is 10 under 7th cpc.. my home town is gurgaon and before retirement i was residing in delhi. distance between my delhi residence/office and gurgaon residence is more than 25 kms . i have claimed my composite transfer grant (ctg) ie 80% of my last basic pay but the deptt has restricted that to 1/3 ctg.

kindly clarify my admissibility with regard to rules on the subject-regards!

As per the T.A.Rules on Transfer Rule (ii) b, CTG have been calculated the distance of less than 20 Kms. from the old station and transferred place within the same city. If it confirmed with any records of 25 Kms.(extract)) you can claim and get the 80% of your last basic pay. Please check up it is as per your pre-revised scale prior to 1.7.2017 and shifted before the date.

Sir my question is if a candidate on course for three months from his duty stn about 1500kms what are the emoluments he deserves 1068/ or above if he is level -II pl clare

Kya rest par ta milta hai ki nhi

If a govt employee travel in bus and claim bus fair with out ticket . can bus fair reimbursement to govt employees

No. They may give punishment or they will not give one increment & you are got bad remarks it will affect your future upgradutations of MACP.

Sir, i am primary teacher of zp school. I am handicapped.

How much my ta da allowance in 7th pay commission

Whether Food expenses and accommodation expenses is admissible for appearing Dept. Competitive Examination with TA.

Whether daily Ii.e food allowance is eligible to government employees who attended residual training programme within 20kms where accomdation and food provided for full day by the training institute itself

My father had visited on official duty a long distance and he stayed in his own arrangement as a paying guest due to his health problem. Whether he is eligible entatiled the hotel charges or not. Kindly clarify the same.

TA/DA advance payment rules. Whether TA/DA advance can be paid if it is approved by competent authority before the tour commences and return to headquarter before the advance is cleared by accounts section

I want to know DA for travelling in same city Mumbai

Is these ta da rules applicable during travelling for departmental interviews?

I am in level 6. Can I claim TA by own car on permanent transfer. What rate per kilometre

?

sir, if an pers who falls in level 13 proceeding on TD and stayed in HQ with their accomodation but indl wants his fooding charges as per their entitlement.

Please verify whether entitled or not.

please attach hindi version.

Attached. Thank you.

I am in Level 7. can i travel in own car on official tour? What will be charges per Km for re-imbursement?

In 7th CPC How long distance (K.M) to acept Travelling allowance from head quarter to working site? OR Kitna kilometers ka bad Travelling allowance milegi ?

Please intimate if second TTA claim will be admissible to officer who is transferred 2nd time within 3 month.

Please quote relevant authority.

thanks

I am drawing pay in the pay band with grade pay Rs.4800/- (pre-revised scale) and I booked Air ticket from Indigo through Balmer & Lawrie on 6-7-2017 for the travel during Octber, 2017. What is my eligibility ? Whether I am entitled to travel by Air ? If so, whether I will get the full fare which is less than Air India ticket fare.

What is the rate of travelling /daily allowances to Indian railway employees ?

What is per day Traveling Allowance for Level 5… Earlier it was 315

what is the per Km price for personal luggage transfer during posting from z city to y city.Kindly mentioned the amount along with policy letter.

I want to know about TA DA for accommodation, food, etc etc. …

I am in level 2

Please give central govt finance ministery approval details. …

Dear Sir,

Right now, I was drawing an amount of TA is 1600+TA and I was in the G.P. is Rs. 1900/- (Level-2 in Pay Matrix). Let me know, any amendment will be coming for TA who are drawing above 7440 pay. As per 7th cpc, my TA was fixed at Rs.1350+DA. The difference between present TA and will be applicable TA is Rs.2200/-. The huge amount will be loss to me. So, kindly inform

I want to know if a central govt. employee retires from Delhi office and settled in Noida and distance from Delhi to Noida is more than 20km. then CTG will be given one third of full. kindly clarify.

Dear Sir,

Right now, I was drawing an amount of TA is 1600+TA and I was in the G.P. is Rs. 1900/- (Level-2 in Pay Matrix). Let me know, any amendment will be coming for TA who are drawing above 7440 pay. As per 7th cpc, my TA was fixed at Rs.1350+DA. The difference between present TA and will be applicable TA is Rs.2200/-. The huge amount will be loss to me. So, kindly inform

From this site, it’s learned that from level 9 to 11 is eligible for flight economy class traveling allowance. But I’m not sure, all Central Govt employees coming under above mentioned levels are getting it. Request to make an enquiry whether all Central Govt Dept. are allowing their employees coming under levels 9 – 11, are provided to avail Air journey for official tour ?

when the cabinet will give HRA allowances.what about TA can you give full details regarding allawances

Will the lumbsum grant ( one months basic pay)eligiblity may be in accordance with new pay, to an employee transferred after 1.1.16 as per 7th CPC rules. The claim has not been settled yet.

Will the lumbsum grant ( one months basic pay)eligiblity may be in accordance with new pay, to an employee transferred after 1.1.16 as per 7th CPC rules. The claim has not been settled yet.

prakashnayak J

Technician T

central govt emp drawing GP 1900/- but drawing basic pay 7103 & above are eligible for tpt 1600+ DA=3600

but they not getting same tpt as per 7th CPC order. As they comming in level 2. Request to consider them for same amt at least

TPt granted for the central govt emp drawing GP 1900/- but drawing basic pay 7440 & above are eligible for tpt 1600+ DA=3600 but they not getting same tpt as per 7th CPC order. As they comming in level 2. Request to consider them for same amt at least

Sir,

I am PC (SL) officer of AOC, retired on 01 Aug 2006. Would the decision of 7th CPC affect on my pension scale after 33% commutation.

Sir,

I am a retired PC (SL) officer of AOC retired on 01 Aug 2016. Will the decision of 7th CPC affect on my pension scale after 33% commutation.

16010 G.Pay 4600 How are the salary in the 7pay

Sir my runing basic 7900 g.p.2000 h.r.a. 10 t.a. ( 2000 ) please calculate 7th pay

Sir driver cadre on T/D all India by govt truck/bus driving only da not ta &depotation pay on govt duty per km pay equal railway drivers 7cpc chairman ji ADA +DA+TA+Depotation+spl pay per trip +1/3 ration old pay +tool tex free& electric bill free + exserviceman benifit equal defense perosonal Danger service & road driving danger service haevy vechicles road drivers good news 1-1-2016 happy new years news drivers

my grade pay is 1900 and basic is 12030 and present da is 3400.but In respect to 7 cpc the DA is 1350 is possible! ? what rule apply by 7th cpc to calculation of DA. The DA is decresed by 7th cpc is possible of level 1 and 2 staff? thanks for reply

My current GP is 1900 and TA 1600+DA(1904) = 3504. but as per 7th CPC recommendation the new TA stands at 1350+DA(0)=1350. Please rectify the anomaly before government notification. A large amount of employee will face the same problem.

Simply multiply it as per 125 % da and see recommendations in hike of allowances I will easily got your results

Sir my present basic pay is 13950 grad pay is 4200 and hr is 10 % and Ta 1600. Please calculate my new pay.

Sir my present basic pay is 6460 grad pay is 2000 and hr is 10 % and Ta 4oo. Please calculate my new pay.

Hallo Sir, Presently my pay scale is ₹.7160/- +2000/-, after 7th CPC what would be my Pay Scale.

waiting for reply

thank you

Sir,

I have only one doubt, either petrol or Diesel rates are through out the India is almost same. May be the difference is nominal. If that is the case why x- City employees should get more and Y-City employees should get less. I personally felt that, Transport allowance should be equal to allover the India. In case govt wants to Differentiate, it can be paid based on the distance KM.

This is purely my personnel opinion. think friends.

7th pay commission should also recommend that one child of cg employ should be adjusted in govt department

GOOD THAT 7TH CPC IS FINALIZING ITS RECOMMENDATION AT AN EARLY DATE, IT SHALL GIVE AN AMPLE SPACE FOR FURTHER CONSIDERATION TO THE GOVT OF INDIA TO ACCEPT IN TIME AND IMPLEMENT IT BY JAN 2016 WITH GOING FOR ANY KIND OF ARREARS.. HOPE IT COMES UP TO THE EXPECTATION OF ITS EMPLOYEES AND SATISFIES EVERY BODY.

sir my pay present 11230basic pay 7th pay commission mein kya hoga

Respected Sir, Military Service Pay Offrs and PBOR same hona better,

Sir,my present basic pay 14250.How much I will expect

Hi, Presently my pay scale is ₹.25540+6600, after 7th CPC what would be my Pay Scale.

Hi, Presently my pay scale is ₹.14120/-, after 7th CPC what would be my Pay Scale.

waiting for reply

thank you

u will get 22680

Sir please mera band pay 9450/’after 7thpay comision kitana hoga