Fixed Conveyance Allowance admissible under SR-25 to Central Government employees

The Conveyance Allowance Chart List is a comprehensive document that outlines the different amounts of allowances that are granted to employees for transportation expenses. This list provides a breakdown of the different categories of employees and the corresponding allowances that they are entitled to, based on their job responsibilities and work location. The chart list also includes important information such as the maximum limit of the allowance, the mode of transportation that is eligible for reimbursement, and the frequency of the allowance payment. This detailed document plays a crucial role in ensuring that employees are fairly compensated for their transportation expenses, while also maintaining accurate records of the organization’s expenses.

Average Monthly Travel on Official Duty: 201-300 km

- For Journey by Own Motor Car: Rs. 1680 per month

- For Journeys by other Modes of Conveyance: Rs. 556 per month

Average Monthly Travel on Official Duty: 301-450 km

- For Journey by Own Motor Car: Rs. 2520 per month

- For Journeys by other Modes of Conveyance: Rs. 720 per month

Average Monthly Travel on Official Duty: 451-600 km

- For Journey by Own Motor Car: Rs. 2980 per month

- For Journeys by other Modes of Conveyance: Rs. 960 per month

Average Monthly Travel on Official Duty: 601-800 km

- For Journey by Own Motor Car: Rs. 3646 per month

- For Journeys by other Modes of Conveyance: Rs. 1126 per month

Average Monthly Travel on Official Duty: >800 km 4500

- For Journey by Own Motor Car: Rs. 1276 per month

- For Journeys by other Modes of Conveyance: 1276 per month

7th Pay Commission Conveyance Allowance – Implementation of the recommendation of the Seventh Central Pay Commission – Finmin Order 2017

F.No.19039/03/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, Dated: 19th July 2017

Office Memorandum

Subject: Implementation of the recommendation of the Seventh Central Pay Commission – Conveyance Allowance

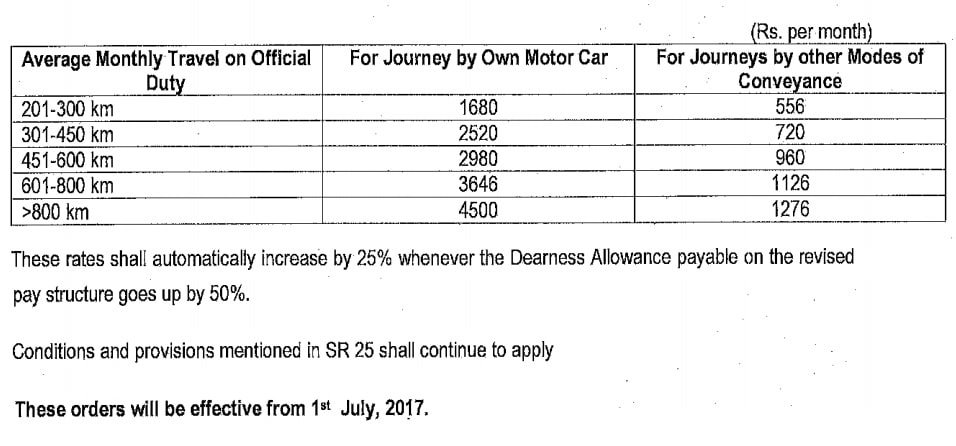

Consequent upon the acceptance of the recommendation of the Seventh Central Pay Commission and in supersession of this Department OM No. 19039/2/2008-E.IV, dated 23rd September, 2008 the President is pleased to revise the rates of Fixed Conveyance Allowance admissible under SR-25 to Central Government employees as indicated below:

| Average Monthly Travel on Official Duty | For Journey by Own Motor Car | For Journeys by other Modes of Conveyance |

| 201-300 km | 1680 | 556 |

| 301-450 km | 2520 | 720 |

| 451-600 km | 2980 | 960 |

| 601-800 km | 3646 | 1126 |

| >800 km | 4500 | 1276 |

2. These rates shall automatically increase by 25% whenever the Dearness Allowance payable on the revised pay structure goes up by 50%.

3. Conditions and provisions mentioned in SR 25 shall continue to apply.

4. These orders will be effective from 1st July, 2017.

5. In so far as the staff serving in the. Audit and Accounts Department are concerned, these orders issue in consultation with the Comptroller & Auditor General of India.

Hindi version is attached.

sd/-

(Annie George Mathew)

Joint Secretary to the Government of India

Click to view the Conveyance Allowance Finance Ministry Order dated 19.7.2017

What is the 7th CPC Conveyance Allowance?

The 7th CPC Conveyance Allowance is an allowance provided to employees for travel on official duty. It covers journeys by own motor car as well as other modes of conveyance.

What is the rate of the 7th CPC Conveyance Allowance?

The rate of the allowance depends on the distance traveled. For journeys up to 300 km, the allowance is 1680 for motor car and 556 for other modes of conveyance. It then increases depending on the distance traveled. For journeys above 800 km, the allowance is 4500 for motor car and 1276 for other modes of conveyance.

Is the 7th CPC Conveyance Allowance taxable?

Yes, the 7th CPC Conveyance Allowance is subject to taxes.

In which Pay Matrix does comes the Grade Pay 4300?