Shortcomings in TA/DA Claims – Frequently Observed

Within the Transportation Wing, there have been frequent observations of shortcomings in the claims for Travelling Allowance and Daily Allowance. The claims submitted by employees have commonly been found to contain errors or omissions, leading to delays in processing and payment. These shortcomings include incomplete documentation, incorrect calculations, and improper categorization of expenses. It is imperative that employees take care to ensure the accuracy and completeness of their TA/DA claims to avoid any such delays.

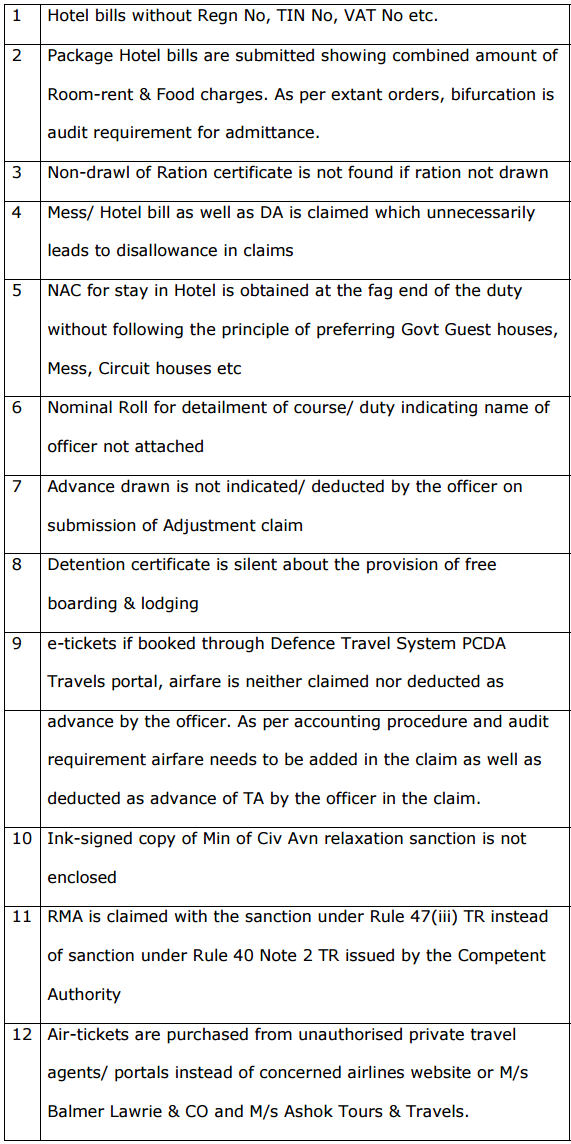

I. TEMPORARY DUTY CLAIM

1. Hotel bills without Regn No, TIN No, VAT No etc.

2. Package Hotel bills are submitted showing combined amount of Room-rent & Food charges. As per extant orders, bifurcation is audit requirement for admittance.

3. Non-drawl of Ration certificate is not found if ration not drawn

4. Mess/Hotel bill as well as DA is claimed which unnecessarily leads to dis allowance in claims

5. NAC for stay in Hotel is obtained at the fag end of the duty without following the principle of preferring Govt Guest houses, Mess, Circuit houses etc

6. Nominal Roll for derailment of course/duty indicating name of officer not attached

7. Advance drawn is not indicated/deducted by the officer on submission of Adjustment claim

8. Detention certificate is silent about the provision of free boarding & lodging

9. e-tickets if booked through Defence Travel System PCDA Travels Portal, airfare is neither claimed nor deducted as advance by the officer, As per accounting procedure and audit requirement airfare needs to be added in the claim as well as deducted as advance of TA by the officer in the claim.

10. Ink-signed copy of Min of Civ Avn relaxation sanction is not enclosed

11. RMA is claimed with the sanction under Rule 47 (iii) TR instead of sanction under Rule 40 Note 2 TR issued by the Competent Authority

12. Air-tickets are purchased from unauthorised private travel agents/portals instead of concerned airlines website or M/s Balmer Lawrie & CO and M/s Ashok Tours & Travels.

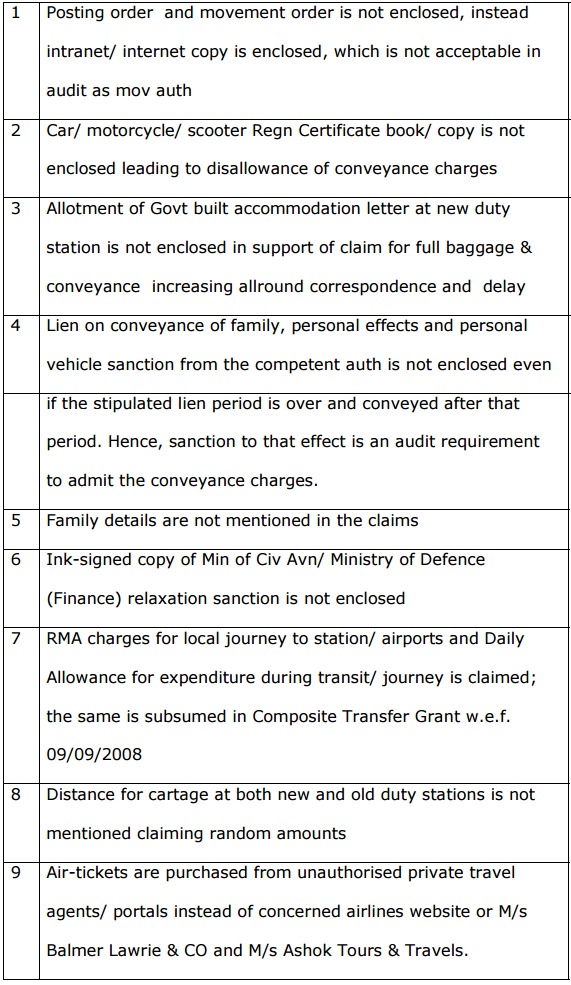

I. PMT DUTY:

1. Posting order and movement order is not enclosed, instead intranet /internet copy is enclosed, which is not acceptable in audit as mov auth

2. Car/ motorcycle/ scooter Regn Certificate book/ copy is not enclosed leading to dis allowance of conveyance charges

3. Allotment of Govt built accommodation letter at new duty station is not enclosed in support of claim for full baggage & conveyance increasing all round correspondence and delay

4. Lien on conveyance of family, personal effects and personal vehicle sanction from the competent auth is not enclosed even if the stipulated lien period is over and conveyed after that period. Hence, sanction to that effect is an audit requirement to admit the conveyance charges.

5. Family details are not mentioned in the claims

6. Ink-signed copy of Min of Civ Avn/ Ministry of Defence(Finance) relaxation sanction is not enclosed

7. RMA charges for local journey to station/ airports and Daily Allowance for expenditure during transit/ journey is claimed; the same is subsumed in Composite Transfer Grant w.e.f. 09/09/2008

8. Distance for cartage at both new and old duty stations is not mentioned claiming random amounts

9. Air-tickets are purchased from unauthorised private travel agents/ portals instead of concerned airlines website or M/s Balmer Lawrie & CO and M/s Ashok Tours & Travels

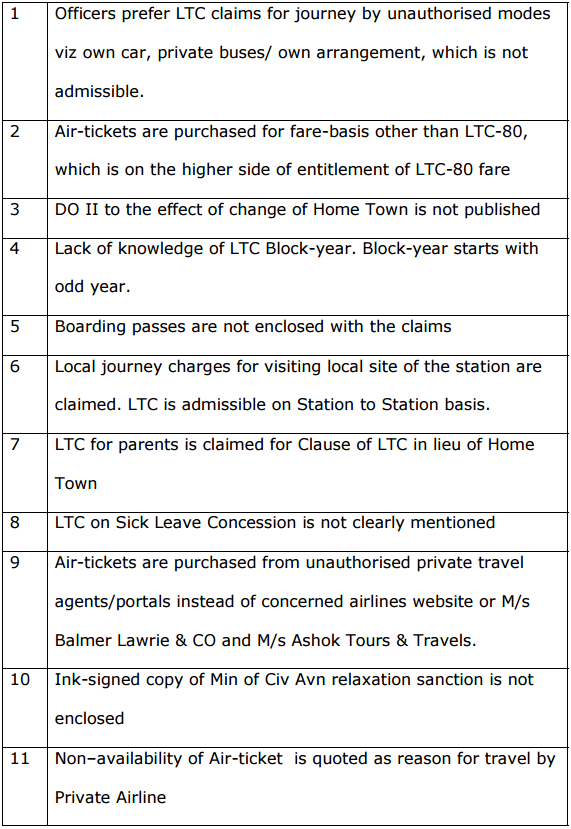

III. LTC Claims

1. Officers prefer LTC claims for journey by unauthorised modes viz own car, private buses/ own arrangement, which is not admissible.

2. Air-tickets are purchased for fare-basis other than LTC-80, which is on the higher side of entitlement of LTC-80 fare

3. DO II to the effect of change of Home Town is not published

4. Lack of knowledge of LTC Block-year. Block-year starts with odd year.

5. Boarding passes are not enclosed with the claims

6. Local journey charges for visiting local site of the station are claimed. LTC is admissible on Station to Station basis.

7. LTC for parents is claimed for Clause of LTC in lieu of Home Town

8. LTC on Sick Leave Concession is not clearly mentioned

9. Air-tickets are purchased from unauthorised private travel agents/portals instead of concerned airlines website or M/s Balmer Lawrie & CO and M/s Ashok Tours & Travels.

10. Ink-signed copy of Min of Civ Avn relaxation sanction is not enclosed

11. Non–availability of Air-ticket is quoted as reason for travel by Private Airline.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Leave a Reply