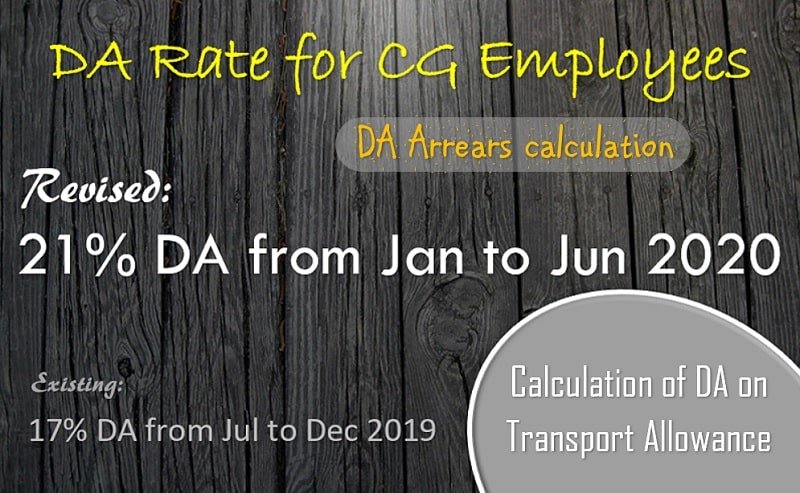

Yesterday the Union Cabinet Committee approved to release the first installment of additional Dearness Allowance to all categories of Central Government employees and Officers with effect from 1.1.2020. As per the calculation prescribed in the 7th pay commission, the additional Dearness Allowance (DA) has been fixed as 4% from Jan 2020.

According to the data of the Consumer Price Index from July to December 2019, the DA has been calculated for the period from Jan to Jul 2020.

Current DA Rate: Existing 17 percent + Additional 4 percent = Total 21 percent

Calculation of DA Table (Excel Sheet Method) Jan 2020

| AICPI | Jul 2019 | Aug 2019 | Sep 2019 | Oct 2019 | Nov 2019 | Dec 2019 |

| 1 | 301 | |||||

| 2 | 301 | 301 | ||||

| 3 | 302 | 302 | 302 | |||

| 4 | 302 | 302 | 302 | 302 | ||

| 5 | 301 | 301 | 301 | 301 | 301 | |

| 6 | 307 | 307 | 307 | 307 | 307 | 307 |

| 7 | 307 | 307 | 307 | 307 | 307 | 307 |

| 8 | 309 | 309 | 309 | 309 | 309 | 309 |

| 9 | 312 | 312 | 312 | 312 | 312 | 312 |

| 10 | 314 | 314 | 314 | 314 | 314 | 314 |

| 11 | 316 | 316 | 316 | 316 | 316 | 316 |

| 12 | 319 | 319 | 319 | 319 | 319 | 319 |

| 320 | 320 | 320 | 320 | 320 | ||

| 322 | 322 | 322 | 322 | |||

| 325 | 325 | 325 | ||||

| 328 | 328 | |||||

| 330 | ||||||

| Total of 12 Months | 3691 | 3710 | 3731 | 3754 | 3780 | 3809 |

| Average of 12 Months | 307.58 | 309.17 | 310.92 | 312.83 | 315 | 317.42 |

| % Increase over 261.42 | 17.66 | 18.27 | 18.93 | 19.67 | 20.5 | 21.42 |

| Percentage of DA | 17% | 18% | 18% | 19% | 20% | 21% |

4% DA Arrears Calculation from Jan 2020

Including the 4 percent Dearness Allowance, the total DA is increased to 21% from January 2020. All CG employees are eligible to get arrears for two months (Jan and Feb 2020) and the 21% DA will be calculated in the current month pay bill. The amount of DA will be calculated based on the basic scale.

For example, if an employee’s basic scale Rs. 49000 in level 6 working in Delhi office, his/her DA Calculation and the arrears will be calculated as given below:

| Month – Year | DA 17% | DA 21% | Arrears |

| January 2020 | 8330 | 10290 | 1960 |

| February 2020 | 8330 | 10290 | 1960 |

| March 2020 | 10290 | ||

| Total | 3920 |

The DA hike also impact on Transport Allowance as follows:

| Month – Year | DA 17% | DA 21% | Arrears |

| January 2020 | 3600 + 612 | 3600 + 756 | 144 |

| February 2020 | 3600 + 612 | 3600 + 756 | 144 |

| March 2020 | 3600 + 756 | ||

| Total | 288 |

Dearness Allowance on Transport Allowance

The DA increase will also impact on Transport Allowance to eligible CG employees as given below:

| 7th CPC Level | TPTA Cities | Other Cities |

| Level-1 (GP 1800) and Level-2 (GP 1900) | ||

| Pay Level 1 | 1350 + DA | 900 + DA |

| 3600 + DA (24200 and Above) | 1800 + DA (24200 and Above) | |

| Pay Level 2 | 1350 + DA | 900 + DA |

| 3600 + DA (24200 and Above) | 1800 + DA (24200 and Above) | |

| Level-3 (GP 2000) to Level-8 (GP 4200) | ||

| Pay Level 3 to 8 | 3600 + DA | 1800 + DA |

| Level-9 and Above (GP 5400 PB-2 and Above) | ||

| Pay Level 9 to 13 | 7200 + DA | 3600 + DA |

7th Pay Commission DA Rates Table

| 7th Pay Commission DA Rate Chart | |

| Month / Year | Dearness Allowance % |

| January 2020 | 21% |

| July 2019 | 17% |

| January 2019 | 12% |

| July 2018 | 9% |

| January 2018 | 7% |

| July 2017 | 5% |

| January 2017 | 4% |

| July 2016 | 2% |

| January 2016 | 0% |

How to Calculate DA? and What is the formula for DA Calculation?

Dearness allowance is calculated based on All India Consumer Price Index for Industrial Workers Base Year 2001=100. The index has been released by the Labour Bureau for every month.

7th CPC DA Percentage = (12 Monthly Average) – 261.42) / 261.42 x 100(ignore decimals) [Click to know more]