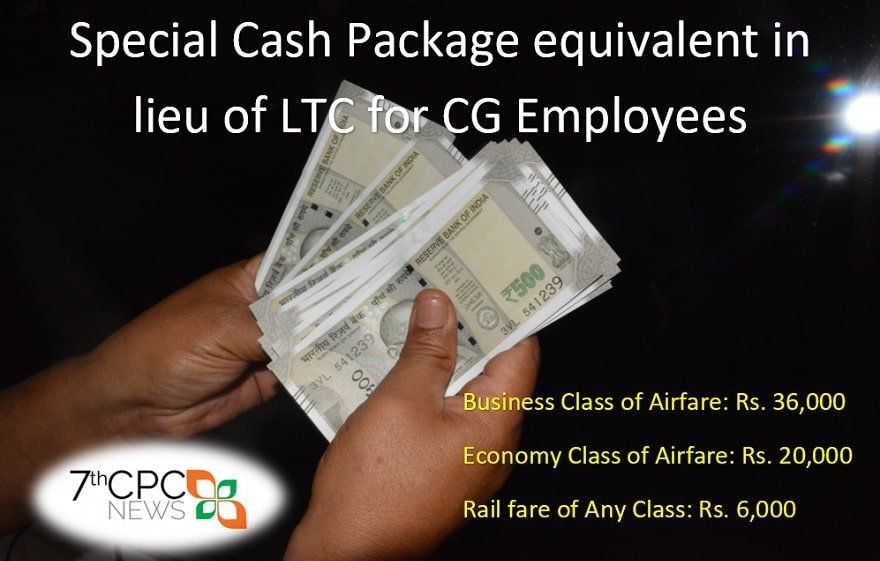

Special Cash Package equivalent in lieu of LTC for Central Government Employees

Certainly, this is good news for Central Government employees!

Special Cash Package scheme is announced by the Central Government to its employees to opt for the cash package on Leave Travel Concession (LTC) in the current block year 2018-2021.

As per the rules framed by the Centre on this scheme, Central Government employees are eligible to receive a bulk amount of cash equivalent of spending on LTC Tour and also Leave Encashment.

In view of the Covid-19 pandemic and resultant nationwide lockdown as well as disruption of transport and hospitality sector, as also the need for observing social distancing, a number of Central Government employees are not in a position to avail themselves of LTC for travel to any place in India or their Hometowns in the current Block of 2018-21.

With a view to compensate and incentivise consumption by Central Government employees thereby giving a boost to consumption expenditure, it has been decided that cash equivalent of LTC, comprising Leave Encashment and LTC fare of the entitled LTC may be paid by way of reimbursement if an employee opts for this in lieu of one LTC in the Block of 2018-21 subject to the following conditions:-

a) The employee spends the money of a larger sum than the entitlement on account of LTC on actual expenditure.

b) Cash equivalent of full leave encashment will be allowed, provided the employee spends an equal sum. This will be counted towards the number of leave encashment on LTC available to an employee.

Calculation of Special Cash Package on LTC

For example, Pay of an employee: Rs. 1,38,500 and has a family of 4 eligible for economy class air travel.

Calculation on Leave Encashment

- (1,38,500 x 1.17) x 10 / 30 = Rs. 54,015

Calculation on Fare Value

- Rs. 20,000 x 4 = Rs. 80,000

Calculation on Total Value

- Rs. 1,34,015

Amount to be spent for full cash benefit

- Rs. 54,015 + Rs. 2,40,000* = Rs. 2,94,015

(a) Share of Leave Encashment in total

- (Rs. 54,015 x 100) / Rs. 2,94,015 = 18%

(b) Share of Fare in Total

- (Rs. 80,000 x 100) / Rs. 2,94,015 = 27%

* 3 Times of Notional Airfare

- Rs. 80,000 x 3 = Rs. 2,40,000

Note:

- Thus, if an employee spends Rs, 2,94,015, or above, he will be allowed a cash amount of Rs. 1,34,015.

- However, if the employee spends Rs. 2,40,000 only, then he may be allowed 18% on account of Leave Encashment (Rs. 43,200) and 27% on account of fare value (Rs. 64,800). The total amount payable shall be Rs. 1,08,000.

Special Cash Package on LTC Calculator 2020

A simple online calculator for finding the maximum amount to avail complete cash benefit from this Special Cash Package Scheme on Leave Travel Concession. [Click to calculate]

Leave a Reply