3rd Pay Revision for CPSE : Date of Implementation and Payment of Allowances Issue of Presidential directive, effective Date of implementation and payment of allowances. The revised pay scales will be effective from 01.01.2017(except the allowances … [Read more...]

3rd Pay Revision for CPSE : Leave regulations/management

3rd Pay Revision for CPSE : Leave regulations/management Leave regulations/management: CPSEs would be allowed to frame their own leave management policies and the same can be decided based on CPSEs operational and administrative requirements subject … [Read more...]

3rd Pay Revision for CPSE : Superannuation Benefits and Medical Benefits

3rd Pay Revision for CPSE : Superannuation Benefits and Medical Benefits Superannuation Benefits: The existing provisions regarding superannuation benefits have been retained as per which CPSEs can contribute upto 30% of BP plus DA towards Provident … [Read more...]

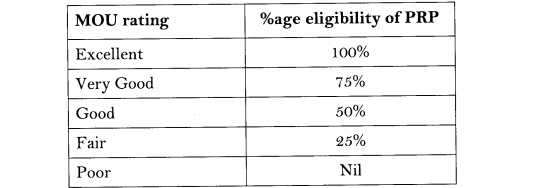

3rd Pay Revision for CPSE : Performance Related Pay (PRP)

3rd Pay Revision for CPSE : Performance Related Pay (PRP) Performance Related Pay (PRP) :- The admissibility, quantum and procedure for determination of PRP has been given in Annexure- IV. The PRP model will be effective from FY 2017-18 and onwards. … [Read more...]

3rd Pay Revision for CPSE : Implementation order issued by DPE on 3.8.2017

3rd Pay Revision for CPSE Implementation order issued by DPE on 3.8.2017 Pay Revision of Board level and below Board level Executives and Non-Unionised Supervisors of Central Public Sector Enterprises (CPSEs) w.e.f. 01.01.2017. No. W-02/0028/2017-DPE … [Read more...]

CSD Car Prices will be Consistent Across the Country

CSD Car Prices will be Consistent Across the Country GST Impact on Automobile Sale Sale Automobiles at CSD Consequent to implementation of GST the impact on sale of vehicles to CSD customers is as follows :- Rates of Four Wheelers to CSD eligible … [Read more...]

Recommendations of Committee on Allowances on 7th CPC

Recommendations of Committee on Allowances on 7th CPC The Committee on Allowances (CoA) recommended the acceptance of the recommendations of the Seventh Central Pay Commission (7th CPC) with 33 modifications. The recommendations of the CoA were … [Read more...]

7th CPC Allowances: Haircutting Allowance and Soap Toilet Allowance admissible to PBOR

7th CPC Allowances: Haircutting Allowance and Soap Toilet Allowance admissible to PBOR Doing away with allowances under 7th CPC The 7th Central Pay Commission recommended that Family Planning Allowance should be abolished. The Government has accepted … [Read more...]

Revision of Pre-2016 Pension : No need to submit application to Head of Office/PAOs

Revision of Pre-2016 Pension and Family Pensioners : No need to submit any application form for processing the revision of pension to Head of Office/PAOs Implementation of Government's decisions on the recommendations of the 7th Pay Commission - … [Read more...]

Enhancement of Constant Attendant Allowance from 4500 to 6750 – Orders issued

Enhancement of Constant Attendant Allowance from 4500 to 6750 - Orders issued Implementation of Government’s decision on the recommendation of the VIIth Pay Commission on CCS (Extraordinary Pension) Rules, 1939 — Enhancement of Constant Attendant … [Read more...]

- « Previous Page

- 1

- …

- 478

- 479

- 480

- 481

- 482

- …

- 808

- Next Page »