3rd Pay Revision for CPSE : Performance Related Pay (PRP)

Performance Related Pay (PRP) :- The admissibility, quantum and procedure for determination of PRP has been given in Annexure- IV. The PRP model will be effective from FY 2017-18 and onwards. For the FY 2017-18, the incremental profit will be based on previous FY 2016-17. The PRP model will be applicable only to those CPSEs which sign Memorandum of Understanding (MOU), and have a Remuneration Committee (headed by an Independent Director) in place to decide on the payment of PRP within the prescribed limits and guidelines.

Performance Related Pay

(I) Allocable profits:

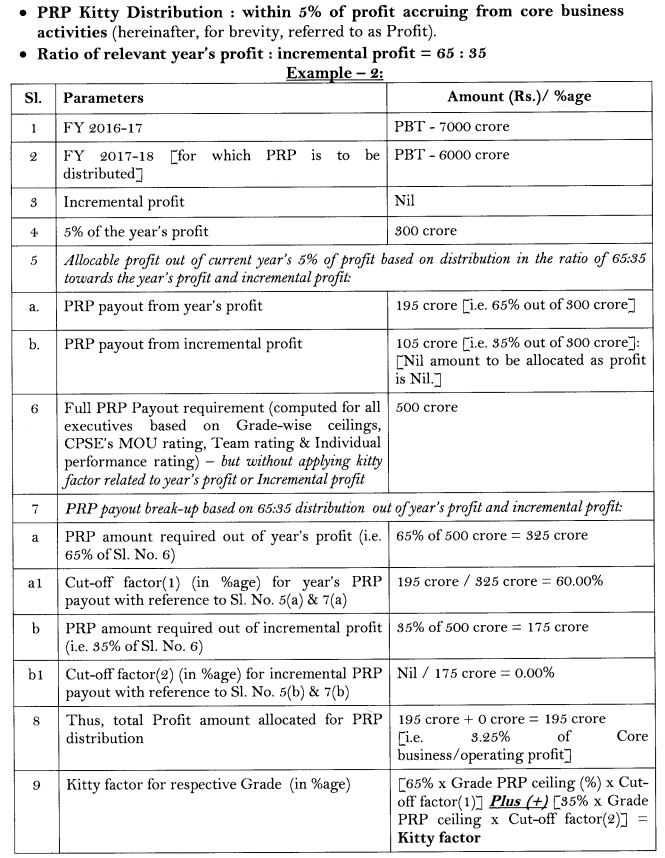

a. The overall profits for distribution of PRP shall be limited to 5% of the year’s profit accruing only from core business activities (without consideration of interest on idle cash / bank balances), which will be exclusively for executives and for non-unionized supervisors of the CPSE. The ratio of break-up of profit

accruing from core business activities for payment of PRP between relevant year’s profit to Incremental profit shall be 65:35 to arrive at the Allocable profits and the Kitty factor.

(I) PRP differentiator components:

(A) PRP payout is to be distributed based on the addition of following parts / components:-

Part-1 : CPSE’s performance component:-

(a) Weightage = 50% of PRP payout

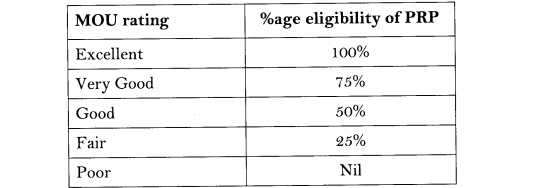

(b) Based on CPSE’s MOU rating:

Part-2 : Team’s performance component:- *

(a) Weightage = 30% of PRP payout

(b) Based on Team rating (i.e. linked to Plant / Unit’s productivity measures and operational / physical performance):

* In case of a CPSE not having Plants/Units and if there is a no Team Performance areas/rating, then the PRP for such CPSE will be determined based specifically on MoU rating after merging the weightage of Team performance component to the Company’s performance component.

(c) The Team rating shall be linked to individual Plant / Unit’s productivity measures and operational / physical performance, as primarily derived from CPSEs’ MOU parameters and as identified by CPSE depending on the nature of industry / business under the following suggested performance areas:-

Achievement Areas’, in which performance has to be maximized (e.g. market shares, sales volume growth, product output / generation, innovations in design or operation, awards and other competitive recognition, etc.); and

Control Areas’ in which control has to be maximized (e.g. stock / fuel loss, operating cost control, litigation cost, safety, etc.).

(d) For office locations of CPSEs, the Team rating should be linked to the Plant / Unit as attached to the said office; and if there is more than one Plant / Unit attached to an office or in case of Head Office / Corporate Office of the CPSE, the Team rating shall be the weighted average of all such Plants / Units. The weighted average shall be based on the employee manpower strength of the respective Plants / Units.

[Plants/Units shall primarily mean the work place where industry’s manufacturing process is carried out and in case of a CPSE not having any manufacturing process, it shall mean the work place where the main business is carried out. The individual department/section within a work place shall not be recognized as a Plant/Unit].

Part-3 : Individual’s performance component:-

(a) Weightage = 20% of PRP payout

(b) Based on Individual performance rating (i.e. as per the CPSE’s Performance Management System):

(c) The forced rating of 10% as below par / Poor performer shall not be made mandatory. Consequently, there shall be discontinuation of Bell-curve. The CPSEs are empowered to decide on the ratings to be given to the executives; however, capping of giving Excellent rating to not more than 15% of the total executive’s in the grade (at below Board level) should be adhered to.

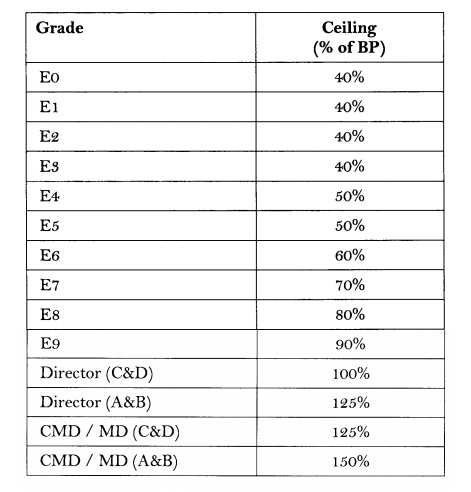

(II) Percentage ceiling of PRP (%age of BP):

(a) The grade-wise percentage ceiling for drawal of PRP within the allocable profits has been rationalized as under:-

Note:

1.For Non- Unionized supervisors, the PRP as percentage of BP will be decided by the respective Board of Directors of the CPSE.

(III) Kitty factor: After considering the relevant year’s profit, incremental profit and the full PRP payout requirement (computed for all executives based on Grade-wise ceilings, CPSE’s MOU rating, Team rating & Individual performance rating), there will be two cut-off factors worked out based on the PRP distribution of 65:35. The first cut-off shall be in respect of PRP amount required out of year’s profit, and the second cut- off shall be in respect of PRP amount required out of incremental profit, which shall be computable based on the break-up of allocable profit (i.e. year’s 5% of profit bifurcated into the ratio of 65:35 towards year’s profit and incremental profit).

The sum of first cut-off factor applied on 65% of Grade PRP ceiling and the second cut-off factor applied on 35% of Grade PRP ceiling will result in Kitty factor. The Kitty factor shall not exceed 100%.

(IV) Based on the PRP components specified above, the PRP pay-out to the executives should be computed upon addition of the following three elements:-

(a) Factor-X (% of BP):

Weightage of 50% Multiplied with Part-1 (CPSE’s MOU rating) Multiplied with Kitty factor

(b) Factor-Y (% of BP):

Weightage of 30% Multiplied with Part-2 (Team’s performance) Multiplied with Kitty factor.

(c) Factor-Z (% of BP):

Weightage of 20% Multiplied with Part-3 (Individual’s performance) Multiplied with Kitty factor.

(d) Net PRP= Factor X + Factor Y + Factor Z =Net %age of Annual BP

EXAMPLES

Performance Related Pay (PRP): Examples for calculating Kitty factor/Allocable profit

Example – 1

PRP Payout to Individual Executives

Example — 1 : For Grade E-1

Performance Related Pay (PRP): Examples for calculating Kitty factor/Allocable profit

Example – 2:

PRP Payout to Individual Executives

Example – 2 : For Grade E-1

3rd Pay Revision for CPSE : FITMENT BENEFIT

3rd Pay Revision for CPSE : METHODOLOGY FOR PAY FIXATION

3rd Pay Revision for CPSE : INCREMENT

3rd Pay Revision for CPSE : DEARNESS ALLOWANCE

3rd Pay Revision for CPSE : HRA and HRR

3rd Pay Revision for CPSE : PERFORMANCE RELATED PAY (PRP)

3rd Pay Revision for CPSE : SUPERANNUATION BENEFITS

3rd Pay Revision for CPSE : LEAVE REGULATIONS/MANAGEMENT

3rd Pay Revision for CPSE : DATE OF IMPLEMENTATION AND PAYMENT OF ALLOWANCES

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Leave a Reply