Depending upon the pension plan selected, each subscriber under APY shall receive a guaranteed minimum pension of Rs. 1000/- per month or Rs. 2000/- per month or Rs. 3000/- per month or Rs. 4000/- per month or Rs. 5000/- per month, after the age of 60 years until his/her death.

Hike in Pension

Government of India in February, 2019 launched Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM), a voluntary and contributory pension Scheme, for the benefit of unorganized workers, as per eligibility. The scheme assures minimum monthly pension of Rs. 3000 to the beneficiaries after attaining the age of 60 years.

All unorganized workers, in the age group of 18-40 years, whose monthly income is up to Rs. 15,000 and who are not members of Employees’ Provident Fund Organization or Employees’ State Insurance Corporation or National Pension System (Government contributed) and are also not income tax payers, are eligible to enroll under the Scheme.

The subscriber is required to pay the prescribed monthly contribution amount and the Central Government provides the equal matching contribution. This Scheme is implemented through Life Insurance Corporation of India. Enrollment under the Scheme can be done through any of the Common Service Centres across the country.

Further, vide notification No. G.S.R. 593 (E) dated 19.08.2014, a minimum pension of Rs. 1000 per month has been fixed with effect from 01.09.2014 for the pensioners under Employees’ Pension Scheme (EPS), 1995 framed under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, applicable to establishments which belong to industries and classes of establishments listed in Schedule-I and where number of employees is 20 or more. No decision has been taken at present to further enhance the minimum pension under EPS, 1995.

Further, Atal Pension Yojana (APY) was launched in May, 2015, by the Government of India, and Indian Citizens between the age group of 18 to 40 years are eligible to join APY through their savings bank account or post office savings bank account.

Depending upon the pension plan selected, each subscriber under APY shall receive a guaranteed minimum pension of Rs. 1000/- per month or Rs. 2000/- per month or Rs. 3000/- per month or Rs. 4000/- per month or Rs. 5000/- per month, after the age of 60 years until his/her death.

Atal Pension Yojana (APY) Benefits, Form, Chart pdf download

Atal Pension Yojana – Benefits of APY Scheme

1. What is pension? Why do I need it?

A Pension provides people with a monthly income when they are no longer earning.

Need for Pension:

- Decreased income earning potential with age.

- The rise of nuclear family-Migration of earning members.

- Rise in cost of living.

- Increased longevity.

- Assured monthly income ensures dignified life in old age.

2. What is Atal Pension Yojana?

Atal Pension Yojana (APY), a pension scheme for citizens of India, is focused on the unorganised sector workers. Under the APY, guaranteed minimum pension of Rs. 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers.

3. Who can subscribe to APY?

Any Citizen of India can join APY scheme. The following are the eligibility criteria:-

(i) The age of the subscriber should be between 18 – 40 years.

(ii) He / She should have a savings bank account/ post office savings bank account.

The prospective applicant may provide Aadhaar and mobile number to the bank during registration to facilitate receipt of periodic updates on APY account. However, Aadhaar is not mandatory for enrolment.

4. For how many Years Government will co-contribute?

The co-contribution of the Government of India is available for 5 years, i.e., from the Financial Year 2015-16 to 2019-20 for the subscribers, who join the scheme during the period from 1st June, 2015 to 31st March, 2016 and who are not covered by any Statutory Social Security Scheme and are not income tax payers.

The Government cocontribution is payable to eligible Permanent Retirement Account Number (PRANs) by the Pension Fund regulatory and Development Authority (PFRDA) after receiving the confirmation from Central Record Keeping Agency to the effect that the subscriber has paid all the installments for the year Government co-contribution will be credited in subscriber’s savings bank account/ post office savings bank account 50% of the total contribution subject to a maximum of Rs 1000/- at the end of financial year .

5. Who are the other social security schemes beneficiaries not eligible to receive Government co-contribution under APY?

The beneficiaries, who are covered under statutory social security schemes, are not eligible to receive Government co-contribution under APY. For example, members of the Social Security Schemes under the following enactments would not be eligible to receive Government co-contribution under APY:

(i) Employees’ Provident Fund and Miscellaneous Provision Act, 1952.

(ii) The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

(iii) Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

(iv) Seamens’ Provident Fund Act, 1966.

(v) Jammu Kashmir Employees’ Provident Fund and Miscellaneous Provision Act, 1961.

(vi) Any other statutory social security scheme.

6. How much pension will be received under APY?

Minimum guaranteed monthly pension of Rs 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given from the age of 60 years onwards depending on the contributions by the subscribers.

7. What is the benefit in joining APY scheme?

The benefit of minimum pension under Atal Pension Yojana would be guaranteed by the Government in the sense that if the actual realised returns on the pension contributions are less than the assumed returns for minimum guaranteed pension, over the period of contribution, such shortfall shall be funded by the Government.

On the other hand, if the actual returns on the pension contributions are higher than the assumed returns for minimum guaranteed pension, over the period of contribution, such excess shall enable the subscriber to receive the higher pension benefits resulting in enhanced scheme benefits to the subscribers.

The Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber, who

joins the scheme during the period 1st June, 2015 to 31st March, 2016 and who is not a beneficiary of any social security scheme and is not an income tax payer.

The Government co-contribution will be given for 5 years from the Financial Year 2015-16 to 2019-20. At present, a subscriber under the National Pension System (NPS) is eligible to get tax benefit for the contribution, upto a ceiling, and even for the investment returns

on such contributions.

Further, the purchase price of the annuity on exit from NPS is also not taxed and only the pension income of the subscribers are considered to be part of normal income and taxed at the appropriate marginal rate of tax, applicable to the subscriber. Similar tax treatment is applicable to the subscribers of APY.

8. How the contributions are invested in APY?

The contributions under APY are invested as per the investment guidelines prescribed by PFRDA for Central Government / State Government / NPS-Lite / Swavalamban Scheme / APY.

9. What is the procedure for opening APY Account?

(i) Approach the bank branch/post office where individual’s savings bank account is held or open a savings account if the subscriber doesn’t have one.

(ii) Provide the Bank A/c number/ Post office savings bank account number and with the help of the Bank staff, fill up the APY registration form.

(iii) Provide Aadhaar / Mobile Number. This is not mandatory, but may be provided to facilitate the communication regarding contribution.

(iv) Ensure keeping the required balance in the savings bank account/ post office savings bank account for transfer of monthly / quarterly / half yearly contribution.

10. Whether Aadhaar Number is compulsory for joining the scheme?

It is not mandatory to provide Aadhaar number for opening APY account. It is however desirable to provide Aadhaar Number for proper identification of the subscriber.

11. Can I open APY Account without savings bank account?

The savings bank account/ post office savings bank account is mandatory for joining APY.

12. What is the mode of contribution to the account?

The contributions can be made at monthly / quarterly / half yearly intervals through autodebit facility from savings bank account/ post office savings bank account of the subscriber.

13. How much to contribute towards APY?

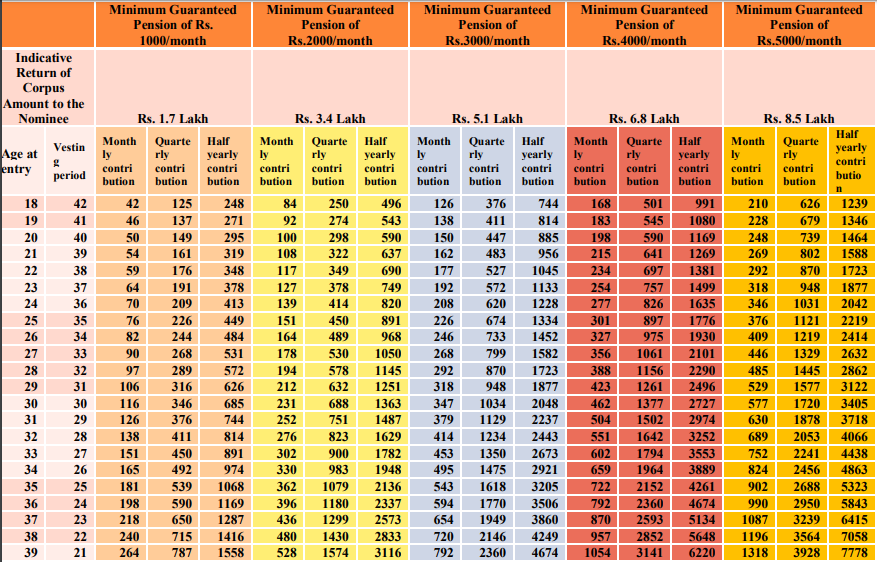

The monthly / quarterly / half yearly contribution depends upon the intended / desired monthly pension and the age of subscriber at entry. The details may be referred to in Annex I.

14. What is the due date for contribution?

The contribution may be paid to APY through savings bank account/ post office savings bank account on any date of the particular month, in case of monthly contributions or any day of the first month of the quarter, in case of quarterly contributions or any day of the first month of the half year, in case of half-yearly contributions.

15. What will happen if required or sufficient amount is not maintained in the savings bank account for contribution on the due date?

The subscribers should keep the required balance in their savings bank accounts/ post office savings bank account on the stipulated due dates to avoid any overdue interest for delayed contributions. The monthly / quarterly / half-yearly contribution may be deposited on the first date of month / quarter / half year in the savings bank account/ post office savings bank account .

However, if there is inadequate balance in the saving bank account/ post office savings bank account of the subscriber till the last

date of the month / last date of the first month in a quarter / last day of the first month in a half year, it will be treated as a default and contribution will have to be paid in the subsequent month along with overdue interest for delayed contributions. Banks are required to collect Rs. 1 per month for contribution of every Rs. 100, or part thereof, for each delayed monthly contributions.

Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest amount collected will remain as part of the pension corpus of the subscriber.

More than one monthly / quarterly / half yearly contribution can be recovered subject to availability of the funds. In all cases, the contribution is to be recovered along with the overdue charges if any. This will be bank’s internal process. The due amount will be recovered as and when funds are available in the account.

16. What will happen to APY account in case of continuous default?

Deduction would be made in the subscribers account for account maintenance charges and other related charges on a periodic basis.. For those subscribers, who have availed Government co-contribution, the account would be treated as becoming zero when the subscriber corpus minus the Government co-contribution would be equal to the account

maintenance charges, fees and overdue interest and hence the net corpus becomes zero. In this case, the Government co-contribution would be given back to the Government.

17. What are the fee and charges involved in maintaining the APY account?

Table of all charges and fees of APY

| Intermediary | Charge Head | Service charge | Method of collection |

| Points of Presence | (i) Initial subscriber registration

(ii) Subsequent Persistence |

Rs.120/- to 150/-, depending upon the number of subscribers. Rs.100/- per annum per subscriber. | Paid by Government as incentive, promotion and development charges for APY, on the pattern of Swavalamban. |

| Central Recordkeeping Agencies | (i) Account opening Charges (ii) Account Maintenance Charges | Rs.15/- per account. Rs. 40/- per account per annum. | Cancellation of units. |

| Pension Fund | Managers Investment Management Fee | 0.0102% per annum of | AUM Adjusted in Net Asset Value |

| Custodian | Investment Maintenance Fee | 0.0075% for electronic and 0.05% per annum for physical segment of AUM | Adjusted in Net Asset Value |

18. Is it required to furnish nomination while joining the scheme?

Yes. It is mandatory to provide nominee details in APY account. If the subscriber is married, the spouse will be the default nominee. Unmarried subscribers can nominate any other person as nominee & they have to provide spouse details after marriage. The Aadhaar details of spouse and nominees may be provided.

19. How many APY accounts I can open?

A subscriber can open only one APY account and it is unique. Multiple accounts are not permitted.

20. What is the withdrawal procedure from APY?

A. On attaining the age of 60 years: Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the guaranteed minimum monthly pension or higher monthly pension, if investment returns are higher than the guaranteed returns embedded in APY. The same amount of monthly pension is payable to spouse (default nominee) upon death of subscriber. Nominee will be eligible for return of pension wealth accumulated till age 60 of the subscriber upon death of both the subscriber and spouse.

B. In case of death of the subscriber due to any cause after the age of 60

years: In case of death of subscriber, pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension wealth accumulated till age 60 of the subscriber would be returned to the nominee.

C. Exit before the age of 60 Years:

In case a subscriber, who has availed Government co-contribution under APY, chooses to voluntarily exit APY at a future date, he shall only be refunded the contributions made by him to APY, along with the net actual accrued income earned on his contributions (after deducting the account maintenance charges). The Government co-contribution, and the accrued income earned on the Government co-contribution, shall not be returned to such subscribers.

D. Death of subscriber before 60 years:

1. In case of death of the subscriber before 60 years, option will be available to the spouse of the subscriber to continue contribution in the APY account of the subscriber, which can be maintained in the spouse’s name, for the remaining vesting period, till the original subscriber would have attained the age of 60 years. The spouse of the subscriber shall be entitled to receive the same pension amount as the subscriber until death of the spouse.

2. Or, the entire accumulated corpus under APY will be returned to the spouse / nominee pension shall not be payable to the spouse / nominee.

21. Will there be any option to increase or decrease the monthly contribution for higher or lower pension amount?

Yes, a subscriber can opt to decrease or increase pension amount during the course of accumulation phase, once a year.

22. How will I know the status of my contribution?

The periodical information to the subscribers regarding activation of PRAN, balance in the account, contribution credits etc. will be intimated to APY subscribers by way of SMS alerts. The subscriber will also be receiving physical Statement of Account once a year.

23. Will I get any statement of transactions?

The physical statement of APY account will be provided to the subscribers annually.

24. If I move my residence / city, how can I make contributions to APY

account?

The contributions may be remitted through auto debit uninterruptedly even in case of change of residence / location.

25. What will happen if a subscriber becomes non-citizen of the country?

The scheme is open to the Indian citizens only. Hence, in that event the APY account will be closed and contribution will be returned to the subscriber as mentioned above in the case of voluntary exit before the age of 60 years.

26. What will happen to existing subscribers in NPS-Lite / Swavalamban

Yojana?

(A) Subscriber between the age group of 18 and 40:

The subscriber would be automatically migrated to APY with an option to opt out. The associated aggregator will facilitate those subscribers for completing the process of migration. The subscribers may also approach the nearest authorised bank branch/post office for shifting their Swavalamban account into APY with PRAN details.

The benefit of co-contribution of the Government of India for those subscribers of Swavalamban Scheme who have migrated to APY would not exceed 5 years under both the Schemes. For example, if a Swavalamban beneficiary has received the benefit of Government co-contribution for 1 year, then the Government co-contribution to that subscriber under APY, after migration from the Swavalamban Scheme, would be available only for 4 years, and so on. The existing Swavalamban beneficiary opting out from the proposed automatic migration to APY will be given Government co-contribution upto 2016-17, if he is eligible, and the NPS Swavalamban would continue till such people attained the age of exit under that scheme.

The accumulated corpus of existing Swavalamban subscriber between the age group of 18 and 40 years, who get migrated to APY will be kept under the same PRAN and remain as an additional wealth of the subscriber till the time of exit. This additional amount may be given to the subscriber as enhanced pension benefit or as lump-sum withdrawal, as the case may be.

The contribution of such subscribers under APY, after migration from the Swavalamban Scheme to APY, would be as per the amount mentioned in the Annex –I, depending on the pension amount selected and the age of the subscriber.

(B) Subscriber above 40 years of age: Swavalamban subscribers above 40 years will have to continue till the age of 60 years, to be eligible for annuities there under.

27. If I am an existing subscriber of APY, can I change my monthly auto debit facility to Quarterly or Half Yearly as per my convenience?

Yes, the subscriber can change the mode (monthly/ quarterly/half yearly) of auto debit facility once in a year during the month of April

28. If I have completed 40 years, can I join Atal Pension Yojana?

No, a person who is in age group of 18 years to 39 years 364 days can join Atal Pension Yojana.

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

Leave a Reply