WB 6th Pay Commission Revised Pay Fixation with Illustrations

WB 6th Pay Commission fixation of initial pay in the revised pay structure

Notification issued by the Department of Finance on 25th September 2019 regarding the 6th Pay Commission revised pay and allowances for West Bengal State Government employees.

Fixation of initial pay in the revised pay structure:-

(1) The initial pay of a Government employee who elects, or is deemed to have elected under rule 6 to be governed by the revised pay structure on and from the 1st day of January, 2016, shall, unless in any case the Governor by special order otherwise directs, be fixed separately in respect of his substantive pay in the permanent post on which he holds a lien or would have held a lien if such lien had not been suspended , and in respect of his pay in the officiating post held by him, in the following manner, namely:‐

(a) in the case of all employees :‐

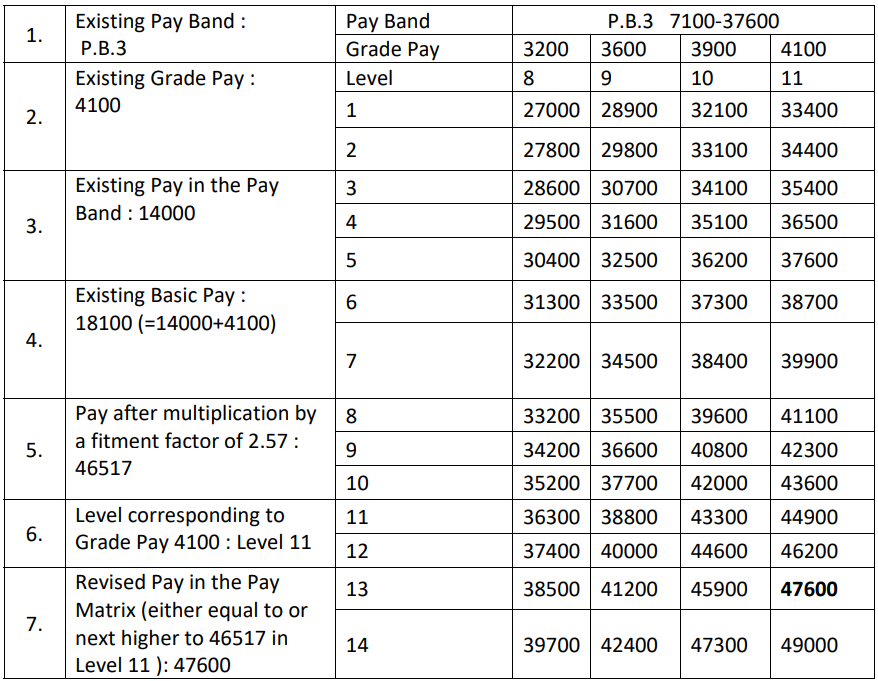

(i) the pay in the applicable level in the Pay Matrix shall be the pay obtained by multiplying the existing basic pay by a factor of 2.57, rounded off to the nearest rupee and the figure so arrived at will be located in that level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable level in the pay matrix , the same shall be the pay, and if no such cell is available in the applicable level , the pay shall be fixed at the immediate next higher Cell in that applicable Level of the Pay Matrix, as per schedule V.

(ii) if the minimum pay or the first cell in the applicable Level is more than the amount arrived at as per sub‐clause (i) above, the pay shall be fixed at minimum pay or the first Cell of that applicable Level.

(b) In the case of Medical Officers and Veterinary Doctors who are in receipt of Non‐Practising Allowance, the pay in the revised pay structure shall be fixed in the following manner:

The existing basic pay shall be multiplied by a factor of 2.57 and the figure so arrived at shall be added to by an amount equivalent to Dearness Allowance on the pre‐revised Non‐Practicing Allowance admissible as on 1st day of January, 2016. The figure so arrived at will be located in the applicable Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level, the same shall be the pay. If, no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell in that applicable Level in the Pay Matrix.

(2) A Government employee who is on leave on the 1st day of January, 2016 and is entitled to leave salary shall be entitled to pay in the revised pay structure from the date of actual effect of the revised emoluments.

(3) A Government employee who is on study leave on the 1st day of January, 2016 shall be entitled to pay in the revised pay structure from the date of actual effect of the revised emoluments.

(4) A Government employee under suspension, shall continue to draw subsistence allowance based on existing pay structure and his pay in the revised pay structure shall be subject to the final order on the pending disciplinary proceedings.

(5) Where the existing emoluments exceed the revised emoluments in the case of any Government employee, the difference shall be allowed as personal pay to be absorbed in future increases in pay.

(6) Where in the fixation of pay under sub‐rule (1) the pay of a Government employee, who, in the existing pay structure was drawing more pay than another Government servant junior to him in the same grade in the cadre immediately before the 1st day of January,2016 , gets fixed in the revised pay structure in a Cell lower than that of such junior , his pay shall be stepped up to the same Cell in the revised pay structure as that of the junior.

(7) In the case where a senior Government employee promoted to a higher post before the 1st day of January,2016 draws less pay in the revised pay structure than his junior who is promoted to the higher post on or after the 1st day of January, 2016 , the pay of senior Government servant in the revised pay structure shall be stepped up to an amount equal to the pay as fixed for his junior in that higher post and such stepping up shall be done with the approval of the Government with effect from the date of promotion of the junior Government servant subject to the fulfilment of the following conditions, namely :‐

(a) both the junior and the senior Governments employees belong to the same cadre and the posts in which they have been promoted are identical in the same cadre ;

(b) the existing pay structure and the revised pay structure of the lower and

higher posts in which they are entitled to draw pay should be identical ;

(c) the senior Government employee at the time of promotion was drawing equal or more pay than the junior ;

(d) the anomaly should arise directly as a result of the applications of the provisions of normal rule or any other rule or order regulating fixation of pay on such promotion in the revised pay structure:

Provided that if the junior officer was drawing more pay in the existing pay structure than the senior by virtue of any advance increment(s) granted to him, the provisions of this sub‐rule shall not be applicable to step up the pay of the senior Government servant. Provided further that the order relating to stepping up of the pay of the senior employee in accordance with the provision of these sub‐rule shall be issued under rule 55(4) of the West Bengal Service Rule, Part I and the senior employee shall be entitled to the next increment on completion of his required qualifying service with reference to the date of such stepping up of pay.

(8) Where a Government employee is in receipt of personal pay on the 1st day of January, 2016, which together with his existing emoluments exceeds the revised emoluments, the difference representing such excess shall be allowed to such Government employee as personal pay to be absorbed in future increases of the pay.

(9) Subject to provisions of rule 5, if the pay as fixed in the officiating post under sub‐rule (1) is lower than the pay fixed in the substantive post, the former shall be fixed at the same stage as the substantive pay.

Also like to read:

WB 6th Pay Commission – List of All Allowances with Revised Rates

WB 6th Pay Commission – Revised Rates of Non‐Practising Allowance

WB 6th Pay Commission Medical Allowance

WB 6th Pay Commission Classification of Posts

WB 6th Pay Commission HRA: Revised Rates of House Rent Allowance

WB 6th Pay Commission Implementation Date – Revised Pay and Allowances

WB 6th Pay Commission Pay Matrix Table

WB Pay Commission Report Download 2019