Latest CBDT Circular October 2020 regarding the Income Tax Returns for the Assessment Year 2019-20 PDF Download F. No. 225/ 150/2020-ITA-II Government of India Ministry of Finance Department of Revenue Central Board of Direct Taxes North Block, … [Read more...]

Clarifications in respect of prescribed electronic modes under section 269SU of the Income-tax Act 1961

CBDT Circular 12/2020: Section 269su Prescribed Electronic Mode and Rule under Income Tax ACT Circular No. 12/2020 F.No.370142/35/2019-TPL Government of India Ministry of Finance Department of Revenue Central Board of Direct Taxes Dated: 20th May, … [Read more...]

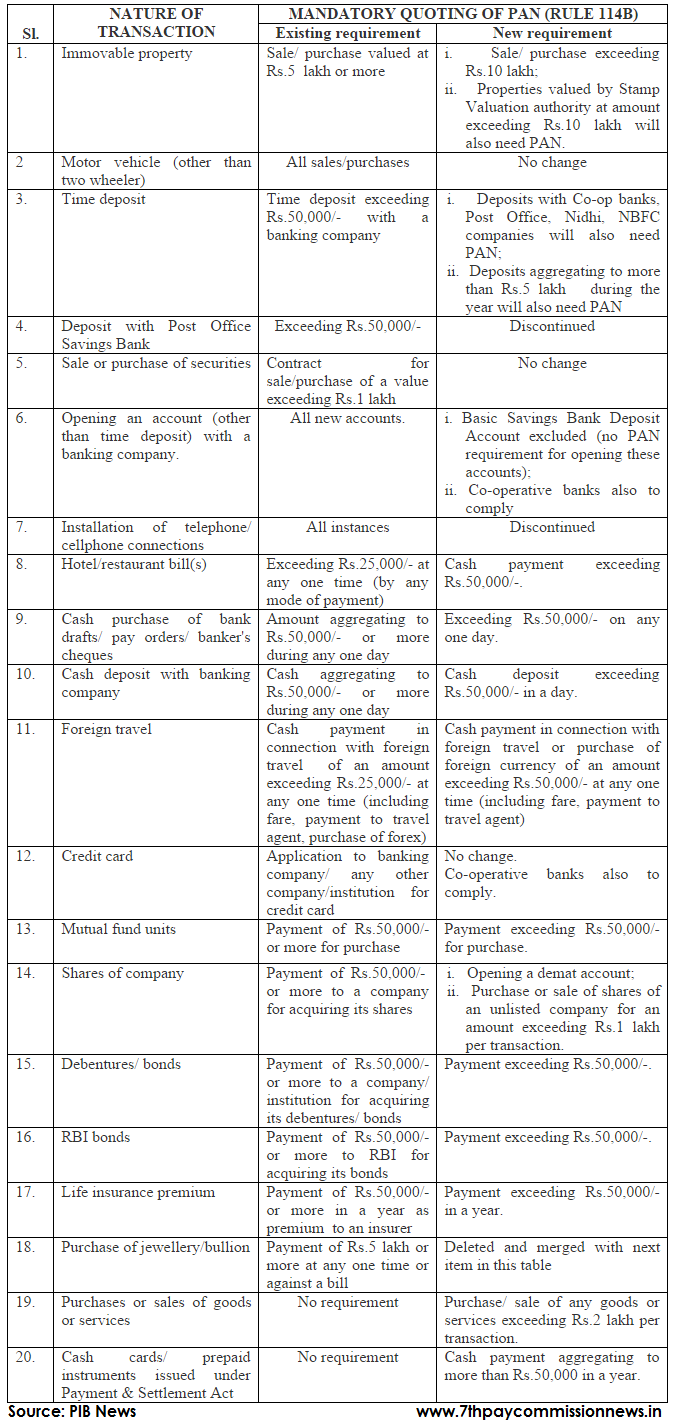

Key changes to Mandatory Quoting of Pan Rules of the Income tax Act

Key changes to Mandatory Quoting of Pan Rules of the Income tax Act Rules regarding quoting of PAN for specified transactions amended The Government is committed to curbing the circulation of black money and widening of tax base. To collect … [Read more...]

CBDT extends due date for E-filing up to 7.9.2015

CBDT extends due date for E-filing up to 7.9.2015 Due-Date for E-Filing Returns of Income for Assessment Year 2015-16 Extended up to 7th September 2015 in Respect of all Taxpayers who were Required to E-File their Returns of Income by 31st August … [Read more...]

Section 80DD of the Income Tax Act – Tax Relief To Family Members of Differently Abled

Tax Relief To Family Members of Differently Abled Section 80DD of the Income Tax Act, 1961, inter alia, provides for a deduction to an individual or HUF, who is a resident in India, and Incurs expenditure for the medical treatment (including … [Read more...]