7th CPC Pay Fixation with Examples 2025

Pay Fixation in the New Pay Structure : The fitment of each employee in the new pay matrix is proposed to be done by multiplying his/her basic pay on the date of implementation by a factor of 2.57.

The figure so arrived at is to be located in the new pay matrix, in the level that corresponds to the employee’s grade pay on the date of implementation, except in cases where the Commission has recommended a change in the existing grade pay. If the identical figure is not available in the given level, the next higher figure closest to it would be the new pay of the concerned employee. A couple of examples are detailed below to make the process amply clear.

The pay in the new pay matrix is to be fixed in the following manner:

Step 1: Identify Basic Pay (Pay in the pay band plus Grade Pay) drawn by an employee as on the date of implementation. This figure is ‘A’.

Step 2: Multiply ‘A’ with 2.57, round-off to the nearest rupee, and obtain result ‘B’.

Step 3: The figure so arrived at, i.e., ‘B’ or the next higher figure closest to it in the Level assigned to his/her grade pay, will be the new pay in the new pay matrix. In case the value of ‘B’ is less than the starting pay of the Level, then the pay will be equal to the starting pay of that level

Example I

i. For example an employee H is presently drawing Basic Pay of ₹55,040 (Pay in the Pay Band ₹46340 + Grade Pay ₹8700 = ₹55040). After multiplying ₹55,040 with 2.57, a figure of ₹1,41,452.80 is arrived at. This is rounded off to ₹1,41,453.

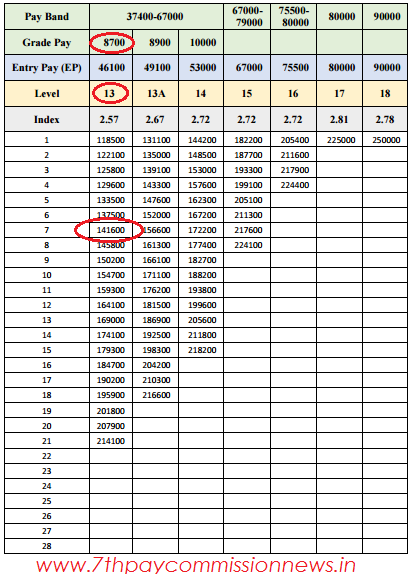

ii. The level corresponding to GP 8700 is level 13, as may be seen from Table 4, which gives the full correspondence between existing Grade Pay and the new Levels being proposed.

iii. In the column for level 13, the figure closest to ₹1,41,453 is ₹1,41,600.

iv. Hence the pay of employee H will be fixed at ₹1,41,600 in level 13 in the new pay matrix as shown below:

As part of its recommendations if Commission has recommended any upgradation or downgrade in the level of a particular post, the person would be placed in the level corresponding to the newly recommended grade pay.

Example II

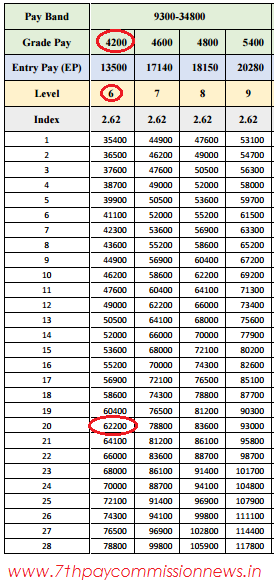

i. Take the case of an employee T in GP 4200, drawing pay of ₹20,000 in PB-2. The Basic Pay is ₹24,200 (20,000+4200). If there was to be no change in T’s level the pay fixation would have been as explained in Example I above. After multiplying by 2.57, the amount fetched viz., ₹62,194 would have been located in Level 6 and T’s pay would have been fixed in Level 6 at ₹62,200.

ii. However, assuming that the Commission has recommended that the post occupied by T should be placed one level higher in GP 4600. T’s basic pay would then be ₹24,600 (20000 + 4600). Multiplying this by 2.57 would fetch ₹63,222.

iii. This value would have to be located in the matrix in Level 7 (the upgraded level of T).

iv. In the column for Level 7 ₹63,222 lies between 62200 and 64100. Accordingly, the pay of T will be fixed in Level 7 at ₹64,100.

My pay as on 01.01.2016 was Rs. 26080/- (Basic-20680+GP-5400).

Pay fitment as on 1.1.2016 under 7CPC:

Rs. 26080 x 2.57= Rs. 67025.60/-

When Rs. 67025.60/- is located in level 10 of the matrix, it falls between index 7 & 8 (i.e. between 67000 & 69000).

As per the 7CPC fitment process, my pay should be fixed at Rs. 69000/- (the next higher figure to 67025.60/- in the pay matrix level 10)

But my organization has fixed my pay under 7cpc as on 1.1.2016 at Rs. 67000/- which I presume is incorrect.

Kindly clarify what should be the correct pay as on 1.1.2016

What will be pay in 7th CPC fitment formula at level 10– if pay is 31150*2.57=80055.5 80000 or 82240 as pay matrix table

As a Sr. Acctt. I am taking basic pay of Rs. 44900/-as on 01.01.2017 after implementation of 7th CPC and w.e.f. 02.01.2017 I have promoted as AAO on officiating basis. My pay restricted under FR 35. Please fix my pay under 22 (1) a (1) under FR-35. I am actually fixed at Rs. 46834/-. Is it correct ?

Points seeking for clarification: I understand that revised pay would be higher of the two amounts worked out based on the following methods: (i) 2.57 times the basic pay plus grade pay as on Jan 01,2016 & (i) Minimum revised basic pay in the related grade plus number of increments one earned in the revised pay scale. It is reported that the increment value to be applied is at 3%. It is not clear whether the rate of 3% shall be worked out based on the initial pay in the grade or on the pay inclusive of increments earned up to the stage of granting increment.

Sir,

As the option once exercised on promotion change of rule of 7th pay commission,I humbly request sir kindly consider the matter under the category of pay anomaly and permit to revise the option so that the pay anomaly could be removed.

There is Anomaly in Transport Allowance for persons whose pay is more than 7440 (excluding grade pay). At present they are drawing transport allowance of Rs.3504. As per the VII Pay commission’s report, they have placed the old GP 1800 and GP 1900 on the same scale with regard to Transport Allowance and given 1350 only.

Multiplication factor has derived as 2.57 but upto 2.25 is 100 +125(113 +12)and might be remaining 32% is from 16% of 200 ,thus 100+125+32=257 leads to a factor of 2.57