What is the dress allowance for the Army?

As a way to boost morale and provide support to the brave men and women who serve in the military, the government has instituted several programs, including the Qualification Incentive and Dress Allowance. This program provides financial assistance to active duty personnel who are working hard to further their education and obtain new qualifications. Additionally, the Dress Allowance ensures that these dedicated service members have the proper attire necessary to perform their duties with pride and professionalism, no matter what the circumstances may be. By providing these important benefits, the government is able to show its appreciation for the sacrifices and hard work of our armed forces.

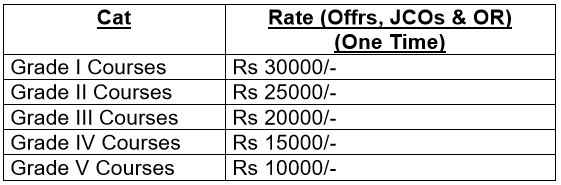

The armed forces have implemented a program known as Higher Qualification Incentive (HQI) which provides a Qualification Allowance to Junior Commissioned Officers (JCOs) and Other Ranks (OR) who complete advanced levels of education or training. This program has been recently extended to provide further motivation and recognition for those who seek to enhance their skills and knowledge through higher education. The HQI program is one way in which the armed forces can encourage professional development and maintain a highly-trained and skilled force.

The Qualification Incentive is an allowance given to Defence Personnel who have achieved certain academic qualifications such as a degree or diploma.

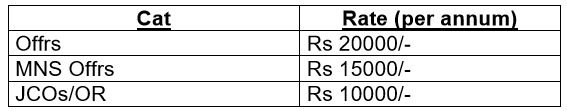

The Dress Allowance is an allowance given to Defence Personnel to maintain and update their uniforms and other clothing items.

No, only those who meet certain criteria and have been approved by their commanding officer are eligible.

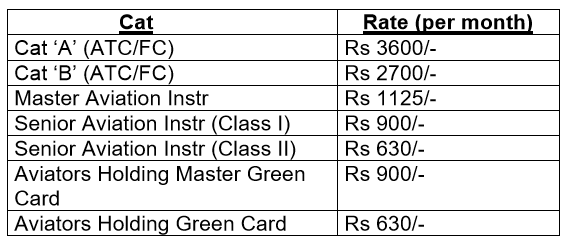

The amount of the Qualification Incentive and Dress Allowance varies depending on the specific qualification achieved and the rank of the personnel receiving it.

Yes, the Qualification Incentive and Dress Allowance is considered taxable income and is subject to the usual income tax rules.

मैं 26 अप्रैल 2000 से मेस बनार जोधपुर में सेवा कर रहा हूं।प्रोत्साहन भत्ता के लिए मैं सुगम हो सकता हूं। अगर मैं निर्दोष कर्मचारी हूं तो डिपार्टमेंट द्वारा मुझे कितना भत्ता दिया जाएगा। क्या प्रक्रिया होगी .. क्योंकि मेरे वेतन का वेतन केवल 1 9 00 है। मैं मैकेनिकल इंजीनियरिंग में एक डिप्लोमा धारक कर्मचारी हूं, जो अभी तक सत्रह वर्षों में कोई पदोन्नति नहीं है। प्रधान मंत्री जी द्वारा भारत के कुशल विकास की योजना का सपना कैसे प्रगति होगी?