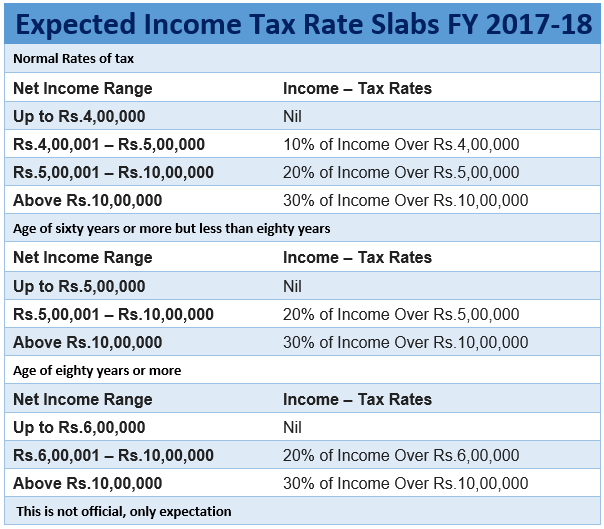

Expected income tax rate slabs FY 2017-18

Expected Rates of tax

A. Normal Rates of tax:

| Net Income Range | Income – Tax Rates |

| Up to Rs. 4,00,000 | Nil |

| Rs. 4,00,001 – Rs.5,00,000 | 10% of Income Over Rs. 4,00,000 |

| Rs. 5,00,001 – Rs.10,00,000 | 20% of Income Over Rs. 5,00,000 |

| Above Rs.10,00,000 | 30% of Income Over Rs. 10,00,000 |

B. Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

| Net Income Range | Income – Tax Rates |

| Up to Rs. 5,00,000 | Nil |

| Rs. 5,00,001 – Rs.10,00,000 | 20% of Income Over Rs. 5,00,000 |

| Above Rs.10,00,000 | 30% of Income Over Rs. 10,00,000 |

C. In case of every individual being a resident in India, who is of the age of eighty years or more at any time during the financial year:

| Net Income Range | Income – Tax Rates |

| Up to Rs. 6,00,000 | Nil |

| Rs. 6,00,001 – Rs.10,00,000 | 20% of Income Over Rs. 6,00,000 |

| Above Rs.10,00,000 | 30% of Income Over Rs. 10,00,000 |

Leave a Reply