Central Govt Relaxes Pension Rules for Family Pensioners

A great step has been taken by the Central Government for Central Government Family Pensioners. The Department of Pension and Pensioners Welfare issued an important Office Memorandum on 29th July 2020 regarding the relaxation of Rule 80-A for payment of provisional Family Pension on death of a Government Servant during service.

No.1/11/2020-P&PW(E)

Government of India

Ministry of Personnel, P.G. & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan,

Khan Market, New Delhi,

Dated 29th July, 2020

OFFICE MEMORANDUM

Sub: Relaxation of Rule 80-A for payment of provisional Family Pension on death of a Government Servant during service.

The undersigned is directed to say that in accordance with Rule 80-A of the CCS (Pension) Rules 1972, on death of a Government servant during service, Head of Office shall sanction and draw provisional family pension and death gratuity in favour of claimant or claimants, after the family pension case, including Form 18 and other documents referred to in Rule 80, has been forwarded by the Head of Office to the Pay & Accounts Office. It has been brought to the notice of this Department that the process of forwarding the family pension case to Pay & Accounts Office along with requisite documents itself takes a long time. It is also understood that, in a large number of cases, provisional family pension and gratuity are not being sanctioned on death of a Government servant. The delay in finalization of family pension and gratuity results in hardship to the family of the deceased Government servant.

2. The matter has been examined in this Department. In accordance with Rule 54 (2) (ii) of the CCS (Pension) Rules, on death of Government servant during service, the family of a deceased Government Servant becomes entitled to family pension even in cases where a government servant dies before completion of one year of continuous service, provided the deceased government servant concerned, immediately prior to his/ her appointment to the service or post, was examined by appropriate medical authority and declared fit by that authority. Thus family pension is payable to the family of deceased Government servant irrespective of the length of service of the Government servant before his death. Therefore, verification of the entire service is not relevant for determining the amount of family pension. The amount of death gratuity, however, depends on the length of qualifying service of the deceased Government servant. Any Government dues in respect of the deceased Government servant are also required to be recovered from the amount of death gratuity.

3. Keeping in view the position mentioned in para 2 above and in order to avoid any hardship to the family of the deceased Government servant, it has been decided to relax the provisions of rule 80-A of the CCS (Pension) Rules, 1972 to the extent that if a claim for family pension in Form 14 along with death certificate and bank account details of the claimant has been received and the Head of Office is satisfied about the bonafide of that claim, he shall sanction provisional family pension immediately. The Head of Office shall not wait for forwarding of the family pension case (including Form-14, Form-18 and other relevant documents mentioned in Rule 80) to Pay & Accounts Office before sanctioning the provisional family pension.

4. The amount of provisional family pension shall not exceed the maximum family pension as admissible under Rule 54 of CCS Pension Rules, 1972.

5. In Central Armed Police Forces related cases, where death of an employee occurs, initially provisional family pension may be sanctioned without waiting for the final Operation Casualty Report.

6. The Pay & Accounts Office shall release the provisional family pension on the basis of sanction order issued by the Head of Office without insisting for any other documents including service book. The provisional family pension shall be paid in the same manner as Pay and Allowances of the establishment are paid.

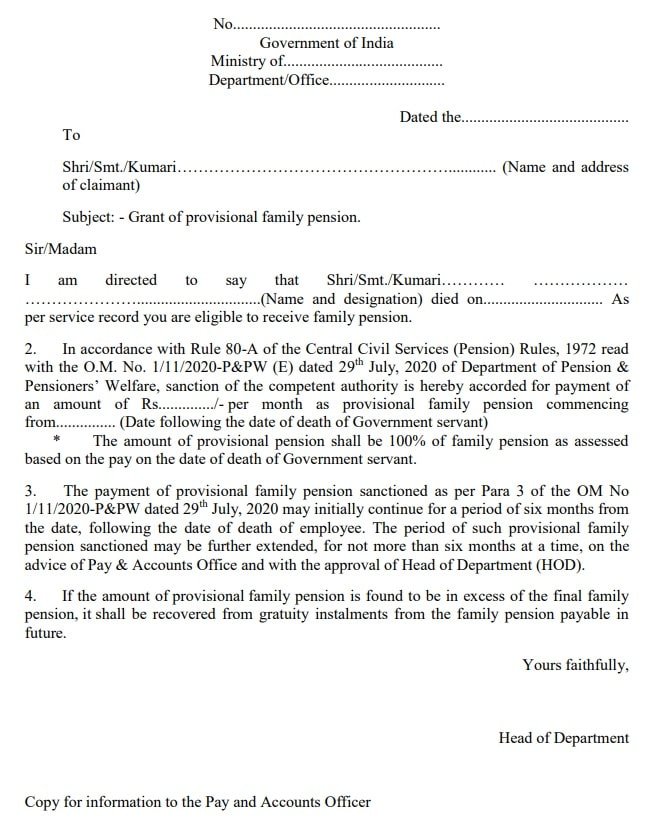

7. A format for sanctioning the provisional family pension by the Head of Department is enclosed.

8. There will be no change in regard to the provisions for sanction of provisional gratuity under Rule 80-A. Action for sanction of death gratuity under rule 80-A may be taken by the Head of Office after forwarding Form-18 and other relevant documents to Pay & Accounts Office. In case the amount of provisional family pension is later found to be in excess of the final family pension, the same may be adjusted from the amount of death gratuity, failing which, it may be recovered in installments from the family pension payable in future.

9. The payment of provisional family pension sanctioned as per Para 3 above may initially continue for a period of six months from the date, following the date of death of employee. The period of such provisional family pension sanctioned may be further extended, for not more than six months at a time, on the advice of Pay & Accounts Office and with the approval of Head of Department (HOD).

10. The provisional family pension may continue to be paid for two months succeeding the month in which the Pension Payment Order for final family pension is issued by the Pay & Accounts Office, keeping in view the time likely to be taken by Central Pension Accounting Office (CPAO) and Central Pension Processing Centre (CPPC) for processing the case. While authorizing final family pension after receipt of complete family pension case, the Pay & Account office shall indicate the date from which the family pension authorized in the Pension Payment Order is to be paid by the Pension Disbursing Authority. Accordingly, the Office of Pay & Account may record a note in the Pension Payment Order, as mentioned below, while authorizing the final family pension:

“Provisional family pension has been/shall be paid for the period from______to_____@ Rs._ plus Dearness Relief. The payment of final family pension may be commenced

by the bank w.e.f._.”

The Administrative Divisions of all Ministries/Department and attached /subordinate offices are requested to bring these instructions to the notice of all concerned for compliance.

The issues with the approval of Competent Authority

sd/-

(Sanjoy Shankar)

Under Secretary to the Government of India

Click to view the order in pdf format

Latest Developments on Central Govt Pensioners

- Government employees retiring during COVID-19 pandemic will get provisional pension July 27, 2020

- Procedures for Retirement benefits as per CCS (Pension) Rules modified July 25, 2020

- Government decides to allow Invalid Pension to Armed Forces Personnel with less than 10 years of qualifying service July 17, 2020

- Central Govt accepts invalid pension to Armed Forces Personnel with less than 10 years of qualifying service July 15, 2020

- Revision of Pension for faculty members of Railway Degree College June 30, 2020

- Dispensing with the requirement of BSR code of bank from the pension claim forms June 29, 2020

- Consolidated instructions for Pension Disbursing Authorities to ensure smooth payment of pension and family pension to pensioners May 15, 2020

- Pension will be paid as usual – No cut or reduction for Central Govt pensioners April 19, 2020

- Payment of Pension for Regular Pension Cases till March 2020 April 18, 2020

- Pension will credit by 30th of March 2020 March 27, 2020

- Life Certificate for Pensioners and Family Pensioners living in Abroad February 24, 2020

- NPS to OPS Latest News – Amendment in CCS (Pension) Rules 1972 – DoPPW Order Dated 17 February 2020 February 18, 2020

- Submission of Annual Life Certificate – 4 Reminder (Through SMS and Email) send to all Pensioners February 4, 2020

- Central Government Employees Salary disburse before 31 of this month January 29, 2020

- One Notional Increment to those retired on 30 June after completion of 365 days January 22, 2020

- Obtaining of Life Certificate by Banks from Doorstep of Pensioners January 22, 2020

- Dearness Relief to Central Govt Freedom Fighters January 17, 2020

The central government has decided to relax the pension rules for family pensioners.

Family pensioners will be the beneficiaries of the relaxed rules.

Details of the changes made to the pension rules have not been specified. However, it is stated that the rules have been relaxed.

Yes, the relaxed pension rules will apply to all family pensioners.

The relaxed pension rules aim to provide more financial support and benefits to family pensioners.

Specific eligibility criteria have not been mentioned. It is expected that all family pensioners will be eligible for the benefits.

The exact date of when the relaxed pension rules will come into effect has not been mentioned, and further guidance regarding implementation is yet to be provided.

Family pensioners can stay updated through official government announcements, notifications, and reliable news sources.

Leave a Reply