7th Pay Commission Gazette Notification – Published in www.egazette.nic.in

7th Pay Commission Commission – Revised Pay Rules, 2016

MINISTRY OF FINANCE

(Department of Expenditure)

NOTIFICATION

New Delhi, the 25th July, 2016

G.S.R. 721(E).—In exercise of the powers conferred by the proviso to article 309, and clause (5) of article 148 of the Constitution and after consultation with the Comptroller and Auditor General in relation to persons serving in the Indian Audit and Accounts Department, the President hereby makes the following rules, namely :-

(1) Short title and commencement:-

These rules may be called the Central Civil Services (Revised Pay) Rules, 2016. They shall be deemed to have come into force on the 1st day of January

2. Categories of Government servants to whom the rules apply:- Save as otherwise provided by or under these rules, these rules shall apply to persons appointed to civil services and posts in connection with the affairs of the Union whose pay is debatable to the Civil Estimates as also to persons serving in the Indian Audit and Accounts.

(2) These rules shall not apply to :

(i) persons appointed to the Central Civil Services and posts in Group ‘A’, ’B’ and ’C’, under the administrative control of the Administrator of the Union Territory of Chandigarh;

(ii) persons locally recruited for services in Diplomatic, Consular or other Indian establishments in foreign countries;

(iii) persons not in whole-time employment;

(iv) persons paid out of contingencies;

(v) persons paid otherwise than on a monthly basis including those paid only on a piece rate basis;

(vi) persons employed on contract except where the contract provides otherwise;

(vii) persons re-employed in Government service after retirement;

(viii) any other class or category of persons whom the President may, by order, specifically exclude from the operation of all or any of the provisions contained in these in these rules

3. Definitions – unless the context otherwise requires,-

(i) “existing basic pay” means pay drawn in the prescribed existing Pay Band and Grade Pay or Pay in the existing scale;

(ii) “existing Pay Band and Grade Pay” in relation to a Government servant means the Pay Band and the Grade Pay applicable to the post held by the Government servant as on the date immediately before the notification of these rules whether in a substantive capacity or in officiating capacity;

(iii) “existing scale” in relation to a Government servant means the pay scale applicable to the post held by the Government servant as on the date immediately before the notification of these rules in the Higher Administrative Grade, Higher Administrative Grade+, Apex scale and that applicable to Cabinet Secretary whether in a substantive or officiating capacity;

(iv) “existing pay structure ” in relation to a Government servant means the present system of Pay Band and Grade Pay or the Pay Scale applicable to the post held by the Government servant as on the date immediately before the coming into force of these rules whether in a substantive or officiating capacity.

Explanation.- The expressions “existing basic pay”, “existing Pay Band and Grade Pay” and “existing scale”, in respect of a Government servant who on the 1st day of January, 2016 was on deputation out of India or on leave or on foreign service, or who would have on that date officiated in one or more lower posts but for his officiating in a higher post, shall mean such basic pay, Pay Band and Grade Pay or scale in relation to the post which he would have held but for his being on deputation out of India or on leave or on foreign service or officiating in higher post, as the case may be;

(v) “existing emoluments” mean the sum of (i) existing basic pay and (ii) existing dearness allowance at index average as on 1st day of January, 2006;

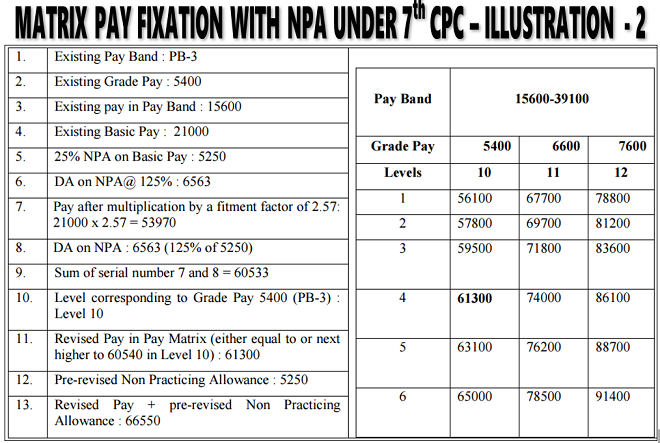

(vi) “Pay Matrix” means Matrix specified in Part A of the Schedule, with Levels of pay arranged in vertical cells as assigned to corresponding existing Pay Band and Grade Pay or scale;

(vii) “Level” in the Pay Matrix shall mean the Level corresponding to the existing Pay Band and Grade Pay or scale specified in Part A of the Schedule;

(viii) “pay in the Level” means pay drawn in the appropriate Cell of the Level as specified in Part A of the Schedule;

(ix) “revised pay structure” in relation to a post means the Pay Matrix and the Levels specified therein corresponding to the existing Pay Band and Grade Pay or scale of the post unless a different revised Level is notified separately for that post;

(x) “basic pay” in the revised pay structure means the pay drawn in the prescribed Level in the Pay Matrix;

(xi) “revised emoluments” means the pay in the Level of a Government servant in the revised pay structure; and

(xii) “Schedule” means a schedule appended to these

Level of posts.– The Level of posts shall be determined in accordance with the various Levels as assigned to the corresponding existing Pay Band and Grade Pay or scale as specified in the Pay Drawal of pay in the revised pay structure.–

Save as otherwise provided in these rules, a Government servant shall draw pay in the Level in the revised pay structure applicable to the post to which he is appointed:

Provided that a Government servant may elect to continue to draw pay in the existing pay structure until the date on which he earns his next or any subsequent increment in the existing pay structure or until he vacates his post or ceases to draw pay in the existing pay structure:

Provided further that in cases where a Government servant has been placed in a higher grade pay or scale between 1st day of January, 2016 and the date of notification of these rules on account of promotion or upgradation, the Government servant may elect to switch over to the revised pay structure from the date of such promotion or upgradation, as the case may be.

Explanation 1.- The option to retain the existing pay structure under the provisos to this rule shall be admissible only in respect of one existing Pay Band and Grade Pay or scale.

Explanation 2.– The aforesaid option shall not be admissible to any person appointed to a post for the first time in Government service or by transfer from another post on or after the 1st day of January, 2016, and he shall be allowed pay only in the revised pay structure.

Explanation 3.– Where a Government servant exercises the option under the provisos to this rule to retain the existing pay structure of a post held by him in an officiating capacity on a regular basis for the purpose of regulation of pay in that pay structure under Fundamental Rule 22, or under any other rule or order applicable to that post, his substantive pay shall be substantive pay which he would have drawn had he retained the existing pay structure in respect of the permanent post on which he holds a lien or would have held a lien had his lien not been suspended or the pay of the officiating post which has acquired the character of substantive pay in accordance with any order for the time being in force, whichever is higher.

1. Exercise of option.–

The option under the provisos to rule 5 shall be exercised in writing in the form appended to these rules so as to reach the authority mentioned in sub-rule (2) within three months of the date of notification of these rules or where any revision in the existing pay structure is made by any order subsequent to the date of notification of these rules, within three months of the date of such order:

Provided that-

(i) in the case of a Government servant who is, on the date of such notification or, as the case may be, date of such order, out of India on leave or deputation or foreign service or active service, the said option shall be exercised in writing so as to reach the said authority within three months of the date of his taking charge of his post in India; and

(ii) where a Government servant is under suspension on the 1st day of January, 2016, the option may be exercised within three months of the date of his return to his duty if that date is later than the date prescribed in this sub-rule.

(2) The option shall be intimated by the Government servant to the Head of his Office along with an undertaking, in the form appended to these rules.

(3) If the intimation regarding option is not received by the authority within the time specified in sub- rule (1), the Government servant shall be deemed to have elected to be governed by the revised pay structure with effect from the 1st day of January, 2016.

(4) The option once exercised shall be final.

7th Pay Commission Resolution – Ministry of Finance

7th Pay Commission Pay Fixation in in Revised Pay Structure

Dearness Allowance Calculation in 7th CPC Gazette Notification

7th CPC MACP – Government Resolution

7th CPC Pay Matrix Table after Gazette Notification

Hari kishan batham says

Sir,

Please send a copy of order under which benefits of 7th benefits given to retirees who reitired on 31.12.2015 1800 hrs. Pm

8890037698

whether the 7th pay commission report is implemented in respect of re-employed central government employees

I DREW 4 INCREMENTS IN THE SCALE 2800 4000 AND MY IS RS 3900 AT THE TIME OF RETIREMENT IN 1992. THE PAY AT THE TIME OF RETIREMENT IS AT THE 9TH LEVEL IN THAT SCALE AS PER GOVT ORDERS PARITY IS ACCPTED FOR PRE2006 RETIRED PERSONS AND A CMITTE IS FORMED TO LOOK ITS IMPLIMETAION AS ACTUALY I HAVE DRAWN 4 INCREMENTS WILL IT BE EQATED FOR THE 4TH S LEVEL IN REVISED PAY MATRIX OR WILL IT BW EQUATED TO 9 TH LEVEL IN THE REVISED PAY MATRIX BECAUSE IT IS AT THAT LVEL I RETIRED. WILL ANYBODY CLRIFY IN THIS REGARD K ADINARAYANA

What about notification on pensioners?

Whether gazette notification by GOI in the matter of amendment of gratuity ceiling of Rs.20 lakhs already been published or not. If it is published please mailed a copy.

there is no mention of pensioners in the gazette notification. Would there be another notification for them?