Admissibility of Transport Allowance to Central Government employees

As per the recommendations of the 7th Pay Commission, transport-related allowances are provided to defence personnel. This includes transport allowance, which is given to compensate for the cost of travel from the residence to the place of work, and conveyance allowance, which is provided to meet the expenses of maintaining a vehicle for official purposes. These allowances are crucial for the defence personnel as they often have to travel frequently for official duties. The implementation of the 7th Pay Commission has brought about significant changes in these allowances, ensuring better remuneration and benefits for the defence personnel.

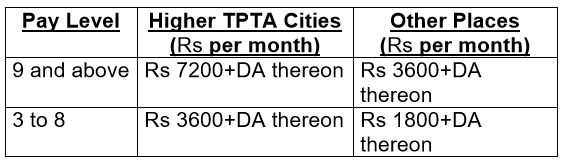

The pay level for employees varies depending on the city they work in. Those working in higher TPTA cities can expect to receive a monthly salary of Rs. 7200 or more, with additional DA. Meanwhile, employees based in other places can expect a monthly salary of Rs. 3600 or more, also with additional DA. The pay level is further broken down into different ranges based on job position. Those in positions 9 and above can expect higher pay rates, while those in positions 3 to 8 can expect a lower salary rate of Rs. 3600+DA thereon in higher TPTA cities and Rs. 1800+DA thereon in other places.

- Please take note that the following metropolitan areas are eligible for higher transportation allowances: Hyderabad, Patna, Delhi, Ahmadabad, Surat, Bengaluru, Kochi, Kozhikode, Indore, Greater Mumbai, Nagpur, Pune, Jaipur, Chennai, Coimbatore, Ghaziabad, Kanpur, Lucknow, and Kolkata.

- The allowance, which is a form of monetary compensation, will not be granted to service personnel who have been provided with the convenience of Government transport. This means that those who are already given a vehicle to use for their official duties will not be eligible to receive this additional benefit. The purpose of this rule is to prevent duplication of benefits and ensure that resources are allocated in a fair and efficient manner.

- Officers in Pay Level 14 and above, who hold important positions and are entitled to use official car for their official duties, will have the option to either avail the official car facility provided by the organization or draw the Tpt Allce at the rate of Rs15,750 + DA per month. This allowance can be used by the officers to arrange for their own transportation. However, the decision to choose between the official car facility and transportation allowance will depend on the personal preferences of the officers and the nature of their work.

- If an employee takes leave for an entire calendar month, they will not be eligible to receive their allowance for that month. This policy is in place to ensure that only active working days are considered for the allowance.

- The government has made a promise to ensure that physically disabled service personnel will continue to receive payment at double the standard rate, regardless of their rank or position. This payment will not fall below a minimum of Rs 2,250 plus DA, ensuring that these individuals are compensated fairly for their service and dedication to their country despite any physical limitations they may face. This commitment demonstrates a deep respect and gratitude for the sacrifices and contributions made by disabled service personnel.

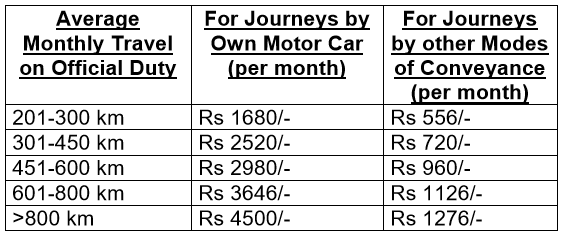

These are the standard monthly travel allowances for official duty based on the distance traveled. If you use your own motor car for official travel, the monthly allowance ranges from Rs. 1680 to Rs. 4500 depending on the distance traveled. However, if you choose to use other modes of conveyance, such as public transport or rented vehicles, the monthly allowance ranges from Rs. 556 to Rs. 1276 depending on the distance traveled. The more distance you cover, the higher the allowance you receive.

Transport related allowances are monetary benefits provided to defence personnel to cover transportation costs during their service tenure.

The most commonly provided transport allowances are Conveyance Allowance, Transport Allowance, and Composite Personal Maintenance Allowance.

The Conveyance Allowance is given to defence personnel who do not have an official quarter and have to hire transport to commute daily. It is provided to all ranks of defence personnel.

The Transport Allowance is provided to defence personnel who are posted in remote and inaccessible areas to cater to their transportation requirements. It is provided to all ranks of defence personnel.

The Composite Personal Maintenance Allowance is given to defence personnel who are posted in field or Active Duty locations and need to meet their personal maintenance expenses, including transportation. It is provided to all ranks of defence personnel.

Yes, the transport allowance can be claimed in combination with other allowances such as House Rent Allowance, Hardship Allowance, and Field Area Allowance.

The calculation of transport allowances is dependent on the ranks of the defence personnel and their place of posting. It is based on the recommendations of the 7th Pay Commission.

Leave a Reply