Special Cash Package Equivalent in Lieu of Leave Travel Concession Fare for Armed Forces Personnel

Message No. 18/2020

Special cash package equivalent in lieu of Leave Travel Concession Fare for Armed Forces Personnel – Covid-19

1) Government of India, Ministry of Defence letter No. 12647/LTC/2020-21/Mov C/229/D (Mov)/2020 dated 11.11.2020, conveying sanction of the Competent Authority for extending the provisions of Ministry of Finance, Department of Expenditure E II (A) Branch, New Delhi OM F.No.12 (2)/2020-E II (A) dated 12/10/2020, (04/11/2020, 10/11/2020 & 25/11/2020) to the Armed Forces personnel and to allow reimbursement of cash package equivalent of Leave Travel Concession to the Armed Forces personnel comprising of Leave Encashment and deemed LTC fare of the entitled LTC in lieu of the LTC in the Block of 2020-21 has been received. Service personnel who have already availed LTC in the year 2020 can claim the above incentive till 31/03/02021 for the year 2021 against their due LTC. This order is effective from 12/10/2020.

2) Officers desiring to avail advance for Special cash package equivalent in lieu of Leave Travel Concession Fare may submit their claims online through a facility made available on PCDA (O) Website.

3) Officers who are not having User ID credentials on PCDA (O) Website, may forward the claim manually in the format at Annexure ‘A’. “Advance for CASH LTC” should be clearly mentioned on the top of the forwarding letter of the claim.

4) Officers are required to spend the amount under this package as per the conditions mentioned in the Govt. letters i.e purchase of Goods or Services with GST 12% or more and digital payment for the same, cited above, before 31 March 2021.

5) Last date of submission of Final claims duly preferred on contingent bill along with original invoices will be 31.03.2021.

6) Officers who are retiring before 31.03.2021 should submit their vouchers/bills well in advance so as to settle the final adjustment claims before the date of superannuation.

7) Amount not spent by 31/03/2021 is recoverable along with Penal Interest as per provisions of LTC advance.

8) Final adjustment claim of officers for reimbursement of cash package equivalent of Leave Travel Concession may forward in the format at Annexure ‘B’.

1. Format for Contingent Bill for Reimbursement of Special Cash package in lieu of LTC.

2. Format For Advance for Special Cash package in lieu of LTC

Click to view the order in pdf

Leave Travel Concession (LTC) Cash Voucher Scheme for Central Govt Employees

Finance Ministry Order on LTC Cash Vouchers Scheme – PDF Download

The Department of Expenditure published an important order on 12th October 2020 regarding the new LTC scheme for Central Government employees.

F.No.12(2) /2020-EII(A)

Ministry of Finance

Department of Expenditure

EN(A) Branch

North Block, New Delhi

12th October 2020

Office Memorandum

Sub: Special cash package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the Block 2018-21.

In view of the Covid-19 pandemic and resultant nationwide lockdown as well as disruption of transport and hospitality sector, as also the need for observing social distancing, a number of Central Government employees are not in a position to avail themselves of LTC for travel to any place in India or their Hometowns in the current Block of 2018-21.

2. With a view to compensate and incentivise consumption by Central Government employees thereby giving a boost to consumption expenditure, it has been decided that cash equivalent of LTC, comprising Leave Encashment and LTC fare of the entitled LTC may be paid by way of reimbursement if an employee opts for this in lieu of one LTC in the Block of 2018-21 subject to the following conditions:-

a) The employee spends the money of a larger sum than the entitlement on account of LTC on actual expenditure.

b) Cash equivalent of full leave encashment will be allowed, provided the employee spends an equal sum. This will be counted towards the number of leave encashment on LTC available to an employee.

C) The deemed LTC fare for this purpose is given below:-

|

Category of employees |

Deemed LTC fare per person |

|

Employees who are entitled to business class of airfare |

Rs. 36,000 |

|

Employees who are entitled to economy class of airfare |

Rs. 20,000 |

|

Employees who are entitled to Rail fare of any class |

Rs. 6,000 |

d) The cash equivalent may be allowed if the employee spends a sum 3 times of the value of the fare given above.

e) The amount both on account of leave encashment and fare shall be admissible if the employee spends (i) an amount equal to the value of leave encashment and; (ii) an amount 3 times of the cash equivalent of deemed fare, as given above on purchase of such items/availing of such services which carry a GST rate of not less than 12% from GST registered vendors/service providers through digital mode and obtains a voucher indicating the GST number and the amount of GST paid.

f) The admissible payment shall be restricted to the full value of the package [leave encashment as admissible for LTC and deemed fare] or depending upon the spending as per example given at Annexure-A.

g) While TDS is applicable in the case of leave encashment, since the cash reimbursement of LTC fare is in lieu of deemed actual travel, the same shall be allowed exemption on the lines of existing income-tax exemption available to LTC fare. The legislative amendment to the provisions of the Income-Tax Act, 1961 for this purpose shall be proposed in the due course. Hence, TDS shall not be required to be deducted on the reimbursement of deemed LTC fare.

3. Head of the Departments / DDOs may make reimbursement under this package as per the details given above on receipt of invoices of purchases made / services availed during the period post the issuance of this order from the employees who are desirous to avail this package. It may be noted that in order to avail this package an employee should opt for both leave encashment and LTC fare.

4. An amount up to 100% of leave encashment and 50% of the value of deemed fare may be paid as advance into the bank account of the employee which shall be settled based on production of receipts towards purchase and availing of goods and services as given in Para 2(e). The claims under this package (with or without advance) are to be made and settled within the current financial year. Non-utilization / under-utilization of advance is to be accounted for by the DDOs in accordance with the extant provisions relating to LTC advance i.e. immediate recovery of full advance in the case of non-utilization and recovery of unutilized portion of the advance with penal interest.

5. These orders will take effect from the date of issuance of this Office Memorandum and will be in force during the current financial year till 31st March 2021.

6. All the Ministries/Departments are requested to bring the contents of this OM to the notice of all its Attached and Subordinate offices for their information.

Hindi version of this Office Memorandum will follow.

sd/-

(B.K.Manthan)

Deputy Secretary to the Govt. of India

Example:

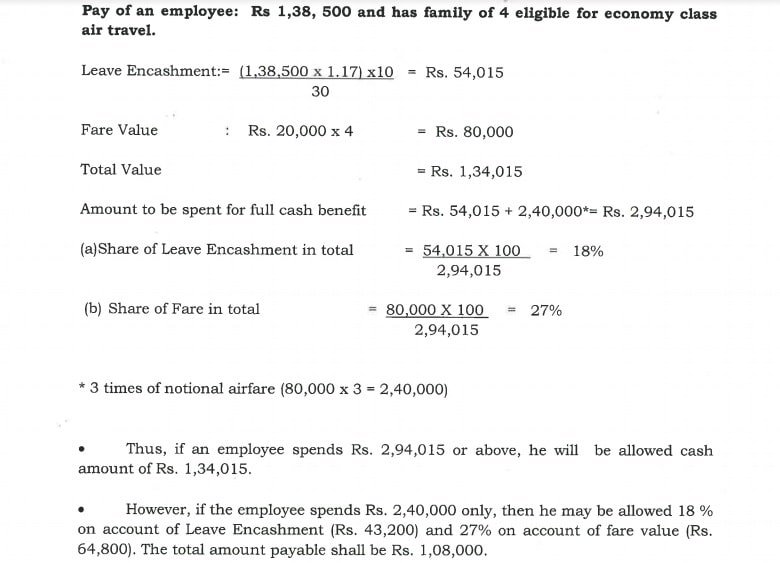

Pay of an employee: Rs 1,38, 500 and has family of 4 eligible for economy class air travel.

- Leave encashment (1,38,500 x 1.17) x10/30 = Rs. 54,015

- Fare Value: Rs. 20,000 x 4 = Rs. 80,000

- Total Value: = Rs. 1,34,015

- Amount to be spent for full cash benefit = Rs. 54,015 + 2,40,000*= Rs. 2,94,015

- (a) Share of Leave Encashment in total = 54,015 X 100 / 2,94,015 = 18%

- (b) Share of Fare in total = 80,000 X 100 / 2,94,015 = 27%

* 3 times of notional airfare (80,000 x 3 = 2,40,000)

- Thus, if an employee spends Rs. 2,94,015 or above, he will be allowed cash amount of Rs. 1,34,015.

- However, if the employee spends Rs. 2,40,000 only, then he may be allowed 18 % on account of Leave Encashment (Rs. 43,200) and 27% on account of fare value (Rs. 64,800). The total amount payable shall be Rs. 1,08,000.

Click to view the Finmin Order dated 12.10.2020

Special Cash Package on LTC Calculator 2020

A simple online calculator for finding the maximum amount to avail complete cash benefit from this Special Cash Package Scheme on Leave Travel Concession. [Click to calculate]

LTC Cash Voucher Scheme 2020 Application Form

Leave Travel Concession (LTC) Cash Voucher Scheme 2020 Application Form PDF Download [Click here to download]

LTC Cash Voucher Calculation Formula

The Leave Travel Concession (LTC) Cash Benefit Voucher Scheme is a little bit confusing on the calculation with or without encashment. As per the recent clarification issued by the Department of Expenditure [Click to read continue]

The last date for applying to claim the benefits of the LTC Cash Voucher Scheme is 31 March 2021.

At present no possibility to extend the last date for claiming the benefits of the LTC Cash Voucher Scheme.

Bills and invoices of goods and services purchased with a GST rate, not less than 12% (Twelve Percent) can be claimed in the new LTC Cash Voucher Benefit Scheme.

Leave a Reply