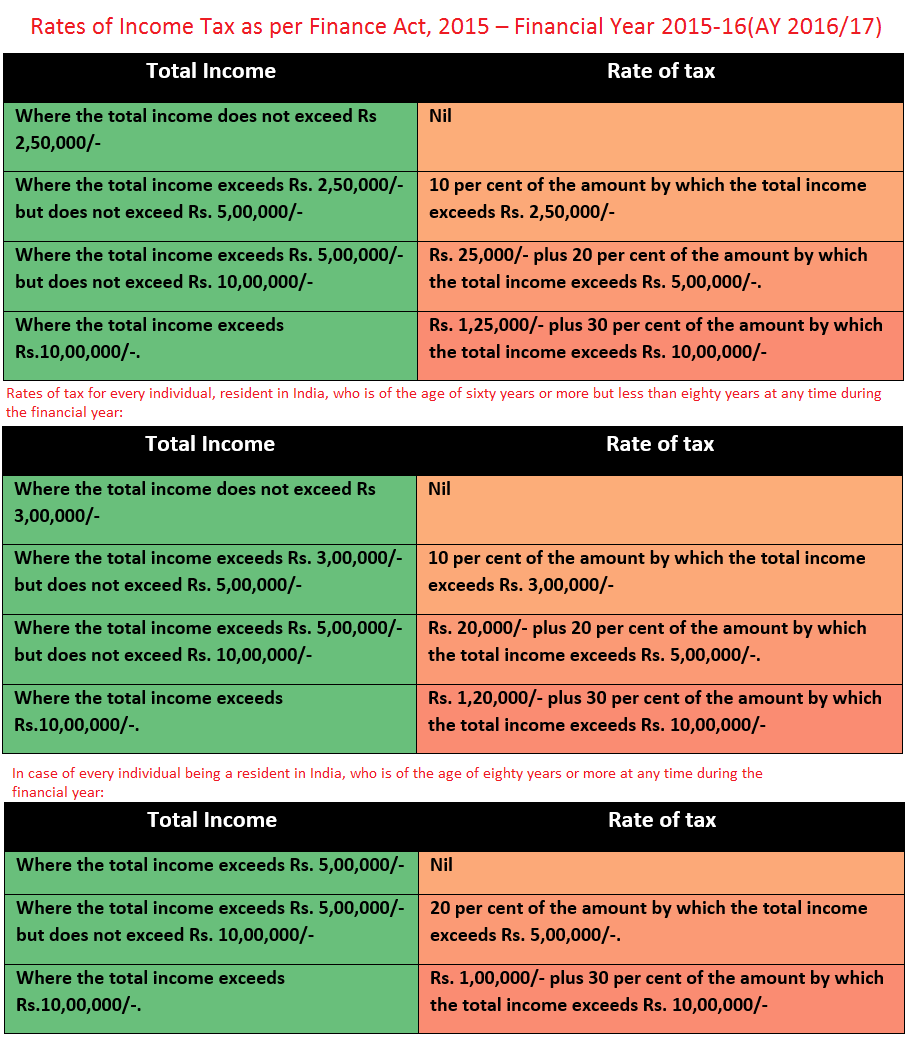

Rates of Income Tax as per Finance Act, 2015 – Financial Year 2015-16(AY 2016/17)

RATES OF INCOME-TAX AS PER FINANCE ACT, 2015: As per the Finance Act, 2015, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2015-16 (i.e. Assessment Year 2016-17) at the following rates:

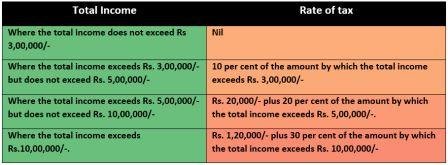

Rates of tax : A. Normal Rates of tax:Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

In case of every individual being a resident in India, who is of the age of eighty years or more at any time during the financial year:

Education Cess on Income tax:

The amount of income-tax including the surcharge if any, shall be increased by Education Cess on Income Tax at the rate of two percent of the income-tax.

Secondary and Higher Education Cess on Income-tax:

An additional education cess is chargeable at the rate of one percent of income-tax including the surcharge if any, but not including the Education Cess on income tax.

Long service CG servants retired in 6CPC regime needs a refined pension scheme in 7cpc. By virtue of promotion from starting level to the present level, some retired within a few years of promotion or some retired after serving long term in one level. Both are not satisfied by virtue of their increments since their basic pay is matched in the promoted level and fixation matrix in each CPC, their basic pay fixed will be much higher than the lower pay scale..

In order to honour those who contributed their dedicated service to govt., the following criteria may be applied for pension fixation to honour their service.

Give 25 points to each of the following.(to be submitted by the office concerned.

1. Consider those who served more than 25 years without any carrier fault /indiscipline action/criminal police action/violation of office rules and regulations/ irregularities etc.

2. Consider who earned half pay leave of 400 days and full pay Earned leave of 300 days in his service period.

3. Consider having one CR remark as “Extra ordinary” or 5 CR remark of “very good” in the total service period.

4. Cosider special contribution to improve efficiency, safety and security of the concerned field.

If the total point is

a) between 25 to 50, increase multiplication factor by 0.5 (say 2.57+0.5=3.07)

b) between 50 to 100, increase multiplication factor by 1 (say 2.7+1.0=3.57)

The Income tax may be up to

3 lakhs.nil

Beyond 3lakhs @15%