Filing of Income Tax Returns by Government Employees Income Tax : Filing of Returns by every Government Servant P.N.DEVADASAN, IRS Principal Commissioner Phone: 8547000030 Chennai 19/06/2018 To The Drawing & Disbursing Officer O/O Dy. Director … [Read more...]

New Income Tax Forms for AY 2018-19 – CBDT Notification

New Income Tax Forms for AY 2018-19 - CBDT Notification Ministry of Finance CBDT notifies Income Tax Return Forms for Assessment Year 2018-19 The Central Board of Direct Taxes(CBDT) has notified Income Tax Return Forms (ITR Forms) for the Assessment … [Read more...]

Standard Deduction Applicable for Pensioners – Clarification

Standard Deduction Applicable for Pensioners - Clarification Ministry of Finance Clarification regarding applicability of standard deduction to pension received from the former employer The Central Board of Direct Taxes (CBDT) has clarified that … [Read more...]

Dress Code prescribed for Income Tax Employees

Dress Code prescribed for Income Tax Employees OFFICE OF THE PRINCIPAL CHIEF COMMISSIONER OF INCOME TAX, DELHI C.R.BUILDING, L.P.ESTATE, NEW DELHI-110002 Phone No.011-23379596/23379245; FAX 011-23378668 F.No.PrCCIT/Admin/2017-18/02 Dated: … [Read more...]

CPPCs Advised to Issue Form-16 by 31st of May every year – CPAO

CPPCs Advised to Issue Form-16 by 31st of May every year - CPAO Deduction of Income Tax at the time of making payment "All Heads of CPPCs are advised to deduct the income tax at the time of each payment itself and issue Form-16 by 31st of May every … [Read more...]

Exemption of Transport Allowance and Medical Reimbursement from Income Tax – NC JCM Staff Side

Exemption of Transport Allowance and Medical Reimbursement from Income Tax - NC JCM Staff Side National Council Staff Side Secretary writes to Finance Ministry regarding the exemption of Transport Allowance and Medical Reimbursement from Income … [Read more...]

Employees thank Prime Minister for allowing standard deduction of Rs 40,000

Employees thank Prime Minister for allowing standard deduction of Rs 40,000 Ministry of Personnel, Public Grievances & Pensions Delegation of DoPT employees calls on MoS (PP) Dr Jitendra Singh Employees thank Prime Minister for allowing … [Read more...]

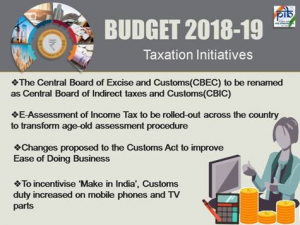

New Scheme for Assessment in Electronic Mode – Finance Minister

New Scheme for Assessment in Electronic Mode - Finance Minister Ministry of Finance Amendments in the income-tax act proposed to notify a new scheme for assessment in electronic mode. E-assessment to be rolled-out across the country to transform … [Read more...]

Exemption of Interest Income on deposits increased to Rs 50,000 to Senior Citizens

Exemption of Interest Income on deposits increased to Rs 50,000 to Senior Citizens Ministry of Finance Relief to Senior Citizens: Exemption of Interest Income on deposits increased to Rs 50,000 Pradhan Mantri Vaya Vandana Yojana extended up to March … [Read more...]

Relief to Salaried Taxpayers – Standard Deduction of Rs 40,000 Allowed

Relief to Salaried Taxpayers - Standard Deduction of Rs 40,000 Allowed Relief to salaried taxpayers: standard deduction of Rs 40,000 allowed in lieu of present exemptions 2.5 Crores salaried employees and pensioners to benefit Differently-Abled … [Read more...]

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 16

- Next Page »