Raise Personal Income Tax Exemption Limit to Rs 4 lakh - Assocham Budget-2016-17: Revision in IT exemption to at least Rs 4 lakh minimum expectation of common-man Monday, February 15, 2016 Revision in the income tax exemption limit to at least Rs … [Read more...]

Electronic Verification CODE (EVC) for electronically filed Income Tax Return Additional Modes

Electronic Verification CODE (EVC) for electronically filed Income Tax Return Additional Modes Additional modes of generating Electronic Verification Code (EVC) have been notified in addition to EVC notified vide earlier Notification No. 2/2015 dated … [Read more...]

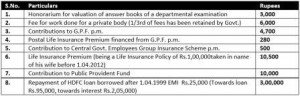

Income Tax Calculation for Interest on Housing Loan and Deduction u/s 80C with illustration

Income Tax Calculation for Interest on Housing Loan and Deduction u/s 80C with illustration One Computation of Taxable Salary and allowances, Deduction for Interest on Housing Loan and Deduction u/s 80C. Mr. X, a Central Govt. Officers in Delhi, is … [Read more...]

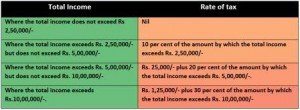

Rates of Income Tax as per Finance Act, 2015 – Financial Year 2015-16(AY 2016/17)

Rates of Income Tax as per Finance Act, 2015 - Financial Year 2015-16(AY 2016/17) RATES OF INCOME-TAX AS PER FINANCE ACT, 2015: As per the Finance Act, 2015, income-tax is required to be deducted under Section 192 of the Act from income chargeable … [Read more...]

Issue of IT Refunds of Smaller Amounts

Issue of IT Refunds of Smaller Amounts In an initiative to reduce taxpayer grievances and enhance the taxpayer satisfaction, the Central Board of Direct Taxes had issued instructions to Central Processing Center (CPC), Bengaluru and the field … [Read more...]

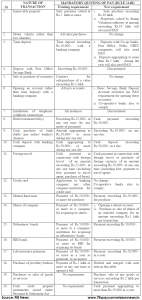

Key changes to Mandatory Quoting of Pan Rules of the Income tax Act

Key changes to Mandatory Quoting of Pan Rules of the Income tax Act Rules regarding quoting of PAN for specified transactions amended The Government is committed to curbing the circulation of black money and widening of tax base. To collect … [Read more...]

Setting-up of ‘Taxpayers Lounge’ at the India International Trade Fair (IITF) – 2015

Setting-up of 'Taxpayers Lounge' at the India International Trade Fair (IITF) - 2015 CBDT to set-up a 'Taxpayers' Lounge' at the India International Trade Fair - 2015 to Highlight the Various Taxpayer-Friendly Initiatives Taken by the Department … [Read more...]

Income Tax Department issued an Advisory on Phishing, Fraudulent Refund E-mail

Income Tax Department issued an Advisory on Phishing, Fraudulent Refund E-mail Taxpayers are requested not to respond to any email or any type of communication sent to them requesting them to furnish their personal particulars such as Bank account … [Read more...]

Income Tax Employees Agitation : Suspend the ongoing programme of agitation temporarily for 3 weeks from 04-11-2015

Income Tax Employees Agitation : Suspend the ongoing programme of agitation temporarily for 3 weeks from 04-11-2015 The Central JCA convened its meeting at the Civic Centre, New Delhi on 03-11-2015 itself to review the ongoing programme of … [Read more...]

Central Govt setup a committee to simplify the provisions of the Income Tax Rules

Central Govt setup a committee to simplify the provisions of the Income Tax Rules Government Sets-Up A Committee to Simplify The Provisions of The Income Tax Act, 1961 The Government of India has constituted a Committee with a view to simplify the … [Read more...]

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 16

- Next Page »