Income Tax Deduction from Salaries F.Y. 2020-21 (A.Y. 2021-22): Format for Self Declaration for Option (Old/New Regime) and intimation of savings for Old regime

Office of the Principal Controller of Defence Accounts (Central Command) 1,

Cariappa Road, Lucknow Cantt. — 226002

Circular

No. AN/IV/I.Tax/Circular

Dated: 24.06.2020

To,

The Officer In-charge

1. All Sections of Main Office

2. All Sub Offices under this Organisation.

3. IFA (CC) Lucknow CDA RTC, Lucknow

4. AO NCC Directorate, Lucknow

Subject:- Income Tax Deduction from Salaries during the Financial Year 2020-21 (Assessment Year: 2021-22) under section 192 of Income Tax Act — 1961.

In finance Act, 2020, the Government has introduced a new income tax regime under section 115 BAC that comprises a significant change in the tax slab rates. Tax payers have been provided an option whether they want to pay taxes according to the new regime or if they want to continue paying according to the existing regime (Old Tax Regime).

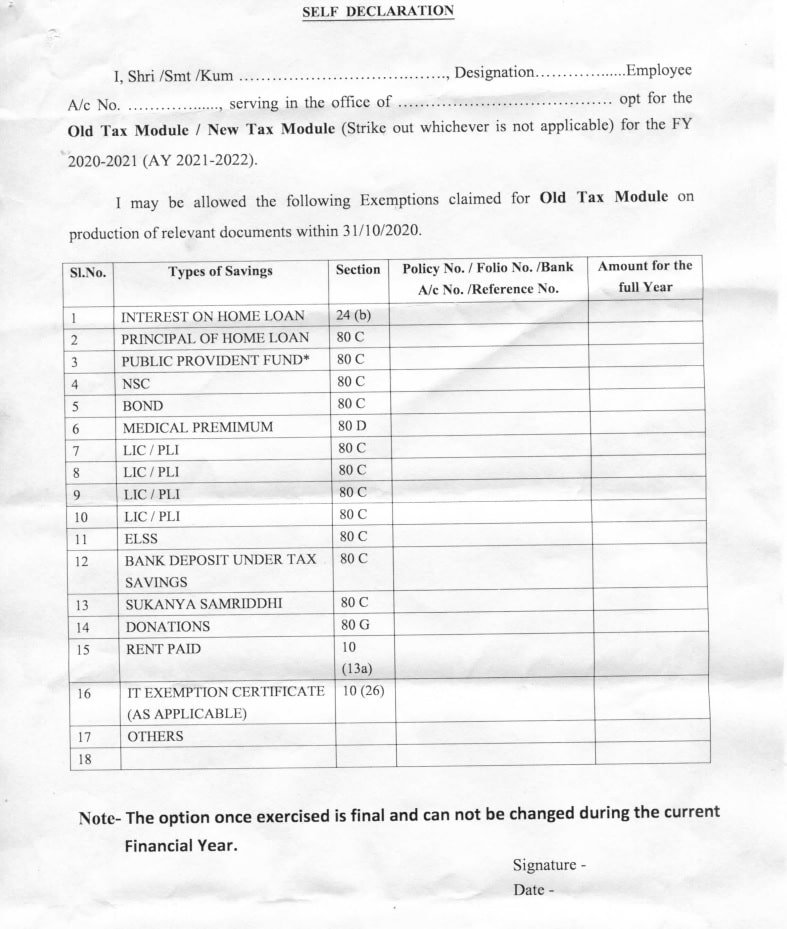

For the purpose of assessing and deduction of Income Tax for the FY 2020-21 (AY 2021-2022) all the officers and staff are requested to submit a “Self Declaration” stating the module of tax deduction chosen.

Where the official chooses tax deduction as per old module, the “Self Declaration” must also reflect all the savings details like Insurance Premium, NCS, infrastructure bonds, rent paid, HBA interest and exemption applicable to Schedule Tribes etc. However, the proof of savings documents must reach this office by 31/10/2020 failing which the exemptions will no longer be applicable.

The contents of this letter may please be got noted by all the officers and staff of respective office /sections. Officers In-Charge are requested to verify the correctness of option exercised by the officers/Staff serving under them. Declaration /Option form, duly completed in all respect may be forwarded to AN-IV Section of this office so that it may reach on or before 15.07.2020 according to which this office will commence deduction of Income Tax as per liability on an average basis from the salary. In case the Declaration 1s not received by the stipulated time or the choice of module is not duly mentioned in the Declaration, the individual shall be deemed to have opted for the deduction of Income Tax as per the old Tax Regime.

Sd/-

(Rankaj Prakash Singh, IDAS)

DCDA (GO AN-IV)

Click to view Self Declaration Form

| Types of Income Tax Savings | Income Tax Exemption under Section |

| Interest on Home loan | 24(b) |

| Principal on Home loan | 80C |

| Public Provident Fund | 80C |

| NSC | 80C |

| BOND | 80C |

| Medical Premium | 80C |

| LIC/PLI | 80C |

| LIC/PLI | 80C |

| LIC/PLI | 80C |

| LIC/PLI | 80C |

| ELSS | 80C |

| Bank Deposit Under Tax Saving | 80C |

| Sukanya Samriddhi | 80C |

| Donation | 80G |

| Rent Paid | 10(13a) |

| IT Exemption Certificate (As applicable) | 10(26) |

Leave a Reply