OROP Implementation : Clarification Circular No.557 issued by PCDA on 17.3.2016

OFFICE OF THE PR. CONTROLLER OF DEFENCE ACCOUNTS (PENSIONS)

DRAUPADI GHAT, ALLAHABAD- 211014

Circular No.557

Dated: 17.03.2016

Subject: Implementation of ‘One Rank One Pension’ (OROP) to Defence pensioners.

Reference: This office circular No 555 dated 04.02.2016.

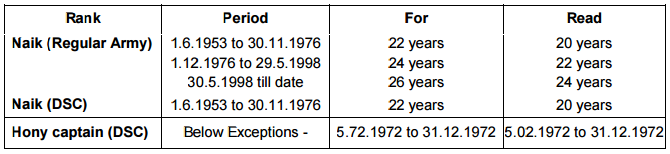

A comprehensive list of maximum term of engagement for JCOs/ORs was enclosed as Appendix-X to this office Circular No. 555 dated 4.2.2016 has been slightly amended as under :-

| Rank | Period | For | Read |

|---|---|---|---|

| Naik (Regular Army) | 1.6. 1953 to 30.11.1976 | 22 years | 20 years |

| 1.12.1976 to 29.5.1998 | 24 years | 22 years | |

| 30.5.1998 till date | 26 years | 24 years | |

| Naik (DSC) | 1.6..1953 to 30.11.1976 | 22 years | 20 years |

| Hony captain (DSC) | Below Exceptions – | 5.72.1972 to 31.12.197 2 | 5.02.1972 to 31.12.1972 |

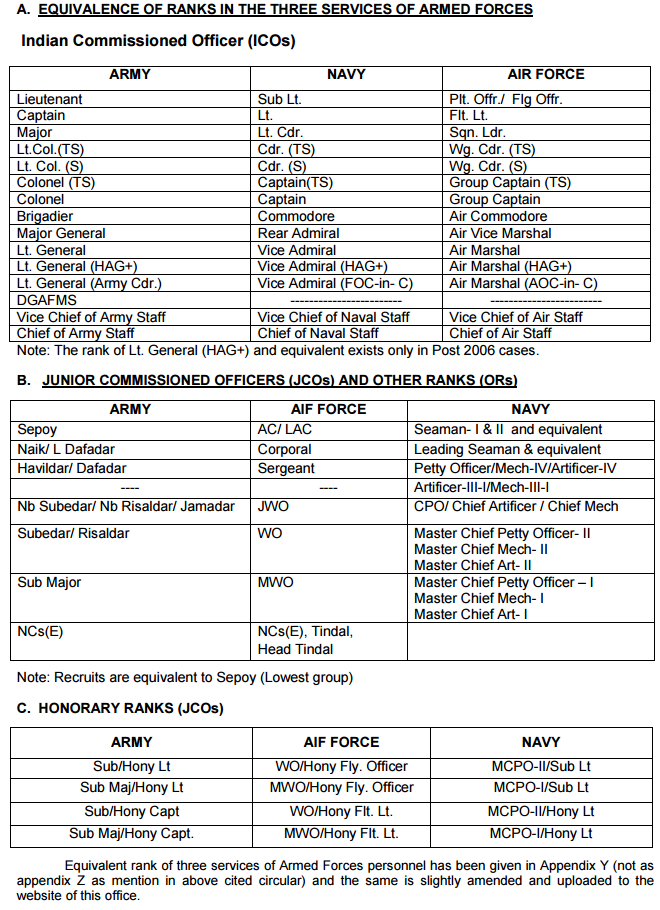

2. Similarly, slightly amended comprehensive list of equivalence of ranks in the three services of Armed Forces is enclosed as Appendix ‘Y’ to this Circular which would substitute the Appendix-‘Y’ of the Circular No. 555 dated 04.02.2016.

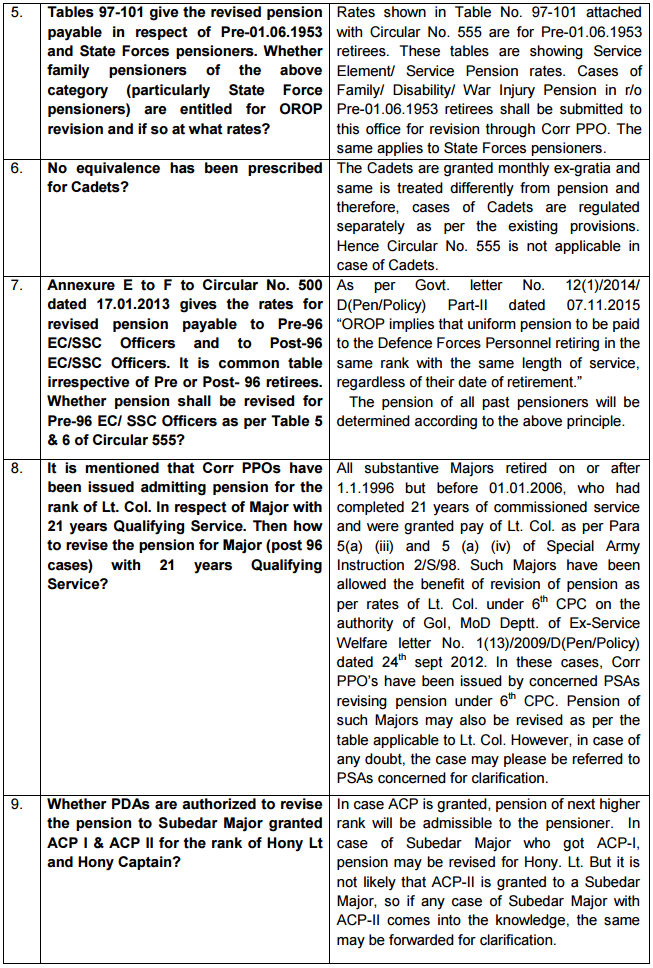

3. PDAs have reported some difficulties on certain points while implementing the scheme of ‘OROP’. Necessary clarification in the matter is as under:-

| SI. | Clarification required | Clarification |

|---|---|---|

| 1. | In the absence of qualifying service, it would be extremely difficult to revise LFP/ SFP as per Circular No. 555? | In case, any information regarding qualifying service, rank, group etc., is not available with PDAs, such cases may be referred to Pension Sanctioning Authorities concerned in the proforma enclosed as Annexure-‘A’ to the Govt. Letter No. (1)/2014/D (Pen/Policy)-Part-II dated 3 rd Feb, 2016. All PDAs are therefore, requested to send Annexure-A both in hard and soft copy by name to Shri Ram Ji Mishra, Sr. AO (Sangam Cell) on e-mail ID: cda-albd@nic.in. Meanwhile, as an interim measure, if qualifying service is not available in case of family pension, minimum family pension rate payable for that particular rank and group w.e.f. 01.07.2014 (as per Circular No. 555 dated 04.02.2016) may be paid. |

| 2. | In the absence of Group/ Qualifying service, revision as per Circular 502 was done by revising family pension for the lowest group in the start of the table. Now in the present OROP orders, the tables start from 0.5 yrs and therefore cases where group/ Q.S. is not available cannot be revised. | If the group of the service pensioner is not available in the PPOs/ Corrigendum PPOs, pension of lowest group (i.e. for group Y for the time being) for that rank and qualifying service may be paid until receipt of clarification from the PSAs concerned. |

| 3. | It is not clear whether the LTA is payable in one lump sum or 4 equal installments? | Arrears on account of revision of pension and LTA from 1.7.2014 to 02.03.2016 shall be paid by the Pension Disbursing Agencies in four equal half-yearly instalments and not in lump- sum. However, all the family pensioners including those in receipt of Special/ Liberalized Family Pension and all Gallantry award winners shall be paid arrears in one instalment as per Para 17 of the Circular No. 555 dated 04.02.2016 |

| 4. | PDAs find it extremely difficult to identify HAG+ rank? | The rank of Lt. Gen (HAG+) was introduced after 01.01.2006. Hence, rank of Lt. Gen (HAG+) is found only in Post-01.01.2006 cases. In such cases, pay scale for that rank i.e. Rs. 75500-80000 is mentioned in the PPO. For Pre-2006 cases, pension of HAG will be payable to retired Lt. Generals, unless retired in the rank of Army Commander or equivalent. Same applies to equivalent ranks in Air Force and Navy. |

| 5. | Tables 97-101 give the revised pension payable in respect of Pre-01.06.1953 and State Forces pensioners. Whether family pensioners of the above category (particularly State Force pensioners) are entitled for OROP revision and if so at what rates? | Rates shown in Table No. 97-101 attached with Circular No. 555 are for Pre-01.06.1953 retirees. These tables are showing Service Element/ Service Pension rates. Cases of Family/ Disability/ War Injury Pension in r/o Pre-01.06.1953 retirees shall be submitted to this office for revision through Corr PPO. The same applies to State Forces pensioners. |

| 6. | No equivalence has been prescribed for Cadets? | The Cadets are granted monthly ex-gratia and same is treated differently from pension and therefore, cases of Cadets are regulated separately as per the existing provisions. Hence Circular No. 555 is not applicable in case of Cadets |

| 7. | Annexure E to F to Circular No. 500 dated 17.01.2013 gives the rates for revised pension payable to Pre-96 EC/SSC Officers and to Post-96 EC/SSC Officers. It is common table irrespective of Pre or Post- 96 retirees. Whether pension shall be revised for Pre-96 EC/ SSC Officers as per Table 5 & 6 of Circular 555? | As per Govt. letter No. 12(1)/2014/ D(Pen/Policy) Part-II dated 07.11.2015 “OROP implies that uniform pension to be paid to the Defence Forces Personnel retiring in the same rank with the same length of service, regardless of their date of retirement.” The pension of all past pensioners will be determined according to the above principle. |

| 8. | It is mentioned that Corr PPOs have been issued admitting pension for the rank of Lt. Col. In respect of Major with 21 years Qualifying Service. Then how to revise the pension for Major (post 96 cases) with 21 years Qualifying Service? | All substantive Majors retired on or after 1.1.1996 but before 01.01.2006, who had completed 21 years of commissioned service and were granted pay of Lt. Col. as per Para 5(a) (iii) and 5 (a) (iv) of Special Army Instruction 2/S/98. Such Majors have been allowed the benefit of revision of pension as per rates of Lt. Col. under 6th CPC on the authority of GoI, MoD Deptt. of Ex-Service Welfare letter No. 1(13)/2009/D(Pen/Policy) dated 24th sept 2012. In these cases, Corr PPO’s have been issued by concerned PSAs revising pension under 6th CPC. Pension of such Majors may also be revised as per the table applicable to Lt. Col. However, in case of any doubt, the case may please be referred to PSAs concerned for clarification. |

| 9. | Whether PDAs are authorized to revise the pension to Subedar Major granted ACP I & ACP II for the rank of Hony Lt and Hony Captain? | In case ACP is granted, pension of next higher rank will be admissible to the pensioner. In case of Subedar Major who got ACP-I, pension may be revised for Hony. Lt. But it is not likely that ACP-II is granted to a Subedar Major, so if any case of Subedar Major with ACP-II comes into the knowledge, the same may be forwarded for clarification. |

| 10. | The difference between Artificer III-I and Artificer I, II, III may please be explained. | The same has been reflected in revised Annexure-Y attached with this Circular. |

| 11. | Orders were issued vide Circular 456 dated 18.03.2011 for broad banding of disability element whereby disability element sanctioned at rates lower than 50% was brought up to 50%. In cases where broad banding has been carried out, it is not beneficial to revise disability at rates lower than 50%. As such no revision has been effected in such cases and current rate of disability element has been retained. It may be confirmed that this is in order. | As already clarified in various circulars issued by this office, the Disability Element shall be proportionately reduced for disability which is less than 100%. Accordingly, in case of broad- banding of disability element, benefit of broad banding may be granted to the individual. Further, Para-6 of ibid GoI, MoD letter dated 03.02.2016 may be referred to wherein it is stated that if the revised pension as on 01.07.2014 works out to less than the existing pension as on 01.07.2014 in terms of these orders, the pension shall not be revised to the disadvantage of the pensioner |

| 12. | Whether Qualifying Service (Q.S.) is to be taken as actual or with weightage? | In Post-2006 retirees cases, weightage had been withdrawn from Qualifying Service. Therefore, the qualifying service mentioned in OROP table is actual qualifying service only. No weightage in qualifying service is to be allowed at all while extending the benefit of OROP in past cases. For example, if actual Q.S. was ‘q’ years and weightage, if any, was ‘y’ years, the pension indicated in the concerned table for ‘q’ years only is to be paid to the pensioner |

| 13. | Whether the amount mentioned in Column 22 of Table No. 7 is applicable to all category of pensioners? | Column 22 of Table No. 7 is applicable to all NCs(E) of the three services i.e. Army, Navy & Air Force. |

PLEASE PUBLISH THIS FOR BENEFITS OF ALL VETRANS

grant reserved liability period benefits towards QFS for pension as per orop table as tge goi mod has ceased weightage period to the Officers ct. ;also period spent during pre commission ttraining period in IMA/OTs etc is merited to be counted for running service period,OFFICER IS ENTITLED THIS BENEFIT;MATTER STANDS QUASSI JUDICIAL CONSIDERAIONS AS PBORS ARE GIVEN THIS BENEFITS OF RESERVED LIABILITIES.AFT DELHI HAS ALREADY SETTLED SUCH CASE LAW WHERE THE DELINQQUENT PETITIONER IS GIVEN 6 YRS RESERVED LIABILITY BENENEFIT FOR QFS PERIOD FOR PENSION

withdrawal of weightage period benefit ; period of reserve liabilities 5 to 10 yrs as per AI 10/s/1963 for officers under such liabilities merits to be considered as part of QFS for pension/gty./OROP TALE; THIS BENEFIT IS GIVEN TO PBORS; AFT PRINCIPAL BENCH NEW DELH HAS SETTLED THIS ISSUE BY CONSIDERING 6 YRS R.L TOWARDS GRANT OF QFS FOR PENSION. MATER STANDS FOR GRANT OF SUCH BENEFITS TO OFFICERS ALSO.; GOI WILL HAVE TO ALLOW SUCH CONSIDERATIONS OF BENEFITS OF RESERVE LIABILITY PERIOD AS PART OF QFS ;AS THE TRMS AND CONDITIONS ARE SAME AND SIMILAR AS FOR REGULAR SERVING OFFICER. IF YOU WITHDRAW WEGHTAGE;GIVE US RES.LIAB. BENEFITS MATTER NOW STANDS AS QUASSI JUDICIAL REVIEW. COL SHAM

Kindly, review pension anomalies rank of Subedar which came in OROP scheme.