7th CPC Pension Calculation

Fixation for Pre-2016 Pensioners

7th CPC Pension Calculation with step by step explanation : Fixation for Pre-2016 Pensioners

Re fixation of Pension is not a simple work to avail new pension as per 7th CPC…

Step-1: Transformation of 4th Pay Commission Basic Pension to 5th Pay Commission Basic Pension for 4th CPC Pensioners…

Step-2: Transformation of 5th Pay Commission Basic Pension to 6th Pay Commission Basic Pension for 5th CPC Pensioners…

Step-3: Transformation of 6th Pay Commission Basic Pension to 7th Pay Commission Basic Pension for 6th CPC Pensioners…

Recommendations of 7th CPC on Pension Fixation

The 7th Pay Commission has recommended the fixation of pension for civil employees including CAPF personnel, who have retired before 01.01.2016, given two formulations with illustrations for fixing of pension. One for the pensioners retired on 2015 and another one is for the pensioners retired on 1989.

And also recommended, the first formulation of fixing the pension may take a little time since the records of each pensioner will have to be checked to ascertain the number of increments earned in the retiring level. The first instance the revised pension may be calculated as in the second formulation and the same may be paid as an interim measure. In the event calculation as per the formulation of fixing the pension yields a higher amount the difference may be paid subsequently.

And one more important recommendation of option given to the pensioners for choosing whichever is beneficial to them.

Recommendations on fixing of Pension by 7th CPC : All the civilian personnel including CAPF who retired prior to 01.01.2016 (expected date of implementation of the Seventh CPC recommendations) shall first be fixed in the Pay Matrix being recommended by this Commission, on the basis of the Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the matrix.

1.This amount shall be raised, to arrive at the notional pay of the retiree, by adding the number of increments he/she had earned in that level while in service, at the rate of three percent. Fifty percent of the total amount so arrived at shall be the revised pension.

2. The second calculation to be carried out is as follows. The pension, as had been fixed at the time of implementation of the VI CPC recommendations, shall be multiplied by 2.57 to arrive at an alternate value for the revised pension.

Illustration on fixation of pension : Case I : Pensioner ‘A’ retired at last pay drawn of Rs. 79,000 on 30 May, 2015 under the VI CPC regime, having drawn three increments in the scale Rs. 67,000 to Rs. 79,000:

| S.NO. | DESCRIPTION | AMOUNT |

| 1. | Basic Pension fixed in VI CPC | Rs. 39,500 |

| 2. | Initial Pension fixed under Seventh CPC (using a multiple of 2.57) | Rs. 1,01,515-Option 1 |

| 3. | Minimum of the corresponding pay level in 7 CPC | Rs. 1,82,200 |

| 4. | Notional Pay fixation based on 3 increments | Rs. 1,99,100 |

| 5. | 50 percent of the notional pay so arrived | Rs. 99,550-Option 2 |

| 6. | Pension amount admissible (higher of Option 1 and 2) | Rs. 1,01,515 |

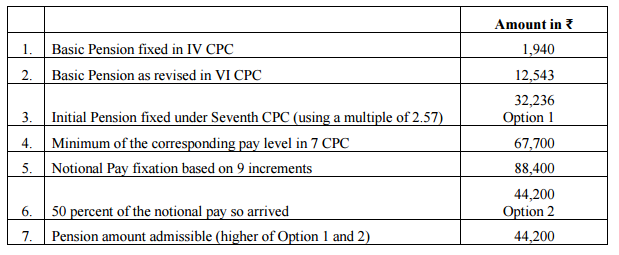

Case II : Pensioner ‘B’ retired at last pay drawn of ₹4,000 on 31 January, 1989 under the IV CPC regime, having drawn 9 increments in the pay scale of ₹3000-100-3500-125-4500:

| S.NO. | DESCRIPTION | AMOUNT |

| 1. | Basic Pension fixed in IV CPC | Rs. 1,940 |

| 2. | Basic Pension as revised in VI CPC | Rs. 12,543 |

| 3. | Initial Pension fixed under Seventh CPC (using a multiple of 2.57) | Rs. 32,236 Option 1 |

| 4. | Minimum of the corresponding pay level in 7 CPC | Rs. 67,700 |

| 5. | Notional Pay fixation based on 9 increments | Rs. 88,400 |

| 6. | 50 percent of the notional pay so arrived | Rs. 44,200 Option 2 |

| 7. | Pension amount admissible (higher of Option 1 and 2) | Rs. 44,200 |

Reference Orders:

Revision of Pension of pre-2016 Pensioners and Family Pensioners – DoPPW OM dt. 12.5.2017

Revision of Pension of Pre-2016 Pensioners and Family Pensioners – DoPPW OM dt. 4.8.2016

| Retired in 4th CPC regime (Retired on 31.12.1984) | ||

| S.No. | Description | 1st case |

| 1 | Date of Retirement | 31.12.1984 |

| 2 | Scale of Pay (or Pay Band & GP) at the time of retirement Or Notional pay scale as on 1.1.1986 for those retired before 1.1.1986 | 975 – 1660 (4th CPC Scale) |

| 3 | Pay on retirement Or Notional pay as on 1.1.1986 for those retired before 1.1.1986 | Rs. 1210 |

| 4 | Pension as on 1.1.2016 before revision | Rs. 4191 |

| 5 | Family pension as on 1.1.2016 before revision | Rs. 3500 |

| 6 | Family pension at enhanced rate as on 1.1.2016 before revision (if applicable) | NA |

| 7 | Revised pension by multiplying pre-revised pension by 2.57 | Rs. 10,771 |

| 8 | Revised family pension by multiplying pre-revised pension by 2.57 | Rs. 9,900 |

| 9 | Revised family at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | NA |

| 10 | Pay fixed on notional basis on 1.1.1996 | Rs. 3,710 (3200-4900) |

| 11 | Pay fixed on notional basis on 1.1.2006 | Rs. 8,910 (PB-1, GP 2000) |

| 12 | Pay fixed on notional basis on 1.1.2016 | Rs. 23,100 (Level-3) |

| 13 | Revised pension w.e.f. 1.1.2016 as per first formulation | Rs. 11,550 |

| 14 | Revised family pension w.e.f. 1.1.2016 as per first formulation | Rs. 9,000 |

| 15 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation | NA |

| 16 | Revised pension payable (Higher of S.No.7 and 13) | Rs. 11,550 |

| 17 | Revised family pension payable (Higher of S.No.8 and 14) | Rs. 9,000 |

| 18 | Revised family at enhanced rate payable (Higher of S.No.9 and 15) | NA |

| Retired in 4th CPC regime (Retired on 31.01.1989) | ||

| S.No. | Description | 2nd case |

| 1 | Date of Retirement | 31.01.1989 |

| 2 | Scale of Pay (or Pay Band & GP) at the time of retirement Or Notional pay scale as on 1.1.1986 for those retired before 1.1.1986 |

3000 – 4550 (4th CPC Scale) |

| 3 | Pay on retirement Or Notional pay as on 1.1.1986 for those retired before 1.1.1986 |

Rs. 4,000 |

| 4 | Pension as on 1.1.2016 before revision | Rs. 12,600 |

| 5 | Family pension as on 1.1.2016 before revision | Rs. 7,560 |

| 6 | Family pension at enhanced rate as on 1.1.2016 before revision (if applicable) | NA |

| 7 | Revised pension by multiplying pre-revised pension by 2.57 | Rs. 32,382 |

| 8 | Revised family pension by multiplying pre-revised pension by 2.57 | Rs. 19,430 |

| 9 | Revised family at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | NA |

| 10 | Pay fixed on notional basis on 1.1.1996 | Rs. 11,300 (10,000-15,200) |

| 11 | Pay fixed on notional basis on 1.1.2006 | Rs. 27,620 (PB-3, GP 6600) |

| 12 | Pay fixed on notional basis on 1.1.2016 | Rs. 71,800 (Level-11) |

| 13 | Revised pension w.e.f. 1.1.2016 as per first formulation | Rs. 35,900 |

| 14 | Revised family pension w.e.f. 1.1.2016 as per first formulation | Rs. 21,540 |

| 15 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation | NA |

| 16 | Revised pension payable (Higher of S.No.7 and 13) | Rs. 35,900 |

| 17 | Revised family pension payable (Higher of S.No.8 and 14) | Rs. 21,540 |

| 18 | Revised family at enhanced rate payable (Higher of S.No.9 and 15) | NA |

| Retired in 5th CPC regime (Retired on 30.06.1999) | ||

| S.No. | Description | 3rd case |

| 1 | Date of Retirement | 30.06.1999 |

| 2 | Scale of Pay (or Pay Band & GP) at the time of retirement Or Notional pay scale as on 1.1.1986 for those retired before 1.1.1986 |

4000 – 6000 (5th CPC Scale) |

| 3 | Pay on retirement Or Notional pay as on 1.1.1986 for those retired before 1.1.1986 |

Rs. 4,800 |

| 4 | Pension as on 1.1.2016 before revision | Rs. 5,424 |

| 5 | Family pension as on 1.1.2016 before revision | Rs. 3,500 |

| 6 | Family pension at enhanced rate as on 1.1.2016 before revision (if applicable) | NA |

| 7 | Revised pension by multiplying pre-revised pension by 2.57 | Rs. 13,940 |

| 8 | Revised family pension by multiplying pre-revised pension by 2.57 | Rs. 9,000 |

| 9 | Revised family at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | NA |

| 10 | Pay fixed on notional basis on 1.1.1996 | NA |

| 11 | Pay fixed on notional basis on 1.1.2006 | Rs. 11,330 (PB-1, GP 2400) |

| 12 | Pay fixed on notional basis on 1.1.2016 | Rs. 29,600 (Level-4) |

| 13 | Revised pension w.e.f. 1.1.2016 as per first formulation | Rs. 14,800 |

| 14 | Revised family pension w.e.f. 1.1.2016 as per first formulation | Rs. 9,000 |

| 15 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation | NA |

| 16 | Revised pension payable (Higher of S.No.7 and 13) | Rs. 14,800 |

| 17 | Revised family pension payable (Higher of S.No.8 and 14) | Rs. 9,000 |

| 18 | Revised family at enhanced rate payable (Higher of S.No.9 and 15) | NA |

| Retired in 6th CPC regime (Retired on 31.05.2015) | ||

| S.No. | Description | 4th case |

| 1 | Date of Retirement | 31.05.2015 |

| 2 | Scale of Pay (or Pay Band & GP) at the time of retirement Or Notional pay scale as on 1.1.1986 for those retired before 1.1.1986 |

67000-79000 (6th CPC Scale) |

| 3 | Pay on retirement Or Notional pay as on 1.1.1986 for those retired before 1.1.1986 |

Rs. 79,000 |

| 4 | Pension as on 1.1.2016 before revision | Rs. 39,500 |

| 5 | Family pension as on 1.1.2016 before revision | Rs. 23,700 |

| 6 | Family pension at enhanced rate as on 1.1.2016 before revision (if applicable) | Rs. 39,500 |

| 7 | Revised pension by multiplying pre-revised pension by 2.57 | Rs. 1,01,515 |

| 8 | Revised family pension by multiplying pre-revised pension by 2.57 | Rs. 60,909 |

| 9 | Revised family at enhanced rate by multiplying pre-revised enhanced family pension by 2.57 | Rs. 1,01,515 |

| 10 | Pay fixed on notional basis on 1.1.1996 | NA |

| 11 | Pay fixed on notional basis on 1.1.2006 | NA |

| 12 | Pay fixed on notional basis on 1.1.2016 | Rs. 2,05,100 (Level-15) |

| 13 | Revised pension w.e.f. 1.1.2016 as per first formulation | Rs. 1,02,550 |

| 14 | Revised family pension w.e.f. 1.1.2016 as per first formulation | Rs. 61,530 |

| 15 | Revised family pension at enhanced rate w.e.f. 1.1.2016 as per first formulation | Rs. 1,02,550 |

| 16 | Revised pension payable (Higher of S.No.7 and 13) | Rs. 1,02,550 |

| 17 | Revised family pension payable (Higher of S.No.8 and 14) | Rs. 61,530 |

| 18 | Revised family at enhanced rate payable (Higher of S.No.9 and 15) | Rs. 1,02,550 |

Details of Central Government Pensioners and Family Pensioners as on 31.03.2019

| S.No. | Type of Pensioners | No. of Pensioners |

| 1 | Civil Pensioners | 10,40,256 |

| 2 | Defence Pensioners | 32,35,730 |

| 3 | Telecom Pensioners | 3,58,000 |

| 4 | Railway Pensioners | 15,73,665 |

| 5 | Postal Pensioners | 3,28,818 |

| Total | 65,36,469 |

More than 65 lakh Central Government pensioners and family pensioners in India as on March, 2019.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

My basic pay was ₹10250 on my retirement in May 1998(after 38 yrs of service) in the 5th CPC scale ₹7500–12000. In 6th CPC my basic pension was fixed at ₹ 11500. What will exactly be my basic pension in 7th CPC?I had earned 11 increments in my scale.

As per your last basic pay 10250 from 1-1-2016 as fixed pension as 31,100 in Concerdance Table 28. If you’re completed 80 years additional pension 20% as 6,220 & D.R. applicable rates as on from 5/2021.

my basic pay was Rs 66000/- at the time of retirement .what will be the pension,

If you are retired after 1-1-2006 50% of basic as pension of Rs.33000 up to 31-12 2015 after 1-1-2016 multiple by 2,57 and as per the matrix level as per your Grade pay by 50% as pension.

If you are retired after 1-1-2006 50% of basic as pension of Rs.33000 up to 31-12 2015 after 1-1-2016 multiple by 2.57 and as per the matrix level in your Grade pay by 50% as pension.

My self send massage since log,

My self retired on 31.12.2015, with any breck, commleted 40y 9m 14 days railway service,in GD pay 4800/ last pay 31060/,

Last parmotion Aug-sept 2008,but mocp will grant in 1.1.2006.

Entry pay fixed on 6cpc also.

Plz arrange fixed as per rule my pay & pension ,

Thanks.

S Ramamurthy

I retired as Deputy General Manager from Ordnance Factories Min.of Defence on 31.10.1992 in the scale of 4500-150-5700 and I was drawing 4950 with 3 increments to my credit.As per one of the concordance table of 7th CPC with 3 increments for level 13 officers applying 2.67 factor my pension should have been fixed at 65300 in the paymatrix of 7th CPC of 130600.as on 1.1.2016.

But my pensin has been fixed at 61550.All my efforts to approach various agencies and concerned departments have failed.

Could somebody help me to sort out my problem

Multiplying factor in 7th CPC for all 2.57 only, the entry pay calculation is 2.67 and minimum in level 13 as basic pay is Rs.123100/- 50% pension as Rs.61550/- only. Your increments counted of your last pay. As per the last pay your pension is decided.

I am Retd.Dy.Commissioner of Incometax.I retired on 31-05-2009 having last basic pay+grade pay of 29530/-& consequently pension was fixed at 14765/-.As per seventh CPC I Retd.in level 11 & consequently my revised pension is fixed as per Concordance table at 38100/-.Wlth the same basic,if I would have Retd in lower level ,say level 6, level 9 etc.my pension as per concordance table would have been fixed at 39250/-.It means that if I would have Retd.with same pension amount fixed in 6th CPC in the lower level,I would have bee benefitted.This anomaly should have been redressed.I also applied to Chairman ,CBDT with required details to remove this anomaly but did not heard anything from him.When this fact was brought toConfederation Secretary Shri.Krishan,he told that the when the pay metrics tables are revised it will automatically be resolved.However,till this date I heard nothing.Can I expect the justice now?

Dear Sir,

I took volunteer retirment from Army on Feb 2017 after completion of 20 years and 10 months of service but the pension of new pay commission yet not started. Is any formailities required to do our side. kindly infom me if any terms require to do my side.

What would have been my basic pension on 1.1.2016 in 7CPC when I retired on superannuation on 1st of April 2009 (DOR: 31st March 2009) where I was in Pay Band of Rs 9,300-34,800 (6PC) and in Grade Pay of Rs 5,400 and Last Pay Drawn was Rs 25,090; and I was also on HPL for 7days during the last 10 months service?

I retired as Investigator (Statistics) with Rs.9900 as basic pay in the scale of Rs.6500-200-10500 on 31.01.2003 from Ministry of Health & Family Welfare, Government of India, New Delhi – 110011. Subsequent to my retirement, the post had been upgraded in the scale of Rs. 7450-225-11500.and my pension had been fixed at Rs. 11074 in the scale of Rs.9300-34800 with Rs.4600 as grade pay as per 6th CPC. I am given to understand that my pension is being fixed as Rs. 29300 as per Concordance table 24 of 7th CPC. I feel that my pension be fixed as Rs. 30200 as per Concordance table 26 by taking into consideration the PPO for revision of pension at the time of implementation of 6th CPC issued by the MOHFW.

Sir as many times I had requested regarding my modified pension but still I could not get my request, I retired 2003 in the my pay scale was 6500 200 10500, at sixth CPC I was fixed basic 9289, then 7th CPC I was given basic pay 23873 so what will be my new modified pension,Kindly give me the details Thank you with Regards, Damodar Kandpal contact no.8169536141.

My Retirement on31 -10-2005 My Basic 16125 in the Grade 12000-375 -16500 completed 34 years service at present I am drawing 46500 pension what will be my 7 th pay commission pension.

I,am a central Govt employee absorbed in PSU in 1982. My scale of pay was Rs/550-20-650-25-750, and my total salary was Rs965/- for the month of june 1980. I took lumpsum amount in leau of pension. After 15 years I was granted 1/3 rd pension of RS2033 for life and DR pay of Rs3500 w.e.f.01-01-2006.

In view of Supream court judjement iam eligeble for full pension .

I request you knowledgeble gentle men to help to know my pension.

Thanks & regards

p.janakiramulu.

Government has not accepted the 7CPC recommendation and that way the discrimination between a prre 2016 (particularly pre 1996) pensioner and a post pensioner, retiring from same/equal post and from the same stage in the pay scale/notional pay band still continues. Government should take steps to remove this discrimination.

I was retired on31-03-2003&my pay scale was10000′-325-15200.my pay at the timE of retirement was Rs 10975/.What will be my revise pension we 01-01-2017..According to calculation I am suppose to get Rs37000/-pension because my stage was 4th ìn retirement scale.

In the month of August 2016 the Govt announces that the pensioners will get the arrears of 7th pay commission in the month of september 2016. But till date no such arear or increased pension has been been. How long the BJP govt will befool the pensioners of defence forces.

Is there any hope to get the increased pension before Dipawali i.e 29/10/16 ? It seems that Government does’t have any formula for simple calculation along with employees. If does’t, then must have stopped the payment of all the central employees..

Or spreads the rumorer as election factor….. Is it ?

When govt will calculate pension on the basis of matrix and number of increments drawn in the same grade

From V. VENKATAKRISHNAN

RETIRED ON 31-3-1995 AFTER 38 YEARS SERVICE IN ICF.CHENNAI

MY PPO NO.IS 1001208330-DISBURING BANK-INDIAN BANK-CHROMEPET BRANCH-CHENNAI-44

My pre-2006 pension is not yet revised as on date 3-10-2016. as per 6th cpc recommendation. but as on date 7th cpc recommendation is given effect as per the old rate of pension.

till date no revision as per 6th cpc is received with arrears .

kindly look into this matter

My basic pension as on 1/1/2006 was fixed as Rs.14755.I retired On 28/02/2002 at the basic pay of Rs.13250/_pm in Sr.scale. scale Rs.10000-325-15200 and my pension was fixed as Rs. 6528.Now what will be my pension after fixation as per 7th.CPC.

From the illustrations,it can be seen that the amount indicated in column 15 index no 1 is taken as minimum of the pay in the 7 th cpc on that 3 increments amounting to Rs16,900/= has been added and arrived at Rs.1,99,100/=i.e.index no 4 in column 15.Similarly those who could not earn any increment has to be 50%of the index I in column 15.which is works out to Rs 91,100/=whereas if his basic pension of Rs39,500 multiply by 2.57 works out to Rs 1,01,515.HENCE he can opt for option 2 i.e beneficial.SIMILARLY whose basic 50%of minimum in the pay matrix is beneficial ,instead of multiplying factor of 2.57,his pension has to be fixed at 50%of the minimumin paymatrix.

one illustration;=basic pension in the scale of pay of RS15,600–39,100 with grade pay of Rs.6,600/=has been fixed at Rs 12,600/= in 6 th cpc ,multiplied by 2.57 works out to Rs 32,382/=Minimum in the paymatrix is Rs 67,700/= in column 11 0f the paymatrix.50%on that works out to Rs.33,850/=His pension has to be refixed at Rs 33,850/=instead of the 32,382/=fixed from 1-1-2016.this has to be taken into account while revising the pension.

My pension basic as on FEB 2015 (retired) was 11400.

Pay scale 9300-34800

Pay grade 4600

Last payment basic 21370,pay grade 4800 = 26170

Increment 10 (since jan 2006)

Please let me know my new basic in option 1 n option 2 separately.(7pay commission)

I took voluntary retirement from 30/06/1981 and was in the 3rd PC grade: 1500-60-1800-100-2000 (with a Special pay of Rs.200/) at the maximum of the grade on that date..

My notional pay was fixed at 4775/-(incl. spl.pay of 200/-) in the 4th PC scale 3700-5000 as on 01/01/86. taking seven increments I had in the 3rd PC scale .

My pay in 5th PC scale was fixed in the grade :12000 – 16500 and revised pension based on 50% pay was fixed at 5518/ +DR.

My 6th PC pay was fixed in the grade: PB3+GP of 7600 and pension was fixed at 12,472/-.with effect from -01/01/2006.

This pension was revised to 14960/= with retrospective effect from 01/01/2006 based on DOP OM: 38/37/08-P&PW(A) dt. 06/04/2016.

I would like to know the correctness of the fixations under various PCs.especially the 5th PC fixation.which appears to have completely ignored the increments in the previous scales.

My pension basic as on May 2015 (retired) was 13085.

Pay scale 9300-34800

Pay grade 4800

Last payment basic 21370,pay grade 4800 = 26170

Increment 6 (since Sept 2008)

Please let me know my new basic in option 1 n option 2 separately.(7pay commission)

I am pre pensioner of 2016, so in the 2006 pay commission rs 22000/-arrears. In the 7th pay commission I received half of the amount i:e rs 12500/-this is the lowest increase history of the CPC, I hope we will get on the anomaly recommendation, thanks.

I retired from CPWD on31-03-2003. My pay scale was10000-325-15200. Mygrade pay was 6600/- as per 6th pay commission (PB3). My basic pension was fixed Rs 12600/ wef 01-01-2016. I got Three increments in the scale of 10000-325-15200 at the time of retirement in 2003.

According to option 1 my pesion becomes 12600×2.57= 32282/pm

According to option 2 taking into cosideration of three increment the pension comes to Rs 37000/-per month. I may be advise to whom I should asked for .Whether it will be done By CPAO or the PAO (NZ) New Delhi.I will be greatful if I know whom it is to be approached for early action for revise fixation of pension.

I RETIRED FROM MIN OF FINANCE , DEPTT OF REVENUE, COMM OF CUSTOMS ON 1.3.2002. On 23.2.2002 i was promoted to gr. A on Assured Career Progression scheme. But these 5 days, ACP benefit was not given effect to while fixing my pension. thereby losing a handsome amount for so long. I do not know whom to approach in this regard. Can any good Sammeritan. help me out? Thanks.

Non consideration of gp of rupees 4600 granted to pre 2006 retirees for computing pension benefits under option 1 of 7 cpc will put to a huge financial loss to them,nearly 3000 to 5000 rupees will be deprived to them.

In this regard,it seems the P & T Karnataka pensioners association has gone to the court . Where does this matter stand?.

Please comment.

Who would do the exercise of verifying how many increments one had drawn in the Grade in which one has retired. Is it the PAO of the Ministry concerned or the CPAO. Apparently, the PAO of the Office concerned.

On had retired at the maximum of the scale then prevailing, even earning one stagnation increment, in May 1988. The person was a Senioir PA (Gazetted) and was in that grade from early 1979 till he retired. The Ministry of Finance had upgraded the Grade Pay from 4200 to 4600 or 4800 in September 2009.

However, the Pay Matix Tabl;e does not reflect this change. To whom should such a one who is now 87 years, represent to get things corrected and obtain correct fixation of basic pension as from 1.1.2016.

I had retired on January 31, 2012 and my basic pension was calculated as Rs 8925/- pm. Prior to my retirement my grade pay was Rs4200/- in the scale of 9300-34800. Now the 7th pay commission has recommended Rs 4600/- as grade pay against my rank w.e.f. January 01,2016.

Kindly inform if the revised grade pay would be effective for calculation of my revised pension.

Thanks.

Option 1 for pensioners

I was in equivant grade pay 4800 in Nov 1982 would have got 28 increments till retirement in Jun 2011 pension according to be matrix is 109100/2== 54550. But getting 3 dept promotions I retd in grade 7600& getting only 2 increments, pension works out as per optio1 is 83600/2 == 41800 & as per option 2 pension is 45643.

Seems Matrix table is more beneficial to those got more & more increments in last post. Pls check other examples

I retired in April 1999 in the pay scale 7450-225-11500 and the last pay drawn at the time of retirement was Rs.9925/. The basic revised pension as per 6th pay commission(wef 1-1-2006 is 11218/-How am I to arrive at the no. of increments earned at the retiring level? Am I correct with the assumption that no. of increments earned is eleven ? because basic pension fixed ( 9925/-) minus the minimu of scale( 7450/-) being 2475/- divided by the rate of increment ie. 225/- works out to 11. If so, kindly let me know my entitlement of pension under BOTH the options thanks

I would like to know for pension fixation the matrix table is refered after multiplying the existing pension of 6cpc with 2.57 before arriving at new pension of 7 th cpc? Can I get the answer in my e mail?

I was compulsorily retired in 1998. My grade pay was 4200 in 6 th cpc. i have rendered 19 years 11 months 10 days service. I am drawing pension Rs 4164 from 1.1.2006. My scale of pay was 5500-175-9000. at the time of retirement. Kindly fix my pension in 7th cpc.

Whome should I approach for calculation and fixation of pension based on increments. I am a civil pensioner drawing pension from IOB. During 6th pay commission my took action. Should I approach My bank or my office . Or pension office at Allahabad?

can any one help?

OPTION-1 GIVEN BY 7th CPC is feasible and can be implemented. During 6th CPC fixation I HAD ALREADY LOST four (4) increments in SA GRADE AND HAD BECOME A RECURRING LOSS TO ME and THIS LOSS CAN BE stopped even from now by adopting OPTION-1..I am having all the details & should be the case with almost all the pensioners AND THE PPOs (pension paying offices/authorities).

I THEREFORE REQUEST THE GOVERNMENT TO READILY ACCEPT THE 7th CPC RECOMENDATION WITHOUT ANY AGITATION & DELAY.

WHEN THE GAZETTE NOTIFICATION WILL BE ISSUED.

Retirement dated 31.05.2013 with Pay Band Rs.9300 – 34800 (6 PC)grade pay=Rs. 4800/-. with no increment in the Pay Band Last pay drawn =Rs.23280/-..Revised Basic Pension=11640/-.Revised Pension Commuted Rs.4656/-.Revised Reduced Pension = Rs.6984/-.

How much total monthly pension will be effected from January 2016,= & how much w.e.f. August,2016 & how much arrear I will get ?..

It would be in the fitness of things if uniform increase is allowed in respect of pensioners retired during the course of various pay commissions. In the present system an employee retired in the lower post/ lower scale of pay gets very much higher pension than the employee retired in the higher post/scale of pay. This can be easily identifiable and analysed so that all pensioners will get right increase depending upon their length of service and the cadre in which they served. This is only a suggestion and may or may not be ignored.

As per recommendation of 6thCPC, post carrying Rs.6550-10500 were upgraded to Rs.7450-11500 and allotted Rs.9300-34800+GP Rs.4600 as against corresponding pay scale as Rs.9300-34800+ GP Rs.4200. In some case, an employee who was working in Rs.6500-10500 prior to 01.01.2006 and upgraded to Rs.7450-11500 and allotted GP Rs 4600/ then how his service prior to 01.01.2006 to reckoned for the purpose of increments at the time of his retirement? Whether his service prior to 01.01.2006 will be considered for the purpose of increment for the purpose of pension as per OPTION N0 2. Similar will be situation in case of merged grades of Rs.5000-8000 & Rs.5500-9000 and allotted Rs.6500-10500 and the corresponding scale is Rs.PB-2 Rs 9300-34800+ GP Rs.4200. This needs clarification to avoid loss of pension.

There is an anomaly in the fixation of those who are retired on the 6th CPC and those who are retiring in 7 th CPC. The illustration below will explain the position.

Pay of Mr.X at the time of retirement in Dec.2015 and pension.

Pay in PB .3 : Rs.25000

GP : Rs.5400

Pension in 6th CPC Rs.15200

Pension in 7 th CPC Rs.39064 say 39070

Pay of Mr.Y retired in Jan 2016 and pension

Pay in PB.3 of 6 th CPC Rs.25000

GP in 6 th CPC Rs.5400

Pay fixed in 7 th CPC Rs.80000

Pension fixed Rs.40000

in the first method it can be seen that two employees drawing same basic pay gets different pension ie., who retired in 6 th CPC gets a pension less Rs.930 than the other assuming he gets no benefit in the second option of pension.

Fight for a pension matrix on the same lines of pay matrix to avoid anomaly.

In the exampleRe 3000-100-3500-125-4500: Words increments earned shoulld be substituted by the words “INCREMENTS DEEMED TO HAVE EARNED TO ARRIVE AT THE PAY GOVT SERVANT WAS DRAWING AT THE TIME OF RETIREMENT” in that Scale of Pay. Its necessary e.g. if pay is fixed at 4375 in the abovementioned scale he should be deemed to have earned 12 increments,, to get indexation at 13 in the matrix table.

My basic pension is Rs 11915/-. Commuted pension is Rs 7149/-. DA @ 125% on Rs 11915 comes to Rs. 14894/-. Total monthly pension is Rs 22043/-. My pay band is Pay Band II and grade pay Rs 4800/-. what is my new pension as per 7th pay commission recommendations

On retirement from the Railway on 30.4.2004 as Head Clerk in scale 5000-150-8000 with my last pay 10200(6800+3400) I was given 3333(pro rata) which was revised as 5022 in the 6th cpc. Now my pension has been revised as 6750 from 1.1.2006 as per Govt letter dated 6.4.2016. Hope Railway will revise my pension as per 7th cpc based on latest revision.

K Rajamanickam

28.7.2016

There is anamoly in pension fixation options given by 7th pay commission as explained under:-A retires on 31/12/15 with BP-14225/- in grade 10000-15200

His B.pension fixed as per VI p.c. is 16075/- pay band-15600-39100 G.P. 7600/- OPTION-1 Pension is to be fixed at 16075*2.57=41312 Option-II as he has earned 13 increments in the retiring scale his basic pension based on increments will be fixed at 56200.Now a personB retires on 31/1/06 with same basic pay 14225/- fixed at 14225*1.86+7600 GP=34060/- & pension fixed at 17030.so his pension as per VII PC will be fixed either at 17030*2.57=43767/- or by II option based on increments will be 78800/2=39400/-(As he has not earned any increment in retiring scale )so forA higher of the two option will be 57900 while for B it will be 43767 .Will you pl.clarify?

Government should be clarified the clear concept by gazette notifications for pensioners getting their pensions from August, 2016.

I retired on 31.12.2014 in the Pay Band-IV (Rs 37,400-67,000) with grade pay of Rs 10,000 and last pay drawn being Rs 67,000. My pension has been fixed at Rs 38,500 and after commutation it is Rs 23,100. Can you please let me know what will be my pension after 7th CPC. As per the 7th CPC calculator, the pension is shown as Rs 98,945 with old pension being Rs 38,500. It is hoped that there will not be any deduction on account of commutation. I will be grateful if this point is clarified.

Basic pension of a person in vi pay commission is 10000/-after commutation of 40 pct he is getting net pension 10000-4000=6000/-plus da on 10000/-,in seventh pay commission his basic pension would be 10000×2.57=25700 and net pension will be 25700-4000=21700 plus da as on 25700/-

There is no option with pay commission except as stated above where in vi pay commission if one person have 10000 basic pension, his basic pension in vii. pay commission would be 10000×2.57=25700 and net pension would be 25700-4000=21700 as on 1-1-2016

To, Ashok Kumar Sainani,

I have not read this at any place, but I think commutation will be counted as amount of pension commuted, instead of percentage of pension commuted. So your new pension will be 25700-4000=21700. Again, I have no information about this, but I hope calculation will be like that.

many sites are showing the way of calculation of pension . there are two ways of calculation of new basic . Then it is divided by 2 to arrive at new pension . But there is another factor witch will effect it and it is commutation portion . Mostly employees opt for 40 % commutation. If 40% is calculated for new pension it will decrease the real pension of a person .So how it will be treated has not been clarified by any body. .e.g. .old basic pension 1oooo less 40% = 6000 plus D.A. @ 125% =12500. Total pension 6000+ 12500+ 18500.

New pension 2.57times= 25700.less 40% =15420 witch is lesser. S0 any clarifications.

EACH CASE WILL HAVE TO BE LOOKED INTO SEPARATELY.

IN No . OF PENSIONERS CASE 20% OR 40% HAS BEEN ADDED DUE TO ATTAINING THE AGE OF 80 OR 85 . HOW THIS EFFECT WILL BE GIVEN WHILE ARRIVING AT NEW PENSION ? I AM ABOVE 80 AND MY NET PENSION IS

34418 /- ( EXCLUDING MEDICAL ALLOW. ) WHAT WOULD BE MY PENSION W.E.F 1-1-2016 ?

It is possible to impliment option 1. Since all informatin such as pay scale ,last basic drawn,available in pension order and no. of incriment can be calculated from these information. pl. repreent this matter to FM, Secretory burocates.

Sri.Ramamoorthy, U say that at the time of ur retirement in 1992, ur lpd was 4950 and pension fixed at 2475 and further u say that after 6cpc, ur basic pay was fixed at 23050 which is difficult to understand. It could be ur pension which would have got fixed at 23050.. and subsequently at 24195., and including the 20%, it works out to 28035 and the option 2 of 7cpc applied, it works out to 72050 and further when option 1 becomes available, it needs to be worked out on the basis of ur no.of increments u drew in ur retiring level.If u can furnish those details like ur scale, in which u worked, it can be worked out.

Sir, I have retired on VR w.e.f. 5.3.2014. My pension is 12480 and reduced pension is Rs.7488 (i.e after deducting the 40% commutation). My Pay band is 9300-34800(PB2- 4800). Kindly calculate my revised pension to be taken w..e.f 1.1.2016

As per 6th CPC my pension was fixed Rs 10120 in pay band 2 with grade pay Rs.5400/=..At the time of my retirement I was getting more than 9 increments in my pay band 2 scale.Further I was getting 50% more amount of my increment amount as I was working as adhock on higher post in pay band 3 with grade pay Rs 5400/=.Kindly intimate me whether I may get 9 or 10 increment for fixing of my pension in 7th cpc.

SURENDRA SINGH

After complecting 80 Years Special Basic Pension was incresed by 20% as per 6th commission .. Is it 20% on New Revised Basic Pension after implementation of 7 th commission. Kindly clarify.

Pension Disbursing Authorities should work out Option I and Option II and fix pension very early and arrange payment to pensioners early.

I retired from Ordnance Factories on 31.10.1992 in the pay scale of Rs 4500-5700.My pension was fixed at Rs 2475 as I was drawing pay of Rs 4950.at the time of retirement. Subsequently as per 6th pc my basic pay was fixed at Rs 23050 which was raised to Rs 24195 as per CAT order and court ruling.After attaining the age of 80 yrs my basic pension was raised to Rs 29034 allowing 20% increase.Now as on 1.1.2016 I am drawing pension Rs 65327 including 125% DA.

I would like to know at what basic pay I would be fixed as per 7 th PC and approved by Govt.

As indicated by 7 th PC I should be fixed at Rs 81005 allowing 24% increase from the present level.

Kindly confirm.

As per illustration of case No.II Pensioner B Pension has been arrived at Rs.44.200/- being the half of Basic Pay of Amount of Rs.88,400 as per the recommendations of the 7th CPC ..In the end it simply states as Pension which should have been mentioned as New Basic Pension as per 7th CPC .It also does not mention whether 125% Dearness Relief admissible to a Pensioner should be added with the new basic pay and paid to the Pensioner. This aspect needs clarification.

Is there any change in minimum family pension according to 7th CPC?

My Drear Murleedharan

your doubt is totally wrong the 7th pay commission pension fixation is not applicable to BSNL retirees. The BSNL pensioners are governed by PSU pay scale and accordingly their pension is fixed. The PSU 3rd PRC is due from 1-1-2017 and the Govt. has already issued its notification on 9-6-2016 from Department of public Enterprises New delhi to review the pay revision of executives level only. However we have to struggle to review pay revision of Gr.C.& D as well pension revision of BSNL retirees from 1-1-2017. Please dont expect anything under 7th CPC for BSNL retiree.

Sri.Muraleedharan,

Ur 7cpc pension would be on ur present pension of 12899, and it is also subject to option 1, which a committee would study and give report after 4 months and then, ur new pension as per option 1 would be based on the no. of increments u have drawn in ur retiring level and out of the 2 options, whichever gives more, would be fixed for u, and it is generally seen that option 1 would give better pension.

I retired from BSNL on 31/08/2006 .I joined service in the then P&T Dept on 17-12-1966. Scale of pay at the time of retirement was7800-225-11175. Total length of qualifying service is 39 years 8months 4days On implementing the.6thCPC recomendations pension was fixed w.e.f 01/01/2007@12899 and residual pension 10548..When 7thCPC recomendation is implemented the enhancement will be 12899×2.57 and residual pension 10568×2.57 is it not .Kindly clarify my doubt Thanking you R. Muraleedharan

I retired on 31.03.2007 I joined in Rly on 19 /03/1969 till retd there is no any adverse comments in my favour , at the time of retd my scale was Rs,7450-225=11500 &lase pay was Rs,11050 +allowances i,e.total was Rs.24366/- but subsi quentally I got promotion in scale uf Rs.7500-250-12000/- just 04 days obefore my retirement accordingly pension refixed.At present i am drawing pension Rs.24476/-Kindly let me know the as per vii cpc what will my pension. with regards, thanking you. Samiran Ray 19/06/2016

I retired on 31.08.2010 after seving a net qualifying period of 39yrs 11mths 16 days. My scale was 15600-39100 gp 6600. My basic pension was fixed at 18280. My last basic pay was 36560. Kindly inform what will be my pension on vii pay cõmm. Regards Asim Sarkar.

what about those who retired in 1979 worked as sub postmaster for more than 33 years and retired as a gazetted officer, now , will they calculate his pension properly>

my father expired in 16 Apr 1978 he was having 26 0519(YYMMDD) he was died at the post of steno(SG) in his Notional pay scale as on 1.1.86 in the scale of 1400-040–050-2300 and it was fixed 1560 QS-25-05-19 wef 1.1..96

and than 1-1-2006 3500(Minimum) now my mother is asking what will her pension she is 82 yers old.

I. TOOK V.R.S .ON 25/04/2016. MY BASIC PENSION WAS. FIXED AT RS.11400 & COMMUTATION WAS. FIXED AT RS . 4560/- WHAT WILL BE MY PENSION IN 7 TH PAY COMMISSION., SCALE PAY 9300- 34800. GRADE. PÀY. RS. 4600. I AM À PHYSICALLY HANDICAPPED WILL I. GET CONVENIENCE ALLOENCE

Sir it is not understood that DA 6% include in revised pension as per calculated chart please clarify in general thanking you V R Patil rtd AAO

Whether DA will be merged in the revision ? If so what will be the existing rate of DA ?

Is there merger of da is there or not

How calculate pension for commutation facility holder as per 7th pay commission.

after calculation of pension who retired before 2016 whether commuted amount will be deducted. if this case applicable for case 1 and case 2, pl clarify.

Reply to Mr Ranganath Rao,

The 20% of rise has to be calculated on 7 cpc pension only

I retired from telecom deptt. On 31-05-1997 My basic pension fixed Rs 1020. My total service was 32years 8months28 days. My pension revised Rs3157 as per 5th pay commission.& again basic pension revised Rs 7136 as 6th pay commission. Now govt. ordered pre.2006 pensioners having less than 33years will get full 33 service benefit.pl.tell will my basic pension revise ?

It is not understood whether 2.57 factor is to be multiplied with basic pension fixed by sixth pay commission or it should be multiplied with basic pension given by OROP. PSE clarify.

How to calculate Family Pension for unmarried daughter. Please give some suggestions.

How to calculate 20% basic pension for pensioners completed 80 years. Is it 20% on 7th pay commission Basic Pension?.

After retirement all central government employees should get equal pension based on their pension fixed.Also number of years service completed should be applicable same to all.

it is not under stood whether the DA of 119% is meged with the new Basic Pension?

Sir my basic pension 7850.after commute pension received 13738 p.m.my retirement date 01 Mar 2016.Rank ACP HAV, Service 19 year. please tell me what will my pension from 01 jan 2016.

I wish go on voluntary Retirement wef 30 Apr 2017. May I know pension calculation and retirement benefit. Also intimate commutataion table

7th CPC pay and pension calculator must be easy so that everybody should calculate easily. 7th CPC Committee should take action on this immediately.

Thanks.

In which amount of pension will be multipuled by 2.57? After commuted orwithout commuted?

This is not enough.

Govt must write simple formula to calculate the pension of 7th pay comn,

As like One rank one pension calculator.

Every one easily calculate his pension.

You are requested do like that.

Sir,

I was appointed as Stenographer way back in March 1990.and presently drawing BP 16530+ Grade Pay 4600=21,130 what will be my pension if I take VRS in January 2017 i.e after implementation of 7th CPC .

Kindly intimate to my email mentioned above.

Sir

I got retired on 31/10/2012 I m getting 12861/- as a pension including DA my grade pay is 2800/- & my basic pay is 7610/-. My service is 16 years. what will be my new pension as per 7th pay commission

Payment of Pension should be the ‘Amount required to lead his and spouse’s lives’ as per VDA rules .Not acc. to his previous service. Govt of India.must change BRITISHERS METHOD to Independent INDIAS rules .This govt. cannot and will not change..Already D A is paid @180% of Basic Salary. How is BASIC PAY related Price Increse?

Guresh C Jinaga

16-04-2016

I retired from Army as per OROP my basix is 7598. my service is 16 years. what is the basic pension and grade pay in 7th CPC . Kindly arrange to send at your earliest.

Not satisfied with 7 cc recommendations

Dear Sir,

I took VRS on 1 June 2001. My pay scale was 6500-200-10500. Total service is 25.5 + 5 = 30.5.

My basic pension was Rs 3263/- and subsequently revised to Rs 7528/- during 2012.

My corresponding revised pay scale after VI Pay Commission is 9300-34800 + 4600 Grade Pay, but my pension is based on grade of pay of Rs 4200 (minimum grade pay in the pay band) instead of the upgraded rate of Grade Pay of Rs 4600 only.

What would be the revised pension as per the 7th Pay Commission proposal..

With regards

no benefit in this factor for pensioner as per 7cpc this less than 6cpc

Sir I am getting 7450rs monthly & my basic is 3500rs .so what will be the 7th pay scale hike amount

Respected sir’

My name is karnail Singh. I am retaird on 31jan.2005 . Now my basics pay is 7795. And disability 1755. What is my new pay according to 7th pay commission.

Sir

I got retired on 31/01/2010 I m getting 12800/- as a pension including DA my grade pay is 2800/- & my basic pay is 7550/- what will be my new pension as per 7th pay commission

I retired from navy as PO and drawing 7550 as basic pension what may be my total pension after 7CPC

Sir,

My basic pension is 15650/- I was getting grade pay 6600/-

I am retired in January 2012.

What will be my new pension basic as per 7th pay commission

I have been retired on 28 .02.2015. My basic pay was Rs. 30610.00, Gr.Pay R s 5400.00. What will be the new pension in 7th. CPC.

I have been retired on 30th April, 2011, My GR Pay was 5400 and I have got 3 increments under this grade. As of now, I am getting Rs. 23,121. What will be my Basic Pension and what pension I will get at the implementation of 7th CPC.

Thanks

MY PRESENT PENSION IS 9857 WHAT IS AFTER7 PAY COMISSION my pension 5225/- basic gradepay 1900/- and medical allowalance 500/-and d.a is 6218/-

my basic pension is 36130 after orop. what will be my pension after 7cpc.

Sir.

My basic family pension Rs.4887 + Rs. 977 (20 % for 80 yrs). grade pay Rs.4880.my birthday is 20-2-1931.

May I request my enhanced pension approximately as per 7th pay commision recommendations please.i do not know the increments.

Mrs.aruna baruah

After implementation of OROP, I am getting Rs 18,446/- as 0n 02 Apr 2016. How much I will get total pension after implementation of 7th CPC? Please reply.

SIR,

i HAVE BEEN RETIRED ON 30/11/2015

MY LAST PAY WAS 28070

GR,PAY 5400

THREE INCREMENT RECEIVED UNDER THIS GRADE

WHAT WILL BE THE NEW PENSION IN THE 7TH PAY COMMISSION

Sir

My mother is family pensioner.now basic RS.5280 after implement 7th CPC what will be next basic..

My basic pension fixed is 18700 per month as per VIth pay commission.. I took VRS after completing 21 years service. I am a Maharashtra state Government pensioner. I took VRS with effect from 30th December 2007. Am I eligible for full pension. My basic is fixed after taking 21 years of proportionate service instead of full 33 years. Am I eligible for full pension

I was appointed as civilian Lower Division Clerk on 19.04.1966 in a Defence Establishment. Promoted as Upper Division Clerk in the year 1981.

My designation was changed from UDC to Stenographer Grade III in the

year 1984.

I retired on 31.12.1992 as Stenographer Grade III under Voluntary Retirement Scheme from Southern Air Command, Trivandrum, after completing 26 years, 8 months and 12 days (plus 5 years weightage as applicable in the case of VRS).

I shall be grateful if informed about the exact amount of my pension as per the 7th Pay Commission.

I retired from air force on 31 Jan 2001 after 20yrs of service in the rank of sergeant y group. How much pension I get as par 7CPC.

So far I did not get any arrears. Whether I get orop or not. Because so far I am not benefitted with any pension hike in orop.

Pl reply

sir, i am group y (old gp c) subedar of army .my basic pen is 11970 before orop. now as per orop basic pen is 12268.. what will be my basic pension vide 7th cpc orders??

How to calculate earned increments.

sir,I joined the Army 7th Aug 1971,ORL (OP)GP*C*,In corps of signals After two

years i had converted ORK (operator radio and key board) gp*B. After 18 Years

completion i retired . Now i want to know about my group.

Sir i nb/Sub dalbir Singh Retired dec 2011 service 27y1m I want know orop 7th cpc pension &arrears

my last pay pension basic 11210 & total basic last basic pay 17820 now how much is getting pension on 2016 as per pay commmission.

For family pension we have to compute the pension first as given earlier then 60% of this will be new pension in one case.

other case multiply present family pension by 2.57 and out of these two calculation which one is higher side that will be your family pension.

Thanks.

Mostly pensioners are not providing full information like how many increments they gained in their retirement scale.

Example: I got six increment in my retirement scale and my basic was xxxx with GP: yyyy apart from last pension fixed.

Thanks.

My basic pension is Rs12077/- I took VR in February 1993. What will be my basic pension now in 7th pay commestion.

I am drawing rs.8000.00 as basic pension what will be my pension after 7th cpc

Sir my basick pension isRs 12077/-. What will be my basick pension 7th pay commestion. Kindly replay me through my email. Thanking you sir

I have take my pension 6460 what is out lesion after 7,the cpv

CORRECTION ON MY LAST FEEDBACK MY BASIC PENSION WAS FIXED 7300 WITHOUT COMMUTATION

I RETIRED ON 01 SEP 2012. MY BASIC PAY WAS 10400 AND GP WAS 4200. MY BASIC PENSION WAS FIXED RS 7300 WITH COMMUTATION. NOW AS ON 01 JAN 2016 WHAT WILL BE MY BASIC PENSION WITHOUT COMMUTATION

nothing has been mentioned for family pension fixation anywhere. Please explain the process of fixation of family pension for pre-1996 family pensioners.

My grandfather is getting a pension of rs 8700 what amount must he get after the implement of 7CPC

WE ARE RECIEVING 15830 FAMILY PENSION

WHAT IS OUR PENSION IN 7 TH CPC

I have take 8165 for today date what is my pension in 7 cpc

Dear Adminlstrater/Raghunafhan Gary/Ramloo Garu pl clarify my doubt……I joined as Assoc Prof during 1972 and was promoted as Prof during 1984 and retired in 1998,in the same grade (prof).So I continued in the Same grade for 14 years without any promotion(14 incriments).The scales were revised in 1986 and 1996 according to the Pay Commission’s recommendations.Pl let me know whether I get 14 incriments for fixing the notional pay for pension because I was in the same grade till retirement OR I am eligible only for the incriments I gained after the pay revision in 1996.

As per the Pay Commission’s recommendations the no of incriments gained in the retiring grade (not retiring scale) are eligible for the notional pay rise for fixing the pension.

I shall be extremely grateful for your clarification.

My basic pension after commutatio of Pesion is Rs, 7398 with Grade Pay of Rs. 4800. How much pension I will receiv e after implementation of 7th Pay Commission. Please give me a corerect reply.

I retired in 2012 December. My basic pension after commuted of pension was Rs.7398 and my G.Pay was Rs.4800. How much pension I will get after effecting 7th Pay Commission.

retired on 31st december 2000 .basic was 7015.00and scale was 5500-9000.after 7th cpc what will be my pension.

Sir, I retired on 1/1/1990 from OCS (Min. of Communication) in the scale Rs.425-700 ( technical resignation due conversion into govt. undertaking as V S N L) My basic pension on 1.1.90 was Rs,797/- (Pro-rata) which was raised in 1996 as Rs.2396/- and as on 1.1.2006 it was Rs.5416/- I got 11 increments in the above grade x my pay band by 6th cpc was Rs. 5200-20200. my grade pay was Rs. 2800/- How much will be my pension on 1..1.2016 ?? Kindly help thanks

I retired on 31 dec 2013. My basic pension is 10029,after orop my basic pension will be 10405. What will be my basic pension after 7th cpc.

Sir 20 years service karke my me volantry retairment liya sir abhi basic pension 3500 +da 4165med500 net pension 8165 milthaji seventh pay omission may kithnamilsakth ji

Just like serving employees, pensioners should also require a pension matrix on the line of serving employees i.e, 50 % of the matrix of serving employees .Thereafter the pension to be fixed at the higher end as in the case of serving employees to avoid anomaly. Otherwise an employee drawing similar pay and retired after July 2015 to December 2015 and those to retire from January 2016 to June 2016 will get different pension even if they have drawn same basic pay.

Vas retirement August 31 2011 basic pay 4600 grade pay tot 23300 scale 9300. 34800 present pension 11515 plus da app getting 20200′. How much will get after revision. Thanks

I retired on 31st August 2013. At that time my basic pension was Rs. 1205/- and grade pay was Rs.4600/-. What will my pension after effecting the 7th cpc.

As per case 2, illustration, the basic pension pay as per 6th CPC is Rs.12543/- and according to 7CPC, based on number of increments, it will be Rs.44200/-. This is 3.57, (say 2.57+1), times ie 100% extra benefit compared to most of the case 1, pensioners, coming under2.57 factor of basic pension drawn in 6th CPC. He/she in case 2 illustration is considered in the PB4 slot category.

But for very large number of pensioners belonging to PB3 and lower than PB3, after serving a long time say more than 20years, the benefit on number of increments, over 2.57 factor case 1) works out getting benefit only after 10 increments that too a very meagre increase in benefit.

Most pensioners get only 14.2% as against claimed by 7CPC as 24%.

Presently no statistics is made publicly available with regard to % of pensioners getting benefit under case2 illustration. I feel only less than 5% of pensioners (belong to PB4 or higher category) may be getting a benefit of 24% or higher as per case 2 illustration. If so, this is certainly injustice to a majority of pensionars. .

The no of incriments to decide the notional pay::

1) Is it the no of increments got in the retiring pay scale?

(2). ,, ,, grade.?

Pay scales are changed with every pay commission If somebody retires after getting 14 /15 increments without promotion there would have been. At least One pay revision

And the pay scales are revised. The no of increments in the revised scale would be very much less than no of lncrements in the grade..There is only revision of pay scales and no promotion

Therefore the no of increments for arriving at the notional pay

Should be the no of increments drawn in the GRADE and not the no of increments in the SCALE at the time of retirement. I shall be grateful if somebody clarifies

I got volunteer retirement on Feb 2008 my withdraw pension today is 17750/- what will be. You new pension

What is said in the beginning of this post that the 7CPC has two formulations one for the pre 01.01.2016 and the other for the post 01.01.2016 retirees appears to be incorrect. The two formulations are equally applicable for the pre and post 01.01.2016 pensioners.

My father was working as driver c in central govt, and retired in 2009 and expired in 2014, now mother become beneficiary of getting pension, her basic is Rs 7100 totally she is getting Rs 15640. so please tell us she want to know after this 7th pay how much pay she will get. thanking you

My pay band was 37400__67000,,&.. grade pay wad 9000,,,,my basic was fixed 6 th cpc was 55590…please let me know the No of increment & may basic with bunching benefi according to 7cpc

मा

My orop pension is 33295

What will be my pension now as per 7 cpc

I have been retired on 31 Dec 2012 basic pension 12340/- in scale of ,9300-34800 GP 4800 earned four increments as on 31/12/12/.Kindly fix my basic pension as per new 7 CPC scales.

Reply is still awaited

old pensin benifite VII CPC ONLY DUST PIN

Sir,

I opted for VR on 01-05-1983. The post was lecturer in geography. The scale of pay was 700-40-1100-50-1600. I worked for nearly 8 years but retired shortly before drawing the 8th increment; thus after 7 full increments my basic was 980. [I rose through ranks class iii & ii to reach class 1 in 18 years] That was in the 3rd pay commission scale. Basic pension was fixed as Rs 595. As I was working in Government college Port Blair my appointment was after UPSC selection. Thus I was a Group ‘A’ in cadre; I hope. I am not sure if my pension is reset correctly, as per 4th,5th,6th P.C. recommendations. It is now Rs. 7915/-. My total service was 25 years, 10yrs as lab assistant, 7yrs as demonstrator, and 8 yrs as lecturer.. Can any goo heart help me re-fix my basic pension as per the 4-5-6 PC stages so to get to the right level for the 7th PC scale fixing?

Yes, Mr.Sharma, ur thinking on the no.of increments in the retiring level is quite in order.The new pay fixed on ur promotion, has to be brought into no. of increments in the new grade(index) and if that happens to be the retiring level.,the no. of increments adding up till u retire, will add up in the index and finally, the notional LPD would be the meeting point of that level and the new index and 50% the pension. I think, the position is clear. Things would have been much clear if the CPC itself were to work out an example involving this type of situation.

There is confusion of arriving at number of increments in the scale of retirement.Is it the actual number of increments earned in existing grade or the increments earned in the lower scale, getting promotion , fixation in that grade after earning him increments in a higher pay scale, as it will definitely be more than the start up from the minimum of higher scale plus adding actual number of yearly service increments in that grade. being a promotee.

ref your illustration fixing the pension of official having retired at Rs 79000/- basic.How are three increments arrived at for fixing notional pay when he is drawing six increments in the scale .67000*(1.03)^6=80001.

I have retired from service in Maharshtra Govt. on 31 July 2005.. as Executive Engineer in Irrigation Dept (now JalSampada Wibhag). What benefit will I get after 7th pay commission recommendations are accepted?

What is the No of increment,, in case of PB 37400____67000,,,,grade pay 90000 ,,basic pay pf 6th cpc 55590 ???

Nothing is clear from Mr Ramoo comments, regarding. Pre-2006 retiree,a person retired in 1989 or in 1999 will remain in the grades in which he or she has retired and get the pension fixed at the minimum of revised pay scale, what benefit earned by them in the revised scale, until unless Notional benefit of Increment given to them, although one has to choose any one of the two option, which is beneficial to the pre- 2006 or pre- 2016 retiree. Benefits must be taken into consideration, those retired ten/ twenty years earlier, and not only those retired after 2016.

It is seen that the methods specified by the 7CPC for refixation of pension under its option 1 method has created confusion inn the minds of many pensioners, especially regarding the no. of increments earned in the retiring level. Normally it so happens that by the time the employee reaches the retiring level, due to delays in the promotion process in the Departments concerned,he would have earned a much higher basic in the new grade than its minimum and due to the benefits accruing in the pay fixation process, he would be earning a much higher basic than the minimum of the retiring level and once his new pay is fixed, his link with the earlier grade ceases and he has to get a higher index in the matrix to suit his new basic and corresponding higher pension.

Retired on 31/01/2005 with basic pension 13550 and in 6 Cpc it was fixed at 22849 on 01/01/2006 in the 37400-67000 and grade pay 9000 I.e. Fixed at the minimum of the scale,,

No notional benefit of service was given, earned 12 increment in the scale at which retired, where it will be fixed in the 7cpc..

WAIING FOR REPLY

My basic pensoon was fixed RS 27795 MY BASIC PAY WAS FIXEC TO RS 55590 MY GRADE PAT RS 37400__67000 GRADE PAY RS 9000___WHAT OS THE NO OF INCREMENT ?

My basic pension -26393

pay band-37400-67000

Grafe pay-9000

No.of increments- 2

Amount commuted-4327

Retired on 31march2008

I retired on 30.04.2004 with basic pension Rs. 14,040. During 1996-2004, I got 11 increments. As per 6th CPC, my pay band was under 37,400-67,000 & grade pay Rs. 9,000. Under 6th CPC, my pension has been fixed as Rs. 23,200. Is it perfect or not? What will be my pension as per 7th CPC to be effective on & from 01.01.2016 ?

In case of Central Civilian Employees the Multiplying Factor (MF) for arriving at their pay under Seventh CPC varies from 2.57 to 2.78 depending on the Pay Band to which they belonged. But in case of Pre-2016 Civilian Pensioners MF has been uniformly fixed at 2.57 irrespective of Pay Band. to which they belonged on the date of their retirement. What is the logic behind it? The MF of Pre-2016 Pensioners should also vary according to the notional MF of the ‘Pay Band to which they belonged on the date of their retirement’.

My pay bad wad.37400__67000 and grade pay was 9000…I retire on 14.6.2007…my badic pay wadfixed 55590 and basic pension was fixef 27795….I would like to knpwNo of increment forthefixation ofpensio

My basic pay during retirement on 30.6.2003 is 11575 drawn 3 months & 11300 drawn for 7 months in scale of 8000-275-13500.

, wherin my my in 5 cpc awarded to Rs. 5692. My revised basic pay was not fixed on this method where in my revised should have been Rs. 13287 . My basic pay fixed by multiplying 2.26×5692= 12863.92 rounded to Rs. 12865.

From 1.1.06. I am insisting to revise my pension as i opted for fixation of pension as 5 th cpc method adopted which is beneficial.

Question 1. Is the same in order ?

Question 2 How much pension will be fixed in 7 cpc ?. Does they follow in fixing my pension as per my option available , if any ?

Kindly furnish solution for my questions.

My e-mail i.d is appanna43@gmail.com.

Thanking you.

,

K.APPANNA

Nothing is heard about DA/DR for pensioners who are to get pension from 1st.Jan 2016

My basic pension 12825 on 31 /7/ 2012. My no of increment

My band in 6 cpc 9300 to 34800

Grade pay 4800 3 increment

Do 4600 6

Do 4200 18

What is no of my increment for national pay

what about pre 2006 retired professor pension case in Gujarat High Court ?

I have retired from Maharashtra Govt. service on 1/4/2009. My basic pension is Rs. 8395/- as on 31/12/2015 (excluding D.A.) My pay scale in the 5th pay commission was 4500-125-7000 and in the 6th pay commission the scale was 5200-20200+GP 3500. I would like to know my pension in the 7th pay commission.

I have retired from the Army as Hav on 5 jan 1980 with Rs 175 as BP for 16 years now getting pension of Rs 5531 from 24.9.2012. I may be advised how my pension will be revised from 1.1.2016.

l Hema Krishnamoorthy Maharashtra state govt pensioner is getting a pension of 13000! I would like to know my pension in the seventh pay commision.

My mother was getting family pension 6216/-upto 25/9/2012 and getting 3729/-basic what will be the7th pay commission basic

Retired as Gr. B officer in June 2014. Last Basic Pay Rs. 29270/-. Pension Fixed Rs. 23416/-. Present Pension Rs. 25197/-. what will be my expected pension w.e.f 01.01.2016 after implementation of VIIth CPC?

I have retired on the post of professor in 2013 from UP govt university. My basic of pension is Rs 36210/

.What will be basic of pension in 7th pay commission on 01-01-2016

A clear cut information.has not been given till date regarding DA/DR please intimate .the existing DA at 119_%will be continued

I took my VRS on 2nd Aug 2014 and my Basic+GP was 25,990.In that time I commuted 40% and now am getting pension 23,280.After my VRS, I got the selection grade and my Basic fixed in 15,600+GP 5400.Now let me know after commuting 40% from the previous Basic( 25990) am getting 23,280 and after 7th CPC how much pension I will get or will be fixed.

hi my family pension is Rs 15900/- per month. what will be family pension of my in 07th pay commision.

i got retirement on 31 dec 2015 will the 7th pay commission superannuation age will effect my service to be increased by 3 years

I am JC 269090 F Sub Dharm Nath Singh i am retiree on 01 Sep 2010 from army after 7th pay commission what is the my pension

I retired in 1993 from Maharashtra govt school. I took voluntary retirement with 29 yrs service. My pension as on dec2015 is 13000. What will be my pension in seventh pay commission. When will it it be commisioned

The 6th pay commission allowed a stage with two increments for those who earned 4 and 5 increments in the pay scale of 14300-400-18300 while fixing pay in 37400-67000 with grade pay of 8700, What will be number of increments to be added to the new pay matrix corresponding to the above pay band proposed by the 7th pay commission in respect of officials retired after 01.01.2006 from the same post. Will there be any variation in the number increments to be added in respect of persons retired before and after 01.01.2006?.

I retired on 31 Aug 1995 in the Pay scale 2300-100-5100 ( 4th CPC) and my pension was fixed Rs 1600/ PM 50% of Rs 3200/- . What will be my Pension at Level 10 B of the Pay Matrix for Defence Forces ?.

I GOT PENSION RS 23424/ON DECEMBER 2015. I RETIRED 31/05/1994. AS POSTGRADUATE SELECTION GRADE TEACHER. WHAT WILL BE MY PENSION ON JANUARY 2016.

THERE ARE 3 SCALES OF PRE-2006 (5000-8000, 5500-9000, 6500-10500)MERGED IN TO PAYBAND 9300+ gr.p 4200. Will those in 6500 grade with one or no increment be allowed to have the number of increment drawn in 5000 grade or 5500 grade, as other wise the juniors in lower grade will get more pension than those in higher grade and senior’

would you clarify

I retd on 31-3-2008 and getting pen.13230/original pen. I got promotion wef 11-02-2008.If my pen. is refixed in mew psy matrix my pen. Will be less than if my present pen. 13230/ is multiplielied by2.57.what is my entitlement.

I retired from service 38 years of service on 31 May 2004. My pension was initially fixed at Rs. 5649.00 vide PPO dated 24 Dec 2003. Subsequently, it was revised to Rs. 8,474.00 due to 50% merger vide amended PPO dated 27 Sep 2004.

I had sent copies of PPO with complete details of present address, e-mail ID and Mobile No. to CPPC, SBI, Chandni Chowk, New Delhi on 16 Oct 2016. It is been telephonically intimated that I am not elegible for the benefit applicable for pre-2006 pensioners. No other reason intimated in writing. Can anyone having full knowledge of this Rule confirm whether I am eligible or not.

present my family pension draw Rs/permonth 17194

so now i want to know what will be my basic pension by the date of implementation of pay commission in option

i retired on 30/04/2007 as per the 6th pay commission i was in the grade pay of rs 5400 and before the 6th pay commission i was in the scale of rs 8000-275-13500 i have earned 15 increment and my basic pay as on 1/01/2006 was rs 12125 and on the date of retirement 28280 now i want to know what will be my basic pension by the date of implementation of pay commission in option 1 and 2 j cgoel

My pay was fixed at Rs.21,360/- in respect of 6th pay commission & my pension was fixed at Rs.10680/PM. I retired on 31st May,2006. what will be my pension on the recomendation of 7th Pay Commission. Whether the 119% DA will be added for fixation or not !

Date of Retirement & Retiring Grade : 31.12.2004. Rs. 6500—- Rs.10500

Last Pay ; Rs.8300 + D.P.Rs. 4150. Basic pension from 1..1..2005 =Rs.6225.

Commuted Rs.2490. Revised pension from 1.1.2006.(vi cpc) = Rs. 9379

Increment availed in the Retiring Grade = 9(Nine) @Rs.200 = total Rs.1800.

Based on the given DATA, pl. confirm which of the options (opt.1 &opt2) of

7cpc recomendation will give me higher pension with the information of commuted amount of higher pension..

Can any brother will Brief me Your Information Like What werew the welfare projects/ scemes available with state govt( Telangana & Andhra pradesh and other regions) for the Re settlement of an Ex service men in regarding Re Employment And Irrigation / housing Land Issue

thank you Ex Sub V S Raju

Before vi cpc stagnation increment were given after 2 years of service like a penalty for misconduct or so. Even person completed over 3.75 yr was to retire with only one stagnation increment.Is there any solution for such situation in 7th CPC or govt forum

I retired on 30th November 1996 and got the benefit of VI PC.. How to fix my pension my pension as per VII PC ? Please explain. Thanks.

7th CPC When will be implemented(added with pension) to the Pensioners? Wii it be from Jan 2016 or it will take few months?

This is very useful infmn tks

Refer my Comments given on 15 DEC 2015 at 10.05 pm

regarding the Increments earned in the Retiring Level for the Purpose of Fixation of Revised Pension as per 7th CPC Recommendations

I had suggested Important Useful Solution applicable to All Pensioners, My Comments have NOT been Published by You till now,

Please check out the following the web page…

click here

PL.CLARIFY THE INCREMENT FORMULA FOR PRE2006 PENSIONER I GOT 6 INCREMENTS IN 1400-2300 AND 7 INCREMENTSIN 1600-2660 SCALE SINCE BOTH THE SCALES HAVE BEEN MERGEDIN 6TH PAY COMMISSION AS 9330-34800 THEN PL,TELL,MEHOW MANY INCREMENTS TO BECONSIDEREDINMY CASE 7 OR 13

Regarding Mr.ALOKE KUMAR BARMAN Comments dated 29 NOV 2015 in respect of Case 2 :

In this Case, the Number of STAGES in the RETIRING PAY SCALE from the STARTING PAY of the PAY SCALE (Rs.3000/-) UPTO the LAST PAY Drawn (Rs.4000/-) is 9 (NINE).which is indicative of the Increments Earned (GAINED) in the RETIRING PAY SCALE.by the Retiree.

The Number of Increments Earned (GAINED) in the RETIRING PAY SCALE should be DETERMINED based on the LAST PAY drawn and the Number of STAGES in the RETIRING PAY SCALE from the STARTING PAY Upto the LAST PAY Drawn. The Number of STAGES from the STARTING PAY Upto the LAST PAY Drawn in the RETIRING PAY SCALE gives the Number of Increments Earned (GAINED) in the RETIRING PAY SCALE by the Retiree.

With Regards

JK RAGHUNATHAN

FIXATION OF REVISED PENSION as per Para 10.1.67 , Sub para (i) of 7th CPC Report :

Pre-2016 RETIREES

Shall First be fixed in the Pay Matrix on the basis of Pay Band and Grade Pay at which they Retired at the minimum of the Corresponding Level in the MATRIX..This amount shall be raised, to arrive at the Notional Pay of the Retiree, by adding th.e number of Increments he/she had earned in that Level while in Service, at the rate of 3 %.. Fifty percent of the Total Amount so arrived at shall be the REVISED PENSION.

To arrive at the Notional Pay, the Number of Increments earned by the Retiree in the PAY SCALE AT THE TIME OF HIS RETIREMENT is to be DETERMINED based on the LAST BASIC PAY drawn in this PAY SCALE..

Hence, the Number of STAGES in the PAY SCALE at the time of Retirement from the STARTING PAY of the Pay Scale UPTO the .LAST BASIC PAY drawn DETERMINES the Number of Increments Earned (GAINED) by the Retiree.

Illustration on Fixation of Pension in Case 2 of Para 10.1.71 is RELEVANT.

In the above Illustration, it is mentioned that Pensioner retired at LAST PAY drawn of Rs.4000/- having drawn 9 Increments in the RETIRING PAY SCALE of Rs.3000-100-3500-125-4500. The Number of STAGES in this PAY SCALE from the STARTING PAY ( Rs.3000/-) UPTO the LAST BASIC PAY (Rs..4000/-) drawn is obviously 9 (NINE) which is Indicative of the Number of Increments Earned (GAINED) by the Retiree.

In View of the above Explanation, THE NUMBER OF STAGES IN THE RETIRING PAY SCALE FROM THE STARTING PAY OF THE PAY SCALE

UPTO THE LAST PAY DRAWN SHOULD BE TREATED AS THE NUMBER OF INCREMENTS EARNED (GAINED) BY THE RETIREE in the Retiring Pay Scale..This is for the Purpose of Fixation of Pension as per the Formulation shown in Para 10.1.67, Sub Para (i) of the 7th CPC Report.

Otherwise, Junior Pensioners will get MORE REVISED PENSION THAN

SENIOR PENSIONERS resulting in Disparity and Injustice.

This may please given wide Circulation and brought to the Notice of Implementation Committee. I am THANKFUL AND GRATEFUL to You Sirs,

for Your Needful action.

RAGHUNATHAN

Retired Central Govt Officer

Sir, I retired on 30th April, 2004. My basic pension as on 1st January, 2006 was Rs. 11217/-. Now as per the recommendations of the 7th Pay Commission, what will be my basic pension or what benefits I can get on the basis of the drecommendations of the 7th Pay Commission,

I was retired on 31 July 2006. My pension was fixed Re 28435 in pay scale 37400- 67000 with grade pay 89p0. What will be my pension on 1 Jan 2016.

Sir,

I retired on 31-01-2006, my salary at that time was Rs.27960/- and my pension was fixed as Rs.13980/-(my grade pay in PB-3 was 5400/-), so pl calculate my pension in 7th PC from 1-1-2016.

thanks

gupta

i was retd from railway on 31-8-2012 pension fix rs 11445./00 in cpc i drawn 6 icrementat 3 persantage. let me know how much pension fix 7 cpc..

I retired on 31st December 2010, in the PB3-15600-39100 and Grade Pay 6600.

I got promotion to the above grade in December,2010 itself.

My last drawn pay plus Grade pay was 26280.

And my basic pension is 13140..

I got promotion from the previous grade pay of 5400..

As my last basic pay fixed/drawn was matching with 6 increments @ 3% increase in increment. Will it be considered for fitment ? Or only the no. of years after promotion is considered for ?

What will be my level of pension fitment and expected amount of pension as per pension fitment matrix of 7th CPC ?.

Which will be best option to choose from Option 1 or 2 ?

I took retirement on 31.7.2010. Basic pension is 7780. What wil b my pensioN wef. 01.1.16 aftrr recomendatoon of 7th pay comm.

I retired on 30th June 2011, in the PB3-15600-39100 and Grade Pay 7600.

I got promotion to the present grade in 2003.

My last drawn pay was 32780 + grade pay 7600 =40380

And my basic pension is 20190..

I got promotion from the previous scientific cadre..

As my last basic pay drawn is matching with 25 increments @ 3% increase in increment. Will it be considered for fitment ? Or only the no. of years afer promotion is considered for ?

My level as per pension fitment matrix is 12.

What will be my pension fitment as per fitment matix of 7th CPC ?.

Which will be best option to choose from Option 1 or 2 ?

Dear friends,

The 7 CPC was graceful enough to concede OROP for civilian pensioners also, in that the pension has to be fixed in 7 CPC scales taking into account the number of increments earned in the scale in which the pensioner had retired. So far it is very clear the consequential new pension wef 1-1-2016 would be a real bonanza for old pensioners !!! But there may be a slip between cup and lip. Will the present employee-unfriendly Govt in position would accept this recommendation ? Many of our friends are sceptic about implementation of this recommendation. Views on this comment are welcome and don’t blame for this pessimistic remark !!!

I retired on 1-8-1991 from the post of Sr.AO (basic pay Rs.3300.in the scale of Rs. 2200-4000 with 13 increments).My pension was fixed at Rs.10994 wef 1-1-2006 by 6th.CPC in the scale 9300-34800 PB-2 , S-15 ,,grade pay Rs.5400.What will I get wef.1-1-2016 under 7th.CPC.

My b pay 7020, da 8354. Commut ded.3510, my net pension 11864. 7th pay mera pensin kitna hoga.

I retired on 1st March 2011.. My Pay Band was 9300-34800 and Grade Pay was 4800. My Basic Pension is 12870. What will be my pension in VII CPC under option I and Option II.

I retired at the pension basic pay Rs. 12005/- on 31.08.2013. What will be the pension after 7th CPC.

sir, will u please guide – how to calculate number of increaments earned (in that level) ie number of inreaments gained in the last scale? are to multiplied by 3? confused please help.

What would be the pension of emloyee retired on 31.01.2013 on basic pay Rs. 23780/- in Pay Band Rs.9300-34800/-

My basic pension is Rs11720 and retired in October 2014. Now what is my pension as per 7th cpc

I was retired in October 2024 and my pension basic was 11720 please calculate my pension as pet 7th cpc

Myself retired in May 2002 in the pre-2006 scale of Rs.10000-325-15200, the last basic pay being Rs.,10,975/. The basic pension was fixed at Rs.5473/- On implemenntation of 6th Cpc recommendation, my basic pension has been fixed at Rs.12,600/-. Idrew three inncrements in my last pay scale. What is likely pension in my case under 7th CPC recommended formula?

.

My basic pension is 3869 and D.A is 4604 and what will be the amount of pension I may get under7th pay commission., please make nexessary calculation and infor above mail address with our fail/

what time will take time to implement the 7th cpc.

SIR I WAS RETIRED ON FEBRUARY 2009 LAST PAY 10290/-

GETTING PENSION OF RS. 9750/- WHAT WILL BE MY NEW MONTHLY PENSION

Sir I retd on 3rd of July 20th . my basic pension fixed under Vth cpc is 8212 in the scale 5000-150-8000.and the scale in VTH cpc raised to 9300-3400.can you please let me know the pension going to be fixed.

I retired in July, 2009 with Last Pay draw n as Rs 37630 (PB-3).

Pension Originally sanctioned Rs.18815 and After Commutation, the Pension ,the reduced pension was Rs 11289.

What would be my Pension be, consequent to the reccomendatio n of 7th CPC.

GRATEFUL FOR THE REQUISITE INFORMATION AT THE EARLIEST,

THANKS.

My basic pension is 10905/-

My pay when retired – 17210/-

Grade Pay – 4600/-

Retired on 29-02-2012

Earned 5 increments.

As per my calculation in the 7 cpc my basic pension would be – 28026/-

please confirm. The pension calculator shown in this site seems to be accurate. My sincere thanks for that.

Please calculate my pension.

1. I retired on 31-12-2014.

2.my basic pension was Rs.31,975/- as on 01-01-2015

3.Grade pay was Rs. 7600/- at the time of retirement.

4.Commutation deduction Rs. 12790/-

5.NPA Rs..12790/-

Pl. calculate my pension.

1..Retired on 31.12.2012

2.Basic pension 14525/- as on 11.11.2015

3.Grade pay was 6600/- at the time of retirement

4..Commutation deduction 5810

My basic pension is Rs.18520 (in the PB-3 & GP Rs.7600)

Considering 124% DA, my total pension amount is Rs.41,485

As per 7th CPC recommendation, my basic pension would be Rs.47,596 + 0% DA

Therefore, there will be a total increase of 14.73%. (Rs.6112).

But as per 7th CPC, it would be about 23%. How?

Case I : Pensioner ‘A’ retired at last pay drawn of ₹79,000 on 30 May, 2015 under the VI CPC regime, having drawn three increments in the scale ₹67,000 to 79,000:

Whether the number of increments which he/she had earned in that level while in service will be calculated on actual basis?