Actual Impact of 7th Pay Commission on Government Finances

Government expenditurer on CG employees and actual impact on government finances

Comrades,

There are various reports in the media about the impact of the 7th CPC recommendations on the common man and the government resources at large, the reports suggest that additional amount of Rs one lakh crores of public money has been spent for implementation of the 7th CPC recommendations for 35 lakhs central Government employees.

Perhaps the strongest criticism of Pay Commission awards is that they play havoc with government finances and also state government demand support to implement the 7th CPC recommendations. At the aggregate level, these concerns are somewhat exaggerated and which is totally wrong.

Let us examine the 7th CPC report vide para no 3.65 and 3.66 and the website of Government of India Ministry of Finance Department of Expenditure Pay Research Unit for Brochure on Pay and Allowances of Central Government Civilian Employees visit website :

The 7th CPC report para number 3.65 and 3.66

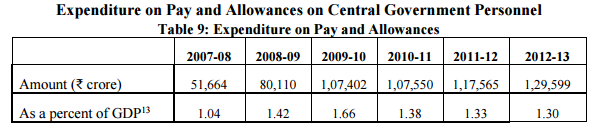

3.65 The total expenditure on pay and allowances for civil personnel of Central Government in the recent years is brought out in Table 9.

Table 9: Expenditure on Pay and Allowance

The Commission has obtained details of expenditure from each ministry/department for up to FY 2012-13. Of the total expenditure on pay and allowances of Rs 1,29,599 crore for the financial year 2012-13.

3.66 The expenditure per capita on pay and allowances for Civil Central Government personnel for FY 2012-13 was Rs 3.92 lakh per annum i.e Rs 32666/- per month.

Add 35% DA for the period 1/4/2013 to 1/1/2016 average salary of Civil Central Government personnel as on 1/1/2016 at 125% DA which works around Rs 37500/- per month (Rs 4.50 lakhs per annum ) without 7th CPC recommendations . ie Rs 1.57,000 crores

Add average 16% wage increase due to 7th CPC which works out to Rs 43500/- per month Rs 5.22 lakhs per annum) with 7th CPC implementation .

Total Expenditure for 35 lakhs for Civil Central Government personnel for FY 2016-17 is around Rs 1,83,000 crores In respect of pensions expenditure for 55 lakhs pensioners amount is around Rs 81,000/ crores as on 1/1/2016. which is against the revenue receipts of Rs 19 lakh crores.

The percentage of revenue receipt and wages is just around 13 % of the total revenue is spent on the wages and pension for the Central Government personnel. In fact it is just at 1.3 % of the GDP.

This clearly shows that that the increase in impact for the government of India finances is just below additional Rs 25,000/- crores not additional Rs 1,00,000/- crores as per the media reports.

The 7th CPC recommendations’ impact need not give jitters to the government because the rise in government wages will amount to only 0.4 per cent of GDP.

One more aspect is that technically, the recommendations of a Central Pay Commission are only for Central Government employees and States are not bound to follow suit. Indeed, up to the 1980s,

States constituted their own Pay Commissions and prescribed their own pay scales, based upon their fiscal capacity.

Let us not be carried over by the media or press reports, hence we should educate each and every employee for struggle and so that a decent wage hike is achieved.

Comradely yours

(P.S.Prasad)

General Secretary

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

In all articals writing about expenditure but income in the name of incometax to be taken into account. For 7 pc. The Net effect is very small amount for government.