Rajasthan Government Employees to get Diwali Bonus this year

The state government of Rajasthan has announced that its employees will receive a Diwali bonus this year, as a token of appreciation for their hard work and dedication. The bonus, which will be distributed before the festival of lights, is expected to bring some much-needed cheer to the state’s workers who have been working tirelessly during these challenging times. This move by the government is sure to boost the morale of its employees and serve as a reminder of their value to the state’s administration.

Grant of ad-hoc bonus to Rajasthan State Government employees for the financial year 2019-20

The Rajasthan State Government has decided to grant an ad-hoc bonus to its employees for the financial year 2019-20, as a token of appreciation for their hard work and dedication. This bonus will be provided to all eligible employees, regardless of their position or seniority. The amount of the bonus will be based on the employee’s basic pay and will be calculated using a pre-determined formula. This decision comes as a welcome relief to the government employees, who have been facing financial challenges due to the economic impact of the COVID-19 pandemic.

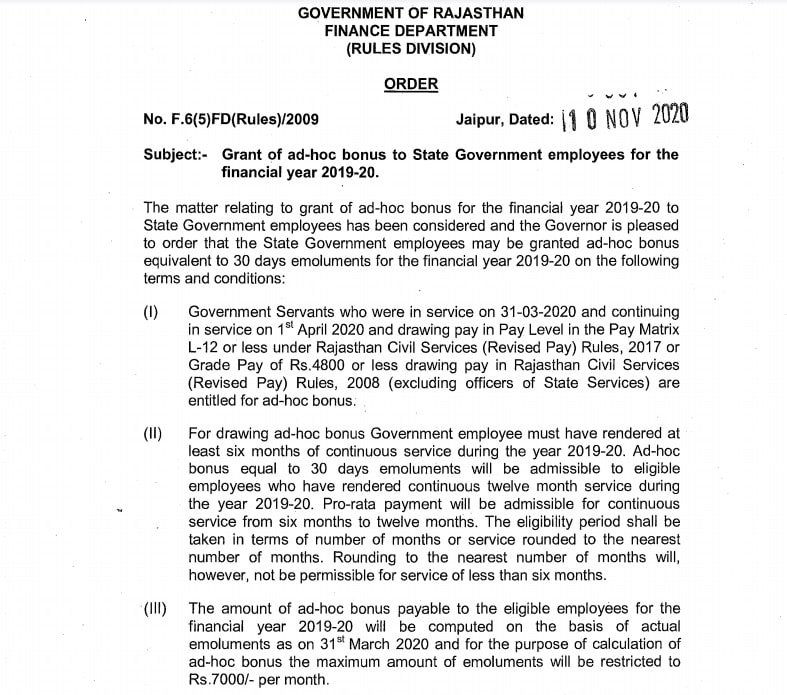

GOVERNMENT OF RAJASTHAN

FINANCE DEPARTMENT

(RULES DIVISION)

ORDER

No.F.6(5)FD(Rules)/2009

Jaipur, Dated: 10 NOV 2020

Subject:- Grant of ad-hoc bonus to State Government employees for the financial year 2019-20.

The matter relating to grant of ad-hoc bonus for the financial year 2019-20 to State Government employees has been considered and the Governor is pleased to order that the State Government employees may be granted ad-hoc bonus equivalent to 30 days emoluments for the financial year 2019-20 on the following terms and conditions:

(I) Government Servants who were in service on 31-03-2020 and continuing in service on 1st April 2020 and drawing pay in Pay Level in the Pay Matrix L-12 or less under Rajasthan Civil Services (Revised Pay) Rules, 2017 or Grade Pay of Rs.4800 or less drawing pay in Rajasthan Civil Services (Revised Pay) Rules, 2008 (excluding officers of State Services) are entitled for ad-hoc bonus.

(II) For drawing ad-hoc bonus Government employee must have rendered at least six months of continuous service during the year 2019-20. Ad-hoc bonus equal to 30 days emoluments will be admissible to eligible employees who have rendered continuous twelve month service during the year 2019-20. Pro-rata payment will be admissible for continuous service from six months to twelve months. The eligibility period shall be taken in terms of number of months or service rounded to the nearest number of months. Rounding to the nearest number of months will, however, not be permissible for service of less than six months.

(III) The amount of ad-hoc bonus payable to the eligible employees for the financial year 2019-20 will be computed on the basis of actual emoluments as on 31st March 2020 and for the purpose of calculation of ad-hoc bonus the maximum amount of emoluments will be restricted to Rs.7000/- per month.

(IV) The term ’emoluments’ occurring in this order will include basic pay, personal pay, deputation allowance and dearness allowance but will not include other allowances such as house rent allowance, compensatory (city) allowance etc.

(V) The amount of ad-hoc bonus payable shall be computed assuming the month of 31 days.

(VI) The amount of ad-hoc bonus payable will be rounded off to the nearest rupee.

(VII) 25% of the ad-hoc bonus shall be paid in cash and 75% of the ad-hoc bonus shall be credited to the General Provident Fund Account of the respective employees who are recruited to the Civil Services before 1-1-2004.

(VIII) For the employees recruited to the Civil Services on or after 1-1-2004 and who are governed by Contributory Pension Scheme the 25% of the ad-hoc bonus shall be paid in cash and 75% of the ad-hoc bonus shall be credited in a Scheme being put in place on lines of GPF. The procedure for operation of this Scheme will be prescribed in due course of time. Meanwhile amount of 25% of ad-hoc bonus which is to be paid in cash can be drawn by DDO for the employees appointed on or after 1-1-2004.

It is further clarified that:-

(a) Except in the case of extra-ordinary leave (leave without pay), the period of leave of other kinds will be included for the purpose of working out eligibility period. The period of extra-ordinary leave (leave without pay) will be excluded from eligibility period but will not count as break in service for the purpose of ad-hod bonus. In case a Government servant is on leave on 31-03-2020 the emoluments last drawn immediately before proceeding on leave shall be taken into account for the purpose of eligibility and calculation of ad-hoc bonus.

(b) The subsistence allowance given to an employee under suspension shall not be treated as emoluments. Such an employee will become eligible for the benefit of ad-hoc bonus if he is re-instated with benefit of full emoluments for the period of suspension and in other cases such period will be excluded for the purpose of eligibility as in the case of employees on leave without pay. In case a Government servant is under suspension on 31-03-2020 no ad-hoc bonus for the year 2019-20 shall be given for the present. If he is reinstated later on, eligibility of the period under suspension for the purpose of ad-hoc bonus shall be decided on the lines indicated above.

(c) The employees who retired on superannuation or on invalidation on medical grounds or on voluntary retirement or died on or before 31st March 2020 will not be eligible for ad-hoc bonus.

(d) The eligibility of the re-employed Government servants for the purpose of ad-hoc bonus shall be determined on the basis of service rendered during the year 2019-20 after re-employment. The basic pay in respect of such persons shall mean basic pay fixed on re-employment or as increased thereafter and admissible on 31-03-2020 plus pension (including commuted part, if any).

(e) Employees who resigned from service on or before 31-03-2020 shall not be eligible for ad-hoc bonus under these orders.

(f) Employees engaged on part time / casual or on a daily wage or on contract basis will not be eligible for ad-hoc bonus.

(g) Employees appointed as probationer trainee shall not be eligible for ad-hoc bonus.

(h) (1) Government servants who were on deputation on 31-03-2020 if have opted for deputation allowance in terms of this department order No. F.1(47)FD(Gr.2)/82 dated 27th June, 1989, as amended from time to time and are eligible for ad-hoc bonus under this order, shall be paid,

the admissible amount of ad-hoc bonus by the borrowing organization. The eligibility period shall include the continuous service rendered under the Government as also the period spent on deputation upto 31st March 2020. Similarly, Government servants who returned from deputation during the year 2019-20 shall be paid ad-hoc bonus by the Government which may be calculated on the basis of eligible and continuous service rendered under the borrowing organization and the Government.

(2) In the case of Government servants who were on deputation to Public Sector Undertakings, Cooperative Societies, Autonomous Bodies etc. and who have opted for deputation allowance in terms of this department order NO.F.1 (47)FD(Gr.2)/82 dated 27th June, 1989, as amended from time to time and are eligible for ad-hoc bonus under this order, out of the amount of bonus paid under the Payment of Bonus Act, 1965 by the aforesaid organization the amount equal to the amount of ad-hoc bonus admissible under this order shall be retained by the Government servants and the residual amount shall be deposited in the Government account.

(3) Government servants on deputation who have opted for bonus and / or ex-gratia payable to the employees of the borrowing organization in terms of this department order referred to above will be entitled to ad-hoc bonus equal to an amount by which, the bonus and / or excreta admissible as per order of the borrowing organization falls short of the total of (a) the deputation allowance which would have been admissible and (b) the ad-hoc bonus admissible under this order.

(4) In the case of Government servants belonging to the Cooperative Department and on deputation to Cooperative Institutions registered under the Rajasthan Cooperative Societies Act, 1965 whose terms of deputation are governed by the Cooperative Department Order No. F. 18 (75) Coop. /76 dated 13.07.1976 as amended from time to time, ad-hoc bonus, equal to an amount by which the bonus/ex-gratia paid/payable as per terms of deputation falls short of the total of (a) 1.5% of basic pay in Rajasthan Civil Services (Revised Pay) Rules, 2017 or 2.5% of Basic Pay in Rajasthan Civil Services (Revised Pay) Rules, 2008 subject to RS.600/- per month drawn during the year 2018-19 and (b) the amount of ad-hoc bonus admissible under this order shall be payable by such borrowing Cooperative Institution.

(i) In cases where it is in the notice of Head of Office that the Government servant eligible for ad-hoc bonus on 31-03-2020 will definitely become ineligible for grant of ad-hoc bonus due to retrospective grant of pay in Pay Level in the Pay Matrix L-13 in Rajasthan Civil Services (Revised Pay) Rules, 2017 or Grade Pay of Rs. 5400/- in Rajasthan Civil Services (Revised Pay) Rules, 2008 and above or promotion in State Services, only pro-rata ad-hoc bonus be permitted provided that the eligibility period is six months or more.

(j) The payment of ad-hoc bonus, except to those Government servants who were on deputation on 31-03-2020, under these orders shall be made by the office in which an employee is posted on the date of issue of this order and it will be chargeable to the Budget Head to which the pay and allowances of the employees are charged. The payment of ad-hoc bonus to those Government servants who were sent on deputation after 31-03-2020, but before issuing of this order, shall be made by the office where the employee was posted as on 31-03-2020.

(k) This order shall also be applicable to the employees of the Zila Parishads & Panchayat Samities and the Work-Charged employees who are drawing pay in the pay scales prescribed for them.

(I) In the case of those PSUs / Boards / Corporations to which the payment of bonus under Bonus Act, 1965 is not applicable but who have been paying ad-hoc bonus / ex-gratia in the past as per orders issued by the State Government, ad-hoc bonus / ex-gratia may be paid at rates not exceeding the rate at which ad-hoc bonus is payable under the orders issued by the State Government for payment of non-productivity linked ad-hoc bonus to its employee. In such case ad-hoc bonus / ex-gratia shall be payable strictly in accordance with the principle on which ad-hoc bonus / ex-gratia is paid by the State Government. Therefore, 25% of the ad-hoc bonus / ex-gratia shall be paid in cash and 75% of the ad-hoc bonus / ex-gratia shall be credited in a Scheme being put in place on lines of General Provident Fund. The procedure for operation of this Scheme will be prescribed in due course of time. Meanwhile amount of 25% of ad-hoc bonus which is to be paid in cash can be drawn by DDG for the employees. State Enterprises Department Le. BPE will issue necessary orders on the lines of orders as applicable to State Government employees and deduction from ad-hoc bonus / ex-gratia will be deposited in the Scheme to be issued in due course. State Enterprises Department will ensure that ad-hoc bonus / ex-gratia will be granted only for the employees of PSUs / Boards / Corporations which are financially in a position to pay the ad-hoc bonus / ex-gratia. For this purpose no grant will be issued by the State Government. Any deviation / exception .to the above would be treated as violation of provisions of RAPSAR Act, 1999.

By order of the Governor

sd/-

(Dr. Prithvi)

Secretary,Finance (Budget)

Rajasthan Bonus Order 2020 PDF

Who is eligible for Diwali Bonus in Rajasthan Government?

Government servants belonging to the Cooperative Department and on deputation to Cooperative Institutions registered under the Rajasthan Cooperative Societies Act, 1965 whose terms of deputation are governed by the Cooperative Department Order No. F. 18 (75) Coop. /76 dated 13.07.1976 as amended from time to time are eligible.

How much is the ad-hoc bonus for Rajasthan Government Employees on deputation?

The ad-hoc bonus is equal to an amount by which the bonus/ex-gratia paid/payable as per terms of deputation falls short of the total of (a) 1.5% of basic pay in Rajasthan Civil Services (Revised Pay) Rules, 2017 or 2.5% of Basic Pay in Rajasthan Civil Services (Revised Pay) Rules, 2008 subject to RS.600/- per month drawn during the year 2018-19 and (b) the amount of ad-hoc bonus admissible under this order.

Who will pay the ad-hoc bonus for Government servants on deputation to Cooperative Institutions?

Such borrowing Cooperative Institution will pay the ad-hoc bonus.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Leave a Reply