Pay Commission be designated as ‘Pay and Productivity Commission’: 14th Finance Commission

“We recommend the linking of pay with productivity, with a simultaneous focus on technology, skill and incentives. We recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’, with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions.We urge that, in future, additional remuneration be linked to increase in productivity.” – 14th Finance Commission

14th Finance Commission’s recommendations related to Pay Commission, Salary, Pension:- Recommendations

x. We reiterate the views of the FC-XI for a consultative mechanism between the Union and States, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments. (para 17.28)

xi. We recommend the linking of pay with productivity, with a simultaneous focus on technology, skill and incentives. We recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’, with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions.We urge that, in future, additional remuneration be linked to increase in productivity. (para 17.29)

xii. We urge States which have not adopted the New Pension Scheme so far to immediately consider doing so for their new recruits in order to reduce their future burden. (para 17.30)

Recommendations – Public Expenditure Management

118. We reiterate the views of the FC-XI for a consultative mechanism between the Union and States, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments.

119. We recommend the linking of pay with productivity, with a simultaneous focus on technology, skill and incentives. We recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’, with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions. We urge that, in future, additional remuneration be linked to increase in productivity. (para 17.29)

120. We urge States which have not adopted the New Pension Scheme so far to immediately consider doing so for their new recruits in order to reduce their future burden. (para 17.30)

14th Finance Commission’s detail report related to Pay Commission, Salary, Pension:- Fiscal Deficit

3.4 The fiscal deficit of the Union Government relative to GDP declined steadily from 6.1 per cent in 2001-02 to 4.5 per cent in 2003-04. The FRBM Act mandated reducing the fiscal deficit to 3 per cent by 2008-09. The Union Government achieved this target in 2007-08, with the fiscal deficit declining to 2.5 per cent of GDP. However, in 2008-09 the Union Government undertook several fiscal expansionary measures such as revision of pay scales based on the recommendations of the Sixth Pay Commission, waiver of farm loans and the expansion of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) to all districts from the 200 districts it was originally slated to cover. In addition, oil prices escalated sharply, leading to a rise in subsidy. As a consequence of all this as well as the global crisis, the fiscal deficit of Union Government increased to 6 per cent in 2008-09 and 6.5 per cent in 2009-10.

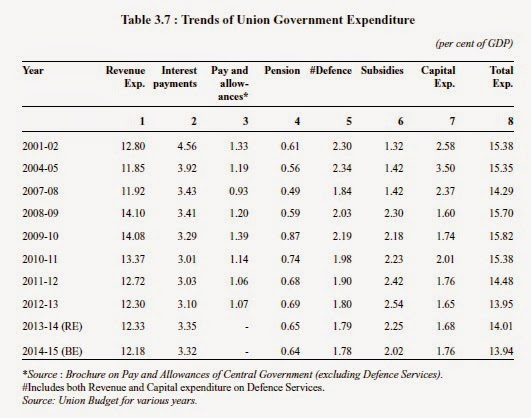

3.38 The share of capital expenditure in the total expenditure of the Union Government declined from 22.8 per cent in 2004-05 to 10.2 per cent in 2008-09 and has remained in the range of 11 per cent to 13 per cent since then. Correspondingly, the revenue expenditure increased to 89.8 per cent in 2008-09, and thereafter declined only marginally, despite expenditure tightening measures. As a ratio of GDP, the revenue expenditure of the Union Government increased from 11.9 per cent in 2004-05 to 14.1 per cent in 2009-10 and is estimated at 12.2 per cent in 2014-15 (BE). The major components of revenue expenditure comprising subsidies, interest payments, defence expenditure, pay and allowances and pensions are briefly analysed in the following paragraphs.

Major Subsidies : Pay and Allowances and Pensions

3.46 Pay and allowances of Union Government employees more than doubled between 2007-08 and 2011-12, from Rs.74, 647 crore to Rs.166, 792 crore due to the implementation of the Sixth Central Pay Commission recommendations( Including Defence Services). As a ratio of GDP, it jumped from a little over 0.9 per cent in 2007-08 to 1.2 per cent in 2008-09 and about 1.4 per cent in 2009-10 on account of both pay revision and payment of arrears. However, it moderated to a little over 1 per cent in 2012-13.

3.47 As in the case of salaries, expenditure of the Union Government on pensions, which had declined to less than 0.5 per cent of GDP in 2007-08, increased to about 0.9 per cent of GDP in 2009-10 due to the impact of revision in pensions. Subsequently, it came down to 0.7 per cent in 2010-11 and is estimated at 0.6 per cent in 2014-15 (BE).

3.48 Expenditure on salary, pensions and interest payments together accounted for 5.67 per cent of GDP in 2004-05 but declined marginally to 5.56 per cent of GDP in 2009-10, with the rise in expenditure on salaries and pensions being more than compensated by the decline in interest expenditure. These expenditures declined further to 4.9 per cent of GDP in 2012-13.

Revenue Expenditure : Pensions

6.34 Pensions are another committed liability which has been fully provided for in our assessment. The assessment of pensions is based on the growth rate of pension expenditure obtained from past data. The year-on-year growth of pension expenditure has shown volatility, with growth declining to a low of 0.42 per cent in 2002-03 and increasing to a high of 70.46 per cent in 2009-10. Given these fluctuations, it is not appropriate for us to take a long-run trend growth rate for this expenditure as a norm for assessment. It would be more appropriate to use the observed growth in the recent past. However, a potential fiscal liability may arise in the future with the introduction of the ‘one rank one pension scheme’ for Defence Services. The Budget 2014-15 has also made an additional allocation for this scheme, which is reflected in the increase in the growth of pension expenditure to10.67 per cent over the 2013-14 (revised estimates) growth of 6.62 per cent. While the Ministry of Finance projects an increase in pension payments by 8.7 per cent in 2015-16, a 30 per cent increase is expected in 2016-17 on account of the impact of the Seventh Pay Commission, followed by an annual growth rate of 8 per cent in subsequent years. Pension expenditures between 2011-12 and 2014-15 have grown on a year-on-year basis at the rate of 9.35 per cent per annum. We are of the view that annual revisions in the Dearness Allowance and annual accretions in the number of pensioners and the corresponding pension obligations can be covered by this growth in pension expenditure during our assessment period.

Defence Revenue Expenditure

6.35 Revenue expenditure on defence has grown at an annual rate of 11.21 per cent between 2001-02 and 2012-13 and at the rate of 10.1 per cent between 2008-09 and 2012-13. In its submission to the Commission, the Ministry of Defence argued that there has been a decline in the defence expenditure-GDP ratio over the years and defence expenditure allocation in the Union budget needs to be increased to expand the acquisition of arms and improve defence preparedness. The Ministry pointed out that it has not been able to make necessary procurements because of the constraint of funds and large amounts of committed expenditure. The Ministry also mentioned that a substantial part of the defence capital budget went into meeting committed expenditures. The Ministry of Finance has also highlighted the need to increase defence outlays in order to modernise and maintain defence assets and to finance defence acquisitions. Accordingly, its projections have provided for an increase in defence revenue expenditure (including salaries) of 30 per cent in 2016-17 which will incorporate the Pay Commission impact, with a stable growth rate of 20 per cent per annum in the remaining years.

Fiscal Consolidation: Assessment and Issues

14.48 Our review shows that, at an aggregate level, States made significant improvements in complying with the FRBM targets prescribed by the FC-XII and FC-XIII. In the pre-crisis period, fiscal consolidation at the State level was aided by a number of factors, including implementation of state-level fiscal responsibility acts, debt waiver and restructuring recommended by Finance Commissions, and improvement in revenues on account of buoyancy of Central taxes and introduction of value-added tax (VAT) at the state level. Despite States experiencing pressure on their fiscal balances in the post-crisis period due to lower buoyancy of Central taxes and increased expenditure commitment due to the implementation of the recommendations of Pay Commissions, they largely continued to comply with the FRBM targets.

Pay and Productivity

17.23 Wages and salaries constitute a significant portion of the committed liabilities of both the Union and States. Periodic revisions based on the recommendations of the Pay Commissions of the Union, with States following suit, have contributed to rising revenue expenditure. For States in particular, the fiscal impact of a pay revision is severe, as the share of salary expenditure in their total revenue expenditure is substantially larger than in the case of the Union. Arrears in pay and bi-annual releases of Dearness Allowance compound the burden.

17.24 Technically, the recommendations of a Central Pay Commission are only for Central Government employees and States are not bound to follow suit. Indeed, up to the 1980s, States constituted their own Pay Commissions and prescribed their own pay scales, based upon their fiscal capacity. However, since the Fifth Central Pay Commission, salaries and allowances in States have tended to converge with those in the Union Government and since the Sixth Central Pay Commission, almost all States have adopted the Union pattern of pay scales, albeit with modifications.

17.25 An internal study by the Commission brought out the fact that the Union Government’s expenditure on pay and allowances (including expenditure for the Union Territories) [2 Excluding productivity linked bonus/ad-hoc bonus, honorarium and encashment of earned leave, and travel allowances] more than doubled for the period 2007-08 to 2012-13, from Rs. 46,230 crore to Rs. 1,08,071 crore [If salary of defence services is included, the corresponding figures will be Rs. 73,073 crore and Rs. 1, 84,711 crore].

This increase can be largely attributed to the implementation of the Sixth Central Pay Commission recommendations, evident from the per employee annual salary (excluding defence salary) increasing from Rs. 1,45,722 to Rs. 3,25,820 over this period. Moreover, the share of expenditure on pay and allowances in revenue expenditure (net of interest payment, pensions and grants-inaid) increased from 11.8 per cent in 2007-08 to 13.1 per cent in 2012-13. The incidence of salary expenditure is much higher in the States than in the Union. In 2012-13, the share of expenditure on pays and allowances of all employees in the revenue expenditure (net of interest payments and pensions) among the States ranged from 28.9 per cent to 79.1 per cent. Per employee (for regular employees) salary in 2012-13 across States ranged between Rs. 2,12,854 and Rs. 5,49,345. Thus, the impact of revisions in pay scales on fiscal positions is uniformly significant, though it varies widely across States.

17.26 Given the variations across States and the lack of knowledge about the probable design and quantum of award of the Seventh Central Pay Commission, we believe that it is neither feasible, nor practicable, to arrive at any reasonable forecast of the impact of the pay revision on the Union Government or the States. Further, any attempt to fix a number in this regard, within the ambit of our recommendations, carries the unavoidable risk of raising undue expectations.

17.27 Our concern is the likely impact on overall budgetary resources, particularly of the States, once the recommendations of the Seventh Central Pay Commission are announced and adopted by the Union Government. All States have asked us to provide a cushion for the pay revision likely during our award period. The Union Government’s memorandum has built, in its forecast, the implications of a pay increase from 2016-17 onwards. The recommendations of the Seventh Central Pay Commission are likely to be made only by August 2015, and unlike the previous Finance Commissions, we would not have the benefit of having any material to base our assessments and projections and to specifically take the impact into account. We have, therefore, adopted the principle of overall sustainability based on past trends, which should realistically capture the overall fiscal needs of the States.

17.28 In our view, on matters that impact the finances of both the Union and States, policies ought to evolve through consultations between the States and the Union. This is especially relevant in the determination of pay and allowances, where a part of the government itself, in the form of the employees, is a stakeholder and influential in policy making. A national view, arrived at through this process, will open avenues for the Union and States to make collective efforts to raise the extra resources required by their commitment to a pay revision. More importantly, it would enable the Union and States to ensure that there is a viable and justifiable relationship between the demands on fiscal resources on account of salaries and contributions to output by employees commensurate with expenditure incurred. In this regard, we reiterate the views of the FC-XI for a consultative mechanism between the Union and States, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments.

17.29 Further,we would like to draw attention to the importance of increasing the productivity of government employees as a part of improving outputs, outcomes and overall quality of services relatable to public expenditures. The Seventh Central Pay Commission, has, inter alia, been tasked with making recommendations on this aspect. Earlier Pay Commissions had also made several recommendations to enhance productivity and improve public administration. Productivity per employee can be raised through the application of technology in public service delivery and in public assets created. Raising the skills of employees through training and capacity building also has a positive impact on productivity. The use of appropriate technology and associated skill development require incentives for employees to raise their individual productivities. A Pay Commission’s first task, therefore, would be to identify the justify mix of technology and skills for different categories of employees. The next step would be to design suitable financial incentives linked to measurable performance. We recommend the linking of pay with productivity, with a simultaneous focus on technology, skills and incentives. Further, we recommend that Pay Commissions be designated as ‘Pay and Productivity Commissions’,with a clear mandate to recommend measures to improve ‘productivity of an employee’, in conjunction with pay revisions. We urge that, in future, additional remuneration be linked to increase in productivity.

Pensions

17.30 Pensions have been growing steadily, and the liability for pension payments is likely to cast a very heavy burden on budgets in the coming years. Some of the factors contributing to this growth are: (i) the rise in pensions recommended by successive Pay Commissions; (ii) removal of the distinction between people retiring at different points of time, so that all pensioners are treated alike in their pension justifys; (iii) taking over the liability for pensions of retired employees of aided institutions and local bodies; and (iv) increasing longevity. The New Pension Scheme (NPS), a contribution-based scheme introduced by the Union Government in 2004 for all new recruits after the cut-off date, has now been adopted by all States, with the exception of West Bengal and Tripura. This scheme has the merit of transferring future liabilities to the New Pension Fund and factoring the current liability on a State’s contribution from its current revenues. We urge States which have not adopted the New Pension Scheme so far to immediately consider doing so for their new recruits in order to reduce their future burden.

Conclusion: – The recommendations of 14th Finance Commission are important for 7th Pay Commission. As the recommendations of 14th FC is applicable with effect from 01.04.2015 the impact of above mentioned recommendations will be the part of 7th CPC. Need not to say that 7th CPC has the challenge to prepare the report in stipulated time including the views of 14th FC.

Source : karnmk.blogspot.in

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Leave a Reply